Compressor Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Compressor Oil Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

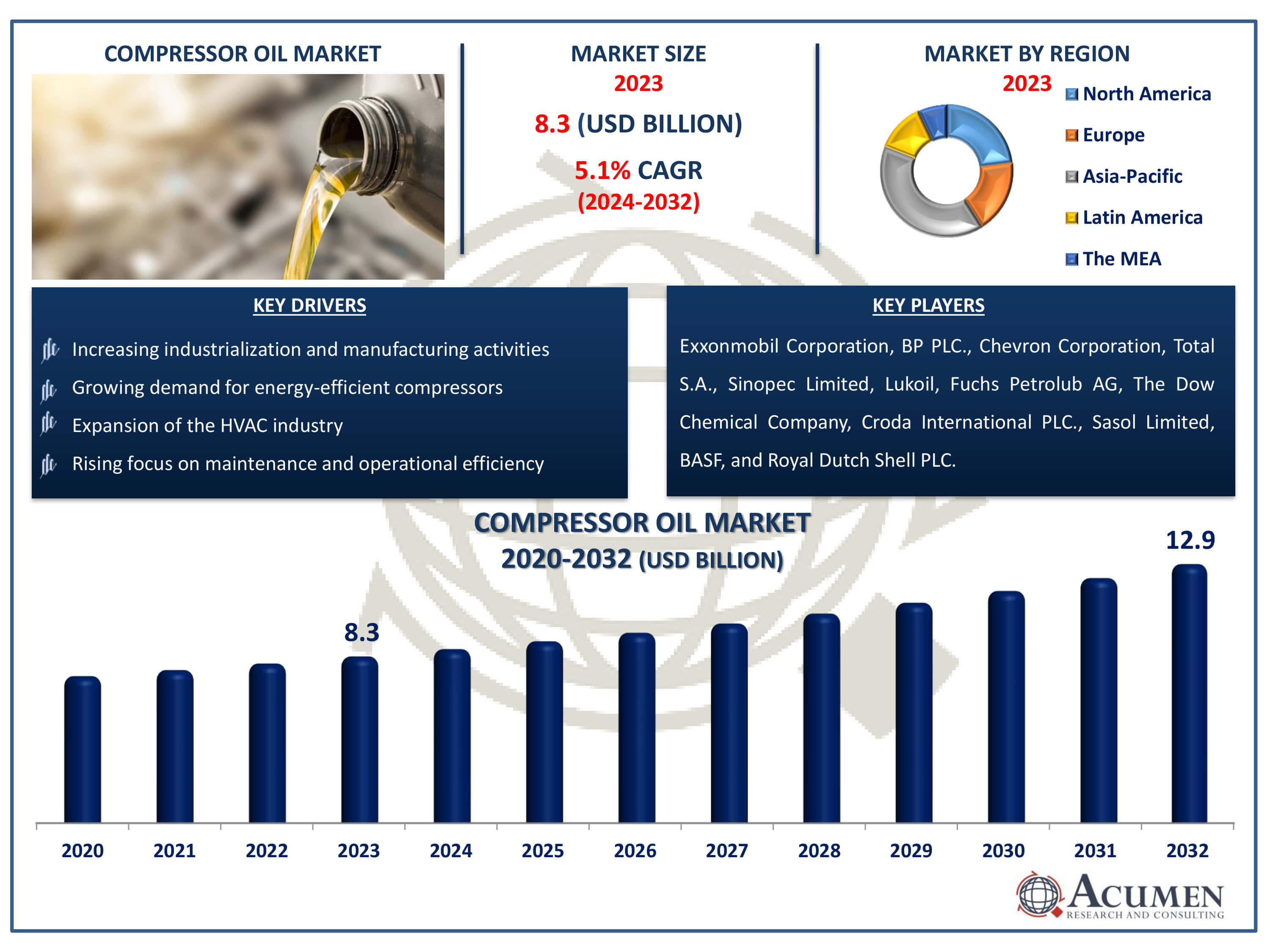

The Compressor Oil Market Size accounted for USD 8.3 Billion in 2023 and is estimated to achieve a market size of USD 12.9 Billion by 2032 growing at a CAGR of 5.1% from 2024 to 2032.

Compressor Oil Market Highlights

- Global compressor oil market revenue is poised to garner USD 12.9 billion by 2032 with a CAGR of 5.1% from 2024 to 2032

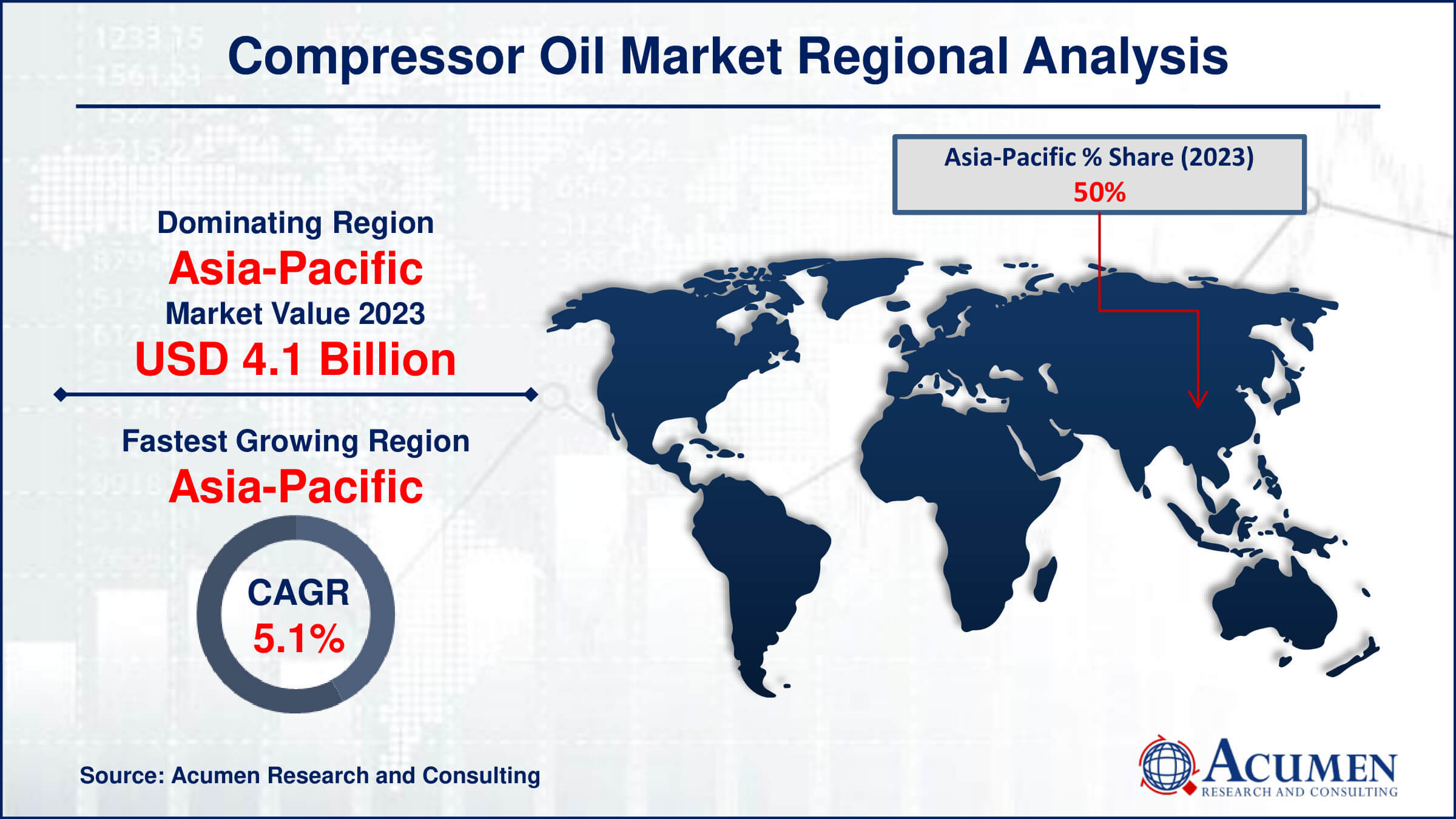

- Asia-Pacific compressor oil market value occupied around USD 4.1 billion in 2023

- Asia-Pacific compressor oil market growth will record a CAGR of more than 6% from 2024 to 2032

- Among oil type, the synthetic oil sub-segment generated significant revenue in 2023

- Based on end-use, the manufacturing sub-segment generated around 45% market share in 2023

- Growing demand for oil-free compressors is a popular compressor oil market trend that fuels the industry demand

Compressor oil is a specialized lubricant designed for use in air compressors. It serves multiple functions, including reducing friction between moving parts, dissipating heat, and minimizing wear and tear on the components. This oil also helps to prevent rust and corrosion within the compressor. It typically has a high viscosity to maintain an effective lubricating film under high pressure and temperature conditions. Unlike regular oils, compressor oil is formulated to handle the specific demands of compressors, such as preventing carbon build-up and providing a longer service life. The type of compressor oil used can vary depending on the compressor type, operating environment, and manufacturer's recommendations. Regular maintenance and oil changes are crucial for the optimal performance and longevity of the compressor.

Global Compressor Oil Market Dynamics

Market Drivers

- Increasing industrialization and manufacturing activities

- Growing demand for energy-efficient compressors

- Expansion of the HVAC industry

- Rising focus on maintenance and operational efficiency

Market Restraints

- High cost of synthetic compressor oils

- Environmental regulations on oil disposal

- Volatility in raw material prices

Market Opportunities

- Development of biodegradable and eco-friendly compressor oils

- Technological advancements in lubricant formulation

- Expansion in emerging markets

Compressor Oil Market Report Coverage

| Market | Compressor Oil Market |

| Compressor Oil Market Size 2022 | USD 8.3 Billion |

| Compressor Oil Market Forecast 2032 | USD 12.9 Billion |

| Compressor Oil Market CAGR During 2023 - 2032 | 5.1% |

| Compressor Oil Market Analysis Period | 2020 - 2032 |

| Compressor Oil Market Base Year |

2022 |

| Compressor Oil Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Compressor Type, By Oil Type, By Sales Channel, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Exxonmobil Corporation, BP PLC., Chevron Corporation, Total S.A., Sinopec Limited, Lukoil, Fuchs Petrolub AG, The Dow Chemical Company, Croda International PLC., Sasol Limited, BASF, and Royal Dutch Shell PLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Compressor Oil Market Insights

Producers of compressor oils must adhere to guidelines and strategies for the disposal of industrial oils due to environmental regulations. The increasing demand for bio-based products, driven by environmental concerns, is expected to significantly influence market growth. However, the high costs associated with the production of bio-based oils pose a challenge for market participants. Bio-based compressor oils have seen a notable increase in market share. Croda International Plc, a key player in this segment, aims to compete with major synthetic lubricant producers by introducing bio-based lubricants.

Compressor oils are primarily used as base oils in industrial compressors. Businesses in this sector often follow a franchise model to establish an effective distribution and sales network. This model allows them to reach a broader market while focusing on core competencies. Many industrial businesses recognize the need to either outsource their retail distribution or develop subsidiary businesses to manage this aspect effectively. The shift towards bio-based products is driven by increasing environmental concerns and regulatory pressures. Bio-based compressor oils are seen as a more sustainable alternative to traditional synthetic oils. They offer environmental benefits such as reduced carbon footprint and biodegradability. Despite their higher production costs, the growing emphasis on sustainability and environmental responsibility is likely to drive the demand for bio-based compressor oils.

Companies like Croda International Plc are leading the way by innovating and expanding their product lines to include more environmentally friendly options. The approval from the U.S. Department of Agriculture for Croda’s bio-based lubricants highlights the potential and acceptance of these products in the market. As the demand for sustainable products continues to rise, the compressor oil market is expected to evolve, with bio-based oils playing a crucial role in its future growth.

Compressor Oil Market Segmentation

The worldwide market for compressor oil is split based on compressor type, oil type, sales channel, end-use, and geography.

Compressor Oil Market By Compressor Type

- Positive Displacement Compressor

- Dynamic Compressor

According to compressor oil industry analysis, the positive displacement compressor segment stands out as the largest category. These compressors operate by trapping air in a chamber and reducing its volume to increase pressure. They are preferred for applications requiring high pressure and continuous operation, such as in industrial settings for manufacturing processes, refrigeration, and air conditioning. Positive displacements compressors offer precise control over output pressure and are known for their reliability and durability. The demand for compressor oils in this segment is driven by the need for efficient lubrication to ensure smooth operation and extended equipment lifespan. Manufacturers focus on formulating oils that can withstand high pressures and temperatures while providing excellent lubrication and protection against wear, making them essential for maintaining optimal performance in various industrial applications.

Compressor Oil Market By Oil Type

- Synthetic Oil

- Mineral Oil

- Semi Synthetic Oil

- Bio-based Oil

In the diverse landscape of the market, synthetic oils emerge as the dominant force and it is expected to grow over the compressor oil market forecast period. Engineered with advanced chemical formulations, synthetic oils offer unparalleled performance in terms of stability, temperature resistance, and longevity. Their molecular precision allows them to maintain viscosity under extreme conditions, ensuring consistent lubrication across a wide range of compressors. This reliability makes synthetic oils particularly favored in industries requiring stringent operational standards, such as aerospace and pharmaceutical manufacturing. While mineral oils still hold significant market share due to their cost-effectiveness, the shift towards synthetic alternatives is driven by the need for enhanced efficiency and reduced environmental impact. As technological advancements continue to refine synthetic oil formulations, their supremacy in the compressor oil market is expected to strengthen further, catering to the evolving demands of modern industrial applications.

Compressor Oil Market By Sales Channel

- OEM

- Aftermarket

Within the compressor oil market, the aftermarket segment emerges as the predominant channel for sales. This segment encompasses the distribution and sales of compressor oils after the initial sale of the compressor itself. It caters to a wide array of industries and businesses that rely on compressors for various applications, including manufacturing, automotive, and HVAC systems. The aftermarket channel thrives on the demand for replacement oils, maintenance products, and specialized lubricants tailored to specific compressor types and operational requirements. This demand is fueled by the need for ongoing maintenance, periodic oil changes, and upgrades to enhance compressor performance and longevity. Companies operating in the aftermarket segment often provide value-added services such as technical support, product customization, and rapid delivery, further solidifying its position as the primary sales channel in the compressor oil market.

Compressor Oil Market By End-Use

- Oil & Gas

- Automotive

- Power Generation

- HVAC-R

- Manufacturing

- Others

Among the several end-use sectors during the compressor oil market forecast period, manufacturing appears as the most important. This industry includes a wide range of businesses such as heavy machinery, metal fabrication, food processing, and electronics manufacturing, all of which rely significantly on compressors for various production processes. Compressor oils are critical in ensuring the efficiency and dependability of compressors used in various applications. They provide smooth operation, minimize wear and corrosion, and increase equipment life, reducing downtime and increasing production. The demand for compressor oils in manufacturing is driven by the continuous running of compressors in severe settings, as well as the strict requirements for consistent performance and dependability. As manufacturing processes become more automated and efficient, the demand for high-quality compressor oils adapted to specific operational circumstances grows, highlighting the manufacturing sector's critical role in the compressor oil market.

Compressor Oil Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Compressor Oil Market Regional Analysis

In terms of compressor oil market analysis, Asia-Pacific led the global industry in 2023, driven by robust growth in key end-user industries such as textiles, food processing, chemicals, and metalworking. This growth was bolstered by rapid urbanization and industrialization across the region, creating substantial demand for compressors and related lubricants. The diverse industrial landscape in Asia-Pacific provided fertile ground for market expansion, offering opportunities for innovative products tailored to niche applications. Visionary companies capitalized on this by introducing compressor oils with enhanced characteristics, such as improved thermal stability, extended service intervals, and environmental sustainability. These products not only catered to the specific needs of various industrial sectors but also addressed growing concerns over operational efficiency and environmental impact. As Asia Pacific continues to evolve as a manufacturing hub and consumer market, the region remains pivotal for strategic product launches and market growth initiatives in the compressor oil industry.

Compressor Oil Market Players

Some of the top compressor oil companies offered in our report includes Exxonmobil Corporation, BP PLC., Chevron Corporation, Total S.A., Sinopec Limited, Lukoil, Fuchs Petrolub AG, The Dow Chemical Company, Croda International PLC., Sasol Limited, BASF, and Royal Dutch Shell PLC.

Frequently Asked Questions

How big is the compressor oil market?

The compressor oil market size was valued at USD 8.3 billion in 2023.

What is the CAGR of the global compressor oil market from 2024 to 2032?

The CAGR of Compressor Oil is 5.1% during the analysis period of 2024 to 2032.

Which are the key players in the Compressor Oil market?

The key players operating in the global market are including ABB Group, Ametek Inc., ARC Systems, Inc., Asmo Co., Ltd., Baldor Electric Company, Inc., Brook Crompton UK Ltd., Dr. Fritz Faulhaber GmbH, Emerson Electric, Franklin Electric Co., Inc., Maxon Motors AG, Regal Beloit Corporation, Rockwell Automation, Inc., and Siemens AG

Which region dominated the global compressor oil market share?

Asia-Pacific held the dominating position in compressor oil industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of compressor oil during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global compressor oil industry?

The current trends and dynamics in the compressor oil industry include increasing industrialization and manufacturing activities, growing demand for energy-efficient compressors, expansion of the HVAC industry, and rising focus on maintenance and operational efficiency.

Which type held the maximum share in 2023?

The synthetic oil type segment held the notable share of the compressor oil industry.