Digital Signature Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Digital Signature Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

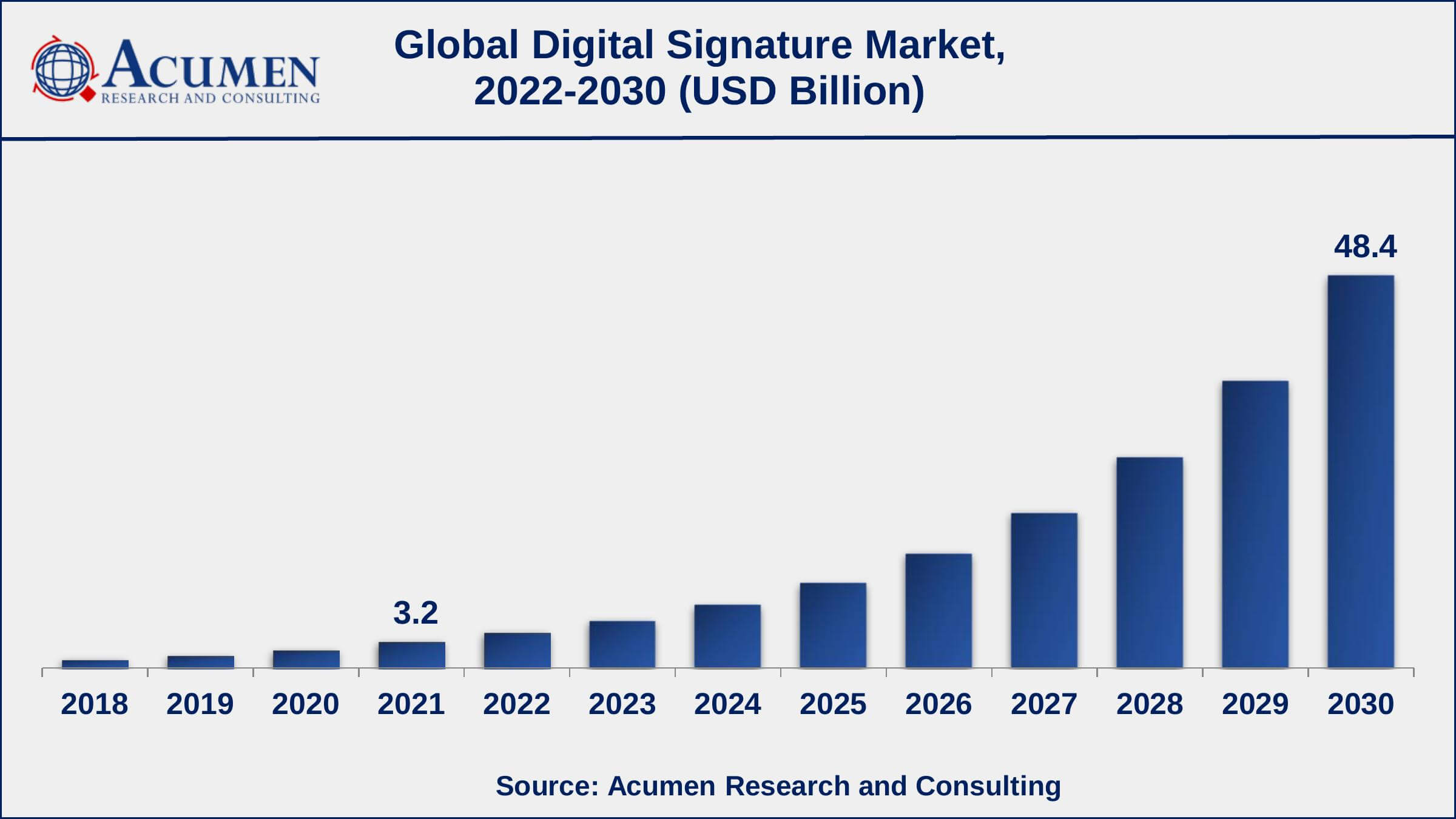

The Global Digital Signature Market Size gathered USD 3.2 Billion in 2021 and is set to garner a market size of USD 48.4 Billion by 2030 growing at a CAGR of 35.4% from 2022 to 2030.

A digital signature is a technique for confirming the legitimacy and integrity of a digital message or document. It assures that the message hasn't been tampered with in transit by encrypting and decrypting a message using a combination of a private key and a public key. The communication must be signed with the sender's private key and then confirmed with the sender's corresponding public key for a digital signature to be regarded as legitimate. This procedure aids in verifying that the message or document is authentic and hasn't been tampered with in any way.

Digital Signature Market Report Statistics

- Global digital signature market revenue is estimated to reach USD 48.4 Billion by 2030 with a CAGR of 35.4% from 2022 to 2030

- North America digital signature market value gathered more than USD 1.1 billion in 2021

- Asia-Pacific digital signature market growth will record a CAGR of more than 36% from 2022 to 2030

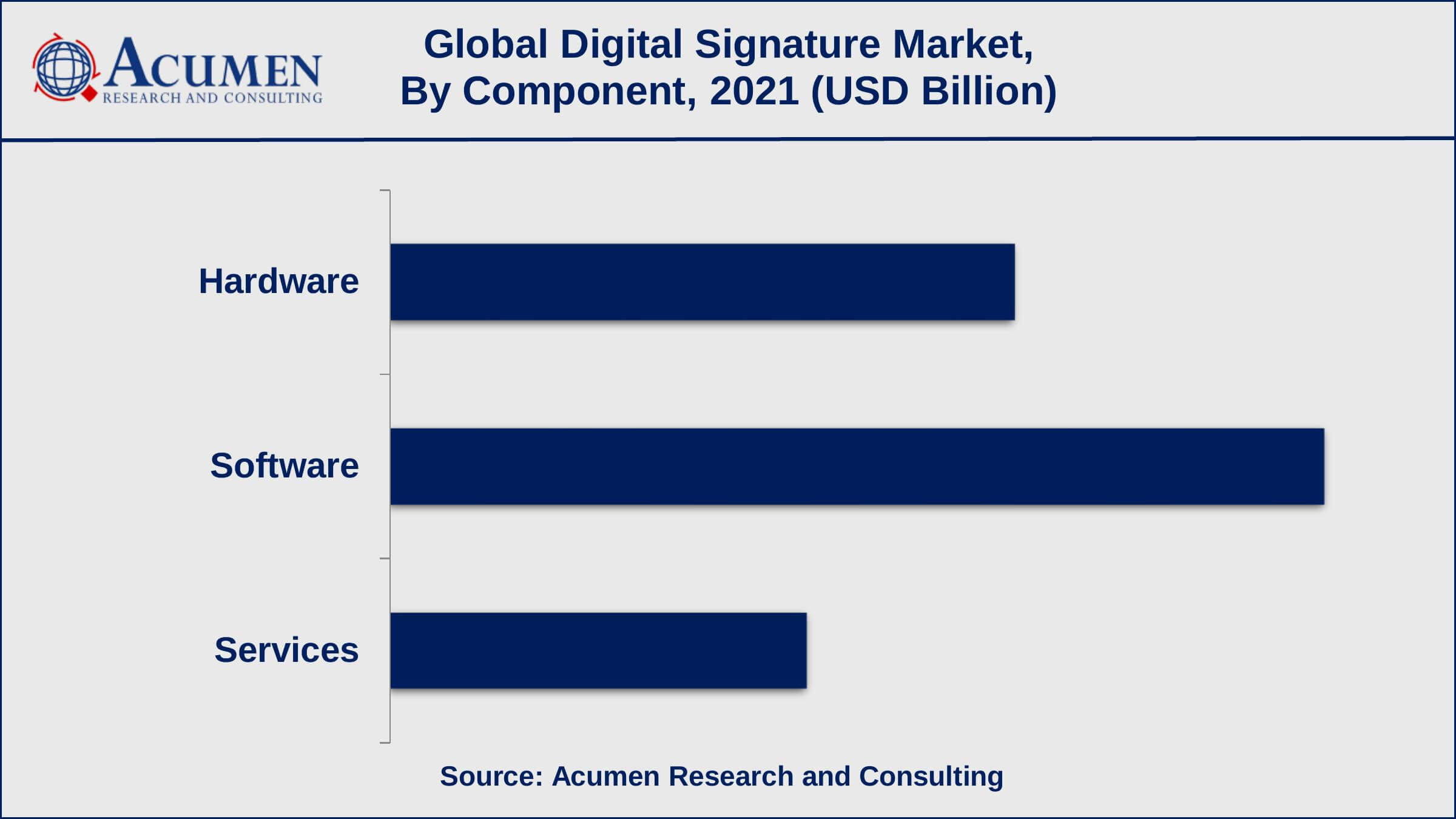

- Among component, the software sub-segment collected 45% share in 2021

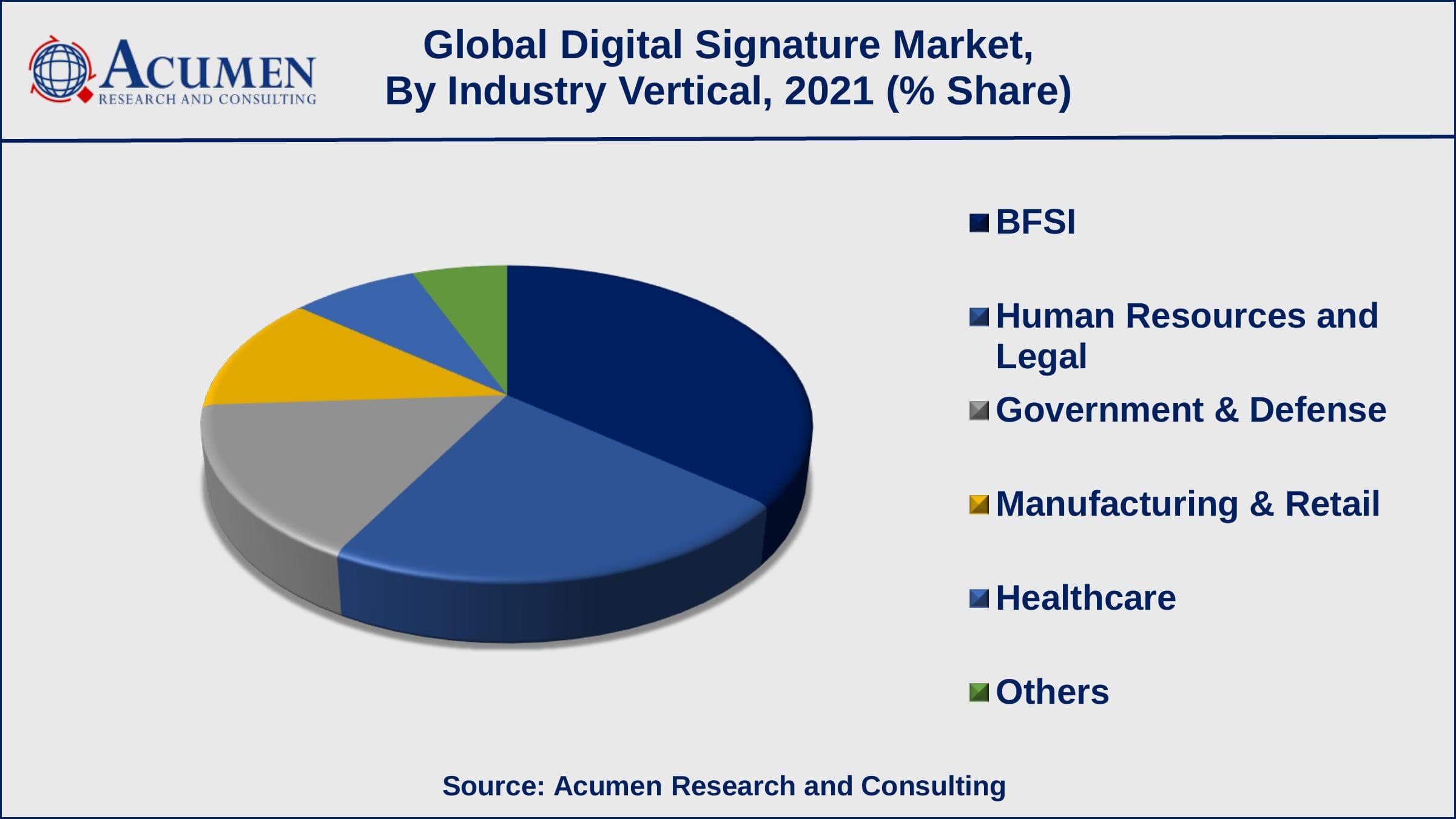

- Based on industry verticals, the BFSI sub-segment achieved US$ 1.2 billion in revenue in 2021

- The emergence of blockchain technology is a popular digital signature market trend that drives the industry demand

Global Digital Signature Market Dynamics

Market Drivers

- Increased adoption of digitalization

- Government regulations and compliance requirements

- The increasing trend of remote working and digital communication

- The need for digital transformation in various sectors

Market Restraints

- Limited awareness and understanding

- High cost of implementation

- Privacy and data security concerns

Market Opportunities

- Integration of digital technologies and IoT

- Advancements in technology such as biometric authentication

Digital Signature Market Report Coverage

| Market | Digital Signature Market |

| Digital Signature Market Size 2021 | USD 3.2 Billion |

| Digital Signature Market Forecast 2030 | USD 48.4 Billion |

| Digital Signature Market CAGR During 2022 - 2030 | 35.4% |

| Digital Signature Market Analysis Period | 2018 - 2030 |

| Digital Signature Market Base Year | 2021 |

| Digital Signature Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Component, By Deployment, By Industry Vertical, By Organization Size, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Adobe Systems, Inc., Ascertia, Datacard Corp., DocuSign, Entrust Corporation, IdenTrust, Inc., Secured Signing Limited, Signix, OneSpan, and Zoho Corporation Pvt. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Signature Market Growth Factors

Increased digitalization adoption is a key factor driving the global digital signature market value. The use of digital signatures is becoming more common as more businesses and individuals move their operations online. Many governments around the world are putting in place regulations requiring the use of digital signatures on certain types of documents and transactions. Digital signatures are more secure than traditional signatures, making them an appealing option for businesses and individuals looking to safeguard sensitive information.

However, many businesses and individuals are still unaware of digital signatures' benefits and capabilities, which can limit their adoption and usage. Digital signature solutions can be technically difficult to implement, especially for organizations with limited IT resources. The digital signature market currently lacks standardization, making it difficult for individuals and companies to know which solutions to trust and then use. Digital signature solutions may be exposed to cyber threats such as hacking or fraud, which may limit the market growth. Besides that, digital signature solutions may raise concerns about privacy and data security, which may limit their adoption and use.

On the other hand, the increasing integration of digital technologies such as IoT and Industry 4.0 in various sectors like manufacturing, healthcare, and logistics is expected to generate numerous growth opportunities for the market in the coming years. Furthermore, the popularity of cloud-based technology has aided in the growth of the digital signature market by making it easier to use and cost-effective.

Digital Signature Market Segmentation

The worldwide digital signature market is categorized based on component, deployment, organization size, industry vertical, and geography.

Digital Signature Market By Component

- Hardware

- Software

- Service

According to a digital signature industry analysis, the software segment generated the most revenue in 2021 and is expected to continue to do so in the future. This is due to the fact that software is the key component that allows digital signature functionality, and it is used in a variety of industries and applications. The digital signature software plug-ins, digital signature software application, and digital signature software libraries are all part of the software component. These software solutions make it possible for businesses and individuals to create, manage, and verify digital signatures, and they can be incorporated into existing systems and workflows. The hardware component includes signature capture devices such as digital signature pads, smartphones, and tablets. The services component includes vendor-provided professional services such as installation, customization, training, and support.

Digital Signature Market By Deployment

- Cloud-Based

- On-Premise

In the digital signature market, the deployment model that generates the fastest growth rate is cloud-based deployment. This is because cloud-based digital signature solutions are becoming increasingly popular among businesses and individuals due to their scalability, flexibility, and cost-effectiveness. Cloud-based deployment refers to the delivery of digital signature services over the internet. These solutions are typically provided as Software-as-a-Service (SaaS) and can be accessed through a web browser. Cloud-based digital signature solutions are highly scalable and can be easily accessed and used by businesses and individuals from anywhere with an internet connection.

Digital Signature Market By Industry Vertical

- BFSI

- Human Resources and Legal

- Government & Defense

- Manufacturing & Retail

- Healthcare

- Others

The banking, financial services, and insurance (BFSI) segment are one of the key segments of the digital signature market. Digital signatures are widely used in the BFSI sector for a wide range of applications, including the signing of contracts, agreements, and financial documents. In addition, the government segment is a significant part of the digital signature market. Digital signatures are widely used in the government sector for a wide range of applications, including the signing of official documents and records, such as birth certificates, ID cards, licenses, and government contracts.

Digital Signature Market By Organization Size

- Large Enterprises

- SMEs

As per the digital signature market forecast, the large enterprise sub-segment is expected to collect the utmost market share from 2022 to 2030. Large enterprises are a significant part of the digital signature market. They use digital signatures to improve the efficiency, security, and compliance of their business processes. Large enterprises use digital signatures for a wide range of applications, such as the signing of contracts, agreements, and financial documents. They also use them for document management, workflow automation, and e-signatures for human resources and procurement processes. Furthermore, large enterprises also have the resources to invest in advanced digital signature solutions and services that can help them to meet their specific needs and requirements.

Digital Signature Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Signature Market Regional Analysis

North America is expected to lead the digital signature market, owing to rising digitalization adoption and the presence of numerous key players in the region. The United States leads the North American digital signature market, closely followed by Canada. The Asia-Pacific digital signature market is expected to grow rapidly, owing to rising digitalization, a large population, and increased use of digital signatures in numerous industries such as healthcare, finance, and government. The Asia-Pacific digital signature market is dominated by China and Japan.

Digital Signature Market Players

Some of the leading Digital Signature companies include Adobe Systems, Inc., Ascertia, Datacard Corp., DocuSign, Entrust Corporation, IdenTrust, Inc., Secured Signing Limited, Signix, OneSpan, and Zoho Corporation Pvt. Ltd.

Frequently Asked Questions

What was the market size of the global digital signature in 2021?

The market size of digital signature was USD 3.2 Billion in 2021.

What is the CAGR of the global digital signature market during forecast period of 2022 to 2030?

The CAGR of digital signature market is 35.4% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global market are Adobe Systems, Inc., Ascertia, Datacard Corp., DocuSign, Entrust Corporation, IdenTrust, Inc., Secured Signing Limited, Signix, OneSpan, and Zoho Corporation Pvt. Ltd.

Which region held the dominating position in the global digital signature market?

North America held the dominating position in digital signature market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for digital signature market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global digital signature market?

The current trends and dynamics in the digital signature industry include increased adoption of digitalization, government regulations and compliance requirements, and the increasing trend of remote working and digital communication.

Which component held the maximum share in 2021?

The software held the maximum share of the digital signature market.