Chlorotoluene Market | Acumen Research and Consulting

Chlorotoluene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

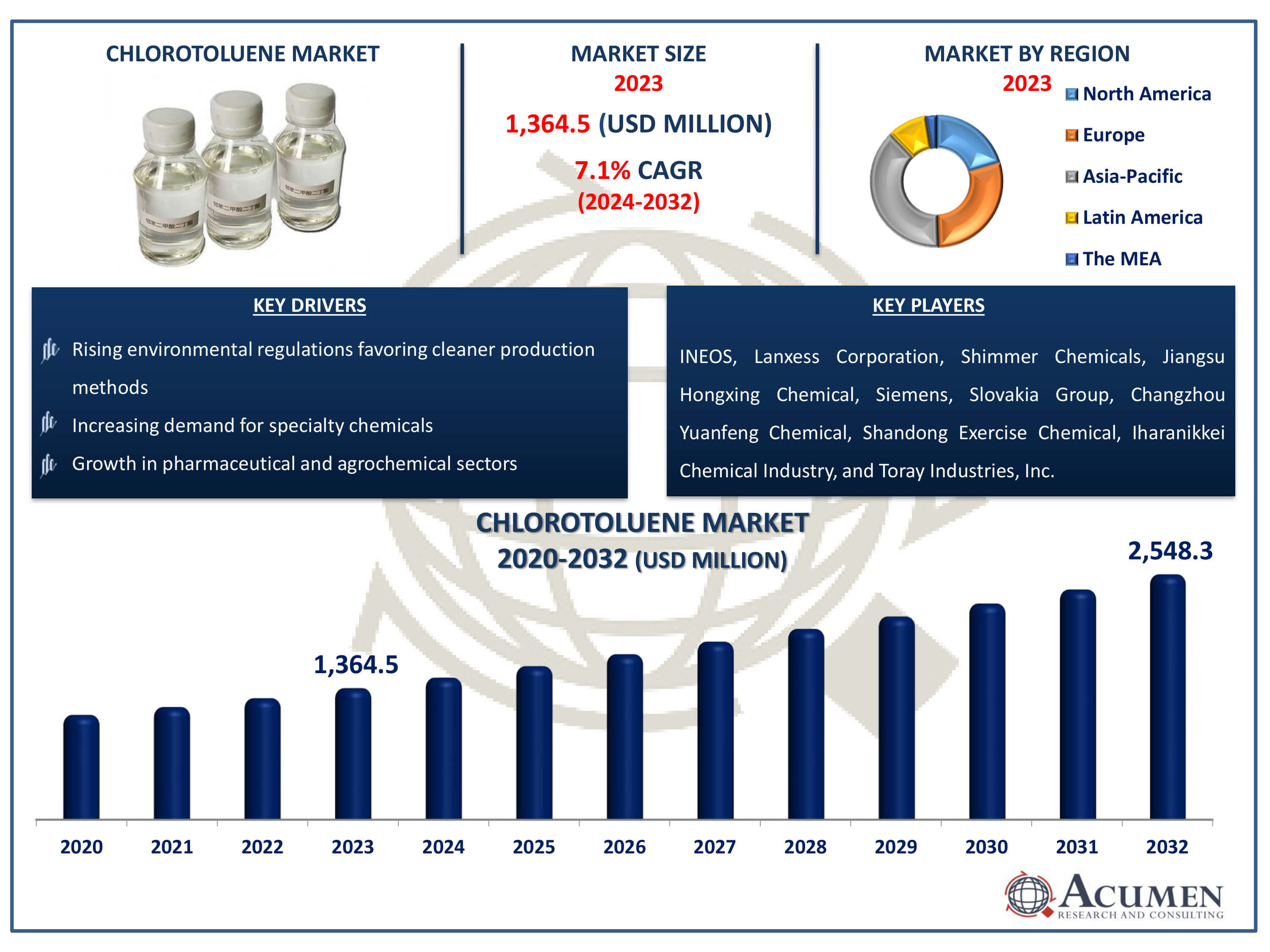

The Chlorotoluene Market Size accounted for USD 1,364.5 Million in 2023 and is estimated to achieve a market size of USD 2,548.3 Million by 2032 growing at a CAGR of 7.1% from 2024 to 2032.

Chlorotoluene Market Highlights

- Global chlorotoluene market revenue is poised to garner USD 2,548.3 million by 2032 with a CAGR of 7.1% from 2024 to 2032

- Asia-Pacific chlorotoluene market value occupied around USD 518.5 million in 2023

- Europe chlorotoluene market growth will record a CAGR of more than 8% from 2024 to 2032

- Among product type, the 2-chlorotoluene sub-segment generated around USD 750.5 million revenue in 2023

- Based on application, the chemical industries sub-segment generated more than 27% chlorotoluene market share in 2023

- Innovations in green chemistry and sustainable practices is a popular chlorotoluene market trend that fuels the industry demand

Chlorotoluene is composed of ortho-chlorotoluene, para-chlorotoluene, and meta-chlorotoluene, each with a benzene ring containing a methyl group and a chlorine atom in varying locations. Chlorotoluene is widely used in the chemical, textile, agricultural, and pharmaceutical industries, where it plays important roles in addition to catalysis. It plays an important role in the synthesis of a wide range of molecules and materials, including pharmaceutical intermediates and specialty chemicals. Its presence also extends to environmental applications and research contexts, where it helps to analyze pollution cleanup and reaction kinetics. This adaptability highlights chlorotoluene's usefulness in a variety of industrial processes and scientific inquiries, demonstrating its broad influence and ongoing relevance in modern chemistry and technology.

Global Chlorotoluene Market Dynamics

Market Drivers

- Increasing demand for specialty chemicals

- Growth in pharmaceutical and agrochemical sectors

- Advancements in chemical synthesis technologies

- Rising environmental regulations favoring cleaner production methods

Market Restraints

- Health and environmental concerns related to chlorinated compounds

- Fluctuating raw material prices

- Regulatory hurdles in different global regions

Market Opportunities

- Development of eco-friendly alternatives

- Expansion in emerging markets

- Application expansion in electronics and automotive sectors

Chlorotoluene Industry Report Coverage

| Market | Chlorotoluene Market |

| Chlorotoluene Market Size 2022 | USD 1,364.5 Million |

| Chlorotoluene Market Forecast 2032 | USD 2,548.3 Million |

| Chlorotoluene Market CAGR During 2023 - 2032 | 7.1% |

| Chlorotoluene Market Analysis Period | 2020 - 2032 |

| Chlorotoluene Market Base Year |

2022 |

| Chlorotoluene Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | INEOS, Lanxess Corporation, Shimmer Chemicals, Jiangsu Hongxing Chemical, Siemens, Slovakia Group, Changzhou Yuanfeng Chemical, Shandong Exercise Chemical, Iharanikkei Chemical Industry, and Toray Industries, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Chlorotoluene Market Insights

A variety of variables drive the worldwide chlorotoluene industry. To begin, there is an increasing need for chlorotoluene derivatives in industries such as textiles and chemicals. These derivatives are crucial in a variety of industrial processes and play a significant role in market growth. Furthermore, chlorotoluene is widely utilized in research, particularly to explore various chemical reactions, which drives market expansion. Another important driver is rising demand from chemical companies, which is aided by the rapid development of the textile sector and the cost-effectiveness of chlorotoluene products. This has resulted to increased global production and consumption rates. Furthermore, continued R&D operations have accelerated advancements in chlorotoluene uses, increasing its usability and market reach.

Nonetheless, the market confronts significant obstacles. Chlorotoluene is known to cause health problems when exposed, with high toxicity levels that can injure the body. These safety issues have limited market expansion to some extent since industries that use chlorotoluene must follow severe safety standards and regulations. In addition, rigorous government laws regarding chlorotoluene use create another challenge for industry participants. Compliance with these rules increases operational difficulties and expenses, influencing market dynamics over the chlorotoluene industry forecast period. To summarize, while the chlorotoluene market benefits from strong demand driven by industrial applications and ongoing research efforts, challenges such as health risks and regulatory compliance must be effectively managed to sustain growth and ensure safe utilization in various sectors around the world.

Chlorotoluene Market Segmentation

The worldwide market for chlorotoluene is split based on product type, application, and geography.

Chlorotoluene Product Types

- 2-Chlorotoluene

- 2,6-Dichlorotoluene

- 2,3-Dichlorotoluene

- 2,5-Dichloorotoluene

- Others

- 4-Chlorotouene

- 2,4-Dichlorotoluene

- 3,4-Dichlorotoluene

- Others

- Others

According to chlorotoluene industry analysis, the market is divided into various product types, with 2-chlorotoluene, 4-chlorotoluene, and others being the most common. The 2-chlorotoluene sector has the highest market share. This supremacy is due to its widespread use in a variety of industrial applications. 2-chlorotoluene is an important intermediary in the synthesis of medicines, agrochemicals, and colors. Its demand stems from its function in the synthesis of herbicides, fungicides, and insecticides, all of which are essential in agriculture. In addition, the pharmaceutical sector uses 2-Chlorotoluene to make a variety of active pharmaceutical ingredients (APIs). The compound's adaptability, combined with increased demand for various end products, contributes greatly to its market significance. Furthermore, innovations in chemical synthesis and increased investments in the chemical sector are projected to keep the 2-Chlorotoluene segment growing over the chlorotoluene market forecast period.

Chlorotoluene Applications

- Chemical Industries

- Textiles Industries

- Agriculture

- Pharmaceutical Industries

- Others

The chemical industries segment dominates the chlorotoluene industry due to its widespread use in numerous chemical synthesis processes. Chlorotoluene compounds are important intermediates in the manufacture of a variety of chemical products, such as solvents, dyes, and resins. Their distinct chemical characteristics make them extremely valuable in reactions involving chlorinated aromatic compounds. The chemical sector's substantial growth, fueled by rising demand for specialized chemicals and innovative materials, has greatly increased chlorotoluene use. Also, the ongoing invention and development of new chemical processes increases the use of chlorotoluene in the production of high-performance materials. The scalability of chemical production facilities, as well as the expansion of industrial applications, contribute to the chemical industries' supremacy in the chlorotoluene industry. The use of chlorotoluene to produce a wide range of chemical products maintains its long-term importance and market leadership.

Chlorotoluene Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Chlorotoluene Market Regional Analysis

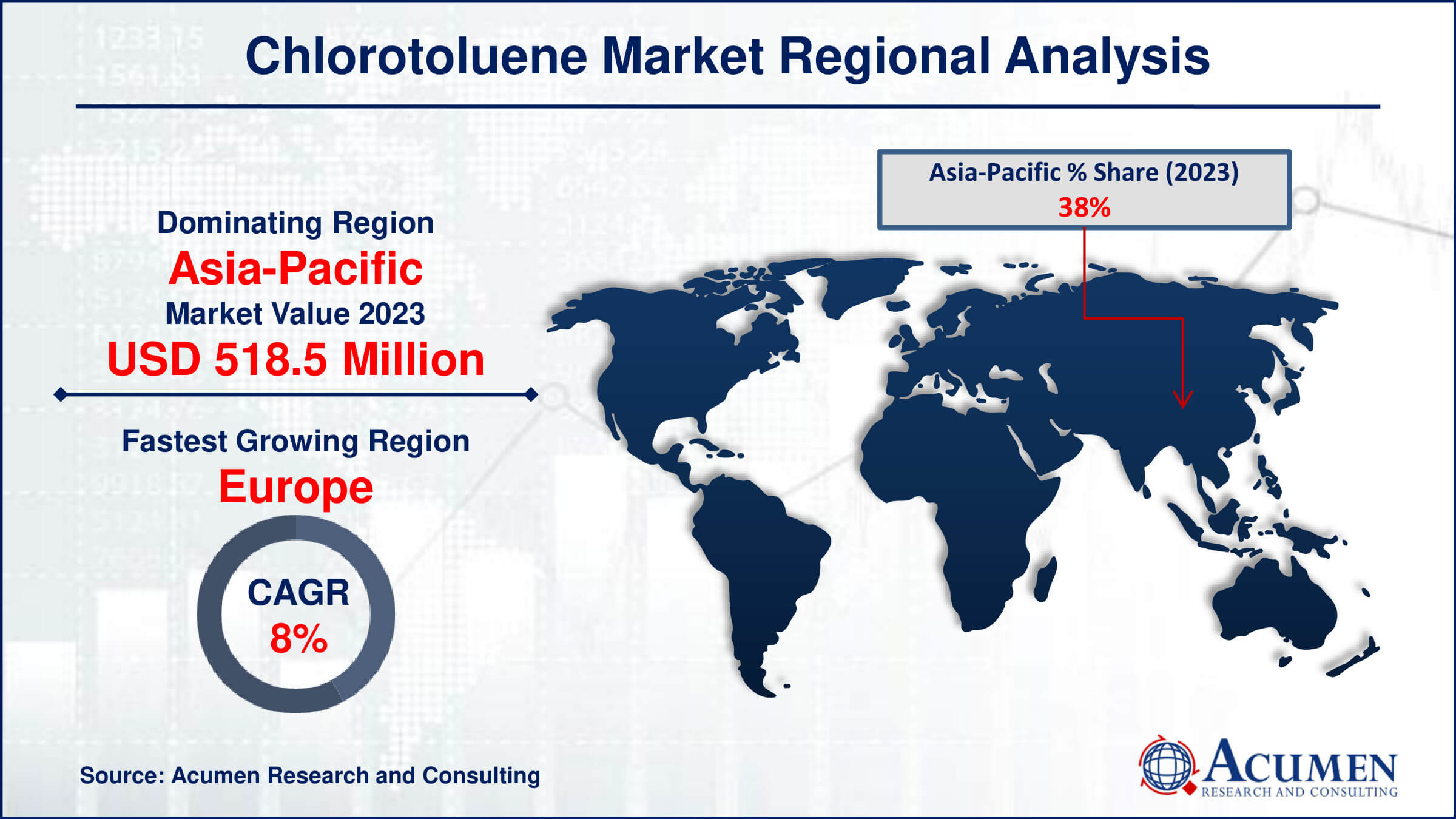

In terms of Chlorotoluene market analysis, in 2023, Asia-Pacific holds the major share in the global industry owing to the presence of major manufacturers and increasing demand from various industries, including textiles, chemicals, pharmaceuticals, and others. The Asia-Pacific region synthesizes over 38% of the total global chlorotoluene volume, making it a dominant region in the market. Additionally, rapid industrialization and developing chemical industries have supported market growth.

Europe is the fastest growing region in the market, followed by North America. Major factors driving the growth of the European market include the availability of funds, increasing demand from the textile industries, the presence of large research centers, and substantial government support. North America's market is expected to experience steady growth in the near future.

LAMEA holds the smallest share of the market, primarily due to the presence of poorer economies, especially in the African region. However, the market is expected to see healthy growth in the near future due to numerous untapped opportunities.

Chlorotoluene Market Players

Some of the top chlorotoluene companies offered in our report include INEOS, Lanxess Corporation, Shimmer Chemicals, Jiangsu Hongxing Chemical, Siemens, Slovakia Group, Changzhou Yuanfeng Chemical, Shandong Exercise Chemical, Iharanikkei Chemical Industry, and Toray Industries, Inc.

Frequently Asked Questions

How big is the chlorotoluene market?

The chlorotoluene market size was valued at USD 1,364.5 million in 2023.

What is the CAGR of the global chlorotoluene market from 2024 to 2032?

The CAGR of chlorotoluene is 7.1% during the analysis period of 2024 to 2032.

Which are the key players in the chlorotoluene market?

The key players operating in the global market are including INEOS, Lanxess Corporation, Shimmer Chemicals, Jiangsu Hongxing Chemical, Siemens, Slovakia Group, Changzhou Yuanfeng Chemical, Shandong Exercise Chemical, Iharanikkei Chemical Industry, and Toray Industries, Inc.

Which region dominated the global chlorotoluene market share?

Asia-Pacific held the dominating position in chlorotoluene industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of chlorotoluene during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global chlorotoluene industry?

The current trends and dynamics in the chlorotoluene industry include increasing demand for specialty chemicals, growth in pharmaceutical and agrochemical sectors, advancements in chemical synthesis technologies, and rising environmental regulations favoring cleaner production methods.

Which application held the maximum share in 2023?

The chemical industries application held the maximum share of the chlorotoluene industry.