Cut and Bend Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cut and Bend Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

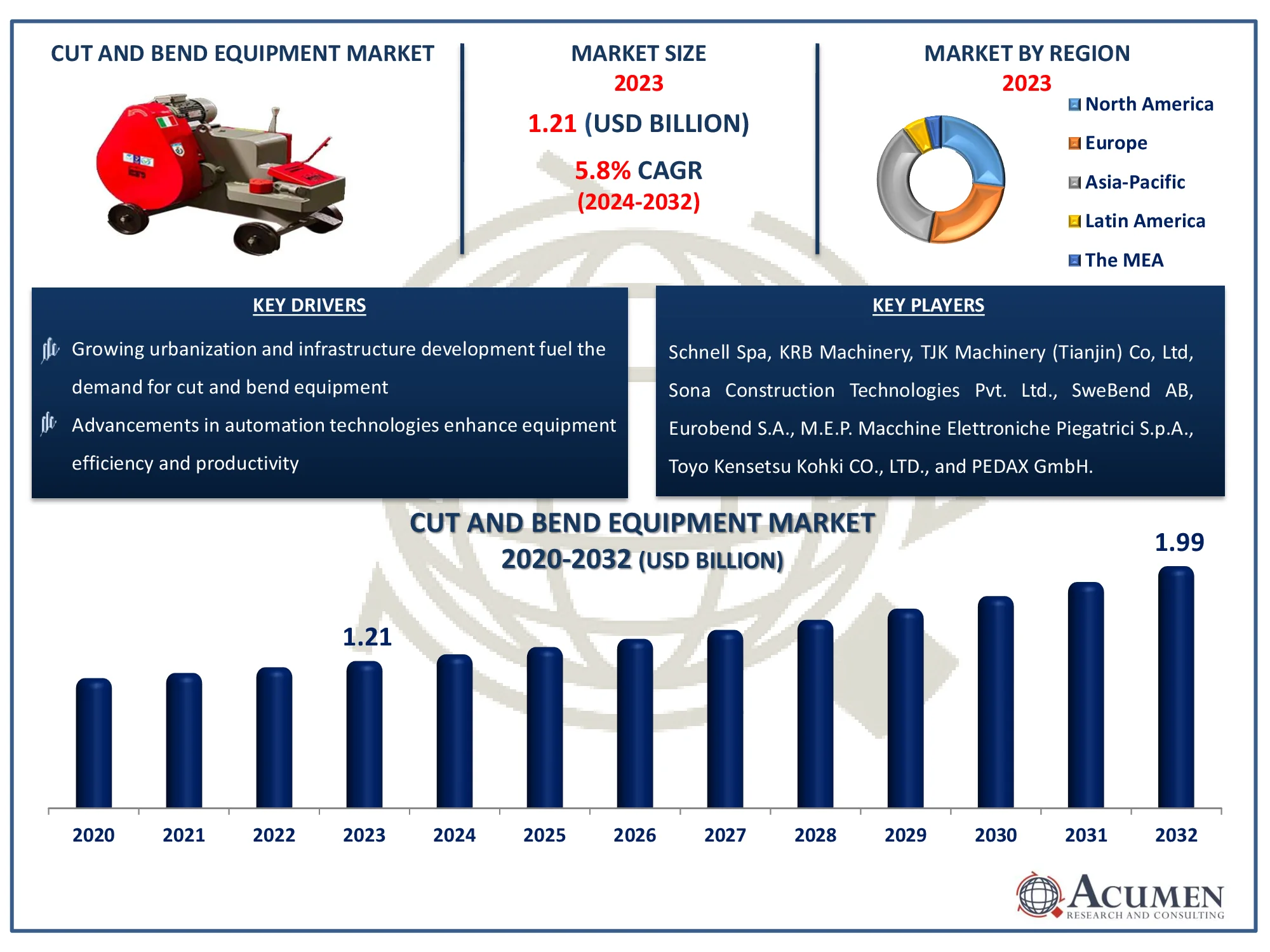

Request Sample Report

The Global Cut and Bend Equipment Market Size accounted for USD 1.21 Billion in 2023 and is estimated to achieve a market size of USD 1.99 Billion by 2032 growing at a CAGR of 5.8% from 2024 to 2032.

Cut and Bend Equipment Market Highlights

- Global cut and bend equipment market revenue is poised to garner USD 1.99 billion by 2032 with a CAGR of 5.8% from 2024 to 2032

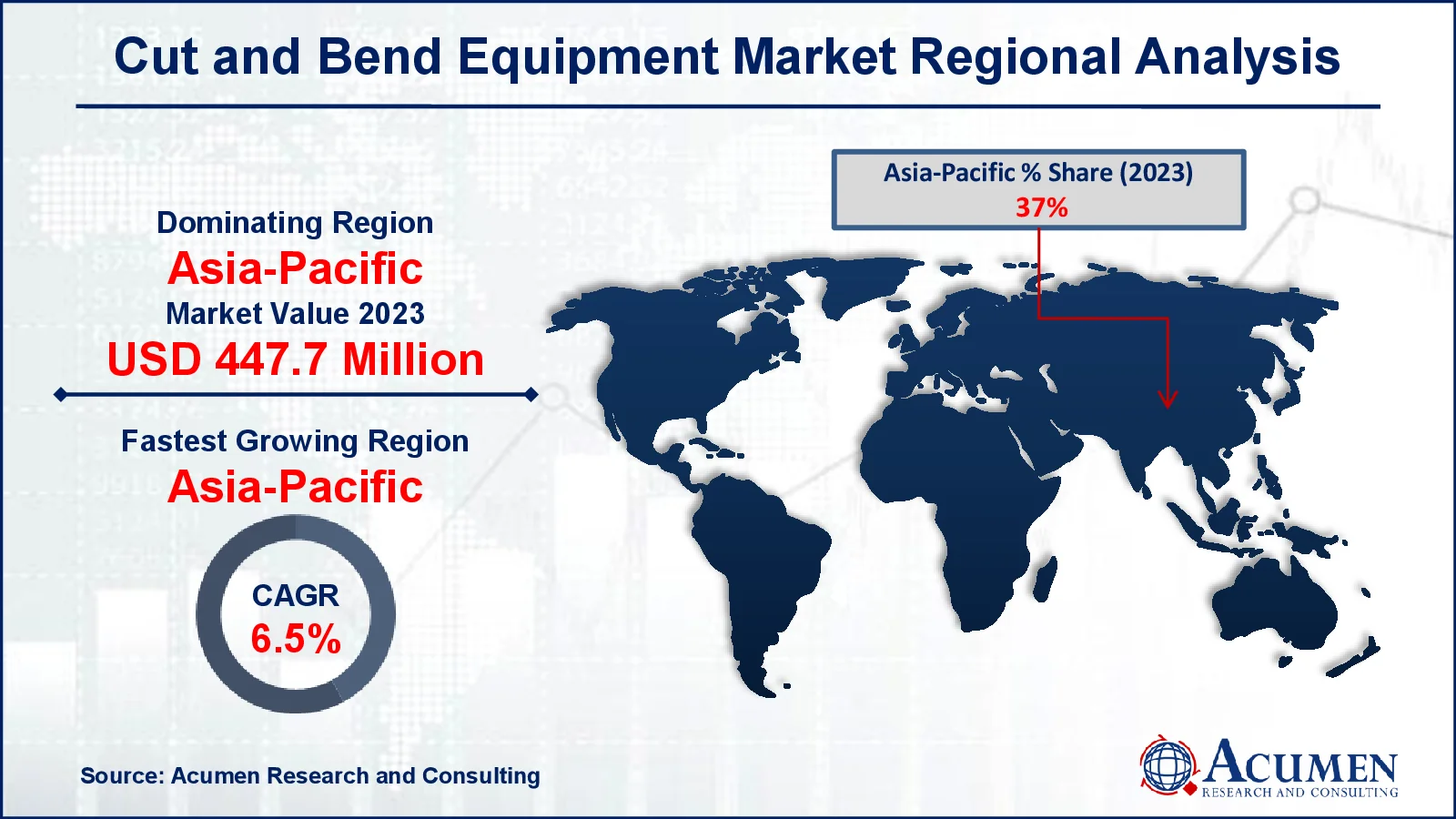

- Asia-Pacific cut and bend equipment market value occupied around USD 447.7 million in 2023

- Asia-Pacific cut and bend equipment market growth will record a CAGR of more than 6.5% from 2024 to 2032

- Among product type, the cutting & shaping sub-segment generated significant revenue in 2023

- Based on end-user, the engineering contractors/construction sub-segment generated notable cut and bend equipment market share in 2023

- Expanding renovation and retrofitting activities in developed countries is a popular cut and bend equipment market trend that fuels the industry demand

Based on its different shapes, sizes and quantities, the cut and bend machines have many applications in the building industry. For the cutting and bending purposes, cut & bend equipment is used. The equipment helps to better manage the inventory, which not only reduces the need for space to maintain bars, but also helps to save labor and waste costs. Due to the increasing popularity of cut-and-bending equipment for cutting, bending, shaping, meshing and others, demand for integrated reinforcement equipment is expected to increase over the cut and bend equipment market forecast period. Integrated equipment can carry out multiple operations with the application of spirals and rebar material such as cutting and bending, straightening and straightening.

Global Cut and Bend Equipment Market Dynamics

Market Drivers

- Growing urbanization and infrastructure development fuel the demand for cut and bend equipment

- Advancements in automation technologies enhance equipment efficiency and productivity

- Increasing government investments in construction projects drive market growth

- Rising labor costs push the adoption of automated cut and bend machines

Market Restraints

- High initial capital investment limits market penetration in small-scale enterprises

- Fluctuating raw material prices impact the profitability of equipment manufacturers

- Limited technical expertise in handling advanced equipment restricts adoption in some regions

Market Opportunities

- Emerging markets in Asia and Latin America offer untapped potential for equipment manufacturers

- Integration of IoT and AI in cut and bend machines opens new growth avenues

- Growing demand for sustainable construction practices encourages innovation in energy-efficient equipment

Cut and Bend Equipment Market Report Coverage

| Market | Cut and Bend Equipment Market |

| Cut and Bend Equipment Market Size 2022 |

USD 1.21 Billion |

| Cut and Bend Equipment Market Forecast 2032 | USD 1.99 Billion |

| Cut and Bend Equipment Market CAGR During 2023 - 2032 | 5.8% |

| Cut and Bend Equipment Market Analysis Period | 2020 - 2032 |

| Cut and Bend Equipment Market Base Year |

2022 |

| Cut and Bend Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Operation Mode, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Schnell Spa, KRB Machinery, TJK Machinery (Tianjin) Co, Ltd, Sona Construction Technologies Pvt. Ltd., SweBend AB, Eurobend S.A., M.E.P. Macchine Elettroniche Piegatrici S.p.A., Progress Holding AG, TabukSteel, Toyo Kensetsu Kohki CO., LTD., and PEDAX GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cut and Bend Equipment Market Insights

The growing demand is a direct consequence of shifting trends in the world's financial and production sectors. As Asia-Pacific's growing population and large markets for various vertical industries have driven businesses to move to these developing economies.The automotive industry and its auxiliary sectors are closely followed by the largest consumers of manufacturing equipment. Manufacturing companies Demand & offer is expected to increase over the forecast period for major industries in cut and bent such as aerospace and defence.

Global population growth drives energy consumption and demand. The demand for cut and bent equipment is expected to increase quickly by industrialisation. However, high costs for raw materials will constitute a significant constraint to the growth of the market. However, technological developments and efforts to develop customized equipment are anticipated in the near future to create business opportunities for producers.

The building materials market is encouraging growing infrastructure and building activities worldwide. Due to the rapid adoption of industrial Internet of Things in the Asia-Pacific region, industrial product manufacturers focus on the advanced technology products. In addition, increased awareness of better government initiatives and infrastructure resulted in a growth in construction, steel and, in turn, the market of cutting and bending equipment.

Cut and Bend Equipment Market Segmentation

The worldwide market for cut and bend equipment is split based on product type, operation mode end-user, and geography.

Cut and Bend Equipment Market By Product Type

- Cutting & Shaping

- Mesh Cutting & Bending

- Straightening

- Stirrups

- Bar Shaping

- Others

According to cut and bend equipment industry analysis, the most substantial market share for cutting and forming machines. Stirrup equipment is currently the most common type of cutting and shaping machine, and it is expected to remain so in the next years. This is because the machine is improved by replacing standard stirrup machines with high-force stirrup machines.

Cut and Bend Equipment Market By Operation Mode

- Semi - Automatic

- Automatic

Automatic cutting and bending systems are a more convenient way to manufacture equipment because they require less user intervention and allow for faster processing (cutting, bending). The advantages include reduced labor requirements, increased speed, lower scrap, and increased output. However, compared to semi-automatic equipment, this equipment is more expensive. Automated machines are also more large due to the integrated components required for automated operations.

Cut and Bend Equipment Market By End-user

- Manufacturing

- Engineering Contractors /Construction

- Steel

- Wire/Mattress

- Others

Constructors and engineering contractors play a key role in the end-users since bar processing, such as cuts and bends, is primarily done on building sites as needed. A number of reasons are driving the expansion of the cut-off equipment market, including rising need for cities in emerging nations, expanding global construction operations, and increased demand for steel products in the infrastructure and real estate sectors.

Cut and Bend Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cut and Bend Equipment Market Regional Analysis

The Asia-Pacific region has the biggest cut and bend equipment market share, thanks to fast urbanization and major infrastructural development, particularly in China and India. These countries are currently undertaking large-scale development projects such as residential complexes, commercial spaces, and transportation infrastructure, increasing need for efficient rebar cutting and bending solutions. in other hand, greater government infrastructure investments have greatly facilitated the adoption of these machines.

In Europe, strong building rules and an emphasis on sustainable construction techniques help to strengthen the business. Countries like Germany, Italy, and France make major contributions thanks to their well-established building industry and advanced automation technology. The demand for cutting-edge equipment that enhances precision and reduces labor costs has been a critical factor in regional growth.

North America follows closely, with rising infrastructure upgrades, including the renovation of aging bridges, roads, and public utilities. The U.S. government’s focus on infrastructure investments and the booming residential construction market are key drivers.

Cut and Bend Equipment Market Players

Some of the top cut and bend equipment companies offered in our report includes Schnell Spa, KRB Machinery, TJK Machinery (Tianjin) Co, Ltd, Sona Construction Technologies Pvt. Ltd., SweBend AB, Eurobend S.A., M.E.P. Macchine Elettroniche Piegatrici S.p.A., Progress Holding AG, TabukSteel, Toyo Kensetsu Kohki CO., LTD., and PEDAX GmbH.

Frequently Asked Questions

How big is the cut and bend equipment market?

The cut and bend equipment market size was valued at USD 1.21 billion in 2023.

What is the CAGR of the global cut and bend equipment market from 2024 to 2032?

The CAGR of cut and bend equipment is 5.8% during the analysis period of 2024 to 2032.

Which are the key players in the cut and bend equipment market?

The key players operating in the global market are including Schnell Spa, KRB Machinery, TJK Machinery (Tianjin) Co, Ltd, Sona Construction Technologies Pvt. Ltd., SweBend AB, Eurobend S.A., M.E.P. Macchine Elettroniche Piegatrici S.p.A., Progress Holding AG, TabukSteel, Toyo Kensetsu Kohki CO., LTD., and PEDAX GmbH.

Which region dominated the global cut and bend equipment market share?

Asia-Pacific held the dominating position in cut and bend equipment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cut and bend equipment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cut and bend equipment industry?

The current trends and dynamics in the cut and bend equipment industry include growing urbanization and infrastructure development fuel the demand for cut and bend equipment, advancements in automation technologies enhance equipment efficiency and productivity, increasing government investments in construction projects drive market growth, and rising labor costs push the adoption of automated cut and bend machines.

Which operation mode held the maximum share in 2023?

The automatic operation mode held the notable share of the cut and bend equipment industry.