Command And Control Systems Market | Acumen Research and Consulting

Command and Control Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

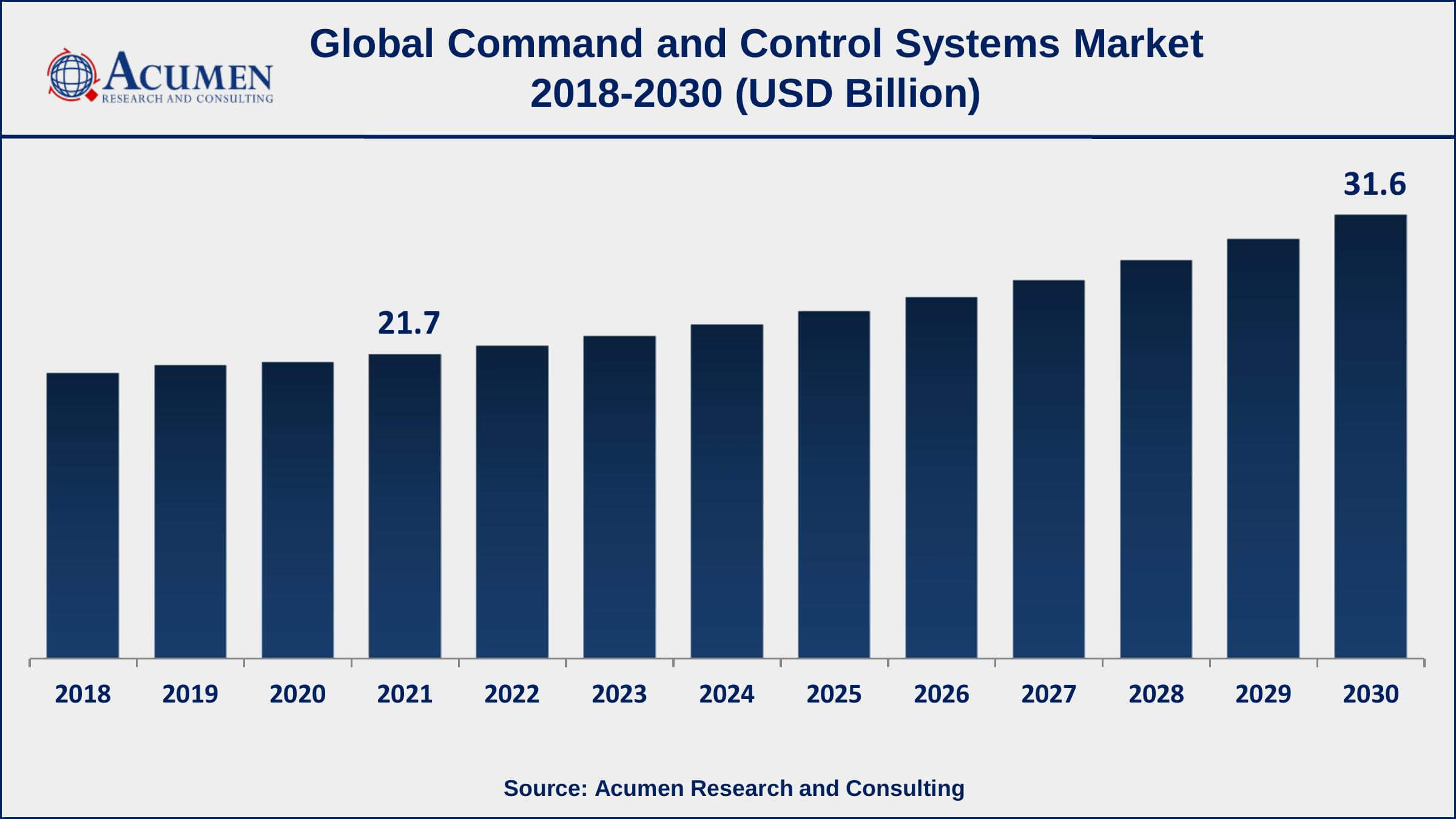

The Global Command and Control Systems Market Size accounted for USD 21.7 Billion in 2021 and is estimated to achieve a market size of USD 31.6 Billion by 2030 growing at a CAGR of 4.4% from 2022 to 2030. The growing demand for situational awareness in the defense, surveillance systems, utilities, law enforcement, and manufacturing industries, combined with an increase in terrorist activity, is likely to fuel the command and control systems market growth. Furthermore, expanding multinational military operations and growing terrorist impact and occurrences in the Middle East are projected to drive the command and control systems market value in the coming years.

Command and Control Systems Market Report Key Highlights

- Global command and control systems market revenue is expected to increase by USD 31.6 billion by 2030, with a 4.4% CAGR from 2022 to 2030

- North America region led with more than 43% of Command and Control Systems market share in 2021

- Asia-Pacific command and control systems market growth will observe strongest CAGR from 2022 to 2030

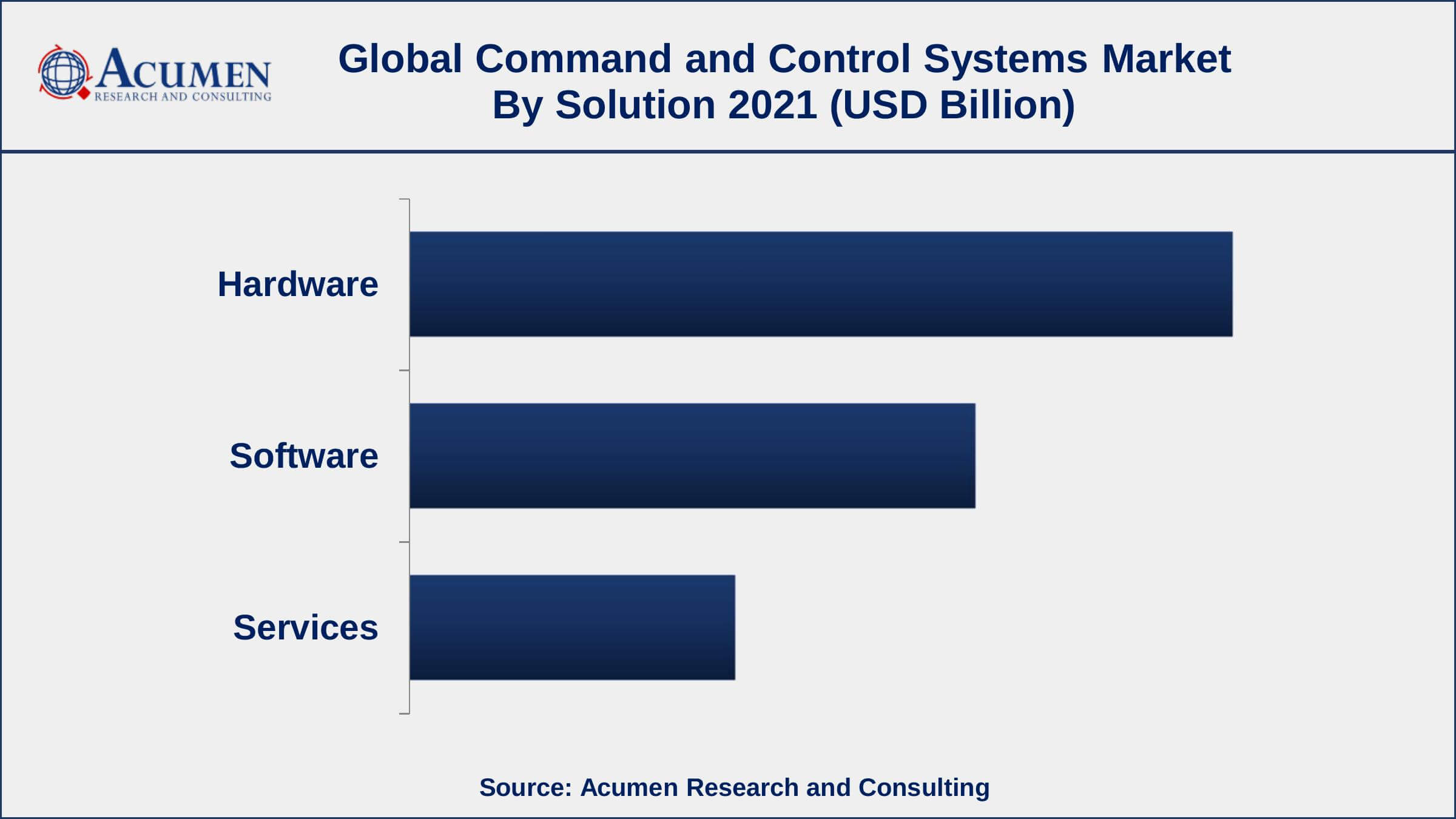

- By solution, the hardware segment has accounted market share of over 48% in 2021

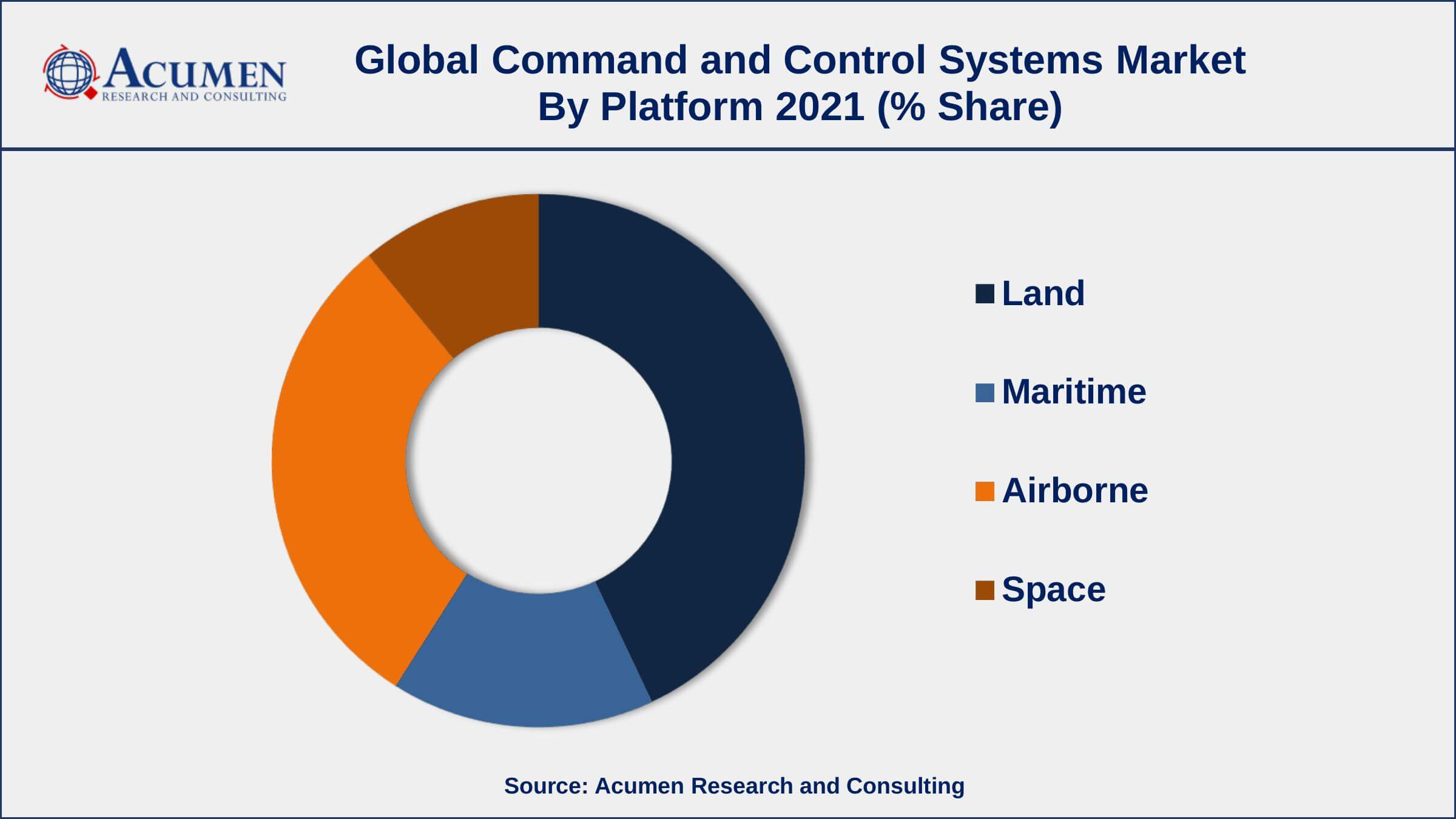

- By platform, land segment engaged more than 42% of the total market share in 2021

- Growing number of terror incidents, drives the command and control systems market size

A command and control system is a collection of buildings, equipment, procedures, communications, and hardware required to conduct military operational activities. It also includes conceptualizing, allocating resources, deploying forces, and monitoring. It helps military organizations organize, direct, & control operations-assigned units while also improving individual performance. Computerized combat direction technologies are being used in complicated multi-threat scenarios to deal with the huge number of hits and shortened response time of conventional combat.

Global Command and Control Systems Market Trends

Market Drivers

- Increase in terror incidents

- Growing need for improved situational awareness in traffic control and industrial production

- Broadening military expenditure over the globe

- Increasing the use of AI, machine learning, and IoT to aid decision-making

Market Restraints

- High development and maintenance costs

- Threats from cyberattacks

Market Opportunities

- Rise of 5G to encourage the implementation of smart city solutions

- Rapid application in transport, healthcare, and law enforcement sectors

Command and Control Systems Market Report Coverage

| Market | Command and Control Systems Market |

| Command and Control Systems Market Size 2021 | USD 21.7 Billion |

| Command and Control Systems Market Forecast 2030 | USD 31.6 Billion |

| Command and Control Systems Market CAGR During 2022 - 2030 | 4.4% |

| Command and Control Systems Market Analysis Period | 2018 - 2030 |

| Command and Control Systems Market Base Year | 2021 |

| Command and Control Systems Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Solution, By Application, By Platform, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | General Dynamics, Lockheed Martin Corporation, Rockwell Collins, Thales Group, BAE Systems, Rolta India Limited, Leonardo SPA, The Boeing Company, Elbit Systems Ltd., Siemens AG, Saab AB, Northrop Grumman Corporation, and CACI International Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Some of the factors which are playing an important part in the growth of the command and control systems market include expanding demand from military division, rising populace, expanding industrialization and urbanization, expanding military spending plans of Asian nations, innovative progressions in the military & defense sector, increasing prominence of terrorist activities in the Middle East, expanding rates of geopolitical clashes and terrorist attacks between nations, expanding adoption of command and control systems in business applications, and stringent government rules and guidelines. In addition, expanding awareness concerning the technological advantages of command and control systems, for instance, data trade, circumstance evaluation, and operational control are some factors that are driving the market growth of command and control systems over the forecast period.

The combination of command and control systems in existing stages is expected to drive global market growth. Different technological innovations in the market, for instance, cloud computing and big data analytics, among others are projected to prompt the advancement of business command and control systems. The establishments in basic framework, transportation parts, and homeland security are different up-and-coming uses of command and control systems. These systems are utilized in maritime, land, sea, space, and airborne-based defense operations. Additionally, these systems are planned to meet the needs of defense and military forces in battlefield activities.

The rising requirement for situational awareness in military, security, and reconnaissance, law authorization, utilities, and assembling enterprises combined with a disturbing increase in terrorist attacks are projected to drive the global market growth. Expanding worldwide mindfulness seeing the technical advantages, for instance, circumstance evaluation, data trade, and operational control can rise the demand. Besides, quickly advancing defense innovation and developing territorial clashes are anticipated to support the selection of these systems in the military & defense segment.

Command and Control Systems Market Segmentation

The global command and control systems market segmentation is based on solution, application, platform, and geography.

Command and Control Systems Market By Solution

- Hardware

- Software

- Services

According to the command and control systems market forecast, the software segment is expected to grow at the fastest rate in the coming years. Advanced digital control software, intrusion detection, and prevention software, cyber security software, & physical information security software solutions are all part of this market. The software allows sophisticated sensors, GPS, as well as other devices used in command centers to function properly. In the near future, the increasing use of intelligent systems in command centers is likely to boost segment growth.

Command and Control Systems Market By Application

- Defense

- Commercial

According to a command and control systems industry analysis, the defense is holding a significant market share in 2021. During the projected timeline, it is expected to increase at a rapid pace. Effective administration of military assets, increased situational awareness, increased environmental security, and protection of vital facilities, borders, & seashores are some of the variables taken into account for growth in the government & defense segment, and consequently the command and control system market, throughout the forecast timeframe.

Command and Control Systems Market By Platform

- Land

- Maritime

- Airborne

- Space

In terms of applications, the land segment is expected to account for the biggest revenue share of the global market over the forecast period. The land platform segment is anticipated to represent the most noteworthy market share of the global market of command and control systems over the estimated time period. Command and control systems for land powers included air protection, fighting the executives, and atomic barrier. Aside from defense applications, land-based command and control systems are being utilized for different transportation systems. Correspondence Based Train Control (CBTC) and European Train Control System (ETRS) are land-based railroad signaling and command systems. Air Traffic Management (ATM) and Vessel Traffic Management (VTM) are other transportation sectors utilizing command and control systems. Other rising applications of land-based business command and control systems incorporate basic foundation and mechanical applications for the security of the executives and observing.

The maritime segment is projected to register a significant rate of growth over the forecasted time frame. Developing interests in maritime advancement over the world alongside expanding worldwide exchange activities and the use of cargos in marine exchange is adding to the segment development. Innovative progressions offer advantages, for example, higher productivity in battlefield activities, situational awareness, viable arranging, and basic leadership in mission-basic circumstances.

Command and Control Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Asia-Pacific Region Is Likely To Have Considerable Market Growth In The Future Years

The Asia-Pacific market is anticipated to witness a growth of significant CAGR in the global command and control systems market over the estimated time frame. The Asia-Pacific market is projected to encounter broad development during the following couple of years. The increment in military and defense spending among nations in the Asia-Pacific region is projected to grow the demand for command and control systems. The increase in clashes among neighboring nations in the Asia-Pacific region and the risks of developing terrorism are some reasons that can drive the target market. Because of geopolitical pressures in the South China Sea and outskirt issues in different nations, the procurement of different C4ISR systems for military and homeland security applications is projected to rise across the Asia-Pacific region.

Command and Control Systems Market Players

Some of the top command and control systems market companies offered in the professional report include General Dynamics, Lockheed Martin Corporation, Rockwell Collins, Thales Group, BAE Systems, Rolta India Limited, Leonardo SPA, The Boeing Company, Elbit Systems Ltd., Siemens AG, Saab AB, Northrop Grumman Corporation, and CACI International Inc.

Frequently Asked Questions

What is the size of global command and control systems market in 2021?

The estimated value of global command and control systems market in 2021 was accounted to be USD 21.7 Billion.

What is the CAGR of global command and control systems market during forecast period of 2022 to 2030?

The projected CAGR command and control systems market during the analysis period of 2022 to 2030 is 4.4%.

Which are the key players operating in the market?

The prominent players of the global command and control systems market are General Dynamics, Lockheed Martin Corporation, Rockwell Collins, Thales Group, BAE Systems, Rolta India Limited, Leonardo SPA, The Boeing Company, Elbit Systems Ltd., Siemens AG, Saab AB, Northrop Grumman Corporation, and CACI International Inc.

Which region held the dominating position in the global command and control systems market?

North America held the dominating command and control systems market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for command and control systems market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global command and control systems market?

Increase in terror incidents, and growing need for improved situational awareness in traffic control and industrial production drives the growth of global command and control systems market.

By application segment, which sub-segment held the maximum share?

Based on application, defense output segment is expected to hold the maximum share of the command and control systems market.