Diesel Gensets Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Diesel Gensets Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

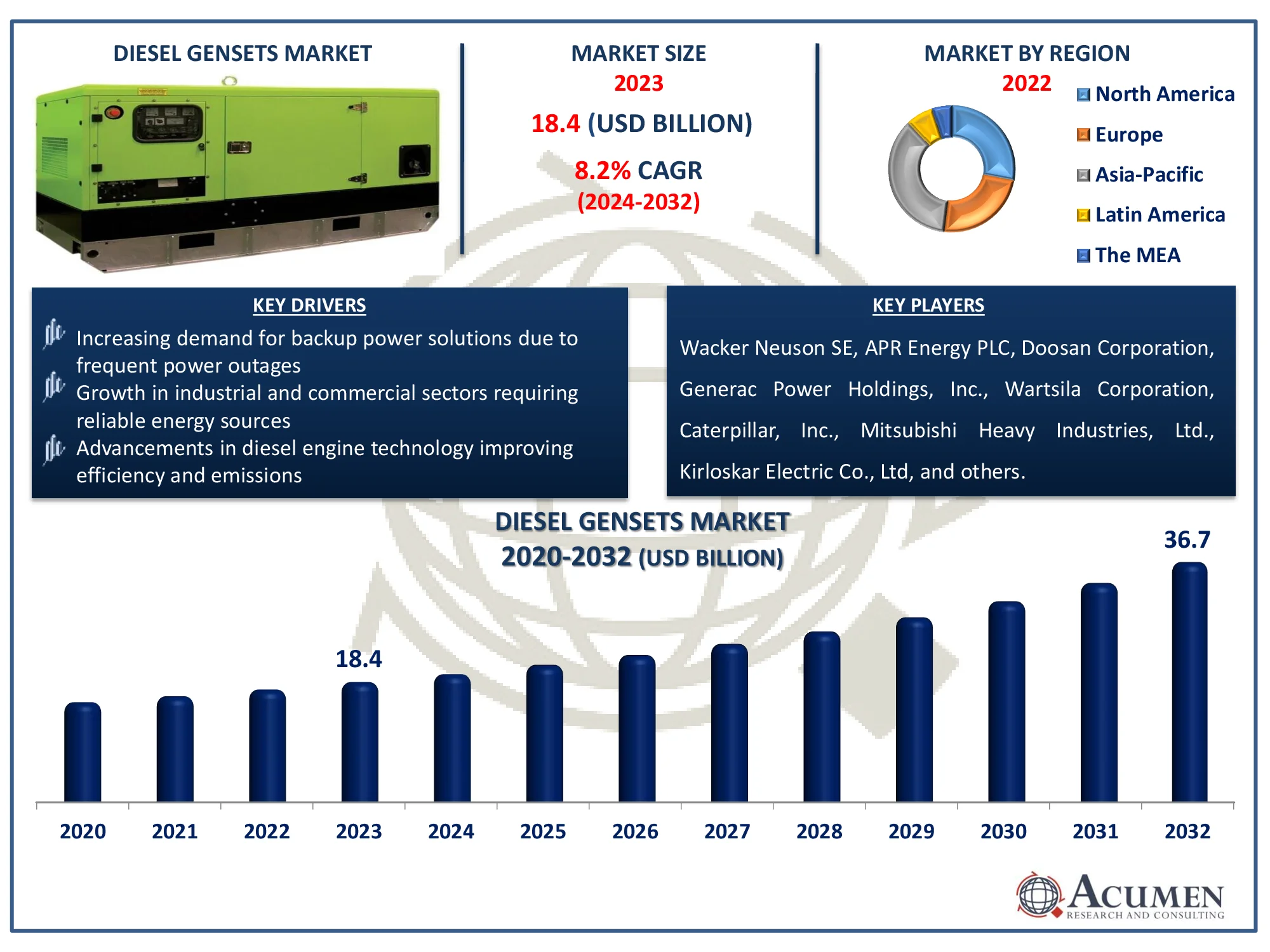

The Global Diesel Gensets Market Size accounted for USD 18.4 Billion in 2023 and is estimated to achieve a market size of USD 36.7 Billion by 2032 growing at a CAGR of 8.2% from 2024 to 2032

Diesel Gensets Market (By Power Rating: <75 kVA, 75-375 kVA, 376-750 kVA, and >750 kVA; By Mobility: Stationary, and Portable; By End-Use: Residential, Commercial, and Industrial; By Application; Standby, Peak Shaving, and Prime/Continuous; and By Region: North America, Europe, Asia-Pacific, Latin America, and the MEA)

Diesel Gensets Market Highlights

- Global diesel gensets market revenue is poised to garner USD 36.7 billion by 2032 with a CAGR of 8.2% from 2024 to 2032

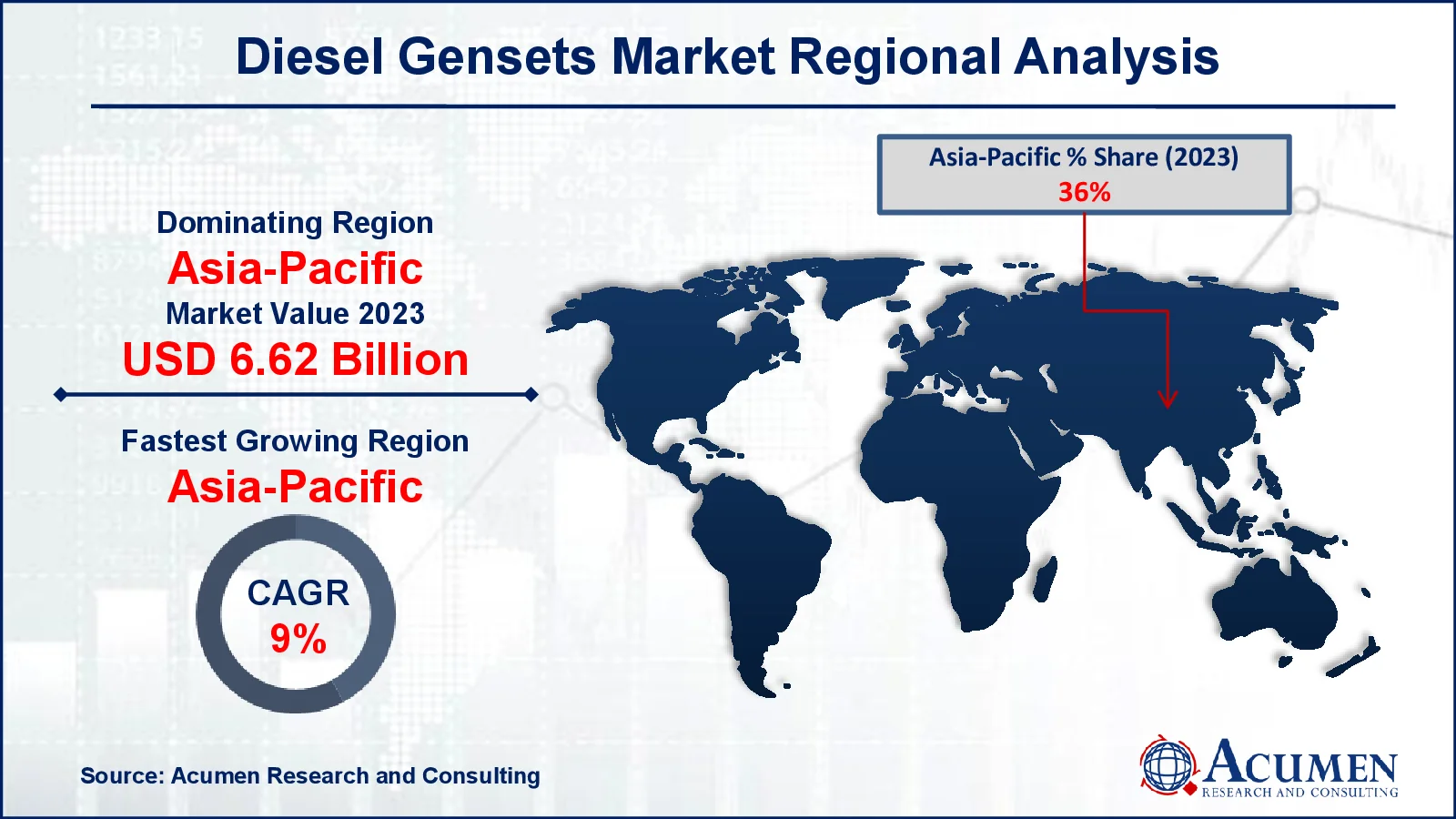

- Asia-Pacific diesel gensets market value occupied around USD 6.62 billion in 2023

- Asia-Pacific diesel gensets market growth will record a CAGR of more than 9% from 2024 to 2032

- Among end use, the commercial sub-segment generated 45% of the market share in 2023

- Based on application, the Standby sub-segment generated 50% of market share in 2023

- Rising demand for reliable backup power in industrial sectors is the diesel gensets market trend that fuels the industry demand

Diesel gensets are a combination of an electric generator and a diesel engine used to generate electricity. This is an explicit example of an engine initiator. A diesel density ignition mechanism is often used with diesel fuel, however others are utilized with other natural gas or liquid fuels. Diesel generators are used in areas without a power grid, as a crisis control supply if the system fails, and for increasingly complicated applications such as crest hacking, grid support, and fare to the power grid. The study analyzes the global diesel generators market with 2032 as the forecast period and 2023 as the base year. According to Acumen Research and Consulting, the worldwide diesel generators market would develop at a substantial CAGR of around 8.2% throughout the forecast period.

Global Diesel Gensets Market Dynamics

Market Drivers

- Increasing demand for backup power solutions due to frequent power outages

- Growth in industrial and commercial sectors requiring reliable energy sources

- Advancements in diesel engine technology improving efficiency and emissions

Market Restraints

- Stringent environmental regulations on diesel emissions

- High initial investment and maintenance costs

- Growing adoption of alternative energy sources like solar and wind

Market Opportunities

- Expansion in emerging markets with rising infrastructure needs

- Integration with hybrid systems for improved fuel efficiency

- Technological advancements in diesel generators for better performance and lower emissions

Diesel Gensets Market Report Coverage

| Market | Diesel Gensets Market |

| Diesel Gensets Market Size 2022 |

USD 18.4 Billion |

| Diesel Gensets Market Forecast 2032 | USD 36.7 Billion |

| Diesel Gensets Market CAGR During 2023 - 2032 | 8.2% |

| Diesel Gensets Market Analysis Period | 2020 - 2032 |

| Diesel Gensets Market Base Year |

2022 |

| Diesel Gensets Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Power Rating, By Mobility, By End-Use, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Wacker Neuson SE, APR Energy PLC, Doosan Corporation, Generac Power Holdings, Inc., Wartsila Corporation, Caterpillar, Inc., Mitsubishi Heavy Industries, Ltd., Kirloskar Electric Co., Ltd, Cummins India Ltd., J C Bamford Excavators Ltd., and Atlas Copco AB. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diesel Gensets Market Insights

Expanding demand for dependable and consistent power supply, rising consumer awareness of emergency backup power solutions, growing urbanization, increasing large infrastructures and commercial centers, and favorable government initiatives are among the primary factors driving global diesel genset market growth. The implementation of automobile emission rules to raise engine productivity and efficiency is fast expanding, consequently promoting the growth of the worldwide diesel gensets market.

Automotive emission legislation is the primary driver behind automakers' transition to low-emission and cleaner automobiles. Expanding need for dependable and regular power supply, as well as the increasing use of critical electronic loads, is among the drivers driving overall market expansion. Furthermore, increased consumer awareness of emergency backup power solutions and the intensity of grid interruptions are expected to boost the total industry in the near future. Continuous expenditures in the expansion of commercial centers, combined with increased urbanization, are likely to drive the growth of the commercial diesel gensets market.

Moreover, as the number of internet users grows, the building of data centers throughout the world is accelerating; this is likely to drive market expansion. Growing urbanization in emerging countries, as well as government initiatives, is boosting the worldwide diesel generators market. The continuous expansion of commercial, industrial, retail, and residential infrastructures contributes to worldwide market growth. The rapidly expanding telecom sector, frequent power outages in several nations and rapid industrial growth are some of the factors driving the growth of the regional diesel gensets market. Continuous infrastructural development, population growth, and rapid industrialization in emerging nations are boosting the global diesel generators market.

Diesel Gensets Market Segmentation

The worldwide market for diesel gensets is split based on power rating, mobility, application, end use, and geography.

Diesel Genset Market By Power Rating

- <75 kVA

- 75-375 kVA

- 376-750 kVA

- >750 kVA

According to the diesel gensets industry analysis, generators with less than 75 kVA capacity are the most popular in the diesel gensets market. They’re commonly used for small businesses, homes, and smaller industries because they are affordable and efficient. Their compact size makes them easy to fit into tight spaces. Advances in technology have improved their reliability and performance. Their lower cost and versatility make them the preffered choice for many users.

Diesel Genset Market By Mobility

- Stationary

- Portable

According to the diesel gensets industry analysis, stationary models are the most popular because they provide reliable and continuous power for important facilities like hospitals and data centers. These generators are built to last and handle large power needs, making them ideal for long-term use. They are preferred over portable gensets due to their ability to deliver steady, uninterrupted electricity. This reliability and efficiency make them a essential power backup.

Diesel Genset Market By Application

- Standby

- Peak Shaving

- Prime/Continuous

According to the diesel gensets industry forecast, standby applications are the most common because they provide backup power during outages. They are crucial for keeping essential services running when the main power fails. Peak Shaving helps reduce energy costs but is less critical compared to backup power. Prime/Continuous use is less common because it requires more frequent operation and is usually only needed in remote areas without other power options.

Diesel Genset Market By End-Use

- Residential

- Commercial

- Industrial

The commercial category is expected to dominate the worldwide diesel gensets market during the projected period due to the increasing use of diesel gensets in a variety of industrial applications. Natural disasters such as hurricanes in coastal areas necessitate regular power backup, increasing demand for diesel generators. Continuous expenditures in the expansion of commercial centers, combined with increased urbanization, are likely to drive the commercial diesel gensets market. Furthermore, as the number of internet users grows, the building of data centers throughout the world is accelerating, which is likely to drive market expansion even further.

Diesel Gensets Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Diesel Gensets Market Regional Analysis

For several reasons, Asia-Pacific dominates and is the fastest-growing region in the diesel generator market, due to rapid industrial growth and frequent power disruptions. For instance, in March 2021, Mahindra Powerol launched a new manufacturing facility to make Perkins diesel generators. GOEM Perfect Generators Technology Pvt Ltd, Ghaziabad, handles manufacture in India's North Region. Countries such as China and India require these generators to keep operations operating properly. Government investments in energy and infrastructure also drive up demand. Due to the region's large size and varying climate, diesel generators are a popular alternative for dependable power.

North America is seeing strong growth in diesel gensets because of rising needs for backup power in homes and businesses. Frequent power outages and new regulations pushing for better energy efficiency also drive demand. Advances in technology by key players make these gensets more efficient and cleaner. For instance, Caterpillar introduced the Cat XQ330 diesel generator set in February 2023. It is designed for prime power and standby applications and meets U.S. EPA Tier 4 Final pollution regulations. The Cat XQ330, powered by the company's C9.3B diesel engine, generates up to 288 kW for standby and 264 kW for prime operations at 60 hertz, and up to 341 kVA for standby and 310 kVA for prime power applications at 50 Hz. In addition, ongoing infrastructure projects continue to boost their use.

Diesel Gensets Market Players

Some of the top diesel gensets companies offered in our report includes Wacker Neuson SE, APR Energy PLC, Doosan Corporation, Generac Power Holdings, Inc., Wartsila Corporation, Caterpillar, Inc., Mitsubishi Heavy Industries, Ltd., Kirloskar Electric Co., Ltd, Cummins India Ltd., J C Bamford Excavators Ltd., and Atlas Copco AB.

Frequently Asked Questions

How big is the diesel gensets market?

The diesel gensets market size was valued at USD 18.4 billion in 2023.

What is the CAGR of the global diesel gensets market from 2024 to 2032?

The CAGR of diesel gensets is 8.2% during the analysis period of 2024 to 2032.

Which are the key players in the diesel gensets market?

The key players operating in the global market are including Wacker Neuson SE, APR Energy PLC, Doosan Corporation, Generac Power Holdings, Inc., Wartsila Corporation, Caterpillar, Inc., Mitsubishi Heavy Industries, Ltd., Kirloskar Electric Co., Ltd, Cummins India Ltd., J C Bamford Excavators Ltd., and Atlas Copco AB.

Which region dominated the global diesel gensets market share?

Asia-Pacific held the dominating position in diesel gensets industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of diesel gensets during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global diesel gensets industry?

The current trends and dynamics in the diesel gensets industry include increasing demand for backup power solutions due to frequent power outages, growth in industrial and commercial sectors requiring reliable energy sources, and advancements in diesel engine technology improving efficiency and emissions.

Which end-use held the maximum share in 2023?

The commercial segment held the maximum share of the diesel gensets industry.