Digestive Health Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Digestive Health Products Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

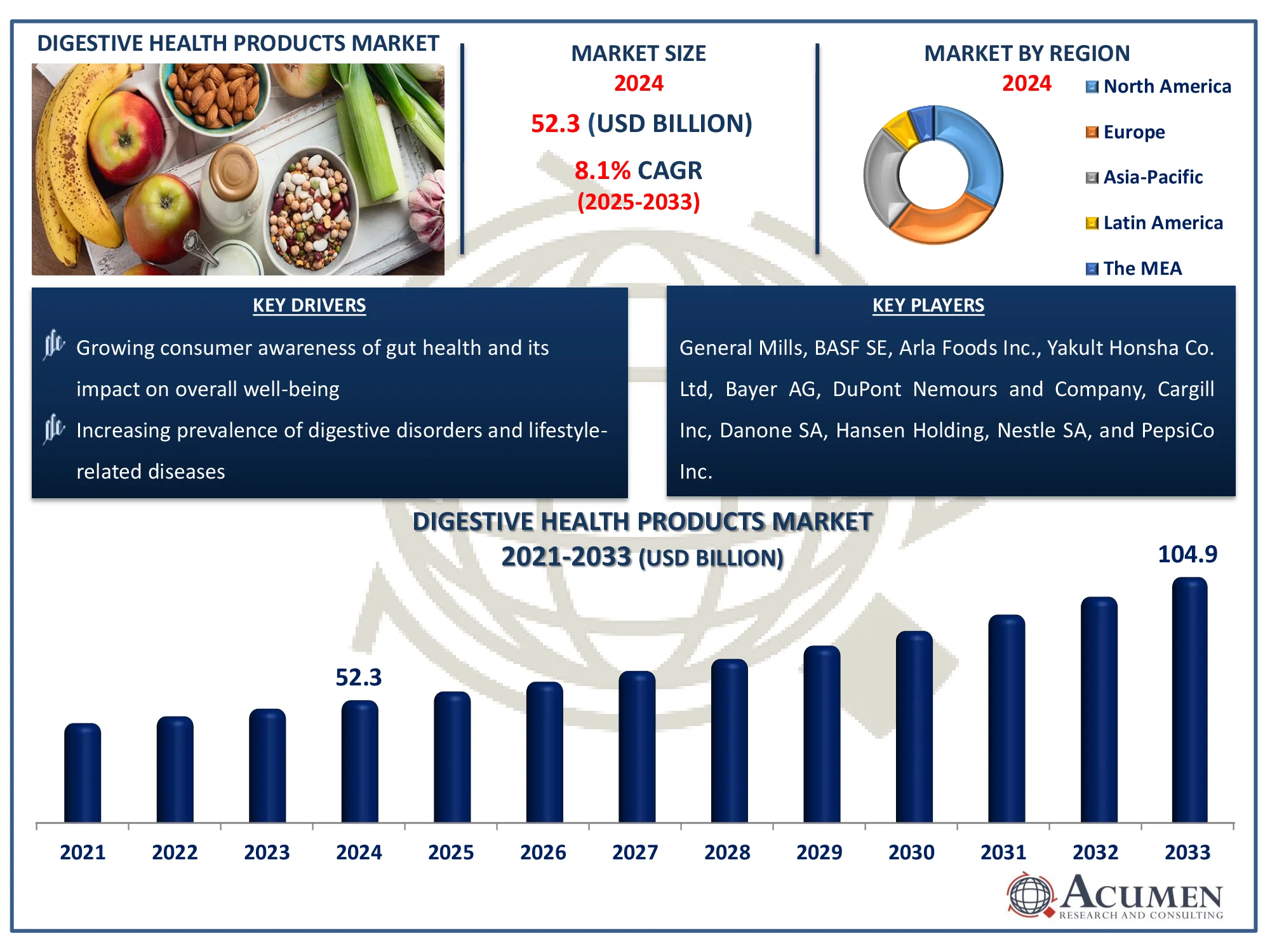

The Global Digestive Health Products Market Size accounted for USD 52.3 Billion in 2024 and is estimated to achieve a market size of USD 104.9 Billion by 2033 growing at a CAGR of 8.1% from 2025 to 2033.

Digestive Health Products Market Highlights

- Global digestive health products market revenue is poised to garner USD 104.9 billion by 2033 with a CAGR of 8.1% from 2025 to 2033

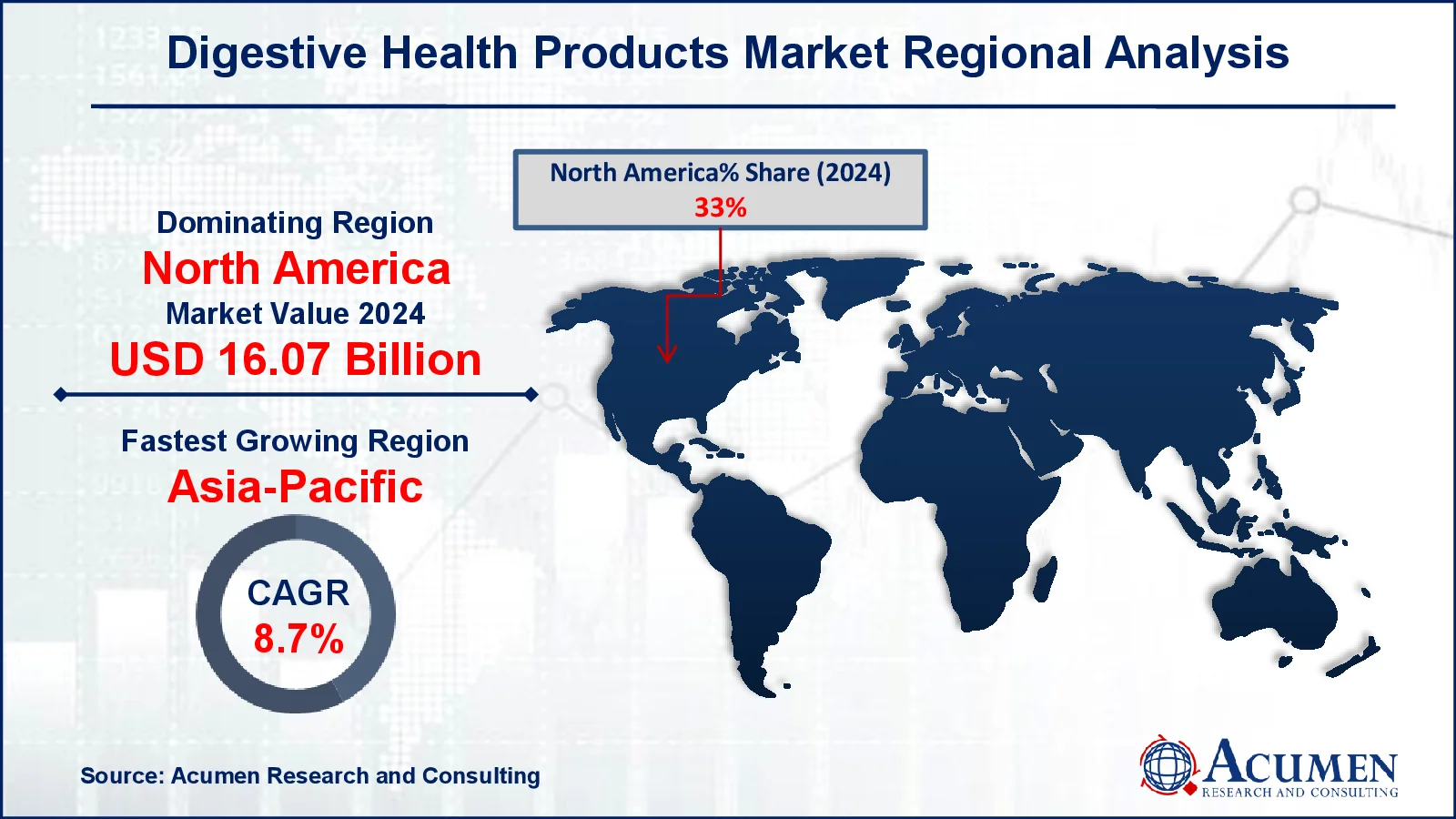

- North America digestive health products market value occupied around USD 16.07 billion in 2024

- Asia-Pacific digestive health products market growth will record a CAGR of more than 8.7% from 2025 to 2033

- Among ingredient, the probiotics sub-segment generated 87% of share in 2024

- Dairy products dominates and covers 73% of share in digestive health products market

- Advancements in gut microbiome research driving customized digestive health solutions is a popular market trend that fuels the industry demand

Digestive health products improve digestive tract function by regulating stomach acid levels and increasing helpful intestinal bacteria. They include probiotics, prebiotics, and supplements that aid in nutritional absorption and digestion. Yogurt helps balance intestinal flora, while omega-3s and carotenoids provide cardiovascular and anti-carcinogenic properties. These health benefits are fueling industry expansion.

According to the National Institute of Health (NIH), research into the effectiveness of probiotics is gaining popularity due to the increased number of publications, products, and general knowledge of their benefits. The general population, researchers, governmental agencies (such as the WHO/FAO), and pharmaceutical and food industries are all becoming increasingly interested in probiotics. This spike in interest is expected to drive up demand for probiotics and, eventually, the digestive health products market.

Global Digestive Health Products Market Dynamics

Market Drivers

- Growing consumer awareness of gut health and its impact on overall well-being

- Increasing prevalence of digestive disorders and lifestyle-related diseases

- Rising demand for functional foods and dietary supplements

Market Restraints

- High cost of digestive health products compared to conventional alternatives

- Stringent regulatory guidelines and approval processes

- Limited consumer awareness in developing regions

Market Opportunities

- Innovation in product formulations, such as plant-based and clean-label options

- Expansion into emerging markets with growing health-conscious populations

- Increased research and scientific backing for the health benefits of probiotics and prebiotics

Digestive Health Products Market Report Coverage

|

Market |

Digestive Health Products Market |

|

Digestive Health Products Market Size 2024 |

USD 52.3 Billion |

|

Digestive Health Products Market Forecast 2033 |

USD 104.9 Billion |

|

Digestive Health Products Market CAGR During 2025 - 2033 |

8.1% |

|

Digestive Health Products Market Analysis Period |

2021 - 2033 |

|

Digestive Health Products Market Base Year |

2024 |

|

Digestive Health Products Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Ingredient, By Product, By Distribution Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

General Mills, BASF SE, Arla Foods Inc., Yakult Honsha Co. Ltd, Bayer AG, DuPont Nemours and Company, Cargill Inc, Danone SA, Hansen Holding, Nestle SA, and PepsiCo Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Digestive Health Products Market Insights

The industry is primarily driven by increased demand for nutritional and food supplements. For example, Food Insight reports that as a result of social media material, half of Americans (51%) have tried a new recipe, 42% have tried a new brand or product, 29% have tried a new restaurant, and 28% have reevaluated their relationship with food. This shift in mentality encourages customers to look for goods that help digestion, such as probiotics, prebiotics, and other digestive health supplements, resulting in growth in the digestive health products market.

In addition, a large increase in food expenditure is supporting market expansion in emerging economies. Lack of information about the benefits of digestive health products and probiotics in developing regions may hamper the growth of the global digestive products market.

Digestive health products assist combat harmful bacteria and promote immunity through the improvement of intestinal health. Probiotic yogurts are one of the few widely utilized digestive health products. Increased awareness of its health benefits propels market expansion, as people are willing to pay more for better health. For example, the World Health Organization believes that increased awareness of the health advantages of a balanced diet is driving efforts to prevent malnutrition and lower the risk of noncommunicable diseases (NCDs). In line with this, WHO member states have pledged to reduce global salt consumption by 30% and halt the rise in diabetes, obesity, and childhood overweight by 2025. These programs demonstrate an increasing appreciation of the role of good eating in fostering long-term well-being.

Healthcare expenses in rising markets such as China, Russia, Brazil, and India are increasing rapidly due to a high patient population. Rising population, disposable income, and growing awareness of probiotics' efficacy for the immune system are expected to fuel market expansion in the near future.

Digestive Health Products Market Segmentation

Digestive Health Products Market Segmentation

The worldwide market for digestive health products is split based on ingredient, product, distribution channel, and geography.

Digestive Health Products Market By Ingredient

- Probiotics

- Prebiotics

- Food Enzymes

- Animal-Based

- Plant-Based

- Microbial-Based

According to digestive health products industry analysis, the probiotic ingredient sector led the market in 2024, as customer demand increased, making it the largest raw material segment. The segment will be further driven by advances in production technology and higher R&D expenditure from major companies. Furthermore, increased knowledge of the health benefits provided by these goods, such as strengthened immune system, will drive market expansion in the coming years.

The segment is expected to grow rapidly over the forecast period as demand for digestive enzyme supplements that replace degraded enzymes within the body increases. Multiple functionalities of dietary enzymes, together with rising demand for crop-based enzymes, will drive market growth in the coming years. In dairy sectors, for goods such as yogurt, ice-creams, etc. food enzymes are mainly used. However, the segment's expansion is hampered due to inconsistent safety requirements.

Digestive Health Products Market By Product

- Dairy Products

- Non-Alcoholic Beverages

- Supplements

- Others

According to digestive health products industry analysis, dairy products segment currently leads the market and intends to remain dominant in the coming years. Rising demand for goods like yogurt and milk, among others, has driven the dairy products market. Furthermore, bad eating habits, sedentary lifestyles, and improved consumer knowledge of healthful dairy products have all contributed to rising demand. Supplements were the second largest segment in 2024 and are predicted to expand substantially throughout the forecast period. The growing relevance of active lives, as well as excellent nutritional and health prospects, all play an important part in encouraging the use of supplements.

Non-alcoholic beverages account for a sizable portion of the global market and are expected to grow at a rapid pace during the forecast period due to factors such as increased popularity of drinks without alcohol due to the absence of adverse effects from alcohol. They serve their alcoholic counterparts as a healthier alternative. The benefits of non-alcoholic beer during breastfeeding are extensively documented. It also helps to reduce anxiety and promotes better sleep. It reduces stress and has showed symptoms of cancer control, which is also useful for cardiac health.

Digestive Health Products Market By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy Stores

- E-commerce

- Others

According to digestive health products market forecast, pharmacy stores are expanding rapidly because they are trustworthy sources for health-related products and provide expert advice, which boosts consumer confidence. Their accessibility and link with medical products make them the best place to buy probiotics, vitamins, and other digestive help. Supermarkets and hypermarkets benefit from significant foot traffic and the convenience of one-stop shopping, yet e-commerce is fast expanding due to rising online purchasing preferences and increased product availability.

Digestive Health Products Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Digestive Health Products Market Regional Analysis

Digestive Health Products Market Regional Analysis

In terms of regional segments, demand in North America has been boosted by increased awareness of digestive health products. Furthermore, the government has created a variety of chances for growth in the region to support development and technical advancements, such as favorable rules in the United States regulating the use of health products to assure the well-being of its residents. Technological advancements, quick product delivery, and a plethora of health specialties have all helped North American markets thrive. For example, in August 2022, Megalabs USA, a subsidiary of Megalabs Inc. that develops, markets, and distributes pharmaceuticals and nutritional supplements throughout the Americas, debuted Glutapak R, a probiotic glutamine supplement for gut health and intestinal healing. Because of the increasing demand for particular, flavorful, and inexpensive food products, bakery and dairy products are projected to remain the dominating segments of the US market.

As a prominent player in introducing their brands to untapped markets in Southeast Asian countries, the Asia-Pacific regional market is expected to grow in terms of product demand. For example, in June 2024, Chong Kun Dang Healthcare (CKDHC) introduced a probiotic pill that helps the body synthesize the hunger hormone. China and India are two of the major marketplaces in Asia-Pacific, owing to their larger populations. Increased awareness of the health benefits of these products will help drive expansion in the region over the forecast period.

The top three reasons for growth include an older population, increased health awareness, and higher disposable money. Latin America's digestive health products industry is predicted to continue to grow rapidly. Vitamins are the most popular nutritional supplements in Latin America, but prebiotics and probiotics are also on the rise. In Mexico, people take vitamin and mineral supplements for overall health. Women utilize specialist supplements at a far higher rate than males. All of these variables contribute to Latin America's rapid growth during the projection timeframe.

Digestive Health Products Market Players

Some of the top digestive health products companies offered in our report includes General Mills, BASF SE, Arla Foods Inc., Yakult Honsha Co. Ltd, Bayer AG, DuPont Nemours and Company, Cargill Inc, Danone SA, Hansen Holding, Nestle SA, and PepsiCo Inc.

Frequently Asked Questions

What was the market size of the global Digestive Health Products in 2024?

The market size of digestive health products was USD 52.3 Billion in 2024.

What is the CAGR of the global Digestive Health Products market from 2025 to 2033?

The CAGR of digestive health products is 8.1% during the analysis period of 2025 to 2033.

Which are the key players in the Digestive Health Products market?

The key players operating in the global market are including General Mills, BASF SE, Arla Foods Inc., Yakult Honsha Co. Ltd, Bayer AG, DuPont Nemours and Company, Cargill Inc, Danone SA, Hansen Holding, Nestle SA, and PepsiCo Inc.

Which region dominated the global Digestive Health Products market share?

North America held the dominating position in digestive health products industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of digestive health products during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Digestive Health Products industry?

The current trends and dynamics in the digestive health products industry include growing consumer awareness of gut health and its impact on overall well-being, increasing prevalence of digestive disorders and lifestyle-related diseases, and rising demand for functional foods and dietary supplements

Which product held the maximum share in 2024?

The probiotics held the maximum share of the digestive health products industry.