Congenital Hyperinsulinism Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Congenital Hyperinsulinism Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

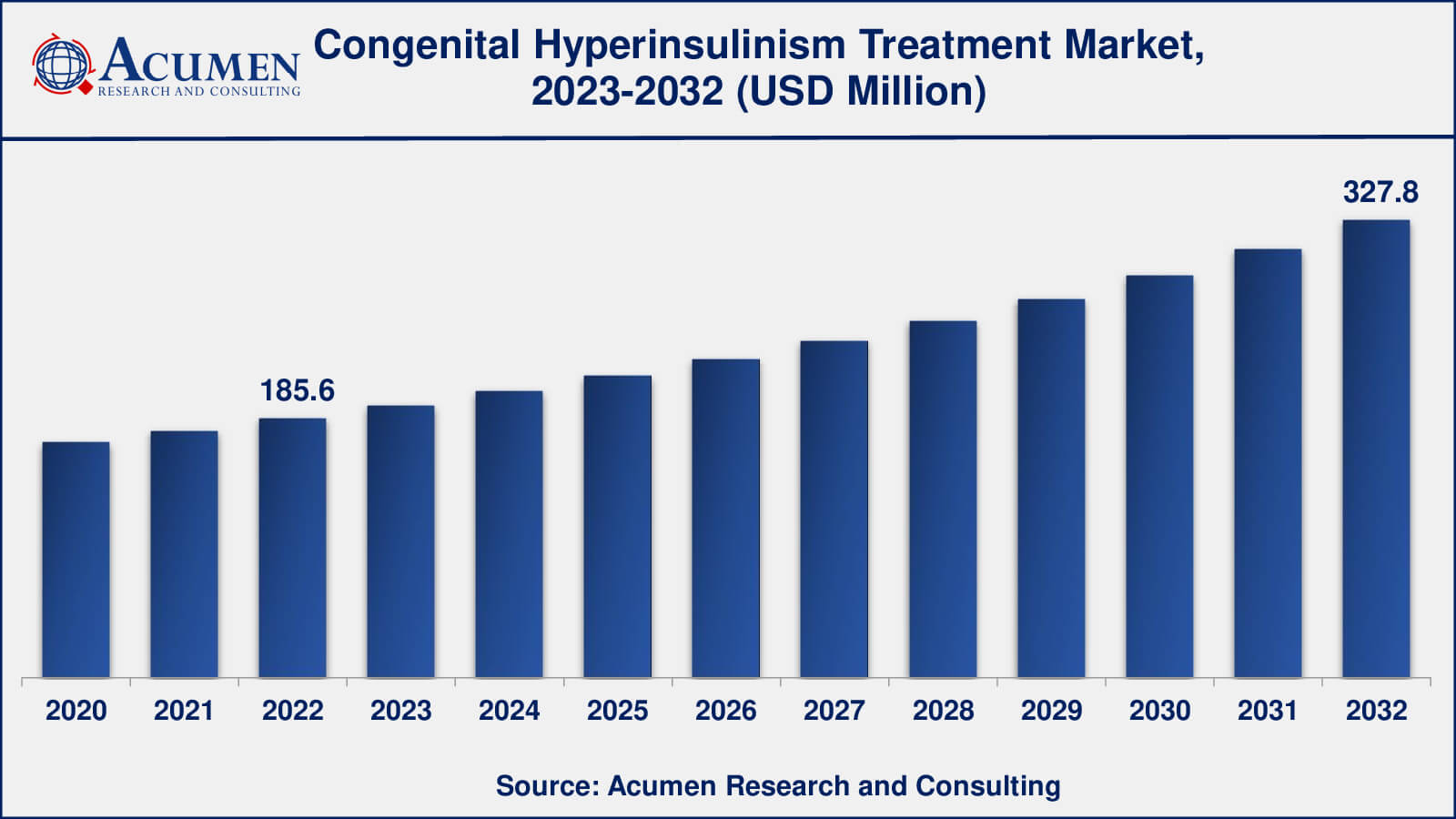

The global Congenital Hyperinsulinism Treatment Market size was valued at USD 185.6 Million in 2022 and is projected to attain USD 327.8 Million by 2032 mounting at a CAGR of 5.9% from 2023 to 2032.

Congenital Hyperinsulinism Treatment Market Highlights

- Global congenital hyperinsulinism treatment market revenue is poised to garner USD 327.8 million by 2032 with a CAGR of 5.9% from 2023 to 2032

- North America congenital hyperinsulinism treatment market value occupied around USD 63.1 million in 2022

- Asia-Pacific congenital hyperinsulinism treatment market growth will record a CAGR of more than 6% from 2023 to 2032

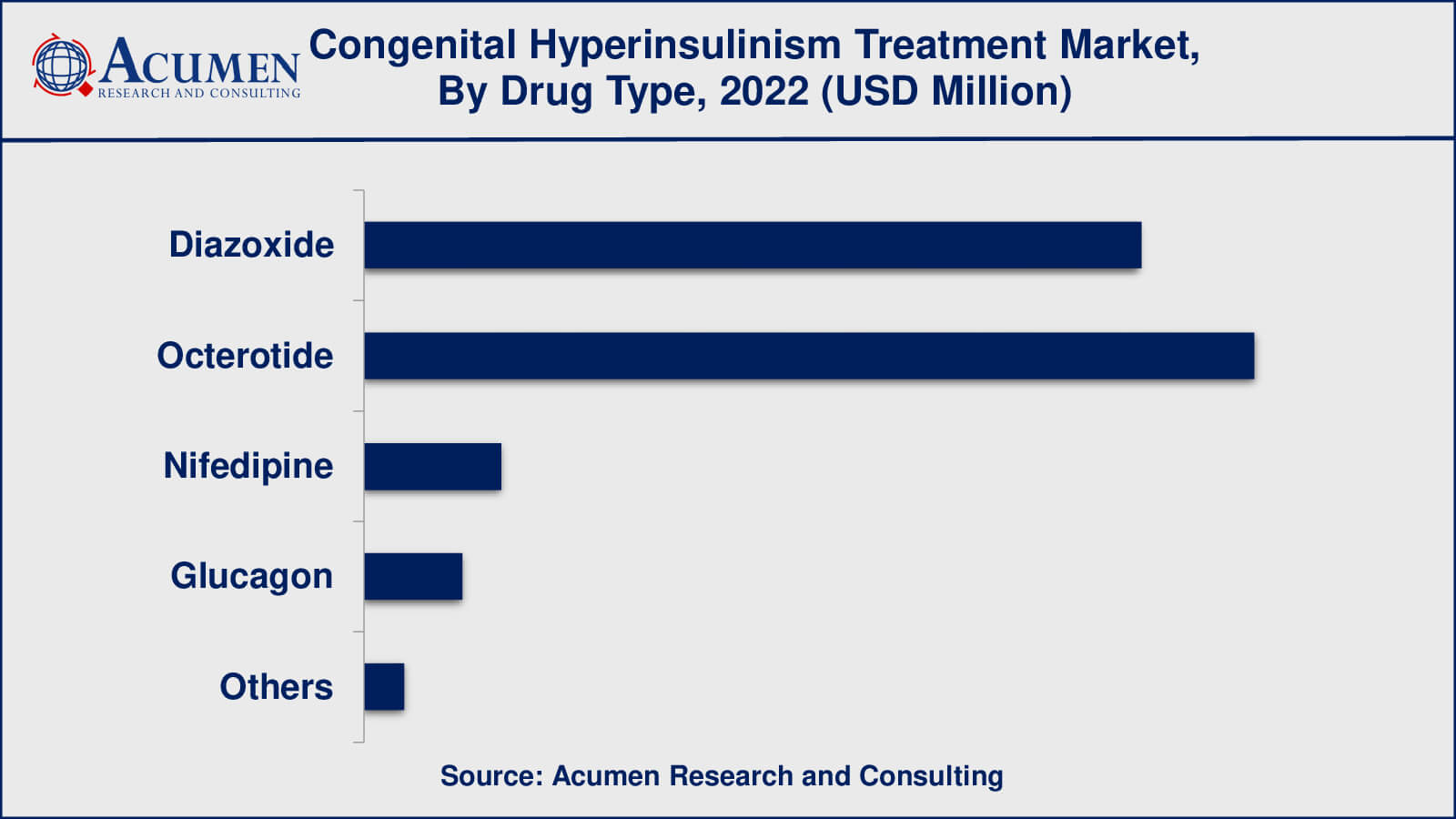

- Among drug type, the octerotide sub-segment occupied over US$ 85.4 million revenue in 2022

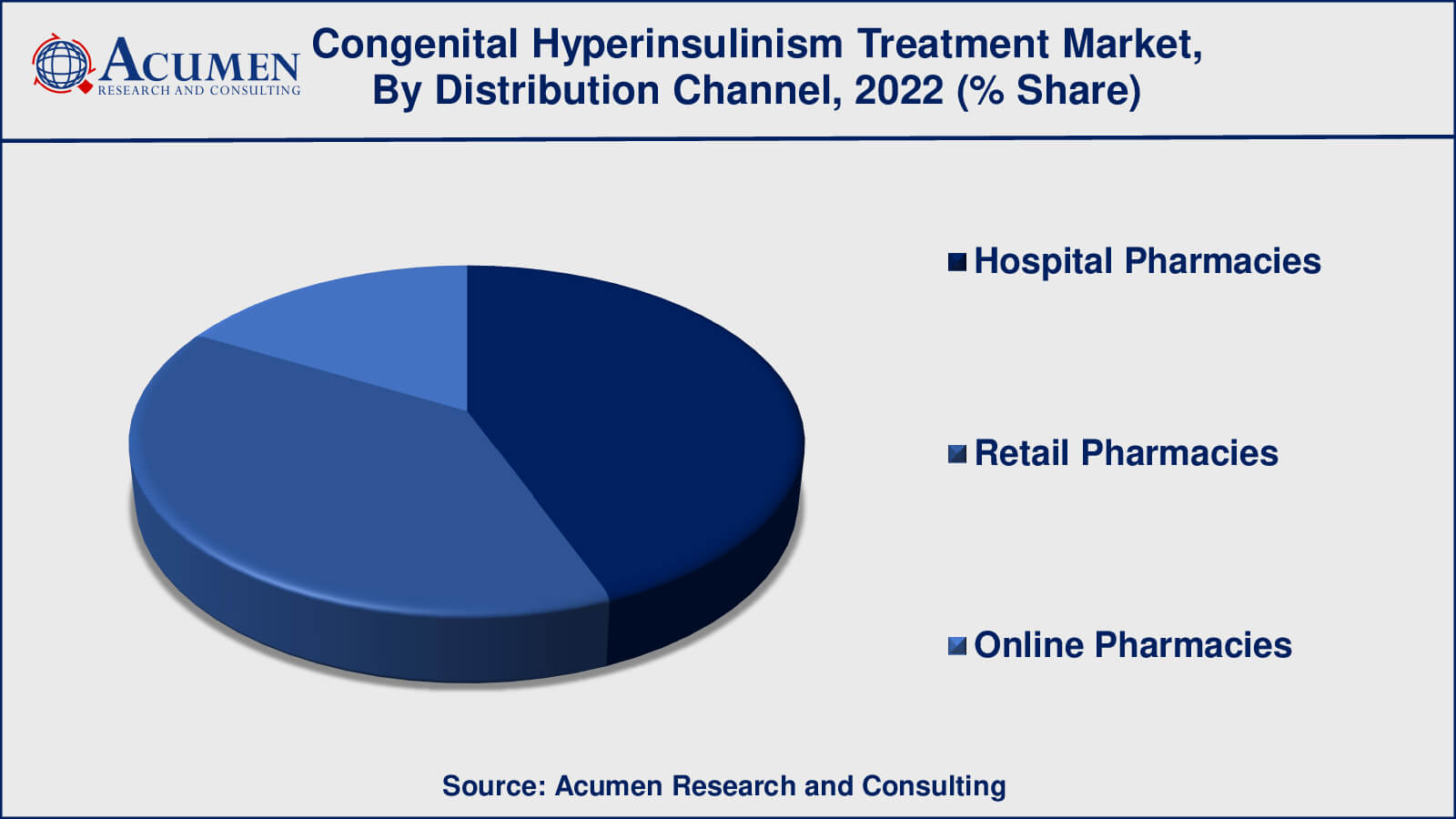

- Based on distribution channel, the retail pharmacies sub-segment gathered around 44% share in 2022

- Tailoring CHI treatment to individual genetic mutations is a popular congenital hyperinsulinism treatment market trend that drives the industry demand

Congenital hyperinsulinism (CHI) is a rare genetic condition that causes the pancreas to produce extra insulin, resulting in dangerously low blood sugar levels (hypoglycemia). Effective therapy is required to control this illness and prevent consequences.

Medication is the major method of treating CHI. Diazoxide is widely used to assist increase and stabilize blood sugar levels by inhibiting pancreatic insulin production. Additional drugs, such as octreotide or glucagon, may be required in rare circumstances to further limit insulin production or to treat hypoglycemia.

Individuals with severe CHI who do not react satisfactorily to medication or other conservative therapy may be candidates for surgical surgery. A pancreatectomy is often used to lower insulin production by surgically removing a piece of the pancreas. However, surgery is only used after all other therapies have failed.

Nutritional assistance is also an important aspect of CHI treatment. To keep blood sugar levels stable, patients frequently require high-carbohydrate feedings. When oral feeding is not possible, feeding tubes or intravenous glucose infusions may be required, especially in infants and children with severe CHI. Long-term monitoring and treatment plan modifications are required to guarantee that people with CHI can maintain stable blood sugar levels and live healthy lives.

Global Congenital Hyperinsulinism Treatment Market Dynamics

Market Drivers

- Growing awareness about congenital hyperinsulinism among healthcare professionals and the general public

- Advancements in treatment options, including medication and surgical techniques

- Increasing prevalence of congenital hyperinsulinism, leading to a larger patients pool in need of treatment

Market Restraints

- Limited availability of specialized healthcare facilities with expertise in CHI treatment

- High treatment costs associated with medication, surgery, and ongoing care

- Potential complications and risks associated with surgical interventions in CHI cases

Market Opportunities

- Ongoing research and development efforts for the discovery of novel therapies and more effective treatment approaches

- Expansion of healthcare infrastructure in regions with limited access to specialized CHI care

- Improved diagnostic methods for early detection and intervention in congenital hyperinsulinism cases

Congenital Hyperinsulinism Treatment Market Report Coverage

| Market | Congenital Hyperinsulinism Treatment Market |

| Congenital Hyperinsulinism Treatment Market Size 2022 | USD 185.6 Million |

| Congenital Hyperinsulinism Treatment Market Forecast 2032 | USD 327.8 Million |

| Congenital Hyperinsulinism Treatment Market CAGR During 2023 - 2032 | 5.9% |

| Congenital Hyperinsulinism Treatment Market Analysis Period | 2020 - 2032 |

| Congenital Hyperinsulinism Treatment Market Base Year | 2022 |

| Congenital Hyperinsulinism Treatment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Disease Type, By Drug Type, By Route of Administration; By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AmideBio LLC, Crinetics Pharmaceuticals, Inc., Eiger BioPharmaceuticals, Eli Lilly, Hanmi Pharm.Co., Ltd, Novartis AG, Rezolute, Inc., Teva Pharmaceutical Industries Ltd, Xeris Pharmaceuticals, Inc., and Zealand Pharma A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Congenital Hyperinsulinism Treatment Market Insights

The market for congenital hyperinsulinism (CHI) therapy is shaped by a number of dynamic elements. The increased awareness of CHI among healthcare professionals and the general public is one of the primary motivations. This greater awareness has resulted in earlier diagnosis and treatment, eventually improving patient outcomes. Furthermore, pharmaceutical firms' continued research and development efforts have led in breakthroughs in treatment choices, including both pharmacological and surgical treatments, fueling market expansion.

However, the CHI treatment market is hampered by substantial constraints, such as a scarcity of specialized healthcare institutions with experience in CHI treatment. This constraint can impede timely access to appropriate care, especially in areas with limited healthcare resources. Furthermore, the high treatment expenditures involved with CHI treatment, including as medicines, surgical treatments, and follow-up care, can be a considerable financial burden for patients and their families. Furthermore, surgical procedures in CHI instances may be fraught with difficulties and hazards, which might function as a constraint.

Despite these obstacles, there are significant prospects in the CHI treatment industry. Efforts in research and development to uncover innovative medicines and more effective treatment procedures offer promise for better patients care. Expansion of healthcare infrastructure in areas where access to specialized CHI care is restricted can improve treatment availability and patient outcomes. Furthermore, new diagnostic procedures for early diagnosis and intervention in cases of congenital hyperinsulinism might lead to better care and prognosis for afflicted individuals. These potential, together with pharmaceutical firms' sustained commitment, point to a good trajectory for the CHI treatment industry in the next years.

Congenital Hyperinsulinism Treatment Market Segmentation

The worldwide market for congenital hyperinsulinism treatment is split based on disease type, drug type, route of administration, distribution channel, and geography.

Congenital Hyperinsulinism Treatment Disease Types

- KATP-HI

- GDH-HI

- GK-HI

- Others (SCHAD HI, HNF4A/HNF1A, etc.)

According to the congenital hyperinsulinism treatment industry analysis, KATP-HI, which stands for "Potassium ATP Channel Hyperinsulinism," is one of the most frequent and well-studied variants of CHI. This type is frequently linked with mutations in the genes encoding pancreatic potassium ATP channel proteins.

As a result, KATP-HI has emerged as a key target of CHI treatment research and development. To treat this kind of CHI, medications like as diazoxide, which target the potassium ATP channel, have been employed. As a result, it can be concluded that KATP-HI has had a major impact on the congenital hyperinsulinism (CHI) treatment market. However, it is important to note that the treatment landscape for other types of CHI, such as GDH-HI (glutamate dehydrogenase hyperinsulinism), GK-HI (glucokinase hyperinsulinism), and others such as SCHAD HI and HNF4A/HNF1A, also plays a major role in overall market dynamics.

Congenital Hyperinsulinism Treatment Drug Types

- Diazoxide

- Glucagon

- Nifedepine

- Octerotide

- Other (Sirolimus, Chlorothiazide, etc.)

Octreotide has been one of the most often used and dominating medicines for CHI therapy, particularly when diazoxide is inadequate or extra insulin secretion control is required. Octreotide is a somatostatin analogue that can aid in insulin release regulation.

Diazoxide is another often used medication. Diazoxide is frequently administered to suppress pancreatic insulin release, so helping to increase and stabilise blood sugar levels in people with CHI, particularly those with KATP-HI (Potassium ATP Channel Hyperinsulinism).

In CHI patients, glucagon is often given in an emergency to treat severe hypoglycemia. It can quickly elevate blood sugar levels and is used as a rescue therapy when necessary.

Nifedipine, a calcium channel blocker, may be administered to assist lower insulin production in some instances of CHI, notably GDH-HI (glutamate dehydrogenase hyperinsulinism).

Other medications, such as sirolimus and chlorothiazide, are being evaluated for some CHI patients, although their usage is likely to be limited and dependent on individual patients responses and unique genetic alterations.

Congenital Hyperinsulinism Treatment Route of Administration

- Oral

- Parenteral

As per the congenital hyperinsulinism (CHI) treatment market analysis, the parenteral method of delivery has historically dominated. Parenteral administration is the non-oral administration of drugs or fluids, such as intravenous (IV) infusion, subcutaneous (under the skin) injection, or intramuscular injection. This method is frequently used in CHI therapy because it provides for accurate and quick medicine administration, especially in emergency circumstances where hypoglycemia must be corrected immediately.

Many CHI drugs, including as diazoxide, octreotide, and glucagon, are delivered via parenteral methods to guarantee quick absorption and efficacy. Glucagon, in example, is frequently used as an emergency remedy through injection to swiftly boost blood sugar levels during severe hypoglycemia episodes.

While oral drugs may be utilised in some circumstances, parenteral administration is frequently preferred for CHI treatment due to its dependability and the requirement for a quick reaction to hypoglycemia, which can be fatal. However, based on the exact circumstances and the treatment plan devised by healthcare specialists, the route of administration may differ.

Congenital Hyperinsulinism Treatment Distribution Channels

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

According to the congenital hyperinsulinism market forecast, hospital pharmacies is expected to dominate the industry as the principal distribution route for CHI drugs. This is due to the fact that CHI is a complicated and sometimes severe medical illness that needs constant monitoring and specialised care. Hospitals are able to deliver the drugs and treatments required to control CHI, and their pharmacies play an important role in ensuring that patients receive their prescribed medications on time.

Retail pharmacies also play a role in the distribution of CHI drugs, especially for those who are managing the illness on an outpatient manner or need to refill their prescriptions. Retail pharmacies, on the other hand, often play a secondary role in CHI care when compared to hospital pharmacies.

Online pharmacies have grown in popularity for a variety of drugs, including those used in CHI therapy. They provide patients with ease and accessibility by allowing them to buy drugs online and have them delivered to their homes. However, internet pharmacies' dominance in the CHI treatment market is not as strong as that of hospital and retail pharmacies, as the illness frequently need specialised care and constant monitoring, which is best supplied by healthcare experts in hospital settings.

Congenital Hyperinsulinism Treatment Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Congenital Hyperinsulinism Treatment Market Regional Analysis

The healthcare system in North America, notably the United States, is well-developed, with specialized centers for CHI diagnosis and treatment. With a high degree of awareness and research effort, it is a big market for CHI treatment.

With various specialized centers, Canada also provides modern healthcare treatments for CHI management. CHI medicines and surgical treatments are widely accessible.

The United Kingdom has significant competence in CHI diagnosis and treatment, with specialized centers located in major cities. CHI therapy is widely available. These nations have developed healthcare systems and offer CHI treatment, albeit the availability of specialized centers varies.

These populous countries are becoming more aware of CHI, yet availability to specialized treatment might be restricted in some areas. Treatment alternatives are available in major cities. Japan has a well-developed healthcare system and research infrastructure, which contributes to the availability of CHI treatment choices.

Congenital Hyperinsulinism Treatment Market Players

Some of the top congenital hyperinsulinism treatment companies offered in our report includes AmideBio LLC, Crinetics Pharmaceuticals, Inc., Eiger BioPharmaceuticals, Eli Lilly, Hanmi Pharm.Co., Ltd, Novartis AG, Rezolute, Inc., Teva Pharmaceutical Industries Ltd, Xeris Pharmaceuticals, Inc., and Zealand Pharma A/S.

Frequently Asked Questions

What was the size of the global congenital hyperinsulinism treatment market in 2022?

The size of congenital hyperinsulinism treatment market was USD 185.6 million in 2022.

What is the congenital hyperinsulinism treatment market CAGR from 2023 to 2032?

The congenital hyperinsulinism treatment market CAGR during the analysis period of 2023 to 2032 is 5.9%.

Which are the key players in the congenital hyperinsulinism treatment market?

The key players operating in the global congenital hyperinsulinism treatment market are AmideBio LLC, Crinetics Pharmaceuticals, Inc., Eiger BioPharmaceuticals, Eli Lilly, Hanmi Pharm.Co., Ltd, Novartis AG, Rezolute, Inc., Teva Pharmaceutical Industries Ltd, Xeris Pharmaceuticals, Inc., and Zealand Pharma A/S.

Which region dominated the global congenital hyperinsulinism treatment market share?

North America region held the dominating position in congenital hyperinsulinism treatment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of congenital hyperinsulinism treatment during the analysis period of 2023 to 2032.

What are the current trends in the global congenital hyperinsulinism treatment industry?

The current trends and dynamics in the congenital hyperinsulinism treatment industry include growing awareness about congenital hyperinsulinism among healthcare professionals and the general public, advancements in treatment options, including medication and surgical techniques, and increasing prevalence of congenital hyperinsulinism, leading to a larger patient�s pool in need of treatment.

Which disease type held the maximum share in 2022?

The KATP-HI disease type held the maximum share of the congenital hyperinsulinism treatment industry.