Dimethyl Ether Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Dimethyl Ether Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

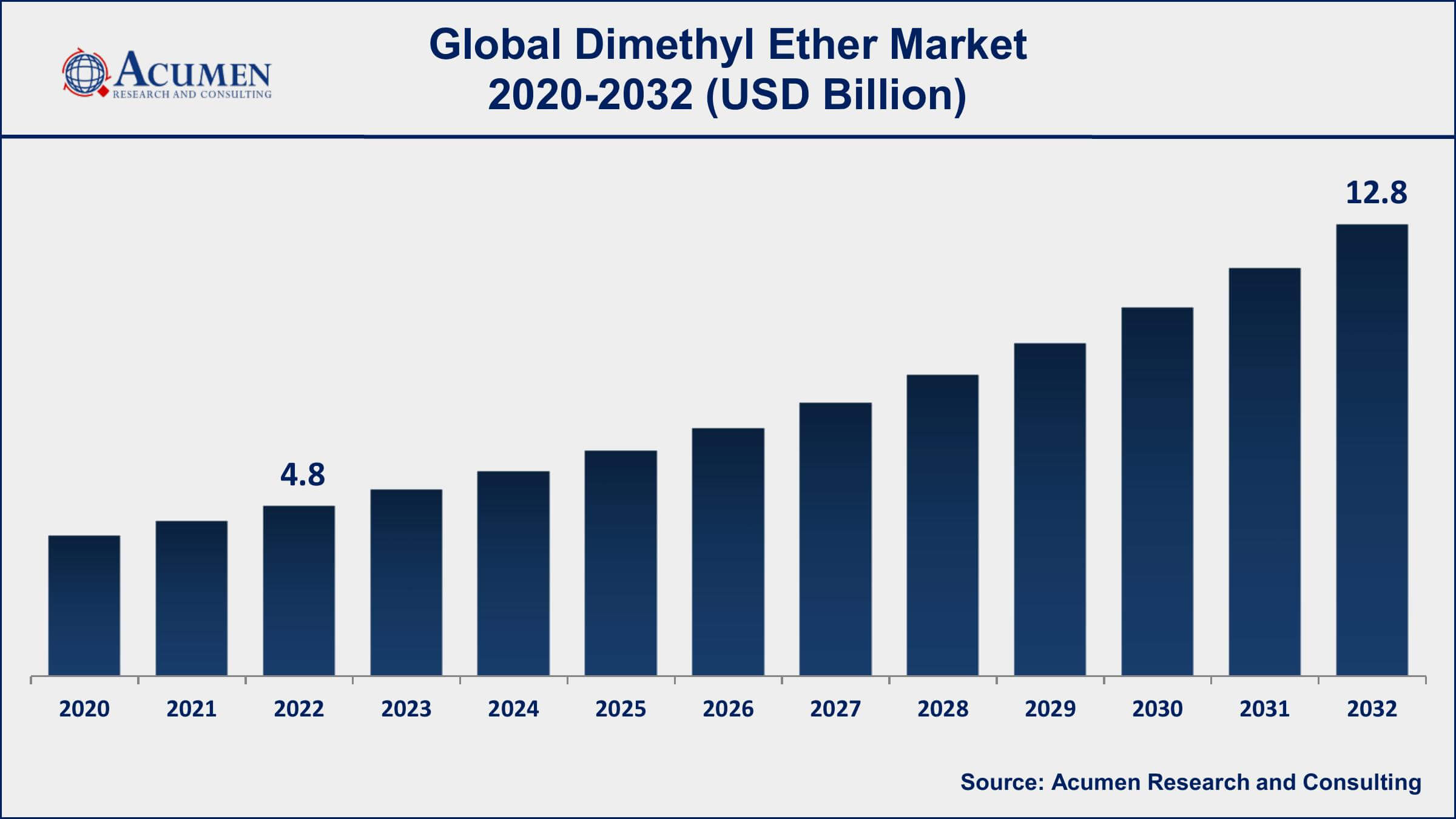

The Global Dimethyl Ether (DME) Market Size accounted for USD 4.8 Billion in 2022 and is projected to achieve a market size of USD 12.8 Billion by 2032 growing at a CAGR of 10.3% from 2023 to 2032.

Dimethyl Ether Market Highlights

- Global dimethyl ether market revenue is expected to increase by USD 12.8 Billion by 2032, with a 10.3% CAGR from 2023 to 2032

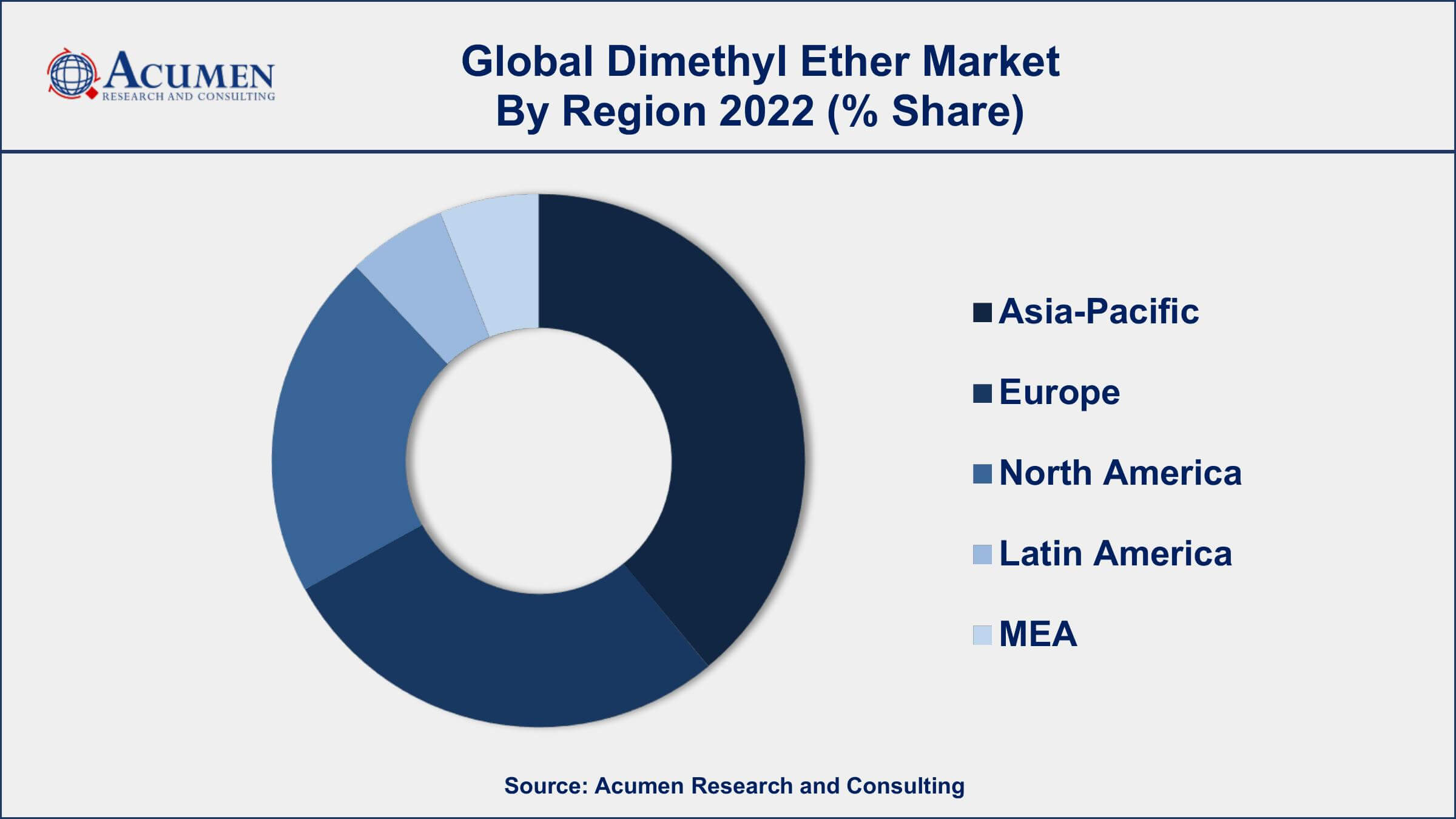

- Asia-Pacific region led with more than 84% of dimethyl ether market share in 2022

- China is the largest producer and consumer of DME, followed by Japan and South Korea

- By raw material, the coal segment is the most widely used method in the market, accounting for more than 42% of the market share in 2022

- By end-user industries, the automotive sector is expected to grow at a CAGR of 11% from 2023 to 2032

- Increasing demand for cleaner fuels and reducing greenhouse gas emissions, drives the dimethyl ether market value

Dimethyl Ether (DME) is a colorless gas with a sweet odor that can be used as a substitute for traditional fuels like diesel and propane. It is produced from various sources such as natural gas, coal, biomass, and waste materials. DME has been gaining attention as a clean-burning fuel that emits fewer pollutants compared to traditional fuels, making it an attractive option for reducing greenhouse gas emissions.

The global DME market has been experiencing significant growth in recent years due to various factors such as increasing demand for cleaner fuels, rising energy prices, and stricter environmental regulations. The Asia-Pacific region is expected to be the largest market for DME due to the presence of countries like China, which has been promoting the use of DME as a cleaner fuel. In addition, the increasing demand for LPG substitutes and transportation fuel is expected to drive the demand for DME in the coming years. The use of DME as a fuel for power generation, transportation, and household cooking is expected to continue to grow in the coming years due to its environmental and economic benefits. Furthermore, ongoing research and development efforts to produce DME from renewable sources such as biomass and waste materials are expected to open up new opportunities for the growth of the DME market value.

Global Dimethyl Ether Market Trends

Market Drivers

- Increasing demand for cleaner fuels and reducing greenhouse gas emissions

- Rising energy prices and a shift toward alternative fuels

- Government support and favorable regulations promoting the use of DME as a cleaner fuel

- Growing demand for LPG substitutes and transportation fuel

- Versatile applications of DME in power generation, transportation, and household cooking

Market Restraints

- Limited availability of feedstock for DME production

- High production costs associated with DME compared to traditional fuels

Market Opportunities

- Increasing demand for DME in emerging markets such as India and Southeast Asia

- Development of new applications for DME, such as in the production of chemicals and materials

Dimethyl Ether Market Report Coverage

| Market | Dimethyl Ether Market |

| Dimethyl Ether Market Size 2022 | USD 4.8 Billion |

| Dimethyl Ether Market Forecast 2032 | USD 12.8 Billion |

| Dimethyl Ether Market CAGR During 2023 - 2032 | 10.3% |

| Dimethyl Ether Market Analysis Period | 2020 - 2032 |

| Dimethyl Ether Market Base Year | 2022 |

| Dimethyl Ether Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Akzo Nobel N.V., BASF SE, China Energy Limited, Grillo-Werke AG, Kaiyue Gas Co. Ltd., Mitsubishi Corporation, Oberon Fuels, Inc., Royal Dutch Shell plc, The Chemours Company, Zagros Petrochemical Company, Guangdong JOVO Group Co. Ltd., and Jiutai Energy Group. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dimethyl ether is a colorless and odorless gas produced from raw materials namely, natural gas, methanol, biomass, and coal. Low boiling point and zero sulfur content are the major factors that have led to the growth of dimethyl ether as a solvent in chemical and petrochemical industries globally. The market for dimethyl ether has witnessed significant growth due to rising demand from various applications such as aerosol propellant and transportation fuel.

The increasing use of non-petroleum based, clean, and high-performance compression ignition fuel as an alternative in diesel engines, along with expansion in emerging economies (such as India, China, Japan, South Korea, and Brazil) and high growth in end-use industries is driving the market for dimethyl ether, globally. The lacks of LPG accessibility in regions, stringent government regulations, as well as the ability to reduce carbon footprints, have led to the global dimethyl ether market growth. The major challenges attributed include performance evaluation plans in North America to assess the viability of dimethyl ether as alternate fuel in the automotive industry and the impact of production cost and flat demand on capacity utilization.

Dimethyl Ether Market Segmentation

The global dimethyl ether market segmentation is based on raw material, application, end-use industry, and geography.

Dimethyl Ether Market By Raw Material

- Methanol

- Coal

- Bio-Based

- Natural Gas

- Others

According to the dimethyl ether industry analysis, the coal segment accounted for the largest market share in 2022. Coal-based DME is produced by gasifying coal and converting it to synthesis gas, which is then converted to DME. China is the largest producer and consumer of coal-based DME, accounting for over 90% of global production. The growth of the coal-based DME market can be attributed to various factors, including the availability of abundant coal reserves, favorable government policies, and the need to reduce greenhouse gas emissions. In China, the use of coal-based DME has been promoted as a cleaner alternative to traditional coal for household cooking, which has resulted in significant reductions in indoor air pollution and improved health outcomes. Additionally, coal-based DME has the potential to reduce China's dependence on imported oil and gas, providing greater energy security.

Dimethyl Ether Market By Application

- Fuel

- Chemical Feedstock

- LPG Blending

- Aerosol Propellent

- Others

In terms of applications, the LPG blending segment is expected to witness significant growth in the coming years. This growth is due to the increasing demand for cleaner fuels, rising energy prices, and stricter environmental regulations. LPG blending is a cost-effective way to reduce emissions from existing LPG infrastructure, making it an attractive option for countries that rely on LPG for household cooking and heating. In addition, ongoing efforts to improve the efficiency and safety of DME-LPG blending processes are expected to drive further growth in this segment. The development of new technologies and applications for DME-LPG blends, such as in transportation and power generation, is also expected to provide new opportunities for the growth of the DME market.

Dimethyl Ether Market By End-Use Industry

- Oil and Gas

- Power Generation

- Automotive

- Cosmetics

- Others

According to the dimethyl ether market forecast, the automotive segment is expected to witness significant growth in the coming years. DME can be used as a transportation fuel and has been gaining attention as a cleaner-burning alternative to traditional fuels like diesel and gasoline. DME has a higher cetane number than diesel, which improves combustion efficiency and reduces emissions of particulate matter, NOx, and other pollutants. The use of DME as a transportation fuel has been primarily focused in Asia, particularly in China, where the government has been promoting its adoption as a clean alternative to diesel. The adoption of DME as a transportation fuel is also gaining traction in other countries like India, Thailand, and Indonesia, where air pollution is a major concern. The growth of the automotive segment is expected to continue in the coming years due to various factors, including increasing demand for cleaner fuels, rising energy prices, and stricter environmental regulations. The development of new DME-powered engines and vehicles, as well as ongoing efforts to improve the efficiency and safety of DME production and storage, are expected to drive further growth in this segment.

Dimethyl Ether Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dimethyl Ether Market Regional Analysis

The Asia-Pacific region dominates the dimethyl ether (DME) market, accounting for over 80% of global production and consumption. The growth of the DME market in Asia-Pacific can be attributed to various factors, including the availability of abundant coal and natural gas resources, favorable government policies, and the need to reduce air pollution and greenhouse gas emissions. China is the largest producer and consumer of DME in the world, driven by the government's promotion of DME as a cleaner alternative to traditional fuels like coal and diesel. The use of DME in China has been primarily focused on household cooking and heating, as well as transportation. India, Indonesia, and Bangladesh are also emerging as key markets for DME due to their significant demand for cleaner cooking fuels. In addition, the Asia-Pacific region is home to many of the world's largest chemical and petrochemical companies, which have been investing in DME production capacity. The region's growing population and economic development have also been driving demand for energy, further supporting the growth of the DME market.

Dimethyl Ether Market Player

Some of the top dimethyl ether market companies offered in the professional report include Akzo Nobel N.V., BASF SE, China Energy Limited, Grillo-Werke AG, Kaiyue Gas Co. Ltd., Mitsubishi Corporation, Oberon Fuels, Inc., Royal Dutch Shell plc, The Chemours Company, Zagros Petrochemical Company, Guangdong JOVO Group Co. Ltd., and Jiutai Energy Group.

Frequently Asked Questions

What was the market size of the global dimethyl ether in 2022?

The market size of dimethyl ether was USD 4.8 Billion in 2022.

What is the CAGR of the global dimethyl ether market from 2023 to 2032?

The CAGR of dimethyl ether is 10.3% during the analysis period of 2023 to 2032.

Which are the key players in the dimethyl ether market?

The key players operating in the global market are including Akzo Nobel N.V., BASF SE, China Energy Limited, Grillo-Werke AG, Kaiyue Gas Co. Ltd., Mitsubishi Corporation, Oberon Fuels, Inc., Royal Dutch Shell plc, The Chemours Company, Zagros Petrochemical Company, Guangdong JOVO Group Co. Ltd., and Jiutai Energy Group.

Which region dominated the global dimethyl ether market share?

Asia-Pacific held the dominating position in dimethyl ether industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of dimethyl ether during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global dimethyl ether industry?

The current trends and dynamics in the dimethyl ether industry include increasing demand for cleaner fuels and reducing greenhouse gas emissions, rising energy prices and a shift toward alternative fuels, and government support and favorable regulations promoting the use of DME as a cleaner fuel.

Which Application held the maximum share in 2022?

The fuel application held the maximum share of the dimethyl ether industry.