Contraceptives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Contraceptives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

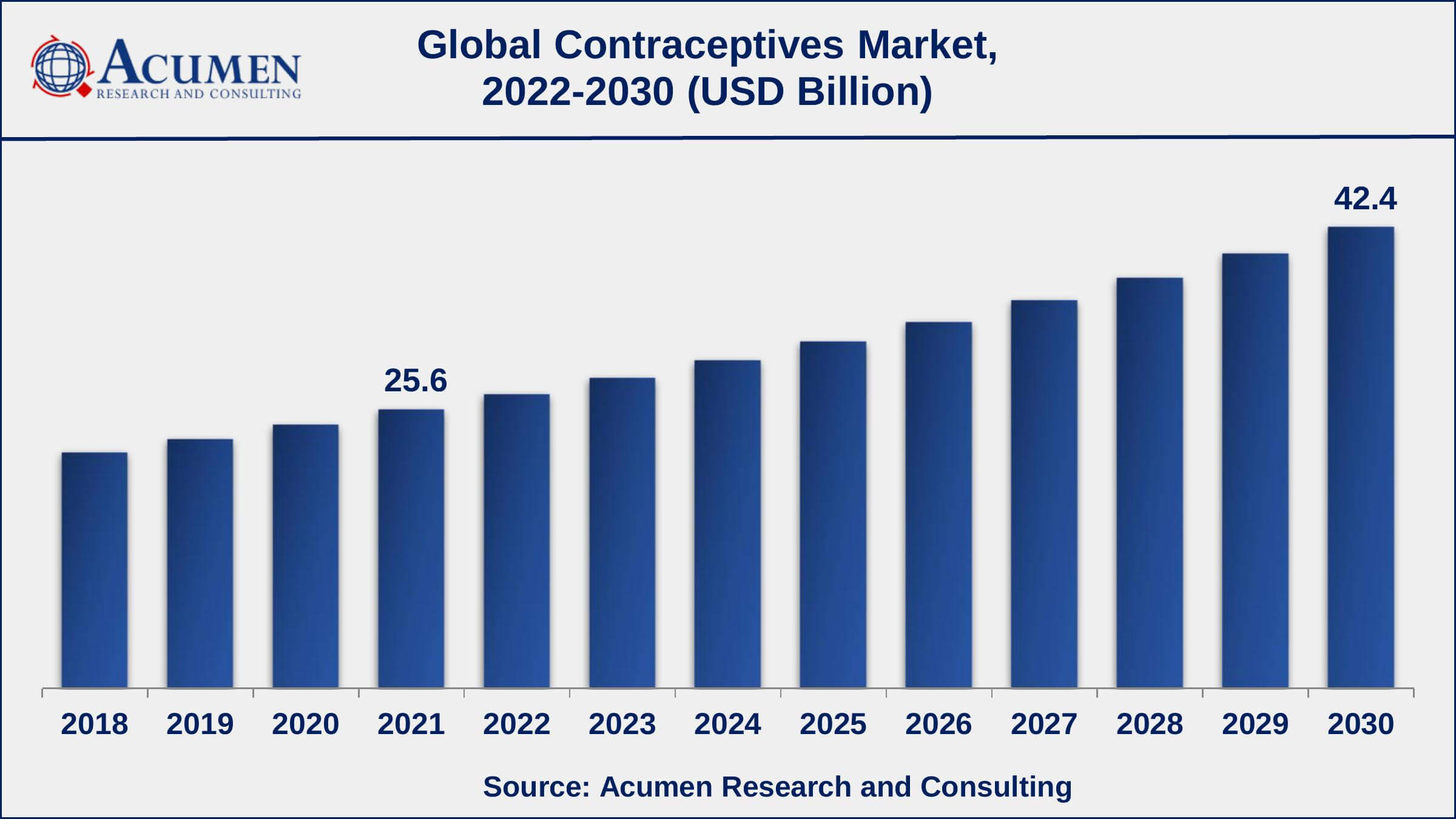

The Global Contraceptives Market Size accounted for USD 25.6 Billion in 2021 and is projected to occupy a market size of USD 42.4 Billion by 2030 growing at a CAGR of 5.8% from 2022 to 2030.

Contraception is a method which helps to protect a woman from unwanted pregnancy. A number of contraceptives, such as physical barriers, hormonal drugs and advanced contraceptive devices have been developed in order to avoid unnecessary pregnancy. Contraceptives also help in preventing sexually transmitted infections. According to recent WHO data, there are 1.9 billion women of reproductive age (15-49 years) worldwide in 2019. Of these, 1.1 billion have a need for family planning, with 842 million using contraceptive methods and 270 million having an unmet need for contraception.

Contraceptives Market Report Statistics

- Global contraceptives market revenue is projected to reach USD 42.4 Billion by 2030 with a CAGR of 5.8% from 2022 to 2030

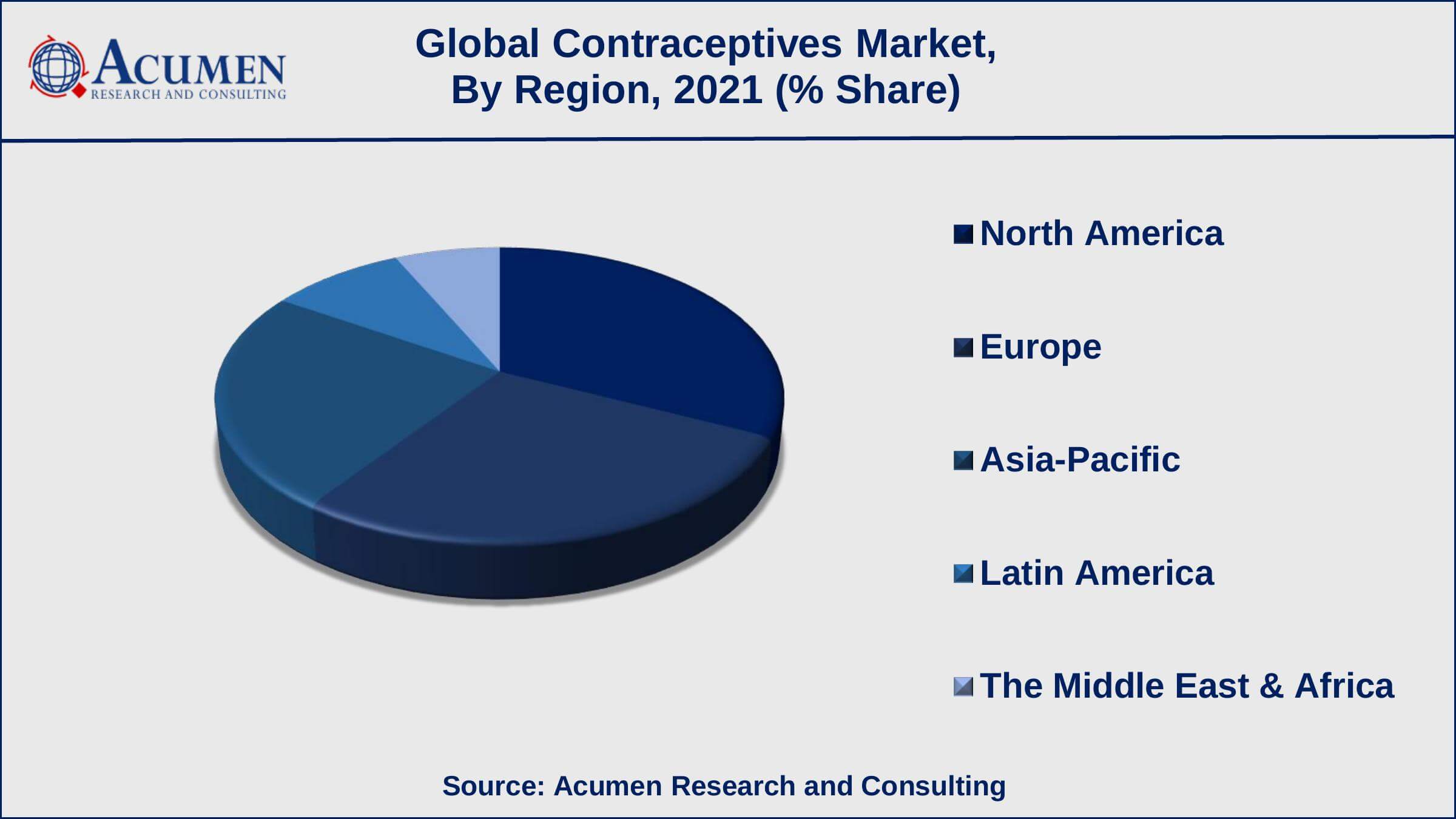

- North America contraceptives market share generated over 32% shares in 2021

- As per the National Center for Health Statistics data, 14.0% of women aged (15-49) currently using the pill in the U.S.

- According to the CDC stats, there were 72.7 million women of reproductive age 15–49 in the United States in 2018

- Asia-Pacific contraceptives market growth will record noteworthy CAGR of over 6.5% from 2022 to 2030

- As per Center for Reproductive Rights, 53.8 million unplanned pregnancies occur every year in Asia

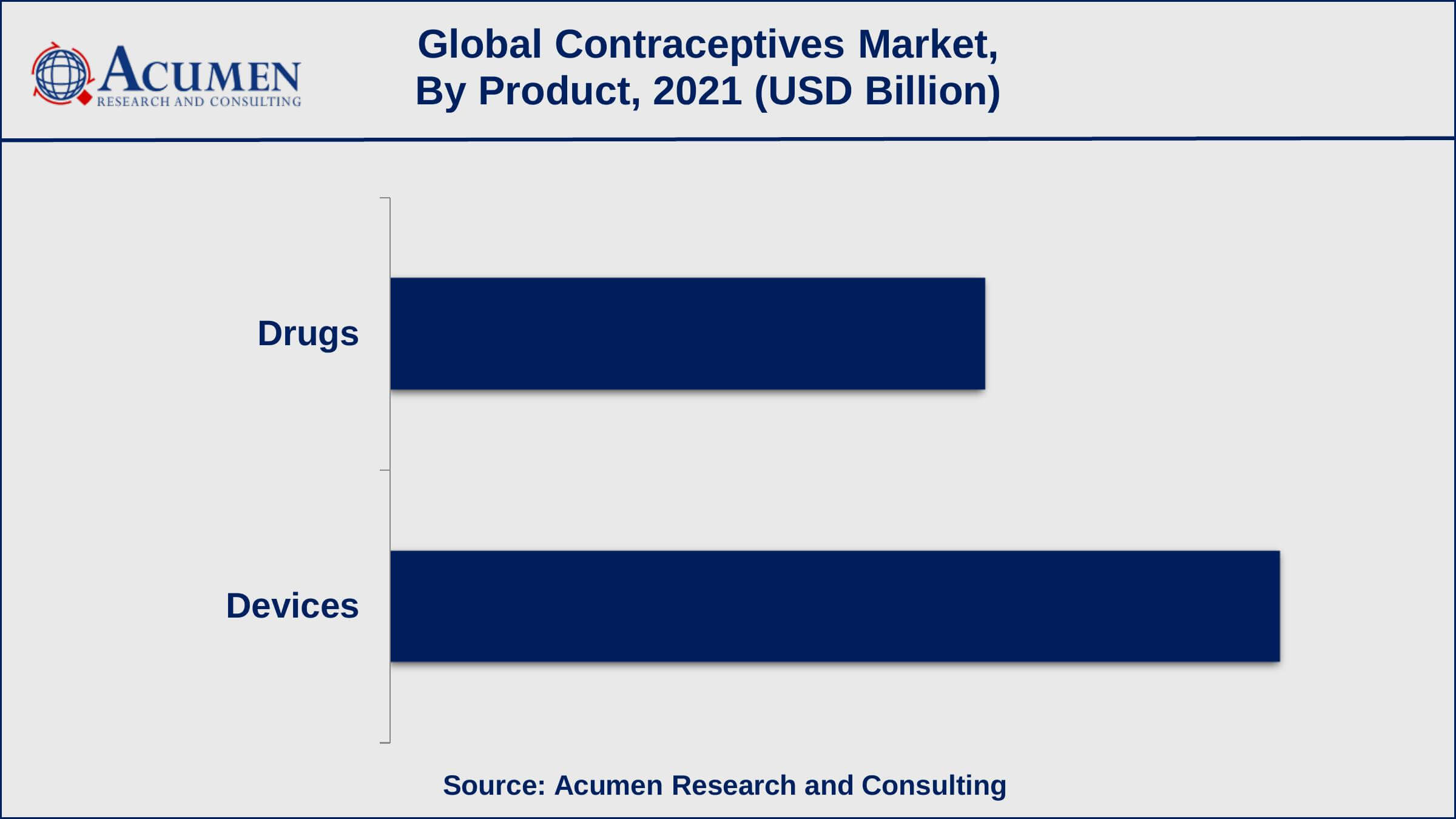

- Based on product, contraceptive devices recorded USD 15.36 billion revenue in 2021

- Growing awareness regarding family planning is a popular contraceptives market trend that fuels the industry demand

Global Contraceptives Market Dynamics

Market Drivers

- Government initiatives to promote contraceptive methods

- Growing awareness among population

- Increasing rate of unwanted pregnancies

Market Restraints

- Availability of alternate contraceptives methods

- Health risk associated with the use of contraceptives

Market Opportunities

- Rise in participation of reproductive women in labor force

- Growing incidence of sexually transmitted diseases (STDs)

Contraceptives Market Report Coverage

| Market | Contraceptives Market |

| Contraceptives Market Size 2021 | USD 25.6 Billion |

| Contraceptives Market Forecast 2030 | USD 42.4 Billion |

| Contraceptives Market CAGR During 2022 - 2030 | 5.8% |

| Contraceptives Market Analysis Period | 2018 - 2030 |

| Contraceptives Market Base Year | 2021 |

| Contraceptives Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Age, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allergan plc, Bayer AG, Cipla Inc., HLL Lifecare Limited, Janssen Pharmaceutical Company, Mankind Pharma, Merck Co. Inc., Mithra Pharmaceuticals, Pfizer Inc., Reckitt Benckiser plc, and Teva Pharmaceutical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Contraceptives Market Growth Factors

Augmenting population, various programs in order to meet the requirement of modern contraception, rapid clinical development, improved contraceptive choices, emergence of advanced contraceptive methods, increase in the occurrences of sexually transmitted diseases, increasing government initiatives in order to support responsiveness towards unplanned pregnancies are some of the primary factors that are propelling the contraceptives market growth across the globe. Emergence of various advanced contraceptive methods including emergency contraceptives methods particularly for teenagers and growth in consciousness about sexually transmitted infections are some of the major factors driving the growth of contraceptives market worldwide. Augmentation in popularity of custom-fit condoms, female condoms and other new products resulted in the high demand for contraceptives, especially in the developed areas. Various awareness programs intended to offer sexual health services and meet the requirement for modern contraception is helping the growth of the global market. Advantages offered by these devices such as affordable cost, prominent level of protection easy to use and smallest amount of side effects among all the other devices are some of the factors positively influencing the segmental growth during the forecast period. Numerous major players in the contraception market are actively focusing on the new product development and research for contraception in order to meet the demand of cost effective long term contraception. However, increasing infertility rate, aging population and side effects of oral contraceptive drugs are some of the factors restraining the global contraceptives market growth.

Contraceptives Market Segmentation

The global contraceptives market is segmented based on product, age, and geography.

Contraceptives Market By Product

- Drugs

- Oral Contraceptive Pills

- Injectable Contraceptives

- Topical Contraceptives

- Devices

- Condoms

- Male Condoms

- Female Condoms

- Diaphragms

- Contraceptive Sponges

- Vaginal Rings

- Subdermal Implants

- Intra-Uterine Devices

- Copper IUD

- Hormonal IUD

- Condoms

According to our contraceptives industry analysis, the devices sub-segment accounted for more than 60% of the market in 2021, and this trend is expected to continue in the coming years. The contraceptive devices sub-segment captured a sizable market share due to increased awareness of STDs and the effectiveness of condoms in preventing infectious diseases such as HIV. Contraceptive drugs, on the other hand, are expected to gain significant traction during the forecast timeframe. The high growth in the segment is credited to the widespread use of oral pills by women. This is primarily due to their high efficacy (up to 99%) in preventing pregnancy.

Contraceptives Market By Age

- 15-44 Years

- Above 44 Years

According to our contraceptives market forecast, the 15-44 age group sub-segments will account for a sizable market share from 2022 to 2030. According to the CDC, 10.4% of women aged 15 to 49 use long-acting reversible contraception. Furthermore, 18.1% of women aged 15-49 use female sterilization, while 5.6% of the same age group uses male sterilization.

Contraceptives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Contraceptives Market Regional Analysis

In 2021, North America gathered significant amount of share with around 32% and will continue to do so during the forthcoming period from 2022 to 2030. The growing population of women between 15 to 44 years, increasing adoption rate, and highly aware population regarding contraceptives are some of the key factors that are driving the North American contraceptives industry. In addition to that, increasing number of teen pregnancies coupled with growing rate of unintended pregnancies is also supporting the American market. On the other hand, Asia-Pacific region will witness a substantial growth rate throughout the projected years i.e. from 2022 to 2030. China accounted for the utmost market shares among APAC countries. In February 2022, China imported 42.3 metric tons of hormonal contraceptives preparations. Adding to that, the Indian contraceptives market is thriving as a result of expanding government initiatives such as the 'National Family Planning Program' known as 'Hum Do,' which aims to provide adequate direction to eligible couples with information and guidance on family planning methods and services.

Contraceptives Market Players

The global contraceptives market is characterized by the presence of experienced and established players. The global contraceptives market is characterized by the presence of experienced and established players. Some of the key players include Allergan plc, Bayer AG, Cipla Inc., HLL Lifecare Limited, Janssen Pharmaceutical Company, Mankind Pharma, Merck Co. Inc., Mithra Pharmaceuticals, Pfizer Inc., Reckitt Benckiser plc, and Teva Pharmaceutical Industries Ltd.

Global contraceptives market is categorized with a high level of competition with a presence of a large number of players worldwide. The global market is anticipated to experience an entry of a number of new entrants in the future, thus reinforcing the market competitive landscape.

Frequently Asked Questions

What is the size of global contraceptives market in 2021?

The market size of contraceptives market in 2021 was accounted to be USD 25.6 Billion.

What is the CAGR of global contraceptives market during forecast period of 2022 to 2030?

The projected CAGR of contraceptives market during the analysis period of 2022 to 2030 is 5.8%.

Which are the key players operating in the market?

The prominent players of the global contraceptives market include Allergan plc, Bayer AG, Cipla Inc., HLL Lifecare Limited, Janssen Pharmaceutical Company, Mankind Pharma, Merck Co. Inc., Mithra Pharmaceuticals, Pfizer Inc., Reckitt Benckiser plc, and Teva Pharmaceutical Industries Ltd.

Which region held the dominating position in the global contraceptives market?

North America held the dominating contraceptives during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for contraceptives during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global contraceptives market?

Government initiatives to promote contraceptive methods, growing awareness among population, and increasing rate of unwanted pregnancies drives the growth of global contraceptives market.

Which product held the maximum share in 2021?

Based on product, devices segment is expected to hold the maximum share of the contraceptives market.