Digital Signage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Digital Signage Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

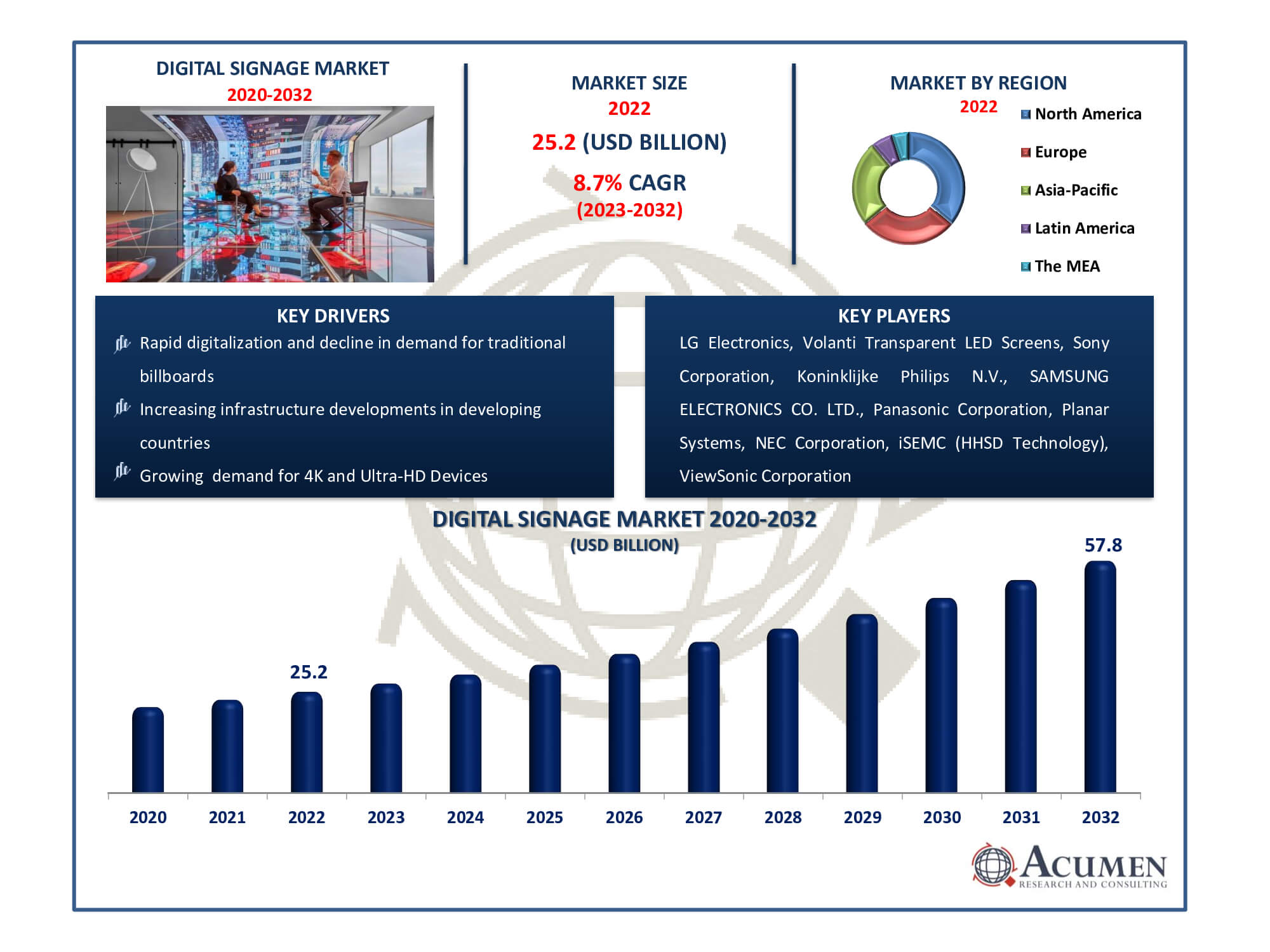

Request Sample Report

The Global Digital Signage Market Size accounted for USD 25.2 Billion in 2022 and is estimated to achieve a market size of USD 57.8 Billion by 2032 growing at a CAGR of 8.7% from 2023 to 2032.

Digital Signage Market Highlights

- Global digital signage market revenue is poised to garner USD 57.8 billion by 2032 with a CAGR of 8.7% from 2023 to 2032

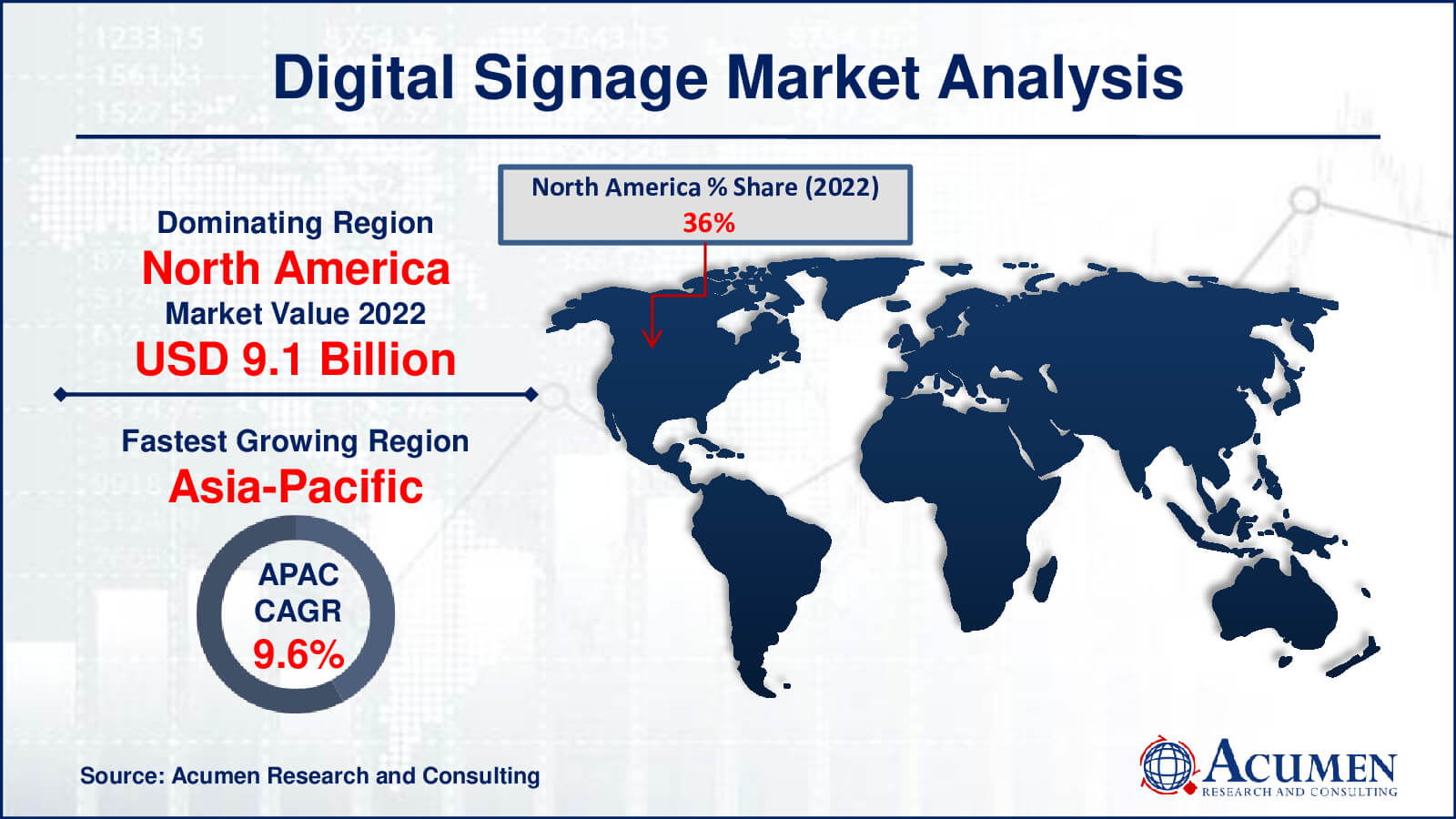

- North America digital signage market value occupied around USD 9.1 billion in 2022

- Asia-Pacific digital signage market growth will record a CAGR of more than 9.6% from 2023 to 2032

- Among offering, the hardware sub-segment generated over US$ 14.4 billion revenue in 2022

- Based on location, the in-store sub-segment generated around 71% share in 2022

- Increased demand for touchless solutions is a popular digital signage market trend that fuels the industry demand

To maintain high-quality content, digital signage relies primarily on hardware components. Conventional small and micro Transparent LED Screens have been replaced by large wall-sized LED and LCD transparent LED screens in many sectors. These transparent LED screens are designed to enhance the consumer experience and maximize the efficiency of marketing messages for retailers. They are suitable for various locations. Digital signage is a dynamic and transformational technology that has transformed how information, advertisements, and messages are communicated to audiences in a variety of locations. Digital signage, as opposed to traditional static signs, uses electronic transparent LED screens, such as LED, LCD, or projection screens, to convey content that can be remotely controlled and updated in real time.

Global Digital Signage Market Dynamics

Market Drivers

- Rapid digitalization and decline in demand for traditional billboards

- Increasing infrastructure developments in developing countries

- Rising demand for customized digital signage solutions across different sectors, especially healthcare and public transportation sectors

- Growing demand for 4K and ultra-HD devices

Market Restraints

- Deployment of widescreen alternatives such as projectors

- High cost of maintenance and support required for digital signage components

- Rise to a multitude of online retailers

Market Opportunities

- Rising demand for contactless kiosk solutions due to the pandemic

- Increase in preference of electronic giants towards large-screen transparent LED Screens

- Adoption of digital signage technology in SMEs

Digital Signage Market Report Coverage

| Market | Digital Signage Market |

| Digital Signage Market Size 2022 | USD 25.2 Billion |

| Digital Signage Market Forecast 2032 | USD 57.8 Billion |

| Digital Signage Market CAGR During 2023 - 2032 | 8.7% |

| Digital Signage Market Analysis Period | 2020 - 2032 |

| Digital Signage Market Base Year |

2022 |

| Digital Signage Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Offering, By Type, By Location, By Content Category, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | LG Electronics, Volanti Transparent LED Screens, Sony Corporation, Koninklijke Philips N.V., SAMSUNG ELECTRONICS CO. LTD., Panasonic Corporation, Planar Systems, NEC Corporation, iSEMC (HHSD Technology), ViewSonic Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Signage Market Insights

The growth of the digital signage market is being propelled by several factors, including increased government spending on technology and education sectors, changing user preferences, and decreasing transparent LED screen costs. Additionally, expanding infrastructure, the rising demand for in-store digital signage to enhance consumer awareness, increased deployment in airports, and heightened customer sensitivity are contributing significantly to market expansion.

Technological advancements in this sector, such as near area networking systems and mobile technology, along with various innovations in digital signage, have opened up new possibilities. However, certain factors may hinder market growth, including high initial capital costs, power-related issues, transparent LED screen damage concerns, and a lack of standardization.

The adoption of smart signage is also on the rise, exceeding traditional viewing experiences. Smart digital signage enhances advertising efforts, enabling marketers to provide engaging experiences that inform, educate, and entertain users, resulting in high user satisfaction. Smart signage serves as a powerful advertising medium for reaching large audiences and has emerged as a rapidly growing platform for information transparent LED screens, thanks to user-friendly systems developed over time through extensive research and development in various industries.

Emerging display technology such as microLED and quantum dots is another key factor. Display vendors are exploring innovation through the advancement of display technologies, which could provide them with a strategic advantage over their competitors. Among the latest developments are quantum dot and microLED displays, offering upgraded features compared to traditional LCD and OLED displays.

Emerging Display Technology such as microLED and Quantum Dots

These displays are built upon conventional LCD display systems to maximize performance, quality, and efficiency. They achieve this by incorporating a layer of quantum dots and microLEDs into an LCD or OLED matrix. In this setup, a coating of quantum dots is applied to a blue LED backlight. These quantum dots absorb all the blue light emitted by the screen while providing the necessary energy for red or green quantum dots to fluoresce. This results in a display with more vibrant colors and a broader range of hues, which are essential for modern Ultra-HD displays.

The integration of such innovative technologies into display systems presents promising growth opportunities for the digital signage market.

Digital Signage Market Segmentation

The worldwide market for digital signage is split based on offering, type, location, content category, end-user, and geography.

Digital Signage Offering

- Hardware

- Software

- Service

According to digital signage industry analysis, hardware have held the largest portion in the past years within the offering segment. While hardware is an essential component of digital signage, its dominance can shift depending on market circumstances and technical maturity. Displays, media players, mounts, and other physical components are examples of hardware. Moreover, The software that manages the content, scheduling, and overall performance of displays is an essential component of any digital signage solution. Content management systems (CMS) and digital signage software platforms allow users to efficiently generate, manage, and distribute content. The simplicity of use, features, and scalability of the software can all have a big impact on the success of digital signage operations.

Digital Signage Type

- Video Screen

- Transparent LED Screen

- Video wall

- Digital Poster

- Kiosks

- Others

Within the type segment, the video wall category emerged as the leader in terms of revenue share in previous years. Video walls are large-format displays with high resolution that produce a visually beautiful and immersive experience. Their impact is difficult to ignore, making them extremely effective at capturing and retaining viewers' attention. This visual effect is critical in industries such as retail and advertising for delivering promotional messages and brand awareness. Another driver is customization and adaptability size, arrangement, and content of video walls are completely configurable. They can be customised to match certain places and needs. Because of their adaptability, they are suited for a wide range of applications, from retail outlets to control rooms.

Digital Signage Location

- In-store

- Out-store

In recent years, the in-stroe segment has emerged as the dominant location segment in the digital signage market. The growth can be attributed to improved customer engagement. In-store digital signage is an efficient way to engage customers in a retail setting. Shoppers' attention is captured by interactive displays, advertising movies, and dynamic information, resulting in greater dwell time and potential sales.

in-store digital signage is used by retailers to promote items, discounts, and special deals. These displays function as an effective advertising tool, influencing purchasing decisions at the point of sale.

Digital Signage Content Category

- Broadcast

- News

- Weather

- Sports

- Others

- Non-Broadcast

In the digital signage market, the content category segment includes broadcast and non-broadcast. One of the key factors contributing to the dominance of the broadcast category is its broad applicability. Broadcast information, such as news, weather, and sports updates, appeals to a wide and diversified audience. These categories of information align with the broad interests and demands of a wide range of viewers, making them ideal for public spaces and high-traffic regions.

Another driving factor is real-time updates. Broadcast content is frequently updated in real time, delivering viewers the most up-to-date information. This real-time nature enhances viewer engagement and keeps them informed about current events, weather conditions, and sports scores.

Digital Signage End-User

- Retail

- Education

- Healthcare

- Corporate

- Stadiums

- Government

- Others

According to the digital signage market forecast, the retail segments have dominated the market share. Improved customer engagement is a key factor. Digital signage is increasingly used by retailers to engage customers and improve their shopping experiences. Dynamic and visually appealing displays capture buyers' attention, allowing shops to successfully sell products and offers.

Promotion and advertising is a key factor for the growth of the market. Retail digital signage is an effective tool for advertising and promoting products. These displays are used by retailers to highlight sales, discounts, and featured items, influencing purchasing decisions at the point of sale. Personalization is another driving factor. Retailers can personalise digital signage content to appeal to specific store locations, consumer demographics, and purchase habits. This level of personalisation makes messaging more relevant to certain audiences.

Digital Signage Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Signage Market Regional Analysis

The global digital signage market is expected to experience significant growth in North America during the forecast period. The decline in traditional mass media, such as broadcasting and print media, has created opportunities for digital signage solutions in the region. Additionally, the increasing trust in advertising through the adoption of digital signage has driven the deployment of digital signage technologies in North America.

In Asia-Pacific, including countries like India and China, as well as other emerging economies, an exponential compound annual growth rate (CAGR) is anticipated due to the adoption of digital signage solutions. The rapid developments in retail, infrastructure, and various industries are expected to generate substantial demand for digital signage in the APAC region.

Asia-Pacific is considered one of the major markets for digital signage solutions, primarily due to the cost-effectiveness of electronic signage services. Furthermore, Asia-Pacific region, with its rapid growth and emerging economies, is expected to be a significant contender for the largest market in the near future

Europe has a robust digital signage sector that is widely used in a variety of businesses. Countries such as the United Kingdom, Germany, and France are important marketplaces.

Digital Signage Market Players

Some of the top digital signage companies offered in our report includes LG Electronics, Volanti Transparent LED Screens, Sony Corporation, Koninklijke Philips N.V., SAMSUNG ELECTRONICS CO. LTD., Panasonic Corporation, Planar Systems, NEC Corporation, iSEMC (HHSD Technology), ViewSonic Corporation.

Frequently Asked Questions

What was the market size of the global digital signage in 2022?

The market size of digital signage was USD 25.2 billion in 2022.

What is the CAGR of the global digital signage market from 2023 to 2032?

The CAGR of digital signage is 8.7% during the analysis period of 2023 to 2032.

Which are the key players in the digital signage market?

The key players operating in the global market are LG Electronics, Volanti Transparent LED Screens, Sony Corporation, Koninklijke Philips N.V., SAMSUNG ELECTRONICS CO. LTD., Panasonic Corporation, Planar Systems, NEC Corporation, iSEMC (HHSD Technology), and ViewSonic Corporation.

Which region dominated the global digital signage market share?

North America held the dominating position in digital signage industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of digital signage during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global digital signage industry?

The current trends and dynamics in the digital signage industry include rapid digitalization and decline in demand for traditional billboards, increasing infrastructure developments in developing countries, rising demand for customized digital signage solutions across different sectors, especially healthcare and public transportation sectors, and growing demand for 4k and Ultra-HD devices.

Which offering held the maximum share in 2022?

The hardware offering held the maximum share of the digital signage industry.