Compact High Pressure Laminates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Compact High Pressure Laminates Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

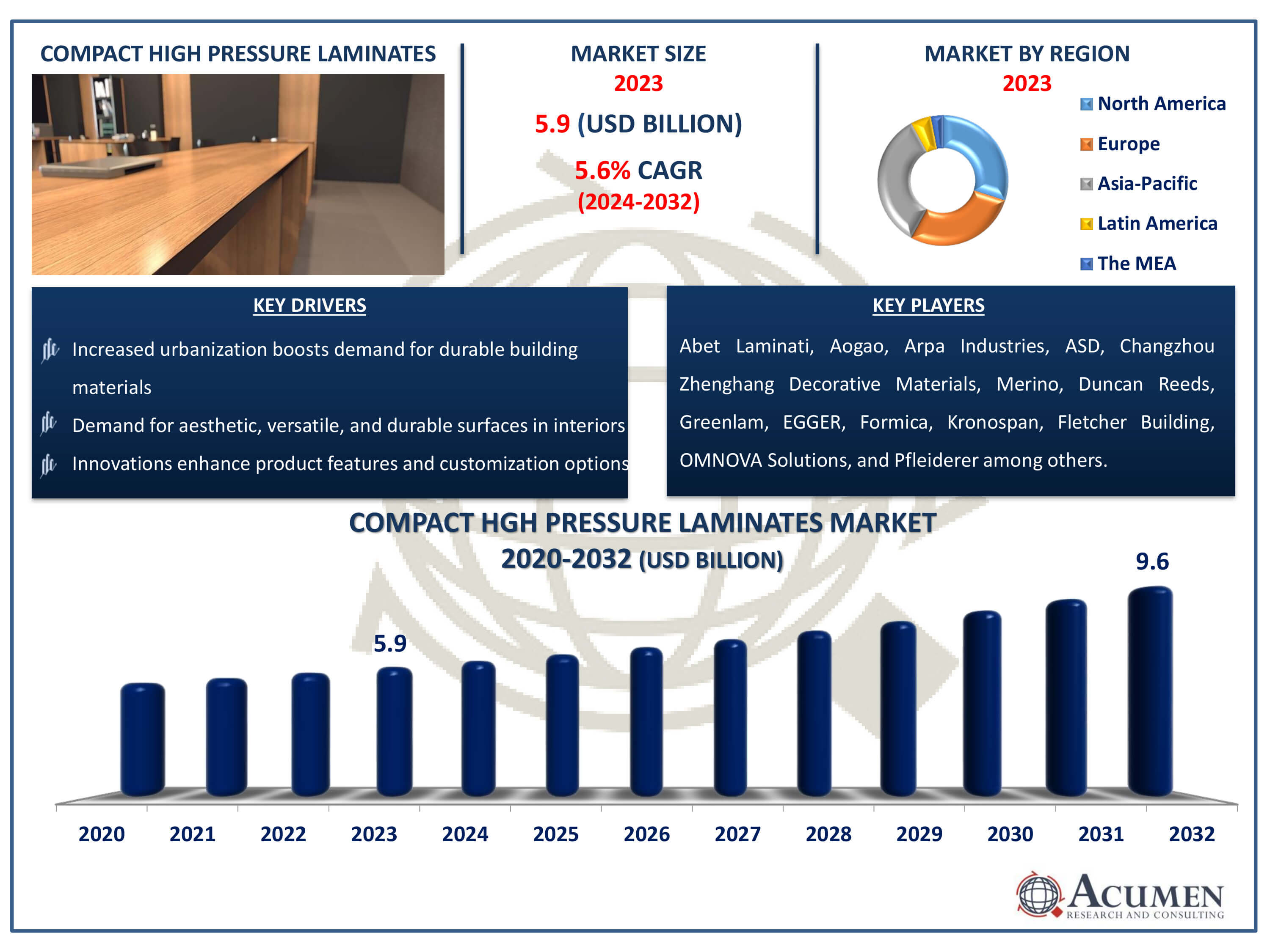

The Compact High Pressure Laminates Market Size accounted for USD 5.9 Billion in 2023 and is estimated to achieve a market size of USD 9.6 Billion by 2032 growing at a CAGR of 5.6% from 2024 to 2032.

Compact High Pressure Laminates Market Highlights

- Global compact high pressure laminates market revenue is poised to garner USD 9.6 billion by 2032 with a CAGR of 5.6% from 2024 to 2032

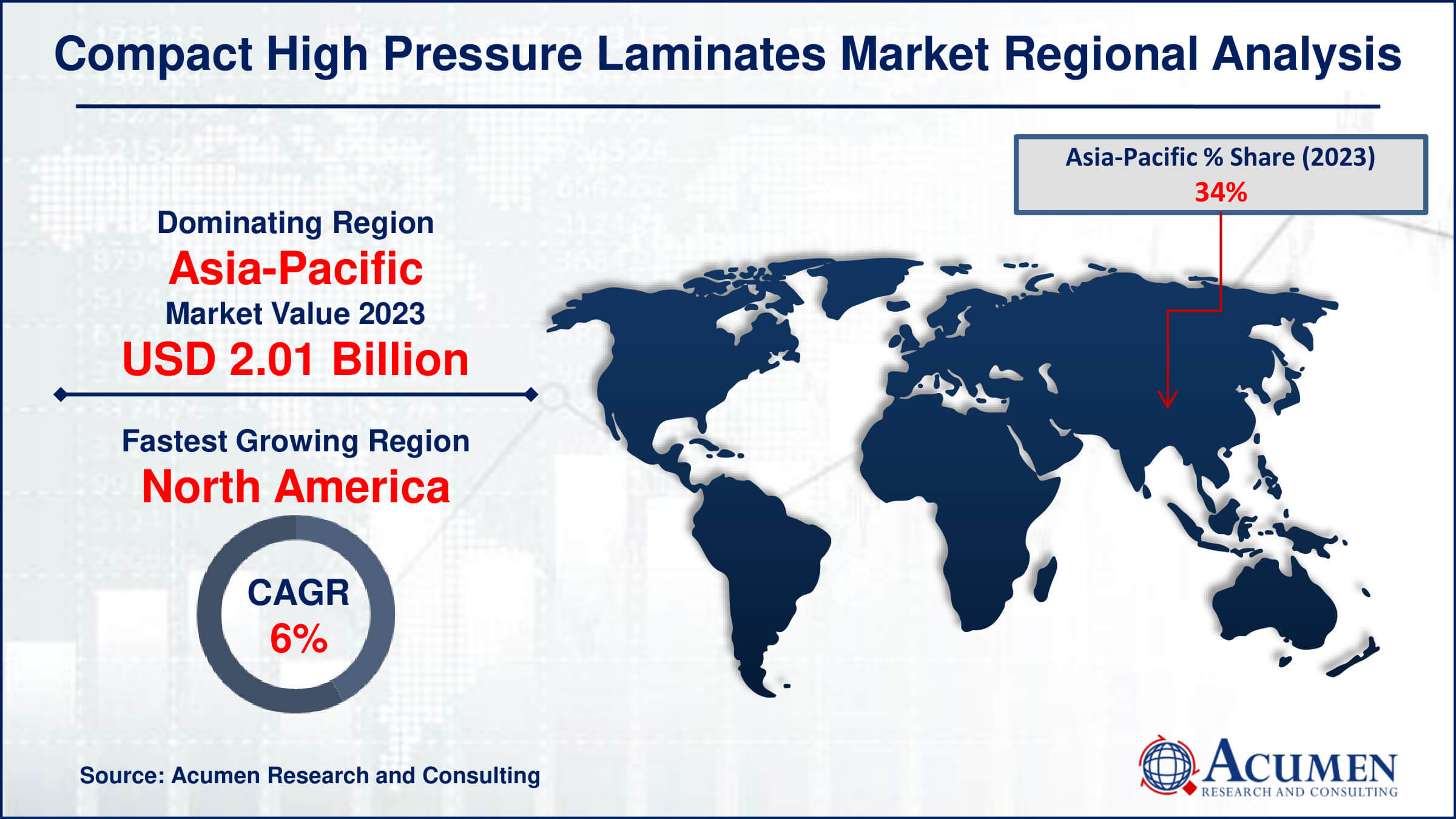

- Asia-Pacific compact high pressure laminates market value occupied around USD 2.01 billion in 2023

- North America compact high pressure laminates market growth will record a CAGR of 6% from 2024 to 2032

- Among type, the standard grade (S-Type) sub-segment gathered significant revenue in 2023

- Based on weight, the thickness above 4-8 mm sub-segment occupied utmost market share in 2023

- Integration of digital printing technology to achieve highly customizable and intricate designs on Compact HPL surfaces is a popular compact high pressure laminates market trend that fuels the industry demand

Compact high pressure laminates (HPL) are a durable and versatile surfacing material created through a process of pressing layers of kraft paper impregnated with phenolic resin, along with a decorative layer impregnated with melamine resin, under high pressure and temperature. This process produces a non-porous, solid, and durable laminate that is resistant to impact, heat, moisture, and scratches, making it an ideal choice for both horizontal and vertical applications. HPL is commonly used for Interior Design and Decors, cabinets, furniture, wall panels, and flooring in residential, commercial, and industrial settings due to its robustness and wide range of aesthetic options.

The high pressure used in the manufacturing process gives compact HPL its distinctive strength and stability. Unlike traditional laminates, compact HPL is self-supporting and can be used in applications where structural integrity is required without the need for additional support. This makes it especially suitable for high-traffic areas such as schools, hospitals, public restrooms, and other public buildings. Additionally, compact HPL is easy to maintain and clean, contributing to its popularity in environments that demand high hygiene standards.

Global Compact High Pressure Laminates Market Dynamics

Market Drivers

- Increased urbanization boosts demand for durable building materials

- Demand for aesthetic, versatile, and durable surfaces in interiors

- Innovations enhance product features and customization options

- Rising demand for sustainable and recycled materials in construction

Market Restraints

- Glass, metal, and stone preferred for aesthetics and durability

- Expensive manufacturing processes impact pricing and market accessibility

- Construction activity sensitive to economic downturns and market instability

Market Opportunities

- Increasing preference for environmentally sustainable construction materials

- Rapid urbanization in Asia-Pacific regions fuels market growth

- New uses in various industries drive market expansion and diversification

Compact High Pressure Laminates Market Report Coverage

| Market | Compact High Pressure Laminates Market |

| Compact High Pressure Laminates Market Size 2022 | USD 5.9 Billion |

| Compact High Pressure Laminates Market Forecast 2032 | USD 9.6 Billion |

| Compact High Pressure Laminates Market CAGR During 2023 - 2032 | 5.6% |

| Compact High Pressure Laminates Market Analysis Period | 2020 - 2032 |

| Compact High Pressure Laminates Market Base Year |

2022 |

| Compact High Pressure Laminates Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Thickness, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abet Laminati, Aogao, Arpa Industries, ASD, Changzhou Zhenghang Decorative Materials, Duncan Reeds, EGGER, Formica, Fletcher Building, Greenlam, Kronospan, Merino, OMNOVA Solutions, Pfleiderer, Royal Crown Laminates, Stylam, and Wilsonart. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Compact High Pressure Laminates Market Insights

The compact high pressure laminates market is driven by a combination of factors that contribute to its robust growth trajectory. The rapid expansion of the construction industry in emerging economies is a key driver, fueled by increased urbanization and infrastructure development in regions like Asia-Pacific. This surge in demand is met by HPL's versatility as a durable and aesthetically pleasing building material suitable for both residential and commercial projects. Moreover, the latest trends in interior design emphasizing durability, moisture-resistance, and visual appeal further propel the market growth as HPL effectively meets these demands.

In addition to these drivers, technological advancements also play a vital role in shaping the compact HPL market. Innovations in manufacturing processes and product customization have increased consumer interest and expanded application areas for HPL. This has led to increased adoption across various industries, including architecture, design, and construction.

Despite the numerous benefits of HPL, the market also faces challenges that can hinder its growth. One significant obstacle is the competition from alternative materials like glass, metal, and natural stone, which are often preferred for their superior aesthetic and durability qualities. Additionally, high production costs associated with the manufacturing process of HPL can be a barrier for smaller manufacturers and result in higher prices for end consumers. Furthermore, economic volatility can also impact the market by reducing construction activities and subsequently decreasing demand for HPL.

However, there are several opportunities that can be leveraged to drive compact high pressure laminated market growth. The increasing focus on environmentally sustainable construction practices presents a significant opportunity as consumers become increasingly aware of the importance of eco-friendly building materials. The demand for green building materials like eco-friendly and recycled HPL products is on the rise. Moreover, emerging markets offer substantial growth potential as rapid urbanization and increasing disposable incomes drive demand for new building materials like HPL.

Furthermore, innovative applications and new use cases in various industries can drive market expansion by providing diversified opportunities for HPL manufacturers and suppliers. As the demand for HPL continues to grow globally, it is essential to stay up-to-date with market trends and adapt to changing consumer preferences to maintain a competitive edge in this dynamic industry.

Compact High Pressure Laminates Market Segmentation

The worldwide market for compact high pressure laminates is split based on grade, thickness, application, and geography.

Compact High Pressure Laminates (HPL) Market By Grade

- Standard Grade (S-Type)

- Post-Forming Grade (P-Type)

- Flame-Retardant Grade (FR-Type)

- Chemical-Resistant Grade (CR-Type)

- Exterior Grade (X-Type)

According to the compact high pressure laminates industry analysis, the standard grade (S-Type) dominated the market in 2023. The widespread adoption of S-Type HPL can be attributed to its remarkable versatility, which has enabled it to meet the performance requirements of a vast array of applications in both residential and commercial settings. The versatility of S-Type HPL is one of its most significant advantages, allowing it to be used effectively in a wide range of applications where standard performance is sufficient.

The ease of availability and cost-effectiveness of S-Type HPL have also contributed to its popularity. The laminate's affordability and widespread availability have made it a preferred choice for manufacturers and end-users alike. As a result, S-Type HPL has become the go-to solution for a variety of applications, including furniture, cabinetry, and wall panels.

Compact High Pressure Laminates (HPL) Market By Thickness

- Thickness Below 4 mm

- Thickness 4-8 mm

- Thickness Above 8 mm

In 2023, the 4-8 mm thickness category held a significant compact high pressure laminates market share, driven by its versatility and balanced properties of durability, making it an ideal choice for a wide range of applications. This thickness range is particularly well-suited for use in various settings, including residential and commercial environments, where it can be used to create Interior Design and Decors, furniture, and wall panels. The 4-8 mm thickness category offers a unique combination of structural strength and ease of handling, which has made it a popular choice among end-users and manufacturers alike. Its adaptability and functionality have earned it widespread adoption across various industries, solidifying its position as a leading player in the market.

Compact High Pressure Laminates (HPL) Market By Application

- Interior Design And Décor

- Residential Buildings (Homes, Apartments)

- Hotels And Hospitality

- Retail Stores

- Offices

- Restaurants And Cafes

- Commercial Spaces

- Offices

- Retail Stores And Shopping Malls

- Banks And Financial Institutions

- Entertainment Venues (Theaters, Cinemas)

- Public Buildings

- Healthcare And Laboratory Facilities

- Hospitals

- Clinics And Medical Offices

- Laboratories (Research And Testing Facilities)

- Pharmacy Interiors

- Education And Institutional Settings

- Schools (Elementary, Middle, High Schools)

- Colleges And Universities

- Libraries

- Exterior Cladding And Facades

- Commercial Buildings

- Residential Buildings (Modern Architecture)

- Hotels And Hospitality

- Retail Displays

- Retail Stores

- Shopping Malls

- Others

- Toilet Cubicles

- Public Bathrooms

- Trade Shows

- Exhibitions

- Others

Compact high pressure laminates (HPL) are widely used in interior design and décor, including residential structures, hotels, retail establishments, workplaces, and restaurants. Compact HPL is highly prized in these contexts due to its versatility, durability, and aesthetic appeal. It is a practical alternative for designing elegant and functional surfaces such as countertops, furniture, wall panels, and cabinetry. Compact HPL's ability to offer a diverse selection of designs, textures, and colors enables designers and architects to create a variety of interior themes and styles while maintaining long-term durability and ease of maintenance. This application segment remains dominating because to the growing demand for high-performance materials that blend aesthetic versatility with practical usefulness in both residential and commercial settings.

Compact High Pressure Laminates Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Compact High Pressure Laminates Market Regional Analysis

The Asia-Pacific (APAC) region leads the compact high pressure laminates (HPL) market due to its rapid urbanization, growing construction activities, and increasing demand for durable and visually appealing building materials. Countries such as China, India, Japan, and Southeast Asia are driving significant growth through their expanding commercial spaces, residential construction projects, and infrastructure developments. The region's growing middle-class population with rising disposable incomes is fostering higher investments in modern interior design and architectural projects that value the versatility, durability, and cost-effectiveness of Compact HPL. Additionally, APAC's focus on sustainability and environmental regulations is driving the adoption of HPL, solidifying its dominant position in the global market.

The North American region remains a key player in the compact HPL market due to its mature construction industry, robust commercial sector, and stringent building codes that prioritize safety and durability. The United States and Canada witness significant demand for HPL in applications such as office spaces, retail environments, healthcare facilities, and educational institutions. Ongoing renovations in urban centers are driving growth, as Compact HPL is preferred for its ability to meet aesthetic demands while offering practical benefits like easy maintenance and resistance to wear and tear. The region's strong economy and technological advancements in manufacturing ensure a steady supply of high-quality HPL products that cater to diverse architectural needs, sustaining North America's prominent position in the global compact high pressure laminates market.

Compact High Pressure Laminates Market Players

Some of the top compact high pressure laminates companies offered in our report includes Abet Laminati, Aogao, Arpa Industries, ASD, Changzhou Zhenghang Decorative Materials, Duncan Reeds, EGGER, Formica, Fletcher Building, Greenlam, Kronospan, Merino, OMNOVA Solutions, Pfleiderer, Royal Crown Laminates, Stylam, and Wilsonart.

Frequently Asked Questions

How big is the compact high pressure laminates market?

The compact high pressure laminates market size was valued at USD 5.9 billion in 2023.

What is the CAGR of the global compact high pressure laminates market from 2024 to 2032?

The CAGR of compact high pressure laminates industry is 5.6% during the analysis period of 2024 to 2032.

Which are the key players in the compact high pressure laminates market?

The key players operating in the global market are including Abet Laminati, Aogao, Arpa Industries, ASD, Changzhou Zhenghang Decorative Materials, Duncan Reeds, EGGER, Formica, Fletcher Building, Greenlam, Kronospan, Merino, OMNOVA Solutions, Pfleiderer, Royal Crown Laminates, Stylam, and Wilsonart.

Which region dominated the global compact high pressure laminates market share?

Asia-Pacific held the dominating position in compact high pressure laminates industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of compact high pressure laminates during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global compact high pressure laminates industry?

The current trends and dynamics in the compact high pressure laminates industries include increased urbanization boosts demand for durable building materials, demand for aesthetic, versatile, and durable surfaces in interiors, and innovations enhance product features and customization options.

Which type held the maximum share in 2023?

The thickness 4-8 mm held the maximum share of the compact high pressure laminates industry.