Containers Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Containers Glass Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Containers Glass Market Size accounted for USD 68.7 Billion in 2023 and is estimated to achieve a market size of USD 104.5 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Containers Glass Market Highlights

- Global containers glass market revenue is poised to garner USD 104.5 Billion by 2032 with a CAGR of 4.8% from 2024 to 2032

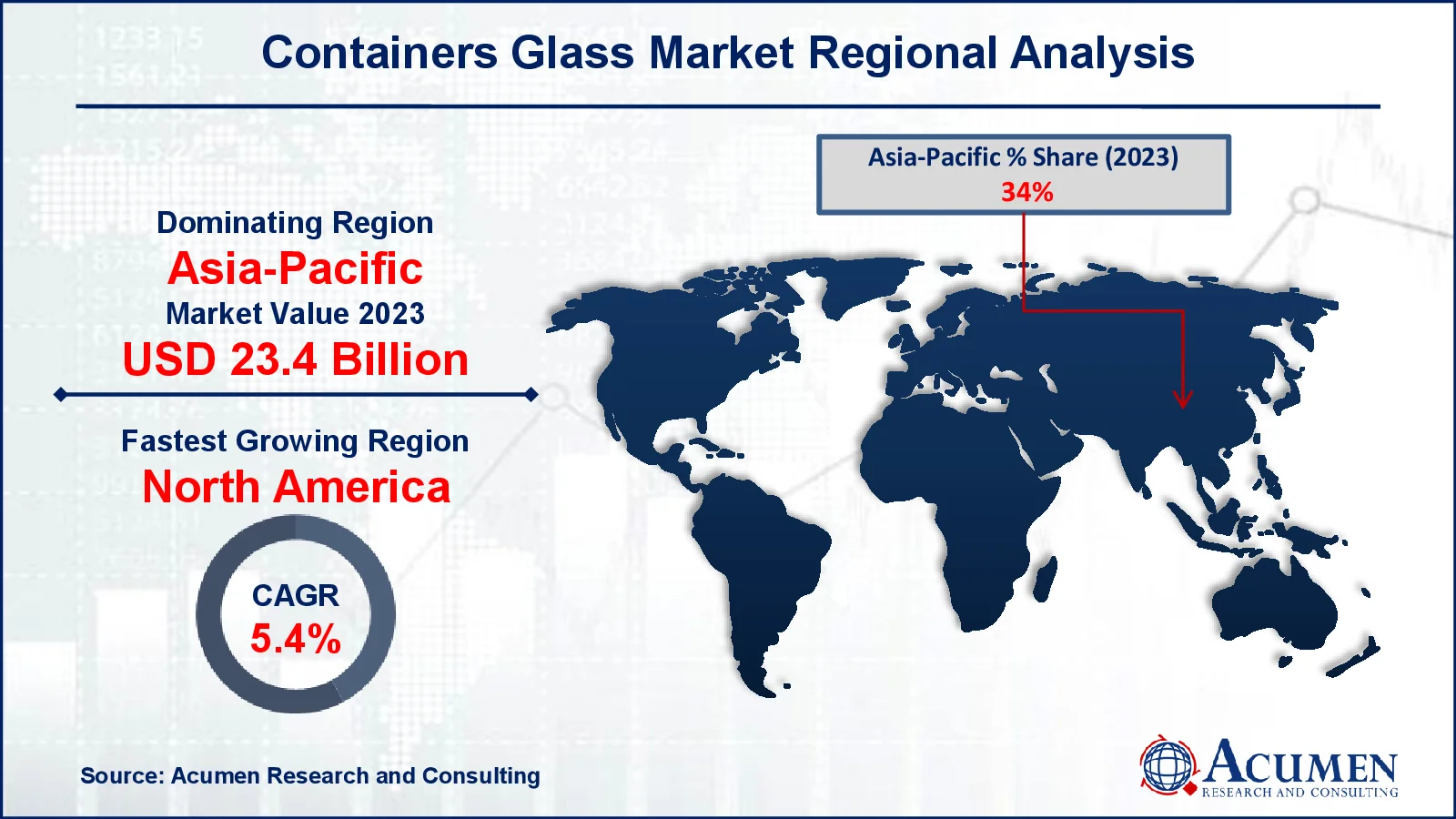

- Asia-Pacific container glass market value occupied around USD 23.4 billion in 2023

- Asia-Pacific container glass market growth will record a CAGR of more than 5.4% from 2024 to 2032

- Among product, the bottles sub-segment generated around USD 41.2 billion revenue in 2023

- Based on end use, the food & beverage industry sub-segment generated 67% glass container market share in 2023

- Rising refillable and returnable glass programs is a popular glass container market trend that fuels the industry demand

Container glass is the glass material used to make bottles, jars, and other rigid packaging solutions for food, beverages, pharmaceuticals, cosmetics, and chemicals. It is principally made of silica (sand), soda ash, and limestone, which provide durability, transparency, and recyclability. Container glass is widely utilized due to its ability to preserve product integrity, resist contamination, and add aesthetic appeal. It comes in a variety of colors, including clear, amber, and green glass, to meet the needs of various industries. The material is highly sustainable because it can be recycled endlessly without losing quality. With expanding environmental concerns and customer preferences for sustainable packaging, the need for container glass is growing across industries, driving advances in lightweight and innovative glass packaging solutions.

Global Containers Glass Market Dynamics

Market Drivers

- Rising demand for premium beverages boosts glass container usage

- Growing preference for sustainable and recyclable packaging drives market expansion

- Stringent regulations against plastic packaging favor glass adoption

- Advancements in glass manufacturing enhance durability and cost efficiency

Market Restraints

- High production and energy costs make glass less competitive

- Fragility and breakability increase transportation and handling risks

- Alternative packaging solutions like metal and plastic pose strong competition

Market Opportunities

- Increasing demand for premium and luxury packaging fuels glass container growth

- Expanding food and beverage sectors in emerging markets drive adoption

- Innovations in lightweight glass enhance cost-effectiveness and usability

Glass Container Market Report Coverage

|

Market |

Container Glass Market |

|

Container Glass Market Size 2023 |

USD 68.7 Billion |

|

Container Glass Market Forecast 2032 |

USD 104.5 Billion |

|

Container Glass Market CAGR During 2024 - 2032 |

4.8% |

|

Container Glass Market Analysis Period |

2020 - 2032 |

|

Container Glass Market Base Year |

2023 |

|

Container Glass Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Glass Type, By Forming Method, By Application, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Vitro, Stevanato Group, Schott AG, Corning Incorporated, Frigoglass SAIC, Ardagh Group, Gerresheimer AG, Saverglass SAS, Piramal Glass Private Limited, O-I Glass, Inc., Borosil, and Unitrade FZE. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Glass Container Market Insights

The containers glass are gaining importance in various industry verticals via food & beverage, pharmaceutical, cosmetic, etc. due to their benefits such as to preserve the product, increase the shelf life, and availability in various size and shape is a major factor augmenting the global market growth. Food & beverage is flourishing across the globe, and consumers are demanding innovative product with no side-effects. Product manufacturers are focused on adoption of better packaging solution that caters to exact consumer needs. Glass containers tend to be a better packaging solution as it preserves the flavor and freshness of product and also does not harm the original taste or purity of the product.

Developing regulatory scenarios of the pharmaceutical industry in developed and developing countries and growing adoption of containers glass from laboratory and hospitals is expected to impact the growth of the market positively. Containers glass being inert provides a major advantage as it does not react with the solution of item contained in it. Moreover, glass being inorganic material they are easy to sterilize, also resistant to water and air which makes it a better storage option. Cosmetic product manufacturers are focused on adopting smart packaging solution that enhance the product life and does not react with the chemical stored in it. Cosmetic products contain small amount chemicals in it and it reaction with the storage container would harm the product.

However, factors such as fragility and critical transportation are hampering the growth of the global market. Technological advancements by the major players such as development of strong light weight glass with UV-resistant are expected to create new revenue opportunities over the glass container market forecast period. In addition, innovative product solution by manufactures and strategic business development activities are expected to further support the revenue traction of the global market.

Containers Glass Market Segmentation

Containers Glass Market Segmentation

The worldwide market for containers glass is split based on product, glass type, forming method, application, end use, and geography.

Glass Container Market By Product

- Bottles

- Vials & Ampoules

- Jars

- Others

According to containers glass industry analysis, the bottle sector is predicted to account for the greatest share of the market. Glass bottles are commonly used to package beverages, food products, medications, and cosmetics due to their versatility, inertness, and luxury appeal. The growing demand for sustainable packaging solutions, as well as increased consumption of beverages and packaged foods, are propelling this industry forward. Furthermore, advances in glass manufacturing technology have resulted in the development of lightweight and long-lasting glass bottles, which has increased their popularity.

Glass Container Market By Glass Type

- Borosilicate-Based

- Soda-Lime-Silica-Based

The soda-lime-silica glass sector leads the container glass industry. This type of glass is used because it is less expensive and easier to manufacture. It is the standard material for a variety of containers, including common beverage bottles, food jars, and cosmetic packaging. Its low production cost makes it an appealing alternative for producers, while its adaptability allows it to be molded into a variety of shapes and dimensions. Although borosilicate glass has superior thermal and chemical resistance, its expensive cost restricts its use to more specialized applications, leaving soda-lime-silica as the principal material in the container glass industry.

Glass Container Market By Forming Method

- Blow & Blow

- Narrow Neck Press & Blow

- Press & Blow

In the container glass market, blow and blow forming currently has the largest market share. This process is exceptionally efficient and suitable for producing a broad variety of glass containers, particularly those with complex geometries and thinner walls, such as bottles and jars. The adaptability of blow & blow enables producers to build lightweight yet durable containers, which is critical in satisfying the growing need for sustainable packaging solutions. Its versatility to various designs and sizes makes it the favored method for mass manufacturing, cementing its position in the container glass business.

Glass Container Market By Application

- Packaging

- Decorative Containers

- Tableware

The packaging category accounts for the majority of the container glass market. Glass containers are commonly used to package a variety of things, including beverages, food, pharmaceuticals, and cosmetics. Glass is commonly used in packaging due to its inert nature, ability to preserve product quality, and luxury image. Furthermore, increasing consumer desire for sustainable and recyclable packaging solutions drives up demand for glass containers. Packaging's dominant role in the container glass market is projected to remain because to the critical function it performs across a wide range of industries.

Glass Container Market By End Use

- Food & Beverage Industry

- Cosmetics & Personal Care Industry

- Pharmaceutical Industry

- Consumer Application

- Chemical Industry

- Others

The food and beverage industry is the largest end-user segment in the container glass market. This industry mainly relies on glass containers to package a variety of items, including soft drinks, alcoholic beverages, juices, sauces, and preserved foods. Glass has several important advantages for food and beverage applications, including its inertness, which prevents it from interacting with the contents and changing their taste or quality.

Container Glass Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Container Glass Market Regional Analysis

Container Glass Market Regional Analysis

The market in Asia-Pacific is expected to account for major revenue share due to high demand from food & beverage and cosmetic manufacturers. In addition, presence of major food & beverage manufacturers operating in the country along with innovative product offerings is expected to further support the growth of target market. Moreover, developing pharmaceutical sector, changing regulatory scenario, and adoption of containers glass from hospitals and laboratories are factors positively impact the regional market growth.

Asia-Pacific market in expected to witness faster growth due to presence of major pharmaceutical and cosmetic manufacturers operating in the country in this region. In addition, changing government regulations and low cost labor is attracting players across the globe to developing countries which is expected to further support the regional market growth. Moreover, business expansion activities through partnerships and agreements in order to increase the customer base is expected to further support the target market growth in this region.

Containers Glass Market Players

Some of the top containers glass companies offered in our report includes Vitro, Stevanato Group, Schott AG, Corning Incorporated, Frigoglass SAIC, Ardagh Group, Gerresheimer AG, Saverglass SAS, Piramal Glass Private Limited, O-I Glass, Inc., Borosil, and Unitrade FZE.

Frequently Asked Questions

How big is the containers glass market?

The containers glass market size was valued at USD 68.7 Billion in 2023.

What is the CAGR of the global containers glass market from 2024 to 2032?

The CAGR of containers glass is 4.8% during the analysis period of 2024 to 2032.

Which are the key players in the containers glass market?

The key players operating in the global market are including Vitro, Stevanato Group, Schott AG, Corning Incorporated, Frigoglass SAIC, Ardagh Group, Gerresheimer AG, Saverglass SAS, Piramal Glass Private Limited, O-I Glass, Inc., Borosil, and Unitrade FZE.

Which region dominated the global containers glass market share?

Asia-Pacific held the dominating position in containers glass industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of containers glass during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global containers glass industry?

The current trends and dynamics in the containers glass industry include stringent regulations against plastic packaging favor glass adoption, and advancements in glass manufacturing enhance durability and cost efficiency.

Which forming method held the maximum share in 2023?

The blow & blow held the notable share of the containers glass industry.