Dental Laboratories Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Dental Laboratories Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

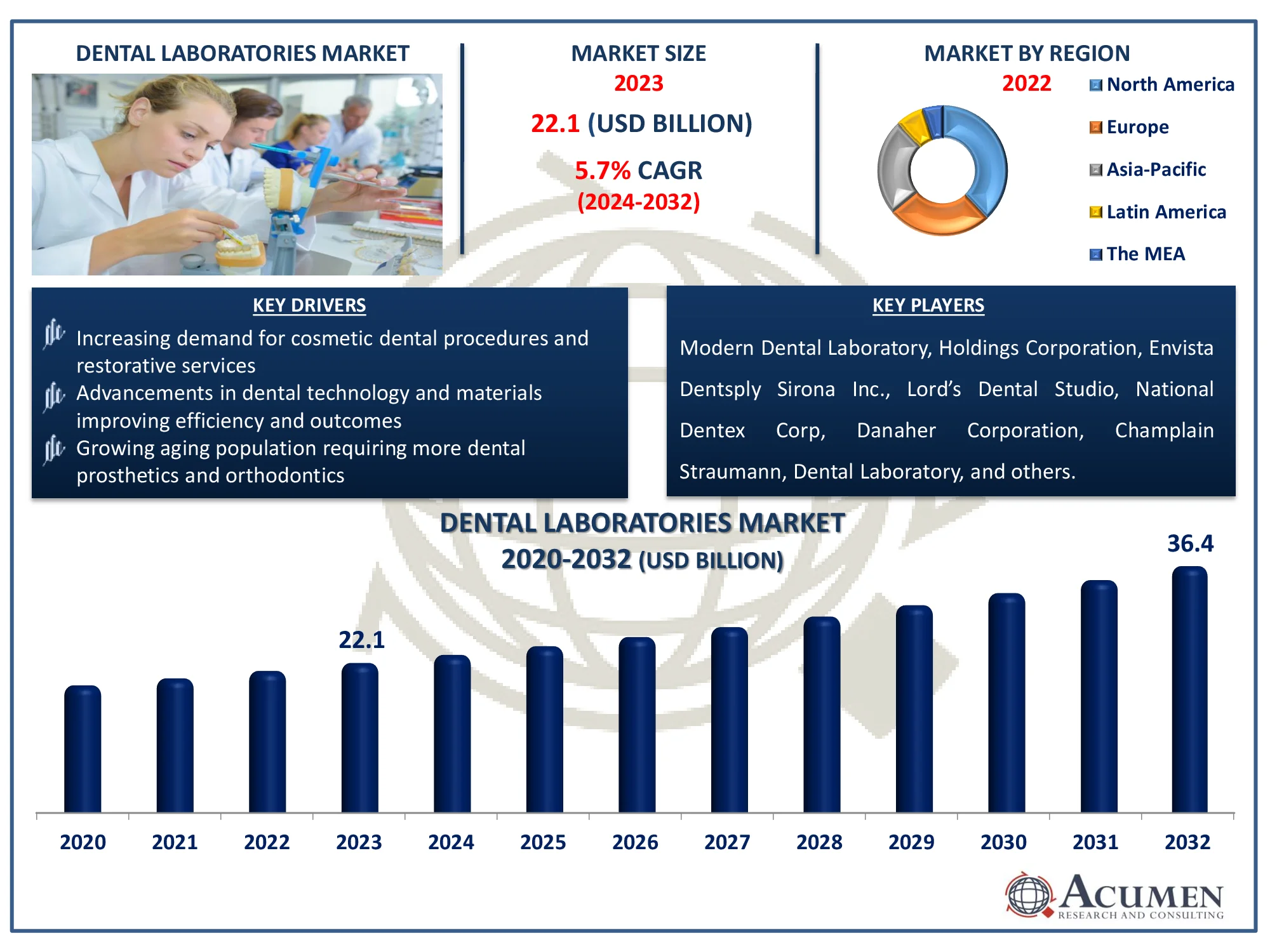

The Global Dental Laboratories Market Size accounted for USD 22.1 Billion in 2023 and is estimated to achieve a market size of USD 36.4 Billion by 2032 growing at a CAGR of 5.7% from 2024 to 2032.

Dental Laboratories Market (By Product: Oral care, Restorative; By Equipment: Dental Radiology Equipment, Dental Lasers, System and Parts, 3D Printing Systems, Integrated CAD/CAM Systems; By Material: Metal Ceramics, Others; By Prosthetic Type: Bridges, Crowns, Veneers, Others; and By Region: North America, Europe, Asia-Pacific, Latin America, and MEA)

Dental Laboratories Market Highlights

- The global dental laboratories market is projected to reach USD 36.4 billion by 2032, with a CAGR of 5.7% from 2024 to 2032

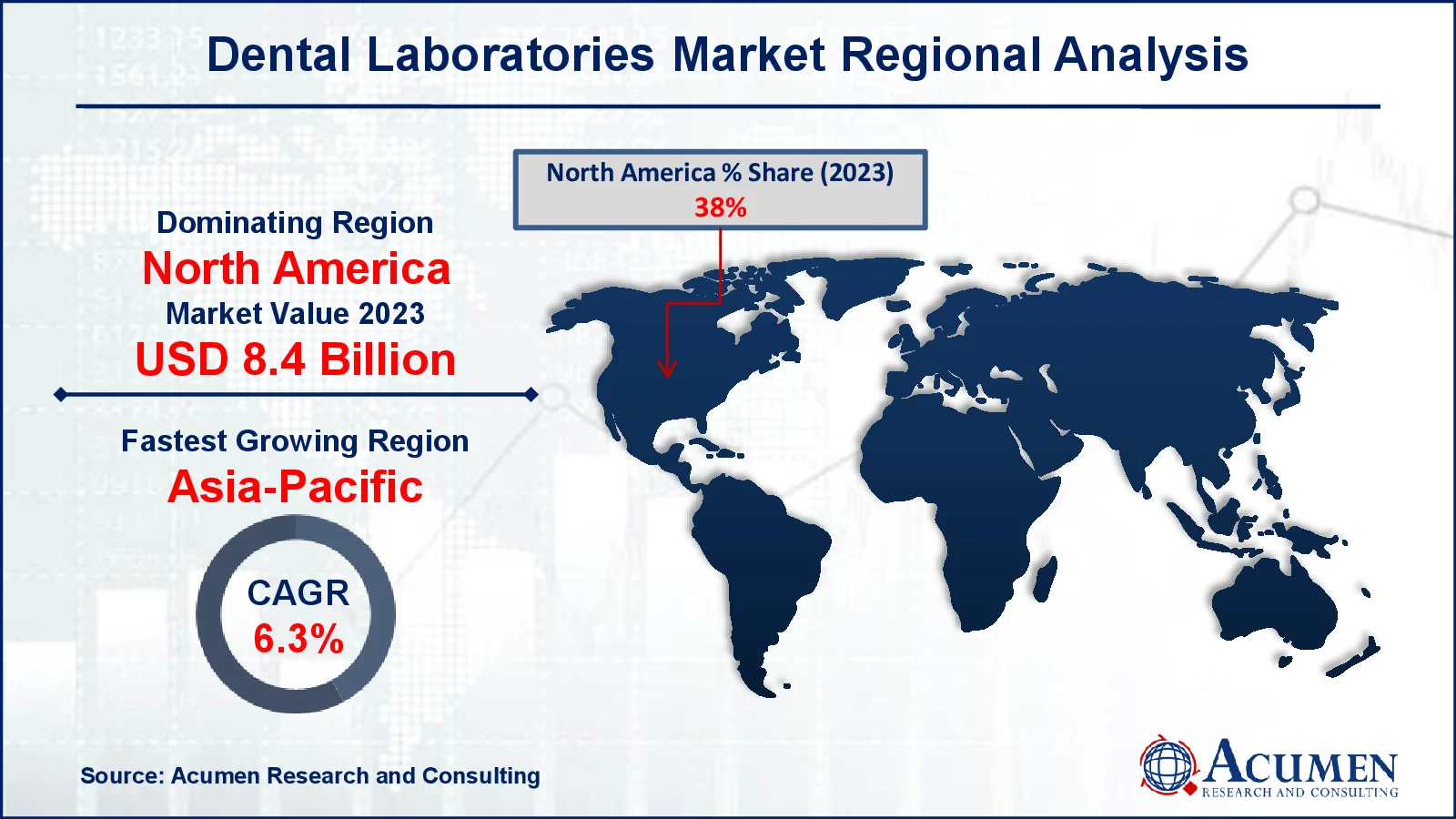

- North America's dental laboratories market was valued at approximately USD 8.4 billion in 2023

- The Asia-Pacific region is expected to grow at a CAGR of over 6.3% between 2024 and 2032

- The oral care product segment accounted for 28% of the market share in 2023

- The systems & parts equipment segment held 36% of the market share in 2023

- Metal ceramics dominated the materials segment with a 56% market share in 2023

- Crowns represented 36% of the market share in the prosthetic type segment in 2023

- Increasing use of 3D printing for customized dental prosthetics is the dental laboratories market trend that fuels the industry demand

Dental caries is one of the most common and treatable chronic diseases in the world. The condition is complex and affects many people. Treatments for such conditions are provided in dental clinics using tools and technology. Dental laboratories employ certified dentists who may fabricate dental prostheses such as removable or fixed toothpastes, bridges, crowns, orthodontic devices, and a variety of other dental appliances to assist patients with tooth problems. Recent development in biomolecular covering synthesis has resulted in good osseointegration outcomes.

Global Dental Laboratories Market Dynamics

Market Drivers

- Increasing demand for cosmetic dental procedures and restorative services

- Advancements in dental technology and materials improving efficiency and outcomes

- Growing aging population requiring more dental prosthetics and orthodontics

Market Restraints

- High initial setup costs for dental laboratory equipment and technology

- Stringent regulatory standards and quality control requirements

- Limited availability of skilled labor and technicians in the dental field

Market Opportunities

- Expansion of dental tourism as patients seek affordable treatments abroad

- Rising integration of digital technologies, such as CAD/CAM and 3D printing

- Increasing awareness and acceptance of preventive dental care and products

Dental Laboratories Market Report Coverage

| Market | Dental Laboratories Market |

| Dental Laboratories Market Size 2022 |

USD 22.1 Billion |

| Dental Laboratories Market Forecast 2032 | USD 36.4 Billion |

| Dental Laboratories Market CAGR During 2023 - 2032 | 5.7% |

| Dental Laboratories Market Analysis Period | 2020 - 2032 |

| Dental Laboratories Market Base Year |

2022 |

| Dental Laboratories Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Equipment, By Material, By Prosthetic Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Modern Dental Laboratory, Envista Holdings Corporation, Dentsply Sirona Inc., Lord’s Dental Studio, National Dentex Corp, Danaher Corporation, Straumann, Champlain Dental Laboratory, Henry Schein Inc., and A-dec Inc.. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Dental Laboratories Market Insights

Parallel to the dental health sector, the dental laboratory industry is growing. The growing number of dentists, hospitals, and endodontists is one of the primary factors propelling the dental laboratory sector forward. The growth of the global economy is also attributed to an increase in the number of maxillofacial and oral surgeons, journalists, orthodontic and prosthodontic surgeons. The global need for dental labs is increasing, as are dental products such as bridges, crowns, dentures, and so on.

Growth is predicted to drive up demand for cosmetic dental procedures, as well as an increase in the aging population. In the approaching years, this factor is projected to boost market expansion. In anticipation of increased demand in the dental laboratory market, elderly people with poor cognitive health may struggle to manage medical situations, medications, or other self-care procedures, such as oral hygiene.

The dental laboratory's technological developments as a material implant have resulted in shorter chair times, faster healing, painless therapy for bone morphologic proteins, and hydroxyapatite coatings. Similarly, it has made it easier to schedule and manage complex processes, as well as 3D imaging dental implants, couronnes, and bridges, which will result in improved paticide diagneses by implementing sophisticated imaged imaging methods such as Computer Aided Design (CAD) and Computer Aided Manufacturing (CAM). Furthermore, the growing number of celebrities and media influencers displaying their flawless smiles on social media platforms has fueled the demand for aesthetic appeal in the world of dentistry.

According to the American Academy of Cosmetic Dentistry, 99.7 percent of people believe their smile is an important social asset, and nearly 84 percent are willing to face increased pressure to complete their smile, increasing the number of celebrities and adults seeking orthodontic treatment. This increased demand prompted the creation of a wide range of procedures and processes that cater to patients' specific needs, ultimately promoting market growth.

Dental Laboratories Market Segmentation

The worldwide market for dental laboratories is split based on product, equipment, material, prosthetic type, and geography.

Dental Laboratories Product

- Oral Care

- Restorative

- Endodontic

- Orthodontic

- Implant

According to the dental laboratories industry analysis, oral care accounted for about 28% of the top market share. This anticipated era is expected to see productive development as awareness of oral hygiene has grown and healthy oral behavior for overall well-being has become increasingly vital. In terms of market share, the restaurant segment trailed the oral care industry. Improves restoration precision, hence boosting growth in disciplines such as CAD/CAM dentistry, digital x-ray, intraoral imaging, and caries diagnosis.

Dental Laboratories Equipment

- Dental Radiology Equipment

- Dental Lasers

- System and Parts

- 3D Printing Systems

- Integrated CAD/CAM Systems

- Other Systems and Parts

- Laboratory Machines

- Casting Machines

- Milling Equipment

- Furnaces

- Articulators

- Other Laboratory Machines

- Dental Scanners

- Others

According to the dental laboratories industry analysis, systems and parts continued to dominate the market. One of the primary drivers of growth is the availability of technologically advanced technologies, which result in shorter wait times and higher accuracy. During the forecast period, dental lasers are expected to grow at a rapid CAGR. Dental lasers can be used in a wide range of diagnostic and surgical applications. Such technologies include bone and ligament tissue regeneration, as well as reduced bleeding and malaise during the operation. As a result, in the future years, these lasers are expected to become profitable.

Dental Laboratories Material

- Metal Ceramics

- Traditional All Ceramics

- CAD/CAM Materials

- Plastic

- Metals

- Others

According to the dental laboratories industry forecast, the metal ceramic segment dominates the market due to its improved chewing ability, chewing, and esthetics, which add to the natural appearance of the face by replacing missing or misaligned teeth. Compared to ceramics and other health-care items, this sector has higher breaking resistance, strength, durability, and biocompatibility.

Dental Laboratories Prosthetic Type

- Bridges

- Crowns

- Veneers

- Dentures

- Clear Aligners

According to the dental laboratories market forecast, crowns, particularly ceramic and zirconia kinds are the most popular prosthetics in dentistry laboratories due to their cosmetic appeal, durability, and biocompatibility. These materials provide a natural tooth-like look and are wear-resistant, making them suitable for both anterior and posterior restorations. Furthermore, developments in CAD/CAM technology have expedited the manufacturing process, increasing precision and efficiency when making personalized crowns. As a result, the demand for crowns continues to rise.

Dental Laboratories Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Dental Laboratories Market Regional Analysis

For several reasons, North America had the largest revenue market share in 2023 due to the region's sophisticated medical infrastructure, supporting government initiatives, and relatively high level of health spending, such as the United States initiative to integrate oral health and primary care. The Health and Human Services Department aims to strengthen the competence and expertise of primary care dentists while also encouraging cross-professional collaboration among healthcare practitioners. For instance, ZimVie Inc. has launched Azure Multi-Platform Product Solutions in October 2023, a comprehensive suite of restorative components designed to efficiently satisfy the needs of the dental laboratory market.

During the predicted period, Asia-Pacific is expected to have profitable growth. The progressive economy, a large population of elderly, increased income availability, and awareness of dental health are expected to drive growth. For instance, with India's elderly population growing at a decadal rate of 41% and projected to double to more than 20% of the total population by 2050, the United Nations Population Fund, India (UNFPA) stated in its 2023 India Ageing Report that by 2046, the elderly population is likely to have surpassed the country's children (aged 0 to 15 years). Furthermore, higher untapped prospects are likely to generate growth opportunities in the region during the forecast period, as will rapid improvements in health infrastructure.

Dental Laboratories Market Players

Some of the top dental laboratories companies offered in our report include Modern Dental Laboratory, Envista Holdings Corporation, Dentsply Sirona Inc., Lord’s Dental Studio, National Dentex Corp, Danaher Corporation, Straumann, Champlain Dental Laboratory, Henry Schein Inc., and A-dec Inc.

Frequently Asked Questions

How big is the dental laboratories market?

The dental laboratories market size was valued at USD 22.1 billion in 2023.

What is the CAGR of the global dental laboratories market from 2024 to 2032?

The CAGR of dental laboratories is 5.7% during the analysis period of 2024 to 2032.

Which are the key players in the dental laboratories market?

The key players operating in the global market are including Modern Dental Laboratory, Envista Holdings Corporation, Dentsply Sirona Inc., Lord’s Dental Studio, National Dentex Corp, Danaher Corporation, Straumann, Champlain Dental Laboratory, Henry Schein Inc., and A-dec Inc.

Which region dominated the global dental laboratories market share?

North America held the dominating position in dental laboratories industry during the analysis period of 2024 to 2032.

Which region registered fastest growing CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of dental laboratories during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global dental laboratories industry?

The current trends and dynamics in the dental laboratories industry include increasing demand for cosmetic dental procedures and restorative services, advancements in dental technology and materials improving efficiency and outcomes, and growing aging population requiring more dental prosthetics and orthodontics.

Which product held the maximum share in 2023?

The oral care product held the maximum share of the dental laboratories industry.