Contact Adhesives Market | Acumen Research and Consulting

Contact Adhesives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

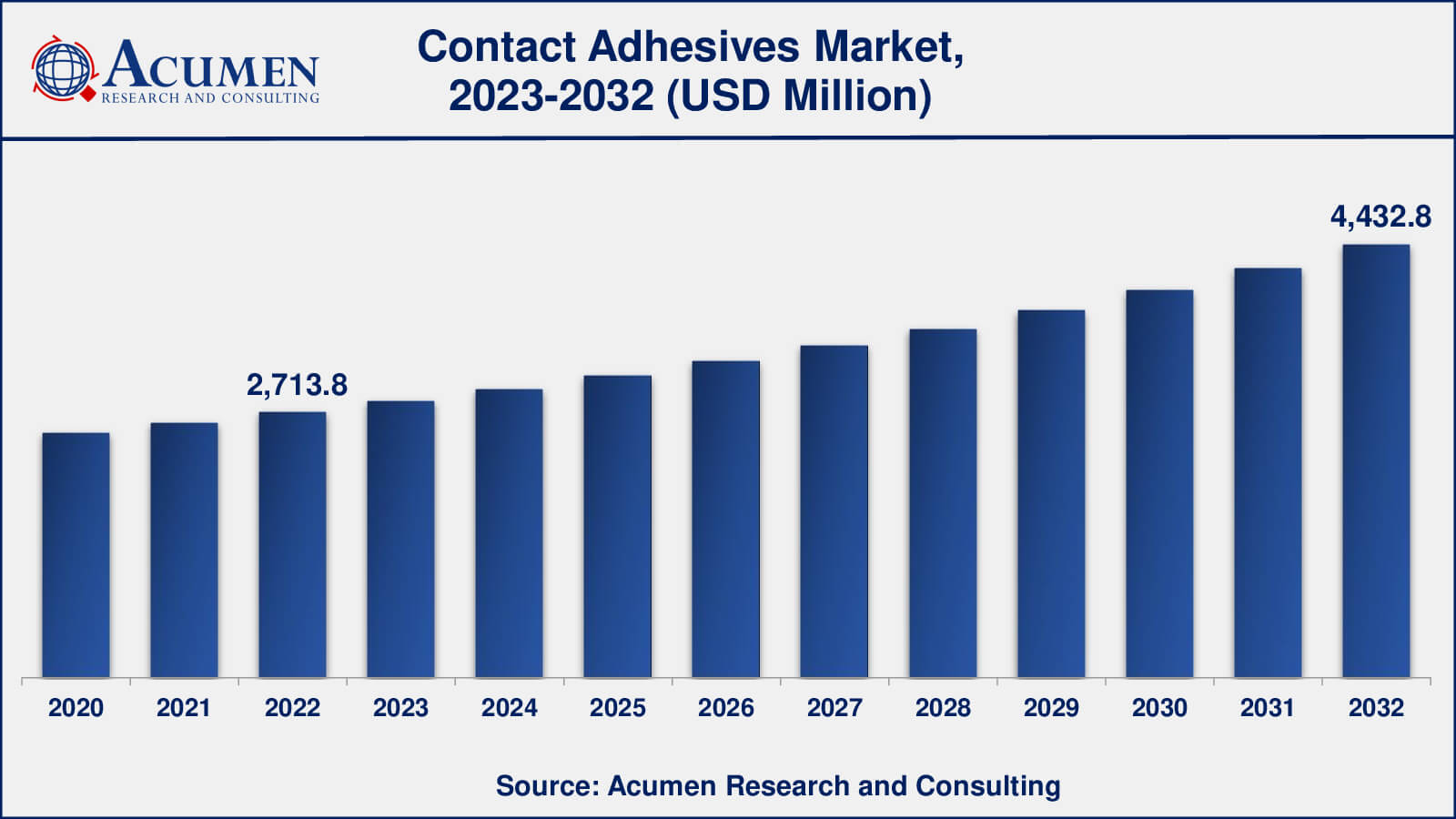

The global Contact Adhesives Market size was valued at USD 2,713.8 Million in 2022 and is projected to attain USD 4,432.8 Million by 2032 mounting at a CAGR of 5.1% from 2023 to 2032.

Contact Adhesives Market Highlights

- Global contact adhesives market revenue is poised to garner USD 4,432.8 million by 2032 with a CAGR of 5.1% from 2023 to 2032

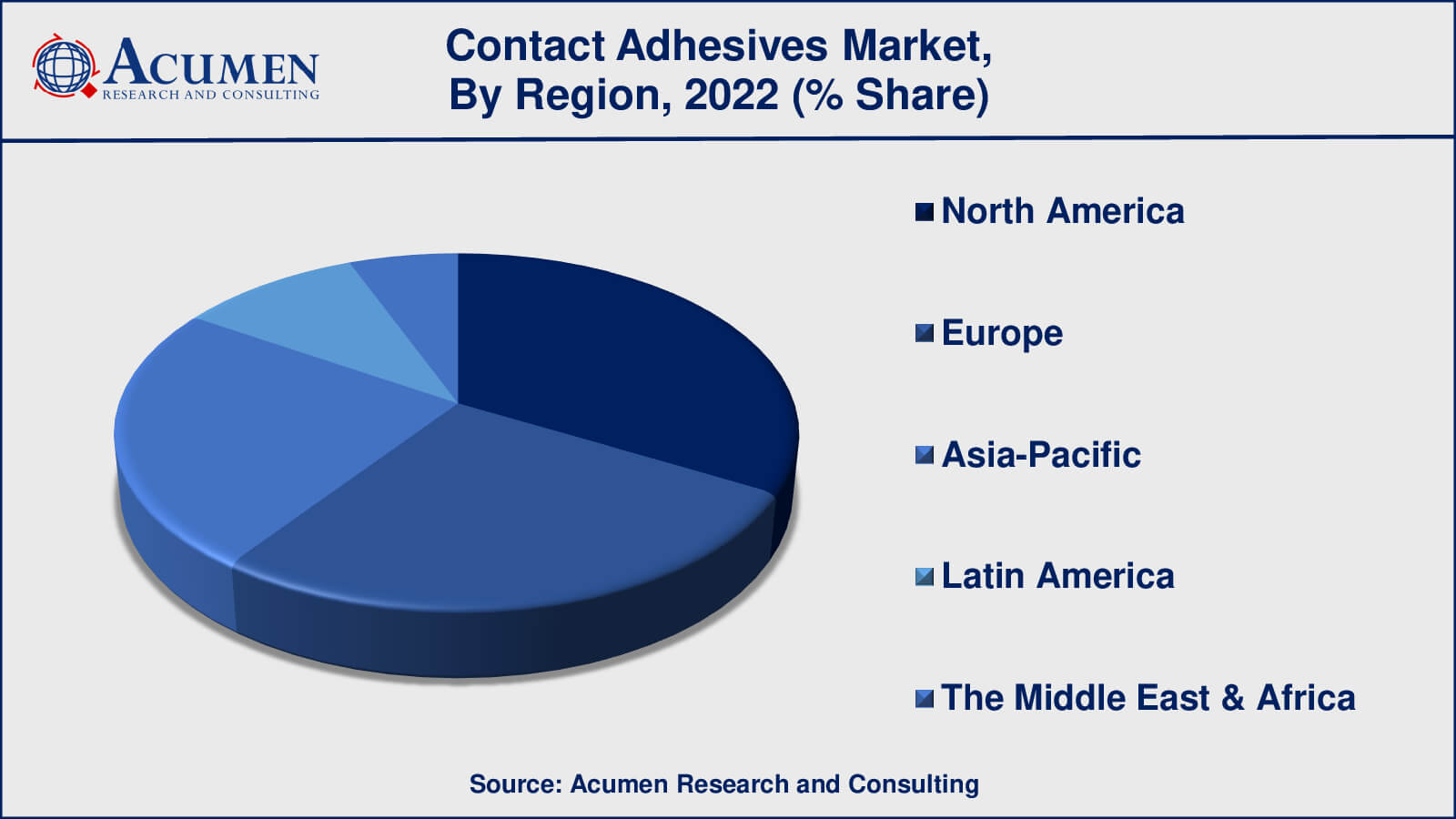

- North America contact adhesives market value occupied around USD 895.5 million in 2022

- Asia-Pacific contact adhesives market growth will record a CAGR of more than 6% from 2023 to 2032

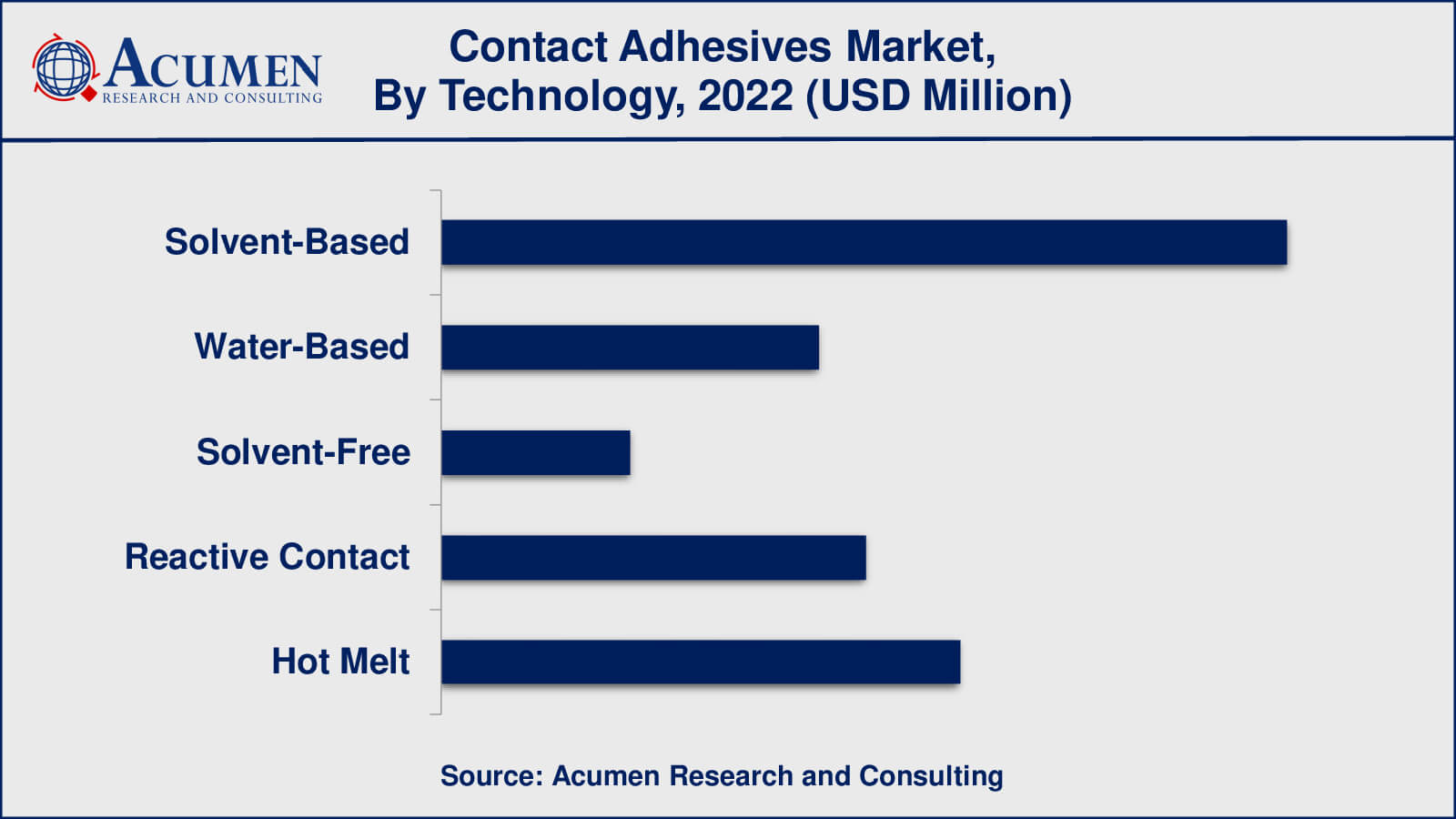

- Among technology, the solvent-based sub-segment occupied over US$ 977 million revenue in 2022

- Based on technology, the hot-melt sub-segment gathered around 22% share in 2022

- Customized adhesive solutions for the aerospace industry is a popular contact adhesives market trend that drives the industry demand

Contact adhesives, sometimes referred to as contact cement or contact bond adhesives, are flexible bonding chemicals that are widely employed in a variety of industries and applications. These adhesives are special in that they attach to surfaces instantly, forming a strong connection. Contact adhesives, unlike other adhesives that require clamping or curing time, produce a fast and solid bond when two adhesive-coated surfaces come into touch with one other.

Contact adhesives are distinguished by their ability to attach a wide range of materials, including wood, metal, plastic, cloth, and even laminate and veneers. Because of their adaptability, they are important in sectors including as construction, automobile production, carpentry, footwear, textiles, and packaging. They are particularly well-suited for applications requiring a strong and quick binding, such as the installation of laminates, automobile headliners, or the attachment of veneers to furniture surfaces.

Contact adhesives is applied to both surfaces to be joined, allowed to partially dry until sticky, and then brought into contact. When bonded, the adhesive generates a strong and robust connection that can tolerate a wide range of environmental conditions, temperature changes, and tensions. Contact adhesives are thus a solid alternative for many professions and companies looking for dependable and effective bonding solutions.

Global Contact Adhesives Market Dynamics

Market Drivers

- Growing construction and infrastructure projects worldwide

- Increasing demand for lightweight automotive materials

- Advancements in eco-friendly and low-VOC adhesive technologies

- Expansion of the packaging industry

Market Restraints

- Volatility in raw material prices impacting production costs

- Stringent environmental regulations affecting solvent-based adhesives

- Competition from alternative bonding methods like welding and fasteners

Market Opportunities

- Development of bio-based and sustainable contact adhesive formulations

- Emerging markets in Asia-Pacific and Latin America

- Technological innovations for specialized applications

- Increased adoption of electric vehicles requiring adhesive solutions

Contact Adhesives Market Report Coverage

| Market | Contact Adhesives Market |

| Contact Adhesives Market Size 2022 | USD 2,713.8 Million |

| Contact Adhesives Market Forecast 2032 | USD 4,432.8 Million |

| Contact Adhesives Market CAGR During 2023 - 2032 | 5.1% |

| Contact Adhesives Market Analysis Period | 2020 - 2032 |

| Contact Adhesives Market Base Year |

2022 |

| Contact Adhesives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin Type, By Technology, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Company, Ashland Inc, Bostik, Delo Industrial Adhesives, Dymax Corporation, Henkel, Hernon Manufacturing, Inc., Hexcel Corporation, H.B. Fuller, Huntsman International, Illinois Tool Works, Jubilant Industries, Loxeal Engineering Adhesives, and Lord Corporation, LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Contact Adhesives Market Insights

A dynamic interaction of different variables influences the contact adhesives industry. The global expansion of construction and infrastructure development is a primary driver of this industry. As the world's population grows, so does the need for adhesives used in laminates, veneers, and other building applications. Furthermore, the automobile sector is important, since the requirement for lightweight materials in vehicle manufacture drives the usage of contact adhesives for interior and exterior applications.

However, the market confronts significant obstacles. Raw material price volatility can have a major influence on glue producers' manufacturing costs. Furthermore, strict environmental laws and the demand for lower volatile organic compound (VOC) emissions have resulted in the reformulation of solvent-based adhesives or the creation of more environmentally friendly alternatives. This regulatory pressure can stifle market growth, particularly for enterprises that are sluggish to adopt greener adhesive solutions.

Opportunities in the contact adhesives industry may be found in a variety of places. The development of bio-based adhesives and sustainable formulations represents a strong growth opportunity, coinciding with the growing emphasis on environmentally responsible industrial practices. Furthermore, as industrialization and building projects increase in these countries, growing markets in Asia-Pacific and Latin America provide additional growth opportunities. Technological advancements that cater to specialized applications, such as high-temperature resistance or low-odor adhesives, can provide opportunities in niche industries. The growing popularity of electric cars drives up demand for specialized adhesive solutions in the automotive industry, while the aerospace industry wants customized adhesive formulations to fulfill demanding performance criteria. To summarizes, the contact adhesives industry is still dynamic, formed by a mix of drivers, restrictions, and opportunities, and flexibility and innovation are critical to success.

Contact Adhesives Market Segmentation

The worldwide market for contact adhesives is split based on resin type, technology, application, and geography.

Contact Adhesives Resin Types

- Neoprene

- Polyurethane

- Acrylic

- SBC

- Others

As per the contact adhesive industry analysis, neoprene-based contact adhesives are extensively utilised for their excellent bonding characteristics, particularly in applications requiring flexibility and resilience to environmental conditions. They've been employed extensively in the automotive and construction sectors.

Contact adhesives based on polyurethane are well-known for their flexibility and strong bonding ability on a broad range of substrates, including wood, metal, plastics, and others. They've found applications in sectors such as furniture manufacture, woodworking, and automotive.

Acrylic-based contact adhesives are prized for their longevity, UV light resistance, and heat resistance. They have seen widespread application in the aerospace, automotive, and construction industries.

Contact Adhesives Technologies

- Solvent-Based

- Water-Based

- Solvent-Free

- Reactive Contact

- Hot Melt

As per the technology analysis, solvent-based contact adhesives have traditionally been widely used due to their fast drying times and strong bonding capabilities. However, due to environmental concerns about volatile organic compounds (VOCs), their use has been reducing in several locations.

Water-based contact adhesives are becoming increasingly popular, particularly in areas with stringent environmental requirements. They emit less VOCs and are said to be more ecologically friendly. Water-based adhesives are widely utilised in sectors such as building, carpentry, and packaging.

Contact adhesives that are solvent-free or 100% solids are noted for their minimal environmental effect and lack of VOCs. They are appropriate for applications requiring low emissions and little environmental impact, such as indoor areas and car interiors.

Curing or cross-linking procedures, frequently involving heat or ultraviolet (UV) radiation, are used in reactive contact adhesives. They are utilised in industries requiring precise bonding and great performance, such as aerospace and electronics.

At normal temperature, hot melt contact adhesives are solid, but when heated, they become liquid. Because of their quick bonding qualities and simplicity of application, they are extensively employed in sectors including as packing, woodworking, and automobile assembly.

Contact Adhesives Applications

- Construction and Building

- Furniture and Woodworking

- Automotive and Transportation

- Footwear and Leather Goods

- Textiles and Fabrics

- Electronics and Appliances

- Packaging

- DIY and Craft

- Others

Contact adhesives are widely utilised in the construction and building industries for bonding laminates, veneers, insulation materials, and other building components. This industry is frequently a primary driving force in the contact adhesives market. They are also widely used in the furniture production and woodworking sectors. These adhesives are used to adhere laminates to hardwood surfaces, as well as for edge banding and other furniture-related applications.

Contact adhesives are used in the automotive and transportation industries for interior applications such as headliners, fabric-to-foam bonding, and other components. The usage of contact adhesives has increased due to the desire for lightweight materials in the automobile industry.

Contact adhesives are an important component in the manufacture of footwear, assisting in the bonding of diverse materials. They're also employed in the construction of leather items like purses and wallets. Furtehermore, other industries and specialty applications that employ contact adhesives are included in the Others category. This can include industries such as aircraft, marine, and medical devices, among others.

Contact Adhesives Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Contact Adhesives Market Regional Analysis

In North America, the demand for contact adhesives in the construction, automotive, and packaging sectors has increased, with a trend towards more ecologically friendly adhesive compositions. Similar patterns may be found in Canada, with an emphasis on sustainability.

Western European nations such as Germany, France, and the United Kingdom have robust manufacturing industries, notably in automotive and aerospace. Due to tight environmental laws, they use water-based and solvent-free adhesives. Construction and furniture manufacture have also risen in Eastern European economies.

The contact adhesives market in Asia-Pacific, particularly in China and India, has grown significantly. China's development and urbanization increase demand in a variety of industries, whilst India focuses on environmentally friendly adhesives. Increased manufacturing activity favors Southeast Asia.

Contact Adhesives Market Players

Some of the top contact adhesives companies offered in our report include 3M Company, Bostik, Ashland Inc, Delo Industrial Adhesives, Henkel, Dymax Corporation, Hernon Manufacturing, Inc., H.B. Fuller, Hexcel Corporation, Huntsman International, Illinois Tool Works, Loxeal Engineering Adhesives, Jubilant Industries, and Lord Corporation, LLC.

Frequently Asked Questions

What was the size of the global contact adhesives market in 2022?

The size of contact adhesives market was USD 2,713.8 million in 2022.

What is the contact adhesives market CAGR from 2023 to 2032?

The contact adhesives market CAGR during the analysis period of 2023 to 2032 is 5.1%.

Which are the key players in the contact adhesives market?

The key players operating in the global contact adhesives market are 3M Company, Ashland Inc, Bostik, Delo Industrial Adhesives, Dymax Corporation, Henkel, Hernon Manufacturing, Inc., Hexcel Corporation, H.B. Fuller, Huntsman International, Illinois Tool Works, Jubilant Industries, Loxeal Engineering Adhesives, and Lord Corporation, LLC.

Which region dominated the global contact adhesives market share?

North America region held the dominating position in contact adhesives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of contact adhesives during the analysis period of 2023 to 2032.

What are the current trends in the global contact adhesives industry?

The current trends and dynamics in the contact adhesives industry include growing construction and infrastructure projects worldwide, increasing demand for lightweight automotive materials, and advancements in eco-friendly and low-VOC adhesive technologies

Which resin type held the maximum share in 2022?

The neoprene resin type held the maximum share of the contact adhesives industry.