Cold Chain Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cold Chain Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

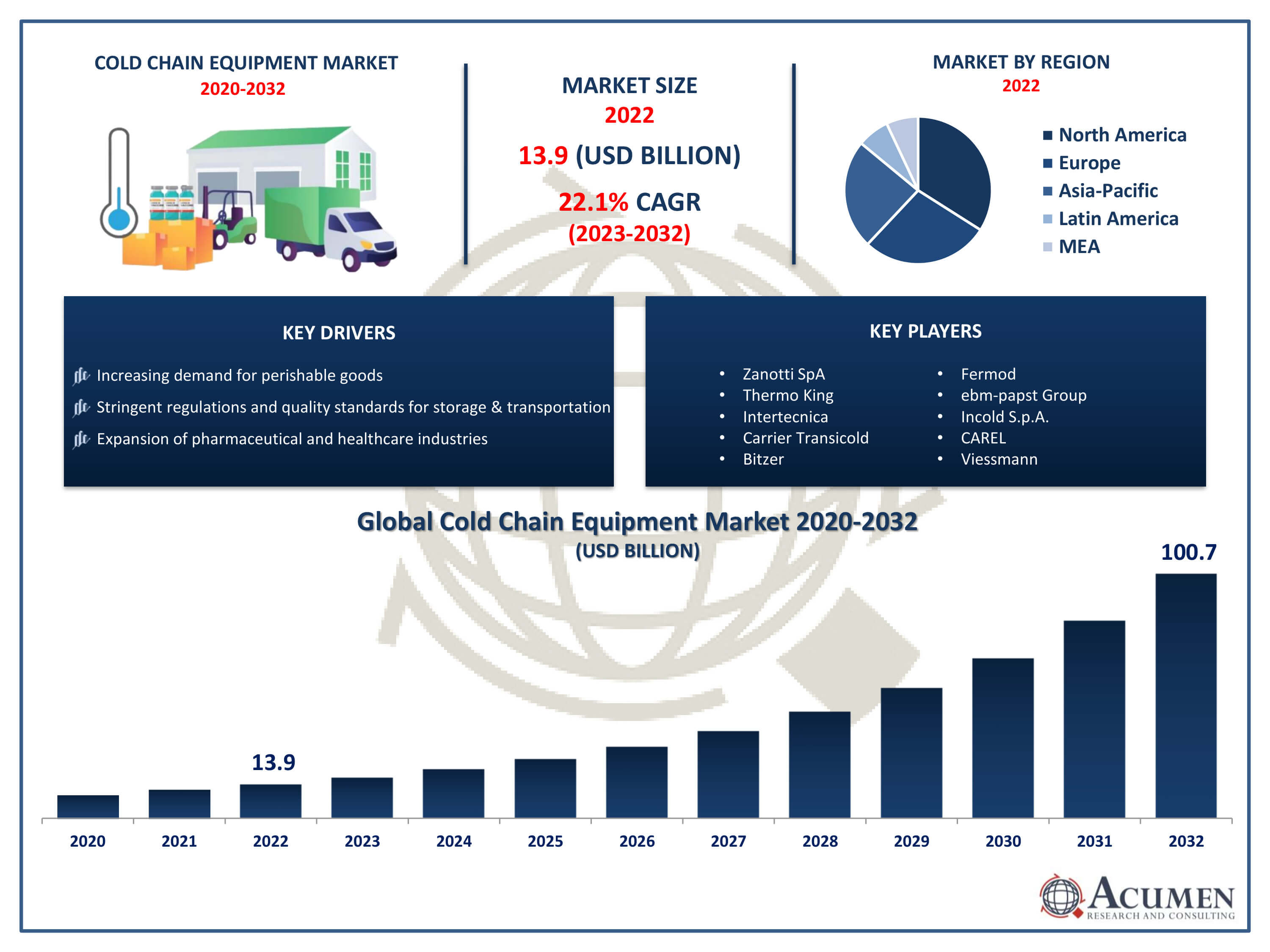

The Cold Chain Equipment Market Size accounted for USD 13.9 Billion in 2022 and is projected to achieve a market size of USD 100.7 Billion by 2032 growing at a CAGR of 22.1% from 2023 to 2032.

Cold Chain Equipment Market Highlights

- Global cold chain equipment market revenue is expected to increase by USD 100.7 billion by 2032, with a 22.1% CAGR from 2023 to 2032

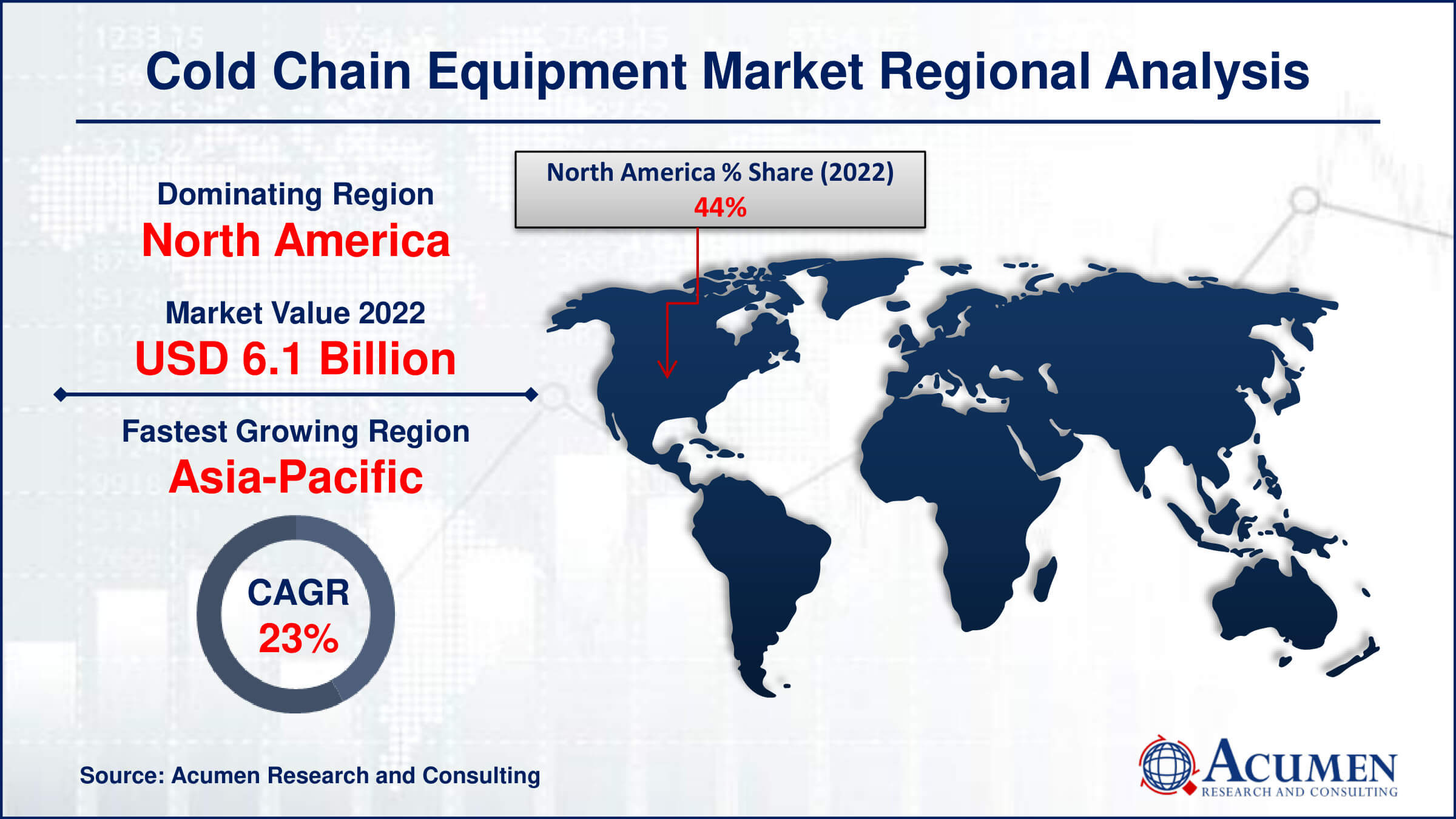

- North America region led with more than 44% of cold chain equipment market share in 2022

- Asia-Pacific cold chain equipment market growth will record a CAGR of more than 23.3% from 2023 to 2032

- By type, the storage equipment is the largest segment of the market, accounting for over 75% of the global market share

- By application, the meat is one of the largest and fastest-growing segments of the cold chain equipment industry

- Increasing demand for perishable goods, especially in emerging economies, drives the cold chain equipment market value

Cold chain equipment includes a variety of specialized machinery and infrastructure designed to maintain consistent temperatures for storing, transporting, and handling temperature-sensitive products such as pharmaceuticals, food items, and chemicals. This equipment comprises refrigerated storage units, transport containers, temperature monitoring devices, and refrigeration systems. The cold chain is crucial for ensuring the quality, safety, and effectiveness of perishable goods throughout the supply chain, from production to consumption.

Cold chain equipment includes a variety of specialized machinery and infrastructure designed to maintain consistent temperatures for storing, transporting, and handling temperature-sensitive products such as pharmaceuticals, food items, and chemicals. This equipment comprises refrigerated storage units, transport containers, temperature monitoring devices, and refrigeration systems. The cold chain is crucial for ensuring the quality, safety, and effectiveness of perishable goods throughout the supply chain, from production to consumption.

Recently, the global market for cold chain equipment has grown significantly due to several factors. A key driver is the rising demand for perishable goods, especially in emerging economies where urbanization and changing consumer preferences have increased the consumption of fresh and frozen foods. Additionally, stringent regulations and quality standards from regulatory authorities and industry bodies regarding the storage and transportation of temperature-sensitive products have driven the adoption of cold chain equipment. Moreover, advancements in refrigeration technology, including the development of energy-efficient and eco-friendly refrigerants, have further fueled market growth by reducing operating costs and minimizing environmental impact.

Global Cold Chain Equipment Market Trends

Market Drivers

- Increasing demand for perishable goods, especially in emerging economies

- Stringent regulations and quality standards for storage and transportation

- Advancements in refrigeration technology, including energy efficiency and eco-friendly refrigerants

- Expansion of pharmaceutical and healthcare industries

- Growth of e-commerce and online grocery platforms, driving demand for last-mile delivery solutions

Market Restraints

- High initial investment and operating costs associated with cold chain equipment

- Lack of infrastructure in certain regions, especially in developing countries

Market Opportunities

- Technological innovations leading to the development of more efficient and cost-effective equipment

- Rising demand for cold chain solutions in the pharmaceutical and biotechnology sectors

Cold Chain Equipment Market Report Coverage

| Market | Cold Chain Equipment Market |

| Cold Chain Equipment Market Size 2022 | USD 13.9 Billion |

| Cold Chain Equipment Market Forecast 2032 |

USD 100.7 Billion |

| Cold Chain Equipment Market CAGR During 2023 - 2032 | 22.1% |

| Cold Chain Equipment Market Analysis Period | 2020 - 2032 |

| Cold Chain Equipment Market Base Year |

2022 |

| Cold Chain Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Zanotti SpA, Thermo King, Intertecnica, Carrier Transicold, Bitzer, Fermod, ebm-papst Group, Incold S.p.A., CAREL, Viessmann, Kelvion, Schmitz Cargobull, Rivacoldsrl, CHG Europe BV, and Kason Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cold chain equipment includes various tools and infrastructure designed to keep perishable goods at controlled temperatures during storage and transportation. This equipment, such as refrigeration units, insulated containers, temperature monitoring devices, and special packaging, helps maintain the quality and safety of products that need to stay cool. The cold chain is essential in industries like pharmaceuticals, food and beverages, chemicals, and biotechnology, ensuring items like vaccines, fresh produce, dairy, and seafood stay safe and effective from production to consumption. In the pharmaceutical industry, cold chain equipment is crucial for keeping drugs and vaccines, which are sensitive to temperature changes, safe and effective. Vaccines, for example, must be kept at specific temperatures during distribution to remain potent. Cold chain equipment ensures these products are stored and transported within the required temperature ranges, meeting regulatory and quality standards.

The market for cold chain equipment has been growing rapidly in recent years due to several factors. As more people consume perishable goods, especially in developing countries, there's a greater need for reliable storage and transport systems to maintain product quality. This demand is also driven by strict regulations and quality standards from authorities, which require advanced cold chain equipment for compliance. Technological advancements, like energy-efficient and environmentally friendly refrigeration systems, have further boosted market growth by improving efficiency and reducing costs. Additionally, the growth of industries like pharmaceuticals and healthcare, where temperature control is critical, has increased the adoption of cold chain equipment.

Cold Chain Equipment Market Segmentation

The global cold chain equipment market segmentation is based on type, application, and geography.

Cold Chain Equipment Market By Type

- Storage Equipment

- On-grid

- Off-grid

- Others

- Transportation Equipment

According to the cold chain equipment industry analysis, in 2022, storage equipment made up the largest share of the market. This growth is mainly due to the rising need for efficient and reliable storage solutions for products that need to stay at specific temperatures. As industries like pharmaceuticals, healthcare, and food continue to grow, there's an increasing demand for specialized storage facilities that can keep products safe and intact by maintaining precise temperature control. This need is especially strong in developing countries, where more people are moving to cities and buying perishable goods.

Technological improvements in cold storage equipment have also helped the market grow. Companies are constantly creating better storage solutions with improved insulation, energy efficiency, and temperature monitoring. These improvements not only make storage equipment work better but also save money and help the environment. Additionally, strict regulations and quality standards set by authorities require advanced storage equipment to meet safety and quality guidelines.

Cold Chain Equipment Market By Application

- Meat

- Bakery & Confectionary

- Dairy & Frozen Desserts

- Processed Food

- Vegetables & Fruits

- Pharmaceuticals

- Others

The meat segment within application category is expected to grow significantly in the cold chain equipment industry forecast period. This growth is due to several factors increasing the need for temperature-controlled storage and transportation. One main reason is the rising global consumption of meat products, driven by higher incomes, urbanization, and changing diets. As people demand fresher and higher-quality meat, there is a greater need for cold chain infrastructure to keep these perishable items safe, high-quality, and with a longer shelf life.

Strict regulations and food safety standards set by authorities worldwide are also pushing meat producers and distributors to invest in advanced cold chain equipment. To comply with these regulations, they must maintain precise temperature control throughout the supply chain, from slaughterhouses to retail stores. This has led to more use of refrigerated storage units, transport containers, and temperature monitoring devices designed for the meat industry. Furthermore, technological advancements in refrigeration systems, such as the development of energy-efficient and eco-friendly refrigerants, are boosting market growth by improving the efficiency and sustainability of cold chain operations.

Cold Chain Equipment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cold Chain Equipment Market Regional Analysis

In terms of cold chain equipment market analysis, North America leads the industry due to several key factors. The region has advanced infrastructure and a strong logistics network, crucial for the efficient storage and transportation of temperature-sensitive products. With well-developed cold chain facilities like refrigerated warehouses, distribution centers, and temperature-controlled transportation, North American businesses can meet strict requirements for product safety and quality. The thriving food and pharmaceutical industries also heavily depend on cold chain logistics. Additionally, stringent regulations from agencies like the FDA and USDA push companies to invest in advanced cold chain solutions. Technological innovation in refrigeration systems further boosts North America's market dominance.

Meanwhile, the Asia-Pacific region is the fastest-growing market for cold chain equipment. This growth is driven by increasing urbanization, rising incomes, and changing consumer preferences for fresh and high-quality products. Expanding industries such as food and pharmaceuticals, along with improving infrastructure and technological advancements, are contributing to the rapid development of cold chain logistics in this region.

Cold Chain Equipment Market Player

Some of the top cold chain equipment market companies offered in the professional report include Zanotti SpA, Thermo King, Intertecnica, Carrier Transicold, Bitzer, Fermod, ebm-papst Group, Incold S.p.A., CAREL, Viessmann, Kelvion, Schmitz Cargobull, Rivacoldsrl, CHG Europe BV, and Kason Industries, Inc.

Key Industry Developments

- In March 2023, Trane Technologies, a company known for making things that help control the temperature in buildings, approved the use of a special kind of fuel made from plants called HVO instead of diesel fuel in their Thermo King cold chain solutions. This new fuel doesn't harm the environment as much because it produces 90% less greenhouse gases and over 30% less dirty particles. Trane Technologies made sure this fuel worked well by testing it a lot, including using it successfully with a big food seller.

- In December 2022, A.P. Moller Maersk unveiled a state-of-the-art facility in Norway, meticulously crafted to cater to the intricate demands of the expansive Norwegian fish industry. This advanced hub ensures flawless supply chain integration, with a special emphasis on facilitating the transportation of frozen and chilled goods for customers.

- In June 2021, Stockhabo got bigger by buying Frigologix, a company that stores things in cold places. With this deal, Stockhabo gained three new places in Belgium where they can keep stuff cold: Herk de-Stad, Lommel, and Val-de-Meuse. Now, Stockhabo has more space to store things, with enough room for 235,000 pallets. This means they can make more money by storing more things for their customers.

Frequently Asked Questions

How big is the cold chain equipment market?

The cold chain equipment market size was USD 13.9 Billion in 2022.

What is the CAGR of the global cold chain equipment market from 2023 to 2032?

The CAGR of cold chain equipment is 22.1% during the analysis period of 2023 to 2032.

Which are the key players in the cold chain equipment market?

The key players operating in the global market are including Zanotti SpA, Thermo King, Intertecnica, Carrier Transicold, Bitzer, Fermod, ebm-papst Group, Incold S.p.A., CAREL, Viessmann, Kelvion, Schmitz Cargobull, Rivacoldsrl, CHG Europe BV, and Kason Industries, Inc.

Which region dominated the global cold chain equipment market share?

North America held the dominating position in cold chain equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cold chain equipment during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cold chain equipment industry?

The current trends and dynamics in the cold chain equipment market growth include increasing demand for perishable goods, especially in emerging economies, and stringent regulations and quality standards for storage and transportation.

Which type held the maximum share in 2022?

The storage equipment type held the maximum share of the cold chain equipment industry.