Corporate eLearning Market Size (By Technology: Learning Management System (LMS), Online e-learning, Mobile e-learning, Virtual Classroom, Rapid e-learning, and Others; By Provider: Instructor Led & Text Based, and Outsourced; By Organization Size: SMEs, and Large Enterprises; By Deployment: Cloud-based, and On-premises) � Global Industry Analysis, Market Size, Opportunities and Forecast 2022 � 2030

Published :

Report ID:

Pages :

Format :

Corporate eLearning Market Size (By Technology: Learning Management System (LMS), Online e-learning, Mobile e-learning, Virtual Classroom, Rapid e-learning, and Others; By Provider: Instructor Led & Text Based, and Outsourced; By Organization Size: SMEs, and Large Enterprises; By Deployment: Cloud-based, and On-premises) � Global Industry Analysis, Market Size, Opportunities and Forecast 2022 � 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

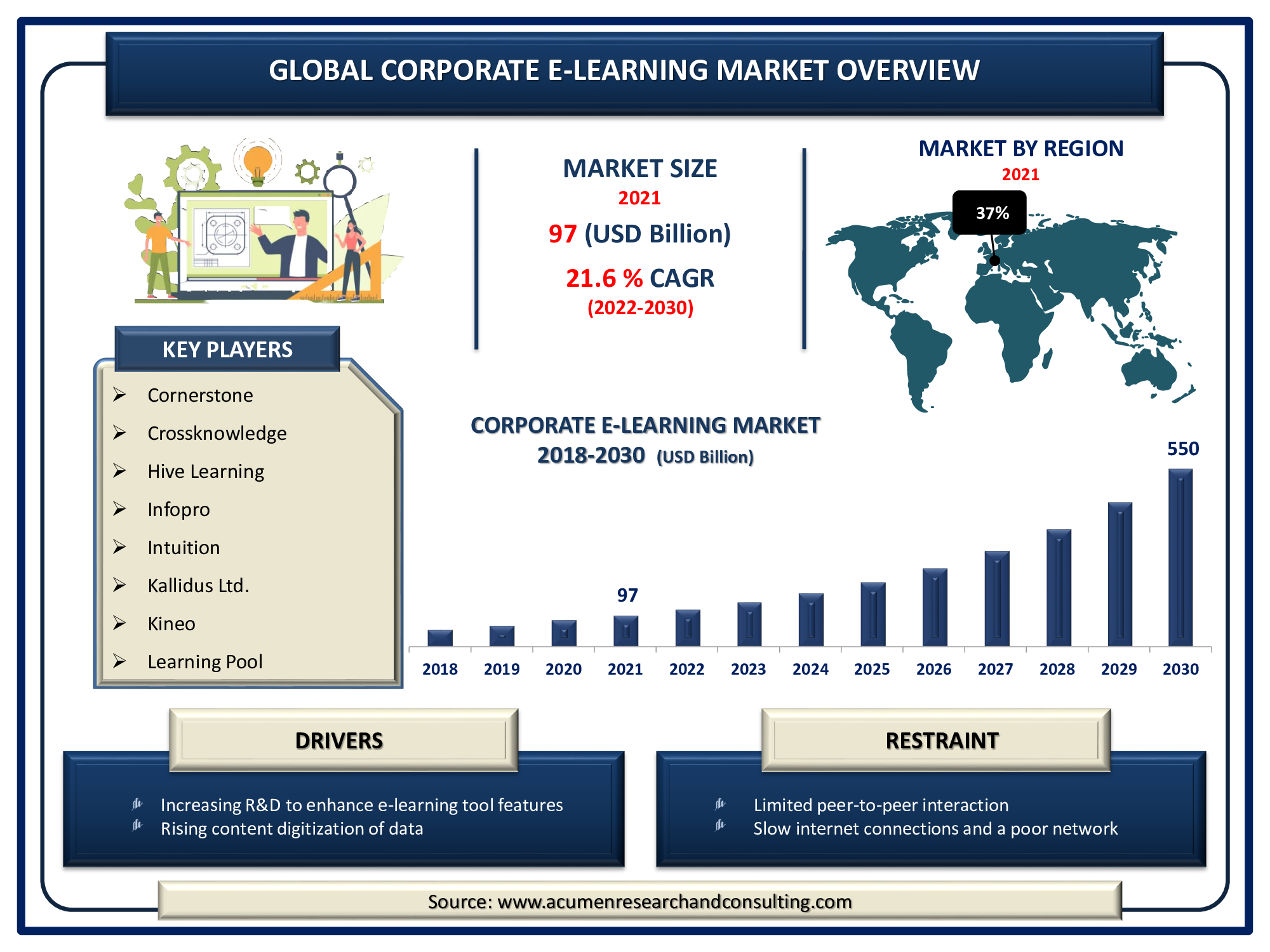

Request Sample Report

The global corporate eLearning market accounted for US$ 97 Bn in 2021 and is expected to reach US$ 550 Bn by 2030 with a considerable CAGR of 21.6% during the forecast timeframe of 2022 to 2030.

The rising emphasis of organizations on updating their development programs will help the corporate eLearning market to flourish. Corporate e-learning is an innovative way of employee training and development. In other words, corporate eLearning is virtual education tailored specifically to the demands and interests of the business context. It could be the standard format, which will be available online, or a more accessible format, which will be available on every platform, such as mobile or computer. Corporate eLearning aims to ensure that staff has the knowledge and abilities to carry out a certain duty, allowing a firm to continue to operate. Corporate training is fundamentally concerned with the transmission of knowledge. Corporate eLearning can be accessed through any device, such as a desktop, laptop, tablet, or smartphone. Finally, because most workers now work remotely, they will most probably take these programs or attend workshops at the home office of their new business.

Drivers

Drivers

- Increasing R&D to enhance e-learning tool features

- The evolving IT & telecom infrastructure across Globe

- Rising content digitization of data

- Increasing online and mobile learning penetration

Restraints

- Limited peer-to-peer interaction

- Slow internet connections and a poor network in emerging and undeveloped countries

Opportunity

- A growing interest in e-learning solutions from the manufacturing industry

Report Coverage:

| Market | Corporate eLearning Market |

| Market Size 2021 | US$ 97 Bn |

| Market Forecast 2028 | US$ 550 Bn |

| CAGR | 21.6% During 2022 - 2030 |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Technology, By Provider, By Organization Size, By Deployment, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cegid, Crossknowledge, Cornerstone, Hive Learning, Intuition, Infopro, Kallidus Ltd., Learning Pool, Kineo, Learning Technologies Group plc (LTG), Mind Tools, Media Zoo, Skillsoft Corp, NIIT Corporation, and Omniplex. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Corporate eLearning Market Dynamics

Corporate e-learning is among the most fast expanding and most promising industries in the education business. Although the market is currently in its early stages, it is expected to grow in the coming years. Organizations seek an all-encompassing strategy to meet their training demands, which leads to convergence in the e-learning business. Growing technical infrastructure advances, increasing acceptability of video instructional teaching methods, and rising investment from important organizations over the world are likely to drive market growth during the forecast period. Furthermore, the increasing usage of online instructor-led training methods, as well as recent technological advances like as augmented and virtual reality open up new opportunities for training delivery. Aside from that, there has been a data breach and a cyber security concern, which may limit the growth of corporate e-learning.

As a result of the global outbreak, several restrictions in the form of shutdowns and restrictions have been enforced. Various organizations' use of work-from-home and remote working is a growing demand for online learning, e-learning, and virtual communication. Enterprises that were sluggish to implement e-learning solutions before the outbreak are now utilizing a large number of digital training programs for their employees. Solution providers provide e-learning and training solutions, as well as developing and testing new online techniques such as activating digital learning systems, self-directed learning content, and the creation of enormous open online course platforms. As a result, it's safe to believe that the epidemic has hastened the growth of corporate e-learning platforms.

Market Segmentation

Market By Technology

- Learning Management System (LMS)

- Online e-learning

- Mobile e-learning

- Virtual Classroom

- Rapid e-learning

- Others

Based on the technology, the learning management system segment is expected to lead the global enterprise e-learning market in the forecast years. A learning management system (LMS) is a software-based or SaaS system that manages, automates, and delivers educational lessons, training programs, or learning and development programs. This helps to provide training materials to a wide range of audiences, from online courses to real-time classroom sessions. In addition, most systems are now accessible via smartphones.

Market By Provider

- Instructor Led & Text Based

- Outsourced

The market is divided into two types of provider: instructor-led and text-based training and outsourced training. Instructor-led training is the activity of passing on training and learning materials between an instructor and students, who might be individuals or groups. Instructors, who may be competent and experienced in the learning content, are also known as facilitators.

Market By Organization Size

- SMEs

- Large Enterprises

Based on the organization size, the large enterprises are accounted for the largest global corporate eLearning market revenue in 2021. Corporate training is essential for offering quality resources and appropriate instructional content to employees. The goal is to enhance business processes and deliver better results. Corporate training fosters ongoing information interchange and provides access to advanced business tools to corporate workers. Furthermore, the corporate eLearning market from SMEs is predicted to expand significantly over the market. These firms use web-based learning tools to give employees the flexibility to take courses when it is convenient for them. The expanding number of small and medium organizations will also contribute to the expansion of worldwide corporate eLearning market trends.

Market By Deployment

- Cloud-based

- On-premises

Based on deployment, the cloud-based segment is expected to dominate the global market over the forecasted timeframes. This deployment methodology is simple to set up and manage, is cost-effective, and provides mobile training for personnel on the go. It eliminates the need for on-premises complicated IT infrastructure, lowering total maintenance costs.

Corporate eLearning Market Regional Overview

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America dominated the corporate e-learning market in 2021 and is predicted to grow at the fastest rate during the forecast period due to increased competition among telecommunications companies in North America. The North American corporate eLearning market accounts for the majority of the industry share and is quickly expanding as a result of several enterprises' rapid technological adoption to give effective training to their employees. Furthermore, prominent players ensure higher data security by offering quick access and greater reach, which drives the growth of the corporate e-learning market in this area. Corporate sectors are actively engaged in improving their staff training programs, which results in increased employee productivity.

Competitive Landscape

Some of the prominent players in global corporate eLearning market are Cegid, Crossknowledge, Cornerstone, Hive Learning, Intuition, Infopro, Kallidus Ltd., Learning Pool, Kineo, Learning Technologies Group plc (LTG), Mind Tools, Media Zoo, Skillsoft Corp, NIIT Corporation, and Omniplex.

Frequently Asked Questions

How much was the estimated value of the global corporate eLearning market in 2021?

The estimated value of global corporate eLearning market in 2021 was accounted to be US $ 97 Bn.

What will be the projected CAGR for global corporate eLearning market during forecast period of 2022 to 2030?

The projected CAGR of corporate eLearning during the analysis period of 2022 to 2030 is 21.6%.

Which are the prominent competitors operating in the market?

The prominent players of the global corporate eLearning market involve Cegid, Crossknowledge, Cornerstone, Hive Learning, Intuition, Infopro, Kallidus Ltd., Learning Pool, Kineo, Learning Technologies Group plc (LTG), Mind Tools, Media Zoo, Skillsoft Corp, NIIT Corporation, and Omniplex.

Which region held the dominating position in the global corporate eLearning market?

Europe held the dominating share for corporate eLearning during the analysis period of 2022 to 2030

Which region exhibited the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for corporate eLearning during the analysis period of 2022 to 2030

What are the current trends and dynamics in the global corporate eLearning market?

Increasing R&D to enhance e-learning tool features, and evolving IT & telecom infrastructure across the globe are the prominent factors that fuel the growth of global corporate eLearning market

By segment Organization Size, which sub-segment held the maximum share?

Based on organization size, large enterprises segment held the maximum share for corporate eLearning market in 2021