Defense Emergency Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Published :

Report ID:

Pages :

Format :

Defense Emergency Medicine Market Size - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2033

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

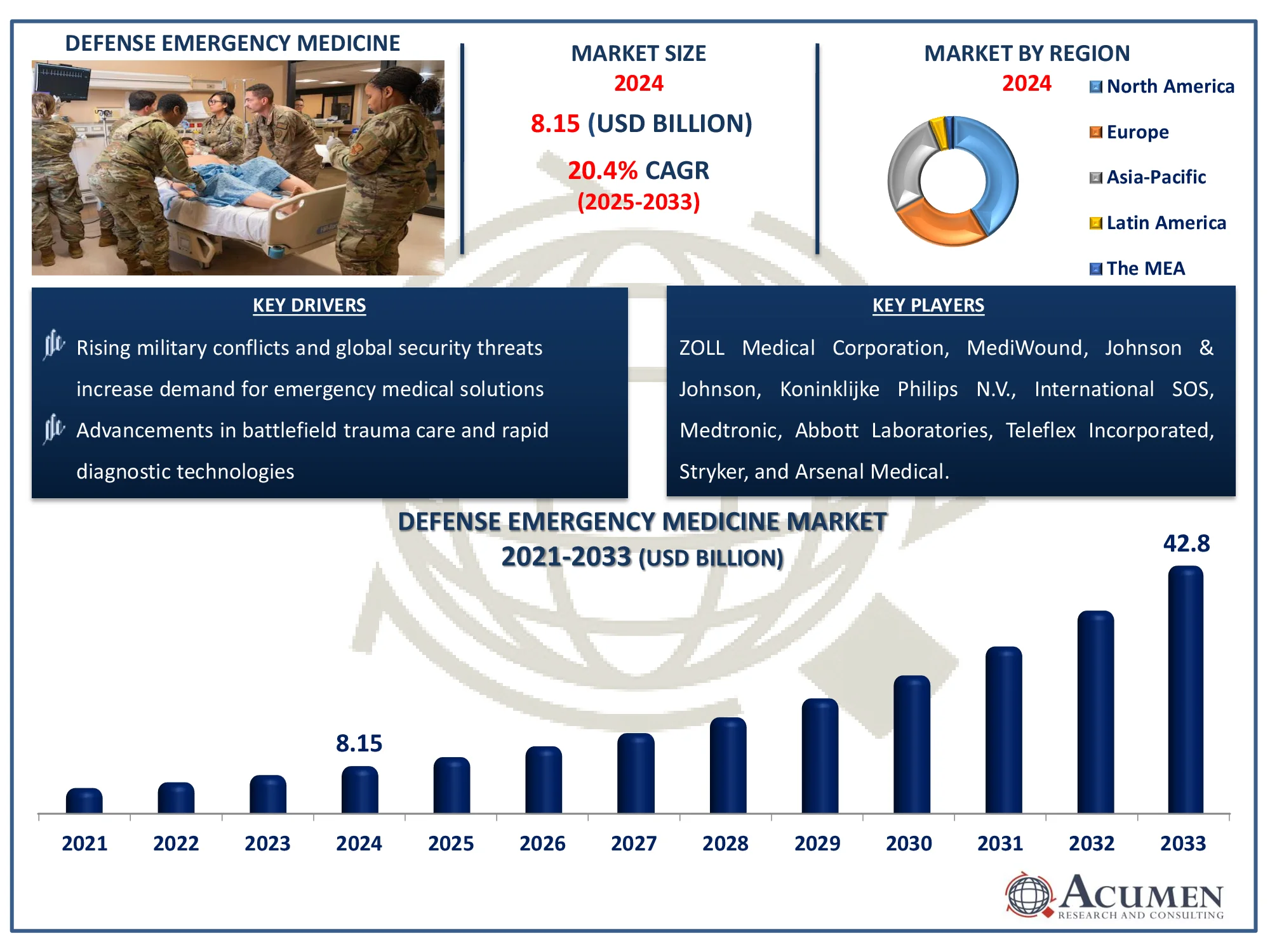

The Global Defense Emergency Medicine Market Size accounted for USD 8.15 Billion in 2024 and is estimated to achieve a market size of USD 42.8 Billion by 2033 growing at a CAGR of 20.4% from 2025 to 2033.

Defense Emergency Medicine Market Highlights

- The global defense emergency medicine market is expected to reach USD 42.8 billion by 2033, with a CAGR of 20.4% from 2025 to 2033

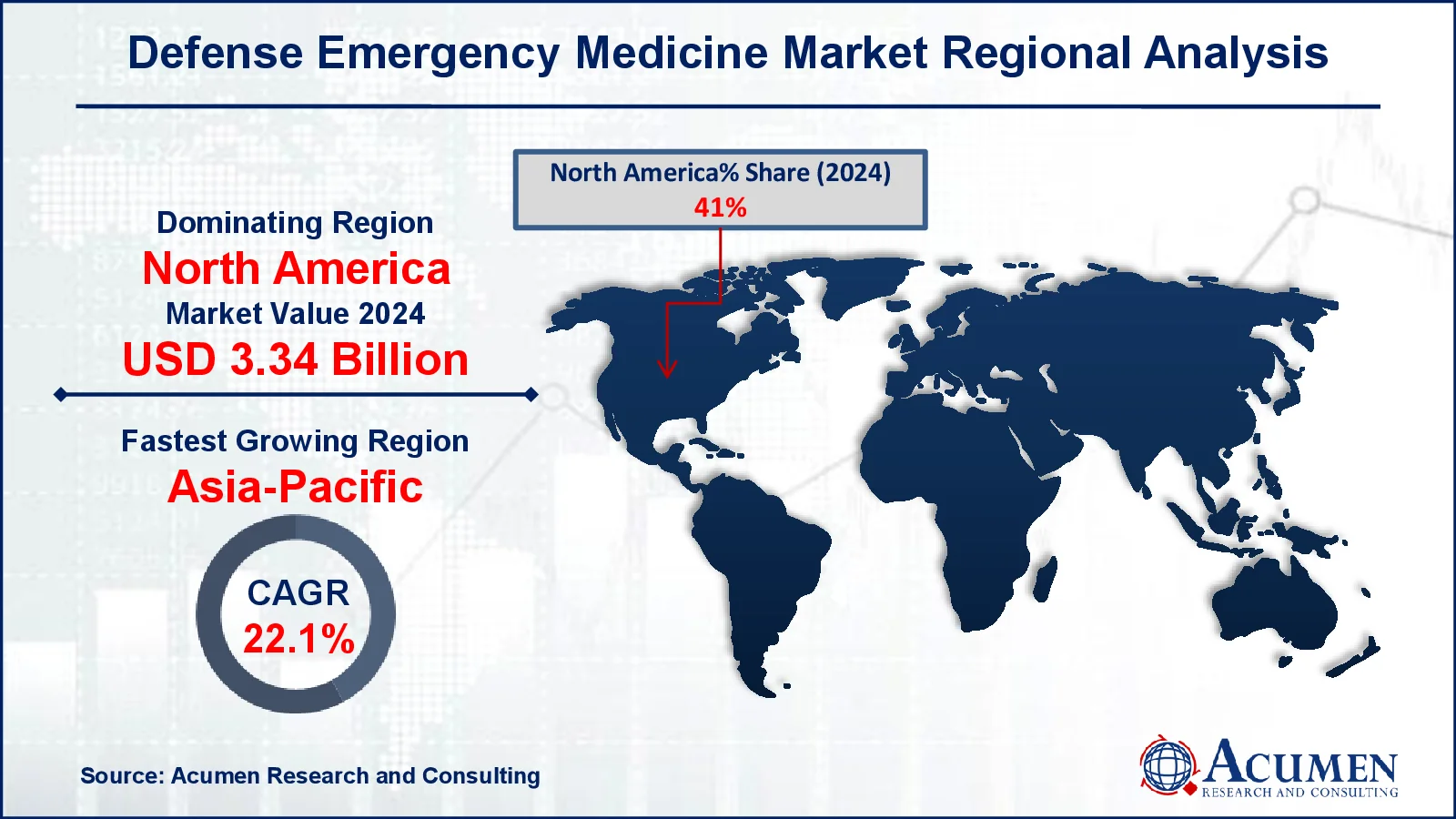

- The North America defense emergency medicine market was valued at approximately USD 3.34 billion in 2024

- The Asia-Pacific defense emergency medicine market is projected to grow at a CAGR of over 22.1% from 2025 to 2033

- Advancements in medical technology such as augmented reality, AI-driven PTSD treatments, and 3D-printed prosthetics, enhancing both military and civilian medical care is a popular market trend that fuels the industry demand

Defense emergency medicines provide urgent care for soldiers in warfare, addressing injuries, respiratory and cardiac issues, infections, and more. Supplies include ventilators, diagnostic kits, bandages, PPE, and other essential equipment. The field has evolved from basic ambulance transport to on-site medical care, ensuring timely treatment and efficient evacuation to hospitals or definitive care facilities.

On February 28, 2022, the FDA approved a naloxone hydrochloride autoinjector for military and chemical event responders. It offers emergency therapy for opioid exposure, including fentanyl analogues, as well as temporary protection for responders in polluted environments. The FDA approved a naloxone autoinjector for military and emergency responders, increasing the demand for quick and simple antidote delivery methods. With the growing threat of potent opioids such as fentanyl in conflict and terrorism, there is a greater demand for quick-acting, portable therapies, resulting in increased investment in military emergency medical solutions.

Global Defense Emergency Medicine Market Dynamics

Market Drivers

- Rising military conflicts and global security threats increase demand for emergency medical solutions

- Advancements in battlefield trauma care and rapid diagnostic technologies

- Government funding and defense budgets support military medical innovations

Market Restraints

- High costs of advanced medical equipment and supplies

- Stringent regulatory approvals and compliance challenges

- Limited accessibility in remote and combat zones

Market Opportunities

- Development of portable and AI-driven medical diagnostic tools

- Increasing collaborations between defense and healthcare industries

- Expansion of telemedicine and remote healthcare solutions for combat zones

Defense Emergency Medicine Market Report Coverage

|

Market |

Defense Emergency Medicine Market |

|

Defense Emergency Medicine Market Size 2024 |

USD 8.15 Billion |

|

Defense Emergency Medicine Market Forecast 2033 |

USD 42.8 Billion |

|

Defense Emergency Medicine Market CAGR During 2025 - 2033 |

20.4% |

|

Defense Emergency Medicine Market Analysis Period |

2021 - 2033 |

|

Defense Emergency Medicine Market Base Year |

2024 |

|

Defense Emergency Medicine Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

ZOLL Medical Corporation, Johnson & Johnson, Koninklijke Philips N.V., International SOS, MediWound, Medtronic, Octapharma AG, Abbott Laboratories, Teleflex Incorporated, Stryker, and Arsenal Medical. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Defense Emergency Medicine Market Insights

The World Health Organization (WHO) has developed standardized medications and medical supplies for crises, ensuring timely, efficient, and effective responses in military scenarios. This program has resulted in the creation of pre-packaged, standardized medical kits intended to address critical health needs during crises. When normal systems fail, these kits provide an urgent primary healthcare supply, helping to boost the defense emergency medicine sector. WHO also uses specialized medical kits to diagnose and treat injuries incurred during a war-related emergency.

Collaboration among governing authorities promotes the advancement and implementation of modern medical technologies. WHO's National Civil-Military Collaboration Framework for Strengthening Health disaster Preparedness promotes collaboration between the public health and military sectors in order to improve disaster response capabilities. This integration promotes medical technology innovation, resulting in increasing demand for specialized medical equipment, medications, and training programs in both military and civilian emergency settings.

Regulatory approvals also create major prospects for market expansion. On August 8, 2024, the FDA issued Octapharma Emergency Use Authorization (EUA) for OctaplasLG Powder (blood group A & AB), a freeze-dried plasma substitute used to treat bleeding and coagulopathy in US military combat emergencies. Unlike traditional plasma, this shelf-stable solution does not require refrigeration and can be swiftly reconstituted, making it perfect for battlefield applications. Given that bleeding is a primary cause of combat deaths, this breakthrough improves timely medical intervention, increasing market growth in defense emergency care.

Additionally, on March 2, 2023, the FDA approved Abbott's Alinity i TBI lab test, which may provide traumatic brain injury (TBI) results in just 18 minutes—a major advance over earlier testing. This rapid diagnostic tool facilitates speedy concussion tests, decreasing dependency on CT scans. The United States Department of Defense (DoD) contributed significantly to its research through USAMRDC and USAMMDA, following Abbott's handheld TBI test's FDA clearance in 2021. These advances in battlefield diagnostics improve the speed and accuracy of medical assessments, hence driving market growth in defense emergency medicine.

Defense Emergency Medicine Market Segmentation

Defense Emergency Medicine Market Segmentation

The worldwide market for defense emergency medicine is split based on type, application, end-use, and geography.

Defense Emergency Medicine Market By Type

- Diagnostics and Monitoring Equipment

- ECG Monitor

- Blood Pressure Monitors

- Blood Glucose Monitors

- Blood Gas and Electrolyte Analyzers

- Others

- Wound Care Supplies

- Dressings and Bandages

- Sutures and Staples

- Others

- Patient Handling Equipment

- Patient Lifting Equipment

- Medical Beds

- Wheelchairs and Scooters

- Others

- Others

According to defense emergency medicine industry analysis, diagnostics and monitoring equipment plays critical role in real-time assessment of soldiers' health on the battlefield. Devices such as portable ultrasound, vital signs monitors, and point-of-care testing kits enable rapid diagnosis, improving survival rates in combat scenarios. The increasing demand for advanced wearable sensors and AI-driven diagnostic tools further strengthens this segment’s growth. Wound care supplies follow closely, essential for treating combat injuries like burns, lacerations, and hemorrhages. Patient handling equipment, including stretchers and evacuation systems, ensures safe transport.

Defense Emergency Medicine Market By Application

- Trauma Care

- Cardiac Care

- Respiratory Care

- Burn Care

- Wound Management

- Infection Control

- Others

According to defense emergency medicine industry analysis, trauma care to the high incidence of combat-related injuries, including gunshot wounds, blast trauma, and fractures. Rapid-response trauma solutions such as tourniquets, hemostatic dressings, and field surgical kits are critical for stabilizing soldiers in battlefield conditions. Wound management and burn care are also vital, addressing injuries from explosions and chemical exposure. Cardiac care, respiratory care, and infection control play crucial roles in treating shock, airway complications, and preventing infections.

Defense Emergency Medicine Market By End-User

- Military Hospitals & Clinics

- Field Medical Units

- Defense Training & Research Centers

- Special Forces Medical Teams

According to defense emergency medicine market forecast, field medical units provide immediate, on-site medical care to injured soldiers in combat zones. These units are equipped with portable diagnostic tools, emergency surgical kits, and life-saving medications to stabilize patients before evacuation. Their ability to operate in extreme environments and deliver rapid trauma care makes them the most critical component of battlefield medicine. Military hospitals & clinics handle long-term recovery and advanced treatments, while special forces medical teams specialize in high-risk, tactical medical support. Defense training & research centers focus on developing cutting-edge medical technologies and training personnel for emergency response.

Defense Emergency Medicine Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Defense Emergency Medicine Market Regional Analysis

Defense Emergency Medicine Market Regional Analysis

In terms of regional segments, North America is predicted to lead the worldwide defense emergency medicine market, followed by Asia-Pacific, owing to strong government participation and strategic initiatives in the United States. According to the Kaiser Family Foundation (KFF), the United States will spend $128 billion on veterans' healthcare in fiscal year 2024, benefiting more than 7 million veterans. Furthermore, the National Institutes of Health (NIH) got $46 billion, accounting for 19% of discretionary funding. Furthermore, a significant restructuring is taking place in the United States Department of Defense, consolidating military hospitals and clinics under a single agency, the Defense Health Agency (DHA), which will oversee healthcare for 9.5 million beneficiaries, marking one of the most significant military healthcare reorganizations in US history.

Meanwhile, Asia-Pacific is quickly increasing in the defense emergency medicine industry, driven by strategic medical equipment procurement and defense modernization initiatives. India is to invest $130 billion in military upgrading over the next five years, with a particular emphasis on self-sufficiency in defense production and emergency medical supplies. Furthermore, in the FY 2024-25 Union Budget, India's Ministry of Defence (MoD) received Rs 6,21,940.85 crore (roughly $75 billion), the most of any ministry. An additional Rs 400 crore has been set out for defense innovation under the ADITI (Acing Development of Innovative Technologies with iDEX) project. Increased investment in defense research and development is likely to foster advances in trauma treatment, battlefield diagnostics, and emergency response systems, further propelling market expansion in Asia.

Defense Emergency Medicine Market Players

Some of the top defense emergency medicine companies offered in our report includes ZOLL Medical Corporation, Johnson & Johnson, Koninklijke Philips N.V., International SOS, MediWound, Medtronic, Octapharma AG, Abbott Laboratories, Teleflex Incorporated, Stryker, and Arsenal Medical.

Frequently Asked Questions

What was the market size of the global Defense Emergency Medicine in 2024?

The market size of defense emergency medicine was USD 8.15 Billion in 2024.

What is the CAGR of the global Defense Emergency Medicine market from 2025 to 2033?

The CAGR of defense emergency medicine is 20.4% during the analysis period of 2025 to 2033.

Which are the key players in the Defense Emergency Medicine market?

The key players operating in the global market are including ZOLL Medical Corporation, Johnson & Johnson, Koninklijke Philips N.V., International SOS, MediWound, Medtronic, Octapharma AG, Abbott Laboratories, Teleflex Incorporated, Stryker, and Arsenal Medical.

Which region dominated the global Defense Emergency Medicine market share?

North America held the dominating position in defense emergency medicine industry during the analysis period of 2025 to 2033.

Which region registered fastest CAGR from 2025 to 2033?

Asia-Pacific region exhibited fastest growing CAGR for market of defense emergency medicine during the analysis period of 2025 to 2033.

What are the current trends and dynamics in the global Defense Emergency Medicine industry?

The current trends and dynamics in the defense emergency medicine industry rising military conflicts and global security threats increase demand for emergency medical solutions, advancements in battlefield trauma care and rapid diagnostic technologies, and government funding and defense budgets support military medical innovations.

Which application held the maximum share in 2024?

The trauma care expected to hold the maximum share of the defense emergency medicine industry.