Collagen Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Collagen Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

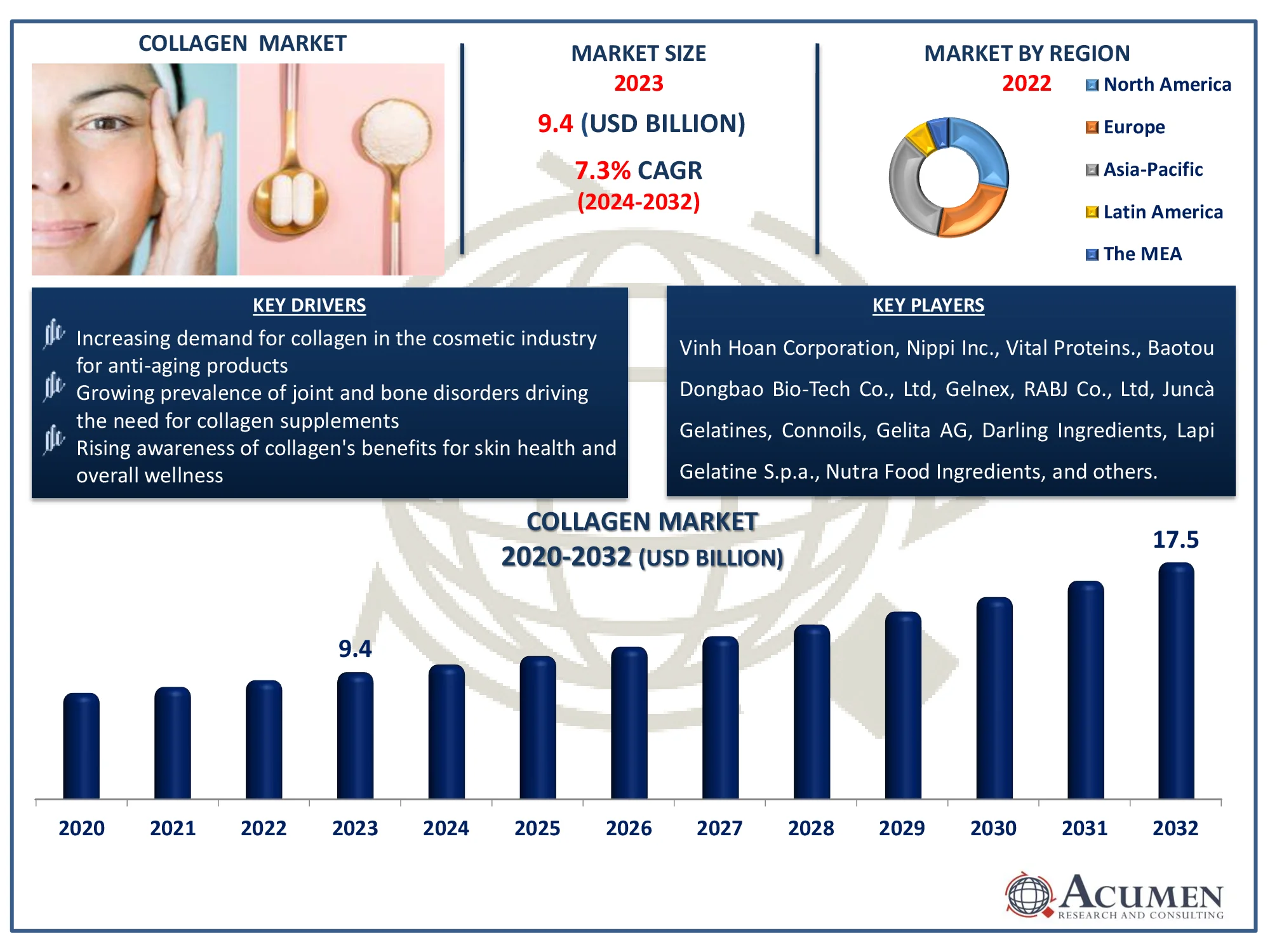

The Global Collagen Market Size accounted for USD 9.4 Billion in 2023 and is estimated to achieve a market size of USD 17.5 Billion by 2032 growing at a CAGR of 7.3% from 2024 to 2032.

Collagen Market Highlights

- Global collagen market revenue is poised to garner USD 17.5 billion by 2032 with a CAGR of 7.3% from 2024 to 2032

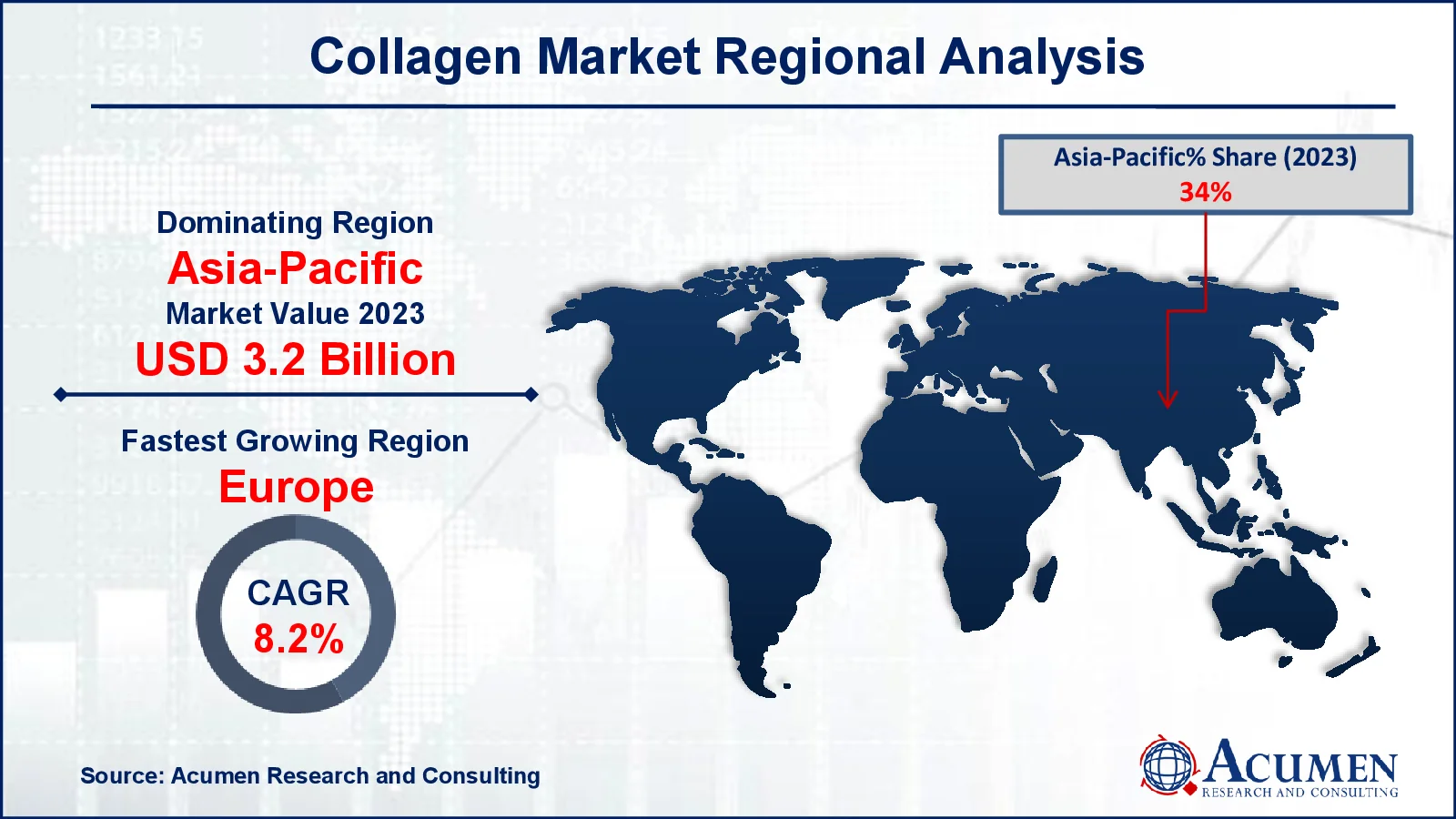

- Asia-Pacific collagen market value occupied around USD 3.2 billion in 2023

- Europe collagen market growth will record a CAGR of more than 8.2% from 2024 to 2032

- Among product type, the gelatin sub-segment generated 66% of the market share in 2023

- Based on source, the bovine sub-segment occupied USD 3.3 billion revenue in 2023

- Based on application, the food & beverages sub-segment generated 57% of market share in 2023

- Expansion in plant-based collagen alternatives is the collagen market trend that fuels the industry demand

Collagen is a structural protein found abundantly in the connective tissues of animals, providing strength and elasticity to tissues such as skin, tendons, and ligaments. It consists of three intertwined polypeptide chains forming a triple helix structure. Collagen plays a crucial role in maintaining skin elasticity and firmness, supporting joint health, and aiding in tissue repair. In the medical field, it is used in wound dressings, surgical implants, and as a scaffold for tissue engineering. In cosmetics, collagen is utilized in anti-aging products to enhance skin hydration and reduce wrinkles. Additionally, it finds applications in the food industry as a gelling agent and in the production of collagen-based supplements for joint and bone health.

Global Collagen Market Dynamics

Market Drivers

- Increasing demand for collagen in the cosmetic industry for anti-aging products

- Growing prevalence of joint and bone disorders driving the need for collagen supplements

- Rising awareness of collagen's benefits for skin health and overall wellness

Market Restraints

- High cost of collagen-based products limiting consumer accessibility

- Lack of standardization and quality control in the collagen market

- Potential allergic reactions and safety concerns related to collagen supplements

Market Opportunities

- Expansion of collagen applications in functional foods and beverages

- Growth of the geriatric population driving demand for health and wellness products

- Innovations in collagen production methods and sustainable sourcing

Collagen Market Report Coverage

| Market | Collagen Market |

| Collagen Market Size 2022 |

USD 9.4 Billion |

| Collagen Market Forecast 2032 | USD 17.5 Billion |

| Collagen Market CAGR During 2023 - 2032 | 7.3% |

| Collagen Market Analysis Period | 2020 - 2032 |

| Collagen Market Base Year |

2022 |

| Collagen Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Vinh Hoan Corporation, Nippi Inc., Vital Proteins., Baotou Dongbao Bio-Tech Co., Ltd, Gelnex, RABJ Co., Ltd, Juncà Gelatines, Connoils, Gelita AG, Darling Ingredients, Lapi Gelatine S.p.a., Nutra Food Ingredients, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Collagen Market Insights

The rising demand for anti-aging products in the cosmetic industry is significantly boosting the collagen market. Collagen, a key protein that helps maintain skin elasticity and firmness, is increasingly sought after in skincare formulations to combat signs of aging. For instance, according to National Institute of Health, collagen, a key ingredient in many cosmetic products, is valued for its natural humectant and moisturizing properties. As the cosmetic industry consistently pursues new and effective solutions, the source of collagen becomes an important focus of research and innovation. As consumers prioritize youthful, radiant skin, beauty brands are incorporating collagen into their products, driving collagen market growth.

Potential allergic reactions and safety concerns pose significant restraints to the collagen market. Some individuals may experience adverse reactions such as rashes, itching, or gastrointestinal issues, raising safety concerns about the supplements. These issues can deter consumers from using collagen products and hinder market growth. Additionally, lack of standardized quality control measures can exacerbate these risks, affecting overall consumer trust and market acceptance.

The increasing geriatric population is significantly driving the demand for health and wellness products, particularly collagen supplements, due to their potential benefits in maintaining skin elasticity, joint health, and overall vitality. For instance, according to World Health Organization, China is experiencing one of the world's fastest-growing aging populations. By 2040, the proportion of people aged 60 and older in China is expected to reach 28%, driven by increased life expectancy and declining fertility rates. As aging individuals seek ways to manage and mitigate age-related issues, collagen's role in promoting better health becomes more prominent. This growing awareness and demand create a lucrative opportunity for the collagen market to expand and innovate.

Collagen Market Segmentation

The worldwide market for collagen is split based on product type, source, application, and geography.

Collagen Product Types

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

- Synthetic Collagen

- Others

According to the collagen industry analysis, gelatin leads the collagen market primarily due to its widespread applications in food, pharmaceuticals, and cosmetics. Its cost-effectiveness, ease of use, and functional properties make it a preferred choice for various products, from gelling agents in desserts to encapsulation in supplements. Additionally, gelatin's versatile nature and established supply chains contribute to its dominance. For instance, in October 2022, PB Leiner expanded its gelwoR Dsolve medicinal gelatin line with the introduction of three new products: Dsolve B, Dsolve P, and Dsolve xTRA. As a result, it consistently outpaces other collagen forms in both production and consumption.

Collagen Sources

- Bovine

- Porcine

- Poultry

- Marine

- Others

The bovine segment is the largest source category in the collagen market and it is expected to increase over the industry, due to its high availability and cost-effectiveness compared to other sources. Bovine collagen is widely used in various applications, including pharmaceuticals, cosmetics, and food products, due to its favorable properties and ease of extraction. As demand for collagen continues to grow, the bovine segment is expected to expand further, driven by its established supply chain and broad applicability. This trend reflects the increasing adoption of collagen in diverse industries and the ongoing developments.

Collagen Applications

- Food & Beverages

- Nutritional Products

- Snacks & Cereals

- Dairy Products

- Beverages

- Meat & Poultry

- Bakery & Confectionery Products

- Pharmaceutical & Healthcare

- Cosmetics & Personal Care Products

- Others

According to the collagen industry forecast, the food and beverages application segment dominates the market due to the growing consumer demand for protein-enriched and health-focused products. Collagen's benefits, such as improving skin elasticity and joint health, make it a popular ingredient in dietary supplements, functional foods, and beverages. Its versatility in enhancing texture and nutritional value drives its widespread use in these products. Additionally, the rise of health-conscious consumers and increased awareness of collagen's benefits contribute significantly to this segment's market leadership.

Collagen Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Collagen Market Regional Analysis

For several reasons, the Asia-Pacific region leads the global collagen market due to its large population, and growing demand for health and beauty products. The rising awareness of collagen's benefits in skin care, joint health, and nutritional supplements drives market growth. Additionally, the region's strong presence of major collagen producers and advancements in biotechnology contribute to its dominance. For instance, in June 2023, Jellice India Private Limited, Ashok Matches, and Timber Industries Private Limited agreed to acquire a 75% stake in Narmada Gelatines Limited from Alfamont Mauritius Ltd. for INR 1 billion. The evolving consumer preferences further solidify Asia-Pacific's market leadership.

Europe is experiencing rapid growth in the collagen market due to increasing demand for collagen-based supplements driven by a rising awareness of health and wellness. The region's aging population is also contributing to this growth, as collagen is known for its benefits in maintaining skin elasticity and joint health. For instance, in 2023, England has 11 million people aged over 65. This number is expected to rise by 10% over the next five years and by 32% by 2043. Additionally, innovations in collagen production and its incorporation into various cosmetic and dietary products are boosting market expansion.

Collagen Market Players

Some of the top collagen companies offered in our report include Vinh Hoan Corporation, Nippi Inc., Vital Proteins., Baotou Dongbao Bio-Tech Co., Ltd, Gelnex, RABJ Co., Ltd, Juncà Gelatines, Connoils, Gelita AG, Darling Ingredients, Lapi Gelatine S.p.a., Nutra Food Ingredients, and others.

Frequently Asked Questions

How big is the collagen market?

The collagen market size was valued at USD 9.4 billion in 2023.

What is the CAGR of the global collagen market from 2024 to 2032?

The CAGR of collagen is 7.3% during the analysis period of 2024 to 2032.

Which are the key players in the collagen market?

The key players operating in the global market are including Vinh Hoan Corporation, Nippi Inc., Vital Proteins., Baotou Dongbao Bio-Tech Co., Ltd, Gelnex, RABJ Co., Ltd, Juncà Gelatines, Connoils, Gelita AG, Darling Ingredients, Lapi Gelatine S.p.a., Nutra Food Ingredients.

Which region dominated the global collagen market share?

Asia-Pacific held the dominating position in collagen industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of collagen during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global collagen industry?

The current trends and dynamics in the collagen industry include increasing demand for collagen in the cosmetic industry for anti-aging products, growing prevalence of joint and bone disorders driving the need for collagen supplements, and rising awareness of collagen's benefits for skin health and overall wellness.

Which product type held the maximum share in 2023?

The gelatin product type held the maximum share of the collagen industry.