Clinical Workflow Solutions Market | Acumen Research and Consulting

Clinical Workflow Solutions Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format : ![]()

The Global Clinical Workflow Solutions Market Size gathered USD 9.2 Billion in 2021 and is set to garner a market size of USD 33.4 Billion by 2030 growing at a CAGR of 15.6% from 2022 to 2030.

Clinical workflow is an interaction between physician or surgeon, nurses or other staff, patients, health records, and third-party applications. A poorly-integrated workflow solution can hinder workflows by making it essential for clinicians to duplicate data for multiple applications or log in and out of several systems to find the relevant clinical data to make clinical decisions. Clinical workflow solutions providers introduce effective and seamless solutions in the market as they are continuously facing pressure to do more in less time.

Clinical Workflow Solutions Market Report Statistics

- Global clinical workflow solutions market revenue is estimated to reach USD 33.4 Billion by 2030 with a CAGR of 15.6% from 2022 to 2030

- North America clinical workflow solutions market value gathered more than USD 3.8 billion in 2021

- Asia-Pacific clinical workflow solutions market growth will record a CAGR of more than 16% from 2022 to 2030

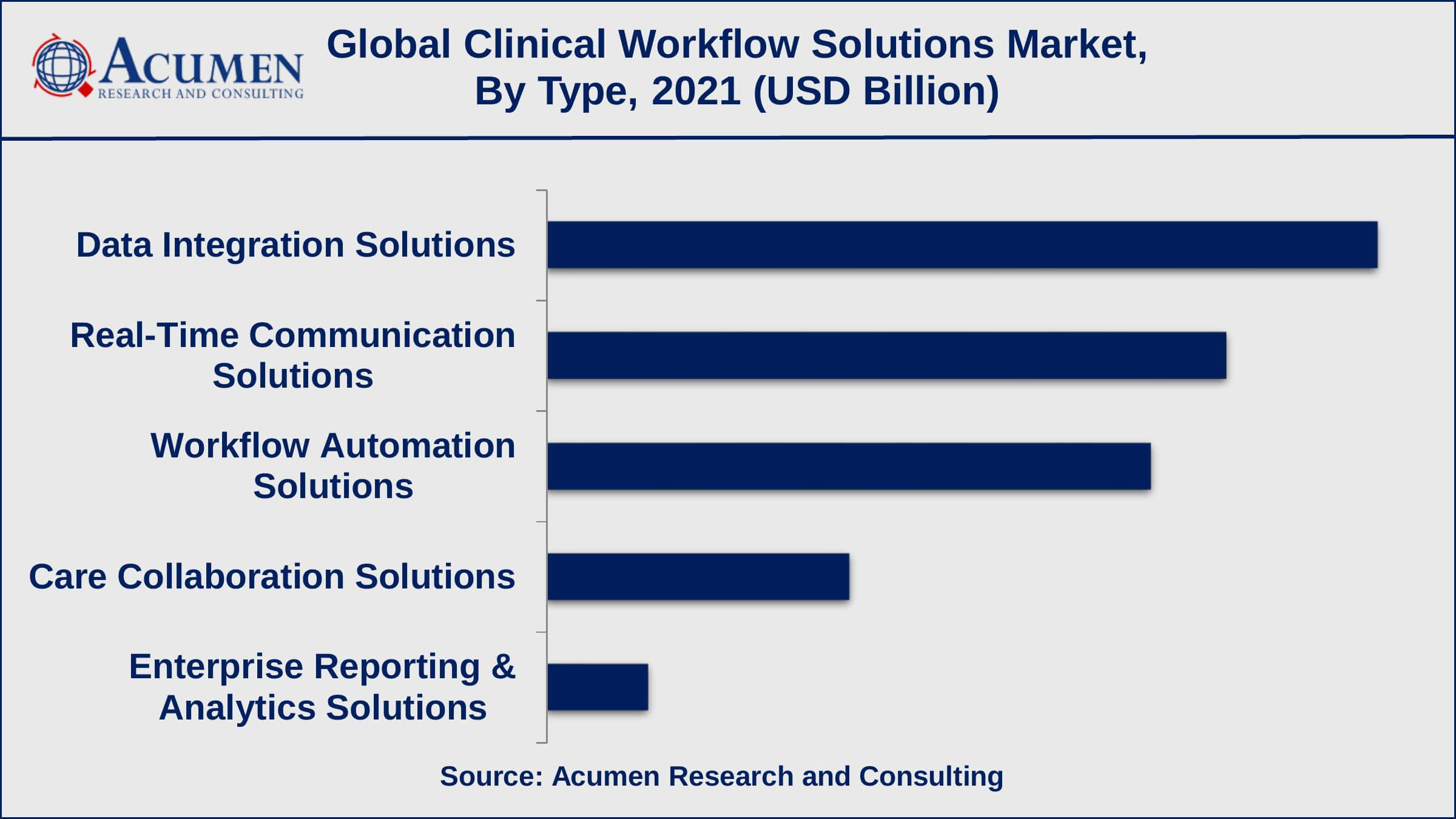

- Among types, the data integration solutions sub-segment collected around 27% share in 2021

- Based on end-use, the hospitals sub-segment achieved US$ 4.2 billion in revenue in 2021

- The technological advancements and innovations in clinical workflow solutions is a popular clinical workflow solutions market trend that drives the industry demand

Global Clinical Workflow Solutions Market Dynamics

Market Drivers

- Increased adoption of electronic health records (EHRs) and health information technology (HIT)

- Rising need for efficient and streamlined clinical processes

- Growing demand for better patient outcomes and improved healthcare delivery

Market Restraints

- High costs associated with implementing and maintaining clinical workflow solutions

- Data security and privacy concerns

- Limited availability of skilled professionals with experience in clinical workflow solutions

Market Opportunities

- Increasing government initiatives and regulations promoting the use of digital solutions in healthcare

- Growing demand for cost-effective and efficient healthcare solutions

Clinical Workflow Solutions Market Report Coverage

| Market | Clinical Workflow Solutions Market |

| Clinical Workflow Solutions Market Size 2021 | USD 9.2 Billion |

| Clinical Workflow Solutions Market Forecast 2030 | USD 33.4 Billion |

| Clinical Workflow Solutions Market CAGR During 2022 - 2030 | 15.6% |

| Clinical Workflow Solutions Market Analysis Period | 2018 - 2030 |

| Clinical Workflow Solutions Market Base Year | 2021 |

| Clinical Workflow Solutions Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Allscripts, AthenaHealth, Cerner Corporation, Cisco, GE Healthcare, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., McKesson Corporation, and NextGenHealthcare Information Systems. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Clinical Workflow Solutions Market Growth Factors

The increase in demand to limit healthcare costs, growing patient volume, due to the rising prevalence of chronic diseases, and the government initiatives to enhance the adoption of healthcare IT are some of the key factors propelling the clinical workflow solutions market growth. Hospitals and other medical facilities are in the process of integrating workflows of tedious documentation, and administrative staff management along with seamless access to the patient’s related clinical and administrative data in all the departments. An increase in demand for clinical workflow solutions for patient-centered care delivery and improved clinician productivity is anticipated to boost market growth.

Reduced complexities and ease of use due to technologically advanced clinical workflow solutions are driving the adoption rate and thereby propelling the market growth. The emergence of collaborations and acquisitions among workflow service providers and hospitals has witnessed a significant increase in the last few years to expand the geographical reach or customer base.

Clinical Workflow Solutions Market Segmentation

The worldwide clinical workflow solutions market is categorized based on type, end-use, and geography.

Clinical Workflow Solutions Market By Type

- Data Integration Solutions

- Real-Time Communication Solutions

- Workflow Automation Solutions

- Care Collaboration Solutions

- Enterprise Reporting & Analytics Solutions

Based on type, the market is divided into data integration solutions, real-time communication solutions, workflow automation solutions, care collaboration solutions, and enterprise reporting &analytics solutions. In 2021, the data integration solutions segment accounted for the largest share of the market. This can be attributed to increasing the necessity for proper management and storage solutions to manage a growing volume of medical records. Furthermore, the need for cost-cutting, government incentives to adopt data integration solutions, and penalties are some of the propelling factors of the market. The care collaboration solutions segment is anticipated to observe the fastest growth during the forecast period due to the increase in the patient-centric services providers. These solutions manage workflow thereby improves patient care which further saves cost and time.

Clinical Workflow Solutions Market By End-Use

- Hospitals

- Ambulatory Care Centers

- Long Term Care Facilities

Based on the end-use, the market is segmented into hospitals, ambulatory care centers, and long-term care facilities. Hospitals accounted for the maximum share of the market in 2021. This can be attributed to the availability of a large number of healthcare facilities clubbed in at a single center that needs proper management of data. Furthermore, government initiatives to support eHealth and the necessity of solutions for proper management of high clinical data are anticipated to boost the drive the market growth.

Clinical Workflow Solutions Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Clinical Workflow Solutions Market Regional Analysis

Geographically, the market has been divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America dominated the clinical workflow solutions market in 2021. This can be attributed to the rising geriatric population and patient admission in the hospitals leading to a high volume of data entry. Furthermore, government initiatives regarding the effective usage of EHR, interoperability, and other solutions and a high focus on patient care are propelling the market for clinical workflow solutions in the region. For instance, according to the data published in August 2018 EHR intelligence, the federal government had invested USD 38 billion in healthcare facilities to install EHR systems through the MU program in Medicare and Medicaid since 2011. However, the Asia Pacific region is anticipated to be the fastest-growing region for the clinical workflow solutions market. The region observed a significant increase in demand for healthcare IT solutions in the medical sector due to increasing investment from emerging economies. Furthermore, supportive initiatives are taken by governments for the implementation of eHealth, rising medical tourism, improving healthcare infrastructure, and the presence of quality healthcare are the factors driving the regional market.

Clinical Workflow Solutions Market Players

Key players operating in the clinical workflow solutions market are Allscripts, AthenaHealth, Cerner Corporation, Cisco, GE Healthcare, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., McKesson Corporation, and NextGenHealthcare Information Systems. Acquisitions, partnerships, and collaborations of market players with healthcare service providers to expand their market presence are the major strategies being adopted by industry players in recent years. Furthermore, solution providers are investing in the development of innovative and effective solutions for clinical workflow management is anticipated to propel market growth.

Frequently Asked Questions

What was the market size of the global clinical workflow solutions in 2021?

The market size of clinical workflow solutions was USD 9.2 Billion in 2021.

What is the CAGR of the global clinical workflow solutions market during forecast period of 2022 to 2030?

The CAGR of clinical workflow solutions market is 15.6% during the analysis period of 2022 to 2030.

Which are the key players operating in the market?

The key players operating in the global market are Allscripts, AthenaHealth, Cerner Corporation, Cisco, GE Healthcare, Hill-Rom Holdings, Inc., Koninklijke Philips N.V., McKesson Corporation, and NextGenHealthcare Information Systems.

Which region held the dominating position in the global clinical workflow solutions market?

North America held the dominating position in clinical workflow solutions market during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for clinical workflow solutions market during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global Clinical Workflow Solutions market?

The current trends and dynamics in the clinical workflow solutions industry include increased adoption of electronic health records (EHRs) and health information technology (HIT), rising need for efficient and streamlined clinical processes, and growing demand for better patient outcomes and improved healthcare delivery.

Which type held the maximum share in 2021?

The data integration solutions type held the maximum share of the clinical workflow solutions market.