Corrosion Monitoring Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Corrosion Monitoring Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

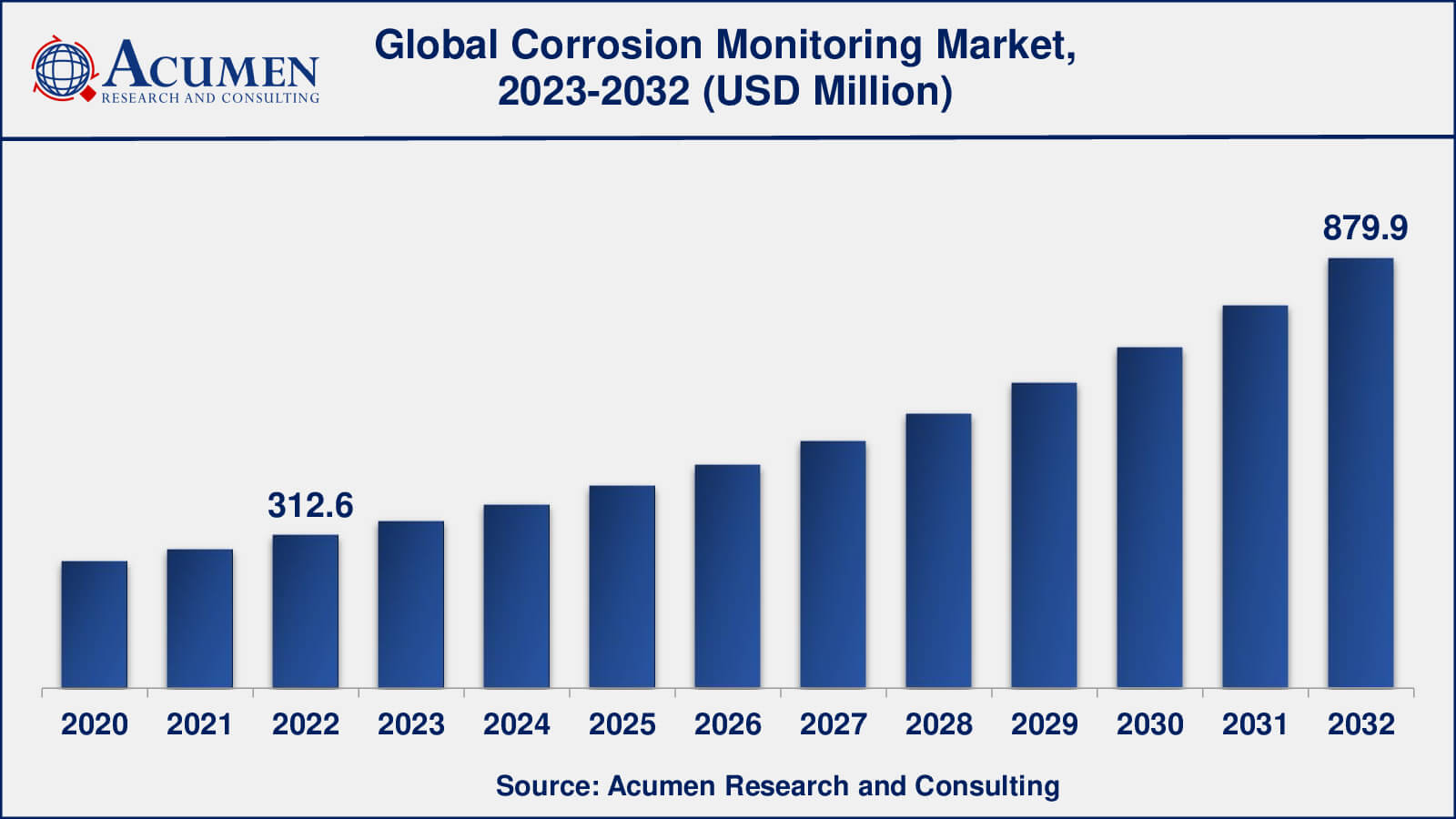

The Global Corrosion Monitoring Market Size accounted for USD 312.6 Million in 2022 and is estimated to achieve a market size of USD 879.9 Million by 2032 growing at a CAGR of 11.1% from 2023 to 2032.

Corrosion Monitoring Market Highlights

- Global corrosion monitoring market revenue is poised to garner USD 879.9 million by 2032 with a CAGR of 11.1% from 2023 to 2032

- Asia-Pacific corrosion monitoring market value occupied almost USD 110 million in 2022

- Asia-Pacific corrosion monitoring market growth will record a CAGR of over 12% from 2023 to 2032

- Among technique, the non-intrusive sub-segment generated over US$ 184 million revenue in 2022

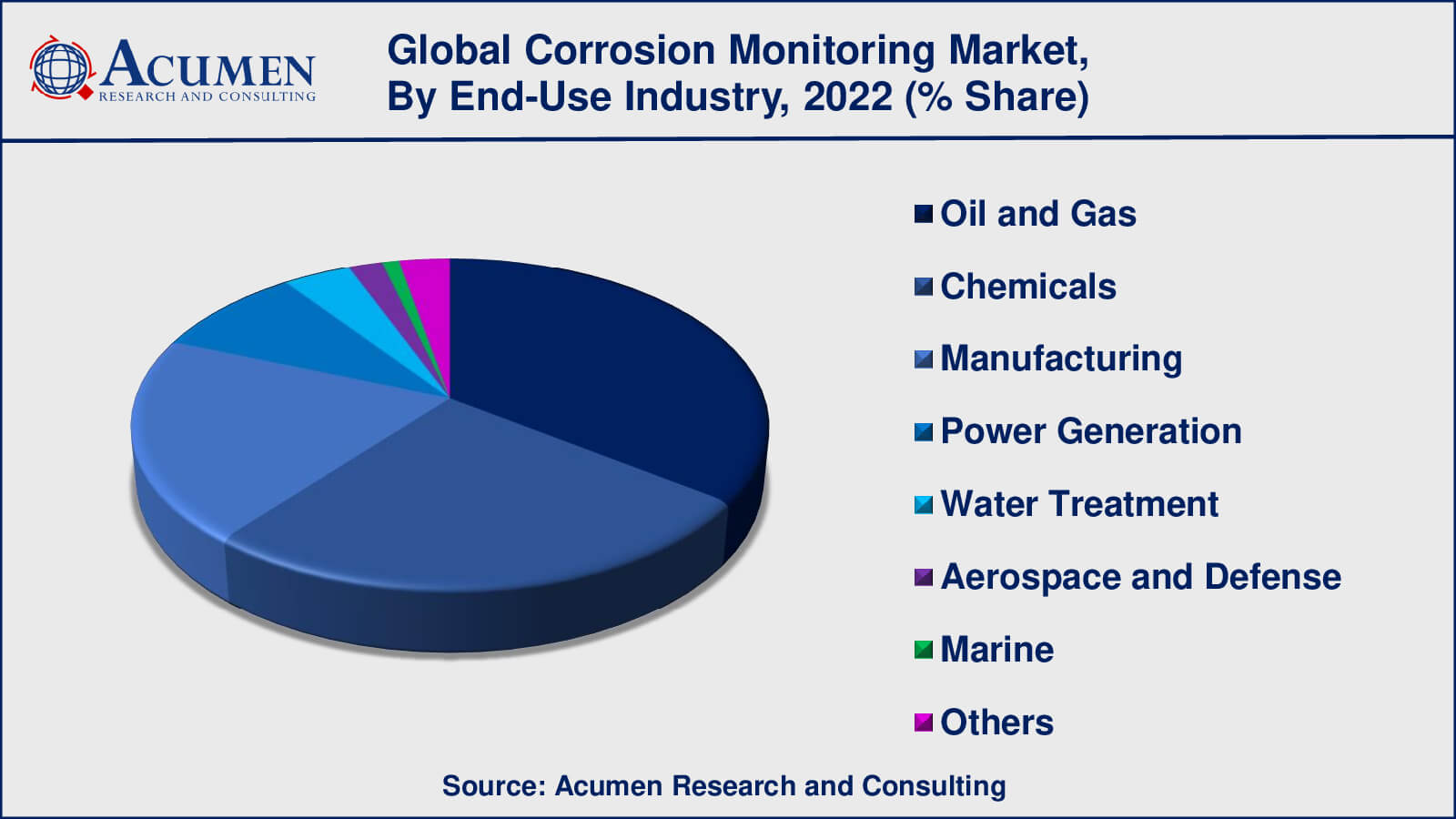

- Based on end-use industry, the oil & gas sub-segment generated around 35% share in 2022

- Growing investments in infrastructure development in developing economies is a popular corrosion monitoring market trend that fuels the industry demand

Corrosion is an electrochemical process of transforming alloys and metals into hydroxides and aqueous salts. Anodic and cathodic are the two reactions that generally occur in the corrosion process. The anodic reaction involves the ionization of metal atoms. The process of monitoring and preventing corrosion on metals is known as corrosion monitoring. Probes are the most important component in the corrosion monitoring process. Probes are electromechanical, electrical, or mechanical. These probes are introduced into the steam process and exposed outside of the process. The corrosion monitoring system process helps in providing accurate measurement of metal being loosed and the rate of corrosion in various industrial applications. Weight loss coupons, microbial, electrical resistance, hydrogen penetration, galvanic current, linear polarization, and electrical resistance are the most popular techniques of corrosion monitoring.

Global Corrosion Monitoring Market Dynamics

Market Drivers

- Increasing awareness about the harmful effects of corrosion on equipment and infrastructure

- Growing demand for efficient and reliable corrosion monitoring systems in various end-use industries

- Stringent government regulations and guidelines for the maintenance of critical infrastructure and assets

Market Restraints

- High costs associated with the installation and maintenance of corrosion monitoring systems

- Lack of skilled workforce and technical expertise for the proper functioning and maintenance

- Difficulty in monitoring corrosion in complex and hard-to-reach areas

Market Opportunities

- Increasing demand for wireless corrosion monitoring systems for remote monitoring and data collection

- Integration of corrosion monitoring systems with the Internet of Things (IoT) and Artificial Intelligence (AI) for predictive maintenance and real-time monitoring

- Growing need for continuous monitoring of assets in critical industries

- Expansion of the market in emerging economies with growing infrastructure development and industrialization

Corrosion Monitoring Market Report Coverage

| Market | Corrosion Monitoring Market |

| Corrosion Monitoring Market Size 2022 | USD 312.6 Million |

| Corrosion Monitoring Market Forecast 2032 | USD 879.9 Million |

| Corrosion Monitoring Market CAGR During 2023 - 2032 | 11.1% |

| Corrosion Monitoring Market Analysis Period | 2020 - 2032 |

| Corrosion Monitoring Market Base Year | 2022 |

| Corrosion Monitoring Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technique, By End-Use Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Emerson Electric Co., Honeywell International Inc., Siemens AG, ABB Ltd., Baker Hughes, a GE Company LLC, Schlumberger Limited, Cosasco, Sensorlink AS, Corrpro Companies, Inc., Permasense Ltd., Rysco Corrosion Services Inc., and Intertek Group plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Corrosion Monitoring Market Insights

The rapidly growing end-use industries and increasing awareness of corrosion monitoring techniques are the driving factors for the growth of the corrosion monitoring system market. Strict government norms regarding safety in the workplace will also drive the market for corrosion monitoring in the coming years. Also, old infrastructure or machinery in ancient industries which leads to the corrosion of metals is likely to drive the market for corrosion monitoring. The downstream projects in the oil & gas sector make extensive use of the corrosion monitoring process, thereby driving market growth. However, the huge investment required to set up corrosion monitoring equipment hampers the growth of the corrosion monitoring system market. Moreover, there is a setback in the upstream projects of the oil & gas sector which is restraining the market for corrosion monitoring. The sudden increase of corrosion monitoring techniques in chemical, energy, and power industries offers huge growth opportunities for corrosion monitoring system manufacturers over the forecast period.

Corrosion Monitoring Market, By Segmentation

The worldwide market for corrosion monitoring is split based on type, technique, end-use industry, and geography.

Corrosion Monitoring Types

- Intrusive

- Non-Intrusive

According to the corrosion monitoring industry analysis, non-intrusive corrosion monitoring is expected to be the market's leading and fastest-growing type. Because of their non-destructive nature and ease of use, non-intrusive corrosion monitoring techniques such as ultrasonic thickness measurement, remote monitoring, and acoustic emission testing are gaining popularity. These techniques enable continuous asset monitoring without the need for shutdowns or interruptions in operations, making them particularly appealing in industries such as oil and gas, chemical, and water treatment.

Corrosion Monitoring Techniques

- Electrical Resistance

- Power Generation

- Manufacturing

- Ultrasonic Thickness Measurement

- Linear Polarization Resistance

The corrosion monitoring techniques used are determined by the specific application and requirements. According to our analysis, electrical resistance (ER) and ultrasonic thickness measurement (UTM) are expected to be the leading and fastest-growing corrosion monitoring techniques in the market. Electrical resistance (ER) probes are widely used for monitoring corrosion rates in pipelines, tanks, and other assets in industries such as oil and gas, chemical, and water treatment. Ultrasonic thickness measurement (UTM) is a non-destructive technique for determining the thickness of metal structures, which is an important parameter in determining corrosion rate.

Corrosion monitoring techniques are widely used in the power generation and manufacturing industries. The technique used is determined by the specific application within these industries. Ultrasonic thickness measurement (UTM) is commonly used in the power generation industry to monitor the thickness of pipes and boilers, while electrical resistance (ER) probes are used to monitor corrosion rates in pipelines and other assets. For monitoring corrosion in equipment and structures, various techniques such as electrochemical impedance spectroscopy (EIS), linear polarisation resistance (LPR), and electrical resistance (ER) probes are used in the manufacturing industry.

Corrosion Monitoring End-Use Industries

- Oil and Gas

- Chemicals

- Manufacturing

- Power Generation

- Water Treatment

- Aerospace and Defense

- Marine

- Others

As per the corrosion monitoring market forecast, oil and gas industry has traditionally been the dominant end-use industry in the corrosion monitoring market. This is due to the oil and gas industry's high sensitivity to corrosion, which can result in safety risks, environmental damage, and significant financial losses. Corrosion can occur in a variety of assets in the oil and gas industry, including pipelines, storage tanks, and offshore structures, which require continuous monitoring to ensure their integrity and safety.

Other industries, such as chemicals, manufacturing, power generation, water treatment, aerospace and defence, and marine, have emerged as significant end-users of corrosion monitoring techniques in recent years. These industries, too, face corrosion-related challenges, necessitating the use of effective corrosion monitoring solutions to ensure the safety, dependability, and longevity of their assets.

Corrosion Monitoring Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Corrosion Monitoring Market Regional Analysis

The Asia-Pacific region is expected to witness significant growth in the corrosion monitoring market, driven by increasing industrialization, urbanization, and the need for asset reliability and safety. China, Japan, India, and South Korea are among the major markets for corrosion monitoring in this region, owing to their significant presence in industries such as oil and gas, chemical, manufacturing, and power generation.

North America and Europe are mature markets for corrosion monitoring, with a significant presence of established players and a high degree of awareness about the importance of corrosion monitoring in various industries. These regions have stringent regulations related to asset integrity and safety, which drive the demand for effective corrosion monitoring solutions. The United States and Canada in North America, and Germany, France, and the United Kingdom in Europe are among the major markets for corrosion monitoring in these regions.

Corrosion Monitoring Market Players

Some of the top corrosion monitoring companies offered in the professional report include Emerson Electric Co., Honeywell International Inc., Siemens AG, ABB Ltd., Baker Hughes, a GE Company LLC, Schlumberger Limited, Cosasco, Sensorlink AS, Corrpro Companies, Inc., Permasense Ltd., Rysco Corrosion Services Inc., and Intertek Group plc.

Frequently Asked Questions

What was the market size of the global corrosion monitoring in 2022?

The market size of corrosion monitoring was USD 312.6 million in 2022.

What is the CAGR of the global corrosion monitoring market from 2023 to 2032?

The CAGR of corrosion monitoring is 11.1% during the analysis period of 2023 to 2032.

Which are the key players in the corrosion monitoring market?

The key players operating in the global corrosion monitoring market is includes Emerson Electric Co., Honeywell International Inc., Siemens AG, ABB Ltd., Baker Hughes, a GE Company LLC, Schlumberger Limited, Cosasco, Sensorlink AS, Corrpro Companies, Inc., Permasense Ltd., Rysco Corrosion Services Inc., and Intertek Group plc.

Which region dominated the global corrosion monitoring market share?

Asia-Pacific held the dominating position in corrosion monitoring industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of corrosion monitoring during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global corrosion monitoring industry?

The current trends and dynamics in the corrosion monitoring industry include increasing awareness about the harmful effects of corrosion on equipment and infrastructure, and growing demand for efficient and reliable corrosion monitoring systems in various end-use industries, and stringent government regulations and guidelines for the maintenance of critical infrastructure and assets.

Which type held the maximum share in 2022?

The non-intrusive type held the maximum share of the corrosion monitoring industry.?