Converting Paper Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Converting Paper Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

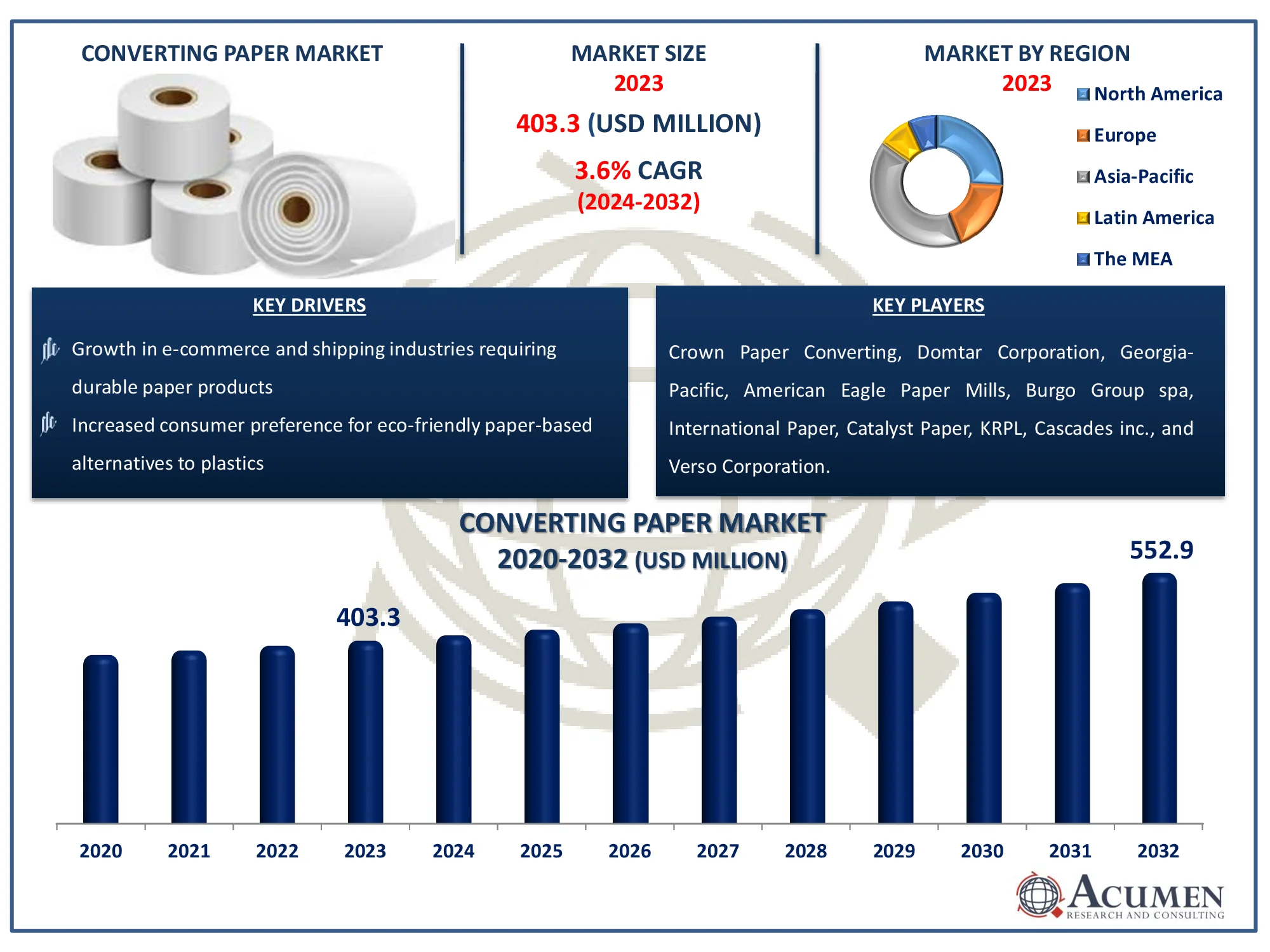

The Global Converting Paper Market Size accounted for USD 403.3 Million in 2023 and is estimated to achieve a market size of USD 552.9 Million by 2032 growing at a CAGR of 3.6% from 2024 to 2032

Converting Paper Market Highlights

- Global converting paper market revenue is poised to garner USD 552.9 million by 2032 with a CAGR of 3.6% from 2024 to 2032

- Asia-Pacific converting paper market value occupied around USD 165.3 million in 2023

- North America converting paper market growth will record a CAGR of more than 4.3% from 2024 to 2032

- Among paper type, the coated sub-segment generated more than notable revenue in 2023

- Based on end use, the packing & wrapping sub-segment generated 44% market converting paper share in 2023

- Growing adoption of automation and advanced technologies in paper converting processes is a popular converting paper market trend that fuels the industry demand

Converting paper refers to a type of paper that undergoes additional processing to transform it into various finished products such as packaging, labels, envelopes, or paper towels. This process involves cutting, coating, laminating, embossing, or printing to meet specific customer requirements. Paper converters work with large rolls of raw paper, turning them into customized formats based on size, texture, or functionality. Converting paper is commonly used in industries like packaging, printing, and consumer goods. The demand for such paper has grown due to the need for sustainable and versatile packaging solutions. Converting paper is essential for producing a wide range of everyday paper products, supporting industries like food packaging, personal care, and office supplies.

Global Converting Paper Market Dynamics

Market Drivers

- Rising demand for sustainable packaging solutions

- Technological advancements in paper converting machinery

- Growth in e-commerce and shipping industries requiring durable paper products

- Increased consumer preference for eco-friendly paper-based alternatives to plastics

Market Restraints

- Environmental regulations restricting deforestation and paper waste

- High costs associated with raw materials and paper production processes

- Competition from digitalization reducing demand for traditional paper products

Market Opportunities

- Increased demand for customized and premium-quality paper products

- Development of innovative biodegradable and recyclable paper products

- Expanding markets in emerging economies with growing packaging needs

Converting Paper Market Report Coverage

| Market | Converting Paper Market |

| Converting Paper Market Size 2022 |

USD 403.3 Million |

| Converting Paper Market Forecast 2032 | USD 552.9 Million |

| Converting Paper Market CAGR During 2023 - 2032 | 3.6% |

| Converting Paper Market Analysis Period | 2020 - 2032 |

| Converting Paper Market Base Year |

2022 |

| Converting Paper Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Paper Type, By Pulp Type, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Crown Paper Converting, Domtar Corporation, Georgia-Pacific, American Eagle Paper Mills, Burgo Group spa, International Paper, Catalyst Paper, KRPL, Cascades inc., and Verso Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Converting Paper Market Insights

The consumption of converting paper for tasks apart from writing and printing is growing across the globe. For instance, the sanitary and packaging industry are using converting paper on a large scale. The adoption of converting paper for industrial packaging is growing owing to the low cost and sustainability as compared to other materials such as plastic or glass. The usage of converting paper material for the manufacturing of bulk containers, liners, and absorbents has significantly improved in the past few years owing to the high-quality products.

The rapid increase in digitalization is expected to reduce the demand for printing and writing paper. The digital media is replacing the paper which can be one of the restraining factors that hinder the growth of the traditional paper market. The evolution from printing paper to packaging paper due to the growing e-commerce market and customer preference for converting paper packaging are the major factors boosting the demand of industry globally during the converting paper market forecast period. With the help of digital tools, converting paper and packaging manufacturers are improving their customer services and manufacturing activities to ensure better product quality, tracking information of shipped goods, and suitable customer support.

Converting Paper Market Segmentation

The worldwide market for converting paper is split based on paper type, pulp type, application, end use, and geography.

Converting Paper Market By Paper Types

- Coated

- Uncoated

According to converting paper industry analysis, the coated paper segment is expected to be the largest in the market. This is largely due to its superior printing and finishing properties. Coated papers are treated with a special coating that enhances smoothness, brightness, and ink adhesion. This makes them ideal for high-quality printing applications such as magazines, brochures, and packaging materials. The demand for coated papers is driven by factors like increasing consumer preference for visually appealing products, the growth of the packaging industry, and advancements in printing technology.

Converting Paper Market By Pulp Types

- Semi-chemical Pulp

- Chemical Wood Pulp

- Mechanical Wood Pulp

- Recycled Pulp

- Non-Wood Pulp

The chemical wood pulp sector is predicted to dominate the converting paper market. This is mostly due to its superior quality and versatility, which make it suited for a wide range of applications, including printing and writing materials and customized packaging. Chemical wood pulp has higher strength and durability, making it suitable for a variety of industries, particularly high-end packaging and coated paper manufacture. Furthermore, its compatibility with modern converting technologies and sustainability programs has accelerated its usage, particularly as industries migrate to environmentally friendly materials and processes. Collectively, these considerations position chemical wood pulp as the market's dominating segment.

Converting Paper Market By Applications

- Hygiene Paper

- Newsprint

- Printing Paper

- Packaging

- Writing Paper

- Others

Based on the application, the global converting paper market can majorly be segmented into five sub-segments, which are newsprint, hygiene paper, printing paper, writing paper, and packaging. The packaging sub-segment is expected to dominate the global converting paper industry. In the packaging segment, converting paper is used for manufacturing carton board, corrugated board, and flexible paper. Most of the converting paper is used in packaging applications due to the low cost and eco-friendly packaging. The carton board segment is expected to witness fast-paced growth over the converting paper industry forecast period.

Converting Paper Market By End Uses

- Packing & Wrapping

- Food Service

- Consumer Goods

- Printing

- Others

The packing & wrapping category holds the majority of the converting paper industry, owing to rising demand for environmentally friendly and recyclable packaging options. With the rapid growth of businesses such as e-commerce, logistics, and retail, there is a greater demand for sustainable, lightweight, and versatile packaging materials. Converting paper, which is frequently used for packing and wrapping, is durable and adaptable, making it ideal for a variety of packaging applications. Furthermore, increased consumer awareness and strict environmental restrictions have accelerated the transition to paper-based packaging. These reasons have helped to propel the packing & wrapping segment to the forefront of the market.

Converting Paper Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Converting Paper Market Regional Analysis

In terms of converting paper market analysis, the Asia-Pacific region dominates the converting paper market, owing to its huge manufacturing base, thriving e-commerce industry, and growing need for packaging solutions. China, India, and Japan all play important roles, with growing industry, increased consumer goods consumption, and a shift toward sustainable packaging materials. Furthermore, the availability of raw materials such as wood pulp and recycled fibers in these countries contributes to the region's dominance. The region's large population, combined with rising retail and logistical sectors, drives up demand for converting paper in the packaging, printing, and consumer products industries.

North America is the market's fastest-growing region during the converting paper market forecast period. This expansion is being driven by increased environmental consciousness and tough rules encouraging the use of recyclable and biodegradable packaging. The growing need for paper-based products in industries including food service, e-commerce, and retail has hastened the region's growth. The United States and Canada, in particular, are seeing a trend toward environmentally friendly packaging, aided by large corporations embracing sustainable practices. Furthermore, advances in paper conversion technologies and the region's strong innovation in sustainable materials help to drive North America's quick growth, positioning it as a major market for future development.

Converting Paper Market Players

Some of the top converting paper companies offered in our report include Crown Paper Converting, Domtar Corporation, Georgia-Pacific, American Eagle Paper Mills, Burgo Group spa, International Paper, Catalyst Paper, KRPL, Cascades inc., and Verso Corporation.

Frequently Asked Questions

How big is the converting paper market?

The converting paper market size was valued at USD 403.3 million in 2023.

What is the CAGR of the global converting paper market from 2024 to 2032?

The CAGR of converting paper is 3.6% during the analysis period of 2024 to 2032.

Which are the key players in the converting paper market?

The key players operating in the global market are including Crown Paper Converting, Domtar Corporation, Georgia-Pacific, American Eagle Paper Mills, Burgo Group spa, International Paper, Catalyst Paper, KRPL, Cascades inc., and Verso Corporation.

Which region dominated the global converting paper market share?

Asia-Pacific held the dominating position in converting paper industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of converting paper during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global converting paper industry?

The current trends and dynamics in the converting paper industry include rising demand for sustainable packaging solutions, growth in e-commerce and shipping industries requiring durable paper products, technological advancements in paper converting machinery, and increased consumer preference for eco-friendly paper-based alternatives to plastics.

Which end use held the maximum share in 2023?

The packing & wrapping end use held the maximum share of the converting paper industry.