Clinical Laboratory Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Clinical Laboratory Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

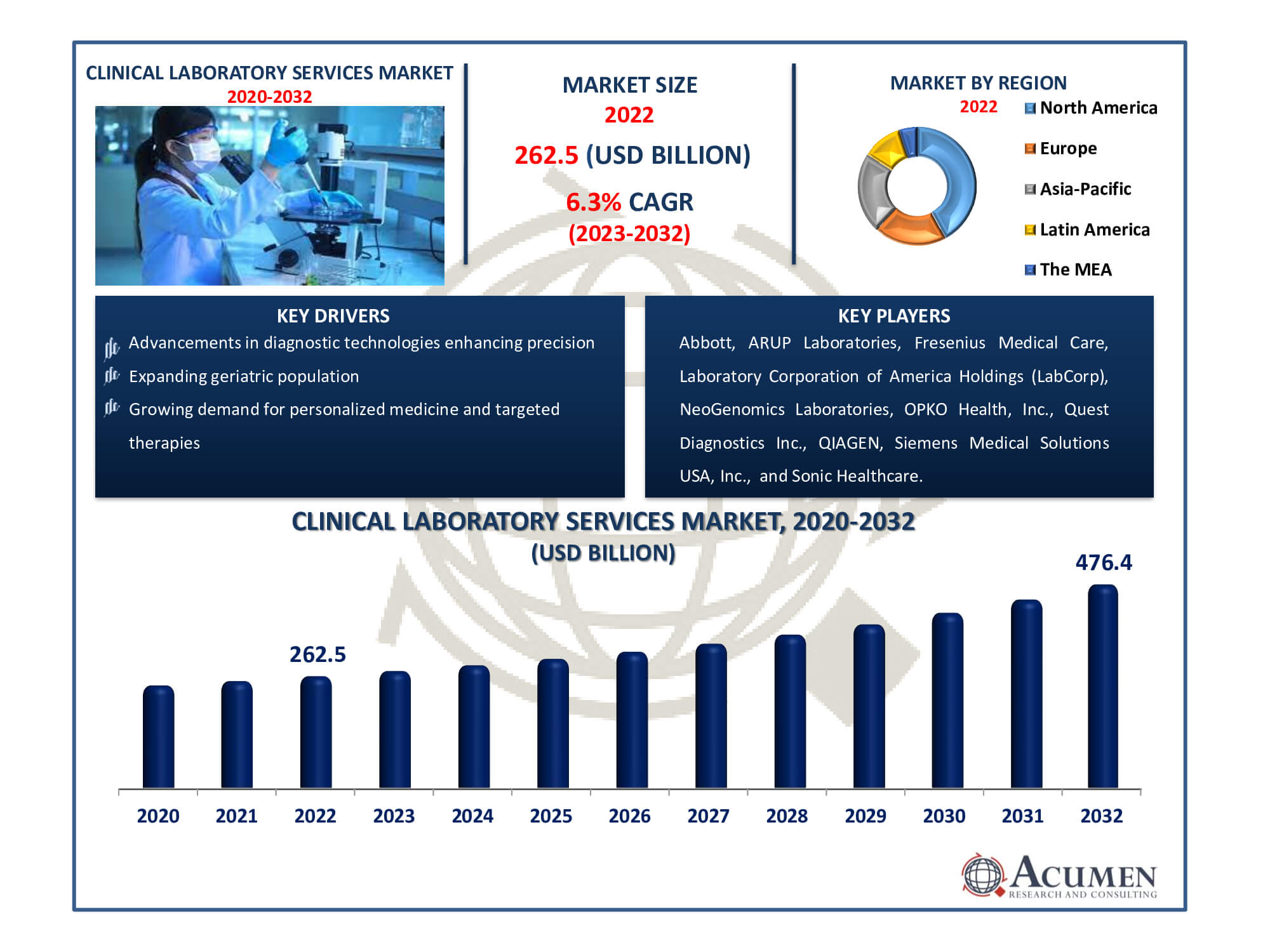

The Global Clinical Laboratory Services Market Size accounted for USD 262.5 Billion in 2022 and is estimated to achieve a market size of USD 476.4 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Clinical Laboratory Services Market Highlights

- Global clinical laboratory services market revenue is poised to garner USD 476.4 billion by 2032 with a CAGR of 6.3% from 2023 to 2032

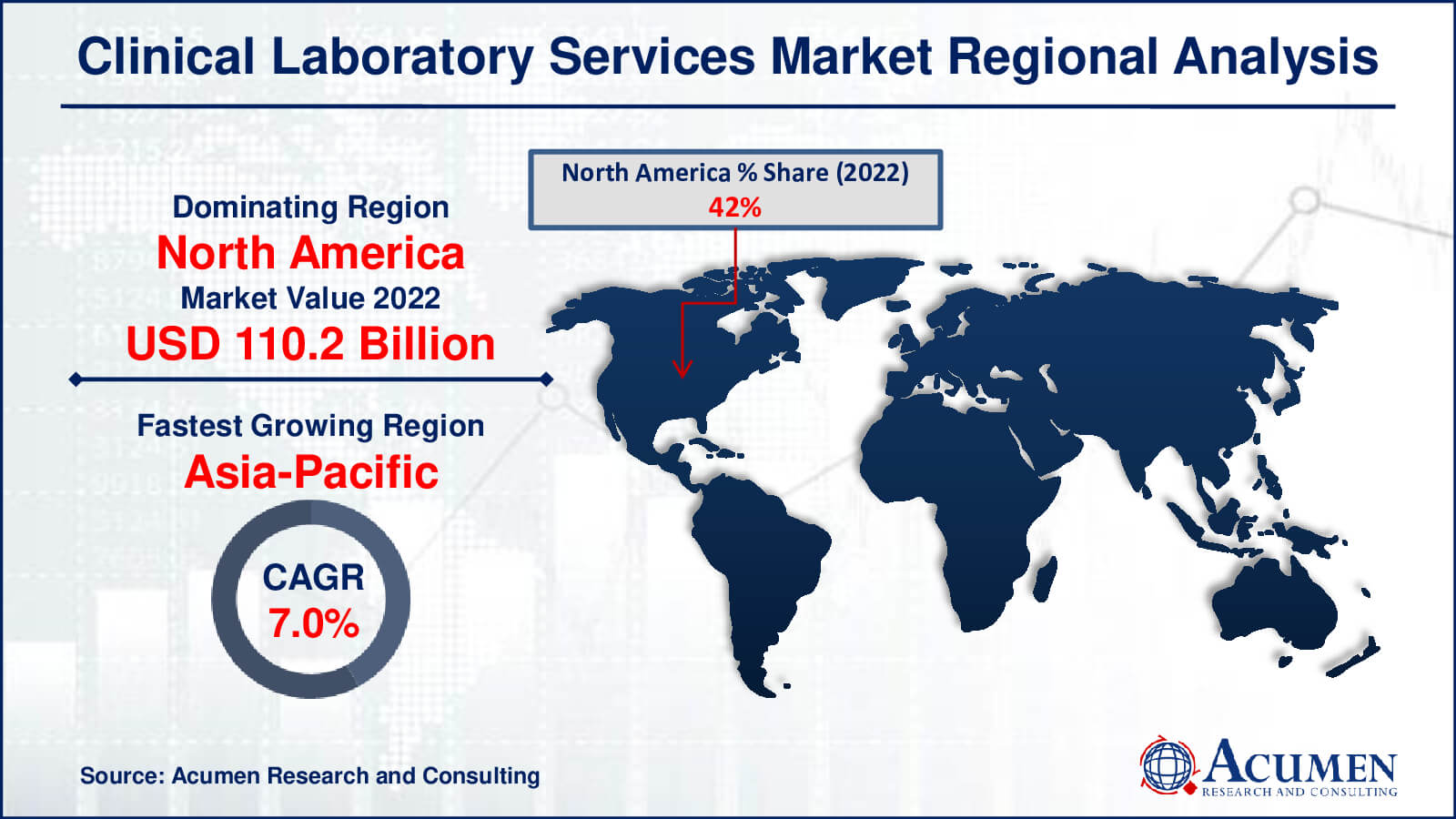

- North America clinical laboratory services market value occupied around USD 110.2 billion in 2022

- Asia-Pacific clinical laboratory services market growth will record a CAGR of more than 7% from 2023 to 2032

- Among test type, the clinical chemistry sub-segment generated over US$ 141.8 billion revenue in 2022

- Based on application, the bioanalytical & lab chemistry services sub-segment generated around 51% share in 2022

- Growing opportunities in emerging markets due to healthcare infrastructure development is a popular clinical laboratory services market trend that fuels the industry demand

The healthcare industry encompasses clinical laboratories where various diseases are diagnosed through an array of diagnostic tests, ranging from blood tests to genetic analyses. These laboratories play a pivotal role in providing information and services that optimize diagnostic delivery and testing outcomes within the healthcare system. They ensure the accuracy of test results, enabling healthcare professionals to make informed therapeutic and diagnostic decisions through diverse resources.

Clinical laboratories aid professionals in initiating, adjusting, or ceasing treatments when lab services are unavailable. ARC has observed an increasing number of clinical laboratory service providers striving to enhance their services to meet evolving end-user needs. Leading players aim to outperform competitors by offering clinical laboratory services capable of diagnosing emerging disease threats. Moreover, emphasizing capacity building stands as a crucial component of a robust strategy for global laboratory service providers.

Global Clinical Laboratory Services Market Dynamics

Market Drivers

- Advancements in diagnostic technologies enhancing precision and efficiency

- Increasing prevalence of chronic diseases necessitating diagnostic testing

- Growing demand for personalized medicine and targeted therapies

- The expanding geriatric population driving the need for diagnostic services

Market Restraints

- Stringent regulatory compliance and accreditation requirements

- High initial investment and operational costs for sophisticated diagnostic equipment

- Challenges in data management and privacy concerns in handling sensitive patient information

Market Opportunities

- Rising adoption of telemedicine and remote diagnostics

- Integration of artificial intelligence and machine learning in diagnostics

- Expansion of point-of-care testing and decentralized laboratory services

Clinical Laboratory Services Market Report Coverage

| Market | Clinical Laboratory Services Market |

| Clinical Laboratory Services Market Size 2022 | USD 262.5 Billion |

| Clinical Laboratory Services Market Forecast 2032 | USD 476.4 Billion |

| Clinical Laboratory Services Market CAGR During 2023 - 2032 | 6.3% |

| Clinical Laboratory Services Market Analysis Period | 2020 - 2032 |

| Clinical Laboratory Services Market Base Year |

2022 |

| Clinical Laboratory Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By Service Provider, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, ARUP Laboratories, Fresenius Medical Care, Laboratory Corporation of America Holdings (LabCorp), NeoGenomics Laboratories, OPKO Health, Inc., Quest Diagnostics Inc., QIAGEN, Siemens Medical Solutions USA, Inc., and Sonic Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Clinical Laboratory Services Market Insights

The increasing incidence rates of diabetes, cancer, and other infectious diseases have led to an emerging market for clinical laboratory services, driven by a growing patient pool seeking these cost-effective and minimally invasive diagnostic methods. These medical technologies offer flexibility in healthcare management, facilitating early disease diagnosis and enhancing treatment efficacy. Furthermore, the market growth is fueled by new technologies that offer faster analysis and user-friendly operation.

However, market growth faces impediments such as lack of reimbursement, shortage of skilled workers, and stringent government policies. Despite this, awareness in the global laboratory services market is growing, particularly in the early diagnosis of conditions in gynecology, endocrinology, and oncology. The increasing population susceptible to infectious diseases and the rising number of elderly individuals experiencing cardiovascular and neurological conditions have also contributed to market growth.

Additionally, new opportunities have emerged in the market with the introduction of technologically advanced products like microarrays, companion diagnostics, and biochips.

According to the clinical laboratory services industry analysis the increasing global demand for improved diagnostics across various disease types is propelling the market, aiming to enhance therapeutic decisions and ultimately improve medical outcomes. Developed and developing countries alike are experiencing a rising demand for advanced diagnostics, particularly for infectious and chronic diseases. Many developing economies have witnessed a surge in these diseases in recent years. Moreover, the prevalence of lifestyle-driven diseases in various regions worldwide is driving progress in the global laboratory services sector.

Private laboratories, especially in developing nations, have significantly expanded their presence, contributing significantly to market growth. Government expenditure on laboratory infrastructure has also risen in support of this expansion. The global clinical laboratory services market is witnessing the emergence of new avenues in laboratory testing, focusing notably on the adoption of high-performance tests. Additionally, service providers in the clinical laboratory sector are developing customized assessments to tap into new revenue streams.

Clinical Laboratory Services Market Segmentation

The worldwide market for clinical laboratory services market is split based on test type, service provider, application, and geography.

Clinical Laboratory Services Market Test Types

- Clinical Chemistry

- Medical Microbiology & Cytology

- Human & Tumor Genetics

- Other Esoteric Tests

The clinical chemistry test category accounted for the biggest revenue share due to its widespread use in evaluating urine, plasma, serum, and other bodily fluids. The segment's growth is expected to enhance tests by introducing new markers and applications for existing ones. The medical microbiology & cytology segment is anticipated to exhibit the maximum CAGR during the clinical laboratory services market forecast period. This growth is attributed to the increasing cases of nosocomial, viral, fungal, and parasitic infections. Additionally, advancements in microbial research have accelerated the development and subsequent decrease in sequencing technology costs, further driving the market. Next generation sequencing technology (NGS) aids microbiologists in gathering information about specific microbes' roles in pathogenesis, thereby refining their portfolio of laboratory services.

Clinical Laboratory Services Market Service Providers

- Hospital-based Laboratories

- Clinics-based Laboratories

- Stand-alone Laboratories

In terms of clinical laboratory services market analysis the market has been categorized into hospital, clinic, and standalone laboratories based on service providers. As digital pathology gradually gains acceptance, independent laboratories are expected to emerge as a lucrative revenue source in the forecast period. Integrating digital workflows to efficiently handle large volumes of diagnostic tests offers service providers economies of scale. Additionally, the growing trend of disease monitoring in retail clinics is projected to positively influence segment growth.

Hospitals' ability to adopt new technology and recruit trained staff for their disease testing units has significantly contributed to the highest income generation in the hospital laboratory segment. Moreover, the critical role of clinical laboratories within hospitals has further propelled segment growth.

Clinical Laboratory Services Market Applications

- Drug Discovery & Development Related Services

- Bioanalytical & Lab Chemistry Services

- Toxicology Testing Services

- Cell & Gene Therapy Related Services

- Preclinical & Clinical Trial Related Services

- Others

Bioanalytical & lab chemistry services dominate the clinical laboratory services market due to their critical role in medication development and analysis. These services include critical activities like as biomarker identification, drug metabolism investigations, and quantitative analysis, all of which are critical in guaranteeing therapeutic efficacy and safety. Their dominance arises from their full support throughout the drug discovery, development, and post-market surveillance processes. These services, which are focused on precision, accuracy, and adherence to regulatory standards, provide critical insights into drug behaviour within biological systems, forming the backbone of pharmaceutical research and development operations.

Clinical Laboratory Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Clinical Laboratory Services Market Regional Analysis

North America is the largest area, driven by high healthcare spending, particularly in the United States. Because of the region's well-established healthcare infrastructure, there is a high need for clinical laboratory services. Furthermore, its modern infrastructure and favorable regulatory environment encourage constant innovation and rapid product approvals, solidifying its industry leadership.

Europe is the second-largest region in the clinical laboratory services industry, behind North America. Europe benefits from comprehensive regulatory frameworks and excellent healthcare infrastructure. The region has a high rate of adoption of advanced diagnostic technologies, resulting in a significant market presence. Furthermore, continuing research activities and collaborations support the market's growth trajectory in Europe.

Asia-Pacific (APAC) is the clinical laboratory services market's fastest-growing region. Strategic initiatives and increased healthcare investments in growing economies such as China, India, and Southeast Asian nations are driving APAC's growth. Rapid urbanization, higher disposable incomes, and increased healthcare awareness all contribute to an increase in demand for clinical laboratory services. Furthermore, joint efforts between large healthcare providers and municipal governments are boosting patient access to comprehensive healthcare systems, considerably encouraging market growth.

Clinical Laboratory Services Market Players

Some of the top clinical laboratory services market companies offered in our report includes Abbott, ARUP Laboratories, Fresenius Medical Care, Laboratory Corporation of America Holdings (LabCorp), NeoGenomics Laboratories, OPKO Health, Inc., Quest Diagnostics Inc., QIAGEN, Siemens Medical Solutions USA, Inc., and Sonic Healthcare.

Frequently Asked Questions

How big is the clinical laboratory services market?

The clinical laboratory services market size was USD 262.5 billion in 2022.

What is the CAGR of the global clinical laboratory services Market from 2023 to 2032?

The CAGR of clinical laboratory services market is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the clinical laboratory services market ?

The key players operating in the global market are including Abbott, ARUP Laboratories, Fresenius Medical Care, Laboratory Corporation of America Holdings (LabCorp), NeoGenomics Laboratories, OPKO Health, Inc., Quest Diagnostics Inc., QIAGEN, Siemens Medical Solutions USA, Inc., and Sonic Healthcare.

Which region dominated the global clinical laboratory services market share?

North America held the dominating position in clinical laboratory services market industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of clinical laboratory services market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global clinical laboratory services market industry?

The current trends and dynamics in the clinical laboratory services market industry include advancements in diagnostic technologies enhancing precision and efficiency, increasing prevalence of chronic diseases necessitating diagnostic testing, growing demand for personalized medicine and targeted therapies, and expanding geriatric population driving the need for diagnostic services.

Which test type held the maximum share in 2022?

The clinical chemistry test type held the maximum share of the clinical laboratory services market industry.