Chitosan Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Chitosan Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

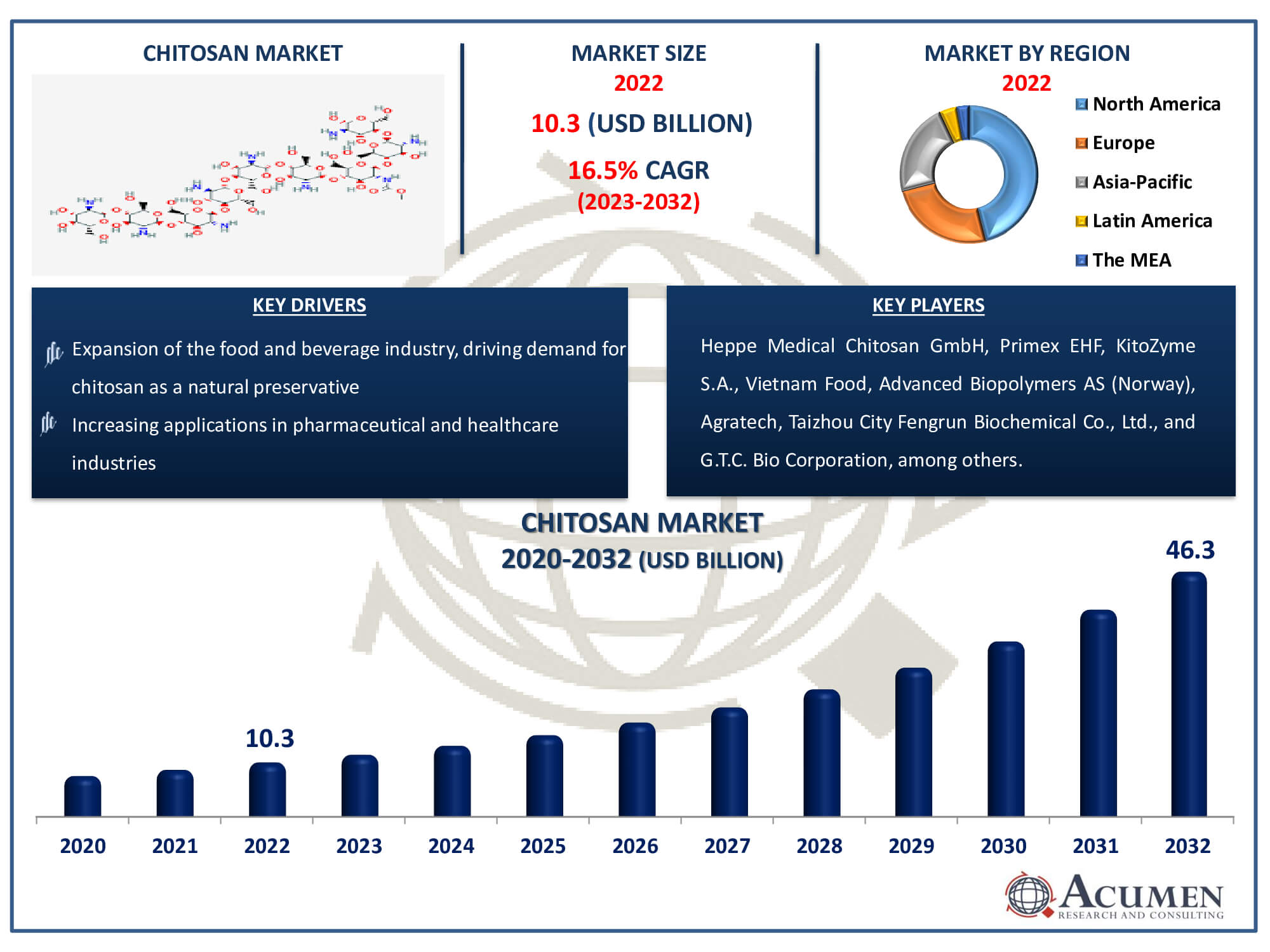

The Chitosan Market Size accounted for USD 10.3 Billion in 2022 and is estimated to achieve a market size of USD 46.3 Billion by 2032 growing at a CAGR of 16.5% from 2023 to 2032.

Chitosan Market Highlights

- Global chitosan market revenue is poised to garner USD 46.3 billion by 2032 with a CAGR of 16.5% from 2023 to 2032

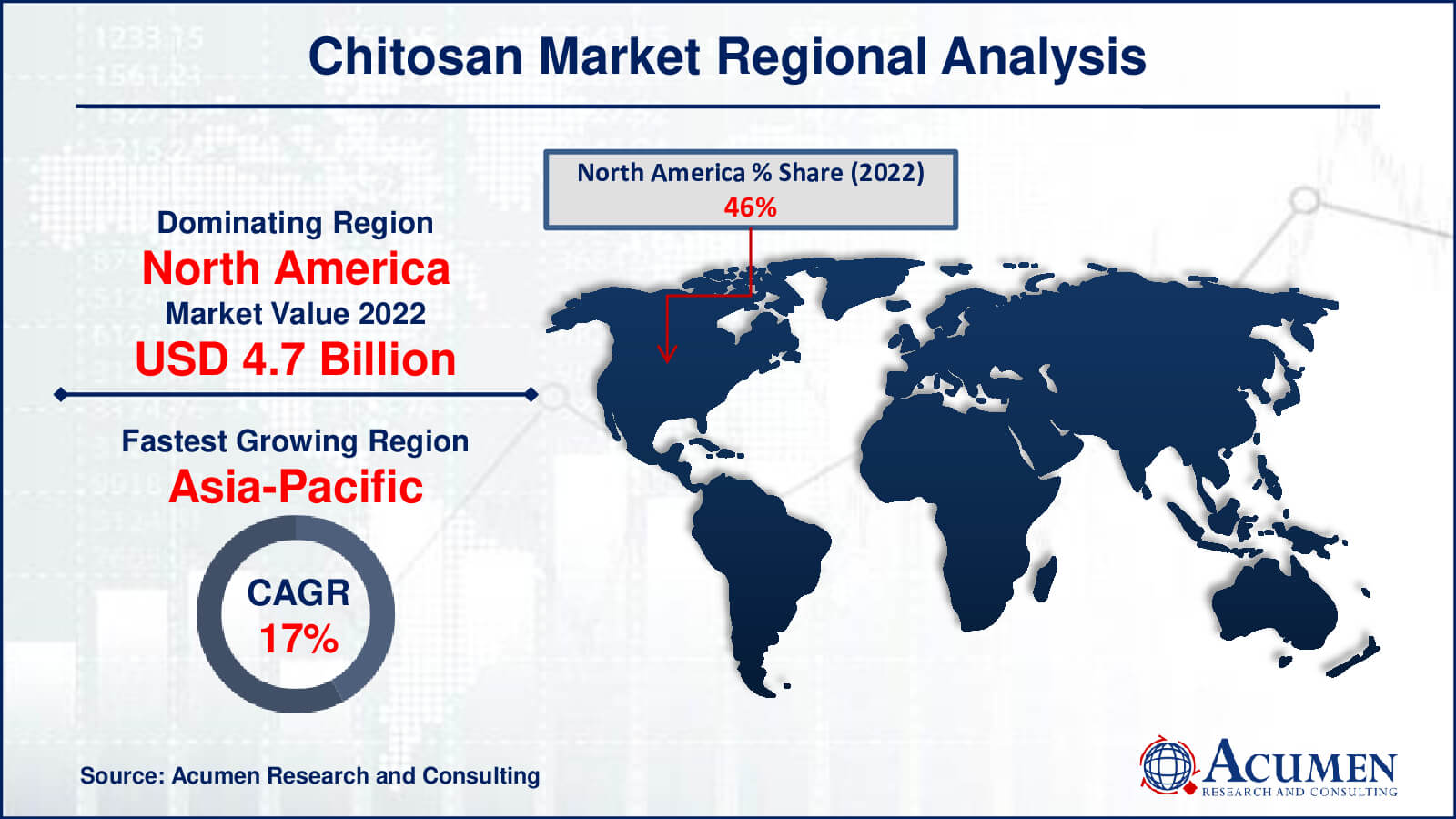

- North America chitosan market value occupied around USD 4.7 billion in 2022

- Asia-Pacific chitosan market growth will record a CAGR of more than 17% from 2023 to 2032

- Among grade, the industrial grade sub-segment generated more than USD 4.6 billion revenue in 2022

- Based on application, the water treatment sub-segment generated significant market share in 2022

- Research and development focus on enhancing chitosan's functionality and efficacy in various applications is a popular chitosan market trend that fuels the industry demand

Chitosan is derived from the deacetylation of chitin, a primary component found in the exoskeletons of marine animals. Shell waste from marine creatures such as squids, shrimp, krill, and crabs is commercially processed to obtain chitosan. This versatile compound finds applications across various industries including food, chemicals, agriculture, cosmetics, pharmaceuticals, and others. Key end uses include water treatment, biomedical and pharmaceutical products, cosmetics, and food and beverages. In Europe, approximately 750,000 tones of shell waste are produced annually according to the Food and Agriculture Organization (FAO) statistics. Around 40% of this waste mass is absorbed during crustacean processing, while the remainder is discarded. Rich in chitin, the waste undergoes processing to yield chitosan, glucosamine, and other derivatives. An average shell of crustacean waste comprises 30-40% protein, 30-50% calcium carbonate, and approximately 30% chitin. Chitin-containing shell waste is subjected to ideal reactions with specialized alkalis and acids for processing. Chitin is then further deacetylated to produce chitosan through continuous demineralization and deproteinization. Although chitosan can also be derived from certain fungi, it is less common due to the low chitin content in fungal cell walls and the lack of an efficient commercial extraction method.

Global Chitosan Market Dynamics

Market Drivers

- Growing demand for eco-friendly and biodegradable materials

- Increasing applications in pharmaceutical and healthcare industries

- Rising awareness about the benefits of chitosan in agriculture

- Expansion of the food and beverage industry, driving demand for chitosan as a natural preservative

Market Restraints

- Limited availability of raw materials for chitosan production

- Stringent regulations regarding chitosan quality and purity

- High production costs associated with chitosan extraction and processing

Market Opportunities

- Exploration of chitosan's potential in wastewater treatment and environmental remediation

- Adoption of chitosan in cosmetics and personal care products due to its skin-enhancing properties

- Growth prospects in the textile industry for chitosan-based fabrics with antimicrobial properties

Chitosan Market Report Coverage

| Market | Chitosan Market |

| Chitosan Market Size 2022 | USD 10.3 Billion |

| Chitosan Market Forecast 2032 |

USD 46.3 Billion |

| Chitosan Market CAGR During 2023 - 2032 | 16.5% |

| Chitosan Market Analysis Period | 2020 - 2032 |

| Chitosan Market Base Year |

2022 |

| Chitosan Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Grade, By Source, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Heppe Medical Chitosan GmbH, Primex EHF, KitoZyme S.A., Vietnam Food, Advanced Biopolymers AS (Norway), Agratech, Taizhou City Fengrun Biochemical Co., Ltd., G.T.C. Bio Corporation, Zhejiang Golden-Shell Pharmaceutical Co., Ltd., BIO21 Co., Ltd., and Biophrame Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Chitosan Market Insights

One of the main drivers of the industry is the rising demand for wastewater treatment products to remove impurities such as heavy minerals, petroleum, and phosphorus. In North America, strict regulations encourage producers of plastics to use bio-based products. Moreover, numerous end-use companies in the region are increasingly utilizing chitosan polymers, which is driving the market growth. In Canada, the pharmaceutical sector stands out as one of the most profitable sectors, as local pharmaceutical projects stimulate the demand for the product.

A growing demand for products from the cosmetics sector is also expected to contribute to market development, along with the expanding application range for products used in wastewater treatment. Additionally, the removal of strict laws restricting the establishment of new manufacturing units by the Government of Mexico has led to the growth of large-scale pharmaceutical installations in the region. This approach has been instrumental in driving national pharmaceutical sector development, which is likely to boost demand for products in the chitosan industry forecast period. However, elevated product expenses are anticipated to hinder market growth depending on quality and purity.

Some of the main drivers of demand in the worldwide chitosan industry include the unique and beneficial characteristics of chitosan, the abundance of raw materials, and an increased understanding of its health advantages. On the other hand, strict regulations on shrimp cultivation, significant drawbacks in drug delivery systems, and instability are hindering the growth of the chitosan market in other applications. The report analysts anticipate the manufacturing of non-aquatic chitosan as an opportunity to increase the market's turnover.

Chitosan Market Segmentation

The worldwide market for chitosan is split based on grade, source, application, and geography.

Chitosan Grades

- Industrial Grade

- Food Grade

- Pharmaceutical Grade

According to chitosan industry analysis, the market is dominated by the industrial grade segment because of its extensive uses in a variety of sectors. Paper production, textiles, cosmetics, wastewater treatment, and agriculture are the main industries that use industrial-grade chitosan. Its supremacy in the industry is a result of its cost-effectiveness and adaptability, which make it a popular option for many applications. The market for industrial-grade chitosan is also expanding as a result of the growing need for eco-friendly goods in industrial operations. Industrial-grade chitosan is still in high demand and is predicted to hold the top spot in the market due to its capacity to bind with contaminants and improve product performance.

Chitosan Sources

- Shrimps

- Prawns

- Crabs

- Other Sources

The shrimps category of the chitosan market has the largest share for a variety of reasons. One of the most plentiful sources of chitosan in the world is prawns, which makes them an affordable and easily accessible raw material for chitosan extraction. Large-scale shrimp shell waste is produced by the food-producing species of shrimp that are widely cultivated; this trash may be effectively processed to produce chitosan. This profusion of leftover prawn shell material guarantees a consistent and dependable supply of raw materials for the synthesis of chitosan. This market's dominance is also fueled by improvements in processing technology, which have made it easier to extract chitosan from prawn shells. The food, cosmetics, and pharmaceutical industries all have increasing demands for chitosan, and this is projected to keep the prawn segment at the top of the market.

Chitosan Applications

- Water Treatment

- Food & Beverage

- Cosmetics

- Pharmaceutical & Biomedical

- Others

According to the chitosan market analysis, water treatment is expected to the biggest segment in the industry because it is used so extensively to address problems with water contamination and purification. Chitosan is an important component of many water treatment procedures because of its special qualities, which include its capacity to bond with impurities including hydrocarbons and heavy metals. Chitosan is used in a variety of sectors, from industrial wastewater treatment facilities to municipal water treatment plants, since it may remove contaminants from water, clarify it, and encourage environmental sustainability. Furthermore, the need for chitosan-based solutions in water treatment applications is driven by the increased attention being paid to clean water programmes worldwide and the tightening of regulations on water quality. The Water Treatment sector is well-positioned to sustain its leadership position in the chitosan market due to its shown effectiveness and adaptability in meeting a range of water treatment requirements.

Chitosan Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Chitosan Market Regional Analysis

The market for chitosan is concentrated in North America. The Asia-Pacific area is anticipated to develop by large percent at a compound annual growth rate (CAGR) over the chitosan industry forecast period due to the existence of several companies in Japan and the simple accessibility of raw materials. Furthermore, it is projected that rising product acceptance in nations like China, Thailand, and India would accelerate industrialization and spur regional growth across a range of end-use industries. It is anticipated that the market would expand due to the growing need for organically derived water treatment chemicals brought on by growing drinking water requirements and depleting freshwater supplies. Market expansion is expected to benefit from the rapid growth in developing markets like China, Korea, and India, especially in the food and beverage, pharmaceutical, and cosmetics industries. The acceptance of chitosan as a natural food ingredient and rising consumer knowledge of its advantages fuel the market's expansion.

However, the European economic crisis has caused the pharmaceutical business in France, Germany, and Italy to expand slowly, which might have an impact on the market for pharmaceutical chitosan. Nonetheless, it is anticipated that rising R&D expenditure would propel industrial expansion. Furthermore, it is projected that the rising demand for natural cosmetics in the area would increase product demand even more.

Chitosan Market Players

Some of the top chitosan companies offered in our report includes Heppe Medical Chitosan GmbH, Primex EHF, KitoZyme S.A., Vietnam Food, Advanced Biopolymers AS (Norway), Agratech, Taizhou City Fengrun Biochemical Co., Ltd., G.T.C. Bio Corporation, Zhejiang Golden-Shell Pharmaceutical Co., Ltd., BIO21 Co., Ltd., and Biophrame Technologies.

Frequently Asked Questions

How big is the chitosan market?

The chitosan market size was valued at USD 10.3 billion in 2022.

What is the CAGR of the global chitosan market from 2023 to 2032?

The CAGR of chitosan is 16.5% during the analysis period of 2023 to 2032.

Which are the key players in the chitosan market?

The key players operating in the global market include Heppe Medical Chitosan GmbH, Primex EHF, KitoZyme S.A., Vietnam Food, Advanced Biopolymers AS (Norway), Agratech, Taizhou City Fengrun Biochemical Co., Ltd., G.T.C. Bio Corporation, Zhejiang Golden-Shell Pharmaceutical Co., Ltd., BIO21 Co., Ltd., and Biophrame Technologies.

Which region dominated the global chitosan market share?

North America held the dominating position in chitosan industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of chitosan during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global chitosan industry?

The current trends and dynamics in the chitosan industry include growing demand for eco-friendly and biodegradable materials, increasing applications in pharmaceutical and healthcare industries, rising awareness about the benefits of chitosan in agriculture, and expansion of the food and beverage industry, driving demand for chitosan as a natural preservative.

Which grade held the maximum share in 2022?

The industrial grade held the maximum share of the chitosan industry.