Ceramic Machinery Market | Acumen Research and Consulting

Ceramic Machinery Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

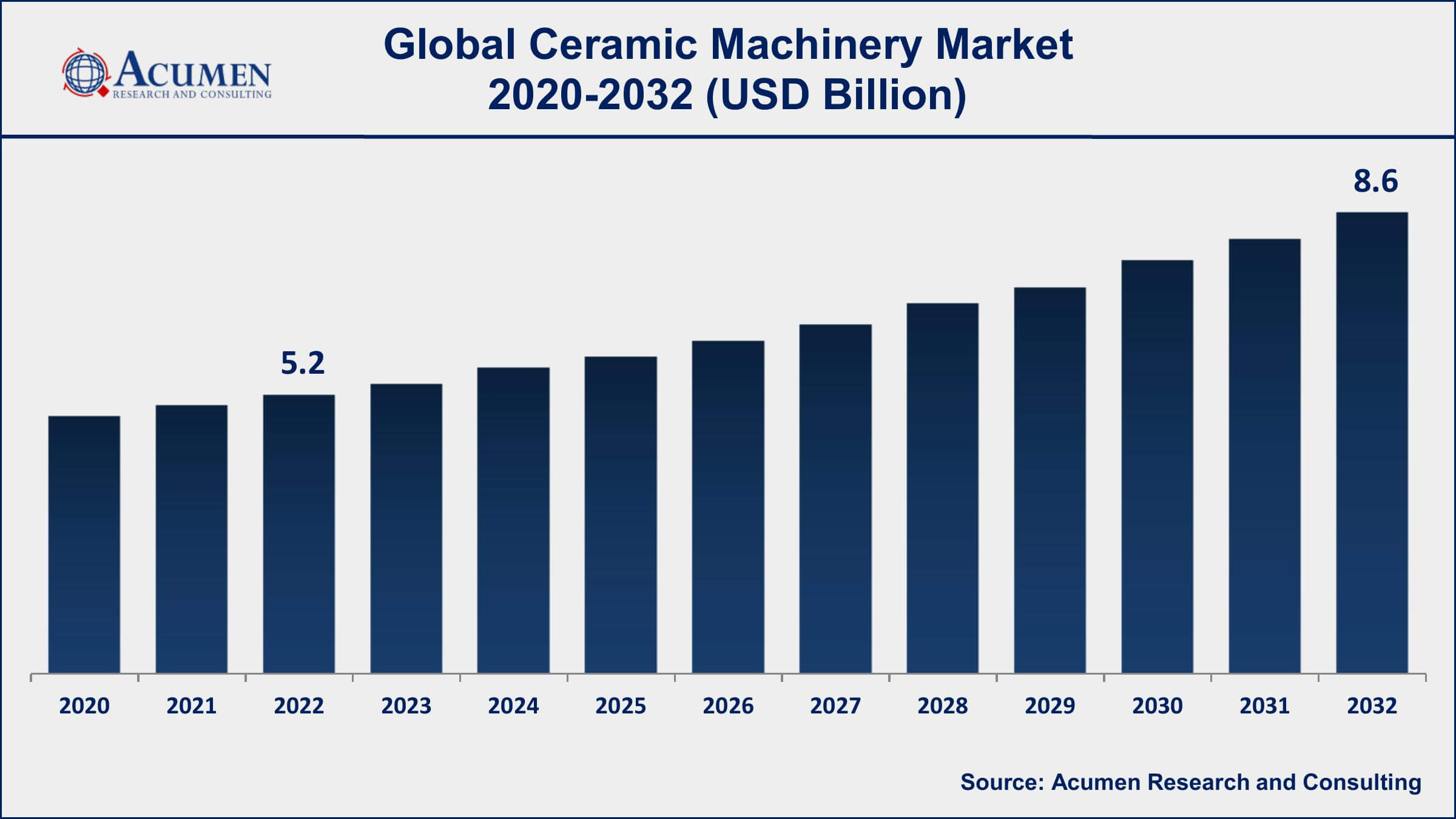

The Global Ceramic Machinery Market Size accounted for USD 5.2 Billion in 2022 and is projected to achieve a market size of USD 8.6 Billion by 2032 growing at a CAGR of 5.3% from 2023 to 2032.

Ceramic Machinery Market Highlights

- Global ceramic machinery market revenue is expected to increase by USD 8.6 Billion by 2032, with a 5.3% CAGR from 2023 to 2032

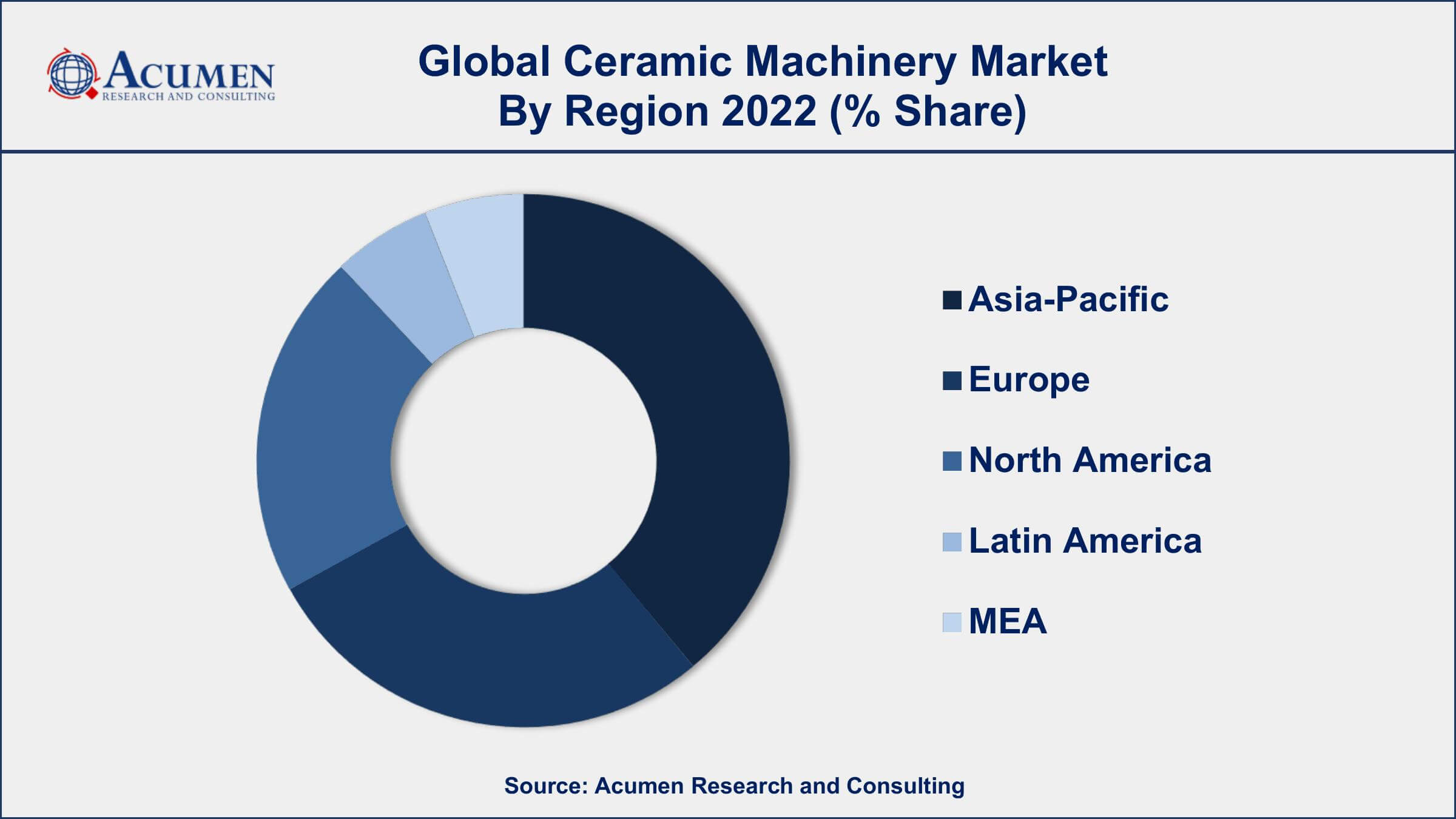

- Asia-Pacific region led with more than 41% of ceramic machinery market share in 2022

- The European Ceramic Tile Manufacturers' Federation (CEVISAMA) reports that in Europe, ceramic tiles are the most commonly used floor and wall covering material, representing over 50% of the total market

- The construction industry is the largest end-use industry in the market, accounting for over 36% of the market share in 2022

- The kilns and firing equipment segment is the largest and fastest-growing segment, accounting for over 29% of the market share in 2022

- Increasing demand for ceramic products from the construction industry, drives the ceramic machinery market value

Ceramic machinery refers to the machines and equipment used in the manufacturing and processing of ceramic products. This machinery includes pressing and molding equipment, kilns and firing equipment, glazing and decorating machinery, cutting and polishing machinery, and grinding machinery. Ceramic machinery is used to produce a wide range of ceramic products, including tableware, kitchenware, sanitaryware, tiles and bricks, and technical ceramics.

The ceramic machinery market has been witnessing steady growth in recent years due to the increasing demand for ceramic products from various end-use industries. The construction industry is a major end-user of ceramic products, including tiles, bricks, and sanitaryware, which is driving the ceramic machinery market growth. Additionally, the automotive and aerospace industries are also using ceramic products for various applications, such as engine components, brake systems, and insulation, further boosting the demand for ceramic machinery. Moreover, technological advancements in the ceramic machinery industry, such as the development of advanced kiln designs, energy-efficient machinery, and automated production systems, are driving the growth of the market.

Global Ceramic Machinery Market Trends

Market Drivers

- Increasing demand for ceramic products from the construction industry

- Growing use of ceramic products in the automotive and aerospace industries

- Technological advancements in the ceramic machinery industry, such as energy-efficient machinery and automated production systems

- Increasing demand for technical ceramics in various end-use industries

Market Restraints

- High initial investment costs associated with the purchase and installation of ceramic machinery

- Volatility in the prices of raw materials used in the production of ceramic products

Market Opportunities

- Growing demand for ceramic products in emerging economies such as China, India, and Brazil

- Rising popularity of 3D printing technology in the production of ceramic products

Ceramic Machinery Market Report Coverage

| Market | Ceramic Machinery Market |

| Ceramic Machinery Market Size 2022 | USD 5.2 Billion |

| Ceramic Machinery Market Forecast 2032 | USD 8.6 Billion |

| Ceramic Machinery Market CAGR During 2023 - 2032 | 5.3% |

| Ceramic Machinery Market Analysis Period | 2020 - 2032 |

| Ceramic Machinery Market Base Year | 2022 |

| Ceramic Machinery Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type of machinery, By Application, By End-use industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Sacmi Group, Sama Maschinenbau GmbH, Manfredini & Schianchi Srl, System Ceramics S.p.A., KEDA Clean Energy Co., Ltd., EFI Cretaprint, BMR Italia S.r.l., Händle GmbH Maschinen und Anlagenbau, Breton S.p.A., LAMGEA S.p.A., CMF Technology S.r.l., and Kajaria Ceramics Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ceramics is an inorganic solid material encompassing non-metal, metal, or semi-metal/metalloid atoms mainly held in ionic and covalent bonds. Ceramic materials are weak in tension and brittle, strong, and hard in compression. Ceramic materials can resist the chemical erosion that happens in materials that are exposed to acidic or caustic environments. Ceramics can generally endure very high temperatures.

The ceramic industry has started integrating automation like other manufacturing industries and focusing on automating their process of manufacturing. For instance, businesses are increasingly accepting vibrating sieves and belt conveyors for raw material automation and are also using hydraulic presses permitted with computerized regulator systems to provide efficient, stable, and continuous performance. In addition, the integration of such automation techniques with ceramic machinery will deduce production time along with ensuring maximum quality. Hence, the growth of the ceramic machinery market is driven due to all the factors mentioned. Environmental hazards in ceramic fabrication may hinder the growth of this market. Implementation and acceptance of programmable logic controller (PLC)-based organizations are also affecting the market positively and hence, it is expected to enhance the growth of this market in the near future.

Ceramic Machinery Market Segmentation

The global ceramic machinery market segmentation is based on type of machinery, application, end-use industry, and geography.

Ceramic Machinery Market By Type of machinery

- Pressing and molding machinery

- Kilns and firing equipment

- Glazing and decorating machinery

- Cutting and polishing machinery

- Grinding machinery

- Others

According to the ceramic machinery industry analysis, the kilns and firing equipment segment accounted for the largest market share in 2022. Kilns and firing equipment are critical components of the ceramic manufacturing process, and they are used to heat ceramic products at high temperatures to achieve the desired properties, such as hardness, strength, and durability. The demand for kilns and firing equipment is being driven by the increasing demand for ceramic products in various end-use industries, such as construction, automotive, aerospace, and healthcare. Additionally, technological advancements in kiln design, such as the development of energy-efficient and high-performance kilns, are further fueling the growth of this segment.

Ceramic Machinery Market By Application

- Tableware and kitchenware

- Sanitaryware

- Tiles and bricks

- Technical ceramics

- Others

In terms of applications, the tiles and bricks segment is expected to witness significant growth in the coming years. Ceramic tiles and bricks are extensively used in the construction industry for flooring, wall cladding, and other applications. The increasing demand for ceramic tiles and bricks from the construction industry is driving the market growth. Additionally, the growing popularity of ceramic tiles and bricks as a sustainable and eco-friendly alternative to other materials is also driving the growth of the segment. One of the key drivers of the growth of the tiles and bricks segment is the increasing demand for these products in emerging economies such as China, India, and Brazil, where the construction industry is growing rapidly.

Ceramic Machinery Market By End-use industry

- Construction

- Automotive

- Aerospace

- Healthcare

- Electronics and electrical

- Others

According to the ceramic machinery market forecast, the construction segment is expected to witness significant growth in the coming years. Ceramic products are extensively used in the construction industry for flooring, wall cladding, roofing, and other applications. The increasing demand for ceramic products from the construction industry is driving the market growth. Furthermore, the growing popularity of ceramic products as a sustainable and eco-friendly alternative to other materials is also driving the growth of the segment. One of the key drivers of the growth of the construction segment is the increasing investment in infrastructure development and urbanization across the world. Developing countries, in particular, are witnessing significant population growth and urbanization, which is driving the demand for affordable and durable building materials.

Ceramic Machinery Market Regional Outlook

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ceramic Machinery Market Regional Analysis

The Asia-Pacific region is dominating the ceramic machinery market due to several factors. The region is home to some of the largest ceramic producing countries, including China, India, and Japan, which collectively account for a significant share of the global ceramic production. The increasing demand for ceramic products from various end-use industries, such as construction, automotive, aerospace, and healthcare, is driving the regional growth. The construction industry, in particular, is growing at a rapid pace in Asia-Pacific, driven by factors such as population growth, urbanization, and increasing investment in infrastructure development. This, in turn, is fueling the demand for ceramic tiles, bricks, and other products, which is driving the growth of the ceramic machinery market. Furthermore, the Asia-Pacific region is witnessing significant technological advancements in the ceramic machinery industry, which is further driving the growth of the market. The increasing adoption of automation and robotics in ceramic manufacturing processes is helping to improve production efficiency and reduce labor costs, which is attracting several ceramic manufacturers to invest in new ceramic machinery.

Ceramic Machinery Market Player

Some of the top ceramic machinery market companies offered in the professional report include Sacmi Group, Sama Maschinenbau GmbH, Manfredini & Schianchi Srl, System Ceramics S.p.A., KEDA Clean Energy Co., Ltd., EFI Cretaprint, BMR Italia S.r.l., Händle GmbH Maschinen und Anlagenbau, Breton S.p.A., LAMGEA S.p.A., CMF Technology S.r.l., and Kajaria Ceramics Limited.

Frequently Asked Questions

What was the market size of the global ceramic machinery in 2022?

The market size of ceramic machinery was USD 5.2 Billion in 2022.

What is the CAGR of the global ceramic machinery market from 2023 to 2032?

The CAGR of ceramic machinery is 5.3% during the analysis period of 2023 to 2032.

Which are the key players in the ceramic machinery market?

The key players operating in the global market are including Sacmi Group, Sama Maschinenbau GmbH, Manfredini & Schianchi Srl, System Ceramics S.p.A., KEDA Clean Energy Co., Ltd., EFI Cretaprint, BMR Italia S.r.l., Händle GmbH Maschinen und Anlagenbau, Breton S.p.A., LAMGEA S.p.A., CMF Technology S.r.l., and Kajaria Ceramics Limited.

Which region dominated the global ceramic machinery market share?

Asia-Pacific held the dominating position in ceramic machinery industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Middle East and Africa region exhibited fastest growing CAGR for market of ceramic machinery during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ceramic machinery industry?

The current trends and dynamics in the ceramic machinery industry include increasing demand for clean water and wastewater treatment, growing concerns over water scarcity and water pollution, and rising demand from the pharmaceutical and chemical industries.

Which end-use industry held the maximum share in 2022?

The construction industry held the maximum share of the ceramic machinery industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date