Cryopreservation Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cryopreservation Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

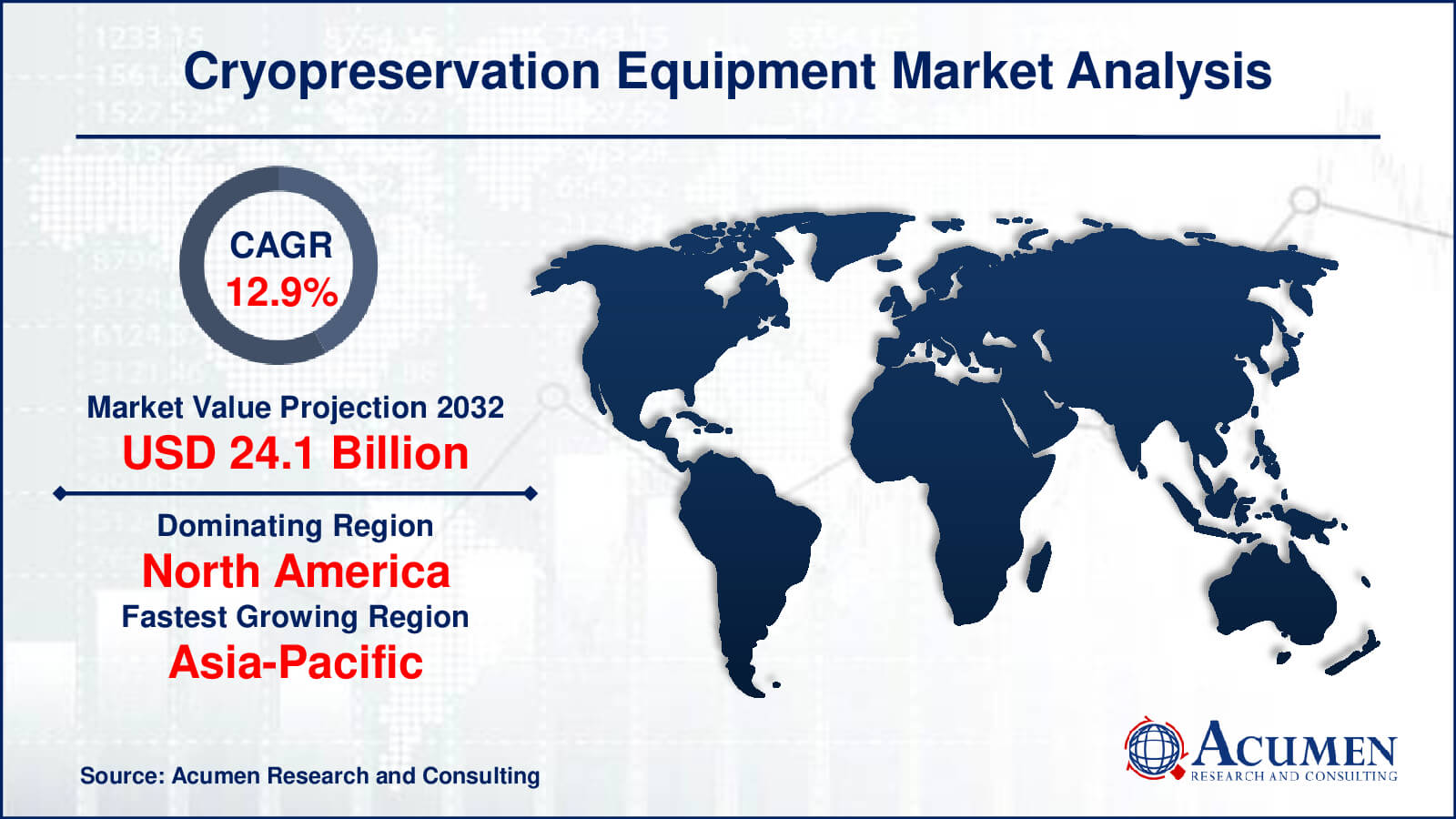

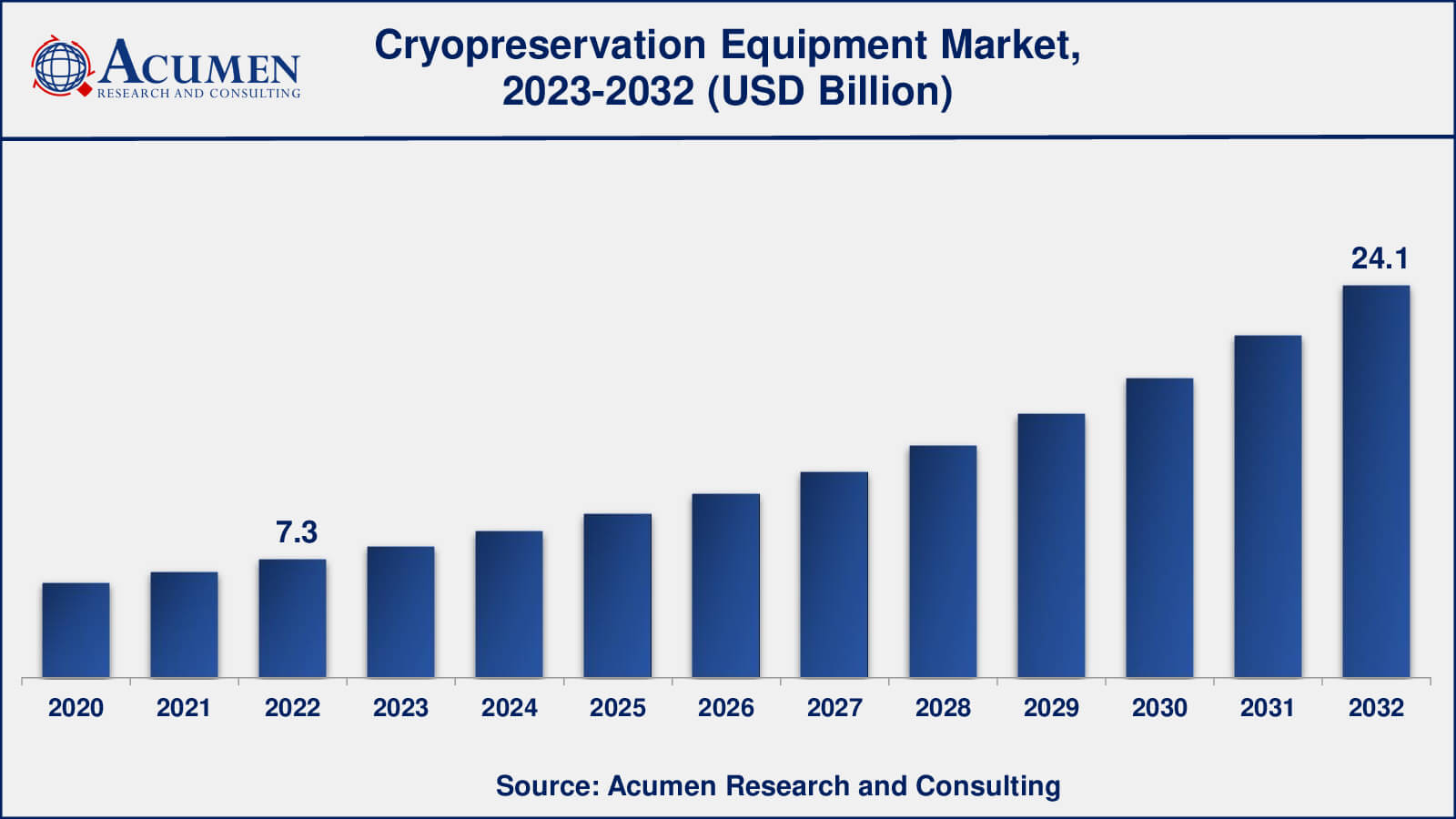

The global Cryopreservation Equipment Market gathered USD 7.3 Billion in 2022 and is expected to reach USD 24.1 Billion by 2032, growing at a CAGR of 12.9% from 2023 to 2032.

Cryopreservation Equipment Market Highlights

- The global cryopreservation equipment market is poised to achieve a revenue of USD 24.1 Billion by 2032, experiencing a CAGR of 12.9% from 2023 to 2032

- In 2022, the North America cryopreservation equipment market held a value of approximately USD 3.1 billion

- The Asia-Pacific cryopreservation equipment market is expected to witness substantial growth, with a projected CAGR of over 13% from 2023 to 2032

- Among equipment, the freezers sub-segment accounted for revenue exceeding USD 3.4 billion in 2022

- In terms of cryogen, the liquid nitrogen sub-segment claimed a significant share, surpassing 39% in 2022

- Increasing adoption of cryopreservation in veterinary medicine is one of the notable cryopreservation equipment market trends

Cryopreservation, which involves the cooling and subsequent storage of frozen cells, is considered a critical process for providing a continuous source of genetically stable living cells for various medical procedures such as bone marrow transplants, organ donations, and in-vitro fertilization (IVF). Cryopreservation plays a vital role by inhibiting all biochemical activity, preventing cell damage through apoptotic reactions.

Cryopreservation is a complex process with many variables that need to be monitored under strict regulations. Techniques such as freezing, cellular metabolism maintenance, ensuring cell viability, and creating an optimized environment require a significant amount of energy. This is due to the lengthy process, which includes slow-rate freezing and long-term storage of valuable cells, and the need to accurately maintain low temperatures. Therefore, the implementation of equipment that consumes minimal energy, emits no waste products, and is cost-effective results in environmentally friendly cryopreservation.

Global Cryopreservation Equipment Market Dynamics

Market Drivers

- Growing demand for organ transplantation and regenerative medicine

- Advancements in cryopreservation techniques and technologies

- Increasing prevalence of chronic diseases requiring cell and tissue banking

- Rising investment in research and development

Market Restraints

- High cost of cryopreservation equipment

- Ethical concerns and regulatory challenges

- Limited awareness about cryopreservation techniques

- Technical challenges in preserving complex biological materials

Market Opportunities

- Emerging applications in stem cell banking and personalized medicine

- Development of portable and automated cryopreservation devices

- Growing demand for long-term preservation of biological samples

- Collaboration opportunities with pharmaceutical companies

Cryopreservation Equipment Market Report Coverage

| Market | Cryopreservation Equipment Market |

| Cryopreservation Equipment Market Size 2022 | USD 7.3 Billion |

| Cryopreservation Equipment Market Forecast 2032 | USD 24.1 Billion |

| Cryopreservation Equipment Market CAGR During 2023 - 2032 | 12.9% |

| Cryopreservation Equipment Market Analysis Period | 2020 - 2032 |

| Cryopreservation Equipment Market Base Year |

2022 |

| Cryopreservation Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Cryogen, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Barber-Nichols Inc. Charter Medicals Chart Biomedical Co. Ltd. Cryogenic Control Cryologic Pty. Ltd. Custom Biogenic Systems Haimen United Laboratory Equipment Development Co., Ltd. Linde LLC Merck KGaA Nikkiso Cryo Inc. Planer PLC Praxair Technology, Inc. Thermo Fisher Scientific, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cryopreservation Equipment Market Insights

Cryopreservation using the slow freezing technique is the standard procedure for preserving cell cultures. This technique is widely employed, and with the increasing use of cell-based therapies and the need for precise procedures adhering to medical and manufacturing standards, the demand for cryopreservation equipment has been on the rise.

Furthermore, cellular materials that do not meet the required biopreservation controls experience significant loss or a reduction in functionality. Moreover, temperature excursions can result in disruptions to the cells. These factors contribute to the demand for cryopreservation equipment to ensure the proper maintenance of bioproducts.

Cryopreservation Equipment Market Trends

Cell Manufacturing and Bio-Banking

Cell therapy is an emerging technique that is revolutionizing regenerative medicine. Several chimeric antigen receptor (CAR) T-cell therapies have received approval from the USFDA for the treatment of leukemia, and there are currently over 500 other studies involving CAR T-cell therapies for cancer treatment in various stages of clinical trials. Therefore, the technology for cryopreservation is crucial to ensure the availability of high-quality cells capable of achieving desirable outcomes.

Quality materials and procedures for cryostoring cells play a pivotal role in biobanking. This technique helps in preserving human biospecimens, including tumor cells, umbilical cord blood, tissue-derived stem cells, and engineered cells. It is particularly valuable in cases where repeated doses are required for effective therapies. Such techniques serve as catalysts driving the global cryopreservation equipment market.

Freezing Accelerates Cryopreservation Trend

Cryopreservation has become a prominent practice in scientific research and medical applications, encompassing assisted reproduction, organ transplantation, cell-based therapies, and biomarker identification. Slow freezing remains the gold standard for preserving cell cultures.

In addition to slow freezing, the vitrification technique has garnered significant attention among manufacturers. Vitrification involves rapid freezing of materials in a high concentration of cryoprotectant while in contact with liquid nitrogen. This method allows water to transition directly from a liquid to a solid state without forming ice crystals. As a result, it prevents ice formation and obviates the need for the slow freezing technique.

Cryopreservation Equipment Market Segmentation

The worldwide market for cryopreservation equipment is split based on type, cryogen, application, end-use industry, and geography.

Cryopreservation Equipment Types

- Freezers

- Cryopreservation Freezers

- Drystore Freezers

- Incubators

- Sample Preparation Systems

- Accessories

- Cryopreservation Vials

- Freezer Box

- Cryocart

- Cryogenic Vaporizer

- Other Accessories

According to cryopreservation equipment market analysis, freezers type has dominated wih significant share in 2022. This is due to heavy investment in R&D activities and merging and acquisition by the key participants that supports the growth of the freezers segment for cryopreservation equipment market. In addition, new product launches by the key participant’s enhances the capability to stay on the forefront by supporting the freezers segment in the global market.

Cryopreservation Equipment Cryogens

- Liquid Nitrogen

- Oxygen

- Liquid Helium

- Argon

In the cryogen segment, liquid nitrogen is expected to capture a significant market share in the cryopreservation equipment market in the coming years. This can be attributed to the leading innovations in laboratory freezers that utilize liquid nitrogen. Liquid nitrogen is the preferred choice in the cryopreservation equipment market, with many manufacturers using it as the refrigeration medium. As liquid nitrogen vaporizes, the cold vapors circulate towards the in-feed end, where they are used for pre-cooling and are responsible for the initial freezing of the product. Furthermore, the low temperature of liquid nitrogen enables rapid freezing, which helps reduce product dehydration and improve overall quality.

Cryopreservation Equipment Applications

- Cord Blood Stem Cells

- Sperms

- Semen

- Testicular Tissues

- Embryos & Oocytes

- Others

In 2022, cord blood stem cells gathered signficant revenue among all the applcations. Cord blood stem cells are derived from the umbilical cord and placenta after childbirth. They are a valuable source of hematopoietic stem cells, which have the potential to develop into various blood cell types. Cryopreservation of cord blood stem cells is crucial because these cells can be used in the treatment of various diseases, particularly blood disorders and certain types of cancer. Cord blood banking allows parents to store these stem cells for potential future use in medical treatments for their child or family members.

Furthermore, in assisted reproductive technologies (ART), such as in-vitro fertilization (IVF), cryopreservation of embryos and oocytes (egg cells) is a common practice. It enables couples to store excess embryos or eggs for future use, preserving their reproductive options. Cryopreserved embryos and oocytes can be thawed and used when needed, increasing the chances of successful pregnancies for couples facing infertility issues.

Cryopreservation Equipment End-Use Industries

- Stem Cell Banks

- Biotechnology & Pharmaceutical Organizations

- Contract Research Organizations

- Stem Cell Research Laboratories

- Research and Academic Institutes

According to the cryopreservation equipment market forecast, the stem cell research laboratories is expected to be a significant and important driver of the industry throughout 2023 to 2032. Stem cell research laboratories are pivotal players in the cryopreservation equipment market. They serve as both users and drivers of cryopreservation technology. These laboratories are at the forefront of cutting-edge research, contributing to the development of advanced cryopreservation techniques and the increased demand for high-quality preservation solutions. With their focus on stem cell therapies and regenerative medicine, these laboratories require precise and reliable cryopreservation equipment to safeguard valuable cell lines, tissues, and specimens. Consequently, their growing demand for such equipment fuels innovation and competition in the market. As stem cell research continues to advance and expand into various medical applications, stem cell research laboratories will remain key influencers shaping the future of the cryopreservation equipment market.

Cryopreservation Equipment Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cryopreservation Equipment Market Regional Analysis

North America is anticipated to gain significant market share for cryopreservation equipment market followed by Asia-Pacific. This is attributed to ongoing R&D activities across the region that serves as a prominent growth factor for regional growth of cryopreservation equipment market.

In February 2016, Renueron a UK based stem cell research company received a US patent for a cryopreservation technology that is not supported by toxic reagent and is considered for other licensing to other stem cell therapy developers. Such new processing technology supports automated production in the US to further streamline the manufacturing process. Such factors contribute utmost for the growth of cryopreservation equipment market in North America.

On the other hand, Asia Pacific will also witness significant growth in the forthcoming years owing to ongoing R&D activities in stem cell research. In December 2020, a number of projects have been supported for stem cells research in India.

The Department of Biotechnology (DBT) in India has implemented several programs for the research in stem cell that is identified as a lucrative program. One such program is Indo-Japan collaborative program that study the major brain and blood disorders in Indian population through combination of clinical investigations, modern human genetics, and stem cell technology. This program has a strong component in iPsc research.

Cryopreservation Equipment Market Players

Some of the top cryopreservation equipment companies offered in our report includes Barber-Nichols Inc. Charter Medicals Chart Biomedical Co. Ltd. Cryogenic Control Cryologic Pty. Ltd. Custom Biogenic Systems Haimen United Laboratory Equipment Development Co., Ltd. Linde LLC Merck KGaA Nikkiso Cryo Inc. Planer PLC Praxair Technology, Inc. Thermo Fisher Scientific, Inc.

Frequently Asked Questions

What was the size of the global cryopreservation equipment market in 2022?

The size of cryopreservation equipment market was USD 7.3 billion in 2022.

What is the cryopreservation equipment market CAGR from 2023 to 2032?

The cryopreservation equipment market CAGR during the analysis period of 2023 to 2032 is 12.9%.

Which are the key players in the cryopreservation equipment market?

The key players operating in the global cryopreservation equipment market are Barber-Nichols Inc., Charter Medicals, Chart Biomedical Co. Ltd., Cryogenic Control, Cryologic Pty. Ltd., Custom Biogenic Systems, Haimen United Laboratory Equipment Development Co., Ltd., Linde LLC, Merck KGaA, Nikkiso Cryo Inc., Planer PLC, Praxair Technology, Inc., and Thermo Fisher Scientific, Inc.

Which region dominated the global cryopreservation equipment market share?

North America region held the dominating position in cryopreservation equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cryopreservation equipment during the analysis period of 2023 to 2032.

What are the current trends in the global cryopreservation equipment industry?

The current trends and dynamics in the cryopreservation equipment industry include growing demand for organ transplantation and regenerative medicine, advancements in cryopreservation techniques and technologies, and increasing prevalence of chronic diseases requiring cell and tissue banking.

Which material held the maximum share in 2022?

The freezers held the maximum share of the cryopreservation equipment industry.