Data Center Liquid Cooling Market | Acumen Research and Consulting

Data Center Liquid Cooling Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

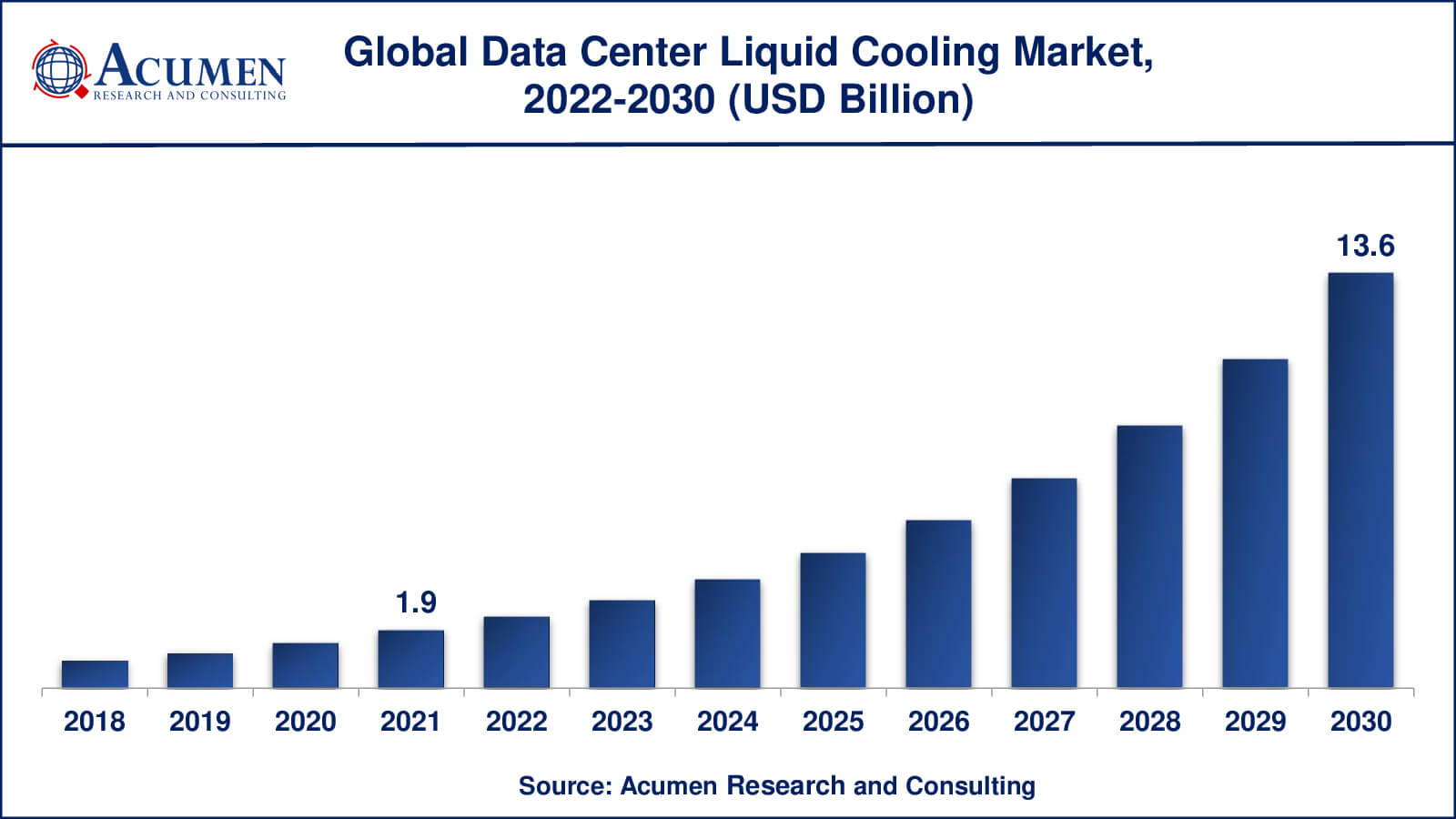

The Global Data Center Liquid Cooling Market Size accounted for USD 1.9 Billion in 2021 and is projected to occupy a market size of USD 13.6 Billion by 2030 growing at a CAGR of 24.6% from 2022 to 2030. Data centers are sophisticated, specialized structures that house critical server equipment that allows businesses to access and transfer critical data. Data centers are in charge of performing search queries, transferring data, and providing computing services to millions of users all over the world at any given time. Data centers are essential for storing information and are critical for businesses to maintain. Servers are at risk of overheating and failing if data centers are not built properly. With an increasing number of industries dependent on digitally stored information, this risk has only increased in recent decades. The more servers there are in a given area, the higher the temperature can rise. If temperatures rise above a critical level, the processor may fail to function properly, or it may even burn out. This is why data centre cooling is critical.

Data Center Liquid Cooling Market Report Statistics

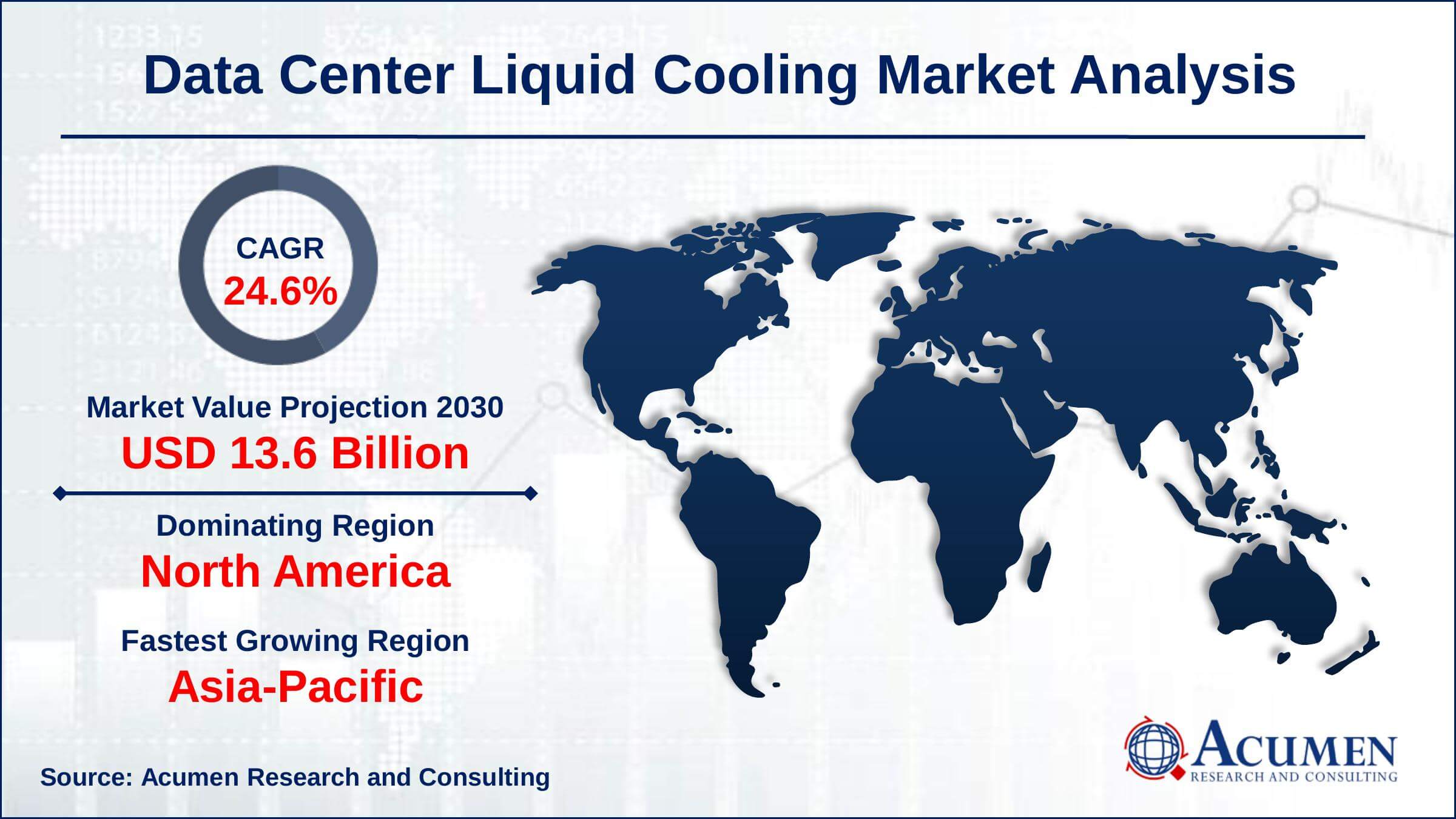

- Global data center liquid cooling market revenue is estimated to reach USD 13.6 Billion by 2030 with a CAGR of 24.6% from 2022 to 2030

- According to our analysis, there will be over 7.2 million data centers by 2022 across the world

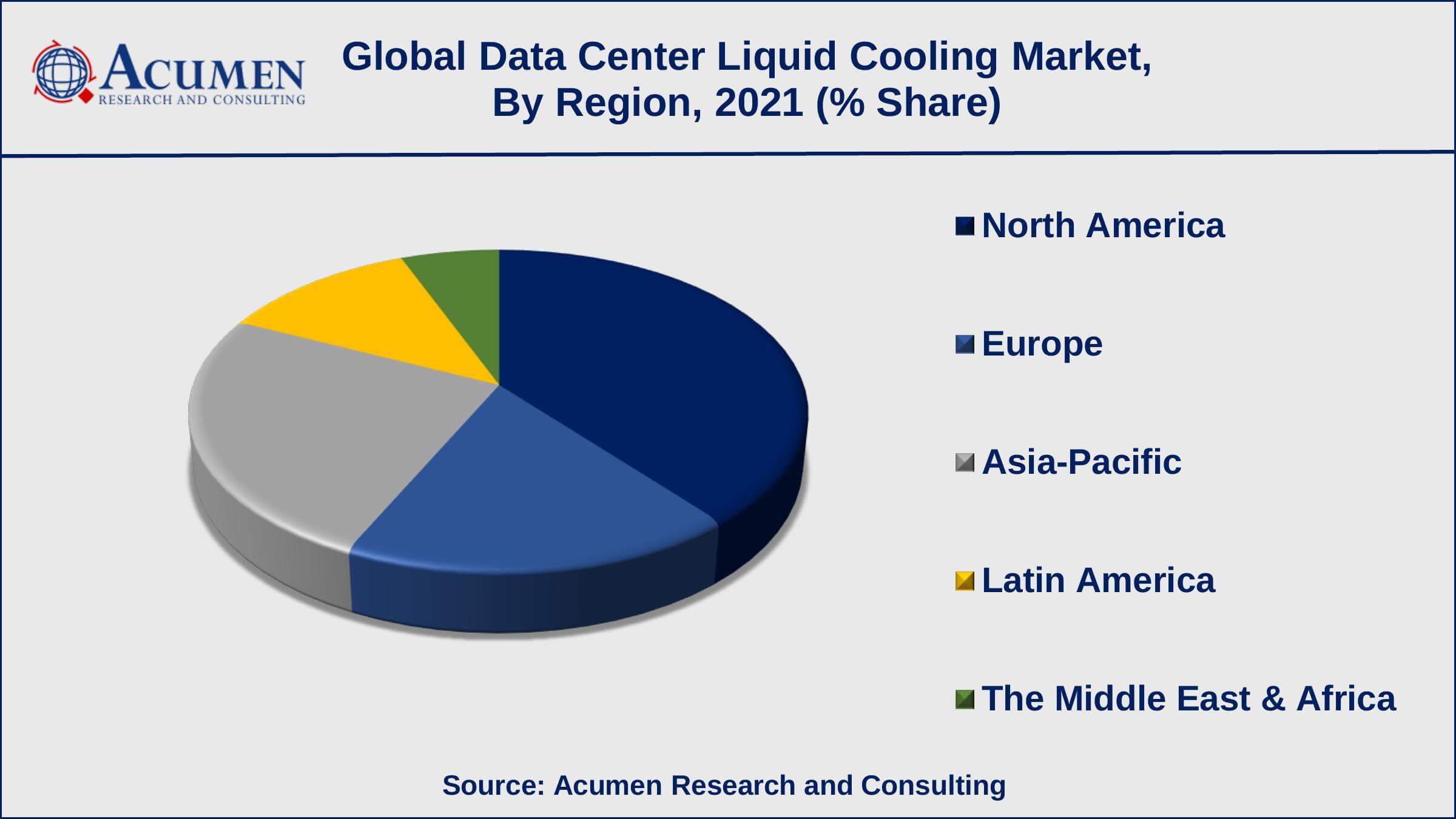

- North America data center liquid cooling market share generated over 37% shares in 2021

- Asia-Pacific data center liquid cooling market growth will record substantial CAGR of over 25% from 2022 to 2030

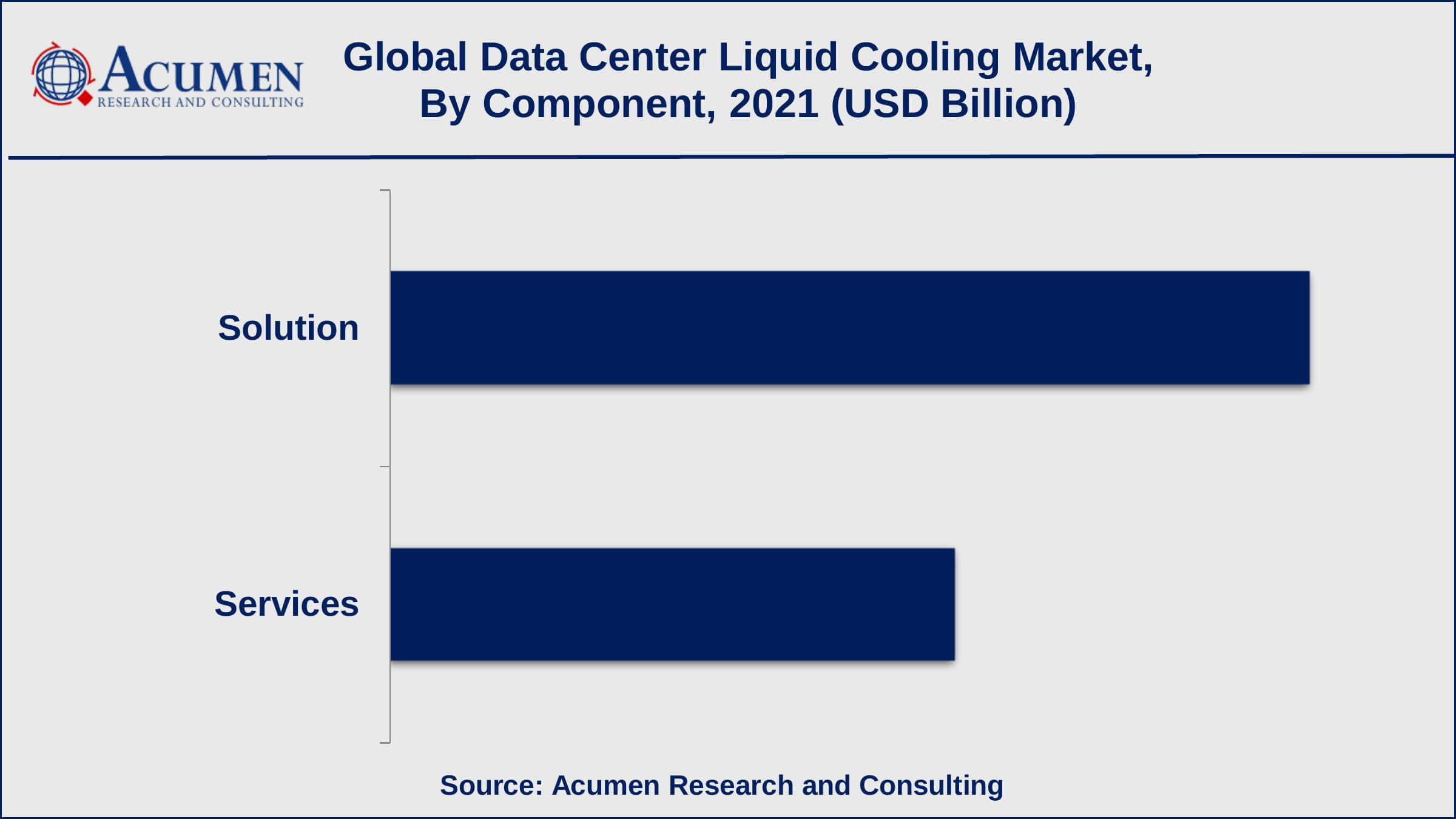

- Based on component, solution captured around 62% of the overall market share in 2021

- Surging need for cloud-based services is a popular data center liquid cooling market trend that is fueling the industry demand

Global Data Center Liquid Cooling Market Dynamics

Market Drivers

- Growing number of data centers and server density

- Increasing trend of energy-efficient cooling solutions

- Rising need for sub-merged data centers

- Surging demand for compact and noise-free solutions

Market Restraints

- High capital spending and maintenance

- Risk associated with data leakage

Market Opportunities

- Growing trend of cloud-computing, AI, crypto, and blockchain

- Upgradation and enhancement and of the existing legacy infrastructure

Data Center Liquid Cooling Market Report Coverage

| Market | Data Center Liquid Cooling Market |

| Data Center Liquid Cooling Market Size 2021 | USD 1.9 Billion |

| Data Center Liquid Cooling Market Forecast 2030 | USD 13.6 Billion |

| Data Center Liquid Cooling Market CAGR During 2022 - 2030 | 24.6% |

| Data Center Liquid Cooling Market Analysis Period | 2018 - 2030 |

| Data Center Liquid Cooling Market Base Year | 2021 |

| Data Center Liquid Cooling Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Cooling Technique, By Component, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Chilldyne Inc., Asetek, Mitsubishi Electric Corporation, CoolIT Systems Inc., Schneider Electric, Vertiv Co., Aecorsis BV, LiquidStack, Rittal GmbH & Co. Kg., and Alfa Laval. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Data Center Liquid Cooling Market Growth Factors

High quality, reliability and effective cooling advantages of data center liquid cooling market products are basically driving their utilization in a few applications including colocation, BFSI, manufacturing, and so on. A few administrators over the globe are confronting difficulties in keeping up suitable temperatures in their offices.

The key driver for the data center liquid cooling market is the expanding power and cooling need of current types of modern equipment. Another driver driving the data center liquid cooling market is high warmth stack inside numerous data centers is making it hard to oblige buy of new equipment which is confining the extension and constraining the development of the associations.

Need of heat management solutions and successful cooling for high density computer and blade servers is additionally the factor enlarging the demand for data center liquid cooling. The data center liquid cooling market is foreseen to develop in view of the cooling with diminished carbon impression because of the utilization of advanced engineering coolants. As liquids are denser than air, they accommodate an amazing cooling medium and subsequently are better conductors of heat energy. This further enlarges the demand for data center liquid cooling. Anyway Liquid is both conductive and destructive alongside power and any kind of rupture in the data center liquid cooling system can be devastating for the facilities and frameworks. This represents a noteworthy test for the data center liquid cooling market

Data Center Liquid Cooling Market Segmentation

The global data center liquid cooling market is segmented based on cooling technique, component, application, and geography.

Data Center Liquid Cooling Market By Cooling Technique

- Small and Mid-Sized Data Center

- Large Data Center

According to the data centre liquid cooling industry analysis, the large data centre sub-segment held the majority of the market share in 2021 and is expected to continue to do so in the coming years. The rise of digitization, rising business preference for cloud solutions, and robust demand from IoT, AI, and blockchain are all bolstering the large data centre industry. Furthermore, as businesses move toward digitalization, more data centers will be required, resulting in increased demand for liquid cooling in the industry. However, due to the increased number of small and medium-sized businesses, small and medium-sized data centers are expected to grow at a rapid pace.

Data Center Liquid Cooling Market By Component

- Solution

- Direct Immersion Cooling

- Single Phase Cooling

- Two Phase Cooling

- Indirect Cooling

- Rack Based Cooling

- Row Based Cooling

- Direct Immersion Cooling

- Services

- Design & Consulting

- Installation & Deployment

- Maintenance & Support

The solution sub-segment will lead the market from 2022 to 2030, according to the data centre liquid cooling market forecast. The services sub-segment, on the other hand, is expected to grow at the fastest CAGR during the forecast period. The segment's rapid growth can be attributed to the fact that data centers require custom-designed liquid cooling services as well as the elimination of heat transfer system overhead costs.

Data Center Liquid Cooling Market By Application

- BFSI

- Colocation

- Energy

- Government

- Healthcare

- Manufacturing

- IT & Telecom

- Others

The BFSI segment in the data center liquid cooling business sector will observer selection because of high remaining tasks at hand and computerized documentation in financial &banking institutions. It likewise incorporates high-recurrence block chain applications and exchanging systems, for example, cryptocurrencies and intelligent contracts. These systems incorporate immense measures of information and require proficient capacity and the executive’s abilities that help the utilization of data center facilities. So as to oversee warm and temperature levels in these offices, suppliers are moving towards liquid cooling options because of the productive execution benefits that further fuel the business development.

Data Center Liquid Cooling Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Data Center Liquid Cooling Market Regional Analysis

North America is quickly emerging in the data center liquid cooling market attributable to the presence of a few complex offices in the U.S. Heavy utilization use of digitized innovations in the nation and the need to deal with the gigantic information abilities bolster the business extension. In addition, significant enterprises including healthcare, manufacturing, colocation, IT & telecom, etc., and so forth are quickly pushing toward digitized tasks. The presence of a few data center& related component suppliers in the U.S. is a noteworthy driver for the regional development.

Data Center Liquid Cooling Market Players

The key enterprises operating in the world-wide data center liquid cooling market are Chilldyne Inc., Asetek, Mitsubishi Electric Corporation, CoolIT Systems Inc., Schneider Electric, Vertiv Co., Aecorsis BV, LiquidStack, Rittal GmbH & Co. Kg., and Alfa Laval.

Frequently Asked Questions

What is the size of global data center liquid cooling market in 2021?

The market size of data center liquid cooling market in 2021 was accounted to be USD 1.9 Billion.

What is the CAGR of global data center liquid cooling market during forecast period of 2022 to 2030?

The projected CAGR of data center liquid cooling market during the analysis period of 2022 to 2030 is 24.6%.

Which are the key players operating in the market?

The prominent players of the global data center liquid cooling payments transaction market include Chilldyne Inc., Asetek, Mitsubishi Electric Corporation, CoolIT Systems Inc., Schneider Electric, Vertiv Co., Aecorsis BV, LiquidStack, Rittal GmbH & Co. Kg., and Alfa Laval.

Which region held the dominating position in the global data center liquid cooling market?

North America held the dominating data center liquid cooling during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for data center liquid cooling during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global data center liquid cooling market?

Growing number of data centers and server density, increasing trend of energy-efficient cooling solutions, and rising need for sub-merged data centers drives the growth of global data center liquid cooling market.

Which component held the maximum share in 2021?

Based on component, solution segment is expected to hold the maximum share data center liquid cooling market.?

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date