Digital Pathology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Digital Pathology Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

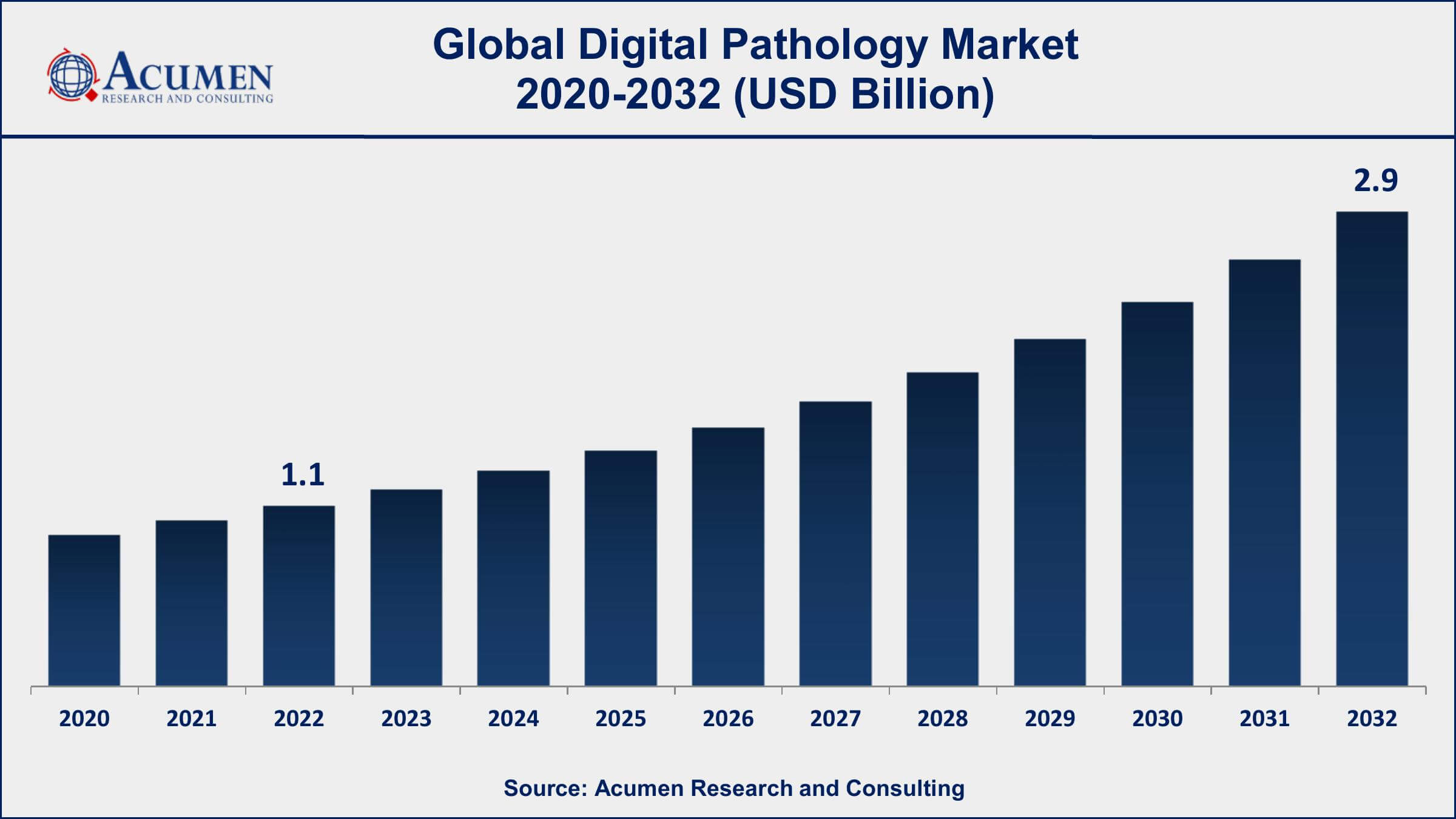

The Global Digital Pathology Market Size accounted for USD 1.1 Billion in 2022 and is projected to achieve a market size of USD 2.9 Billion by 2032 growing at a CAGR of 10.3% from 2023 to 2032.

Digital Pathology Market Highlights

- Global Digital Pathology Market revenue is expected to increase by USD 2.9 Billion by 2032, with a 10.3% CAGR from 2023 to 2032

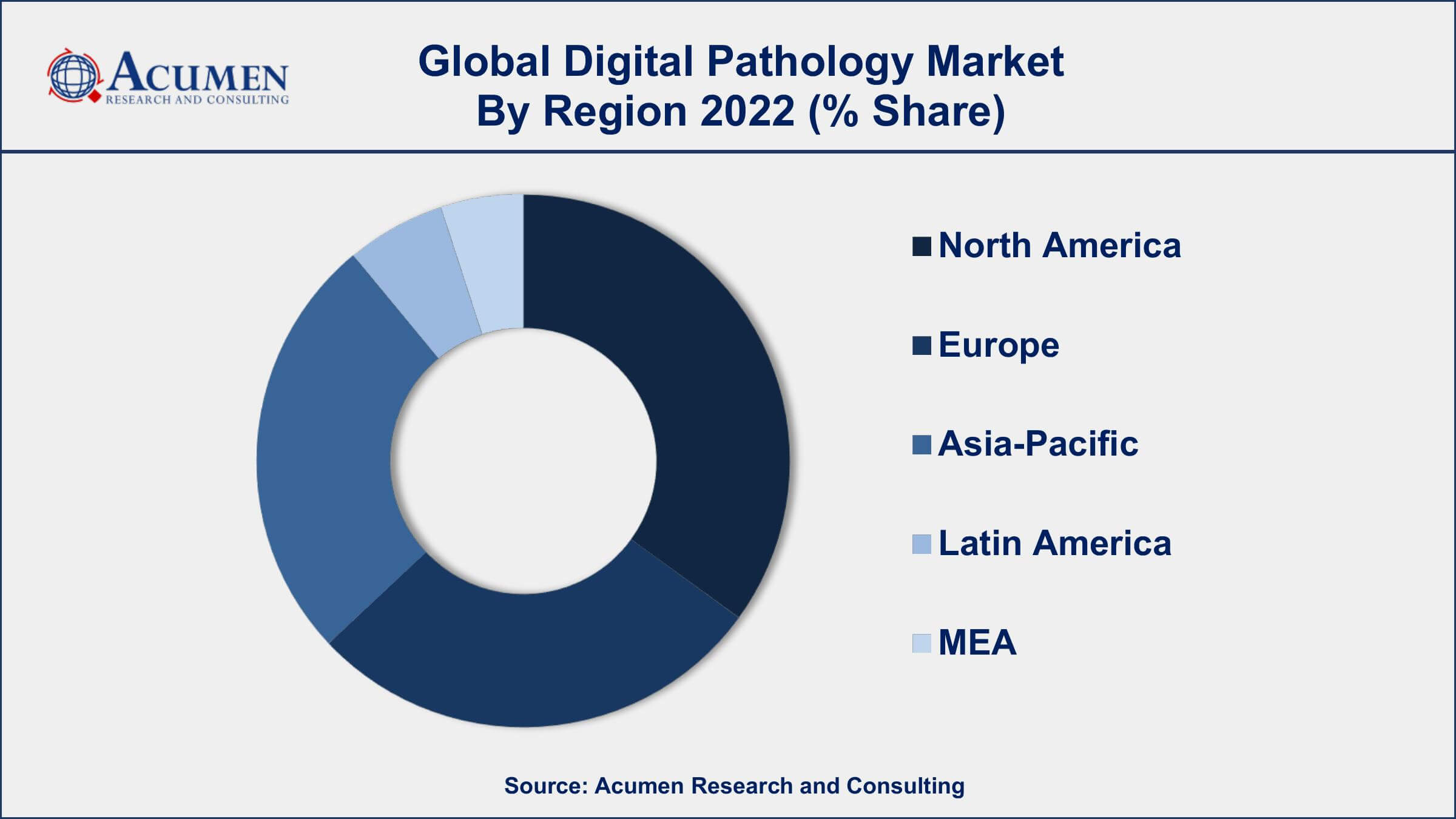

- North America region led with more than 41% of Digital Pathology Market share in 2022

- Asia-Pacific Digital Pathology Market growth will record a CAGR of more than 12.2% from 2023 to 2032

- By product, the device segment has recorded more than 52% of the revenue share in 2022

- By application, the academic research segment has accounted more than 44% of the revenue share in 2022

- Increasing demand for efficient and accurate diagnostic solutions, drives the Digital Pathology Market value

Digital pathology is a specialized field in medicine that involves the digitization of traditional glass slides containing tissue samples. Instead of analyzing tissue samples under a microscope, digital pathology uses high-resolution scanners to convert these slides into digital images. These digitized images can be stored, viewed, analyzed, and shared using computer technology. The application of digital pathology enables pathologists, researchers, and clinicians to access and collaborate on pathology data remotely, leading to more efficient diagnostics, better decision-making, and improved patient outcomes.

The market for digital pathology has been experiencing significant growth in recent years. Advancements in imaging technology, the increasing adoption of digital solutions in healthcare, and the growing need for better diagnostic accuracy and efficiency are key drivers of this growth. Moreover, the rise in cancer prevalence and the demand for personalized medicine have further fueled the demand for digital pathology solutions. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms with digital pathology systems has opened up new possibilities for automated analysis and enhanced diagnostic capabilities. The global digital pathology market encompasses various components, including hardware, software, and services, with a wide range of applications in research, diagnostics, drug development, and education.

Global Digital Pathology Market Trends

Market Drivers

- Increasing demand for efficient and accurate diagnostic solutions

- Advancements in imaging technology and slide scanning systems

- Growing prevalence of chronic diseases, especially cancer

- Rising adoption of digitalization in healthcare

- Need for remote access and collaboration among pathologists

Market Restraints

- High initial setup costs and infrastructure requirements

- Concerns about data privacy and security

Market Opportunities

- Expansion of digital pathology applications in drug discovery and development

- Potential for personalized medicine and targeted therapies

Digital Pathology Market Report Coverage

| Market | Digital Pathology Market |

| Digital Pathology Market Size 2022 | USD 1.1 Billion |

| Digital Pathology Market Forecast 2032 | USD 2.9 Billion |

| Digital Pathology Market CAGR During 2023 - 2032 | 10.3% |

| Digital Pathology Market Analysis Period | 2020 - 2032 |

| Digital Pathology Market Base Year | 2022 |

| Digital Pathology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Philips Healthcare, Leica Biosystems Nussloch GmbH (Danaher Corporation), Roche Diagnostics, Hamamatsu Photonics K.K., Ventana Medical Systems, Inc. (Roche), Olympus Corporation, Nikon Corporation, Sectra AB, Visiopharm A/S, Indica Labs, Inc., Huron Digital Pathology Inc., and 3DHISTECH Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital pathology is a cutting-edge medical technology that involves the digitization of traditional glass slides containing tissue samples. Instead of analyzing these samples under a microscope, high-resolution scanners are used to convert the slides into digital images. These digitized images can then be stored, viewed, and analyzed using computer technology. Digital pathology allows pathologists, researchers, and clinicians to access and share pathology data remotely, enabling efficient diagnostics, better collaboration, and improved patient care. Moreover, it opens up opportunities for leveraging artificial intelligence and machine learning algorithms to assist in automated image analysis, leading to faster and more accurate diagnoses.

The application of digital pathology spans across various areas in healthcare. In diagnostics, digital pathology facilitates telepathology, where pathologists can review and interpret slides remotely, making it easier to access expertise regardless of geographical boundaries. It also streamlines the process of second opinions and consultations among experts. Furthermore, digital pathology plays a crucial role in research and education. Researchers can store large volumes of digitized samples in databases, enabling efficient analysis and comparison of pathological data.

The digital pathology market had been experiencing robust growth and was expected to continue its upward trajectory in the coming years. The market growth was primarily driven by several factors, including the increasing demand for efficient and accurate diagnostic solutions, advancements in imaging technology, and the rising prevalence of chronic diseases, especially cancer. As healthcare providers and researchers sought improved ways to diagnose and treat diseases, digital pathology emerged as a promising solution, enabling pathologists to access, analyze, and collaborate on pathology data remotely. Moreover, the integration of artificial intelligence (AI) and machine learning in digital pathology systems offered enhanced image analysis and diagnostic capabilities, further propelling market growth.

Digital Pathology Market Segmentation

The global Digital Pathology Market segmentation is based on product, application, end-use, and geography.

Digital Pathology Market By Product

- Software

- Storage System

- Device

According to the digital pathology industry analysis, the device segment accounted for the largest market share in 2022. The device segment encompasses various components critical to the digital pathology workflow, including slide scanners, image analysis software, and communication systems. One of the primary drivers of device segment growth was the continuous advancement in imaging technology and slide scanning systems. High-resolution scanners capable of producing clear and detailed digital images of tissue samples allowed for more accurate and precise diagnoses, attracting healthcare institutions and laboratories to invest in these devices. Additionally, the integration of artificial intelligence (AI) and machine learning algorithms with digital pathology devices offered significant opportunities for growth.

Digital Pathology Market By Application

- Drug Discovery & Development

- Disease Diagnosis

- Academic Research

In terms of applications, the academic research segment is expected to witness significant growth in the coming years. Academic research institutions play a crucial role in advancing medical knowledge and understanding disease pathology, making digital pathology an essential tool in their research endeavors. Digital pathology offers various advantages for academic researchers, such as the ability to digitize and store vast collections of tissue samples, facilitating easier access and sharing of data among researchers worldwide. One of the primary drivers of the academic research segment's growth was the increasing demand for advanced imaging and analytical tools. Digital pathology systems enable researchers to analyze tissue samples with greater precision, aiding in the discovery of new biomarkers, understanding disease mechanisms, and identifying potential therapeutic targets.

Digital Pathology Market By End-use

- Hospitals

- Diagnostic Labs

- Biotech & Pharma Companies

- Academic & Research Institutes

According to the digital pathology market forecast, the diagnostic labs segment is expected to witness significant growth in the coming years. Diagnostic laboratories are crucial components of the healthcare ecosystem, providing essential pathology services for disease diagnosis and treatment planning. The adoption of digital pathology in diagnostic labs offered numerous benefits, including improved diagnostic accuracy, enhanced workflow efficiency, and streamlined collaboration between pathologists and healthcare professionals. One of the primary drivers of the diagnostic labs segment's growth was the increasing demand for faster and more accurate diagnostic solutions. Digital pathology systems allowed pathologists to access and analyze digitized tissue samples remotely, reducing turnaround times and enabling quicker diagnoses.

Digital Pathology Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Pathology Market Regional Analysis

North America dominates the digital pathology market for several reasons, making it a major player in this rapidly evolving industry. One of the key factors contributing to North America's dominance is the region's advanced healthcare infrastructure and high adoption rate of digital technologies. The United States and Canada have well-established healthcare systems, leading to early adoption and integration of digital pathology solutions into their medical practices. Moreover, the presence of leading companies and research institutions specializing in digital pathology technologies in North America has further propelled the market's growth and innovation. Additionally, North America boasts a strong emphasis on research and development, which has led to the continuous evolution and improvement of digital pathology systems. The region's focus on cutting-edge technologies, such as artificial intelligence (AI) and machine learning, has driven the integration of these capabilities into digital pathology solutions, enhancing diagnostic accuracy and efficiency. The availability of skilled healthcare professionals and pathologists who are open to embracing new technologies has also played a significant role in the region's dominance.

Digital Pathology Market Player

Some of the top digital pathology market companies offered in the professional report include Philips Healthcare, Leica Biosystems Nussloch GmbH (Danaher Corporation), Roche Diagnostics, Hamamatsu Photonics K.K., Ventana Medical Systems, Inc. (Roche), Olympus Corporation, Nikon Corporation, Sectra AB, Visiopharm A/S, Indica Labs, Inc., Huron Digital Pathology Inc., and 3DHISTECH Ltd.

Frequently Asked Questions

What was the market size of the global digital pathology in 2022?

The market size of digital pathology was USD 1.1 Billion in 2022.

What is the CAGR of the global digital pathology market from 2023 to 2032?

The CAGR of digital pathology is 10.3% during the analysis period of 2023 to 2032.

Which are the key players in the digital pathology market?

The key players operating in the global market are including Philips Healthcare, Leica Biosystems Nussloch GmbH (Danaher Corporation), Roche Diagnostics, Hamamatsu Photonics K.K., Ventana Medical Systems, Inc. (Roche), Olympus Corporation, Nikon Corporation, Sectra AB, Visiopharm A/S, Indica Labs, Inc., Huron Digital Pathology Inc., and 3DHISTECH Ltd.

Which region dominated the global digital pathology market share?

North America held the dominating position in digital pathology industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of digital pathology during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global digital pathology industry?

The current trends and dynamics in the digital pathology industry include increasing demand for efficient and accurate diagnostic solutions, advancements in imaging technology and slide scanning systems, and growing prevalence of chronic diseases, especially cancer.

Which application held the maximum share in 2022?

The academic research application held the maximum share of the digital pathology industry.