Directed Energy Weapons Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Directed Energy Weapons Market Analysis - Global Industry Size, Share, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

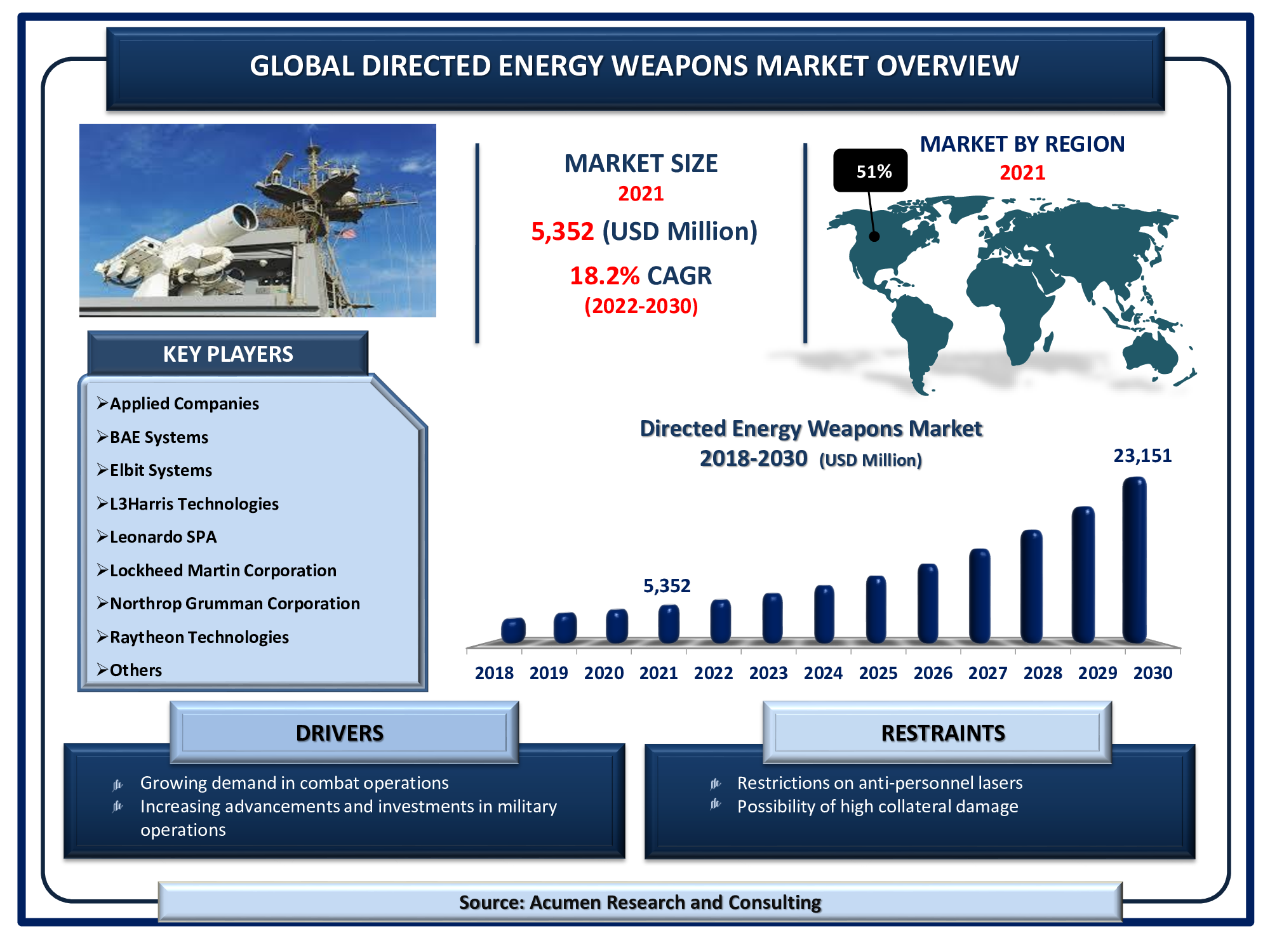

The Global Directed Energy Weapons Market Size is valued at USD 5,352 Million in 2021 and is projected to reach a market size of USD 23,151 million by 2030; growing at a CAGR of 18.2%.

Directed energy weapons (DEW) are a type of advanced weapon that uses highly focused energy to destroy or damage its targets, such as microwaves, lasers, particle beams, and sound beams. The global DEW market is expected to expand significantly in the coming years. This is due to increased demand from various armed forces that operate on land, air, and sea. The global directed energy weapons market is being propelled forward by rising demand for crowd control weapons and the prevention of unrelenting enemy attacks such as terrorist activities. Furthermore, the continuous improvements in the defense sector are expected to fuel the global directed energy weapons market revenue throughout the projected timeframe from 2022 to 2030.

Global Directed Energy Weapons Market DRO’s:

Market Drivers:

- Growing demand in combat operations

- Increasing advancements and investments in military operations

- Rising integration of AI, big data analytics, and robotics technologies

- Rising incidences of regional disputes, terrorism, and political conflicts

Market Restraints:

- Restrictions on anti-personnel lasers

- Possibility of high collateral damage

Market Opportunities:

- Growing number of R&D activities

- Growing emphasis on the development of compact DEW

Report Coverage

| Market | Directed Energy Weapons Market |

| Market Size 2021 | USD 5,352 Million |

| Market Forecast 2030 | USD 23,151 Million |

| CAGR During 2022 - 2030 | 18.2% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Applied Companies, BAE Systems, Elbit Systems, L3Harris Technologies, Leonardo SPA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, Rheinmetall AG, Thales Group, and The Boeing Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

One of the trends in the directed energy weapons market is the increasing integration of AI, big data analytics, and robotics technologies. The integration of these technologies in the defense sector results in futuristic solutions capable of performing high-precision missions. Because of these advantages, the Indian Air Force is working on a USD 5 billion plan to build the 5th generation medium-weight deep penetration fighter jet, which will significantly improve its air power capability. The importance of carrying out targeted strikes has significantly aided the DEW industry's growth. DEW also provides greater accuracy than its conventional counterparts. Directed energy weapon systems have pinpoint accuracy, which helps to limit collateral damage. Furthermore, because directed energy travels at the speed of light, no projectile or missile can outrun it.

When compared to a conventional missile defense system, which costs more than a million dollars per unit, directed energy is remarkably inexpensive. Missile defense systems are a major application area for directed energy weapon (DEW) systems. A DEW missile defense system employs one or more high-powered beams to heat up the opponent and shoot it down for a few dollars per shot. In addition, rising incidences of regional disputes, terrorism, and political conflicts are also expected to drive the directed energy weapons market value. In the last decade, there has been a global increase in the number of protests and political unrest. Several countries around the world, including Brazil, Egypt, Ukraine, and Israel, have experienced unrest and social instability. As a result, governments use non-lethal weapons to control mobs because they pose no threat to human life.

However, restrictions on anti-personnel lasers and the influence of humanitarian organizations protesting the use of DEW are stifling market growth. Human rights groups argue that directed energy weapon systems raise a slew of new juridical and ethical concerns that do not apply to prior generations of conventional weapons. The Geneva Convention forbids the use of weapons that cause undue suffering to individuals. However, most modern non-lethal DEW systems, such as ADS, do not cause permanent damage or harm to targets. Furthermore, the growing number of R&D activities in the defense sector and increasing spending on creating compact directed energy weapons are some of the aspects that are likely to generate numerous growth opportunities for the market in the coming years.

Directed Energy Weapons Market Segmentation

The worldwide directed energy weapons market is split based on product, technology, application, end-user, and geography.

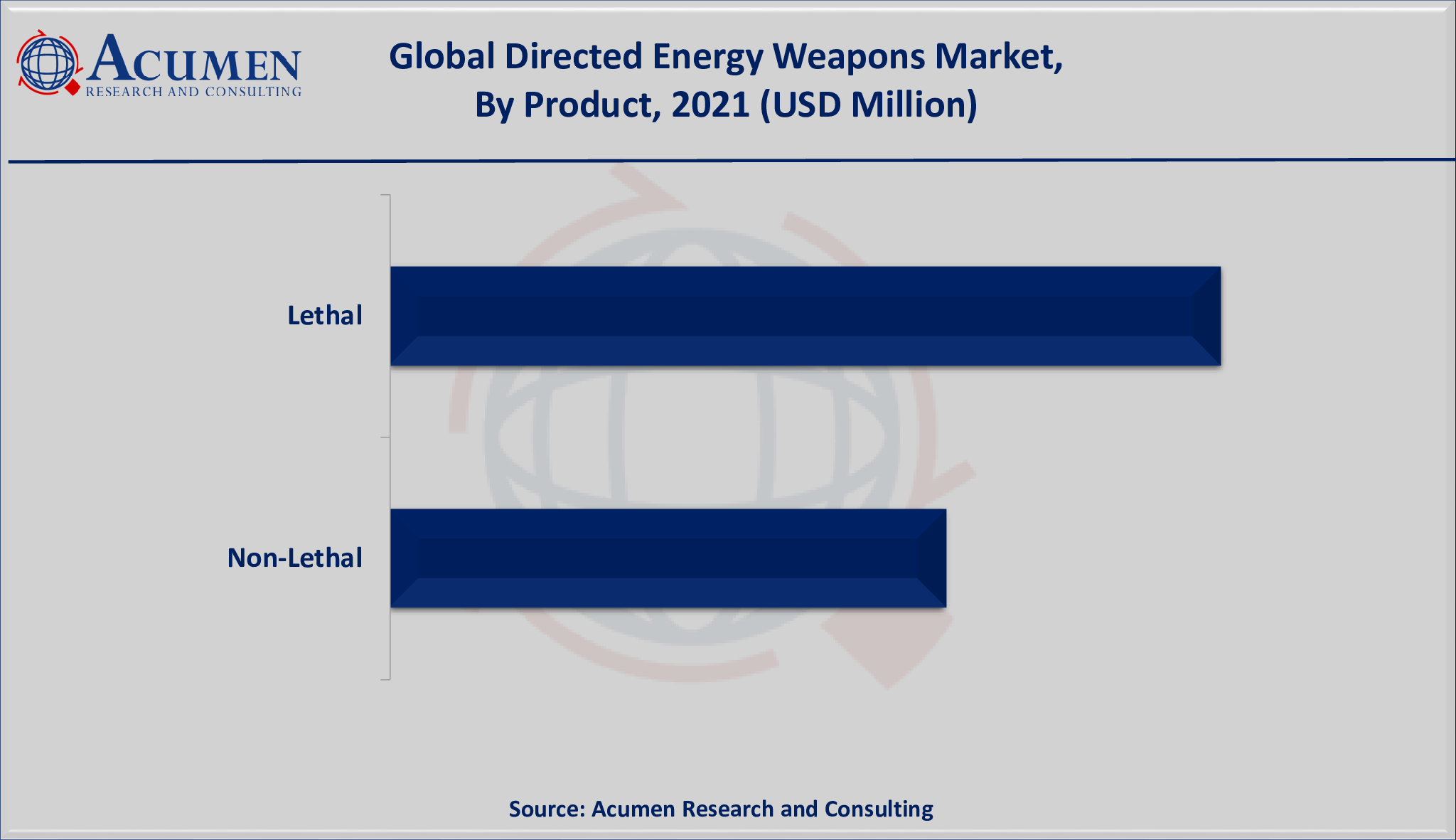

Market by Product

- Lethal

- Non-Lethal

According to our forecast for the directed energy weapons market, lethal directed energy weapons held the largest share from 2022 to 2030. The increased demand for lethal and precise weapons has driven the lethal product type. In addition, due to an increase in demand for precision technology in lethal weapons from military forces worldwide the market is exponentially rising. Some of the lethal directed energy weapons include automated shotguns, electromagnetic bombs (e-bombs), gun-launched guided projectile, microwave guns, navy laser cannons, plasma cannons (electrothermal accelerator), plasma grenades, and rail guns.

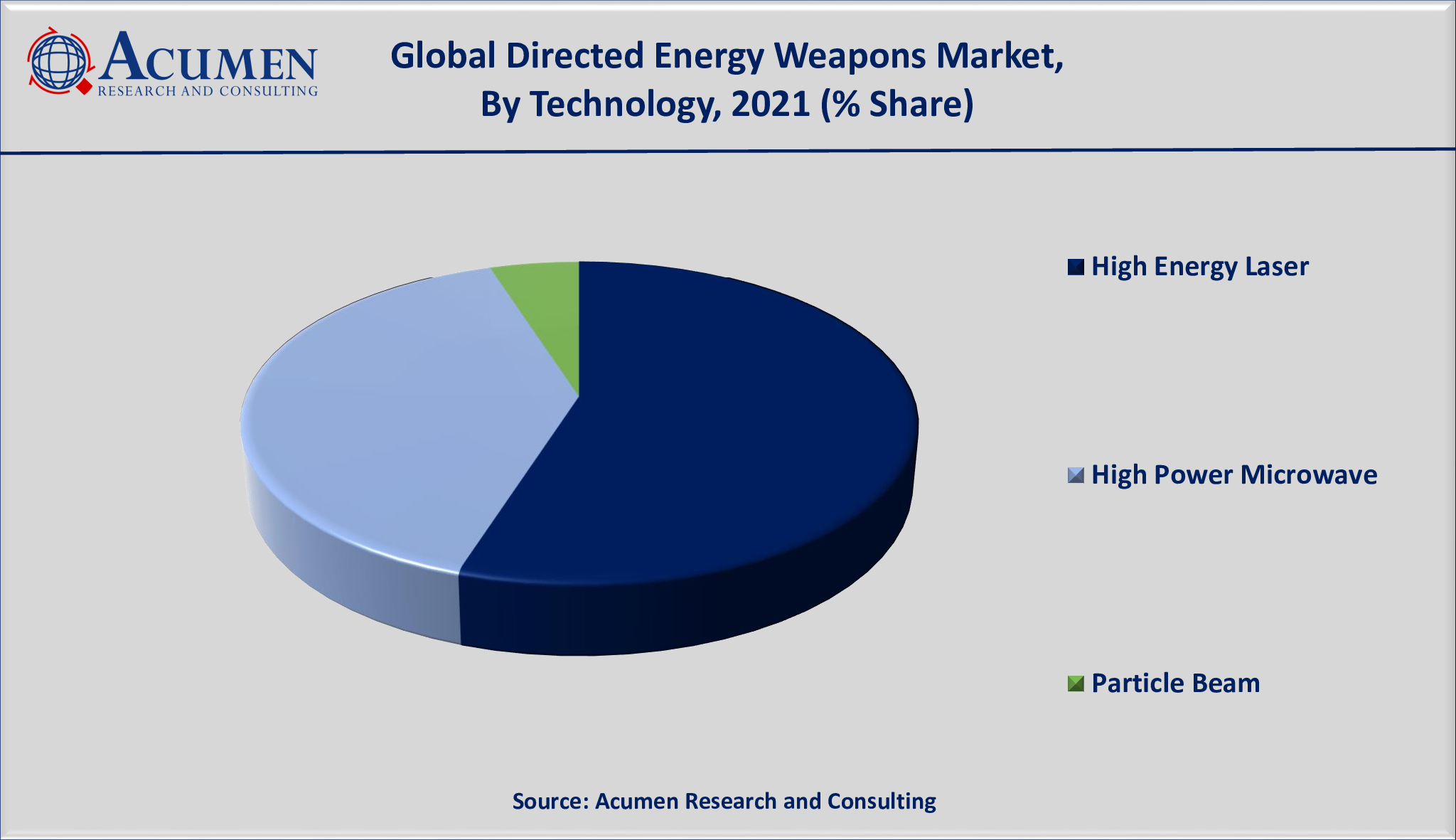

Market by Technology

- High Energy Laser

- High Power Microwave

- Particle Beam

Based on our directed energy weapons industry analysis, high energy lasers commanded the maximum market share in 2021 and are projected to do so during the forecasted period from 2022 to 2030. High-energy laser (HEL) weapons can be deployed in a warzone by mounting them on a land-based platform, an aircraft, or a ship. HEL weapons deliver a large amount of energy at the speed of light to a distant target, causing structural and incendiary damage. Many defense forces around the world are expected to adopt HEL weapons in the coming years due to their effectiveness.

Market by Application

- Homeland Security

- Defense

By applications, the defense sub-segment gathered a significant market share throughout the forecasted period. The defense application segment is likely to hold a considerable market share during the forecast timeframe from 2022 to 2030. The increasing defense expenditure by countries such as China, India, Brazil, and South Korea is anticipated to boost the defense sector revenue. However, the homeland security segment is poised to witness the fastest growth rate in the coming years. The rising number of political disputes, local riots, and rising demand for non-lethal weapons are some of the factors supporting the homeland security industry.

Market by End-User

- Land

- Airborne

- Naval

The land-based DEW held the majority of the market share in 2021 and is expected to continue to do so in the coming years. The growing popularity of land-based DEW systems can be attributed to programs such as Active Denial System, iron beam, and WB-1 Microwave DEW, among others. When compared to other conventional weapon systems, land-based DEW systems are extremely effective against ballistic missiles, UAVs, and mortars. With an increasing number of advanced laser weapon systems programs worldwide, demand for land-based DEW systems is expected to grow significantly during the forecast period.

Directed Energy Weapons Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

The increasing focus on military modernization in North America fuels the regional directed energy weapons market growth

According to our regional analysis of the directed energy weapons market, North America is expected to have the largest regional share between 2022 and 2030. The North American directed energy weapons market is expanding due to a greater emphasis on military modernization and the development of technologically advanced weaponry in order to limit major anti-national threats. The growing demand for crowd control weapons is also influencing the growth of the North American directed energy weapons market.

The Asia-Pacific region, on the other hand, will experience the fastest growth in the coming years. The Asia-Pacific directed energy weapons market is primarily driven by rising military spending in countries such as China, India, Japan, South Korea, Singapore, Taiwan, and Malaysia.

Directed Energy Weapons Market Players

Some of the top directed energy weapons companies offered in the professional report includes Applied Companies, BAE Systems, Elbit Systems, L3Harris Technologies, Leonardo SPA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies, Rheinmetall AG, Thales Group, and The Boeing Company.

Frequently Asked Questions

How much was the estimated value of the global directed energy weapons market in 2021?

The estimated value of global directed energy weapons market in 2021 was accounted to be USD 5,352 Million.

What will be the projected CAGR for global directed energy weapons market during forecast period of 2022 to 2030?

The projected CAGR directed energy weapons market during the analysis period of 2022 to 2030 is 18.2%.

Which are the prominent competitors operating in the market?

The prominent players of the global directed energy weapons market are Applied Companies, BAE Systems, Elbit Systems, L3Harris Technologies, Leonardo SPA, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon technologies, Rheinmetall AG, Thales Group, and The Boeing Company.

Which region held the dominating position in the global directed energy weapons market?

North America held the dominating directed energy weapons during the analysis period of 2022 to 2030.

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for directed energy weapons during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global directed energy weapons market?

Growing demand in combat operations, increasing advancements and investments in military operations, and rising integration of AI, big data analytics, and robotics technologies drives the growth of global directed energy weapons market.

By product segment, which sub-segment held the maximum share?

Based on product, lethal segment held the maximum share directed energy weapons market in 2021.