Disaster Preparedness Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Disaster Preparedness Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

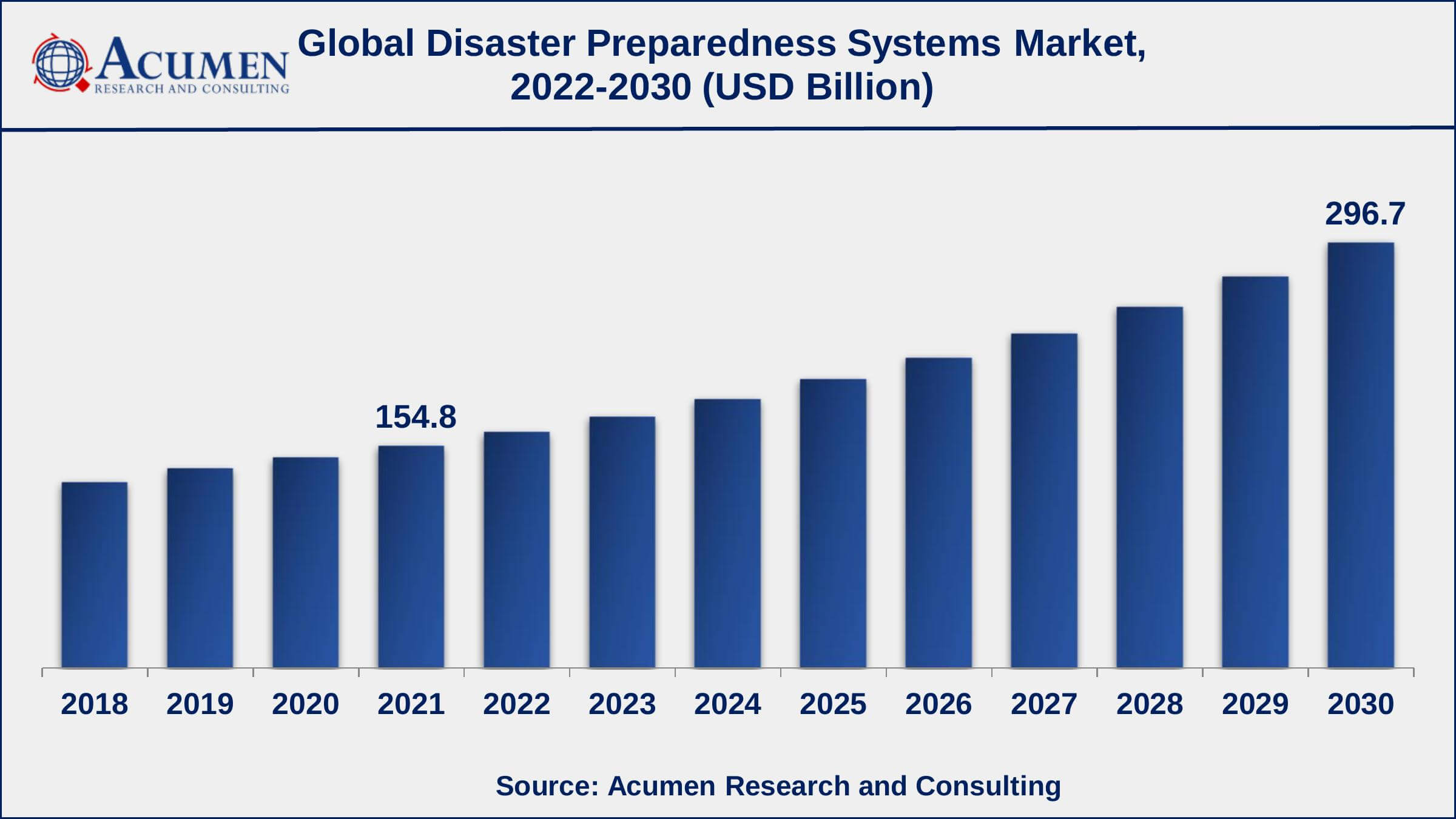

The Global Disaster Preparedness Systems Market Size gathered USD 154.8 Billion in 2021 and is set to garner a market size of USD 296.7 Billion by 2030 growing at a CAGR of 7.7% from 2022 to 2030.

Disaster preparedness systems are the plans, policies, and procedures in place to prepare for and respond to natural or man-made disasters. The objective of disaster preparedness systems is to reduce the impact of disasters on communities while also ensuring quick and effective response in order to minimize loss of life and property. Emergency management plans, evacuation plans, emergency communication systems, and training and drills for emergency personnel and the general public are examples of such systems. In recent years, there has been a greater emphasis on community-based disaster preparedness, which entails engaging and empowering individuals and communities to play an active role in disaster preparedness and response efforts. This approach acknowledges that communities are frequently the first responders in a disaster and can play an important role in recovery efforts.

Disaster Preparedness Systems Market Report Statistics

- Global disaster preparedness systems market revenue is estimated to reach USD 296.7 Billion by 2030 with a CAGR of 7.7% from 2022 to 2030

- According to World Bank Group data, natural disaster losses in 2022 will total $270 billion, slightly downwards from $280 billion in 2021

- According to the Internal Displacement Monitoring Center (IDMC) stats, disasters caused 23.7 million of the 38 million internal displacements recorded globally in 2021

- North America disaster preparedness systems market value gathered more than USD 54.2 billion in 2021

- Asia-Pacific disaster preparedness systems market growth will record a CAGR of more than 8% from 2022 to 2030

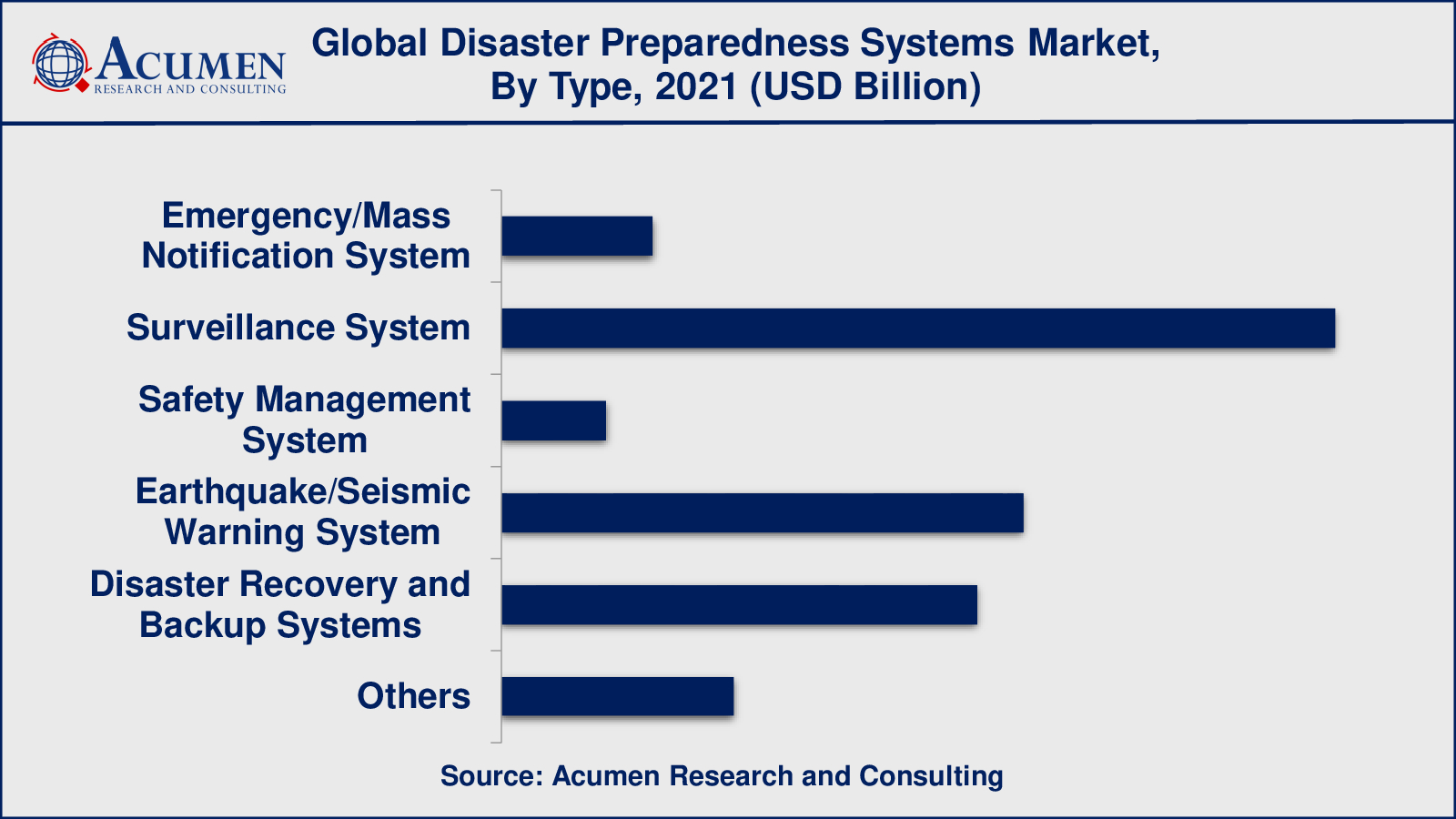

- Among types, the emergency/mass notification system sub-segment collected revenue of US$ 55.7 million in 2021

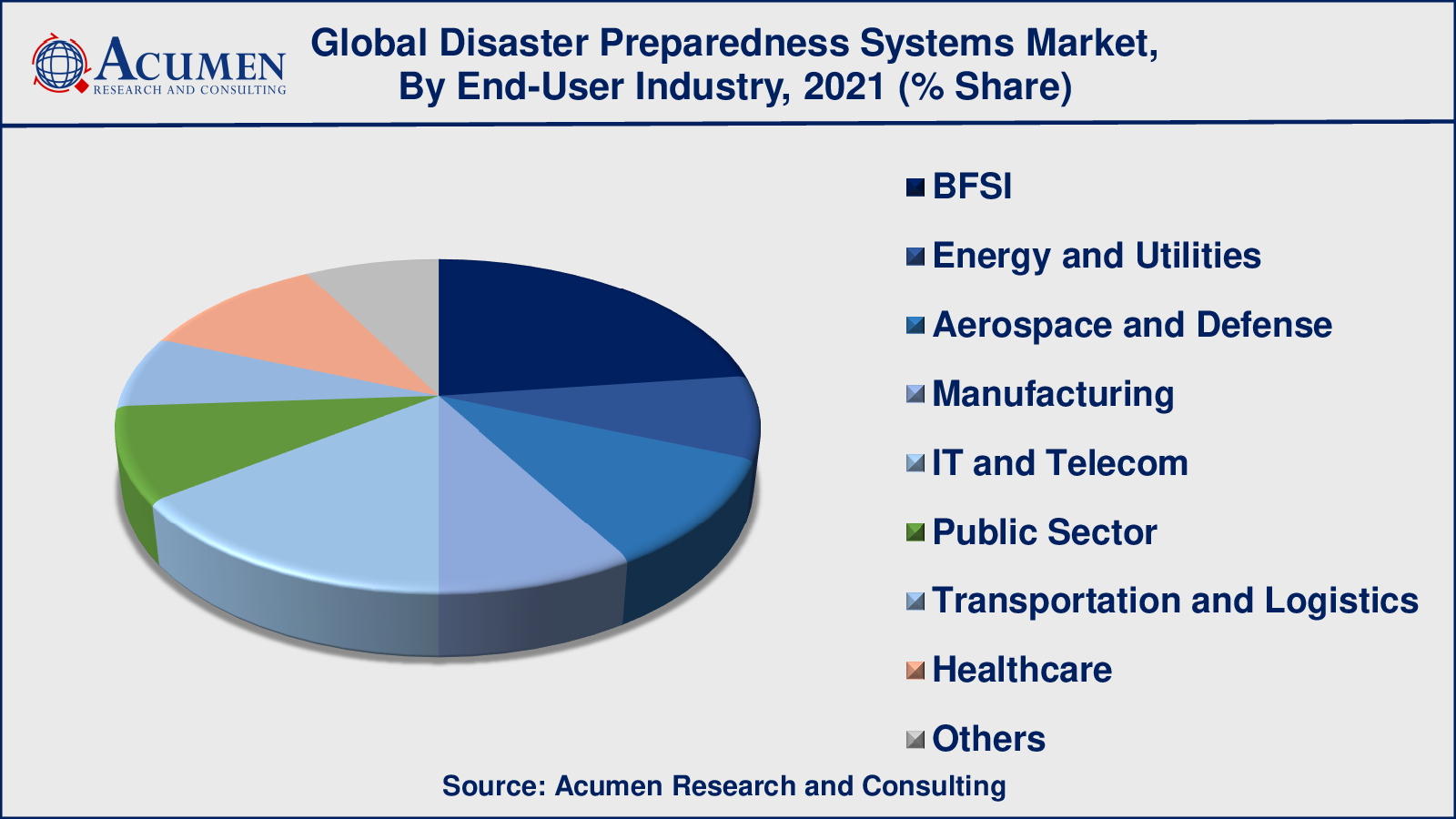

- Based on end-use industry, the BFSI sub-segment achieved over 22% of the share in 2021

- The increased use of technology in forecasting disaster is a popular disaster preparedness systems market trend that drives the industry demand

Global Disaster Preparedness Systems Market Dynamics

Market Drivers

- Increasing occurrence of natural disasters

- Rising number of terrorist attacks and criminal activities

- Favorable government support and funding

Market Restraints

- High implementation cost

- False prediction of disasters

Market Opportunities

- Increasing adoption of business continuity management

- Growing integration of advanced technology such as cybersecurity

Disaster Preparedness Systems Market Report Coverage

| Market | Disaster Preparedness Systems Market |

| Disaster Preparedness Systems Market Size 2021 | USD 154.8 Billion |

| Disaster Preparedness Systems Market Forecast 2030 | USD 296.7 Billion |

| Disaster Preparedness Systems Market CAGR During 2022 - 2030 | 7.7% |

| Disaster Preparedness Systems Market Analysis Period | 2018 - 2030 |

| Disaster Preparedness Systems Market Base Year | 2021 |

| Disaster Preparedness Systems Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Solution, By Service, By Communication Technology, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alertus, Honeywell, IBM, Juvare, Lockheed Martin, Motorola Solutions, NEC Corporation, OnSolve, Siemens, and Singlewire Software. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Disaster Preparedness Systems Market Growth Factors

The increasing frequency and severity of natural disasters is a key factor that is driving the global disaster preparedness systems market. Climate change, combined with increasing population density in some areas, is increasing the frequency and severity of natural disasters such as hurricanes, floods, and earthquakes, driving demand for disaster preparedness systems. In addition, governments all over the world are enacting regulations and raising funds for disaster preparedness systems, which is fueling the growth of the disaster preparedness systems market.

New technologies such as GIS mapping, early warning systems, and social media are driving market growth because they are widely used in disaster preparedness and response. Another trend in disaster preparedness is the increased use of technology to improve communication and coordination during a disaster, such as early warning systems, GIS mapping, and social media. During an emergency, this technology can be used to quickly disseminate information and track the movement of people and resources.

The high cost of implementing disaster preparedness systems is proving to impede some organizations and governments, limiting market growth. Furthermore, the difficulty in predicting and assessing disasters can make designing and implementing effective disaster preparedness systems difficult. This is yet another factor limiting the market growth. Furthermore, as cyber threats can disrupt critical infrastructure and communication systems during a disaster, the growing need for cybersecurity in disaster preparedness systems is generating lucrative growth opportunities.

Disaster Preparedness Systems Market Segmentation

The worldwide disaster preparedness systems market is categorized based on type, solution, service, communication technology, end-use industry, and geography.

Disaster Preparedness Systems Market By Type

- Disaster Recovery and Backup Systems

- Earthquake/Seismic Warning System

- Emergency/Mass Notification System

- Surveillance System

- Safety Management System

- Others

According to an industry analysis of disaster preparedness systems, the surveillance system captured the most market share in 2021 and is expected to continue to do so in the coming years. During a disaster, surveillance systems can provide real-time information on the movement of people and resources, allowing first responders and emergency management officials to make better decisions and respond more effectively. Surveillance systems can also be used to monitor critical infrastructure, such as power plants, bridges, and transportation systems, to ensure that they are operational during and after a disaster.

Disaster Preparedness Systems Market By Solution

- Disaster Recovery Solutions

- Geospatial Solutions

- Situational Awareness Solutions

In the solution segment, disaster recovery solutions captured the most market share. Disaster recovery solutions are the processes, procedures, and technology used by businesses to restore their operations and data following a disaster. Business continuity plans, backup and recovery systems, and incident response protocols are examples of this. Disaster recovery solutions aim to minimize downtime and data loss while ensuring that the organization can resume normal operations as soon as possible.

Disaster Preparedness Systems Market By Service

- Consulting Services

- Design & Integration Services

- Training & Education Services

- Support & Maintenance Services

According to the disaster preparedness systems market forecast, the design & integration services service sub-segment will account for a sizable market share between 2022 and 2030. Consulting services are professional advice and assistance provided by subject matter experts. Consulting services in the context of disaster preparedness may include aid with conducting risk assessments, creating and carrying out emergency response plans, and providing employee training and drills. Consultants may also provide guidance on the selection and implementation of systems and technologies that can assist organizations in preparing for and responding to disasters.

Disaster Preparedness Systems Market By Communication Technology

- Emergency Response Radars

- First Responder Tools

- Satellite Phones

- Vehicle-Ready Gateways

- Others

In terms of communication technology, the emergency response radars sub-segment achieved the highest market share in 2021. A type of technology that can be used as part of a disaster preparedness system is emergency response radars. These radars are built to detect and track potential hazards like severe weather, wildfires, and other natural disasters. They are also useful for monitoring traffic, search and rescue operations and other emergency response scenarios. Emergency response radars are extremely sensitive and precise, and they can provide critical information in real-time. This information can be used to warn emergency responders and the general public about potential hazards, as well as to aid decision-making during an emergency response.

Disaster Preparedness Systems Market By End-Use Industry

- Aerospace and Defense

- BFSI

- Energy and Utilities

- Healthcare

- IT and Telecom

- Manufacturing

- Public Sector

- Transportation and Logistics

- Others

The BFSI sub-segment represented a significant market share in 2021 and is expected to continue to do so in the years ahead, from 2022 to 2030. Natural and man-made disasters have the potential to disrupt operations and cause significant financial losses in the banking, financial services, and insurance (BFSI) sector. As a result, disaster preparedness systems are critical for organizations in this sector to reduce the impact of such events while maintaining operational continuity. On the other hand, the healthcare sector is especially vulnerable to the effects of natural and man-made disasters, which can disrupt operations and endanger patients. As a result, disaster preparedness systems are critical for healthcare organizations to reduce the impact of such events while maintaining continuity of care.

Disaster Preparedness Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Disaster Preparedness Systems Market Regional Analysis

North America is expected to dominate the global disaster preparedness systems market with maximum revenue from 2022 to 2030. The huge share in the region is credited to the high adoption of advanced technologies, the presence of well-established market players, and favorable government support for disaster management. Europe is also expected to be a major contributor to the market, owing to rising awareness of the importance of disaster preparedness and rising demand for advanced disaster management technologies. Furthermore, Asia Pacific is anticipated to witness a noteworthy growth rate throughout the forecasted years, owing to factors such as increased disaster preparedness awareness, increased government support for disaster management, and increased natural disaster frequency.

Disaster Preparedness Systems Market Players

Some of the leading disaster preparedness systems companies include Alertus, Honeywell, IBM, Juvare, Lockheed Martin, Motorola Solutions, NEC Corporation, OnSolve, Siemens, and Singlewire Software.

Frequently Asked Questions

What was the market size of the global disaster preparedness systems in 2021?

The market size of disaster preparedness systems was USD 154.8 Billion in 2021.

What is the CAGR of the global disaster preparedness systems market during forecast period of 2022 to 2030?

The CAGR of disaster preparedness systems market is 7.7% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global disaster preparedness systems market are Alertus, Honeywell, IBM, Juvare, Lockheed Martin, Motorola Solutions, NEC Corporation, OnSolve, Siemens, and Singlewire Software.

Which region held the dominating position in the global disaster preparedness systems market?

North America held the dominating position in disaster preparedness systems market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for disaster preparedness systems market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global disaster preparedness systems market?

The current trends and dynamics in the disaster preparedness systems industry include increasing occurrence of natural disasters, rising number of terrorist attacks and criminal activities, and favorable government support and funding.

Which type held the maximum share in 2021?

The surveillance system type held the maximum share of the disaster preparedness systems market.