Cyber Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cyber Insurance Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

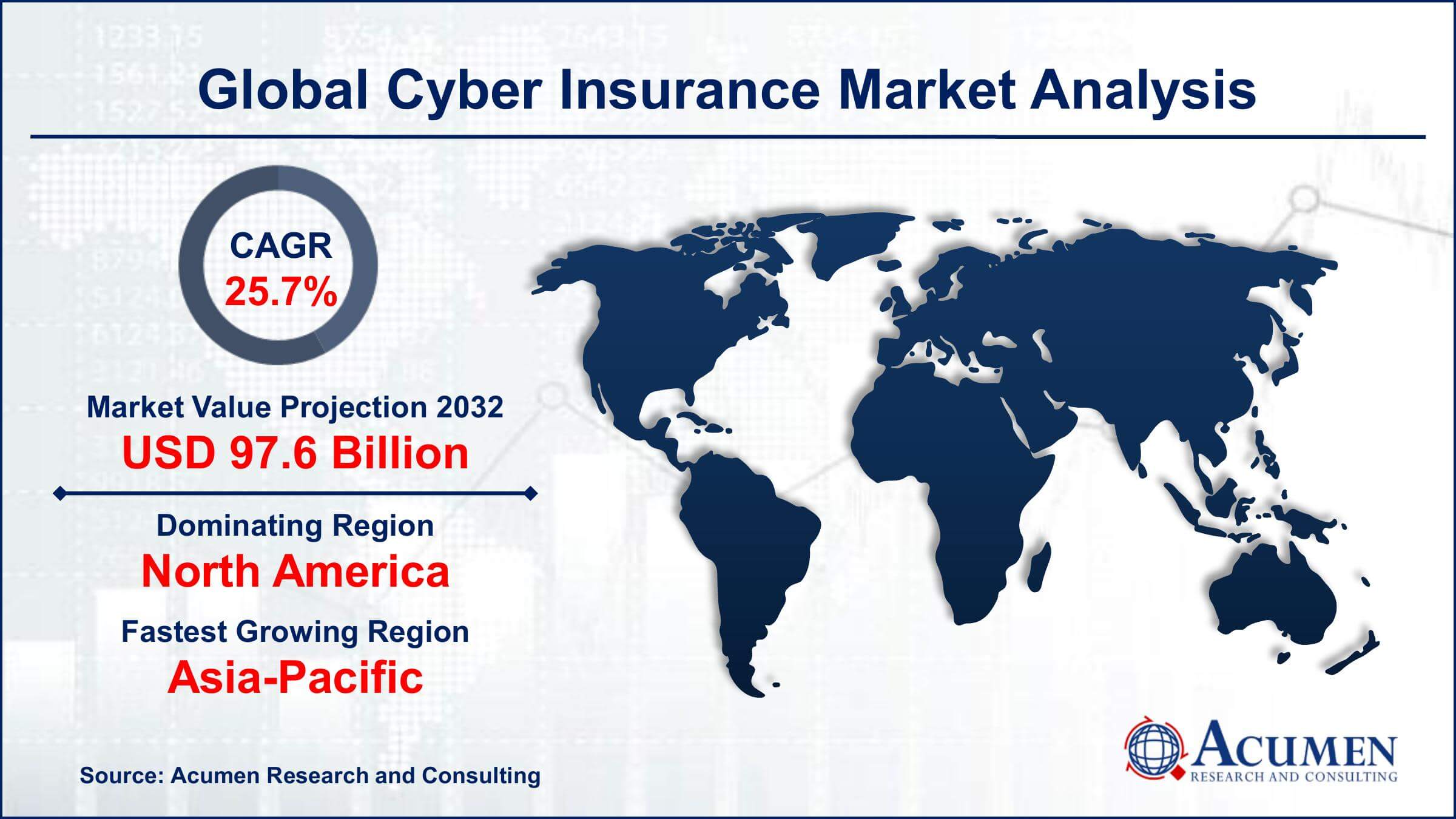

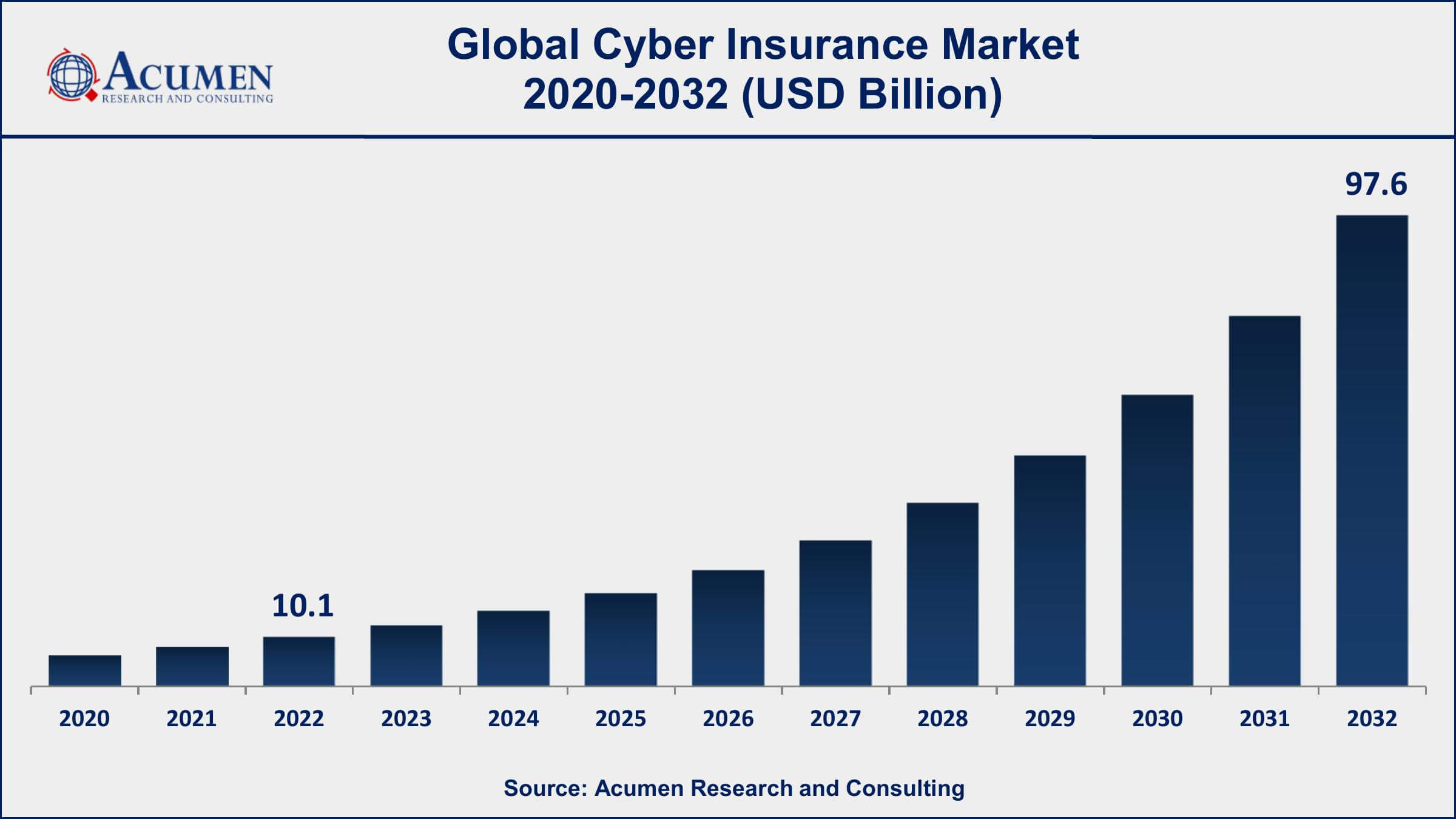

The Global Cyber Insurance Market Size accounted for USD 10.1 Billion in 2022 and is projected to achieve a market size of USD 97.6 Billion by 2032 growing at a CAGR of 25.7% from 2023 to 2032.

Cyber Insurance Market Highlights

- Global Cyber Insurance Market revenue is expected to increase by USD 97.6 Billion by 2032, with a 25.7% CAGR from 2023 to 2032

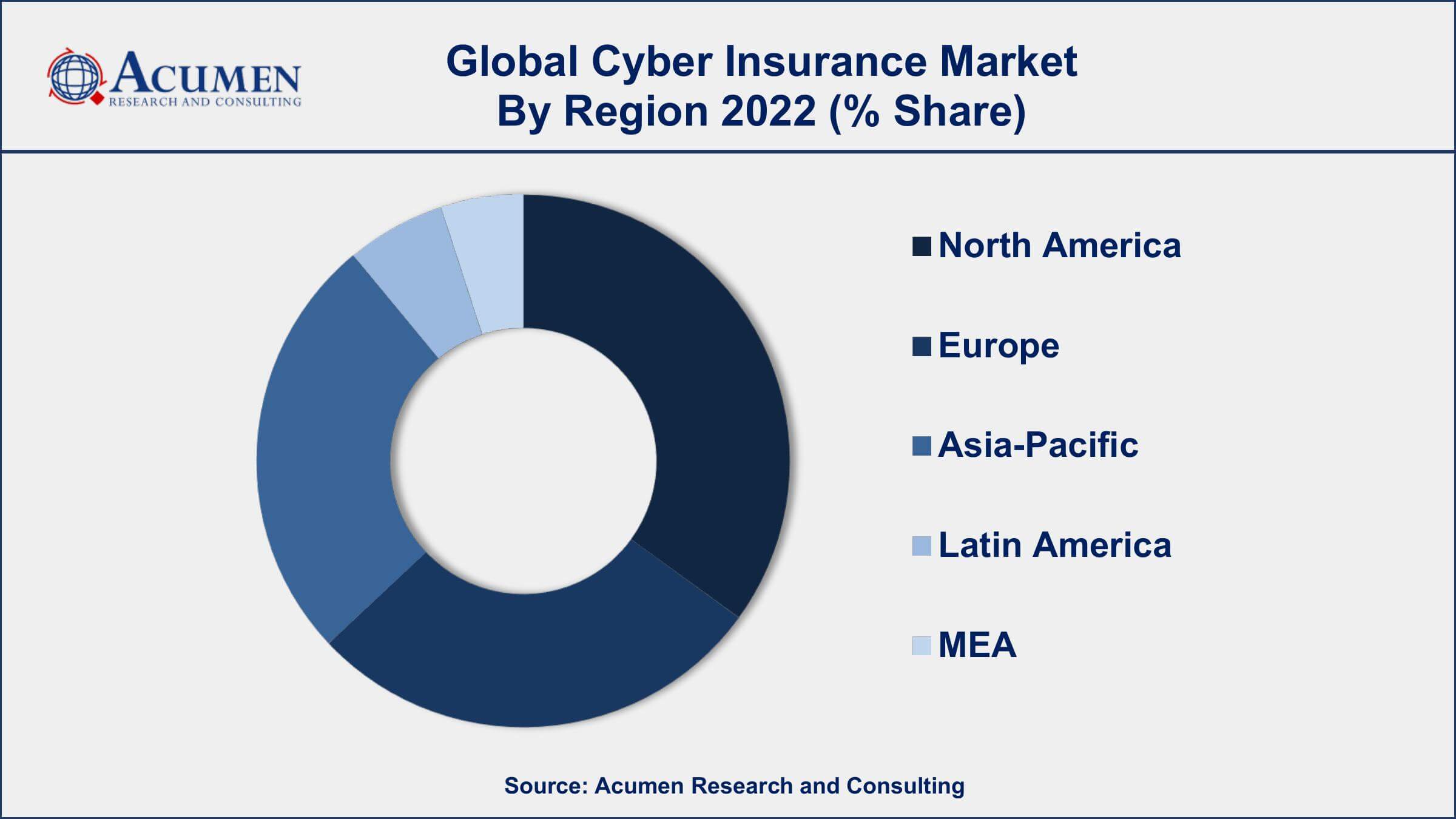

- North America region led with more than 36% of Cyber Insurance Market share in 2022

- Asia-Pacific Cyber Insurance Market growth will record a CAGR of around 26.9% from 2023 to 2032

- By insurance type, the stand-alone segment is the largest segment in the market, accounting for over 57% of the market share in 2022

- By end use industry, the BFSI segment has recorded more than 26% of the revenue share in 2022

- Increasing frequency and sophistication of cyberattacks, drives the Cyber Insurance Market value

Cyber insurance, also known as cybersecurity insurance or cyber liability insurance, is a specialized insurance product designed to protect businesses and individuals from financial losses and liabilities resulting from cyberattacks and data breaches. It provides coverage for various aspects of cyber risks, including the costs associated with recovering from a cyber incident, such as data restoration, legal expenses, public relations efforts, and potential regulatory fines. Additionally, cyber insurance may offer coverage for third-party claims, such as lawsuits filed by customers or partners affected by a data breach. This type of insurance has become increasingly important as businesses and individuals have become more reliant on digital technologies and face growing cyber threats.

The cyber insurance market has experienced significant growth in recent years. This expansion can be attributed to the rising frequency and sophistication of cyberattacks, which have resulted in substantial financial losses for organizations across various industries. As awareness of cyber risks has increased, so has the demand for cyber insurance policies. Additionally, regulatory requirements and data protection laws, such as GDPR in Europe and various state-level regulations in the United States, have driven companies to consider cyber insurance as a means of mitigating compliance-related risks. The market growth is also fueled by advancements in underwriting and risk assessment models, as insurers work to better understand and quantify cyber risks.

Global Cyber Insurance Market Trends

Market Drivers

- Increasing frequency and sophistication of cyberattacks

- Evolving data protection regulations and compliance requirements

- Greater reliance on digital technologies and data

- Growing awareness of cyber risks

- Expanding cyber risk landscape due to remote work and cloud adoption

Market Restraints

- Lack of standardization in cyber risk assessment

- Uncertainty in quantifying and modeling cyber risks

Market Opportunities

- Development of tailored cyber insurance products for small businesses

- Integration of technology and analytics for better risk assessment

Cyber Insurance Market Report Coverage

| Market | Cyber Insurance Market |

| Cyber Insurance Market Size 2022 | USD 10.1 Billion |

| Cyber Insurance Market Forecast 2032 | USD 97.6 Billion |

| Cyber Insurance Market CAGR During 2023 - 2032 | 25.7% |

| Cyber Insurance Market Analysis Period | 2020 - 2032 |

| Cyber Insurance Market Base Year |

2022 |

| Cyber Insurance Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Insurance Type, By Organization Size, By End Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AIG (American International Group), Chubb, Zurich Insurance Group, Allianz, AXA, Travelers Insurance, Beazley, Hiscox, Liberty Mutual, CNA Financial, Berkshire Hathaway Specialty Insurance, and Marsh & McLennan. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cyber insurance is a specialized insurance product designed to protect individuals and organizations from the financial consequences of cyber risks and incidents. It offers coverage for a range of cybersecurity-related issues, including data breaches, ransomware attacks, network security breaches, and other forms of cyberattacks. This insurance is particularly relevant in today's digital age, where businesses and individuals are heavily reliant on technology and face an ever-increasing number of cyber threats.

The primary application of cyber insurance is to provide financial protection against the potentially devastating consequences of a cyber incident. It helps cover the costs associated with mitigating and recovering from such incidents, which can include expenses for data recovery, legal fees, public relations efforts, notification and credit monitoring for affected individuals, and even fines or penalties imposed by regulatory authorities. Additionally, cyber insurance can extend to cover third-party liabilities, including lawsuits from customers or partners affected by a data breach. As cyber threats continue to evolve and cybersecurity becomes an integral part of risk management for organizations, cyber insurance has become a crucial tool in helping businesses navigate the complex and ever-changing landscape of digital security.

The cyber insurance market was experiencing robust growth, driven primarily by the escalating threat landscape and increased awareness of cyber risks among businesses and individuals. The market has been expanding globally as organizations recognized the need to protect themselves from the financial fallout of data breaches, ransomware attacks, and other cyber incidents. One of the key factors contributing to the growth of the cyber insurance market was the rising frequency and sophistication of cyberattacks. High-profile breaches and ransomware incidents have become commonplace, pushing companies to seek coverage to mitigate the potential financial losses and liabilities associated with such events. Additionally, the evolving regulatory environment, including the implementation of stringent data protection laws like GDPR and CCPA, compelled organizations to consider cyber insurance as a means of achieving compliance and managing regulatory risks.

Cyber Insurance Market Segmentation

The global Cyber Insurance Market segmentation is based on component, insurance type, organization size, end use industry, and geography.

Cyber Insurance Market By Component

- Services

- Solution

According to the cyber insurance industry analysis, the solution segment accounted for the largest market share in 2022. This growth as insurers and technology providers collaborate to offer more comprehensive and innovative solutions to address the evolving cyber risks faced by businesses and individuals. One of the notable trends in this segment is the development of cyber risk assessment and prevention tools. Insurers are partnering with cybersecurity firms to provide policyholders with access to risk assessment services that help identify vulnerabilities and improve their cybersecurity posture. These solutions can include vulnerability scanning, penetration testing, and security awareness training. By offering proactive measures, insurers aim to reduce the likelihood of policyholders experiencing a cyber incident in the first place, ultimately lowering their claims payouts.

Cyber Insurance Market By Insurance Type

- Stand-alone

- Packaged

In terms of insurance types, the stand-alone segment is expected to witness significant growth in the coming years. This growth due to the increasing demand for specialized coverage that addresses the unique and evolving risks associated with cyberattacks and data breaches. One of the key factors driving the growth of the stand-alone segment is the recognition by businesses that traditional insurance policies, such as general liability or property insurance, often provide inadequate coverage for cyber risks. Stand-alone cyber insurance policies offer more tailored coverage, encompassing a wide range of cyber threats, including data breaches, ransomware attacks, business interruption, and liability arising from cyber incidents. This specialization has become essential as cyberattacks have grown in frequency and complexity, making it crucial for businesses to have dedicated cyber insurance protection.

Cyber Insurance Market By Organization Size

- Large Enterprises

- Small and Medium Enterprises

According to the cyber insurance market forecast, the small and medium enterprises segment is expected to witness significant growth in the coming years. One of the primary drivers behind the growth of cyber insurance among SMEs is the increasing frequency of cyberattacks targeting smaller businesses. Cybercriminals often view SMEs as attractive targets due to potentially weaker cybersecurity defenses compared to larger enterprises. As a result, SMEs have become more proactive in seeking cyber insurance coverage to protect their sensitive data, customer information, and financial stability in case of a cyber incident. Another factor contributing to the growth of cyber insurance in the SME segment is the availability of tailored and affordable policies. Insurers are designing policies specifically catering to the needs and budgets of SMEs, making cyber insurance more accessible to this market segment.

Cyber Insurance Market By End Use Industry

- BFSI

- Retail

- IT and Telecom

- Healthcare

- Others

Based on the end use industry, the BFSI segment is expected to continue its growth trajectory in the coming years. This growth is primarily attributed to the sector's heavy reliance on digital technology, sensitive customer data, and the recognition of the ever-increasing cyber threats it faces. One of the primary factors fueling the demand for cyber insurance in the BFSI segment is the need to safeguard critical financial data and maintain customer trust. Banks, insurance companies, and other financial institutions are attractive targets for cybercriminals seeking to steal valuable financial information or disrupt financial systems. As such, the BFSI sector has invested heavily in cybersecurity measures and turned to cyber insurance to provide an additional layer of protection against potential financial losses, legal liabilities, and reputational damage resulting from cyber incidents.

Cyber Insurance Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cyber Insurance Market Regional Analysis

Geographically, North America has emerged as the dominant region in the cyber insurance market in 2022. North America, particularly the United States, has been at the forefront of technological advancements and digitalization. This region is home to a vast number of tech companies, financial institutions, and a thriving ecosystem of startups, all of which are highly dependent on digital infrastructure. As a result, the awareness of cyber risks and the need for cyber insurance is particularly high in North America. The sheer volume of businesses and individuals relying on digital systems has led to a significant demand for cyber insurance policies. Moreover, regulatory pressures and legal frameworks in North America have played a crucial role in driving the cyber insurance market. The United States has various state-level data breach notification laws, and businesses operating in multiple states must navigate a complex regulatory landscape. Furthermore, the adoption of the California Consumer Privacy Act (CCPA) and discussions around a potential federal data privacy law have heightened awareness of data protection and privacy compliance. As a result, North American businesses are more inclined to seek cyber insurance to ensure they meet regulatory requirements and manage the financial risks associated with non-compliance.

Cyber Insurance Market Player

Some of the top cyber insurance market companies offered in the professional report include AIG (American International Group), Chubb, Zurich Insurance Group, Allianz, AXA, Travelers Insurance, Beazley, Hiscox, Liberty Mutual, CNA Financial, Berkshire Hathaway Specialty Insurance, and Marsh & McLennan.

Frequently Asked Questions

What was the market size of the global cyber insurance in 2022?

The market size of cyber insurance was USD 10.1 Billion in 2022.

What is the CAGR of the global cyber insurance market from 2023 to 2032?

The CAGR of cyber insurance is 25.7% during the analysis period of 2023 to 2032.

Which are the key players in the cyber insurance market?

The key players operating in the global market are including AIG (American International Group), Chubb, Zurich Insurance Group, Allianz, AXA, Travelers Insurance, Beazley, Hiscox, Liberty Mutual, CNA Financial, Berkshire Hathaway Specialty Insurance, and Marsh & McLennan.

Which region dominated the global cyber insurance market share?

North America held the dominating position in cyber insurance industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cyber insurance during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cyber insurance industry?

The current trends and dynamics in the cyber insurance industry include increasing frequency and sophistication of cyberattacks and greater reliance on digital technologies and data.

Which insurance type held the maximum share in 2022?

The stand-alone insurance type held the maximum share of the cyber insurance industry.