Corrosion Resistant Resins Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Corrosion Resistant Resins Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

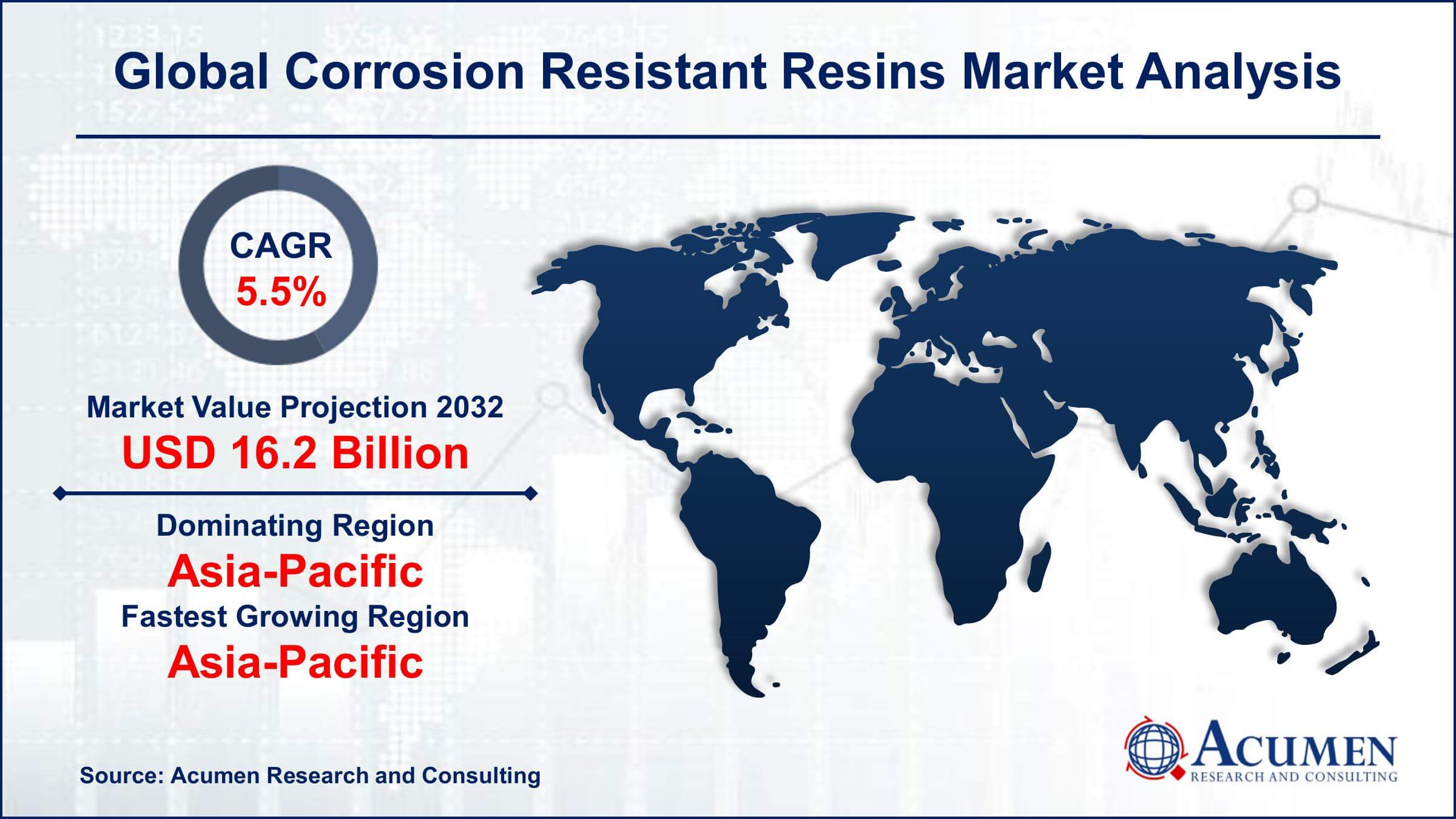

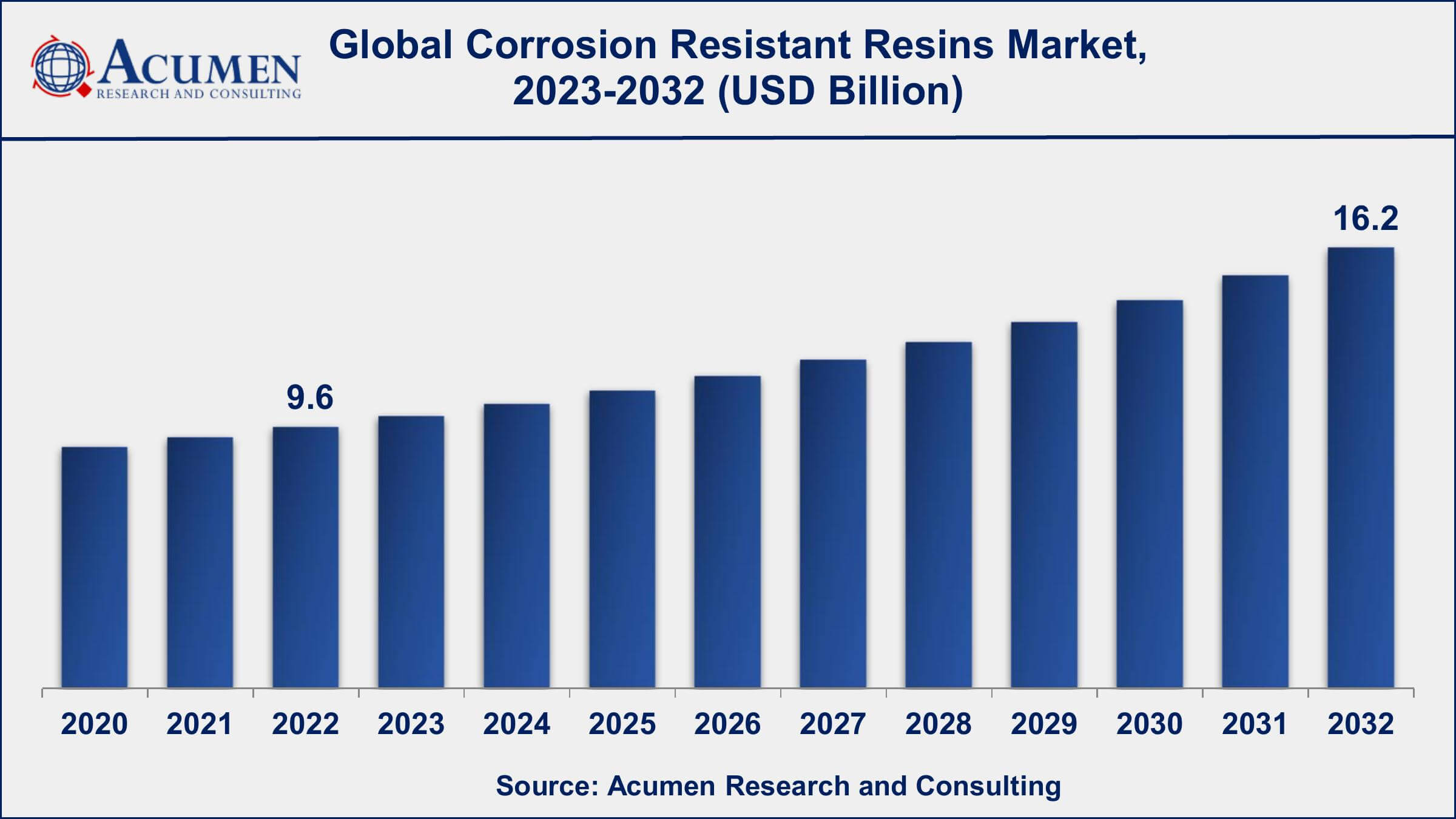

The Global Corrosion Resistant Resins Market Size accounted for USD 9.6 Billion in 2022 and is estimated to achieve a market size of USD 16.2 Billion by 2032 growing at a CAGR of 5.5% from 2023 to 2032.

Corrosion Resistant Resins Market Highlights

- Global corrosion resistant resins market revenue is poised to garner USD 16.2 billion by 2032 with a CAGR of 5.5% from 2023 to 2032

- Asia-Pacific corrosion resistant resins market value occupied almost USD 4.3 billion in 2022

- Asia-Pacific corrosion resistant resins market growth will record a CAGR of over 6% from 2023 to 2032

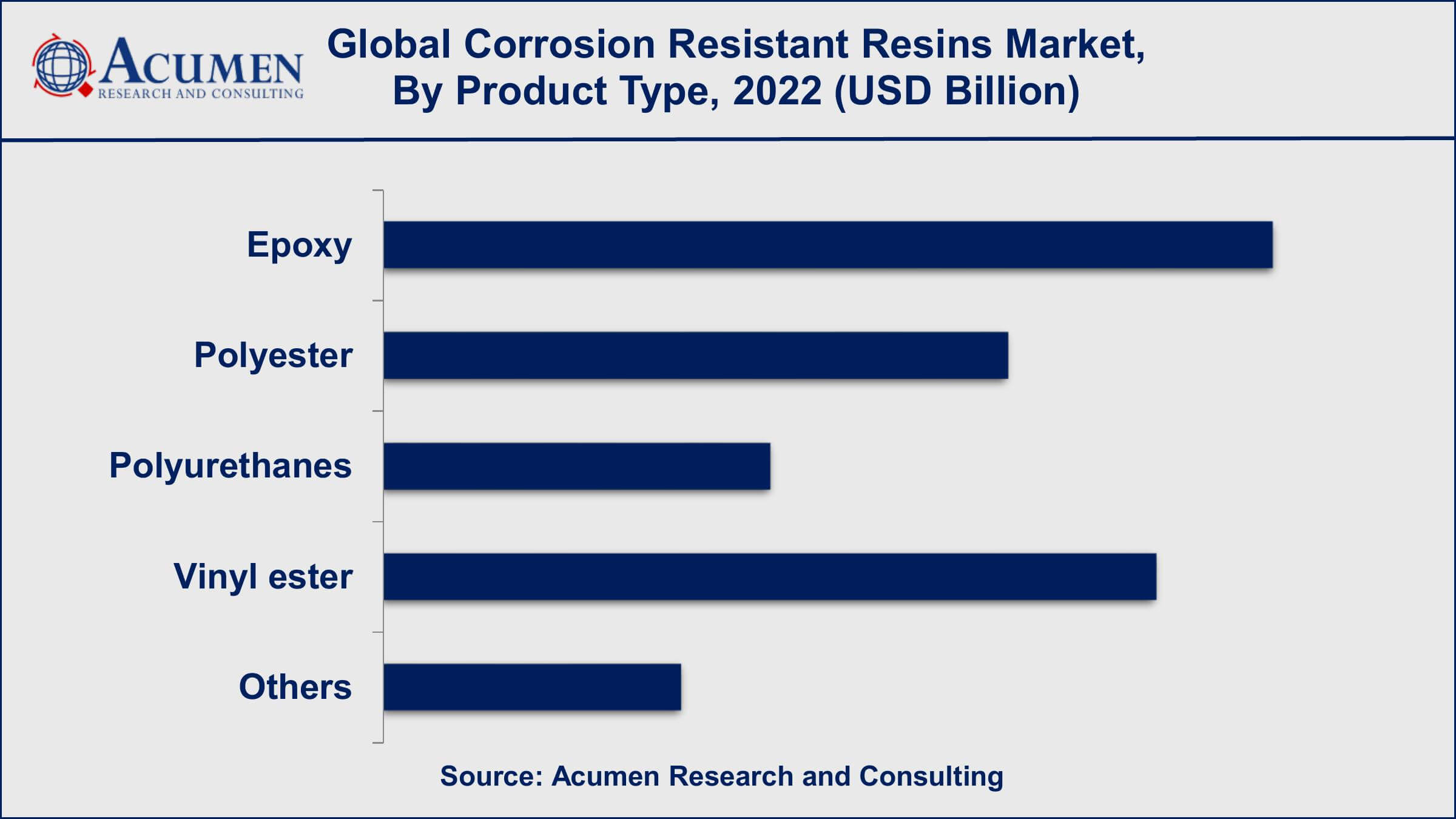

- Among product, the epoxy sub-segment generated over US$ 2.9 billion revenue in 2022

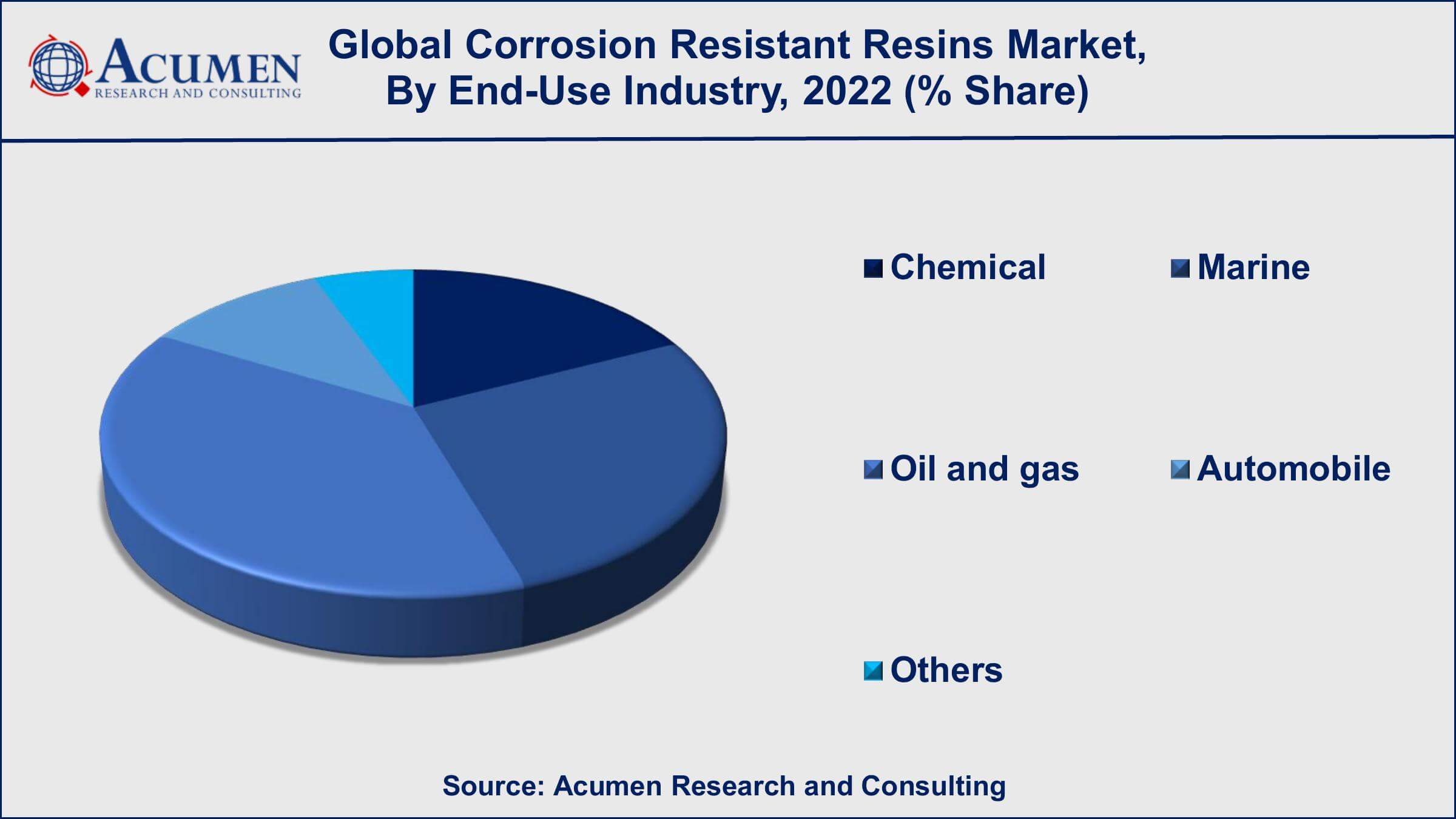

- Based on end-use industry, the oil & gas sub-segment generated around 38% share in 2022

- Focus on innovation and product development by key players is a popular corrosion resistant resins market trend that fuels the industry demand

Polyester resins come under the family of polymers and are used to produce a wide range of products. Most commonly, thermoset polyesters are also known as unsaturated polyester resins and are available in a wide number of formulations generally made for specific applications. Such formulations are generally designated by the key raw materials involved which determine the overall performance characteristics of the concluding polymer backbone. Isophthalic polyester resins are a wide range of resins designed from glycols, isophthalic acid, maleic anhydride, and others. The special resin is picked up to impart the required properties as well as corrosion resistance. Such corrosion-resistant resins can be employed for applications related to moderate corrosion resistance to a specific temperature range of approximately 180°F. Isophthalic corrosion-resistant resins impart efficient resistance to acids, water, hydrocarbons, and weak bases such as oil and gasoline. Practically, vinyl ester resins refer to polyester resins although they are generally classified on a separate basis from polyesters owing to their efficient and improved corrosion resistance and mechanical properties.

Global Corrosion Resistant Resins Market Dynamics

Market Drivers

- Growing demand from end-use industries such as construction, automotive, and aerospace

- Increasing awareness about the benefits of corrosion resistant resins in protecting industrial assets from corrosion

- Technological advancements in resin manufacturing

- Growing focus on sustainability and the use of eco-friendly materials

Market Restraints

- High cost of corrosion resistant resins

- Limited availability of raw materials used in the manufacturing of corrosion resistant resins

- Stringent regulations regarding the use of certain chemicals in resin manufacturing

Market Opportunities

- Growing demand for lightweight materials in the automotive and aerospace industries

- Increasing demand for corrosion resistant coatings in emerging economies

- Growing use of composites in the construction industry

- Development of customized and high-performance drilling fluid formulations

Corrosion Resistant Resins Market Report Coverage

| Market | Corrosion Resistant Resins Market |

| Corrosion Resistant Resins Market Size 2022 | USD 9.6 Billion |

| Corrosion Resistant Resins Market Forecast 2032 | USD 16.2 Billion |

| Corrosion Resistant Resins Market CAGR During 2023 - 2032 | 5.5% |

| Corrosion Resistant Resins Market Analysis Period | 2020 - 2032 |

| Corrosion Resistant Resins Market Base Year | 2022 |

| Corrosion Resistant Resins Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eastman Chemical Company, Huntsman Corporation, BASF SE, GE Plastics, Hexion Inc., Ashland Inc., Reichhold LLC, Aditya Birla Chemicals, Olin Corporation, Scott Bader Company Ltd., Sika AG, and Polynt Composites Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Corrosion Resistant Resins Market Insights

Industries incur great losses owing to corrosion. Corrosion can pose a serious threat to people and property. Corrosion-resistant resins aid in minimizing such losses and help in avoiding damage to equipment, structures, and machinery. These are some of the key factors anticipated to drive the growth of the global corrosion-resistant resins market over the forecast period. An increasing number of applications of corrosion-resistant resins and development of the end-use industries such as marine coatings, transportation, electrical & electronic laminates, aerospace, decorative powder coatings, and composites are expected to bolster the growth of global corrosion-resistant resins demand over the forecast period. This trend is analyzed to continue throughout the forecast period due to increased automotive and infrastructure demand. Some of the favorable properties of corrosion-resistant resins such as mechanical strength, high thermal stability, adhesion, moisture resistivity, mechanical, heat resistance, and electrical make corrosion-resistant resins best suitable for several end-use applications including jewelry, laminates, industrial and insulators applications. Also, increasing research and development coupled with advancement in technology in the field of advanced and modified resins is anticipated to create new opportunities for various industrial applications. The increasing growth of the automotive and construction industry on the basis of rising per capita disposable income along with changing demographics and lifestyles, especially in emerging economies are some other key factors driving the global corrosion resistant resins market over the forecast period.

Corrosion Resistant Resins Market, By Segmentation

The worldwide market for corrosion resistant resins is split based on product, application, end-use industry, and geography.

Corrosion Resistant Resin Products

- Epoxy

- Polyester

- Polyurethanes

- Vinyl Ester

- Others

According to our corrosion resistant resins industry analysis, epoxy resins are frequently used in corrosion protection applications because of their outstanding adhesion, chemical resistance, and durability. Epoxy resins are widely used in the construction industry to protect reinforced concrete structures, as well as in the marine industry to prevent corrosion on boats and ships. Polyester resins are also broadly used in the corrosion resistant resins market, especially in the production of fibreglass reinforced plastic (FRP) composites. Polyester resins are inexpensive and resistant to water and chemicals, making them ideal for use in the marine, automotive, and construction industries.

Polyurethane resins, on the other hand, are used in applications that require flexibility and impact resistance. They are commonly used in storage tank coatings and linings, as well as other industrial equipment. Vinyl ester resins are a cross between epoxy and polyester resins that have high chemical resistance, toughness, and durability. They are frequently used in the production of FRP composites for use in the chemical, food, and pharmaceutical industries.

Corrosion Resistant Resin Applications

- Coating

- Composites

Coatings are the most common application for corrosion resistant resins in the construction industry, particularly for protecting concrete and steel structures from corrosion. Epoxy and polyester coatings are widely used in bridge decks, parking structures, and industrial flooring.

Composites are the most common application for corrosion-resistant resins in the marine industry, particularly in the manufacture of boats, ships, and other marine structures. Because of their excellent resistance to water and chemicals, polyester and vinyl ester resins are widely used in the marine industry.

Coatings and composites are both important applications for corrosion resistant resins in the oil and gas industry. Coatings are used to prevent corrosion on pipelines, tanks, and other equipment, whereas composites are used in the construction of offshore structures such as platforms and risers.

Corrosion Resistant Resin End-Use Industries

- Chemical

- Marine

- Oil and gas

- Automobile

- Others

The chemical industry is a significant end-use industry for corrosion resistant resins, according to our corrosion resistant resins market forecast. Corrosion can seriously damage chemical processing equipment, resulting in downtime, maintenance costs, and safety risks. In chemical processing applications, epoxy and vinyl ester resins are commonly used to protect equipment from corrosion.

The oil and gas industry is a major end-user of corrosion resistant resins. Corrosion can severely damage pipelines, tanks, and other equipment, posing safety risks and increasing maintenance costs. In oil and gas applications, epoxy and vinyl ester resins are commonly used to protect equipment from corrosion.

Another important end-use industry for corrosion resistant resins is the marine industry. Corrosion can cause serious damage to boats, ships, and other marine structures, posing safety risks and increasing maintenance costs. Because of their excellent resistance to water and chemicals, polyester and vinyl ester resins are commonly used in marine applications.

Corrosion Resistant Resins Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Corrosion Resistant Resins Market Regional Analysis

The market for corrosion-resistant resins is expanding at the fastest rate in Asia-Pacific as a result of rising demand from a variety of end-use industries, including the chemical, marine, and automotive sectors. The region's growing infrastructure, urbanization, and industrialization are driving demand for corrosion-resistant coatings and composites. In Asia-Pacific, the largest markets for corrosion resistant resins are China, India, and Japan.

The presence of numerous industries, including the oil and gas, automotive, and chemical sectors, makes North America a significant market for corrosion-resistant resins. The region's rising demand for corrosion-resistant coatings and composites is propelling market growth. The United States is North America's largest market for corrosion resistant resins.

Europe is another important market for corrosion resistant resins due to the presence of various industries such as marine, automobile, and infrastructure. The region's growing demand for environmentally friendly and cost-effective corrosion-resistant coatings and composites is propelling market growth. Germany, the United Kingdom, and France are Europe's largest markets for corrosion resistant resins.

Corrosion Resistant Resins Market Players

Some of the top corrosion resistant resins companies offered in the professional report include Eastman Chemical Company, Huntsman Corporation, BASF SE, GE Plastics, Hexion Inc., Ashland Inc., Reichhold LLC, Aditya Birla Chemicals, Olin Corporation, Scott Bader Company Ltd., Sika AG, and Polynt Composites Inc.

Frequently Asked Questions

What was the market size of the global corrosion resistant resins in 2022?

The market size of corrosion resistant resins was USD 9.6 billion in 2022.

What is the CAGR of the global corrosion resistant resins market from 2023 to 2032?

The CAGR of corrosion resistant resins is 5.5% during the analysis period of 2023 to 2032.

Which are the key players in the corrosion resistant resins market?

The key players operating in the global corrosion resistant resins market is includes Eastman Chemical Company, Huntsman Corporation, BASF SE, GE Plastics, Hexion Inc., Ashland Inc., Reichhold LLC, Aditya Birla Chemicals, Olin Corporation, Scott Bader Company Ltd., Sika AG, and Polynt Composites Inc.

Which region dominated the global corrosion resistant resins market share?

Asia-Pacific held the dominating position in corrosion resistant resins industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of corrosion resistant resins during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global corrosion resistant resins industry?

The current trends and dynamics in the corrosion resistant resins industry include growing demand from end-use industries such as construction, automotive, and aerospace, increasing awareness about the benefits of corrosion resistant resins in protecting industrial assets from corrosion, technological advancements in resin manufacturing, and growing focus on sustainability and the use of eco-friendly materials.

Which product held the maximum share in 2022?

The epoxy product held the maximum share of the corrosion resistant resins industry.?