Clinical Decision Support System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Clinical Decision Support System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

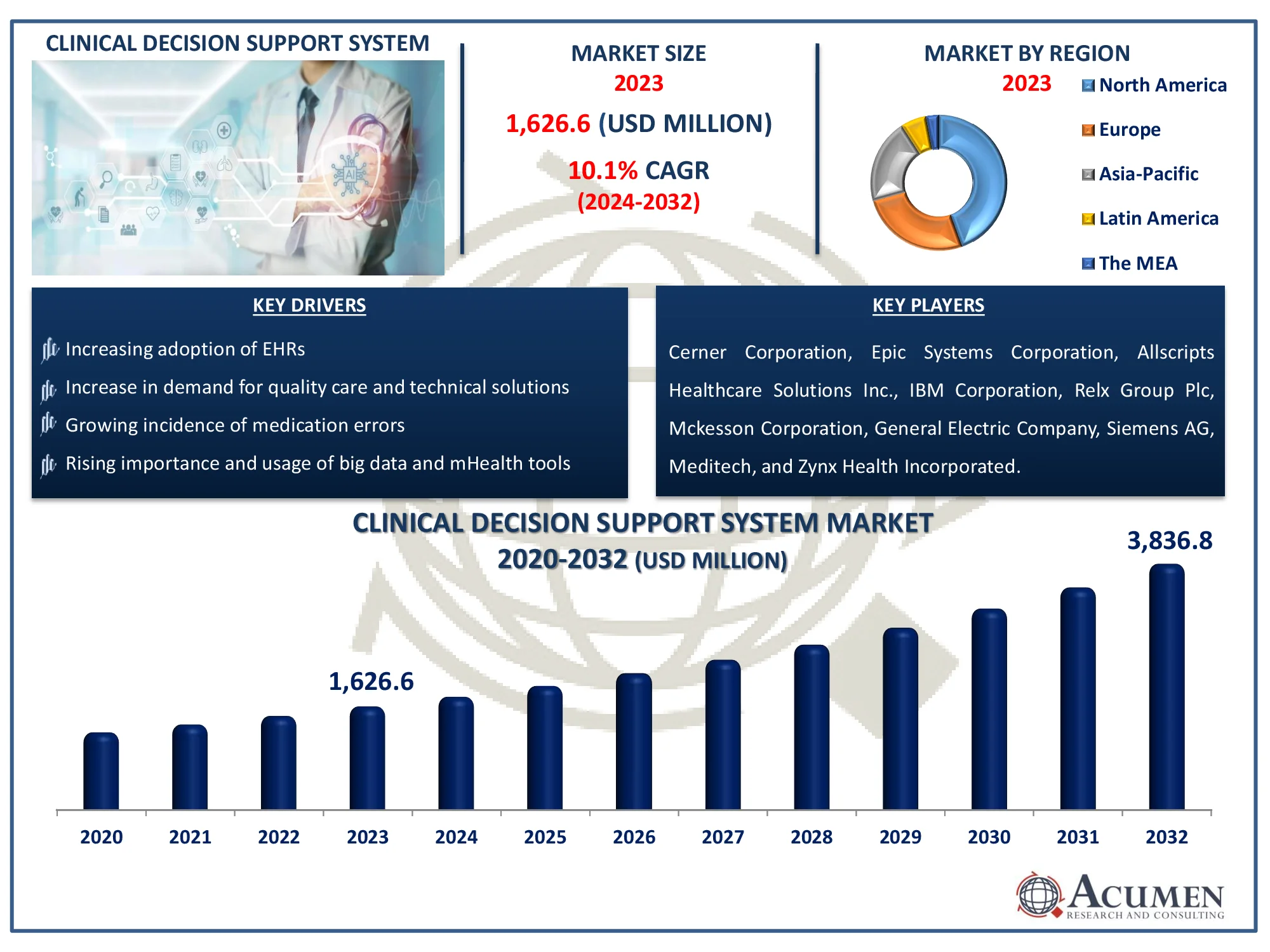

The Global Clinical Decision Support System Market Size accounted for USD 1,626.6 Million in 2023 and is estimated to achieve a market size of USD 3,836.8 Million by 2032 growing at a CAGR of 10.1% from 2024 to 2032.

Clinical Decision Support System Market Highlights

- Global clinical decision support system market revenue is poised to garner USD 3,836.8 million by 2032 with a CAGR of 10.1% from 2024 to 2032

- North America clinical decision support system market value occupied around USD 715.7 million in 2023

- Asia-Pacific clinical decision support system market growth will record a CAGR of more than 10.9% from 2024 to 2032

- Among product, the standalone CDSS sub-segment generated 31% of share in 2023

- According to component segment, services sub segment accomplished 42% of share in 2023

- By mode of delivery, on-premises creates significant share in clinical decision support system industry

- Integration of artificial intelligence (AI) and machine learning (ML) for predictive analytics and personalized medicine is a popular market trend that fuels the industry demand

Clinical decision support system (CDSS) is a health information system designed to patients, staff, clinicians, and other healthcare professionals with the patient specific information and intelligently filters or presents the information at appropriate times to improve health care process. This technology encompasses a variety of tools to improve decision making in clinical workflow. CDSS solutions include computerized reminders and alerts, clinical guidelines, condition specific order sets, patient information records and summaries, diagnostic support, documentation template, and other relevant reference information. Other important benefits offered by CDSS include increased quality of health care and improved health outcomes, elimination in errors, cost benefit and improved efficiency, and patient and provider satisfaction.

Global Clinical Decision Support System Market Dynamics

Market Drivers

- Increasing adoption of EHRs

- Increase in demand for quality care and technical solutions

- Growing incidence of medication errors

- Rising importance and usage of big data and mHealth tools

Market Restraints

- Data security concerns related to cloud-based CDSS

- Inadequate interoperability

Market Opportunities

- The growth potential of emerging markets

- Government initiatives for better healthcare in developing countries

- Growing adoption of cloud-based clinical decision support systems for real-time data access and seamless interoperability

Clinical Decision Support System Market Report Coverage

|

Market |

Clinical Decision Support System Market |

|

Clinical Decision Support System Market Size 2023 |

USD 1,626.6 Million |

|

Clinical Decision Support System Market Forecast 2032 |

USD 3,836.8 Million |

|

Clinical Decision Support System Market CAGR During 2024 - 2032 |

10.1% |

|

Clinical Decision Support System Market Analysis Period |

2020 - 2032 |

|

Clinical Decision Support System Market Base Year |

2023 |

|

Clinical Decision Support System Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Type, By Component, By Model, By Mode of Delivery, By Level of Interactivity, By Settings, By Application, and by Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions Inc., IBM Corporation, Relx Group Plc, Mckesson Corporation, General Electric Company, Siemens AG, Meditech, and Zynx Health Incorporated. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Clinical Decision Support System Market Insights

The global clinical decision support systems market is growing at a significant rate owing to the growing need of advanced healthcare information systems and increasing investments by health information technology (HIT) players. In addition, growing need for remote patient monitoring services and increasing support from government organizations is also driving the growth of global CDSS market. However, privacy and security concerns, high capital expenditure and maintenance requirement, and inadequate healthcare infrastructure in developing economies are inhibiting the growth of the global market. The increasing popularity of CDSS in healthcare facilities is the key trend observed in the global CDSS market.

CDSS and their software are gaining popularity in healthcare facilities, due to innovative and advanced applications such as, double-checking medication administration properties, drug reminders, and drug allergy alerts. These innovative and advanced applications of CDSS reduce chances of adverse drug events, and medication errors. Moreover, they improve healthcare quality, and reduce healthcare cost. In home healthcare settings, the CDSS integrated with medication management system plays a pivotal role in medication delivery and dosage calculations. Most patients cannot remember their entire medication regimen and forget to take their medication. In such conditions, CDSS integrated smartphone-based self-management systems with real-time medication monitoring technology reminds patients to take medication on time and prevent medication errors. Thus, these innovative applications of integrated CDSS attract end users to adopt the technology.

Clinical Decision Support System Market Segmentation

The worldwide market for clinical decision support system is split based on product, type, component, model, mode of delivery, level of interactivity, settings, application, and geography.

Clinical Decision Support Systems (CDSS) Market By Product

- Standalone CDSS

- Integrated EHR with CDSS

- Integrated CPOE with CDSS

- Integrated CDSS with CPOE & EHR

According to clinical decision support system industry analysis, currently, standalone CDSS holds the largest market share, around 31%. This supremacy could be attributed to a number of factors, including lower prices and more simplicity when compared to integrated solutions. Standalone CDSS can be easily implemented without the requirement for extensive standardization or onerous interface with existing healthcare systems. Furthermore, they can work without real-time patient data, making them a more viable choice for smaller healthcare companies or individual practitioners. However, as EHR and CPOE systems become more widely used, the demand for integrated CDSS solutions is projected to rise in coming years.

Clinical Decision Support Systems (CDSS) Market By Type

- Diagnostic

- Therapeutic

The diagnostics category is expected to be the largest in the clinical decision support system market. With the increasing application of AI and machine learning in healthcare, diagnostic CDSS is revolutionizing disease identification and treatment planning. These technologies assist healthcare practitioners by analyzing enormous amounts of patient data, improving accuracy and reducing diagnostic errors. The rising burden of chronic diseases, combined with the growing need for precision medicine, is driving demand. Furthermore, regulatory backing and integration with electronic health records (EHRs) are improving diagnostic capabilities, making this segment a significant growth contributor to the CDSS market.

Clinical Decision Support Systems (CDSS) Market By Component

- Software

- Hardware

- Services

The clinical decision support system (CDSS) market is segmented into three segments: software, hardware, and services. In 2023, the services category held the most significant market share. This dominance stems from the crucial role that services play in the effective implementation and ongoing operation of CDSS. These services cover a wide range of operations, such as system integration, customization for specialized healthcare settings, professional training, and continuing maintenance and support. Furthermore, as CDSS solutions become more complicated and interoperable with existing healthcare systems, the demand for expert services grows. While software and hardware are critical components, it is the entire suite of services that ensures CDSS's successful use and maximizes its benefits, considerably contributing to its market dominance.

Clinical Decision Support Systems (CDSS) Market By Model

- Knowledge-based CDSS Solutions

- Non-Knowledge-based CDSS Solutions

Knowledge-based CDSS solutions are predicted to be the notable section of the clinical decision support system market. These systems use structured medical knowledge, such as clinical guidelines and expert-defined rules, to help healthcare providers make decisions. Their broad use is motivated by regulatory compliance requirements, ease of connection with existing electronic health records (EHRs), and the ability to provide transparent suggestions. Unlike non-knowledge-based models, they do not necessitate substantial machine learning training, making them more suitable for quick clinical use. The growing need for standardized treatment regimens and patient safety drives up demand for this segment.

Clinical Decision Support Systems (CDSS) Market By Mode of Delivery

- On-Premises

- Web-Based

- Cloud-Based

The on-premises section of the clinical decision support system market earned USD 699.4 million in revenue, with healthcare facilities preferring data protection and management. Many large hospitals and research organizations prefer on-premises implementation due to tight regulatory constraints and worries about patient data privacy. These systems give comprehensive flexibility, simple integration with hospital networks, and a reduced reliance on third-party cloud providers. Despite higher initial costs, they offer long-term advantages such as increased security, faster processing speeds, and less external cyber dangers. The category remains important for organizations that handle sensitive medical data and must adhere to regional healthcare norms.

Clinical Decision Support Systems (CDSS) Market By Level of Interactivity

- Passive CDSS

- Active CDSS

Based on the level of interactivity, the active CDSS sector generates significant revenue in the clinical decision support system market because of its ability to make decisions in real time. Unlike passive systems, active CDSS integrates automated warnings, reminders, and treatment recommendations directly into clinical processes. Hospitals and healthcare providers are increasingly relying on these technologies to enhance patient outcomes, prevent medical errors, and ensure adherence to evidence-based guidelines. Active CDSS is becoming more sophisticated as artificial intelligence and machine learning advance, enabling predictive analytics and personalized therapy alternatives. Its ability to improve clinical efficiency and patient safety makes it a significant income generator in the market.

Clinical Decision Support Systems (CDSS) Market By Settings

- Ambulatory care settings

- In Patient

Ambulatory care settings are seeing significant expansion in the clinical decision support system market forecast period as demand for efficient outpatient treatment rises. With more patients visiting clinics, diagnostic centers, and specialty care facilities, healthcare providers are incorporating CDSS to improve clinical decision-making and streamline workflows. The change to value-based care, along with developments in cloud-based CDSS technologies, is speeding up adoption in ambulatory settings. These technologies benefit doctors by providing real-time information, reducing diagnostic errors, and increasing treatment precision. As outpatient services expand worldwide, the demand for CDSS in ambulatory care is expected to soar.

Clinical Decision Support Systems (CDSS) Market By Application

- Drug Dosing Support

- Clinical Guidelines

- Clinical Reminders

- Drug-Drug Interactions

- Drug Allergy Alerts

- Others

The drug-drug interactions (DDI) category has emerged as the most dominant in the clinical decision support system industry, accounting for 30% of the total. As polypharmacy grows more widespread, especially among the elderly and chronically ill patients, healthcare providers rely on CDSS to avoid hazardous drug interactions. These technologies assess patient prescriptions in real time, alerting clinicians to potential conflicts that could result in negative side effects or lower therapeutic efficacy. Regulatory standards stressing medicine safety help to increase uptake. With increased integration with electronic health records (EHRs), the DDI segment continues to play an important role in improving patient care quality.

Clinical Decision Support System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

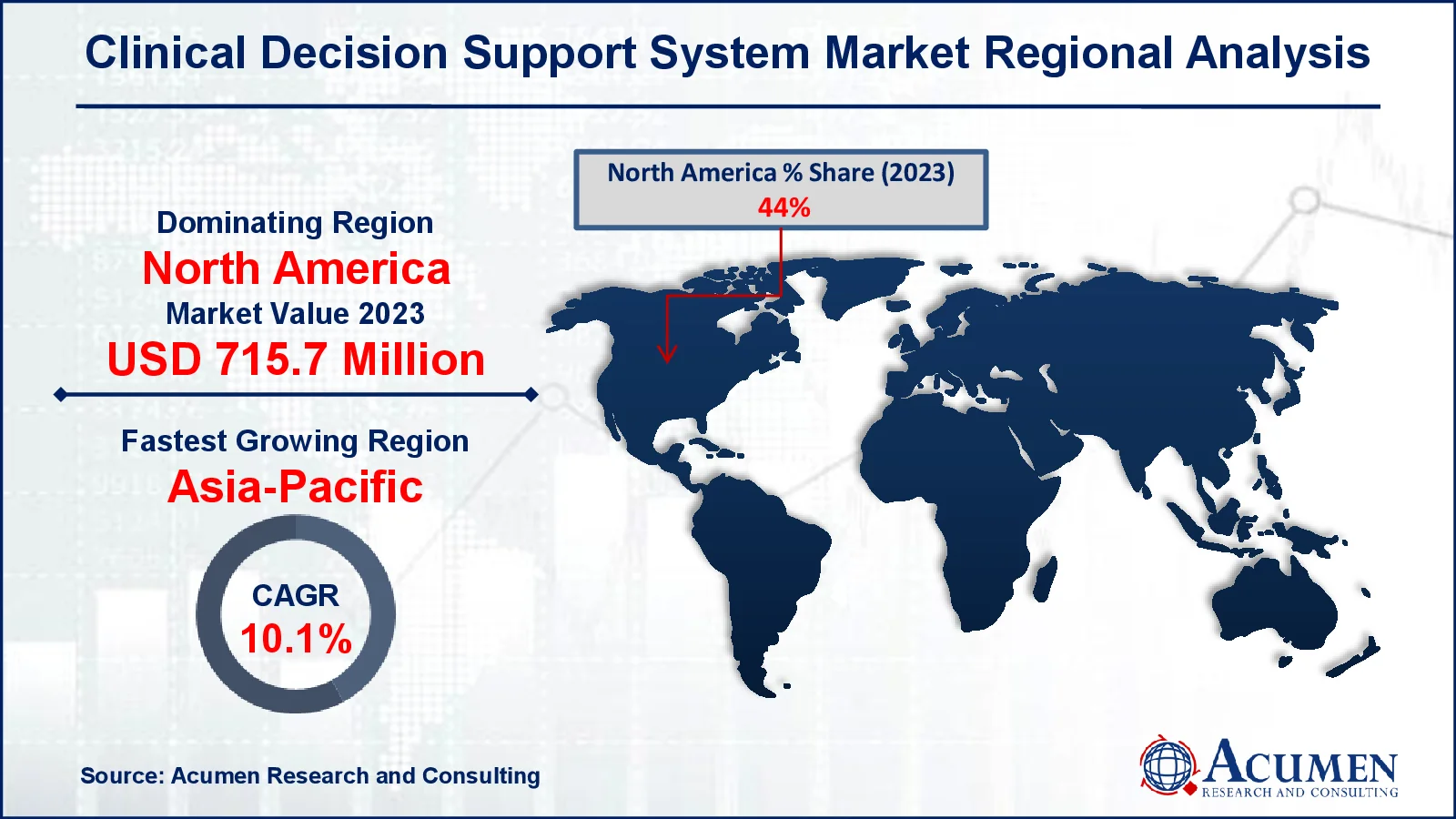

Clinical Decision Support System Market Regional Analysis

North America was the largest market for clinical decision support system in 2023 in terms of revenue generation, and accounted for more than 44% share. This region is expected to maintain its dominance throughout the forecast period majorly attributed by increased health spending on the region, improved healthcare infrastructure, rising prevalence of chronic illnesses and lifestyle associated diseases. For instance, according to American Diabetes Association (ADA), diabetes affected 38.4 million Americans in 2021, accounting for 11.6% of the population. Type 1 diabetes affects 2 million Americans, including around 304,000 kids and adolescents. Further, rise in geriatric population in North America has positively impacted the growth of CDSS market.

Clinical Decision Support System Market Players

Some of the top clinical decision support system companies offered in our report includes Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions Inc., IBM Corporation, Relx Group Plc, Mckesson Corporation, General Electric Company, Siemens AG, Meditech, and Zynx Health Incorporated.

Frequently Asked Questions

What was the market size of the global clinical decision support system in 2023?

The market size of clinical decision support system was USD 1,626.6 Million in 2023.

What is the CAGR of the global clinical decision support system market from 2024 to 2032?

The CAGR of clinical decision support system is 10.1% during the analysis period of 2024 to 2032.

Which are the key players in the clinical decision support system market?

The key players operating in the global market are including Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions Inc., IBM Corporation, Relx Group Plc, Mckesson Corporation, General Electric Company, Siemens AG, Meditech, and Zynx Health Incorporated.

Which region dominated the global clinical decision support system market share?

North America held the dominating position in clinical decision support system industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of clinical decision support system during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global clinical decision support system industry?

The current trends and dynamics in the clinical decision support system industry include increasing adoption of EHRs, increase in demand for quality care and technical solutions, growing incidence of medication errors, and rising importance and usage of big data and mHealth tools.

Which product held the maximum share in 2023?

The standalone CDSS held the maximum share of the clinical decision support system industry.