Cord Blood Banking Market | Acumen Research and Consulting

Cord Blood Banking Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

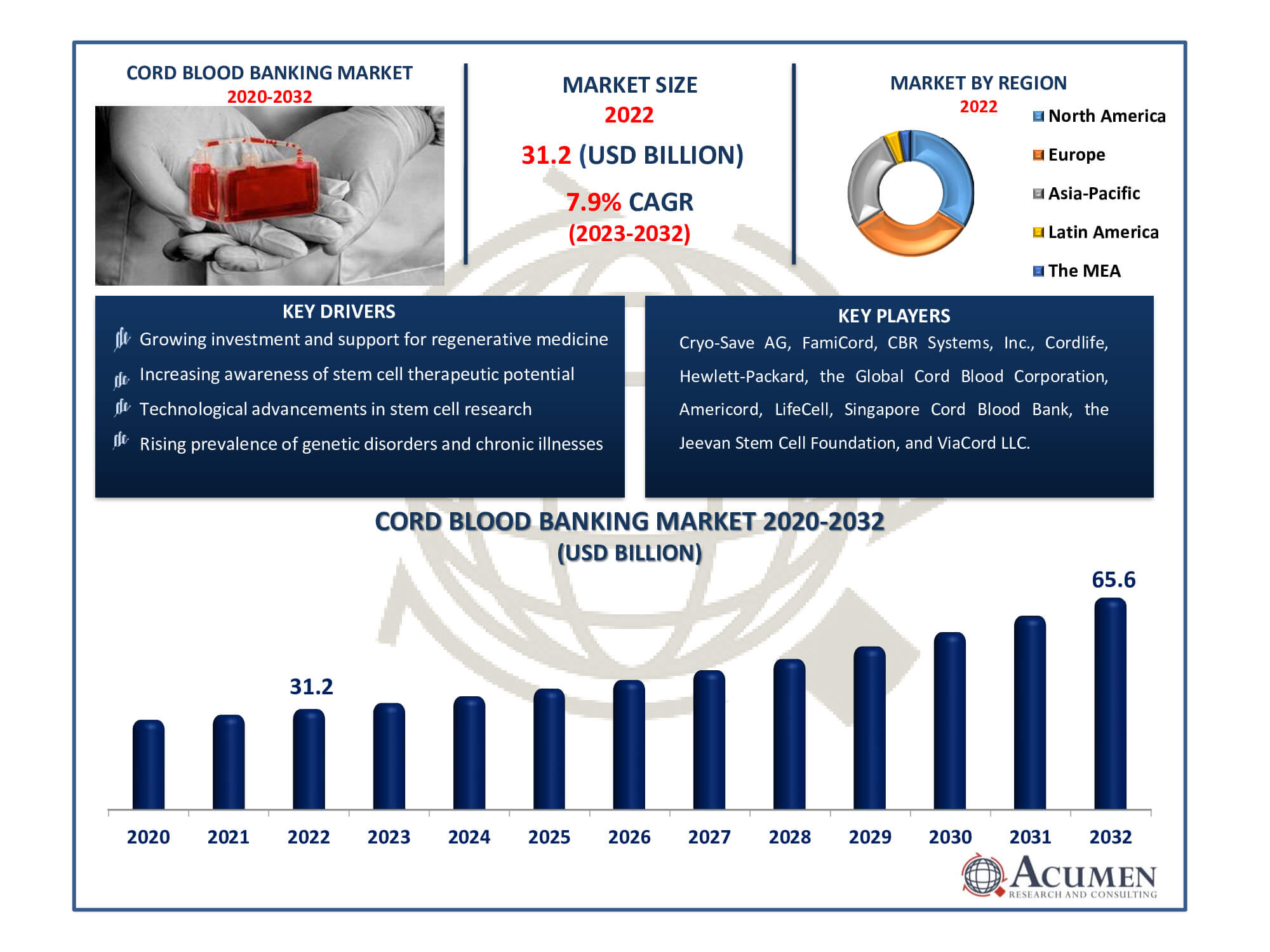

The Cord Blood Banking Market Size accounted for USD 31.2 Billion in 2022 and is estimated to achieve a market size of USD 65.6 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Cord Blood Banking Market Highlights

- Global cord blood banking market revenue is poised to garner USD 65.6 Billion by 2032 with a CAGR of 7.9% from 2023 to 2032

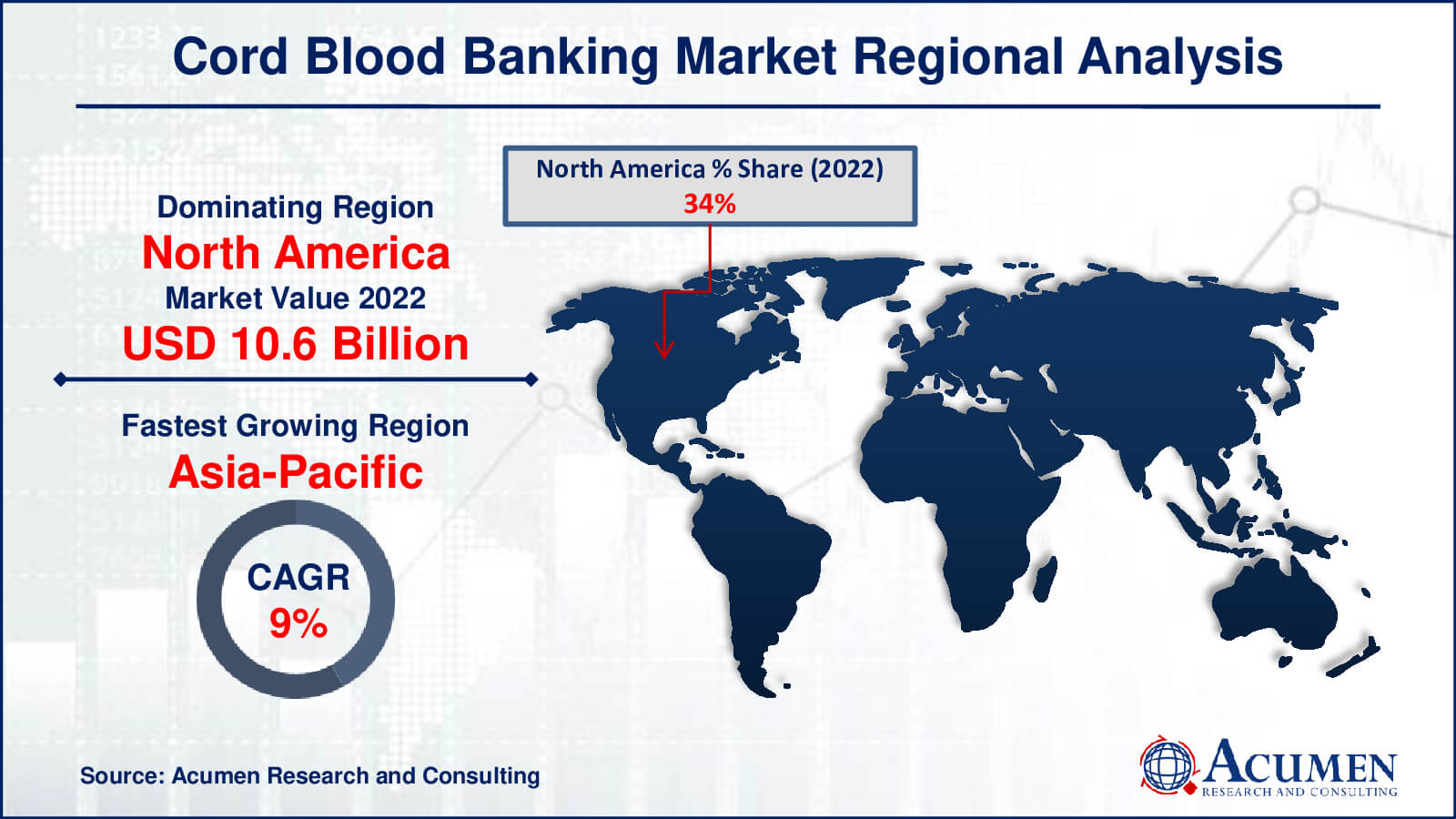

- North America cord blood banking market value occupied around USD 10.6 billion in 2022

- Asia-Pacific cord blood banking market growth will record a CAGR of more than 9% from 2023 to 2032

- Among services, the processing sub-segment generated over US$ 23.8 billion revenue in 2022

- Based on type of bank, the private sub-segment generated around 80% share in 2022

- Integration of cord blood in emerging healthcare trends like precision medicine is a popular cord blood banking market trend that fuels the industry demand

A rich source of stem cells, contained in cord blood, offers treatment for over 80 genetic diseases and various chronic illnesses like cancer, diabetes, blood disorders, and immune disorders. Despite each umbilical cord containing a limited amount of cord blood, it holds diverse types of stem cells, the sole type stored for future use. Collected in hospitals, these cells find preservation in cord blood banks for an average of 20 to 25 years. The cord blood banking market is swiftly expanding globally, driven by increasing awareness and ongoing research into cord blood's therapeutic potential. This growth is propelled by augmented funding, breakthroughs in technology, and a rising interest in personalized medicine, showcasing a promising pathway for medical advancement.

Global Cord Blood Banking Market Dynamics

Market Drivers

- Increasing awareness of stem cell therapeutic potential

- Rising prevalence of genetic disorders and chronic illnesses

- Technological advancements in stem cell research

- Growing investment and support for regenerative medicine

Market Restraints

- High costs associated with cord blood banking

- Ethical and legal considerations in stem cell use

- Limited public understanding of cord blood banking benefits

Market Opportunities

- Expanding applications in novel therapies and treatments

- Development of innovative storage and preservation techniques

- Collaborations for wider accessibility and affordability

Cord Blood Banking Market Report Coverage

| Market | Cord Blood Banking Market |

| Cord Blood Banking Market Size 2022 | USD 31.2 Billion |

| Cord Blood Banking Market Forecast 2032 | USD 65.6 Billion |

| Cord Blood Banking Market CAGR During 2023 - 2032 | 7.9% |

| Cord Blood Banking Market Analysis Period | 2020 - 2032 |

| Cord Blood Banking Market Base Year |

2022 |

| Cord Blood Banking Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type of Bank, By Services, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cryo-Save AG, FamiCord, CBR Systems, Inc., Cordlife, Hewlett-Packard, the Global Cord Blood Corporation, Americord, LifeCell, Singapore Cord Blood Bank, the Jeevan Stem Cell Foundation, and ViaCord LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cord Blood Banking Market Insights

In the coming years, the market for cord blood banking is expected to experience significant growth. Health professionals recognize the importance of newborn stem cells and strongly recommend parents to consider cord blood banking. This market growth is driven by the beneficial factors of cord blood, including its effectiveness in treating various life-threatening diseases such as cancer, blood disorders, certain immune and metabolic disorders, resulting in fewer complications and improved medical outcomes.

Many families are encouraged to donate stem cells to public banks to aid those in need. Cord blood is utilized in treating nearly 80 diseases, including cancer, metabolic and immune disorders, and blood-related conditions, for transplants. Furthermore, researchers are exploring the potential of cord blood in other chronic diseases like Alzheimer's, diabetes, multiple sclerosis, spinal cord injuries, and cardiac diseases, which could contribute to the market's growth. Private cord blood banks hold a significant share in the overall market. These banks are profit-driven entities that exclusively store cord blood for the donor and their relatives. The segment's growth is driven by factors such as assured blood availability and a sufficient supply of cord blood for multiple family members requiring transplants.

Public cord blood banks are anticipated to experience significant expansion throughout the cord blood banking industry forecast period, driven by a steady growth rate. These banks play a crucial role in promoting public health and well-being, thereby fueling growth within this segment. Moreover, public banks facilitate research professionals' access to cord blood samples, enabling them to explore new and potentially life-saving therapies for patients.

Cord Blood Banking Market Segmentation

The worldwide market for cord blood banking is split based on type of bank, services, application, end-use, and geography.

Cord Blood Banking Types

- Private

- Public

According to cord blood banking industry analysis, the private sector controls the majority share of the industry. Private banks primarily serve individual families, providing exclusive cord blood storage for personal use. This segment's supremacy stems from its emphasis on personalised services and dedicated storage for donors and their families. The appeal of the private sector resides in ensuring fast access to stored cord blood for prospective familial medical requirements, which contributes significantly to its huge market share. The emphasis on exclusive usage and personalised services in this market segment has advanced its domination over the public sector in the cord blood banking industry.

Cord Blood Banking Services

- Processing

- Storage

- Others

The service processing segment dominated the industry, representing over $23.7 billion USD in 2022. Nearly every collected cord blood undergoes processing within 24 hours. This process involves separating cord-based blood cells and plasma, while cryopreserving white blood cells and stem cells, conducted by both public and private banking sectors. Such practices drive growth in this segment during the cord blood banking market forecast period.

The storage services market is projected to rapidly increasing during the forecast period. Units of cord blood can be stored for extended periods at relatively low costs, catering to future treatment of life-threatening illnesses. These factors are poised to drive the global cord blood banking market's storage services sector in the coming years.

Cord Blood Banking Applications

- Cancer

- Blood Disorders

- Metabolic Disorders

- Bone Marrow Failure Syndrome

- Immuno-deficiency Disorders

In 2022, cancer held a significant share in generating maximum revenues. cord blood's utilization in treating various diseases like leukemia, lymphoma, and multiple myeloma is anticipated to drive growth in several segments. Government organizations, in conjunction with efforts to raise awareness about stem cell transplants for cancer treatment, continue to provide funding, facilitating effective treatment schemes for patients and their families.

Strong growth is expected in applications such as traumatic brain injury, Alzheimer's disease, cardiovascular conditions, etc., over the projection period. The increased incidence of these diseases, coupled with expanding research and clinical trials assessing the effectiveness of cord blood treatments, holds potential to positively impact numerous lives and drive segment growth during the forecast timeframe.

Cord Blood Banking End-Uses

- Hospitals

- Specialty Clinics

- Research Institutes

In 2022, hospitals emerged as the leading revenue-generating segment. The growth of cord blood banking in hospitals is poised to increase due to several factors, including the heightened use of cord blood units for treating life-threatening diseases such as cancer, blood disorders, and immune disorders, alongside the rising rate of hospital admissions. During the projection period, research institutes are expected to experience robust growth. The current success of cord blood in treating various disorders has sparked interest in developing stem cell therapies. Researchers actively utilize cord blood to investigate a wide array of conditions, including neurological and cardiovascular diseases, driving growth within this segment.

Cord Blood Banking Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cord Blood Banking Market Regional Analysis

North America is the largest area in the cord blood banking market due to sophisticated healthcare infrastructure and widespread acceptance of cord blood banking procedures. The region benefits from active research and development, increased awareness, and favorable government policies encouraging stem cell therapy. With well-established laws, North America leads in technical breakthroughs, resulting in significant market growth.

Asia-Pacific is the fastest-growing region in the cord blood banking market, driven by rising healthcare spending, increased awareness of stem cell therapies, and increased investments in medical research. Due to a growing population and an increase in the frequency of chronic diseases, the region's dynamic economies are seeing an increase in demand for cord blood banking services, fostering significant market expansion.

Europe is the second-largest area in the cord blood banking market, with major developments in healthcare infrastructure and a strong emphasis on R&D. The region's well-defined regulatory structure guarantees that cord blood banking techniques are safe and effective. Europe's modern healthcare systems and rising public awareness contribute to the market's rapid expansion, positioning it as a key player in the global cord blood banking scene.

Cord Blood Banking Market Players

Some of the top cord blood banking companies offered in our report includes Cryo-Save AG, FamiCord, CBR Systems, Inc., Cordlife, Hewlett-Packard, the Global Cord Blood Corporation, Americord, LifeCell, Singapore Cord Blood Bank, the Jeevan Stem Cell Foundation, and ViaCord LLC.

Frequently Asked Questions

How big is cord blood banking the market?

The cord blood banking market size was USD 31.2 billion in 2022.

What is the CAGR of the global cord blood banking market from 2023 to 2032?

The CAGR of cord blood banking is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the cord blood banking market?

The key players operating in the global market are including Cryo-Save AG, FamiCord, CBR Systems, Inc., Cordlife, Hewlett-Packard, the Global Cord Blood Corporation, Americord, LifeCell, Singapore Cord Blood Bank, the Jeevan Stem Cell Foundation, and ViaCord LLC.

Which region dominated the global cord blood banking market share?

North America held the dominating position in cord blood banking industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cord blood banking during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cord blood banking industry?

The current trends and dynamics in the cord blood banking industry include increasing awareness of stem cell therapeutic potential, rising prevalence of genetic disorders and chronic illnesses, technological advancements in stem cell research, and growing investment and support for regenerative medicine.

Which type of bank held the maximum share in 2022?

The private type of bank held the maximum share of the cord blood banking industry.