Copper Clad Laminates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Copper Clad Laminates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

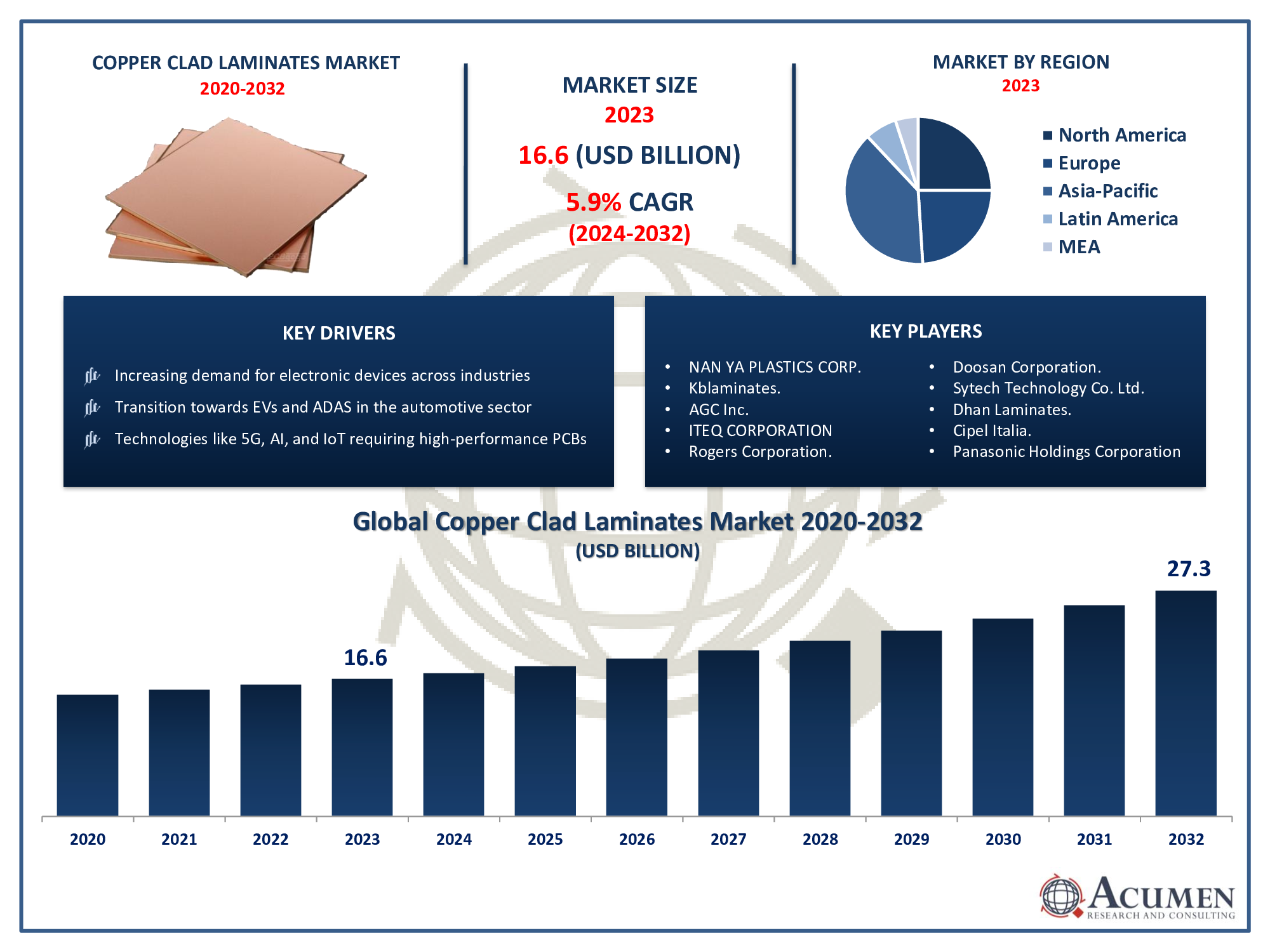

The Copper Clad Laminates Market Size accounted for USD 16.6 Billion in 2023 and is projected to achieve a market size of USD 27.3 Billion by 2032 growing at a CAGR of 5.9% from 2024 to 2032.

Copper Clad Laminates Market Highlights

- Global copper clad laminates market revenue is expected to increase by USD 27.3 Billion by 2032, with a 5.9% CAGR from 2024 to 2032

- Asia-Pacific region led with more than 42% of copper clad laminates market share in 2023

- Europe copper clad laminates market growth will record a CAGR of around 6.7% from 2024 to 2032

- By laminate type, the rigid segment is the largest segment in the market, accounting for over 80% of the market share in 2023

- By application, the communication systems segment has recorded more than 32% of the revenue share in 2023

- Increasing demand for electronic devices across industries, drives the copper clad laminates market value

Copper clad laminates (CCL) are essential materials used in the manufacturing of printed circuit boards (PCBs). They consist of a layer of copper foil bonded onto a substrate material such as fiberglass, phenolic resin, or epoxy resin. The copper foil provides the conductive pathways for electronic components, while the substrate offers mechanical support and insulation. CCLs come in various thicknesses and types, catering to different applications ranging from consumer electronics to aerospace and automotive industries.

The market for copper clad laminates has witnessed significant growth in recent years, driven by the burgeoning demand for electronic devices across industries. The proliferation of smartphones, tablets, wearables, and IoT devices has fueled the need for more advanced and compact PCBs, thereby increasing the demand for high-performance CCLs. Additionally, the automotive sector's transition towards electric vehicles (EVs) and the integration of electronic systems for advanced driver assistance systems (ADAS) have further augmented the demand for CCLs with enhanced thermal and mechanical properties.

Global Copper Clad Laminates Market Trends

Market Drivers

- Increasing demand for electronic devices across industries

- Transition towards electric vehicles (EVs) and advanced driver assistance systems (ADAS) in the automotive sector

- Emerging technologies like 5G, AI, and IoT requiring high-performance PCBs

- Focus on developing eco-friendly CCLs to meet sustainability goals

- Growth in consumer electronics, especially smartphones, wearables, and IoT devices

Market Restraints

- Fluctuating prices of raw materials, particularly copper

- Challenges related to recycling and disposal of electronic waste

Market Opportunities

- Expansion of the automotive electronics market with the rise of autonomous vehicles

- Increasing adoption of CCLs in aerospace and defense applications

Copper Clad Laminates Market Report Coverage

| Market | Copper Clad Laminates Market |

| Copper Clad Laminates Market Size 2022 | USD 16.6 Billion |

| Copper Clad Laminates Market Forecast 2032 | USD 27.3 Billion |

| Copper Clad Laminates Market CAGR During 2023 - 2032 | 5.9% |

| Copper Clad Laminates Market Analysis Period | 2020 - 2032 |

| Copper Clad Laminates Market Base Year |

2022 |

| Copper Clad Laminates Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Laminate Type, By Reinforcement Material, By Resin, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | NAN YA PLASTICS CORPORATION, Kblaminates., Taiwan Union Technology Corporation., AGC Inc., Rogers Corporation., Isola Group, Doosan Corporation., Sytech Technology Co. Ltd., Dhan Laminates., Cipel Italia., Panasonic Holdings Corporation, and Shandong JinBao Electric Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Copper Clad Laminates Market Dynamics

Copper clad laminates (CCL) are composite materials used in the production of printed circuit boards (PCBs). They consist of a thin layer of copper foil bonded to a substrate material, typically made of fiberglass, phenolic resin, or epoxy resin. The copper foil serves as the conductive pathway for electrical signals, while the substrate provides mechanical support and insulation. CCLs come in various thicknesses and grades, tailored to specific applications and performance requirements. The applications of copper clad laminates are diverse and span across numerous industries. In the realm of consumer electronics, CCLs are essential components in devices like smartphones, tablets, laptops, and televisions. These devices rely on compact and reliable PCBs enabled by CCLs to function optimally.

The copper clad laminates (CCL) market has been experiencing steady growth in recent years, driven by the expanding demand for electronic devices across various industries. With the proliferation of smartphones, tablets, wearables, and IoT devices, the need for high-performance PCBs has surged, consequently boosting the demand for CCLs. Moreover, the automotive sector's shift towards electric vehicles (EVs) and the integration of advanced electronic systems like ADAS have further propelled market growth. These trends indicate a continued upward trajectory for the CCL market as electronic devices become increasingly integrated into everyday life and industry. Furthermore, the advent of emerging technologies such as 5G, AI, and IoT is expected to fuel additional growth opportunities for the CCL market. These technologies require PCBs with enhanced performance characteristics such as higher data transmission rates and improved signal integrity, which in turn drive the demand for advanced CCL materials. Additionally, there is a growing focus on sustainability and environmental concerns within the electronics industry, leading to the development of eco-friendly CCLs made from recyclable materials.

Copper Clad Laminates Market Segmentation

The global copper clad laminates market segmentation is based on laminate type, reinforcement material, resin, application, and geography.

Copper Clad Laminates Market By Laminate Type

- Flexible

- Rigid

According to the copper clad laminates industry analysis, the rigid segment accounted for the largest market share in 2023. Rigid CCLs are widely used in various applications where structural stability and durability are paramount, such as in consumer electronics, automotive electronics, and industrial equipment. The robust demand for rigid CCLs can be attributed to several factors. Firstly, the proliferation of smartphones, tablets, and other handheld devices has driven the need for compact yet resilient PCBs, thus boosting demand for rigid CCLs. Additionally, the automotive industry's transition towards electric vehicles (EVs) and the incorporation of advanced electronic systems like ADAS have further fueled the demand for rigid CCLs in vehicle electronics. Moreover, the increasing adoption of advanced technologies such as 5G, AI, and IoT has contributed to the growth of the rigid CCL segment.

Copper Clad Laminates Market By Reinforcement Material

- Glass Fiber

- Compound Materials

- Paper Base

In terms of reinforcement materials, the glass fiber segment is expected to witness significant growth in the coming years. Glass fiber-reinforced CCLs are widely utilized in industries ranging from consumer electronics to aerospace and automotive sectors. The robust demand for glass fiber-based CCLs can be attributed to several factors. Firstly, the increasing demand for lightweight yet durable materials in electronics manufacturing has propelled the adoption of glass fiber-reinforced substrates. These substrates offer excellent dimensional stability, thermal resistance, and mechanical strength, making them ideal for use in high-performance PCBs. Furthermore, the automotive industry's shift towards electric vehicles (EVs) and the integration of advanced electronic systems have contributed to the growth of the glass fiber segment. EVs require PCBs with enhanced thermal management capabilities and reliability, driving the demand for glass fiber-reinforced CCLs in vehicle electronics.

Copper Clad Laminates Market By Resin

- Epoxy

- Polyimide

- Phenolic

- Others

According to the copper clad laminates market forecast, the epoxy resin segment is expected to witness significant growth in the coming years. Epoxy resin-based CCLs are known for their high mechanical strength, chemical resistance, and thermal stability, making them a preferred choice for demanding applications in electronics manufacturing. The robust demand for epoxy resin-based CCLs can be attributed to several factors. Firstly, the proliferation of consumer electronics such as smartphones, tablets, and wearables has driven the need for PCBs with superior performance and reliability, fueling the demand for epoxy resin-based substrates. Moreover, the automotive industry's transition towards electric vehicles (EVs) and the integration of advanced electronic systems like ADAS have further propelled the growth of the epoxy resin segment.

Copper Clad Laminates Market By Application

- Computers

- Consumer Appliances

- Communication Systems

- Vehicle Electronics

- Defense Technology

- Healthcare Devices

Based on the application, the communication systems segment is expected to continue its growth trajectory in the coming years. This growth is due to the increasing demand for high-speed data transmission, enhanced signal integrity, and reliability in communication infrastructure. As communication networks evolve to support technologies like 5G, the need for advanced PCB materials becomes critical. Copper clad laminates play a vital role in these systems by providing the necessary substrate for the fabrication of high-frequency and high-performance PCBs. The robust demand for communication systems drives the growth of the CCL market, particularly in segments such as telecommunications, networking equipment, and data centers. The deployment of 5G technology is a significant driver for the communication systems segment of the CCL market. 5G networks require PCBs with higher data transmission rates, lower latency, and improved signal integrity to support the increased bandwidth and connectivity demands. This has led to a growing demand for advanced CCL materials capable of meeting these stringent performance requirements.

Copper Clad Laminates Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Copper Clad Laminates Market Regional Analysis

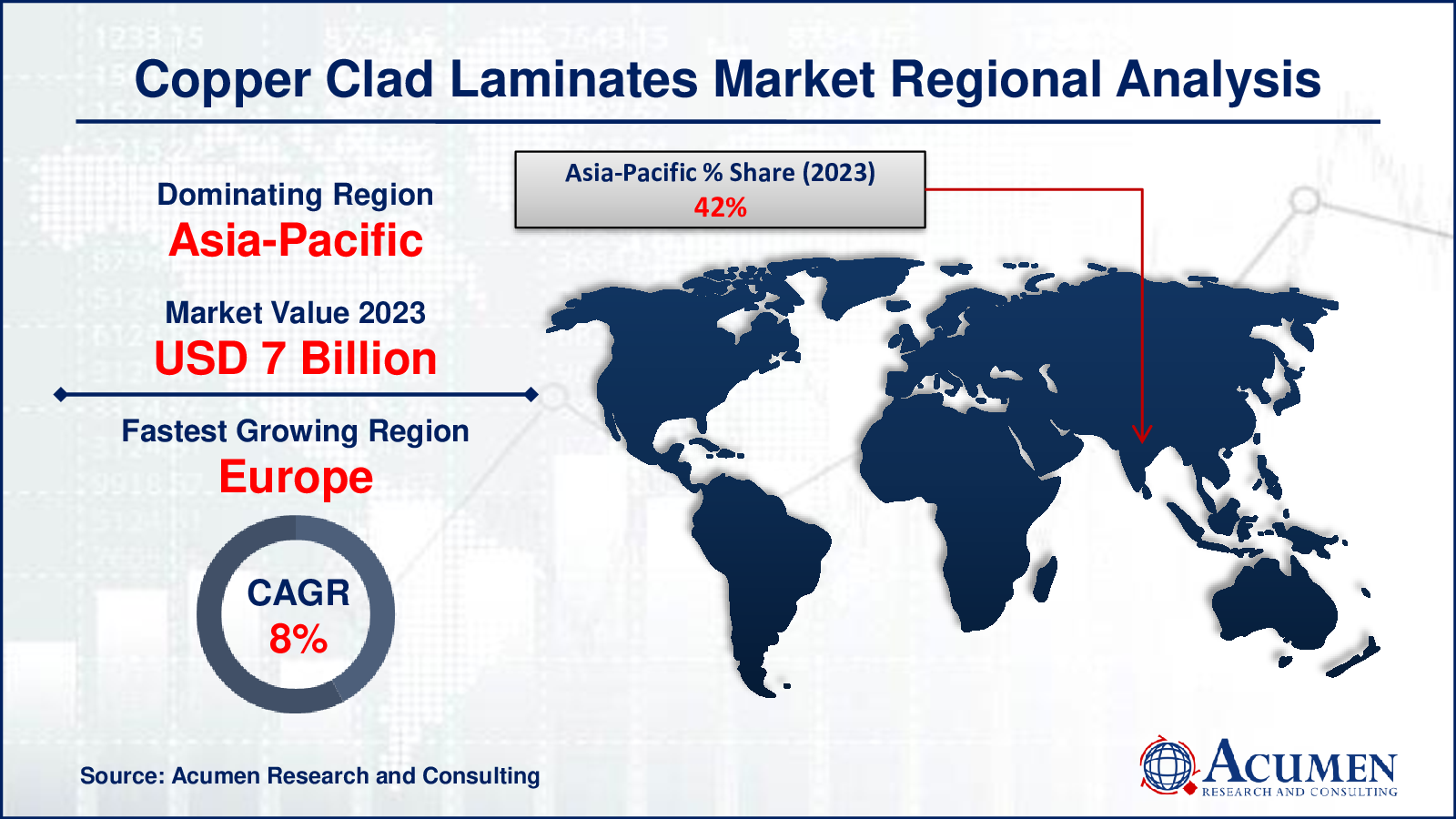

The Asia-Pacific region has emerged as the dominating force in the copper clad laminates (CCL) market, owing to several factors that have fueled its rapid growth and development. One of the primary drivers is the region's thriving electronics manufacturing industry, particularly in countries like China, Japan, South Korea, and Taiwan. These countries serve as global manufacturing hubs for consumer electronics, automotive electronics, telecommunications equipment, and other electronic devices, driving substantial demand for CCLs. The presence of a vast network of electronics OEMs and contract manufacturers in the Asia-Pacific region has created a robust ecosystem for the production and supply of CCLs to meet the growing needs of various industries. Furthermore, the Asia-Pacific region benefits from favorable factors such as skilled labor, infrastructure development, and government support for the electronics industry. Governments in countries like China and India have implemented policies and incentives to encourage domestic manufacturing and attract foreign investment in the electronics sector, further bolstering the region's dominance in the CCL market. Additionally, the presence of leading CCL manufacturers and suppliers in the Asia-Pacific region has contributed to its competitive advantage in terms of production capacity, technological expertise, and cost efficiency.

Copper Clad Laminates Market Player

Some of the top copper clad laminates market companies offered in the professional report include NAN YA PLASTICS CORPORATION, Kblaminates., Taiwan Union Technology Corporation., AGC Inc., Rogers Corporation., Isola Group, Doosan Corporation., Sytech Technology Co. Ltd., Dhan Laminates., Cipel Italia., Panasonic Holdings Corporation, and Shandong JinBao Electric Co., Ltd.

Frequently Asked Questions

What was the market size of the global copper clad laminates in 2023?

The market size of copper clad laminates was USD 3.5 Billion in 2023.

What is the CAGR of the global copper clad laminates market from 2024 to 2032?

The CAGR of copper clad laminates is 7.1% during the analysis period of 2024 to 2032.

Which are the key players in the copper clad laminates market?

The key players operating in the global market are including NAN YA PLASTICS CORPORATION, Kblaminates., Taiwan Union Technology Corporation., AGC Inc., Rogers Corporation., Isola Group, Doosan Corporation., Sytech Technology Co. Ltd., Dhan Laminates., Cipel Italia., Panasonic Holdings Corporation, and Shandong JinBao Electric Co., Ltd.

Which region dominated the global copper clad laminates market share?

Asia-Pacific held the dominating position in copper clad laminates industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of copper clad laminates during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global copper clad laminates industry?

The current trends and dynamics in the copper clad laminates industry include increasing demand for electronic devices across industries, and transition towards electric vehicles (EVs) and advanced driver assistance systems (ADAS) in the automotive sector.

Which laminate type held the maximum share in 2023?

The rigid laminate type held the maximum share of the copper clad laminates industry.