Diabetic Neuropathy Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Diabetic Neuropathy Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

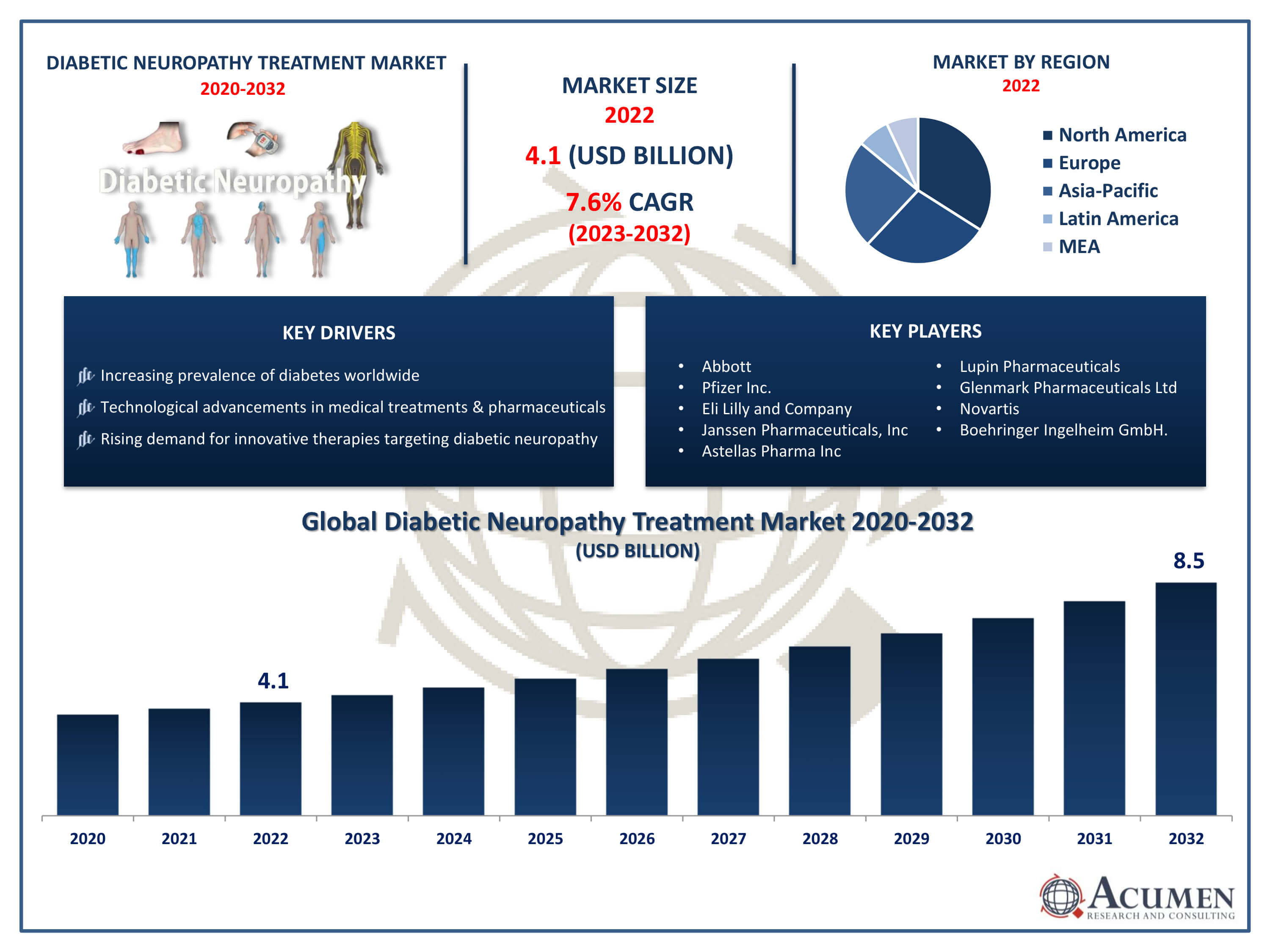

The Diabetic Neuropathy Treatment Market Size accounted for USD 4.1 Billion in 2022 and is projected to achieve a market size of USD 8.5 Billion by 2032 growing at a CAGR of 7.6% from 2023 to 2032.

Diabetic Neuropathy Treatment Market Highlights

- Global diabetic neuropathy treatment market revenue is expected to increase by USD 8.5 billion by 2032, with a 7.6% CAGR from 2023 to 2032

- Diabetic neuropathy is the most common complication of diabetes mellitus (DM), affecting up to 50% of patients with type 1 and type 2 DM

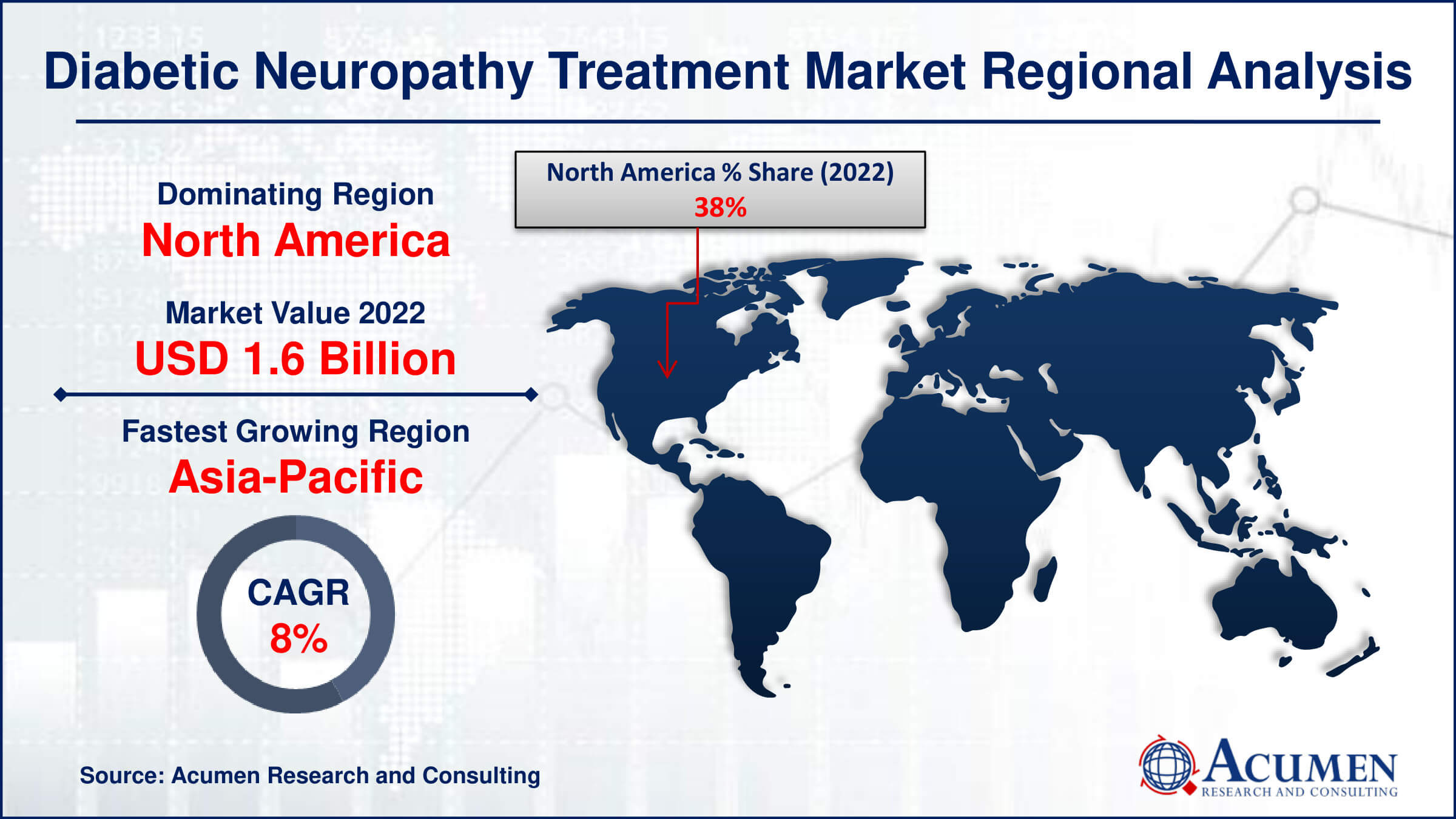

- North America region led with more than 38% of diabetic neuropathy treatment market share in 2022

- Asia-Pacific diabetic neuropathy treatment market growth will record a CAGR of more than 8.3% from 2023 to 2032

- By disorder type, the peripheral neuropathy segment captured more than 63% of revenue share in 2022

- By drug class, the non-steroidal anti-inflammatory drugs (NSAIDs) segment is projected to expand at the fastest CAGR over the projected period

- Increasing prevalence of diabetes worldwide, drives the diabetic neuropathy treatment market value

Diabetic neuropathy is a common complication of diabetes that affects the nerves, causing symptoms such as numbness, tingling, pain, and weakness, typically starting in the feet and hands and gradually spreading throughout the body. The treatment of diabetic neuropathy primarily focuses on managing symptoms, slowing progression, and preventing complications. Several approaches are used in the treatment of diabetic neuropathy, including medication management to control pain and discomfort, blood sugar control to prevent further nerve damage, physical therapy to improve strength and mobility, and lifestyle changes such as a healthy diet and regular exercise.

Diabetic neuropathy is a common complication of diabetes that affects the nerves, causing symptoms such as numbness, tingling, pain, and weakness, typically starting in the feet and hands and gradually spreading throughout the body. The treatment of diabetic neuropathy primarily focuses on managing symptoms, slowing progression, and preventing complications. Several approaches are used in the treatment of diabetic neuropathy, including medication management to control pain and discomfort, blood sugar control to prevent further nerve damage, physical therapy to improve strength and mobility, and lifestyle changes such as a healthy diet and regular exercise.

In recent years, the market for diabetic neuropathy treatment has witnessed steady growth due to the increasing prevalence of diabetes globally. As the number of individuals diagnosed with diabetes continues to rise, the demand for effective treatments for diabetic neuropathy is expected to increase correspondingly. Moreover, advancements in medical technology and pharmaceutical research have led to the development of innovative therapies and drugs targeting diabetic neuropathy, further driving market growth. Additionally, rising awareness about diabetes-related complications and the importance of early intervention and management among both healthcare professionals and patients contribute to the expansion of the diabetic neuropathy treatment industry.

Global Diabetic Neuropathy Treatment Market Trends

Market Drivers

- Increasing prevalence of diabetes worldwide

- Technological advancements in medical treatments and pharmaceuticals

- Growing awareness about the importance of early intervention and management

- Rising demand for innovative therapies targeting diabetic neuropathy

Market Restraints

- High cost associated with advanced treatment options

- Side effects and limitations of existing medications

Market Opportunities

- Development of personalized medicine for diabetic neuropathy

- Expansion of telemedicine and remote monitoring solutions

Diabetic Neuropathy Treatment Market Report Coverage

| Market | Diabetic Neuropathy Treatment Market |

| Diabetic Neuropathy Treatment Market Size 2022 | USD 4.1 Billion |

| Diabetic Neuropathy Treatment Market Forecast 2032 |

USD 8.5 Billion |

| Diabetic Neuropathy Treatment Market CAGR During 2023 - 2032 | 7.6% |

| Diabetic Neuropathy Treatment Market Analysis Period | 2020 - 2032 |

| Diabetic Neuropathy Treatment Market Base Year |

2022 |

| Diabetic Neuropathy Treatment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Disorder Type, By Drug Class, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, Pfizer Inc, Eli Lilly and Company, Janssen Pharmaceuticals, Inc, Astellas Pharma Inc, Lupin Pharmaceuticals, Glenmark Pharmaceuticals Ltd, Novartis, and Boehringer Ingelheim GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Diabetic neuropathy treatment encompasses a range of approaches aimed at managing symptoms, slowing disease progression, and preventing complications associated with nerve damage in individuals with diabetes. The primary goal of treatment is to alleviate pain and discomfort while improving overall quality of life. Medications play a crucial role in diabetic neuropathy management, with options including pain relievers, antidepressants, anticonvulsants, and topical treatments to target nerve pain. Additionally, maintaining tight control over blood sugar levels through diet, exercise, and medication is essential in preventing further nerve damage and managing symptoms effectively. Beyond medication management, diabetic neuropathy treatment often involves a multidisciplinary approach that may include physical therapy, occupational therapy, and lifestyle modifications. Physical therapy techniques such as exercise programs, stretching, and massage can help improve strength, flexibility, and circulation, thereby reducing pain and enhancing mobility.

The diabetic neuropathy treatment market has been experiencing significant growth over the past few years and is projected to continue expanding in the foreseeable future. This growth can be attributed to several factors, including the rising prevalence of diabetes worldwide, particularly in developing countries where lifestyle changes and urbanization contribute to the increased incidence of the disease. With diabetic neuropathy being one of the most common and debilitating complications of diabetes, there is a growing demand for effective treatment options to manage its symptoms and slow its progression. As a result, pharmaceutical companies and medical device manufacturers are investing in research and development efforts to innovate new therapies and technologies targeting diabetic neuropathy, further fueling market growth. Moreover, technological advancements in medical treatments and pharmaceuticals are driving the growth of the diabetic neuropathy market.

Rapidly Rising Diabetes Cases Fuels the Diabetic Neuropathy Treatment Market

Diabetes affects people of all ages and is present in over half a billion people worldwide. According to a report published in The Lancet, this figure is expected to more than double to 1.3 billion over the next 30 years, with increases in every country. Diabetes currently has a global prevalence rate of 6.1%, ranking it among the top ten leading causes of death and disability. The highest prevalence at the superregion level is 9.3% in North Africa and the Middle East, which is expected to rise to 16.8% by 2050, while Latin America and the Caribbean will see an increase to 11.3%.

Diabetes is especially common in people over the age of 65, with a global prevalence rate of more than 20%. The highest prevalence, 24.4%, is observed in people aged 75 to 79. North Africa and the Middle East have the highest rate in this age group (39.4%), while Central Europe, Eastern Europe, and Central Asia have the lowest (19.8%). Almost all diabetes cases worldwide (96%) are type 2 diabetes (T2D). The main risk factor for type 2 diabetes (T2D) among the 16 risk factors examined is a high body mass index (BMI), which accounts for 52.2% of T2D-related disability and mortality. Other risk factors include dietary, occupational, and environmental risks, cigarette use, low physical activity, and alcohol consumption.

Diabetic Neuropathy Treatment Market Segmentation

The global market for diabetic neuropathy treatment segmentation is based on disorder type, drug class, distribution channel, and geography.

Diabetic Neuropathy Treatment Market By Disorder Type

- Peripheral Neuropathy

- Proximal Neuropathy

- Autonomic Neuropathy

- Focal Neuropathy

According to the diabetic neuropathy treatment industry analysis, the peripheral neuropathy segment accounted for the largest market share in 2022. Diabetic peripheral neuropathy (DPN) is the most prevalent type of neuropathy globally, impacting up to 50% of individuals with diabetes. A 2021 study revealed that adults aged 70–79 exhibit the highest incidence of DPN, with a significant proportion of cases occurring in women. Peripheral neuropathy refers to damage to the peripheral nerves, commonly affecting the extremities such as the hands and feet, which is a prevalent manifestation of diabetic neuropathy. As the incidence of diabetes continues to rise globally, the prevalence of peripheral neuropathy among diabetic patients is also increasing. This has created a significant peripheral neuropathy market demand for effective treatments targeting peripheral neuropathy symptoms, such as pain, numbness, and tingling sensations. Moreover, advancements in medical technology and pharmaceutical research have led to the development of innovative therapies specifically designed to address peripheral neuropathy in diabetic patients. These treatments range from medications aimed at managing pain and discomfort to medical devices and interventions targeting nerve regeneration and symptom relief.

Diabetic Neuropathy Treatment Market By Drug Class

- Capsaicin

- Opioid

- Morphine

- Others

- Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

- Ibuprofen

- Naproxen

- Others

- Antidepressants

- Tricyclic Antidepressants (TCAs)

- Serotonin and Norepinephrine Reuptake Inhibitors (SNRIs)

- Selective Serotonin Reuptake Inhibitors (SSRIs)

- Anticonvulsant Drugs

- Other

In terms of drug classes, the non-steroidal anti-inflammatory drugs (NSAIDs) segment is expected to witness significant growth in the coming years. NSAIDs are commonly used to manage pain and inflammation associated with various conditions, including diabetic neuropathy. With diabetic neuropathy often characterized by symptoms such as neuropathic pain and inflammation, NSAIDs play a crucial role in providing relief and improving the quality of life for affected individuals. As the prevalence of diabetes rises globally, so does the demand for effective pain management solutions, thereby driving the growth of the NSAIDs segment within the diabetic neuropathy treatment. Additionally, advancements in pharmaceutical research have led to the development of novel NSAIDs formulations with improved efficacy and safety profiles, catering specifically to diabetic neuropathy patients.

Diabetic Neuropathy Treatment Market By Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Other

According to the diabetic neuropathy treatment market forecast, the hospitals pharmacies segment is expected to witness significant growth in the coming years. Hospitals serve as primary hubs for the diagnosis and treatment of diabetic neuropathy, with healthcare professionals often prescribing medications and therapies to manage the condition. Hospital pharmacies play a critical role in ensuring the availability and accessibility of these treatments, catering to the needs of both inpatient and outpatient populations. With the rising prevalence of diabetes globally, the demand for diabetic neuropathy treatments provided through hospital pharmacies has been steadily increasing, contributing to the growth of this segment. Moreover, hospitals are increasingly adopting comprehensive approaches to diabetic neuropathy management, which include the integration of multidisciplinary teams and specialized clinics dedicated to neuropathy care. These initiatives create opportunities for hospital pharmacies to expand their range of diabetic neuropathy treatment offerings, including medications, medical devices, and specialized formulations.

Diabetic Neuropathy Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Diabetic Neuropathy Treatment Market Regional Analysis

North America dominates the diabetic neuropathy treatment market for several reasons, primarily due to its well-established healthcare infrastructure, significant investments in research and development, and high prevalence of diabetes within the region. In 2019, research found that 28% of adults with diabetes in the United States experienced peripheral neuropathy. The United States and Canada boast some of the most advanced medical facilities and pharmaceutical companies globally, facilitating easy access to cutting-edge treatments for diabetic neuropathy. Additionally, the region's strong regulatory framework ensures the safety and efficacy of diabetic neuropathy treatments, instilling confidence among healthcare providers and patients alike. Moreover, North America leads in research and development efforts aimed at addressing diabetic neuropathy, with numerous academic institutions, research centers, and pharmaceutical companies actively engaged in exploring innovative treatment options. This commitment to scientific advancement results in the continuous introduction of new therapies, medications, and medical devices tailored to manage diabetic neuropathy effectively. Furthermore, the region's high healthcare expenditure and insurance coverage contribute to the accessibility of diabetic neuropathy treatments, enabling patients to receive comprehensive care without financial barriers. Overall, North America's dominance in the diabetic neuropathy market stems from its advanced healthcare infrastructure, robust research ecosystem, and commitment to improving patient outcomes in managing this prevalent complication of diabetes.

Diabetic Neuropathy Treatment Market Player

Some of the top diabetic neuropathy treatment companies offered in the professional report include Abbott, Pfizer Inc, Eli Lilly and Company, Janssen Pharmaceuticals, Inc, Astellas Pharma Inc, Lupin Pharmaceuticals, Glenmark Pharmaceuticals Ltd, Novartis, and Boehringer Ingelheim GmbH.

Frequently Asked Questions

How big is the diabetic neuropathy treatment market?

The diabetic neuropathy treatment market size was USD 4.1Billionin 2022.

What is the CAGR of the global diabetic neuropathy treatment market from 2023 to 2032?

The CAGR of diabetic neuropathy treatment is 7.6% during the analysis period of 2023 to 2032.

Which are the key players in the diabetic neuropathy treatment market?

The key players operating in the global market are including Abbott, Pfizer Inc, Eli Lilly and Company, Janssen Pharmaceuticals, Inc, Astellas Pharma Inc, Lupin Pharmaceuticals, Glenmark Pharmaceuticals Ltd, Novartis, and Boehringer Ingelheim GmbH.

Which region dominated the global diabetic neuropathy treatment market share?

North America held the dominating position in diabetic neuropathy treatment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of diabetic neuropathy treatment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global diabetic neuropathy treatment industry?

The current trends and dynamics in the diabetic neuropathy treatment industry include increasing prevalence of diabetes worldwide, technological advancements in medical treatments and pharmaceuticals, and growing awareness about the importance of early intervention and management.

Which drug class held the maximum share in 2022?

The non-steroidal anti-inflammatory drugs (NSAIDs) class held the maximum share of the diabetic neuropathy treatment industry.