Concentrated Nitric Acid Market | Acumen Research and Consulting

Concentrated Nitric Acid Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

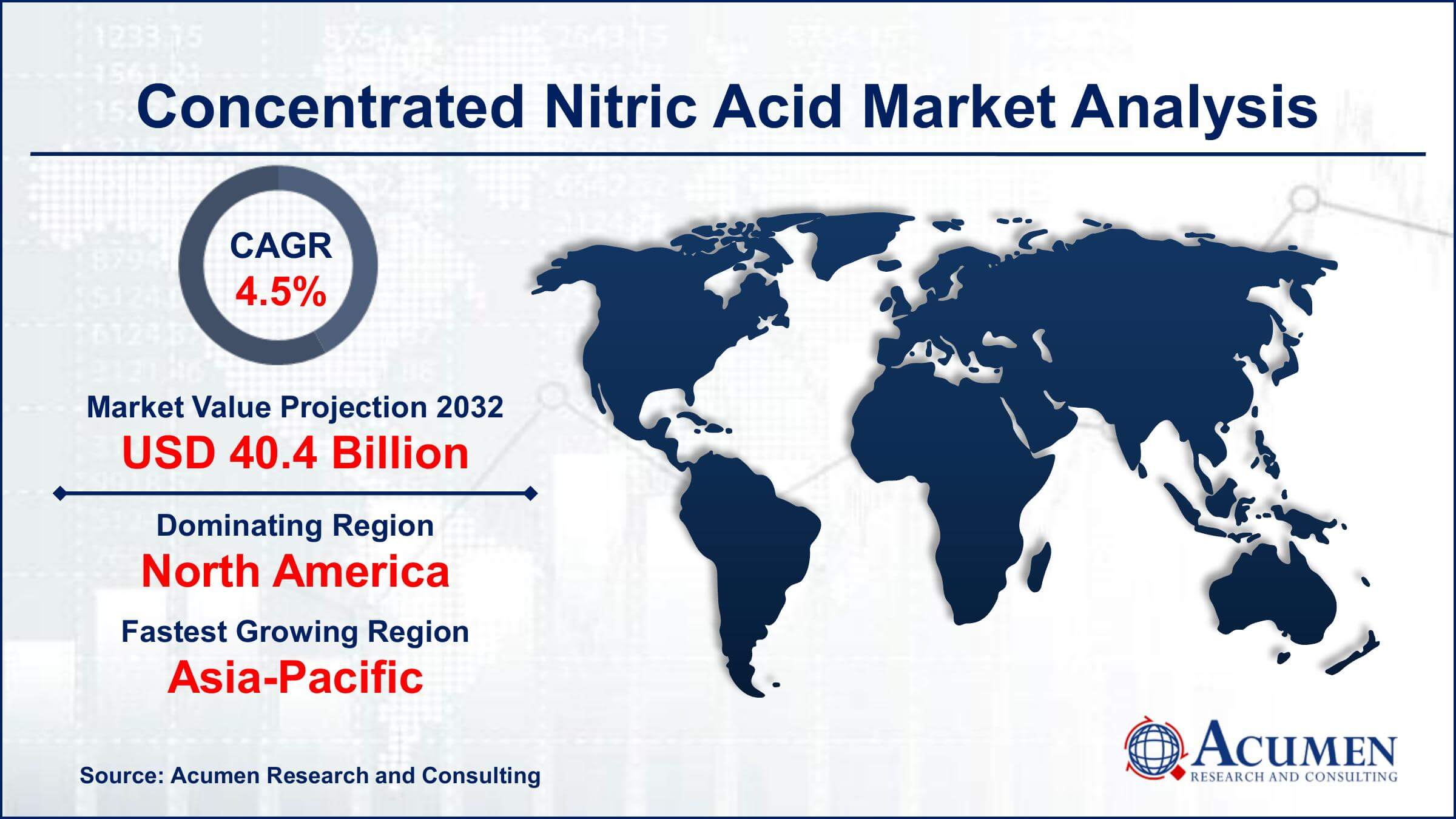

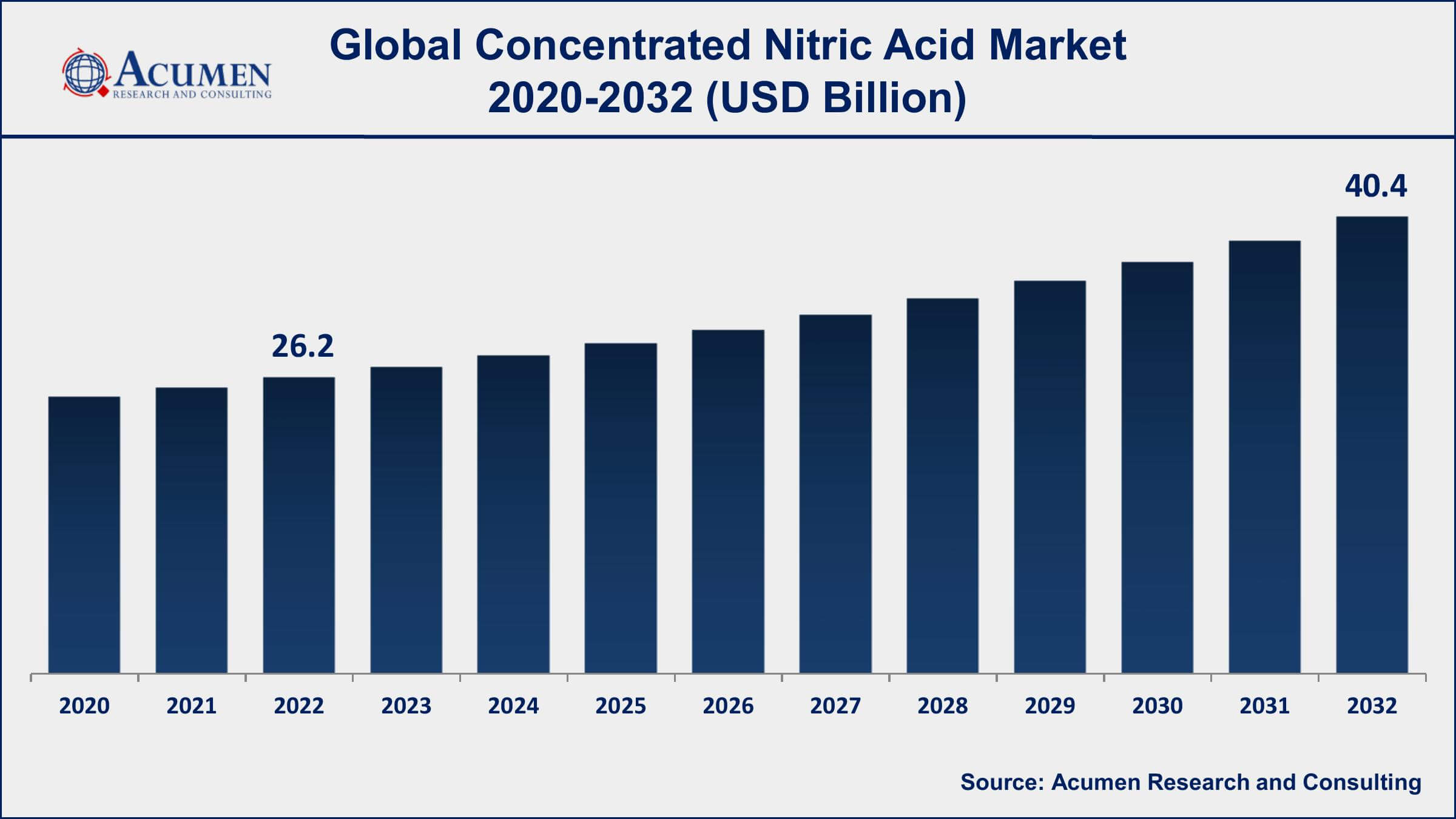

The Global Concentrated Nitric Acid Market Size accounted for USD 26.2 Billion in 2022 and is projected to achieve a market size of USD 40.4 Billion by 2032 growing at a CAGR of 4.5% from 2023 to 2032.

Report Key Highlights

- Global concentrated nitric acid market revenue is expected to increase by USD 40.4 Billion by 2032, with a 4.5% CAGR from 2023 to 2032

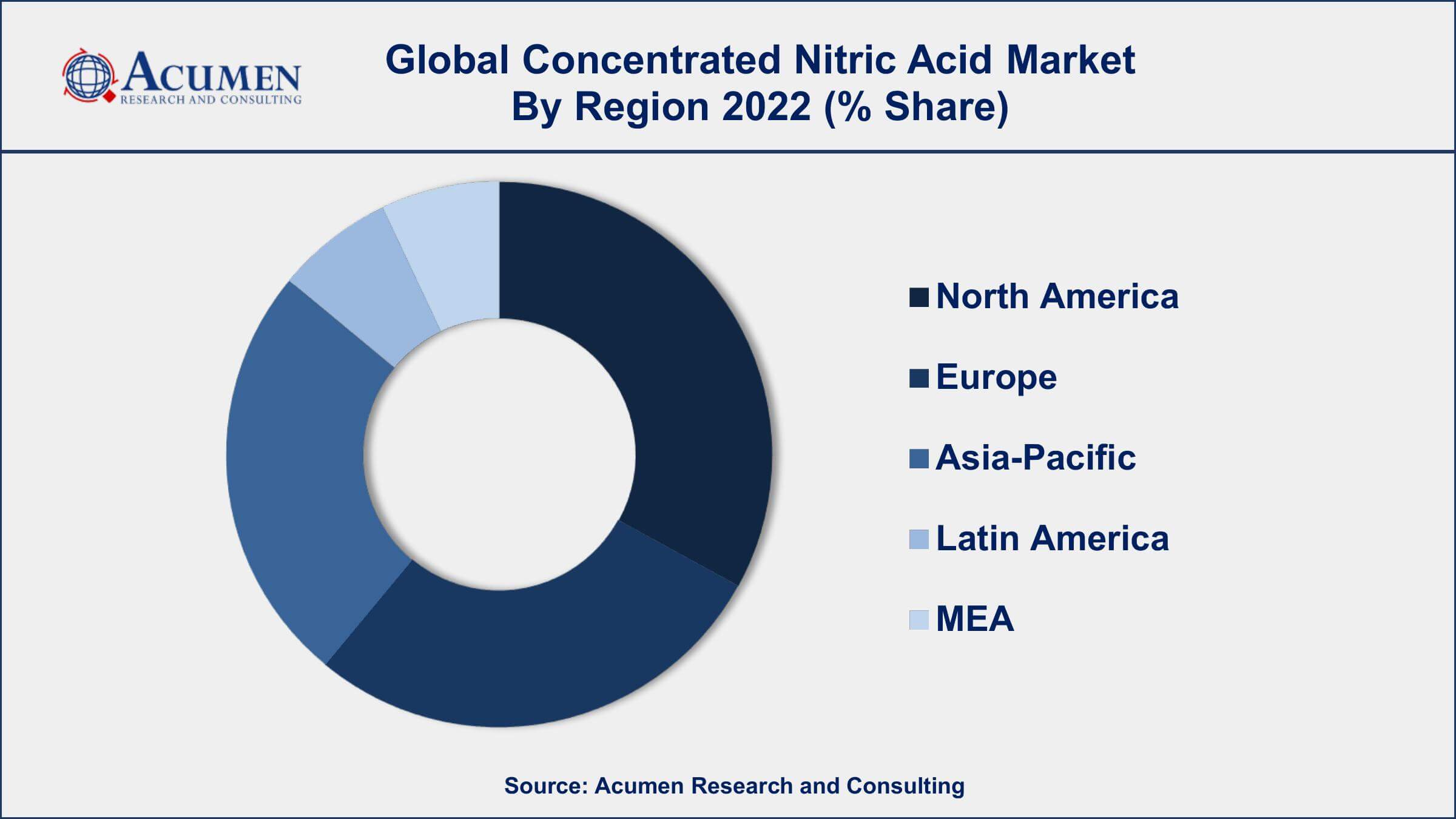

- North America region led with more than 36% of concentrated nitric acid market share in 2022

- The United States is the world's leading producer of nitric acid, followed by China and Europe

- According to the EPA, over 70% of nitric acid is used to produce ammonium nitrate, which is used in fertilizers.

- According to the IBEF, India's agrochemical sector will increase at a 7.5% annual rate

- According to the United States Geographical Survey, a mixture of ammonium nitrate and fuel oil is utilized in approximately 80% of the explosives used in North America

- Development of new applications in industries such as electronics and energy, drives the concentrated nitric acid market size

Concentrated nitric acid, also known as strong nitric acid, is a highly corrosive and dangerous acid that is widely used in various industrial and laboratory processes. It is a colorless or yellowish liquid with a pungent odor and is usually sold at concentrations ranging from 68% to 98%. Nitric acid is a vital raw material in the production of fertilizers, explosives, dyes, and other chemicals. It is also used for etching metals, cleaning, and purifying metals, and as a reagent in analytical chemistry.

The global concentrated nitric acid market is expected to grow significantly in the coming years, driven by the increasing demand for nitric acid in various applications. The fertilizer industry is one of the primary consumers of nitric acid, accounting for a significant share of the global market. The growing population and rising food demand are expected to boost the demand for fertilizers, thereby driving the demand for nitric acid. Additionally, the increasing demand for explosives and other chemicals in various industries, such as mining, construction, and automotive, is expected to propel the concentrated nitric acid market value growth further.

Global Concentrated Nitric Acid Market Trends

Market Drivers

- Growing demand for nitric acid in the production of fertilizers and other chemicals

- Increasing population and food demand driving demand for fertilizers

- Rising demand for explosives and other chemicals in various industries such as mining, construction, and automotive

- Growth in the pharmaceutical industry driving demand for nitric acid in drug production

Market Restraints

- Strict regulations and safety concerns

- Availability of substitutes for nitric acid in some applications

Market Opportunities

- Development of new applications in industries such as electronics and energy

- Growing demand for high-quality and pure nitric acid in the pharmaceutical industry

Concentrated Nitric Acid Market Report Coverage

| Market | Concentrated Nitric Acid Market |

| Concentrated Nitric Acid Market Size 2022 | USD 26.2 Billion |

| Concentrated Nitric Acid Market Forecast 2032 | USD 40.4 Billion |

| Concentrated Nitric Acid Market CAGR During 2023 - 2032 | 4.5% |

| Concentrated Nitric Acid Market Analysis Period | 2020 - 2032 |

| Concentrated Nitric Acid Market Base Year | 2022 |

| Concentrated Nitric Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF SE, Dow Chemical Company, DuPont de Nemours, Inc., Eastman Chemical Company, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group Holdings SA, Mitsubishi Chemical Corporation, Sumitomo Chemical Company Limited, The Chemours Company, UBE Industries, Ltd., and Yara International ASA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Concentrated nitric acid, which has the chemical formula HNO3, is mainly used in explosives pesticides, the production of nitrogen fertilizers, synthetic rubbers, polyurethane foams, and elastomers. In rocket propellants and dyes, intermediate concentrated nitric acid also acts as an oxidizer. Concentrated nitric acids are majorly applicable and are used in explosive industries and agrochemicals. One of the largest applications of concentrated nitric acid is ammonium nitrate. Ammonium nitrate is mainly found in two forms - solid and liquid - which depend on the solution of concentration of ammonium nitrate. Ammonium nitrate can be used as an intermediate for other fertilizers such as calcium ammonium nitrate fertilizer and urea ammonium nitrate or directly as a fertilizer. Strong nitric acid comprises various concentrations ranging from 50%-85%, which almost covers all the application areas of concentrated nitric acid. This is also used in manufacturing a variety of applications such as adipic acid, ammonium nitrate, nitrobenzene, toluene diisocyanate (TDI), nitro chlorobenzene, and trinitrotoluene (TNT). More than 70% of concentrated nitric acid is used in the production of ammonium nitrate. It is also used as an intermediate for explosives and agrochemicals. Strong nitric acid, which is also known as a class-2 oxidizer, can increase the burn rate of material after it comes in contact. This property is used in developing secondary explosives.

Concentrated nitric acid is used in producing toluene diisocyanate (TDI), ammonium nitrate, adipic, nitrobenzene, and nitro chlorobenzene. It is used in secondary explosives, which increase the rate of burning of materials whenever they come in contact with it. Hence, the demand for concentrated nitric acid from various end-use industries such as agrochemicals, explosives, automotive, and electronics is increasing impulsively. According to harmonized classification and labeling approved by European Union, concentrated nitric acid causes severe eye damage and skin burns and may also catch fire when it comes in contact with air. Owing to the health hazards of concentrated nitric acid, higher precautionary measures are required to be taken by people who are in continuous contact with this chemical. The adoption of concentrated nitric acid is increasing, due to the growing usage of nylon 6, 6, elastomers, and synthetic rubbers. These elements are replacing wood, metal, and glass in furniture, automotive, and building & construction industries. Also, in manufacturing, urea ammonium nitrate (UNA) can be used in making explosives. The increasing demand for concentrated nitric acid in explosives, mining, construction, adipic acid, and nitrobenzene applications is expected to boost the concentrated nitric acid market growth in near future.

Concentrated Nitric Acid Market Segmentation

Concentrated Nitric Acid Market Segmentation

The global concentrated nitric acid market segmentation is based on type, application, end-user industry, and geography.

Concentrated Nitric Acid Market By Type

- Fuming

- Strong

According to the concentrated nitric acid industry analysis, the strong segment accounted for the largest market share in 2022. This is because strong nitric acid is widely used in various industrial and laboratory processes, and it has a higher concentration compared to fuming nitric acid. Strong nitric acid is commonly sold at concentrations ranging from 68% to 98% while fuming nitric acid is typically sold at concentrations between 90% and 98%. Strong nitric acid is used in the production of fertilizers, explosives, dyes, and other chemicals, as well as in metal purification, etching, and cleaning. It is also used as a reagent in analytical chemistry and in the pharmaceutical industry.

Concentrated Nitric Acid Market By Application

- Ammonium Nitrate

- Nitrobenzene

- Adipic Acid

- Trinitrotoluene

- Toluene Diisocyanate

- Other

In terms of applications, the ammonium nitrate segment leads the concentrated nitric acid market in recent years. Ammonium nitrate is an important fertilizer that is used in agriculture to promote plant growth and increase crop yields. It is also used as an explosive in the mining, construction, and demolition industries. The production of ammonium nitrate involves the reaction of nitric acid with ammonia, and therefore, concentrated nitric acid is a crucial raw material in the production of ammonium nitrate. The demand for ammonium nitrate is expected to grow significantly in the coming years due to the increasing population and the rising demand for food, which is driving the demand for fertilizers. Additionally, the growing demand for explosives and blasting agents in the mining and construction industries is expected to further drive the demand for ammonium nitrate.

Concentrated Nitric Acid Market By End-user Industry

- Agrochemical

- Explosives

- Electronics

- Automotive

- Other

According to the concentrated nitric acid market forecast, the agrochemical segment is expected to witness significant growth in the coming years. agrochemical segment is a significant and growing end-use application for concentrated nitric acid in the market. Nitric acid is a key raw material in the production of various nitrogen-based fertilizers, such as ammonium nitrate, urea ammonium nitrate (UAN), and calcium ammonium nitrate (CAN). These fertilizers are used to enhance plant growth and increase crop yields, thereby playing a crucial role in modern agriculture. The demand for agrochemicals, and therefore concentrated nitric acid, is expected to grow in the coming years due to various factors. The rising global population and the subsequent increase in food demand are driving the demand for agrochemicals to improve crop yields and meet the food demand. Moreover, the expansion of arable land, increasing adoption of modern farming techniques, and the need to improve soil fertility are also contributing to the growth of the agrochemical segment.

Concentrated Nitric Acid Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Concentrated Nitric Acid Market Regional Analysis

North America is dominating the concentrated nitric acid market due to several factors, including the presence of a well-established chemical manufacturing industry, significant investments in research and development activities, and the growing demand for ammonium nitrate in the agriculture and mining sectors. The United States is a major producer of concentrated nitric acid, with several leading manufacturers operating in the region. These manufacturers have established state-of-the-art production facilities and employ advanced production processes to produce high-quality concentrated nitric acid. Moreover, the region is home to several chemical manufacturers that use concentrated nitric acid as a key raw material in the production of various chemicals, including fertilizers, explosives, and dyes. Additionally, significant investments in research and development activities by the government and private players have also contributed to the market's growth.

Concentrated Nitric Acid Market Player

Some of the top concentrated nitric acid market companies offered in the professional report include BASF SE, Dow Chemical Company, DuPont de Nemours, Inc., Eastman Chemical Company, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group Holdings SA, Mitsubishi Chemical Corporation, Sumitomo Chemical Company Limited, The Chemours Company, UBE Industries, Ltd., and Yara International ASA.

Frequently Asked Questions

What was the market size of the global concentrated nitric acid in 2022?

The market size of concentrated nitric acid was USD 26.2 Billion in 2022.

What is the CAGR of the global concentrated nitric acid market from 2023 to 2032?

The CAGR of concentrated nitric acid is 4.5% during the analysis period of 2023 to 2032.

Which are the key players in the concentrated nitric acid market?

The key players operating in the global market are including BASF SE, Dow Chemical Company, DuPont de Nemours, Inc., Eastman Chemical Company, Formosa Plastics Corporation, Hanwha Chemical Corporation, INEOS Group Holdings SA, Mitsubishi Chemical Corporation, Sumitomo Chemical Company Limited, The Chemours Company, UBE Industries, Ltd., and Yara International ASA.

Which region dominated the global concentrated nitric acid market share?

North America held the dominating position in concentrated nitric acid industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of concentrated nitric acid during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global concentrated nitric acid industry?

The current trends and dynamics in the concentrated nitric acid industry include rising demand for explosives and other chemicals in various industries such as mining, construction, and automotive.

Which application held the maximum share in 2022?

The ammonium nitrate application held the maximum share of the concentrated nitric acid industry.