Disposable Syringes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Disposable Syringes Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

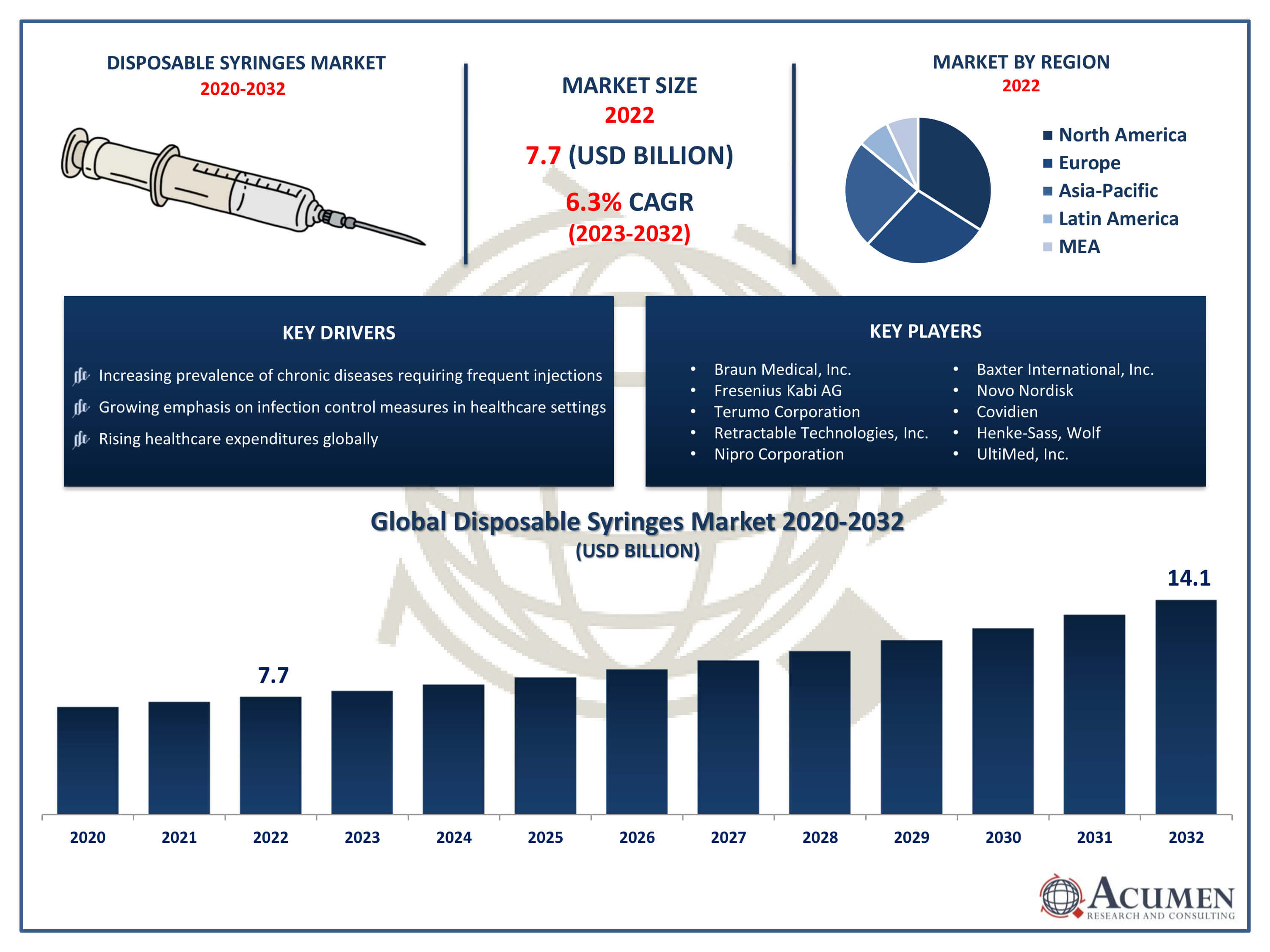

The Disposable Syringes Market Size accounted for USD 7.7 Billion in 2022 and is projected to achieve a market size of USD 14.1 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Disposable Syringes Market Highlights

- Global disposable syringes market revenue is expected to increase by USD 14.1 Billion by 2032, with a 6.3% CAGR from 2023 to 2032

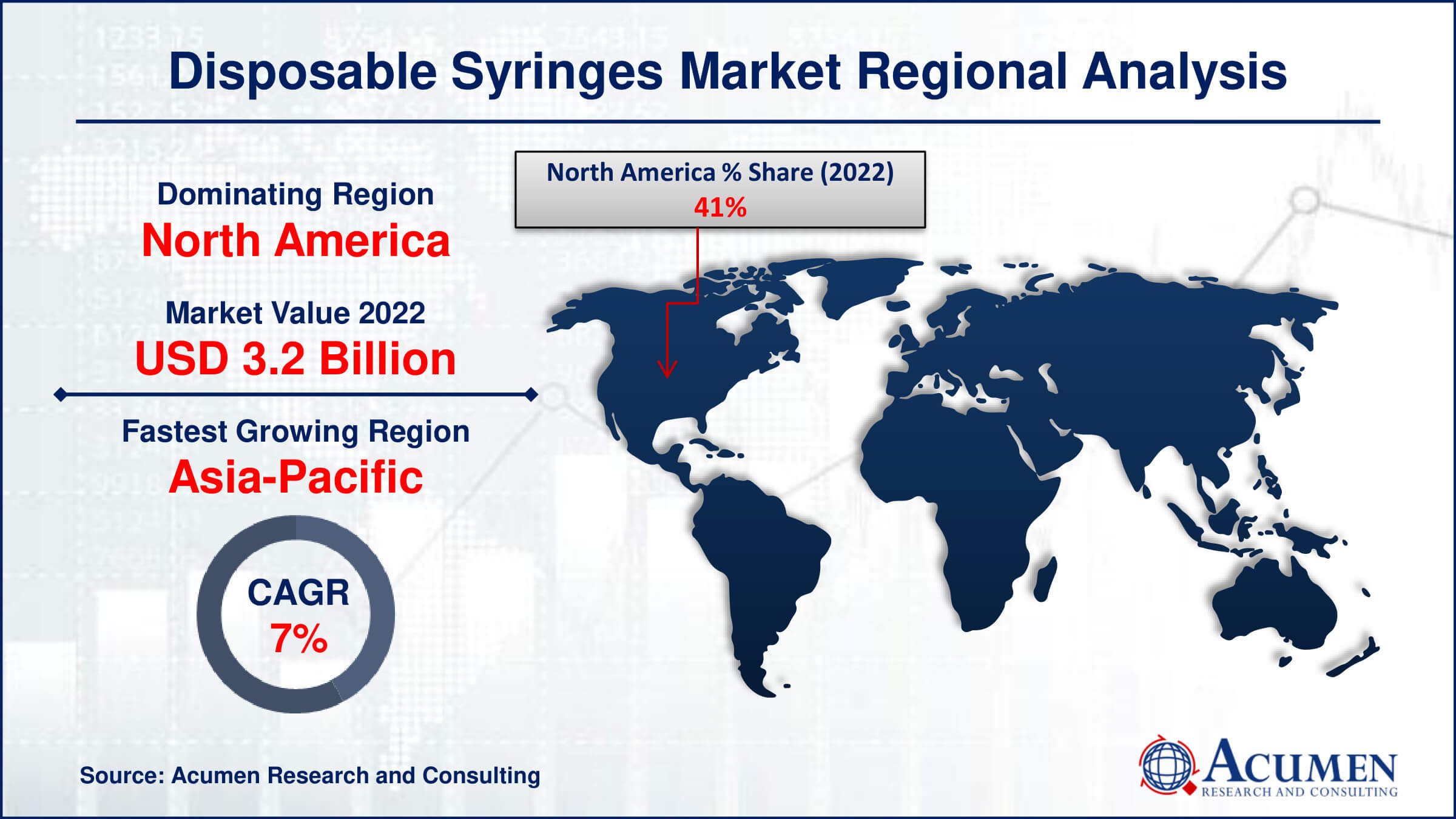

- North America region led with more than 41% of disposable syringes market share in 2022

- Asia-Pacific disposable syringes market growth will record a CAGR of more than 7.5% from 2023 to 2032

- By type, the safety syringes segment captured more than 58% of revenue share in 2022.

- By application, the therapeutic injections segment generated over 67% of the market share in 2022

- Increasing prevalence of chronic diseases requiring frequent injections, drives the disposable syringes market value

Disposable syringes are essential medical instruments designed for single-use administration of medications or injections. They consist of a plastic barrel with a plunger, a needle attachment tip, and a safety cap. Their widespread adoption across healthcare facilities, including hospitals, clinics, and home care, is due to their convenience, safety, and effectiveness in preventing cross-contamination and the transmission of infectious diseases.

Disposable syringes are essential medical instruments designed for single-use administration of medications or injections. They consist of a plastic barrel with a plunger, a needle attachment tip, and a safety cap. Their widespread adoption across healthcare facilities, including hospitals, clinics, and home care, is due to their convenience, safety, and effectiveness in preventing cross-contamination and the transmission of infectious diseases.

In recent years, the global market for disposable syringes has experienced significant growth. This expansion is driven by factors such as the increasing incidence of chronic ailments, rising healthcare spending, heightened awareness of infection control protocols, and advancements in healthcare infrastructure, especially in emerging markets. Additionally, ongoing innovations in materials and design aim to enhance safety, precision, and ease of use for healthcare practitioners and patients.

Global Disposable Syringes Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases requiring frequent injections

- Growing emphasis on infection control measures in healthcare settings

- Rising healthcare expenditures globally

- Advancements in healthcare infrastructure, especially in emerging economies

- Accelerated demand due to mass vaccination campaigns, such as during the COVID-19 pandemic

Market Restraints

- Environmental concerns related to the disposal of plastic syringes

- Regulatory challenges and compliance requirements

Market Opportunities

- Technological advancements in syringe design for enhanced safety and usability

- Increasing adoption of self-administered injectable medications

Disposable Syringes Market Report Coverage

| Market | Disposable Syringes Market |

| Disposable Syringes Market Size 2022 | USD 7.7 Billion |

| Disposable Syringes Market Forecast 2032 | USD 14.1 Billion |

| Disposable Syringes Market CAGR During 2023 - 2032 | 6.3% |

| Disposable Syringes Market Analysis Period | 2020 - 2032 |

| Disposable Syringes Market Base Year |

2022 |

| Disposable Syringes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Braun Medical, Inc., Fresenius Kabi AG, Terumo Corporation, Flextronics International Vita Needle Company, Retractable Technologies, Inc., Nipro Corporation, Baxter International, Inc., Novo Nordisk, Covidien, Henke-Sass, Wolf, UltiMed, Inc., and Becton, Dickinson and Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Disposable syringes are medical tools designed for one-time use, intended for administering medications or fluids via injection or aspiration. They consist of a plastic barrel with volume indicators, a plunger, and a tip for attaching a needle, playing a crucial role in preventing contamination and the transmission of infectious diseases. By being discarded after a single use, they mitigate the risk of cross-contamination among patients or from healthcare providers to patients. Widely employed across healthcare settings such as hospitals, clinics, ambulatory care centers, and even home care, these syringes facilitate the delivery of vaccines, insulin, medications, and other injectable treatments. They are also vital in diagnostic procedures, including blood sample collection and specimen acquisition for laboratory analysis.

Key players in the industry are focusing on increasing production capacity to meet demand. For instance, in early 2022, SCHOTT Pharma introduced a new manufacturing facility dedicated to producing pre-fillable syringes made from advanced polymer materials, further boosting market demand.

The disposable syringes industry has experienced significant growth recently, driven by various factors. The growing prevalence of chronic diseases like diabetes and autoimmune disorders, which necessitate frequent medication injections, has notably boosted the demand for disposable syringes. According to the 2023 ICMR INDIAB study, the number of individuals affected by diabetes in India stands at 101 million. Additionally, there is an increasing focus on infection control in healthcare environments and the need to curb cross-contamination and the spread of infectious diseases, leading to greater adoption of disposable syringes over reusable options. This surge in demand has led to increased production and sales and spurred innovations in manufacturing methods to meet the escalating demand.

Disposable Syringes Market Segmentation

The global disposable syringes industry segmentation is based on type, application, end user, and geography.

Disposable Syringes Market By Type

- Safety Syringes

- Retractable Safety Syringes

- Non-retractable Safety Syringes

- Conventional Syringes

According to the disposable syringes industry analysis, the safety syringes segment accounted for the largest market share in 2022. For example, in June 2021, Hindustan Syringes and Medical Devices Ltd. entered a technical partnership with Star Syringes from the UK to introduce disposable safety needles with built-in features for preventing sharps injuries under the Disposjekt Needle brand. These needles can be easily adapted for use with regular dispo valve disposable syringes or connected to K.O.J.A.K. auto-disable safety needles.

The surge in demand for safety syringes is driven by heightened concerns about needlestick injuries and the potential transmission of bloodborne pathogens among healthcare professionals. These specialized syringes are designed to minimize the risk of needlestick accidents and inadvertent needle reuse, improving safety for both healthcare providers and patients. Consequently, there has been increasing adoption of safety syringes across diverse healthcare settings such as hospitals, clinics, and ambulatory care centers. Furthermore, the growing recognition of the importance of preventing needlestick injuries has led healthcare institutions to prioritize the integration of safety syringes into their infection control protocols.

Disposable Syringes Market By Application

- Therapeutic Injections

- Immunization Injections

In terms of applications, the therapeutic injections segment is expected to witness significant growth in the coming years. Therapeutic injections, which involve the delivery of medications, vaccines, and other therapeutic substances, play a pivotal role in medical treatment across various healthcare environments. Disposable syringes are widely utilized for these injections due to their convenience, safety, and efficacy in preventing cross-contamination and infections.

A significant factor fueling the expansion of the therapeutic injections sector is the growing incidence of chronic diseases and the consequent surge in demand for injectable medications. Conditions such as diabetes, autoimmune disorders, and cancer often require regular injections, leading to an increased need for disposable syringes.

Disposable Syringes Market By End User

- Hospitals

- Blood collection centers

- Diabetic centers

- Veterinary Clinics

- Others

According to the disposable syringes industry forecast, the hospital segment is expected to witness significant growth in the coming years. Hospitals heavily rely on disposable syringes for various medical procedures such as medication administration, vaccinations, blood collection, and diagnostic and therapeutic interventions. The rising prevalence of chronic illnesses, coupled with a global increase in hospital admissions, has significantly boosted the demand for disposable syringes within hospital settings. Additionally, there is a growing emphasis on infection control protocols and the need to reduce healthcare-associated infections (HAIs), which has led to the widespread adoption of disposable syringes. Compared to reusable counterparts, disposable syringes offer superior safety by eliminating the risk of cross-contamination and the transmission of infectious diseases among patients.

Disposable Syringes Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Disposable Syringes Market Regional Analysis

Disposable Syringes Market Regional Analysis

North America dominates the disposable syringes market due to its advanced healthcare infrastructure, high healthcare expenditure, and stringent regulatory framework. For example, in 2022, U.S. health spending rose by 4.1% to reach $4.4 trillion, equivalent to $13,493 per person, mirroring pre-pandemic levels. The region hosts numerous leading pharmaceutical and medical device companies, contributing to disposable syringe development and production. In early 2023, Genixus, a U.S. pharmaceutical company, announced plans for a 30,000-square-foot production facility in North Carolina, equipped with state-of-the-art automated machinery for KinetiX syringe production. Additionally, North America's robust distribution network ensures widespread availability of disposable syringes across healthcare settings. Furthermore, the rising prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and autoimmune conditions, has significantly driven market growth. For instance, United Health Group reports that diabetes affects 11.5% of U.S. adults, impacting nearly 31.9 million individuals, leading to increased demand for medications requiring regular injections.

The Asia Pacific region is the fastest-growing in the disposable syringes market, driven by population growth, expanding healthcare infrastructure, rising awareness of safe medical practices, and government initiatives promoting immunization and healthcare access. Advancements in technology and manufacturing processes have made disposable syringes more affordable and widely available. For instance, in January 2020, Nipro Corporation acquired JMI Marketing Ltd., a medical device company in Bangladesh, through Nipro Asia Pte Ltd., bolstering its presence in Bangladesh's economy, particularly in disposable medical devices like syringes and infusion sets. Consequently, the Asia Pacific region emerges as a key driver of market growth.

Disposable Syringes Market Player

Some of the top disposable syringes market companies offered in the professional report include Braun Medical, Inc., Fresenius Kabi AG, Terumo Corporation, Flextronics International Vita Needle Company, Retractable Technologies, Inc., Nipro Corporation, Baxter International, Inc., Novo Nordisk, Covidien, Henke-Sass, Wolf, UltiMed, Inc., and Becton, Dickinson and Company.

Frequently Asked Questions

How big is the disposable syringes market?

The disposable syringes market size was USD 7.7 Billion in 2022.

What is the CAGR of the global disposable syringes market from 2023 to 2032?

The CAGR of disposable syringes is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the disposable syringes market?

The key players operating in the global market are including Braun Medical, Inc., Fresenius Kabi AG, Terumo Corporation, Flextronics International Vita Needle Company, Retractable Technologies, Inc., Nipro Corporation, Baxter International, Inc., Novo Nordisk, Covidien,, Henke-Sass, Wolf, UltiMed, Inc., and Becton, Dickinson and Company.

Which region dominated the global disposable syringes market share?

North America held the dominating position in disposable syringes industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of disposable syringes during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global disposable syringes industry?

The current trends and dynamics in the disposable syringes industry include increasing prevalence of chronic diseases requiring frequent injections, growing emphasis on infection control measures in healthcare settings, and rising healthcare expenditures globally.

Which application held the maximum share in 2022?

The therapeutic injections application held the maximum share of the disposable syringes industry.