Digital Banking Market | Acumen Research and Consulting

Digital Banking Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format : ![]()

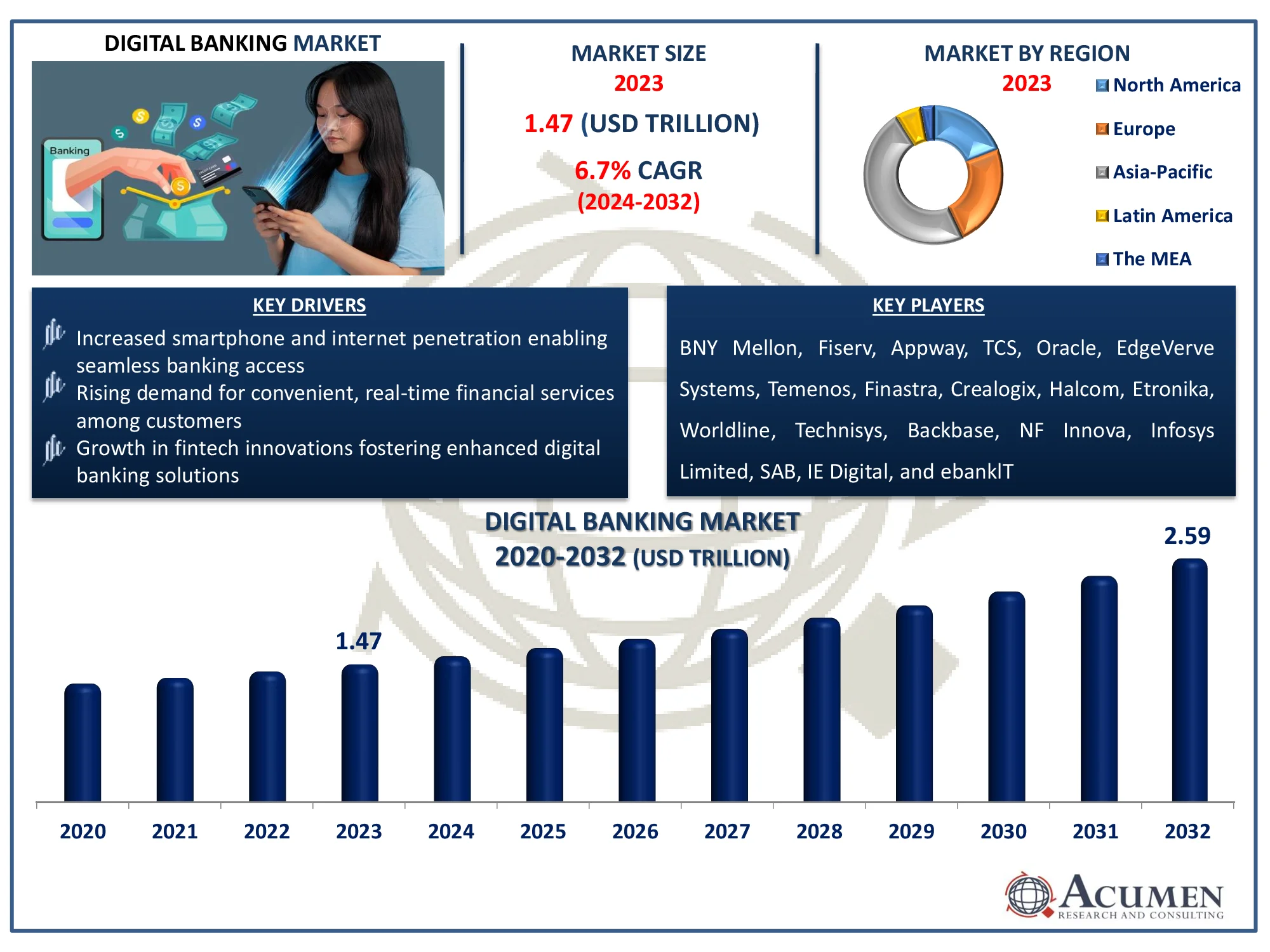

The Global Digital Banking Market Size accounted for USD 1.47 Trillion in 2023 and is estimated to achieve a market size of USD 2.59 Trillion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Digital Banking Market Highlights

- The global digital banking market is anticipated to reach USD 2.59 trillion by 2032, growing at a CAGR of 6.7% between 2024 and 2032

- In 2023, the Asia-Pacific digital banking market was valued at approximately USD 704.16 billion

- The North American digital banking market is projected to expand at a CAGR exceeding 5.5% from 2024 to 2032

- The investment banking segment accounted for 36% of the total market share in 2023

- Transactional services dominated the market in 2023, capturing 81% of the market share

- Enhanced focus on cybersecurity and fraud prevention measure is the digital banking market trend that fuels the industry demand

Digital banking refers to the digitization of traditional banking services, enabling banking activities to be conducted entirely through the internet. This transition from conventional to digital banking is a gradual process involving various stages of digitizing banking services. It encompasses web-based solutions, extensive process automation, and cross-institutional services facilitated by APIs to deliver banking products and execute transactions seamlessly. Digital banking allows users to access financial information and perform transactions via mobile devices, desktop platforms, and ATMs. Its core functionalities include money transfers, remote deposits, account management, and bill payments.

Global Digital Banking Market Dynamics

Market Drivers

- Increased smartphone and internet penetration enabling seamless banking access

- Rising demand for convenient, real-time financial services among customers

- Growth in fintech innovations fostering enhanced digital banking solutions

Market Restraints

- Cybersecurity concerns and data breaches affecting customer trust

- High initial costs of implementing digital banking infrastructure

- Regulatory challenges and compliance complexities in different regions

Market Opportunities

- Expansion of digital banking services in emerging markets with unbanked populations

- Integration of advanced technologies like AI and blockchain for enhanced offerings

- Growing adoption of APIs for cross-institutional collaborations and innovative solutions

Digital Banking Market Report Coverage

|

Market |

Digital Banking Market |

|

Digital Banking Market Size 2023 |

USD 1.47 Trillion |

|

Digital Banking Market Forecast 2032 |

USD 2.59 Trillion |

|

Digital Banking Market CAGR During 2024 - 2032 |

6.7% |

|

Digital Banking Market Analysis Period |

2020 - 2032 |

|

Digital Banking Market Base Year |

2023 |

|

Digital Banking Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Service, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

BNY Mellon, Fiserv, Appway, TCS, Oracle, EdgeVerve Systems, Temenos, Finastra, Crealogix, Halcom, Etronika, Worldline, Technisys, Backbase, NF Innova, Infosys Limited, SAB, IE Digital, and ebanklT. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digital Banking Market Insights

The global digital banking market is driven by several key factors, including the widespread adoption of online and mobile banking platforms, increasing smartphone usage, and growing internet penetration. For instance, as per India Brand Equity Foundation, as of July 2024, a total of 602 banks were actively utilizing the Unified Payments Interface (UPI). During this period, the number of digital transactions reached 15.08 billion, with a cumulative transaction value of approximately US$ 25.27 billion (INR. 2.1 trillion).

The integration of advanced technologies, the need to enhance customer experiences, rising retail banking activities, and supportive government policies further contribute to market growth. For instance, on October 16, 2022, Prime Minister Shri Narendra Modi inaugurated 75 Digital Banking Units (DBUs), for nation. This initiative strengthens the digital banking ecosystem and contributes to market expansion.

The rapid adoption of online and mobile banking platforms stands out as a major growth driver, with many banking institutions shifting to digital channels to meet customer demands. This shift is fueled by the global surge in smartphone usage and internet accessibility. For instance, in 2022, the International Telecommunication Union (ITU) reported over 8.58 billion mobile subscriptions globally, surpassing the mid-year world population of 7.95 billion. Growing smartphone usage further boosts industry’s adoption of digital banking in forecast year.

To remain competitive, banks are implementing innovative technologies to reduce operating costs while modernizing their systems to provide personalized services and an improved customer experience at lower costs. Library of Congress Research Guides states that with the growing prevalence of digital money and the fact that over 50% of the global population now owns a smartphone, many believe that blockchain technology could replace the outdated systems used by the banking industry. This emerging partnership in financial technology may pave the way for more accessible and widespread digital financial products. However, the growing threat of cyberattacks poses a significant challenge to the global digital banking market, potentially hindering its growth.

Digital Banking Market Segmentation

The worldwide market for digital banking is split based on type, service, end-user, and geography.

Digital Banking Market By Type

- Retail Banking

- Corporate Banking

- Investment Banking

According to the digital banking industry analysis, investment banking dominates due to its critical role in facilitating high-value transactions, mergers, acquisitions, and capital raising. With advanced digital platforms, investment banks streamline operations, enhance client experiences, and offer personalized solutions to businesses and high-net-worth individuals. The integration of cutting-edge technologies like AI and blockchain has further strengthened investment banking’s efficiency and scalability. This dominance reflects the segment’s ability to adapt to evolving financial landscapes while maintaining robust profitability.

Digital Banking Market By Service

- Transactional Services

- Cash Deposits And Withdrawal

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Non-Transactional Services

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

Transactional services lead the digital banking industry by catering to the everyday banking needs of individuals and businesses, such as fund transfers, bill payments, and account management. Their dominance is driven by the convenience, speed, and security provided through digital platforms, which have become integral to modern financial activities. Innovations like mobile wallets, instant payments, and real-time transaction tracking further enhance user adoption. As these services address essential financial operations, their widespread usage cements their leadership in the digital banking landscape.

Digital Banking Market By End-User

- Small- and Medium-Sized Enterprises

- Large-Sized Enterprises

According to the digital banking market forecast, large-sized enterprise having extensive financial needs and higher transaction volumes. They rely on digital banking solutions for efficient cash flow management, multi-currency transactions, and streamlined treasury services. These enterprises benefit from customized digital platforms that integrate advanced analytics, automation, and secure payment systems, making them a key driver of market growth.

On the other hand, small-and medium-sized enterprises (SMEs) are rapidly adopting digital banking to access affordable and scalable financial services, driving growth in this segment as they embrace technology for streamlined operations.

Digital Banking Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digital Banking Market Regional Analysis

For several reasons, Asia-Pacific dominates in digital banking market, fueled by its large, tech-savvy population and rapidly expanding smartphone usage. Governments in countries like India and China are actively promoting digital financial inclusion through initiatives such as cashless economies and digital ID systems. The region’s increasing investment in digital infrastructure and key players initiatives boosts digital banking sector in Asian region. For instance, in February 2024, nCino collaborated with Saikyo Bank, Ltd. in Japan to streamline its mortgage business processes, spanning from reception to loan execution, with the goal of boosting operational efficiency and enhancing customer convenience.

North American region is fastest-growing in digital banking market due to its advanced technological infrastructure, high internet penetration, and early adoption of digital financial services. The region's mature banking sector and strong emphasis on customer-centric innovations drive growth. For instance, in April 2024, nCino upgraded its consumer banking solution for banks and credit unions by enhancing omnichannel functionality and simplifying multi-product origination workflows for both bankers and customers. Additionally, regulatory frameworks supporting fintech partnerships and digital transformation further strengthen North America's leadership in the market.

Digital Banking Market Players

Some of the top digital banking companies offered in our report includes BNY Mellon, Fiserv, Appway, TCS, Oracle, EdgeVerve Systems, Temenos, Finastra, Crealogix, Halcom, Etronika, Worldline, Technisys, Backbase, NF Innova, Infosys Limited, SAB, IE Digital, and ebanklT.

Frequently Asked Questions

How big is the Digital Banking market?

The digital banking market size was valued at USD 1.47 Trillion in 2023.

What is the CAGR of the global Digital Banking market from 2024 to 2032?

The CAGR of digital banking is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the Digital Banking market?

The key players operating in the global market are including BNY Mellon, Fiserv, Appway, TCS, Oracle, EdgeVerve Systems, Temenos, Finastra, Crealogix, Halcom, Etronika, Worldline, Technisys, Backbase, NF Innova, Infosys Limited, SAB, IE Digital, and ebanklT

Which region dominated the global Digital Banking market share?

Asia-Pacific held the dominating position in digital banking industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of digital banking during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global Digital Banking industry?

The current trends and dynamics in the digital banking industry include increased smartphone and internet penetration enabling seamless banking access, rising demand for convenient, real-time financial services among customers, and growth in fintech innovations fostering enhanced digital banking solutions.

Which type held the maximum share in 2023?

The investment banking type held the maximum share of the digital banking industry.