Citrus Fiber Market | Acumen Research and Consulting

Citrus Fiber Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

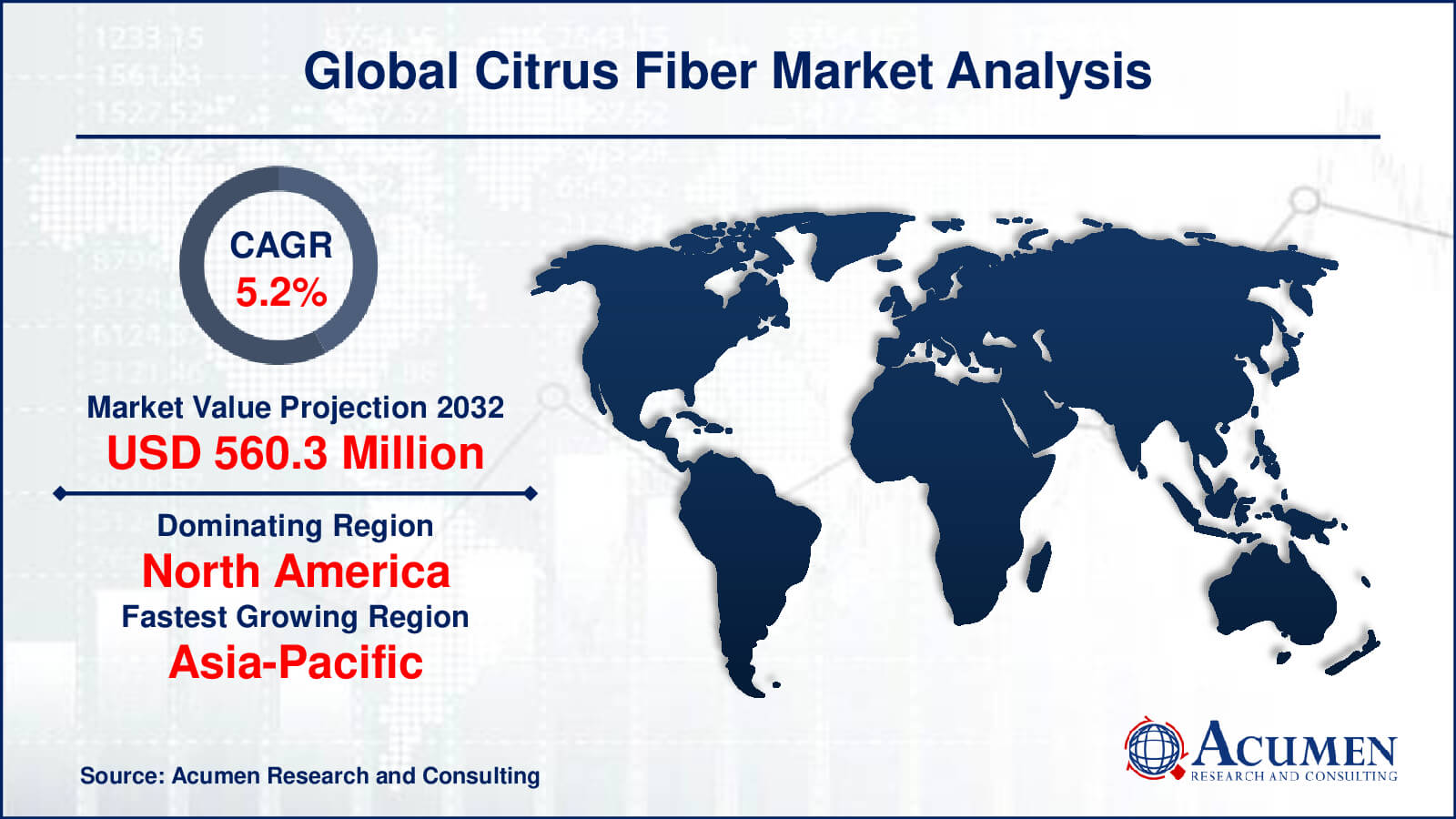

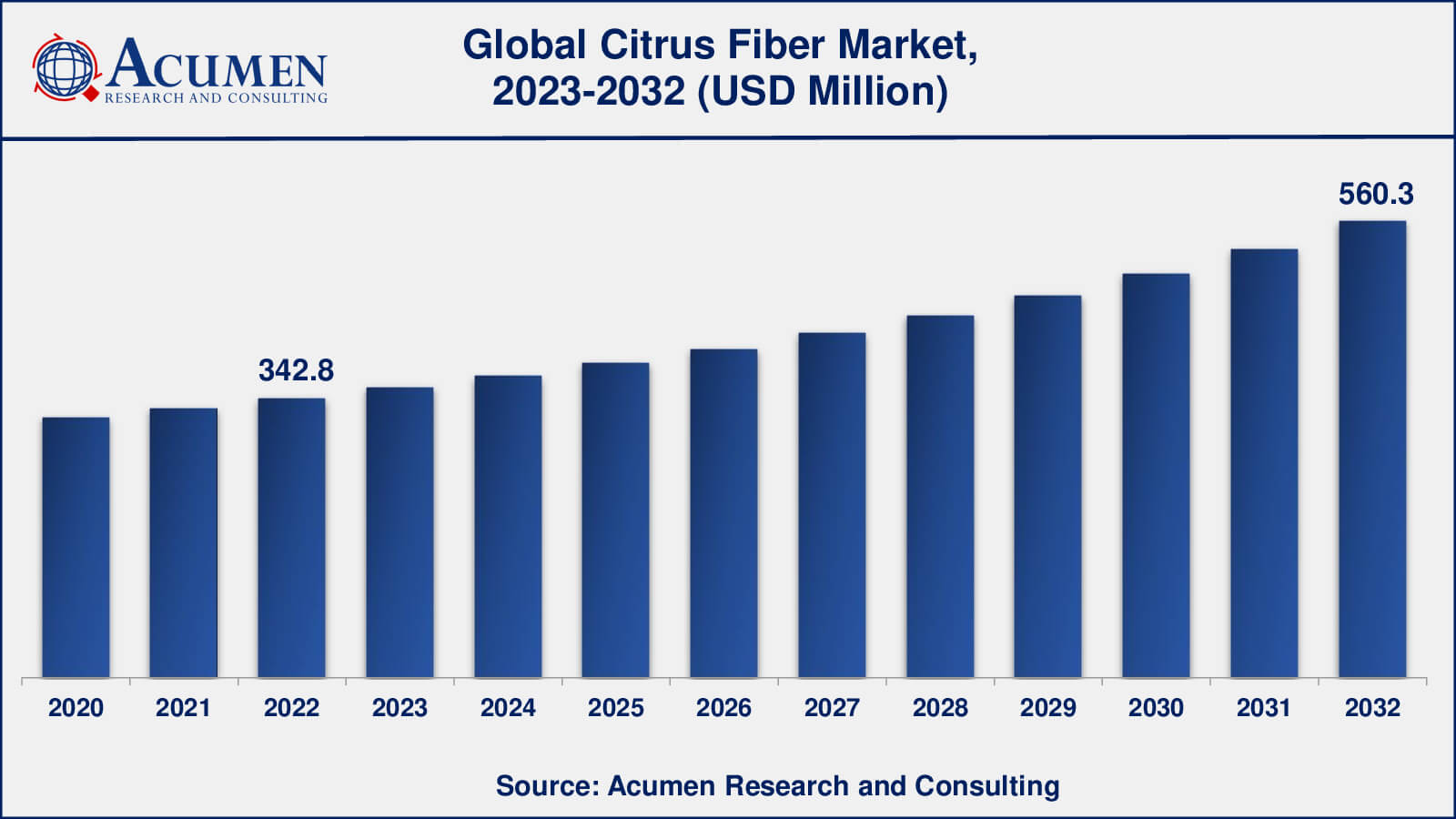

The global Citrus Fiber Market size was valued at USD 342.8 Million in 2022 and is projected to attain USD 560.3 Million by 2032 mounting at a CAGR of 5.2% from 2023 to 2032.

Citrus Fiber Market Highlights

- Global citrus fiber market revenue is poised to garner USD 560.3 million by 2032 with a CAGR of 5.2% from 2023 to 2032

- North America citrus fiber market value occupied around USD 202.5 million in 2022

- Asia-Pacific citrus fiber market growth will record a CAGR of more than 6% from 2023 to 2032

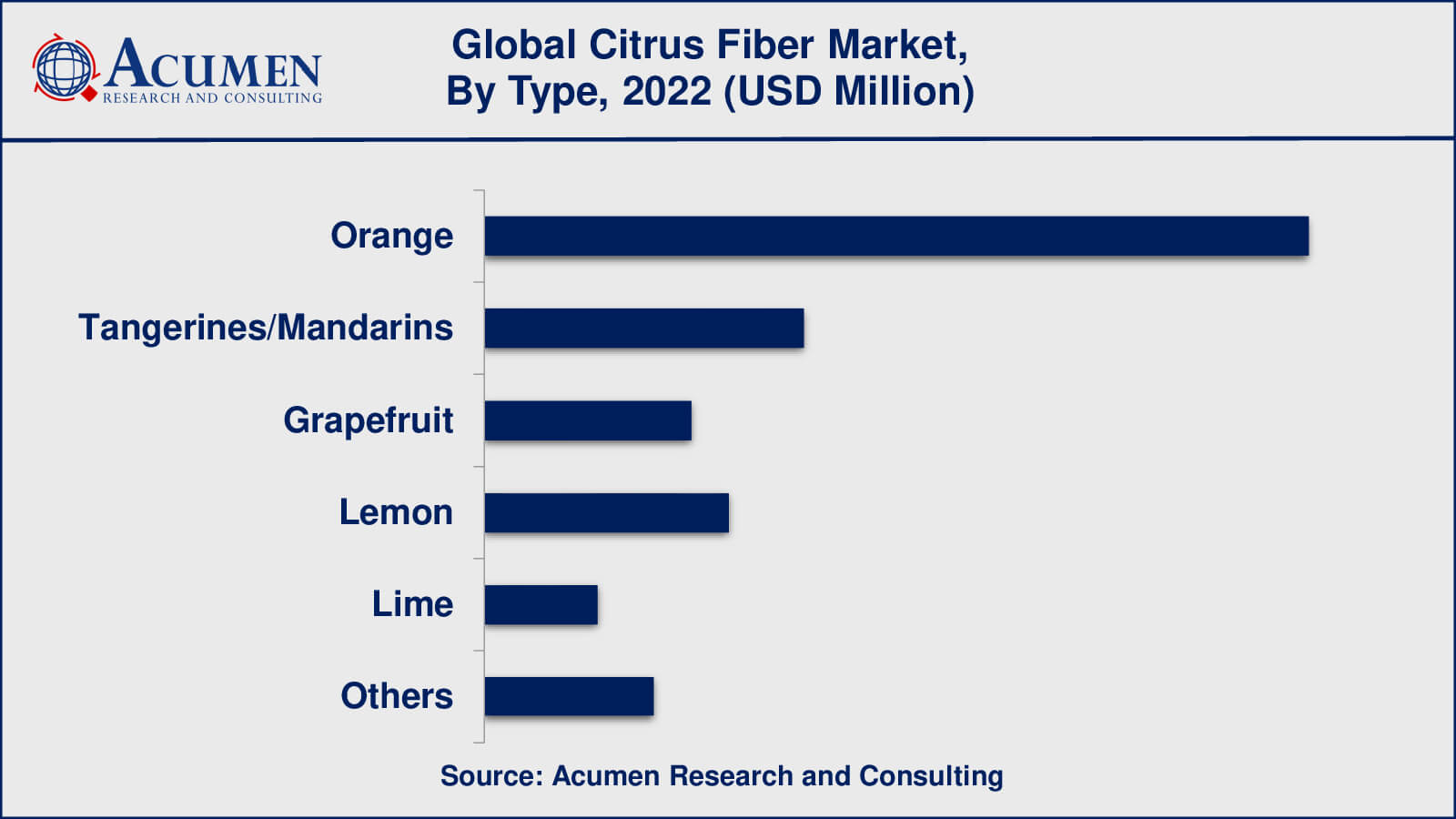

- Among type, the orange sub-segment occupied over US$ 150.8 million revenue in 2022

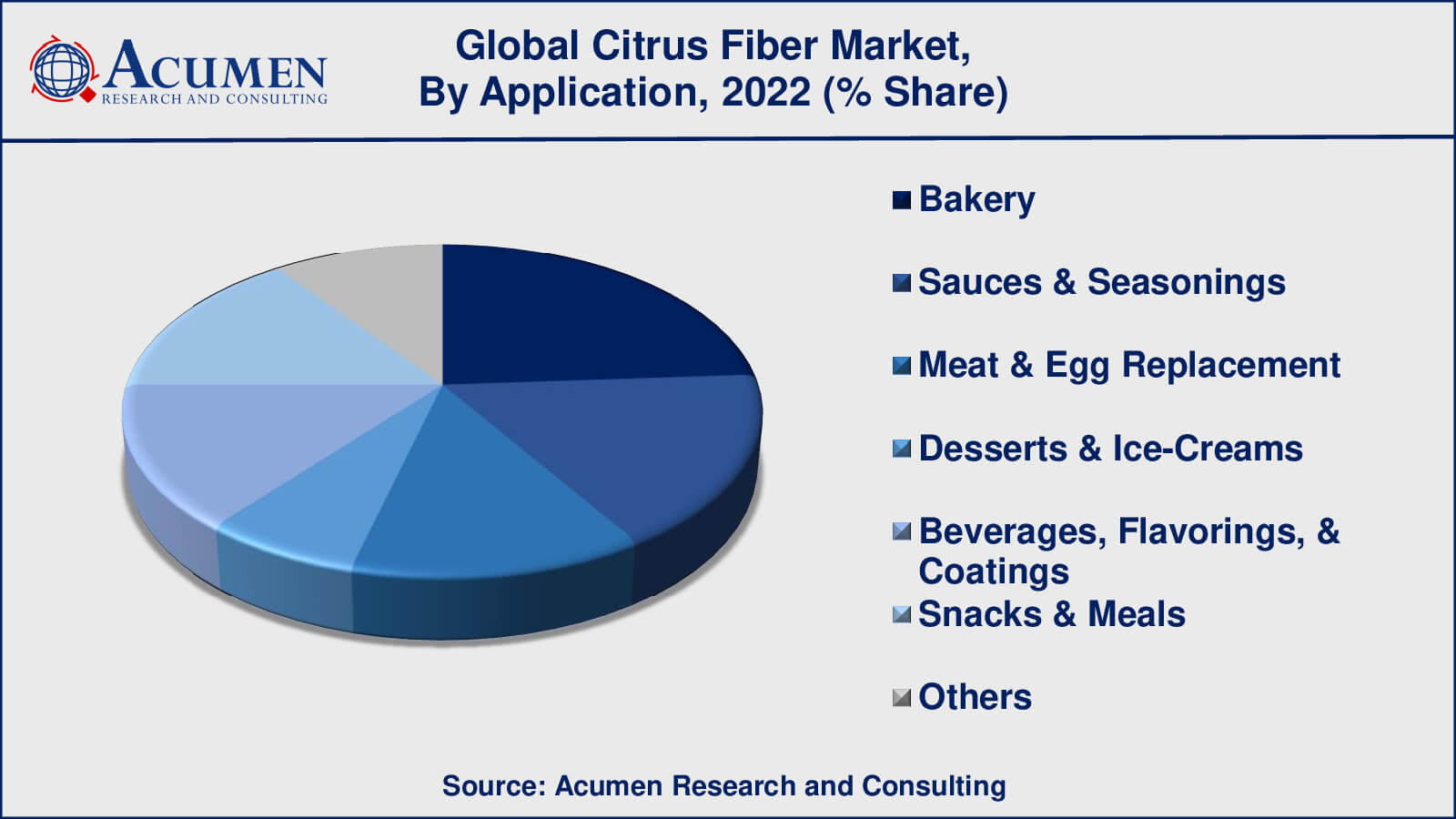

- Based on application, the bakery sub-segment gathered around 24% share in 2022

- Government regulations promoting the use of natural and healthy ingredients is a popular citrus fiber market trend that drives the industry demand

Citrus fiber is a dietary fiber obtained from the peel or pulp of citrus fruits such as oranges, lemons, and grapefruits. The juice from the fruits is mechanically extracted, and the residual peel or pulp is dried and processed into a fibrous powder or granules. Citrus fiber contains both soluble and insoluble fiber, such as pectin, cellulose, and hemicelluloses. It is frequently utilized as a functional ingredient in food, beverage, and supplement products to improve texture, moisture retention, fiber content, and to give a variety of health advantages. Citrus fiber is popular because of its natural origins, clean label status, and compatibility with various food processing procedures.

Global Citrus Fiber Market Dynamics

Market Drivers

- Growing consumer demand for natural and clean label ingredients

- Increasing awareness about health benefits of dietary fiber

- Rising demand for functional food and beverages

- Expanding applications in the food and beverage industry

Market Restraints

- Limited availability of raw materials

- High production costs

- Challenges in maintaining product quality and consistency

Market Opportunities

- Rising demand for plant-based alternatives

- Increasing use in pharmaceutical and nutraceutical industries

- Potential for innovation and product development in various sectors

Citrus Fiber Market Report Coverage

| Market | Citrus Fiber Market |

| Citrus Fiber Market Size 2022 | USD 342.8 Million |

| Citrus Fiber Market Forecast 2032 | USD 560.3 Million |

| Citrus Fiber Market CAGR During 2023 - 2032 | 5.2% |

| Citrus Fiber Market Analysis Period | 2020 - 2032 |

| Citrus Fiber Market Base Year | 2022 |

| Citrus Fiber Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Cargill Incorporated, CP Kelco, DuPont de Nemours, Inc., Fiberstar, Inc., Golden Health, Herbafood Ingredients GmbH, Ingredients by Nature, JRS Silvateam Ingredients S.r.l., Naturex SA, Quadra Chemicals Ltd., Royal DSM, and CEAMSA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Citrus Fiber Market Insights

The growing consumer desire for natural and clean label components is one of the primary causes. Citrus fiber has gained appeal as a natural dietary fiber source as people grow more health-conscious and seek for goods with less ingredients. Its citrus fruit origins appeal to people searching for recognizable and healthful products. In addition, there is a rising understanding of the health advantages of dietary fiber, which has increased demand for citrus fiber. Fiber has been shown to improve digestive health, control blood sugar levels, and help in weight loss. Consumers are actively searching for items with high fiber content as they become more cognizant of their nutritional choices, and citrus fiber provides an efficient way to address this need.

The food and beverage sector is a major driver of the citrus fiber market. Manufacturers are integrating citrus fiber into their goods to improve texture, moisture retention, and fiber content in response to increased customer demands for functional and healthier food alternatives. Citrus fiber is a popular alternative for product development due to its flexibility and compatibility with various food processing procedures.

Despite the strong development drivers, the citrus fiber industry has several challenges. One of these is the scarcity of raw resources. Citrus fiber is derived from citrus fruits, and changes in fruit availability can have an influence on citrus fiber output. Furthermore, the manufacturing process can be costly, which influences the entire cost of citrus fiber-based goods. Maintaining constant product quality and texture is particularly difficult, because differences in citrus peel content might affect the qualities of the resultant fiber.

Nonetheless, the citrus fiber industry offers several prospects for expansion. Citrus fiber, which is obtained from natural sources, has a huge opportunity due to the increased demand for plant-based alternatives. Furthermore, citrus fiber is rapidly being used in the pharmaceutical and nutraceutical sectors for its functional qualities and health advantages. The market also provides opportunities for product research and innovation as producers investigate novel applications and formulations for citrus fiber in a variety of industries.

Government rules encouraging the use of natural and healthful ingredients contribute to the market's expansion. Citrus fiber, a byproduct of the citrus juice business, benefits from consumers' increasing tastes towards sustainable and eco-friendly products. Processing technology advancements also contribute to market dynamics by offering improved extraction methods and quality control.

Citrus Fiber Market Segmentation

The worldwide market for citrus fiber is split based on type, application, and geography.

Citrus Fiber Types

- Orange

- Tangerines/Mandarins

- Grapefruit

- Lemon

- Lime

- Others

According to the citrus fiber industry analysis, orange is the type that has dominated the citrus fiber market. Oranges are widely grown and consumed across the world, and their peels and pulp are an important source of citrus fiber manufacturing. The citrus fiber industry's leading position is due to the significant availability and use of orange peel and pulp.

While oranges dominate the citrus fiber market, other citrus fruits such as tangerines/mandarins, grapefruit, lemon, lime, and others also play a role. These fruits have distinct qualities and flavours that can provide unique attributes and uses in the citrus fiber industry. However, in terms of market domination, orange is the dominant citrus fiber production and utilisation type.

Citrus Fiber Applications

- Bakery

- Beverages, Flavorings, & Coatings

- Desserts & Ice-Creams

- Meat & Egg Replacement

- Sauces & Seasonings

- Snacks & Meals

- Others

As per the citrus fiber market forecast, baking industry has is expected to dominated the industry throughout 2023 to 2032. Citrus fiber is often utilised in bakery products to improve texture, moisture retention, and the fiber content of baked foods. It aids in the softening, volume, and shelf life of bread, cakes, pastries, and other bakery goods.

While the baking industry accounts for a sizable portion of the citrus fiber market, other applications also contribute to overall demand. Citrus fiber is used as a natural thickener and stabiliser in drinks, sauces, dressings, and flavourings by the beverages, flavourings, and coatings industry. Citrus fiber adds texture and solidity to sweets and ice creams, enabling for the development of creamy and decadent goods.

Citrus Fiber Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Citrus Fiber Market Regional Analysis

Citrus fiber is a substantial market in North America, owing to the increased demand for clean label and natural ingredients in the food and beverage sector. Because of the presence of large food and beverage producers and the rising use of dietary fiber-rich products, the United States, in particular, leads the market in this area.

Europe is another important location in the citrus fiber market, owing to strict rules supporting clean label components and increased customer desire for natural and healthy food items. Germany, France, and the United Kingdom are major contributors to this region's market growth.

The Asia Pacific area has enormous development potential for the citrus fiber industry. The growing population, increased disposable income, and changing consumer lifestyles have spurred demand for functional foods and beverages, propelling citrus fiber uptake. China, Japan, India, and Southeast Asian countries are seeing rapid market expansion.

Citrus Fiber Market Players

Some of the top citrus fiber companies offered in our report include Cargill Incorporated, CP Kelco, DuPont de Nemours, Inc., Fiberstar, Inc., Herbafood Ingredients GmbH, Golden Health, Ingredients by Nature, Naturex SA, JRS Silvateam Ingredients S.r.l., Quadra Chemicals Ltd., Royal DSM, and CEAMSA.

Citrus Fiber Industry Recent Developments

- In 2021, Cargill announced a collaboration with Infinite Acres, a prominent developer of vertical farming technologies. The cooperation intends to use new technologies to build sustainable indoor farming solutions and increase the availability of fresh, locally farmed products.

- Grindsted® Citrus Fiber is a new citrus fiber product created by DuPont Nutrition & Biosciences, a commercial subsidiary of DuPont. This premium fiber has outstanding water-binding and texturizing capabilities, making it suited for a wide range of culinary applications, including meat and plant-based products.

Frequently Asked Questions

What was the size of the global citrus fiber market in 2022?

The size of citrus fiber market was USD 342.8 Million in 2022.

What is the citrus fiber market CAGR from 2023 to 2032?

The Citrus Fiber market CAGR during the analysis period of 2023 to 2032 is 5.2%.

Which are the key players in the citrus fiber market?

The key players operating in the global citrus fiber market are including Cargill Incorporated, CP Kelco, DuPont de Nemours, Inc., Fiberstar, Inc., Herbafood Ingredients GmbH, Golden Health, Ingredients by Nature, Naturex SA, JRS Silvateam Ingredients S.r.l., Quadra Chemicals Ltd., Royal DSM, and CEAMSA.

Which region dominated the global citrus fiber market share?

North America region held the dominating position in citrus fiber industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of citrus fiber during the analysis period of 2023 to 2032.

What are the current trends in the global Citrus Fiber industry?

The current trends and dynamics in the citrus fiber industry include growing consumer demand for natural and clean label ingredients, increasing awareness about health benefits of dietary fiber, and rising demand for functional food and beverages.

Which type held the maximum share in 2022?

The orange type held the maximum share of the citrus fiber industry.