Crime Risk Report Market | Acumen Research and Consulting

Crime Risk Report Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

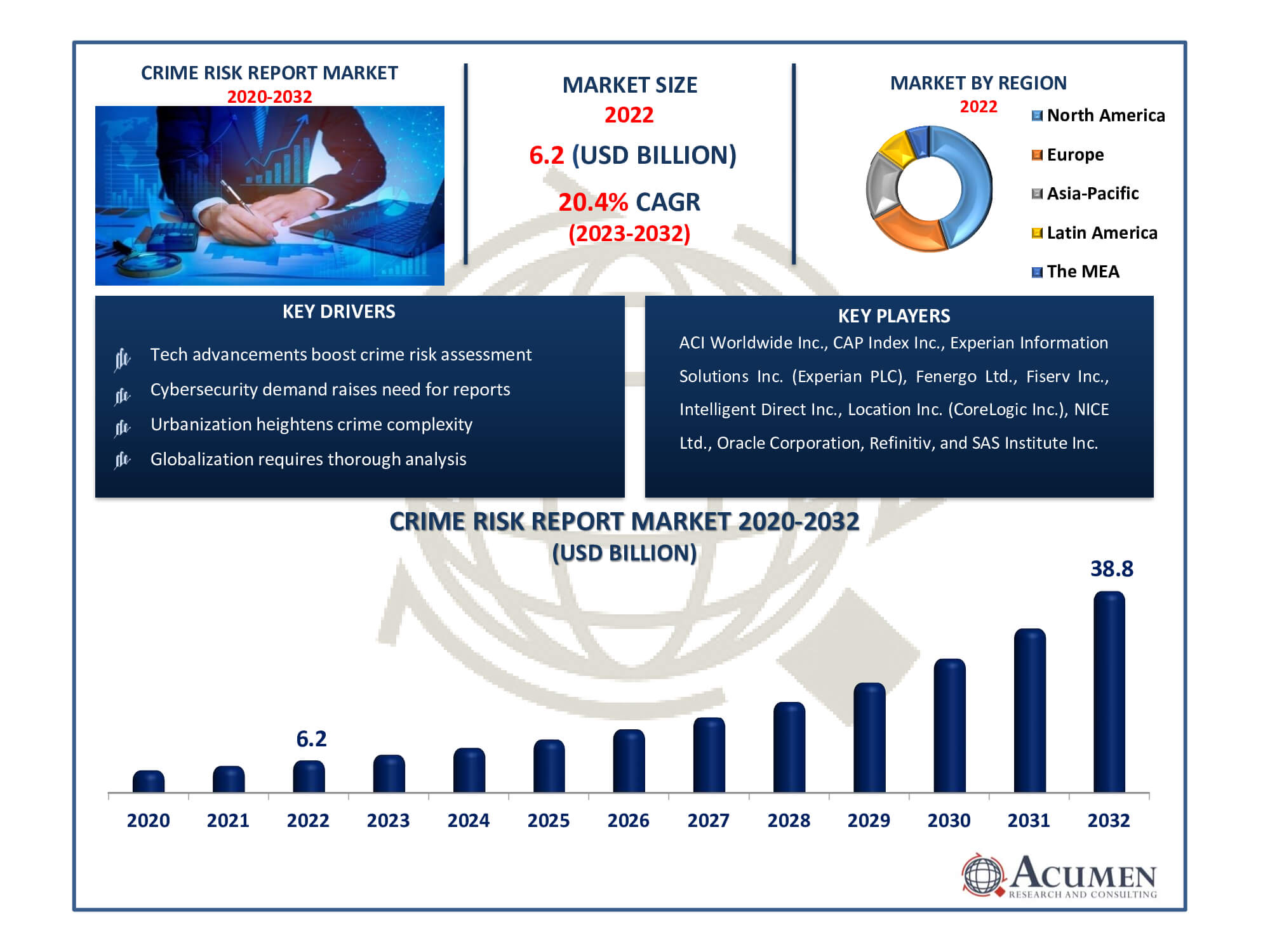

The Crime Risk Report Market Size accounted for USD 6.2 Billion in 2022 and is estimated to achieve a market size of USD 38.8 Billion by 2032 growing at a CAGR of 20.4% from 2023 to 2032.

Crime Risk Report Market Highlights

- Global crime risk report market revenue is poised to garner USD 38.8 billion by 2032 with a CAGR of 20.4% from 2023 to 2032

- North America crime risk report market value occupied around USD 2.8 billion in 2022

- Asia-Pacific crime risk report market growth will record a CAGR of more than 23% from 2023 to 2032

- Among type, the financial & cybercrime sub-segment generated over US$ 2.5 billion revenue in 2022

- Based on deployment, the on-premises sub-segment generated around 60% share in 2022

- Emerging markets need reporting services is a popular crime risk report market trend that fuels the industry demand

A crime risk report is a thorough examination of the possibility and consequences of criminal activity in a certain location or region. These reports, which are compiled utilizing multiple data sources such as crime statistics, law enforcement records, and demographic information, provide insights into the crime rates, trends, and types of offences prevalent in a certain location. They assist individuals, businesses, and organizations in making informed decisions about safety precautions, resource allocation, and knowing the security landscape of a particular region. There are numerous advantages to companies in crime risk reports. For example, the report provides a structured approach to risk management, a better understanding of the context of illegal activity, facilitates decision-making, and helps to produce reproducible outcomes. Furthermore, the reports help to identify, assess, analyze and mitigate risks, which ultimately contribute to market growth. These reports also support organizations in the allocation and decision making processes related to security budgets.

Global Crime Risk Report Market Dynamics

Market Drivers

- Increasing demand for cybersecurity

- Advancements in technology drive the enhancement of crime risk assessment capabilities

- Urbanization increases the complexity of crime, necessitating advanced assessment methods

- Globalization requires thorough crime risk analysis for diverse and interconnected environments

Market Restraints

- Stringent regulations limit access to data crucial for effective crime risk assessment

- Funding hampers advanced systems

- Poor collaboration among stakeholders affects accuracy

Market Opportunities

- Integration of AI technologies

- Tailoring reports for specific industries

- Collaboration between public and private sectors

Crime Risk Report Market Report Coverage

| Market | Crime Risk Report Market |

| Crime Risk Report Market Size 2022 | USD 6.2 Billion |

| Crime Risk Report Market Forecast 2032 | USD 38.8 Billion |

| Crime Risk Report Market CAGR During 2023 - 2032 | 20.4% |

| Crime Risk Report Market Analysis Period | 2020 - 2032 |

| Crime Risk Report Market Base Year |

2022 |

| Crime Risk Report Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Deployment, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ACI Worldwide Inc., CAP Index Inc., Experian Information Solutions Inc. (Experian PLC), Fenergo Ltd., Fiserv Inc., Intelligent Direct Inc., Location Inc. (CoreLogic Inc.), NICE Ltd., Oracle Corporation, Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.), Refinitiv, and SAS Institute Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Crime Risk Report Market Insights

Governments and law enforcement agencies are increasingly engaging crime risk consulting companies due to a surge in criminal cases, leading to significant market growth. The market is further propelled by the escalating rates of homicide and bribery in countries like Brazil, Mexico, and the USA. Growing demands from healthcare organizations, financial service providers, and private industries for criminal risk reports are boosting market expansion. Increased organizational awareness of safety measures against unlawful acts is anticipated to drive market growth. These reports enable comprehensive risk assessments based on clients, areas, services, and products. They often include color-coded Risk Intelligence maps detailing past, current, and future crime statistics, like the CRIMECAST report, which provides regional and national data on unlawful acts against property and people. Companies like CAP Index, Inc. are expected to experience heightened demand. In the United States, companies operating in this market must comply with specific state and federal regulations. Failure to adhere to these regulations could result in potential restrictions on providing predictive analysis support services, potentially impeding market growth during the crime risk report industry forecast period.

The forecasted market growth is driven by the increasing threats posed by domestic and external terrorists, alongside a rise in financial fraud incidents like fraudulent investments, Ponzi schemes, illegal online lotteries, and money laundering activities. Crime risk analytical solutions aim to gather crime-related data from law enforcement agencies and statistically predict crime rates for various crime types. As global criminal cases surge, the demand for such solutions is on the rise.

Individuals are increasingly seeking guidance from crime-related risk companies due to escalating crimes such as homicides and abductions. Preventive measures are also sought for property crimes including carjacking, burglaries, robberies, and armed robberies. These factors will fuel market growth in the crime risk report market forecast period. The rapid adoption of cutting-edge technologies like IoT and Big Data introduces heightened complexities in networks and systems, amplifying security challenges. This factor is poised to contribute to the market's growth in the coming years.

Crime Risk Report Market Segmentation

The worldwide market for crime risk report is split based on type, deployment, application, and geography.

Crime Risk Report Types

- Financial & Cybercrime

- Property

- Personal

- Others

According to crime risk report industry analysis, the market is categorized into financial & cybercrime, personal crime, real estate crime, and others based on types. The finance and cybercrime segment dominated the market in 2022. The escalating instances of cyber attacks like malware, phishing, and brute force attacks are prompting organizations to explore effective security solutions as preventive measures against crime risks.

Anticipated growth in this segment is driven by attackers' use of intelligence, social media, and network information to infiltrate business processes, leading to business downtime. Moreover, the persistence of fraudulent financial transactions necessitates organizations to seek advice from security solution and risk consulting firms. These factors are poised to contribute significantly to market growth during the crime risk report market forecast period.

Crime Risk Report Deployments

- On-premises

- Cloud-based

The on-premises deployment approach dominates the crime risk report market due to its advantages in data control, security, and compliance. On-premises solutions are preferred by businesses because they allow direct control over hardware, software, and data, ensuring sensitive information remains within their physical limits. This deployment strategy allows for greater customisation and specialised security measures, which is critical in industries with strong legal requirements. Despite the growing popularity of cloud-based solutions for their scalability and flexibility, on-premises solutions remain critical for enterprises seeking comprehensive control over their crime risk reporting infrastructure, especially when data sovereignty and stringent security standards are prioritised.

Crime Risk Report Applications

- Real Estate

- BFSI

- Government

- Others

The BFSI (banking, financial services, and insurance) industry holds a significant share of the crime risk report market due to its growing sensitivity to financial crime, cyber risks, and regulatory compliance concerns. With strict laws and the ongoing threat of fraud, BFSI organisations rely largely on detailed crime risk reports to analyse vulnerabilities, prevent financial crimes, and assure regulatory compliance. These reports help detect and mitigate threats such as money laundering, identity theft, and cyberattacks, as well as protect sensitive financial data and boost client trust. The BFSI sector's reliance on strong risk reporting solutions highlights its critical role in driving developments and innovations in the crime risk report market.

Crime Risk Report Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Crime Risk Report Market Regional Analysis

In North America, the market turnover reached USD 2.8 billion in 2022, and it's expected to continue growing in the coming years due to the rising cases of identity theft, credit card fraud, ransomware, email hacking, and account theft. Anticipated growth in violence cases in the region further emphasizes the need for designing and implementing programs aimed at preventing violence against women and minors.

Asia- Pacific is the fastest growing region. Governmental agencies in the region leverage crime risk reporting to assess the impact of unlawful actions and violence on the economic sector, as well as on the region's economic, cultural, and demographic characteristics, contributing to its social development. These reports play a pivotal role in enhancing cross-country awareness and knowledge regarding suitable strategies, programs, and capacities for ensuring safer use of ICTs.

Aside from this, the crime risk report market has huge worldwide growth potential. Technological developments, rising cybersecurity concerns, demand from various industries such as healthcare and finance, and the implementation of AI and machine learning for predictive analysis are all driving market growth. Collaboration between the public and private sectors also presents attractive potential for comprehensive criminal risk management and reporting services globally.

Crime Risk Report Market Players

Some of the top crime risk report companies offered in our report includes ACI Worldwide Inc., CAP Index Inc., Experian Information Solutions Inc. (Experian PLC), Fenergo Ltd., Fiserv Inc., Intelligent Direct Inc., Location Inc. (CoreLogic Inc.), NICE Ltd., Oracle Corporation, Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.), Refinitiv, and SAS Institute Inc.

Frequently Asked Questions

How big is the crime risk report market?

The crime risk report market size was USD 6.2 billion in 2022.

What is the CAGR of the global crime risk report market from 2023 to 2032?

The CAGR of crime risk report is 20.4% during the analysis period of 2023 to 2032.

Which are the key players in the crime risk report market?

The key players operating in the global market are including ACI Worldwide Inc., CAP Index Inc., Experian Information Solutions Inc. (Experian PLC), Fenergo Ltd., Fiserv Inc., Intelligent Direct Inc., Location Inc. (CoreLogic Inc.), NICE Ltd., Oracle Corporation, Pinkerton Consulting & Investigations Inc. (Securitas Security Services USA Inc.), Refinitiv, and SAS Institute Inc.

Which region dominated the global crime risk report market share?

North America held the dominating position in crime risk report industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of crime risk report during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global Crime Risk Report industry?

The current trends and dynamics in the crime risk report industry include tech advancements boost crime risk assessment, cybersecurity demand raises need for reports, urbanization heightens crime complexity, and globalization requires thorough analysis.

Which type held the maximum share in 2022?

The financial & cybercrime type held the maximum share of the crime risk report industry.