Digital Therapeutics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Digital Therapeutics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

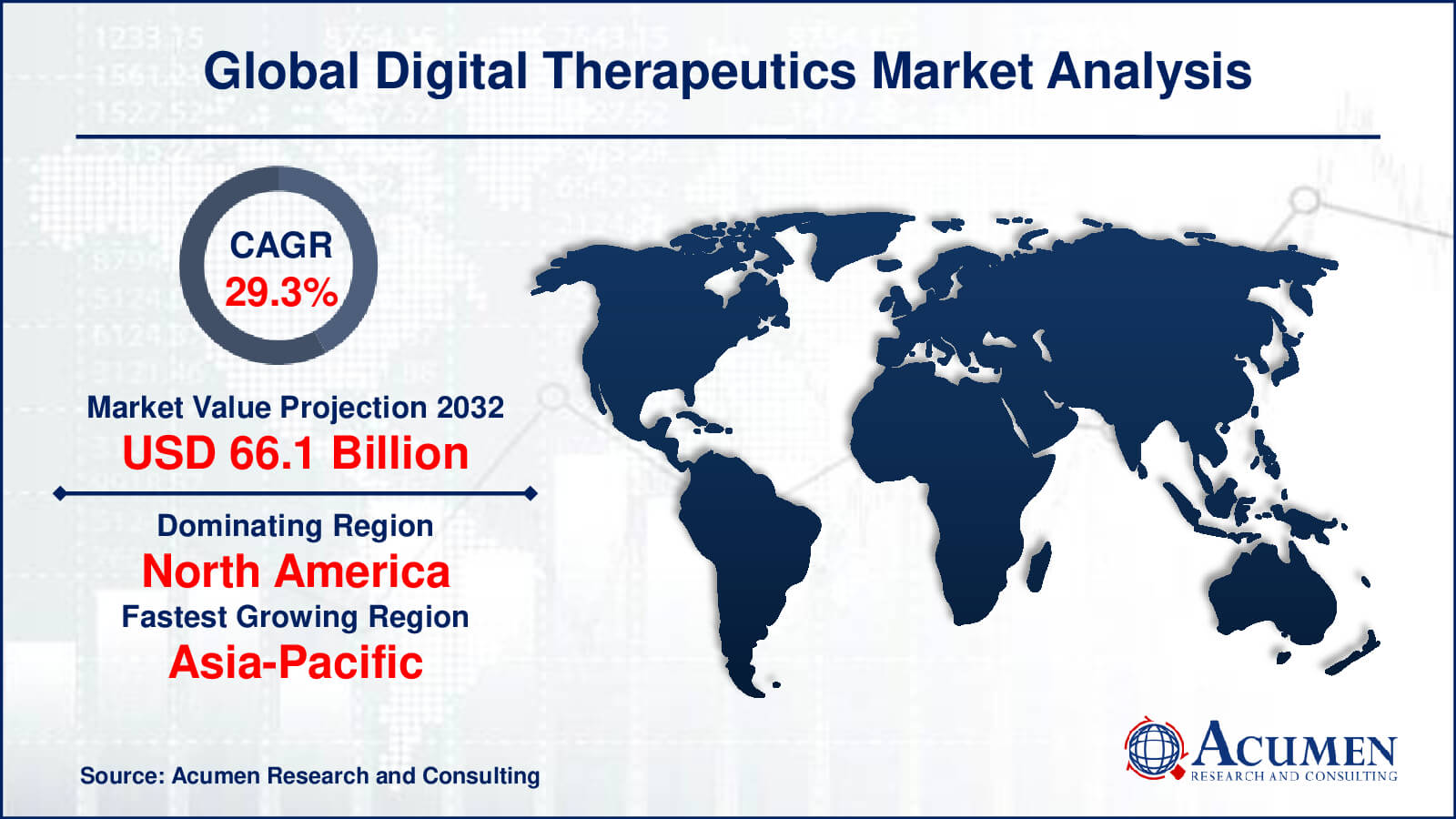

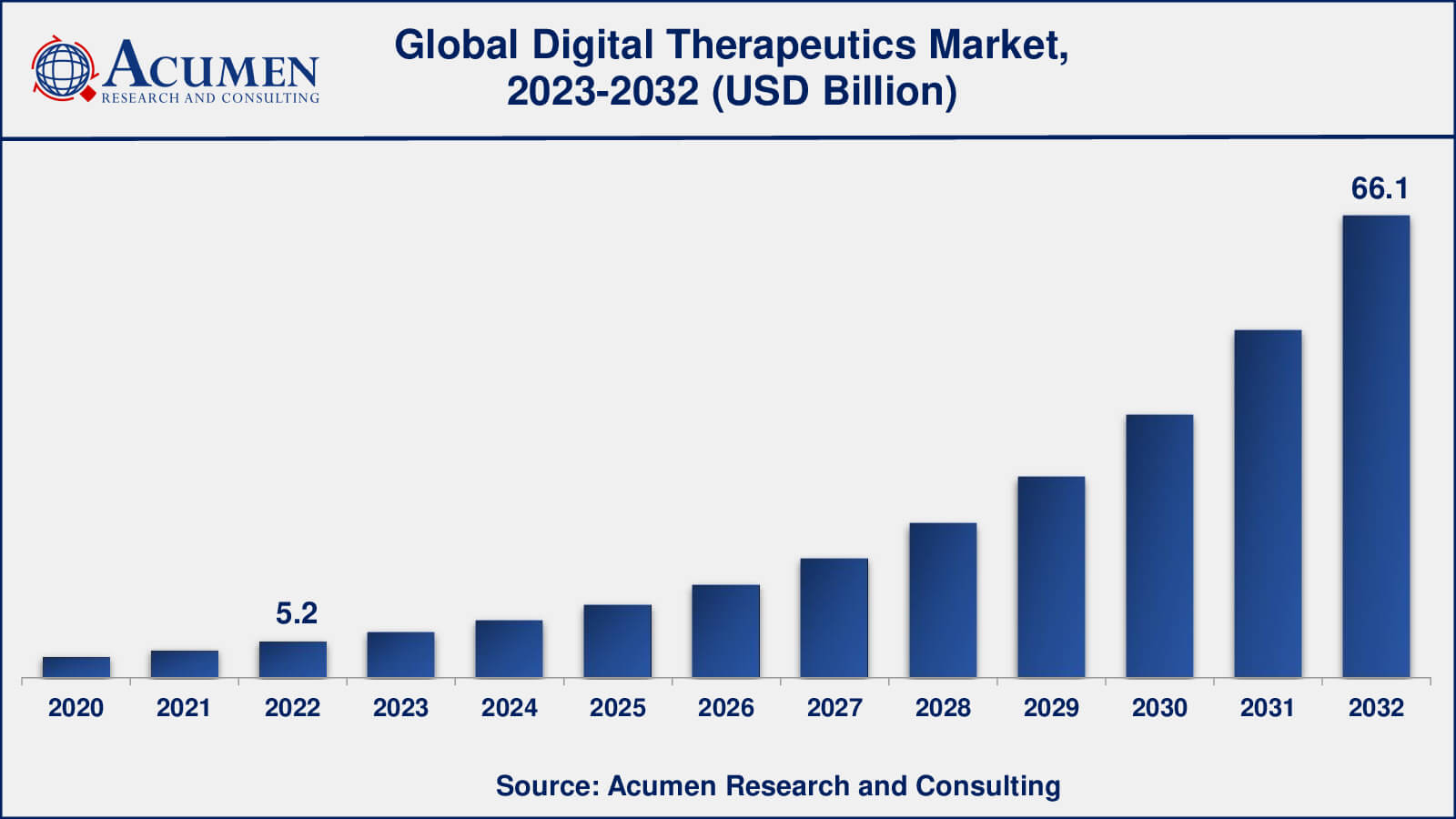

The global Digital Therapeutics Market size accounted for USD 5.2 Billion in 2022 and is expected to reach USD 66.1 Billion by 2032 with a considerable CAGR of 29.3% during the forecast period of 2023 to 2032.

Digital Therapeutics Market Highlights

- Global digital therapeutics market revenue is poised to garner USD 66.1 billion by 2032 with a CAGR of 29.3% from 2023 to 2032

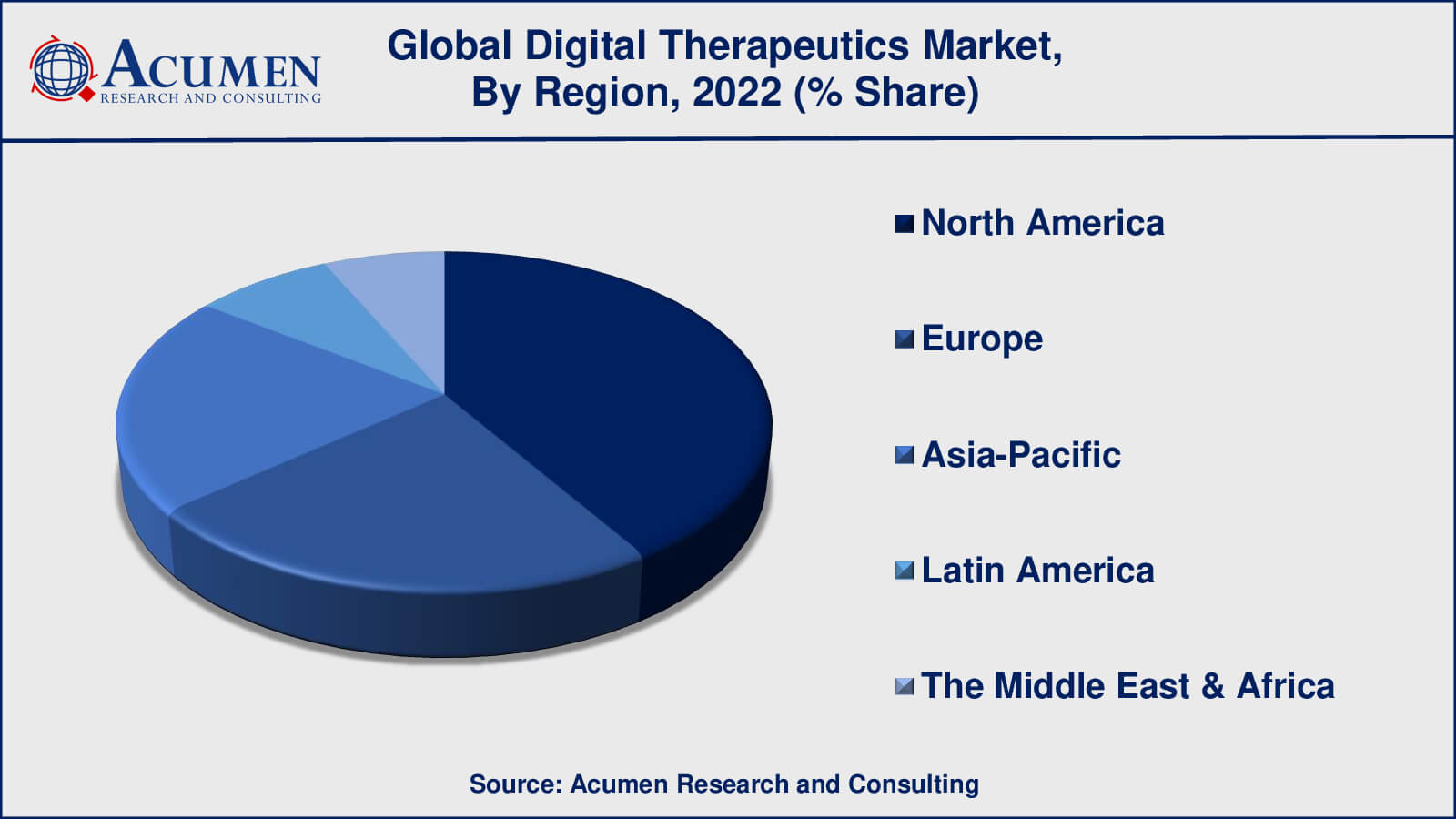

- North America digital therapeutics market value occupied around 2.2 billion in 2022

- Asia-Pacific digital therapeutics market growth will record a CAGR of more than 30% from 2023 to 2032

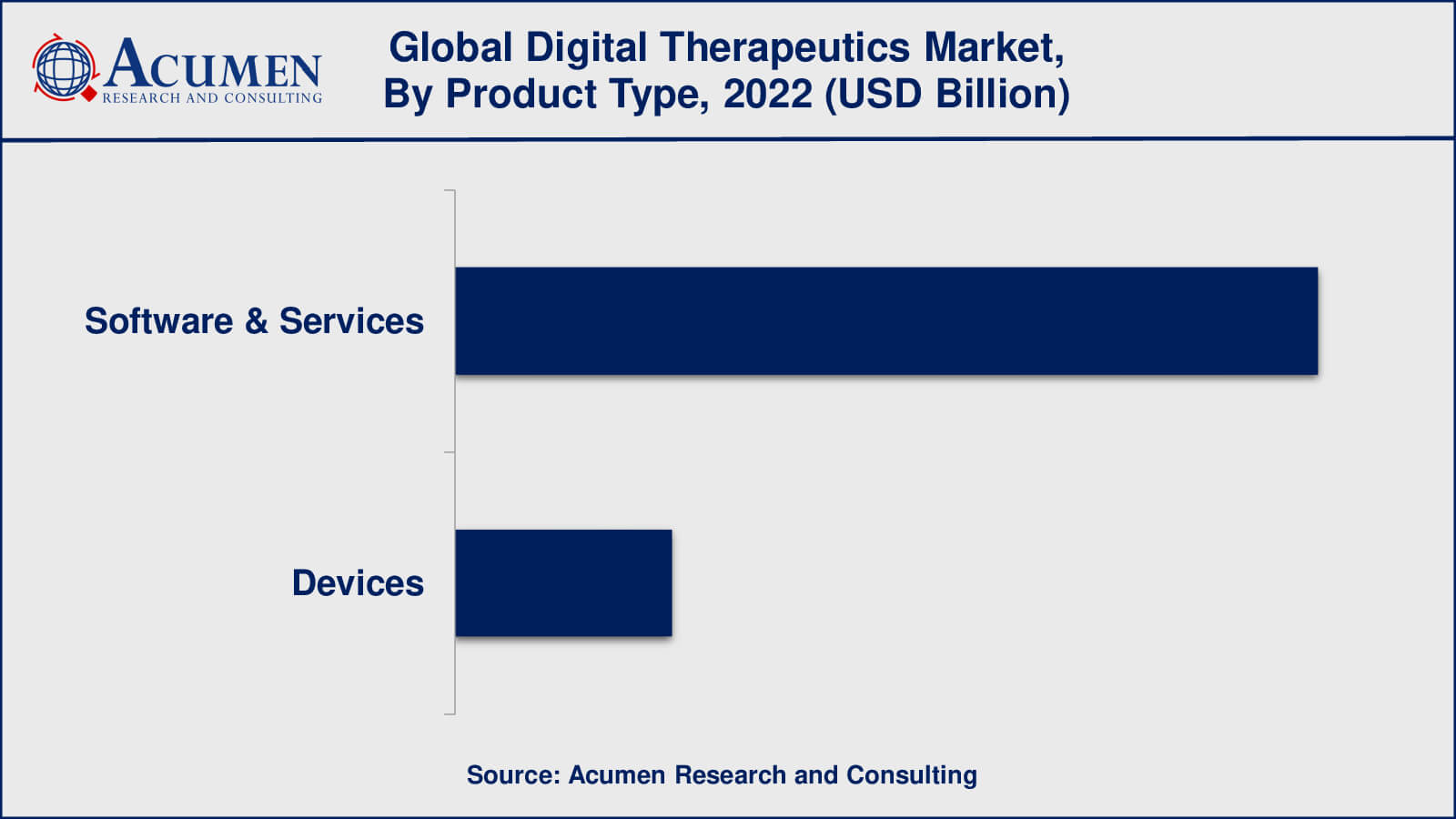

- Among product type, the software & services sub-segment occupied over US$ 4.2 billion revenue in 2022

- Based on sales channel, the B2C sub-segment gathered around 60% share in 2022

- Personalized treatment approaches driven by AI and data analytics is a popular digital therapeutics market trend that drives the industry demand

Digital therapeutics offer evidence-based therapeutic solutions to assist patients through an enhanced software program, ensuring the appropriate treatment of medical disorders. This approach involves analyzing patient data received from linked devices and sending notifications about changes in the patient's behavior. It is specifically designed for patients who are at risk of conditions such as diabetes, obesity, and type II diabetes, among others. The linked devices utilize external sensors to monitor the effects of medication taken by the patient. Diabetes and obesity are the major application areas for digital therapeutics. Devices such as insulin pumps, wearable gadgets, and blood glucose meters are connected to the system or application in order to send and receive critical patient data.

Digital Therapeutics Market Dynamics

Market Growth Drivers

- Rising awareness towards individual well being and health

- Increase in smart phones and internet usage amid public

- Growing demand for non-pharmacological treatment options

- Advances in technology and connectivity enhance the feasibility and effectiveness of digital therapeutic solutions

- Rising prevalence of chronic diseases like diabetes and cardiovascular conditions

- Cost-effectiveness and scalability of digital therapeutics appeal to healthcare providers and payers

Market Restraints

- Patient’s data privacy concerns related with digital therapeutic devices

- The elevated price of software development and public’s preference towards the traditional healthcare suppliers instead of digital consultancy

- Regulatory challenges and uncertainties regarding approval processes

- Limited reimbursement policies for digital therapeutics

- Connectivity issues and the digital divide pose barriers to accessing digital therapeutics

Market Opportunities

- Government proposals for precautionary healthcare measures

- Technological development in mobile healthcare, and enhancement in business enterprise asset funds

- The growing acceptance of smart phones and tablets, united with healthcare apps

- Integration of virtual reality (VR) and augmented reality (AR) technologies

Digital Therapeutics Market Report Coverage

| Market | Digital Therapeutics Market |

| Digital Therapeutics Market Size 2022 | USD 5.2 Billion |

| Digital Therapeutics Market Forecast 2032 | USD 66.1 Billion |

| Digital Therapeutics Market CAGR During 2023 - 2032 | 29.3% |

| Digital Therapeutics Market Analysis Period | 2020 - 2032 |

| Digital Therapeutics Market Base Year | 2022 |

| Digital Therapeutics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Akili Interactive, Biofourmis, CureApp, Dexcom, Ginger, Happify Health, Livongo (Now Teladoc Health), MyoKardia (Acquired by Bristol Myers Squibb), Otsuka Pharmaceutical and Click Therapeutics, Omada Health, Pear Therapeutics, Propeller Health, ResMed, Voluntis, and WellDoc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Therapeutics Market Insights

The digital landscape has been growing rapidly, driven by the rising health consciousness among people. This increasing awareness is poised to propel the market forward. Moreover, the market is being fueled by the rising incidences of chronic diseases and ongoing technological advancements. Changing customer preferences towards digital health, coupled with the demand for available, customized, and user-friendly medical solutions, are expected to further boost the market.

Digital therapeutics apps, including those for asthma, lifestyle management, mental health, and nutrition for diabetes, are particularly attractive to customers. The widespread use of the internet and the growing demand for smartphones are other major drivers for the digital therapeutics market.

The Food and Drug Administration (FDA) is playing a pivotal role in facilitating the rapid development of the digital therapeutics market. This motivation has led key players in the DTx field to accelerate the launch of their software platforms. The increase in venture capital investment and spending in the DTx market, along with the acceptance of regulatory guidelines, has generated substantial interest from customers in digital health and platforms. Consequently, key players are actively increasing their investments in this market.

Mental health is another significant factor expected to drive the growth of the digital therapeutics market. The COVID-19 pandemic exacerbated mental health challenges and underscored the need for innovative treatment options. This scenario presents excellent opportunities for digital therapeutics companies. For instance, in November 2020, the U.S. Food and Drug Administration (FDA) granted marketing authorization to Nightware, a digital therapeutics company, for the temporary reduction of sleep disturbances in patients with Post-Traumatic Stress Disorder.

Digital Therapeutics Market Segmentation

The global market for digital therapeutics is segmented based on product type, application, sales channel, end-user, and region.

Digital Therapeutics Product Type

- Software & Services

- Devices

As per the digital therapeutics industry analysis, the software and services category has historically dominated the market. To offer evidence-based treatment interventions, remote monitoring, and patient involvement, digital therapies predominantly rely on software applications and services. These software systems are intended to enhance patient outcomes for a variety of medical illnesses by providing personalized treatment plans, behavioral interventions, and data analytics.

While wearable sensors and connected medical devices are important for collecting patient data and improving the efficacy of digital therapeutics, the software and services component has frequently been the market's primary driver due to its central role in delivering therapeutic interventions.

Digital Therapeutics Applications

- Preventive

- Prediabetes

- Obesity

- Others

- Treatment

- Diabetes

- Respiratory Care

- Mental Health

- Cardiovascular

- Others

As per our digital therapeutics market analysis, treatment application accounted for utmost shares in 2022. Digital therapies treatment applications encompass the use of technology to supplement or replace traditional medical treatments for a variety of health issues. These applications are intended to enhance illness management and outcomes by offering evidence-based treatments and support. Chronic disease management, personalized treatments, behavioral therapy, rehabilitation, and pharmaceutical management are all important parts of therapeutic applications.

Among treatments, the diabetes segment has dominated the global market for digital therapeutics, holding the leading revenue share of over 28% in 2022. This segment is projected to witness the highest growth throughout the forecast period. This growth is driven by the increasing prevalence of diabetes worldwide. In 2019, according to the International Diabetes Federation (IDF), 463 million people suffered from diabetes, and by 2045, this number is estimated to reach around 700 million. This projection is expected to drive the demand for digital therapeutics solutions. For instance, patients suffering from diabetes require effective management, education, and monitoring to handle symptoms such as polyuria, polydipsia, polyphagia, as well as medical reminders.

On the other hand, preventive applications are expected to grow with rapid rate throughout the forecast period. Preventive applications of digital therapies aim to promote and maintain good health in order to avoid the development of chronic illnesses and other health issues. These applications seek to educate and empower people to adopt healthy behaviours and make educated decisions in order to lower their risk of disease. Key aspects include lifestyle interventions, behavioral change, risk assessment, wellness program, etc.

Digital Therapeutics Sales Channels

- B2C

- Patients

- Caregivers

- B2B

- Providers

- Payers

- Employers

- Pharmaceutical Companies

- Others

As per the digital therapeutics market forecast, the B2C sales channel is likely to gain significant traction from 2023 to 2032. The B2C sales channel involves directly reaching out to consumers and patients, often through app stores, online platforms, and marketing campaigns. This channel focuses on making digital therapeutics products accessible to individuals seeking self-management of their health conditions. Within the B2C landscape, the patient segment has dominated the digital therapeutics market, capturing significant revenue share in 2022. This segment is projected to achieve the highest compound annual growth rate (CAGR) throughout the forecast period. Patients constitute the primary end-users of therapeutic healthcare applications and programs. With the increasing number of patients grappling with chronic conditions, the demand for digital therapeutics is on the rise.

However, the B2B sales channel involves selling digital therapeutics solutions directly to healthcare providers, hospitals, clinics, pharmaceutical companies, and other businesses within the healthcare industry. B2B interactions often involve negotiations, partnerships, and collaborations to integrate digital therapeutics into existing healthcare systems.

Digital Therapeutics Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Therapeutics Market Regional Overview

North America is expected to be the largest market for digital therapeutics because of the fully developed health sector and increase in chronic diseases. Due to COVID-19, in April 2020, some rules and regulations were released by the U.S.FDA for the accessibility of digital therapeutic health devices for patients who are suffering from medical conditions. North America, notably the United States, has been a forerunner in digital therapies adoption. The region is well-developed in terms of healthcare, technical infrastructure, and regulatory frameworks. Market growth has been fueled by the existence of multiple digital health firms and cooperation with traditional healthcare institutions. Strong investments, increased venture capital financing, and a high frequency of chronic illnesses have all led to the expansion of this region's digital therapeutics industry.

The digital therapeutics market in Europe has also grown significantly. Countries with solid healthcare systems and supportive regulatory settings, such as the United Kingdom, Germany, and France, assist the adoption of digital health technologies. Government and healthcare organization initiatives to manage chronic illnesses and enhance patient outcomes through technology have fueled market growth.

Asia-Pacific region is expected to record the highest digital therapeutics market growth during the forecast period. This growth is mainly spurred by two major reasons– the presence of a large younger population base as compared to the other regions and fast digitization and urbanization. The Asia-Pacific region also presents a growing market for digital therapeutics due to its large population, rising healthcare awareness, and increasing smartphone penetration. To solve healthcare difficulties, countries such as China, Japan, and India are embracing digital health solutions. The need to treat chronic diseases widespread in the region, as well as attempts to improve healthcare accessibility and cost, are driving the use of digital therapies.

Digital Therapeutics Market Players

This section of the report pinpoints various key vendors of the market. Some of the prominent digital therapeutics companies offered in the report include Akili Interactive, Biofourmis, CureApp, Dexcom, Ginger, Happify Health, Livongo (Now Teladoc Health), MyoKardia (Acquired by Bristol Myers Squibb), Otsuka Pharmaceutical and Click Therapeutics, Omada Health, Pear Therapeutics, Propeller Health, ResMed, Voluntis, and WellDoc.

Frequently Asked Questions

What was the size of the global digital therapeutics market in 2022?

The size of digital therapeutics market was USD 5.2 billion in 2022.

What is the digital therapeutics market CAGR from 2023 to 2032?

The digital therapeutics market CAGR during the analysis period of 2023 to 2032 is 29.3%.

Which are the key players in the digital therapeutics market?

The key players operating in the global digital therapeutics market are including Akili Interactive, Biofourmis, CureApp, Dexcom, Ginger, Happify Health, Livongo (Now Teladoc Health), MyoKardia (Acquired by Bristol Myers Squibb), Otsuka Pharmaceutical and Click Therapeutics, Omada Health, Pear Therapeutics, Propeller Health, ResMed, Voluntis, and WellDoc.

Which region dominated the global digital therapeutics market share?

North America region held the dominating position in digital therapeutics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of digital therapeutics during the analysis period of 2023 to 2032.

What are the current trends in the global digital therapeutics industry?

The current trends and dynamics in the Digital Therapeutics industry include rising awareness towards individual well being and health, increase in smart phones and internet usage amid public, and growing demand for non-pharmacological treatment options.

Which product type held the maximum share in 2022?

The software & services product type held the maximum share of the digital therapeutics industry.?