Data Governance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Data Governance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

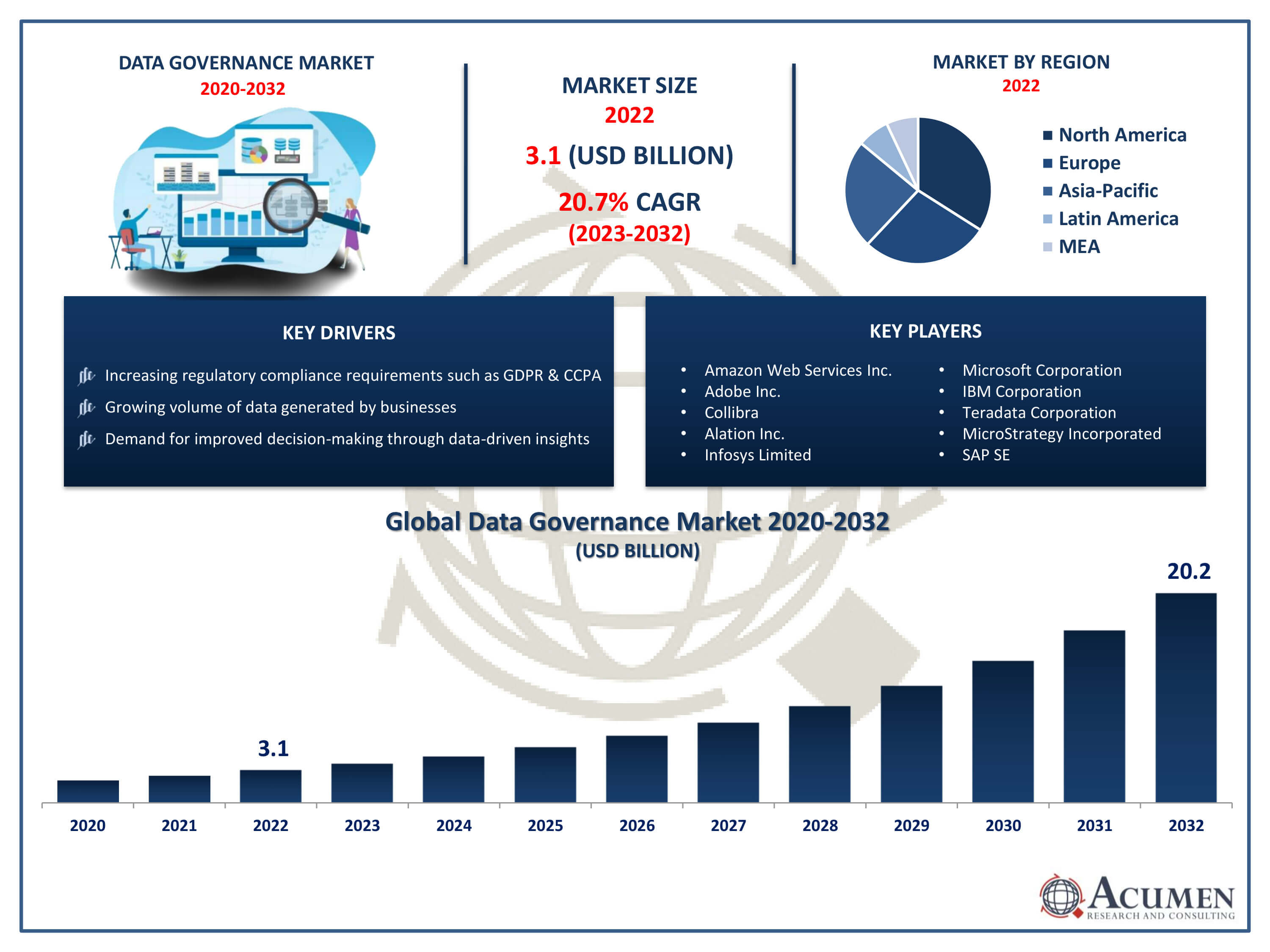

The Data Governance Market Size accounted for USD 3.1 Billion in 2022 and is projected to achieve a market size of USD 20.2 Billion by 2032 growing at a CAGR of 20.7% from 2023 to 2032.

Data Governance Market Highlights

- Global data governance market revenue is expected to increase by USD 20.2 Billion by 2032, with a 20.7% CAGR from 2023 to 2032

- North America region led with more than 36% of data governance market share in 2022

- Asia-Pacific data governance market growth will record a CAGR of around 21.6% from 2023 to 2032

- By application, the risk management segment is the largest segment in the market, accounting for over 33% of the market share in 2022

- By deployment, the cloud segment is expected to grow at the remarkable CAGR of 21.4% over the projected period

- Increasing regulatory compliance requirements such as GDPR and CCPA, drives the data governance market value

Data governance is a set of processes, policies, and standards that ensure high data quality, availability, usability, and security within an organization. It encompasses the management of data assets across their entire lifecycle, from creation to archival or deletion, and involves establishing roles and responsibilities for data stewardship, defining data standards, implementing data management technologies, and enforcing compliance with regulatory requirements. Effective data governance enables organizations to derive actionable insights, make informed decisions, mitigate risks associated with data breaches or inaccuracies, and maintain regulatory compliance.

The market for data governance solutions and services has been experiencing significant growth in response to these escalating demands. Organizations are increasingly investing in data governance technologies to address challenges related to data quality, privacy, security, and regulatory compliance. Additionally, regulatory requirements such as GDPR, CCPA, and others mandate strict data protection and privacy measures, further driving the adoption of data governance solutions. Moreover, the rise of data-driven decision-making across industries underscores the importance of having reliable, high-quality data, spurring organizations to invest in data governance initiatives to ensure data integrity and accuracy.

Global Data Governance Market Trends

Market Drivers

- Increasing regulatory compliance requirements such as GDPR and CCPA

- Growing volume of data generated by businesses

- Recognition of data as a strategic asset driving innovation and efficiency

- Demand for improved decision-making through data-driven insights

- Adoption of cloud-based data governance solutions for scalability and flexibility

Market Restraints

- Complexity in implementing comprehensive data governance frameworks

- Lack of skilled professionals for managing data governance initiatives

Market Opportunities

- Integration of artificial intelligence and machine learning for automated data governance

- Expansion of data governance solutions tailored for specific industries or use cases

Data Governance Market Report Coverage

| Market | Data Governance Market |

| Data Governance Market Size 2022 | USD 3.1 Billion |

| Data Governance Market Forecast 2032 |

USD 20.2 Billion |

| Data Governance Market CAGR During 2023 - 2032 | 20.7% |

| Data Governance Market Analysis Period | 2020 - 2032 |

| Data Governance Market Base Year |

2022 |

| Data Governance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, By Deployment, By Vertical, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amazon Web Services Inc. (Amazon.com Inc.), Adobe Inc., Collibra, Alation Inc., Infosys Limited, Microsoft Corporation, International Business Machines Corporation, Teradata Corporation, MicroStrategy Incorporated, SAP SE, Oracle Corporation, and SAS Institute Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Data governance is a comprehensive framework for managing the availability, usability, integrity, and security of an organization's data assets. It involves establishing policies, processes, and controls to ensure that data is managed efficiently, remains consistent and accurate, and complies with regulatory requirements. Data governance encompasses various aspects, including data quality management, metadata management, data security, privacy, and compliance. At its core, data governance aims to facilitate effective decision-making, enhance operational efficiency, mitigate risks, and maximize the value derived from data across an organization. The applications of data governance span across numerous sectors and functions within an organization. In finance and banking, data governance ensures regulatory compliance, risk management, and accurate financial reporting.

The data governance market has witnessed robust growth in recent years, driven by several key factors. With the exponential increase in data volumes generated by businesses worldwide, organizations are increasingly recognizing the importance of effectively managing and governing their data assets. Regulatory compliance requirements such as GDPR, CCPA, and other data privacy laws have further accelerated the adoption of data governance solutions. These regulations mandate stringent measures for data handling, storage, and protection, compelling organizations to invest in robust data governance frameworks to ensure compliance and mitigate risks. Moreover, the growing recognition of data as a strategic asset has fueled investments in data governance initiatives. Businesses are realizing the potential of leveraging data to drive innovation, improve decision-making processes, and gain a competitive edge. As a result, there is a heightened focus on implementing comprehensive data governance strategies to unlock the value of data assets.

Data Governance Market Segmentation

The global data governance market segmentation is based on component, application, deployment, vertical, and geography.

Data Governance Market By Component

- Services

- Solution

According to the data governance industry analysis, the solution segment accounted for the largest market share in 2022. One notable segment is metadata management solutions. Metadata, which provides context and information about data, plays a crucial role in data governance by facilitating data discovery, understanding data lineage, and ensuring data quality. As organizations grapple with increasingly complex data landscapes, the demand for robust metadata management solutions is on the rise. These solutions enable organizations to catalog and manage metadata effectively, enhancing data governance capabilities and supporting regulatory compliance efforts. Another rapidly growing segment is data quality solutions. Ensuring the accuracy, consistency, and completeness of data is fundamental to effective data governance. Data quality solutions help organizations address data quality issues by identifying and rectifying errors, inconsistencies, and duplications in data.

Data Governance Market By Application

- Compliance Management

- Audit Management

- Risk Management

- Incident Management

- Others

In terms of applications, the risk management segment is expected to witness significant growth in the coming years. With the proliferation of data breaches, cyber threats, and regulatory scrutiny, organizations are increasingly investing in risk management solutions as part of their broader data governance strategies. These solutions enable organizations to identify, assess, and mitigate risks associated with their data assets, including risks related to data privacy, security, and compliance. One key driver of growth in the risk management segment is the implementation of regulatory compliance measures such as GDPR, CCPA, and other data privacy laws. These regulations impose strict requirements for data handling, storage, and protection, making it imperative for organizations to adopt robust risk management practices to ensure compliance and avoid hefty fines and penalties. Risk management solutions offer capabilities for assessing and managing compliance risks, implementing data access controls, and monitoring data usage to safeguard sensitive information and maintain regulatory compliance.

Data Governance Market By Deployment

- On-Premises

- Cloud

According to the data governance market forecast, the cloud segment is expected to witness significant growth in the coming years. This growth is driven by the increasing adoption of cloud computing and the growing recognition of the benefits offered by cloud-based data governance solutions. Organizations are increasingly migrating their data and applications to the cloud to leverage scalability, flexibility, and cost-effectiveness. As a result, there is a growing need for data governance solutions that can seamlessly integrate with cloud environments and support the governance of cloud-based data assets. One key driver of growth in the cloud segment is the scalability and agility provided by cloud-based data governance solutions. Cloud platforms offer elastic infrastructure and resources, allowing organizations to scale their data governance initiatives as their data volumes and complexity grow. Cloud-based data governance solutions enable organizations to deploy rapidly, without the need for significant upfront investments in infrastructure, and can easily adapt to changing business requirements and data landscapes.

Data Governance Market By Vertical

- BFSI

- Government

- Retail & Consumer

- Manufacturing

- Healthcare

- Transportation & Logistics

- Telecom and IT

- Other

Based on the vertical, the BFSI segment is expected to continue its growth trajectory in the coming years. This growth is due to stringent regulatory requirements, the increasing volume of data, and the critical importance of data integrity and security. Regulatory bodies such as the Basel Committee on Banking Supervision, the Securities and Exchange Commission (SEC), and various central banks impose strict regulations on data management, privacy, and security to safeguard customer information and maintain the stability and transparency of financial systems. Consequently, BFSI organizations are investing heavily in data governance solutions to ensure compliance with these regulations while effectively managing and securing their vast volumes of financial data. Moreover, the BFSI sector is witnessing a surge in data-driven decision-making and digital transformation initiatives, further driving the demand for robust data governance frameworks. As BFSI organizations strive to enhance customer experiences, streamline operations, and develop innovative financial products and services, they rely heavily on high-quality, accurate, and well-governed data.

Data Governance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

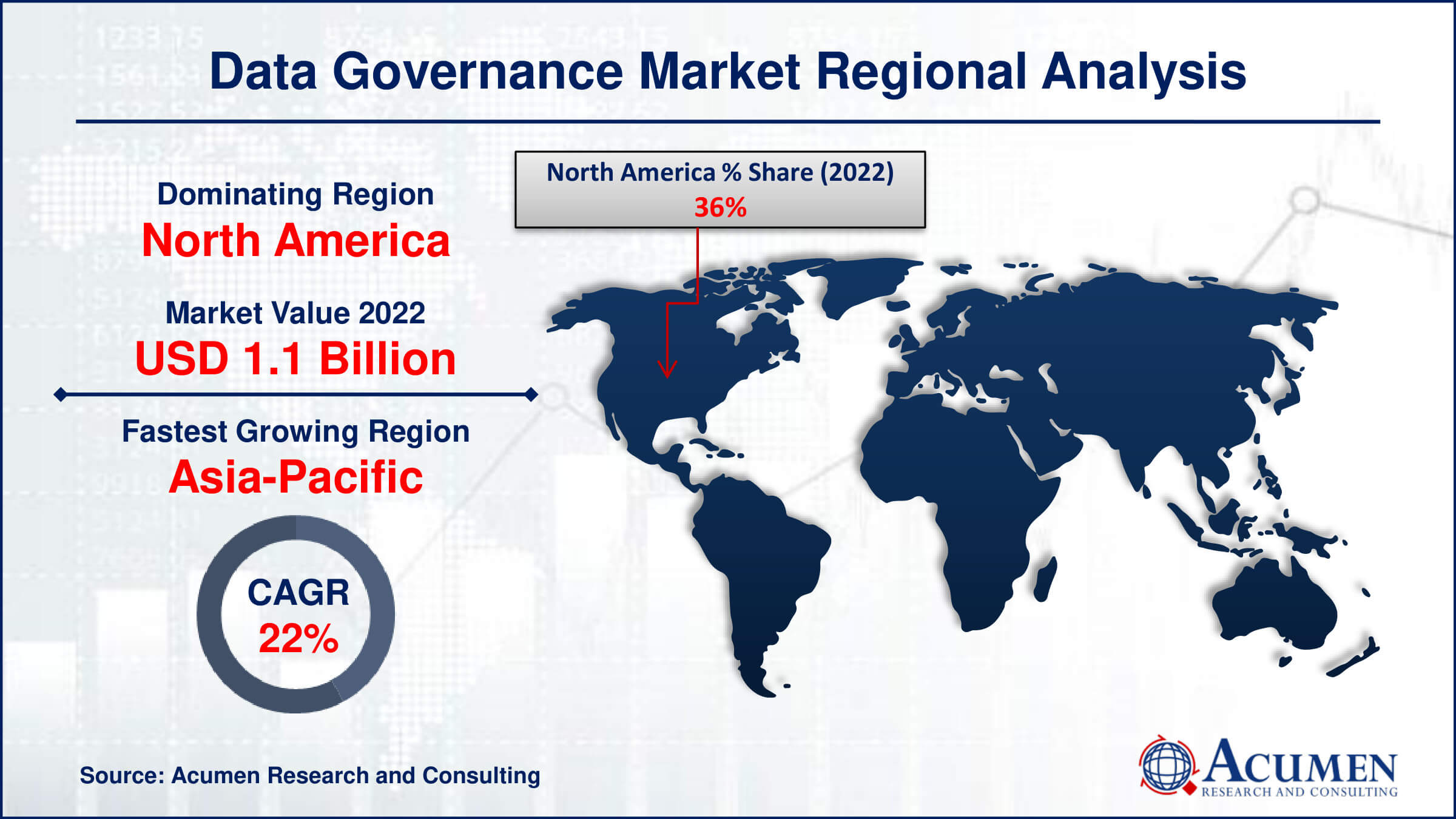

Data Governance Market Regional Analysis

North America dominates the data governance market for several reasons, primarily due to its robust technological infrastructure, strong regulatory environment, and widespread adoption of data-driven practices across industries. The region hosts a plethora of established and emerging technology companies that drive innovation in data governance solutions and services. Additionally, North American enterprises, particularly in sectors such as finance, healthcare, and retail, are early adopters of advanced data governance practices to manage vast amounts of data effectively. Furthermore, North America boasts stringent regulatory frameworks such as GDPR, CCPA, HIPAA, and SOX, which mandate strict data governance and compliance measures. This regulatory landscape compels organizations to invest heavily in data governance solutions to ensure adherence to data protection laws and mitigate the risk of non-compliance. Moreover, the region's heightened focus on cybersecurity and data privacy further drives the demand for comprehensive data governance solutions, including data encryption, access controls, and audit trails. Moreover, the North American market benefits from a strong ecosystem of data governance vendors, consultants, and service providers, offering a wide array of solutions tailored to the diverse needs of businesses.

Data Governance Market Player

Some of the top data governance market companies offered in the professional report include Amazon Web Services Inc. (Amazon.com Inc.), Adobe Inc., Collibra, Alation Inc., Infosys Limited, Microsoft Corporation, International Business Machines Corporation, Teradata Corporation, MicroStrategy Incorporated, SAP SE, Oracle Corporation, and SAS Institute Inc.

Frequently Asked Questions

How big is the data governance market?

The data governance market size was USD 3.1 Billion in 2022.

What is the CAGR of the global data governance market from 2023 to 2032?

The CAGR of data governance is 20.7% during the analysis period of 2023 to 2032.

Which are the key players in the data governance market?

The key players operating in the global market are including Amazon Web Services Inc. (Amazon.com Inc.), Adobe Inc., Collibra, Alation Inc., Infosys Limited, Microsoft Corporation, International Business Machines Corporation, Teradata Corporation, MicroStrategy Incorporated, SAP SE, Oracle Corporation, and SAS Institute Inc.

Which region dominated the global data governance market share?

North America held the dominating position in data governance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of data governance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global data governance industry?

The current trends and dynamics in the data governance industry include increasing regulatory compliance requirements such as GDPR and CCPA, growing volume of data generated by businesses, and recognition of data as a strategic asset driving innovation and efficiency.

Which application held the maximum share in 2022?

The risk management application held the maximum share of the data governance industry.