Coil Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Coil Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

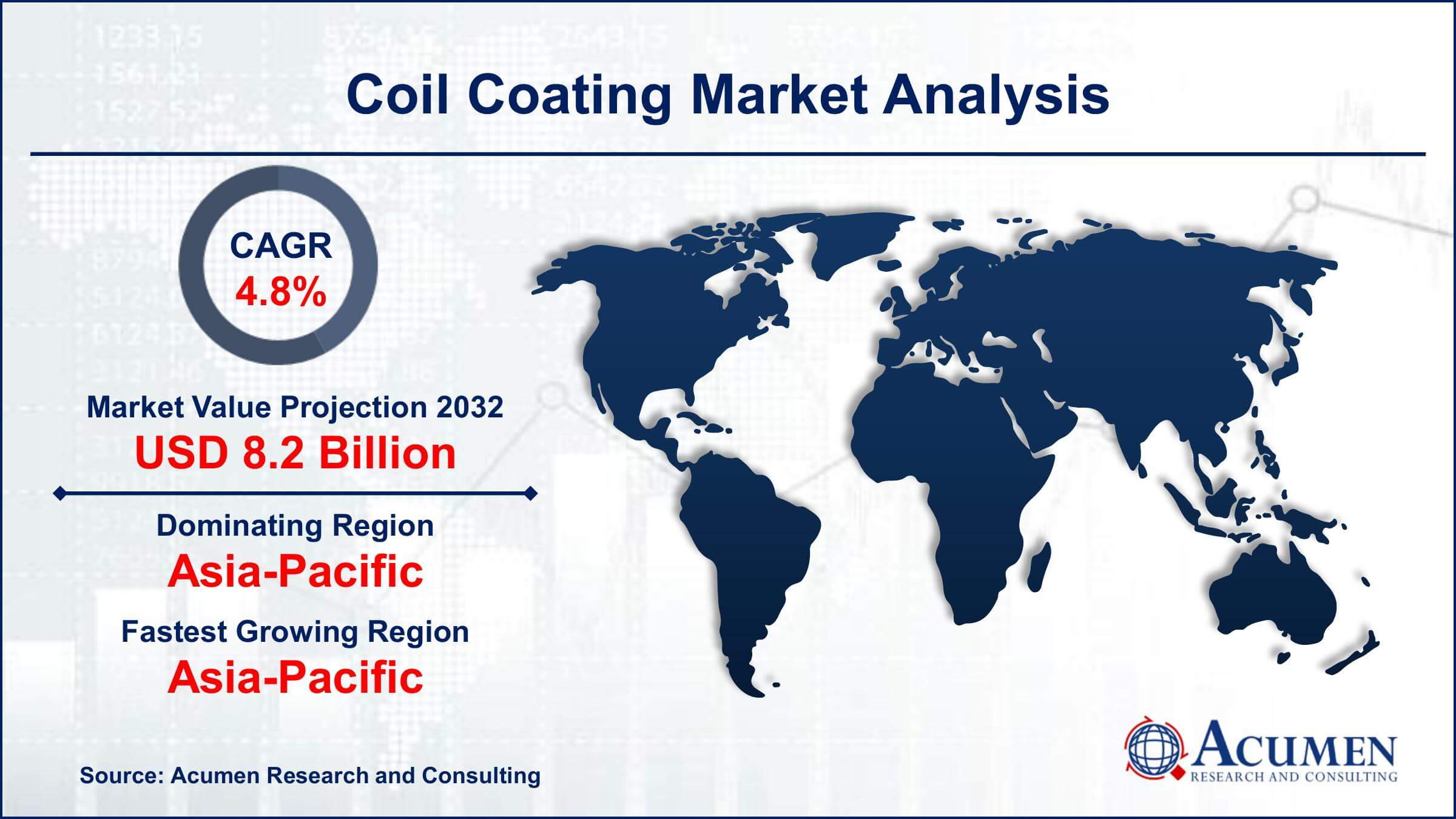

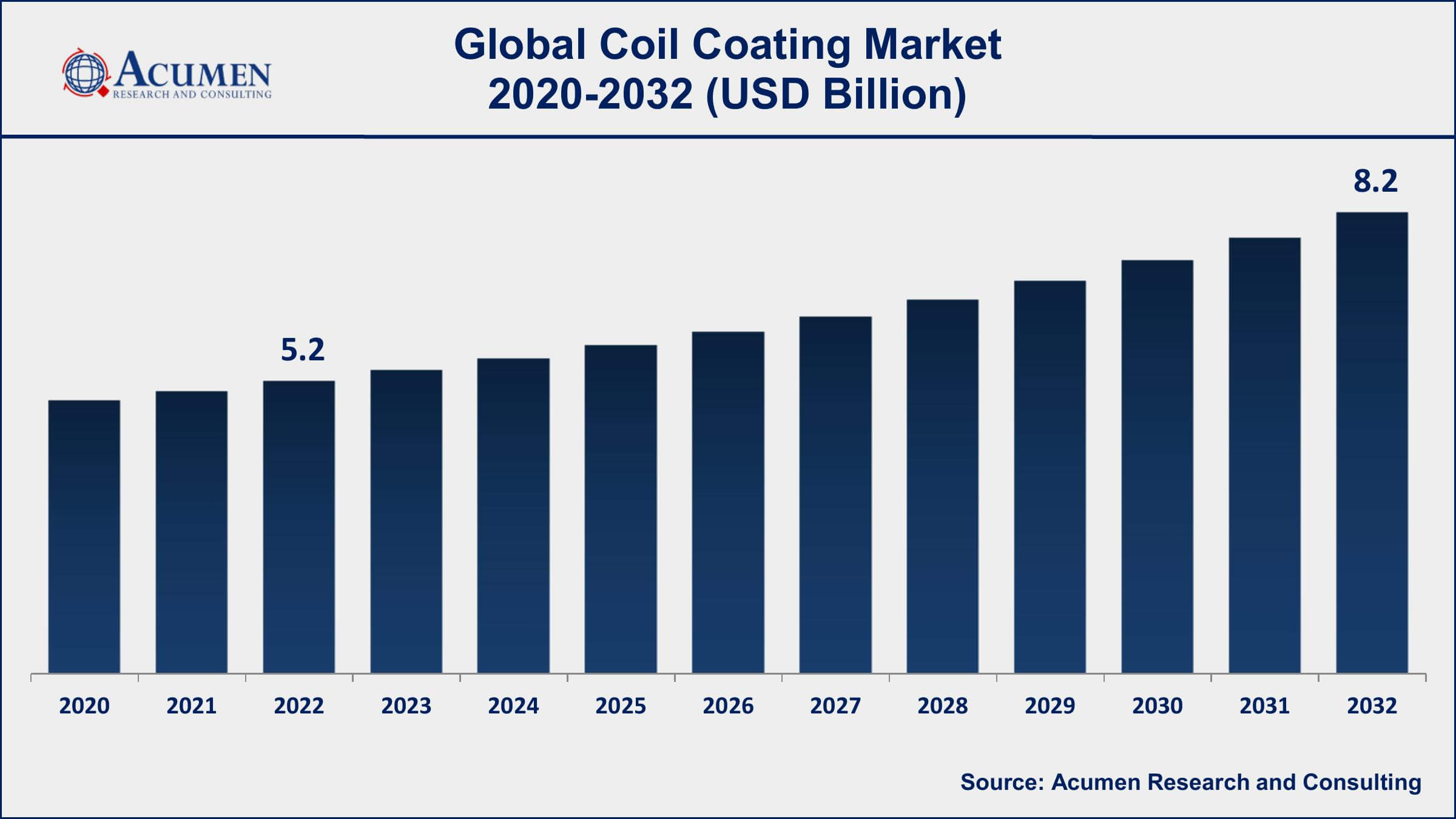

The Global Coil Coating Market Size accounted for USD 5.2 Billion in 2022 and is projected to achieve a market size of USD 8.2 Billion by 2032 growing at a CAGR of 4.8% from 2023 to 2032.

Coil Coating Market Highlights

- Global coil coating market revenue is expected to increase by USD 8.2 Billion by 2032, with a 4.8% CAGR from 2023 to 2032

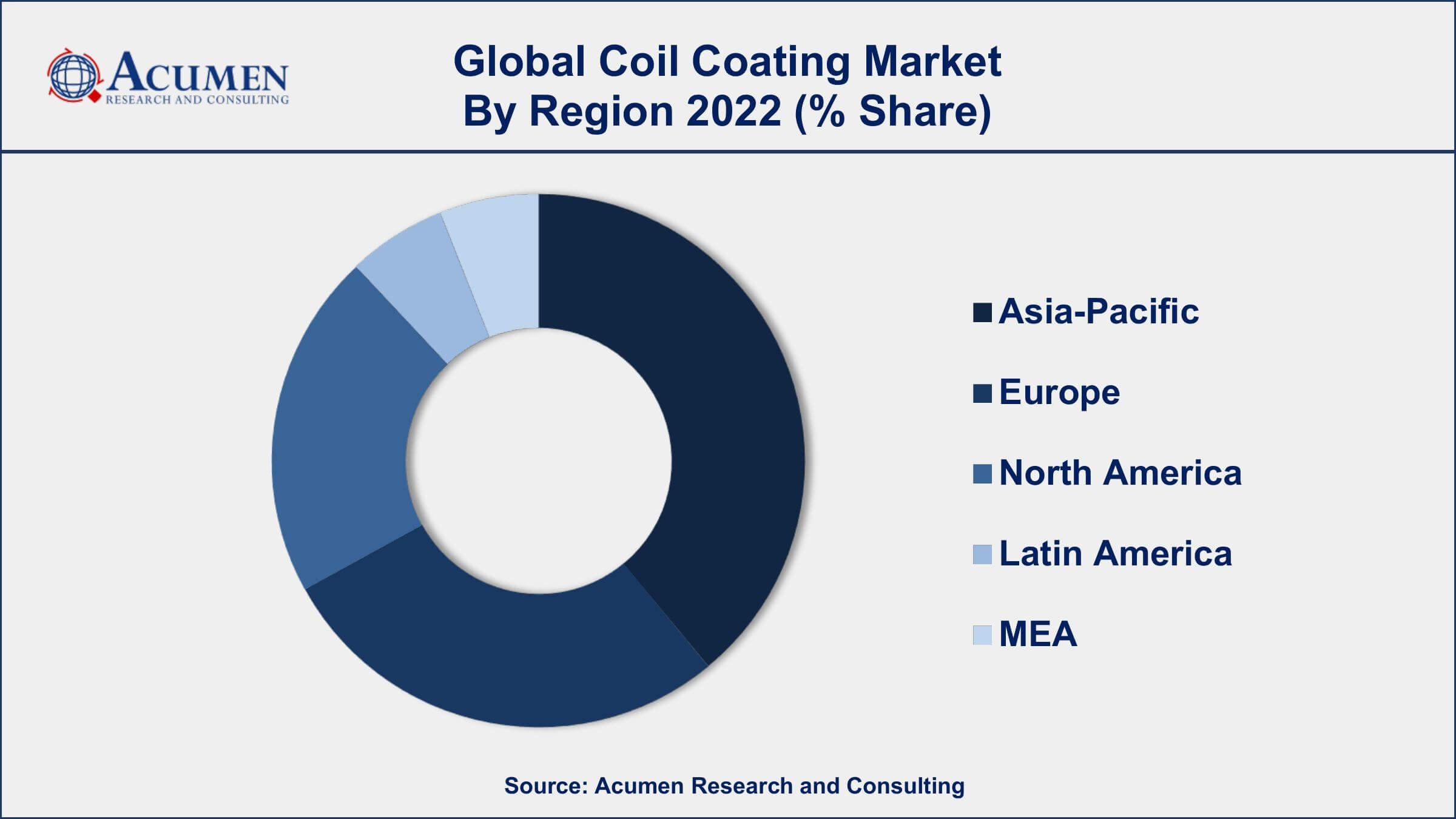

- Asia-Pacific region led with more than 39% of coil coating market share in 2022

- Steel is the most commonly used substrate material in the coil coating, accounting for over 71% of the market share

- Polyester resins are the most widely used coating type in the coil coating market, accounting for over 42% of the market share

- The building and construction industry is the largest end-use industry for coil-coated products, accounting for over 47% of the market share

- Growing demand for coil coated products in the construction industry, drives the coil coating market value

Coil coating is a continuous and automated process used for coating metal coils, typically made of steel or aluminum, with a thin layer of paint or other protective coating. The coated coils are then used for a variety of applications, including roofing, wall panels, automotive parts, and appliances. Coil coating offers numerous benefits, such as improved corrosion resistance, enhanced durability, and cost-effectiveness, as it allows for the precise application of coatings in a controlled environment.

The global coil coating market has been witnessing significant growth in recent years, driven by the increasing demand for coated metal coils across various end-use industries. The construction sector, in particular, is a major consumer of coil-coated products, as it is widely used in the production of building and construction materials. The automotive industry is also a key market for coil coatings, as the demand for lightweight and fuel-efficient vehicles is growing, leading to increased use of coated aluminum and steel components. Additionally, the growing awareness about the benefits of coil coatings, such as reduced maintenance costs, is further fueling the coil coating market growth.

Global Coil Coating Market Trends

Market Drivers

- Growing demand for coil coated products in the construction industry

- Increasing use of coated metal coils in the automotive industry

- Improved durability and corrosion resistance offered by coil coatings

- Cost-effectiveness of coil coating compared to traditional painting methods

Market Restraints

- Volatility in raw material prices

- Stringent environmental regulations regarding the use of coil coatings

Market Opportunities

- Increasing demand for eco-friendly and sustainable coil coatings

- Growing use of coated metal coils in the packaging industry

Coil Coating Market Report Coverage

| Market | Coil Coating Market |

| Coil Coating Market Size 2022 | USD 5.2 Billion |

| Coil Coating Market Forecast 2032 | USD 8.2 Billion |

| Coil Coating Market CAGR During 2023 - 2032 | 4.8% |

| Coil Coating Market Analysis Period | 2020 - 2032 |

| Coil Coating Market Base Year | 2022 |

| Coil Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin, By Metal Type, By End-User Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AkzoNobel N.V., BASF SE, Beckers Group, Nippon Paint Co. Ltd., PPG Industries Inc., Kansai Paint Co. Ltd., The Valspar Corporation, Axalta Coating Systems LLC, Henkel AG & Co. KGaA, The Sherwin-Williams Company, Wacker Chemie AG, and Jotun A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Coil coating is a process of coating metal coils with a thin layer of paint or other protective coating. The process involves cleaning and pre-treating the metal surface, applying the coating using roll coating techniques, and then curing the coating in an oven. The coated metal coils are then used in various industries such as construction, automotive, appliances, and packaging. Coil coating provides a number of benefits, such as improved corrosion resistance, enhanced durability, and cost-effectiveness, as it allows for the precise application of coatings in a controlled environment.

In the construction industry, coil-coated metal is used in a wide range of applications such as roofing, wall panels, and building facades. The use of coated metal in construction provides several advantages such as improved energy efficiency, reduced maintenance, and improved aesthetics. Coil-coated metal is also widely used in the automotive industry, particularly for exterior body panels, as it provides lightweight and durable solutions. In the appliance industry, coil-coated metal is used for various applications such as refrigerators, air conditioners, and washing machines, where durability and aesthetics are key factors.

The global coil coating market has been experiencing significant growth in recent years, owing to the increasing demand for coated metal coils across various end-use industries. The construction sector is a major consumer of coil-coated products, as it is widely used in the production of building and construction materials. Additionally, the automotive industry is also a key market for coil coatings, as the demand for lightweight and fuel-efficient vehicles is growing, leading to increased use of coated aluminum and steel components.

Coil Coating Market Segmentation

The global coil coating market segmentation is based on resin, metal type, end-user industry, and geography.

Coil Coating Market By Resin

- Polyester resins

- Polyurethane (PU) resins

- Polyvinylidene Fluorides (PVDF) resins

- Siliconized polyester resins

- Plastisol resins

- Others

According to the coil coating industry analysis, the polyester resins segment accounted for the largest market share in 2022. This growth is owing to the increasing demand for high-performance coatings in various end-use industries, such as construction, automotive, and appliances. Polyester resins are particularly suitable for coil coating applications, as they offer superior weather ability, flexibility, and resistance to UV radiation. The growth of the polyester resins segment can be attributed to several factors, such as the increasing demand for high-quality coil coatings with enhanced properties, such as scratch resistance, chemical resistance, and gloss retention. Additionally, the development of new polyester resins with improved performance characteristics is expected to create new growth opportunities for the market.

Coil Coating Market By Metal Type

- Aluminum

- Steel

In terms of metal types, the steel segment is expected to witness significant growth in the coming years. This growth is owing to the increasing demand for coated steel products in various end-use industries, such as construction, automotive, and appliances. Steel is the most commonly used substrate material in the coil coating, as it offers several benefits, such as high strength, durability, and cost-effectiveness. Furthermore, steel substrates can be easily coated with a variety of coatings, such as polyester, polyurethane, and epoxy, to enhance their performance and aesthetics. The growth of the steel segment can be attributed to several factors, such as the increasing demand for high-quality coated steel products with enhanced properties, such as corrosion resistance, weather ability, and color retention.

Coil Coating Market By End-User Industry

- Building and Construction

- Furniture

- Transportation

- Industrial and Domestic Appliances

- Others

According to the coil coating market forecast, the building and construction segment is expected to witness significant growth in the coming years. This growth is owing to the increasing demand for high-quality and durable coated metal products in various construction applications, such as roofing, cladding, and insulation. Coil-coated products are preferred in the building and construction industry, as they offer several benefits, such as enhanced durability, weather resistance, and aesthetic appeal. Additionally, the use of coil-coated products in construction can help reduce energy consumption and lower maintenance costs. The growth of the building and construction segment can be attributed to several factors, such as the increasing demand for eco-friendly and sustainable coatings, the growing construction industry in emerging economies, and the increasing adoption of green building practices.

Coil Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Coil Coating Market Regional Analysis

The Asia-Pacific region dominates the coil coating market and accounts for a significant share of the global market, owing to several factors such as the presence of a large number of end-use industries, growing population, rapid urbanization, and rising construction and automotive sectors. The region is home to some of the world's largest economies, such as China, India, Japan, and South Korea, which are major consumers of coil-coated products. The growth of the market in the region can be attributed to several factors such as the increasing demand for coated steel products, the growing construction industry, and the rising adoption of green building practices. Additionally, the expanding automotive industry in the region is driving the demand for coil-coated products for automotive applications such as body panels, bumpers, and interior trims. Moreover, the Asia-Pacific region has a large manufacturing base for coil-coated products, owing to the availability of low-cost labor and raw materials. The region's governments are also investing heavily in infrastructure development, which is driving the demand for coil-coated products in the construction industry.

Coil Coating Market Player

Some of the top coil coating market companies offered in the professional report include AkzoNobel N.V., BASF SE, Beckers Group, Nippon Paint Co. Ltd., PPG Industries Inc., Kansai Paint Co. Ltd., The Valspar Corporation, Axalta Coating Systems LLC, Henkel AG & Co. KGaA, The Sherwin-Williams Company, Wacker Chemie AG, and Jotun A/S.

Frequently Asked Questions

What was the market size of the global coil coating in 2022?

The market size of coil coating was USD 5.2 Billion in 2022.

What is the CAGR of the global coil coating market from 2023 to 2032?

The CAGR of coil coating is 4.8% during the analysis period of 2023 to 2032.

Which are the key players in the coil coating market?

The key players operating in the global market are including AkzoNobel N.V., BASF SE, Beckers Group, Nippon Paint Co. Ltd., PPG Industries Inc., Kansai Paint Co. Ltd., The Valspar Corporation, Axalta Coating Systems LLC, Henkel AG & Co. KGaA, The Sherwin-Williams Company, Wacker Chemie AG, and Jotun A/S.

Which region dominated the global coil coating market share?

Asia-Pacific held the dominating position in coil coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of coil coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global coil coating industry?

The current trends and dynamics in the coil coating industry include growing demand for coil coated products in the construction industry, increasing use of coated metal coils in the automotive industry, and improved durability and corrosion resistance offered by coil coatings.

Which metal type held the maximum share in 2022?

The steel metal type held the maximum share of the coil coating industry.