Ceramic Filtration Membrane Market | Acumen Research and Consulting

Ceramic Filtration Membrane Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

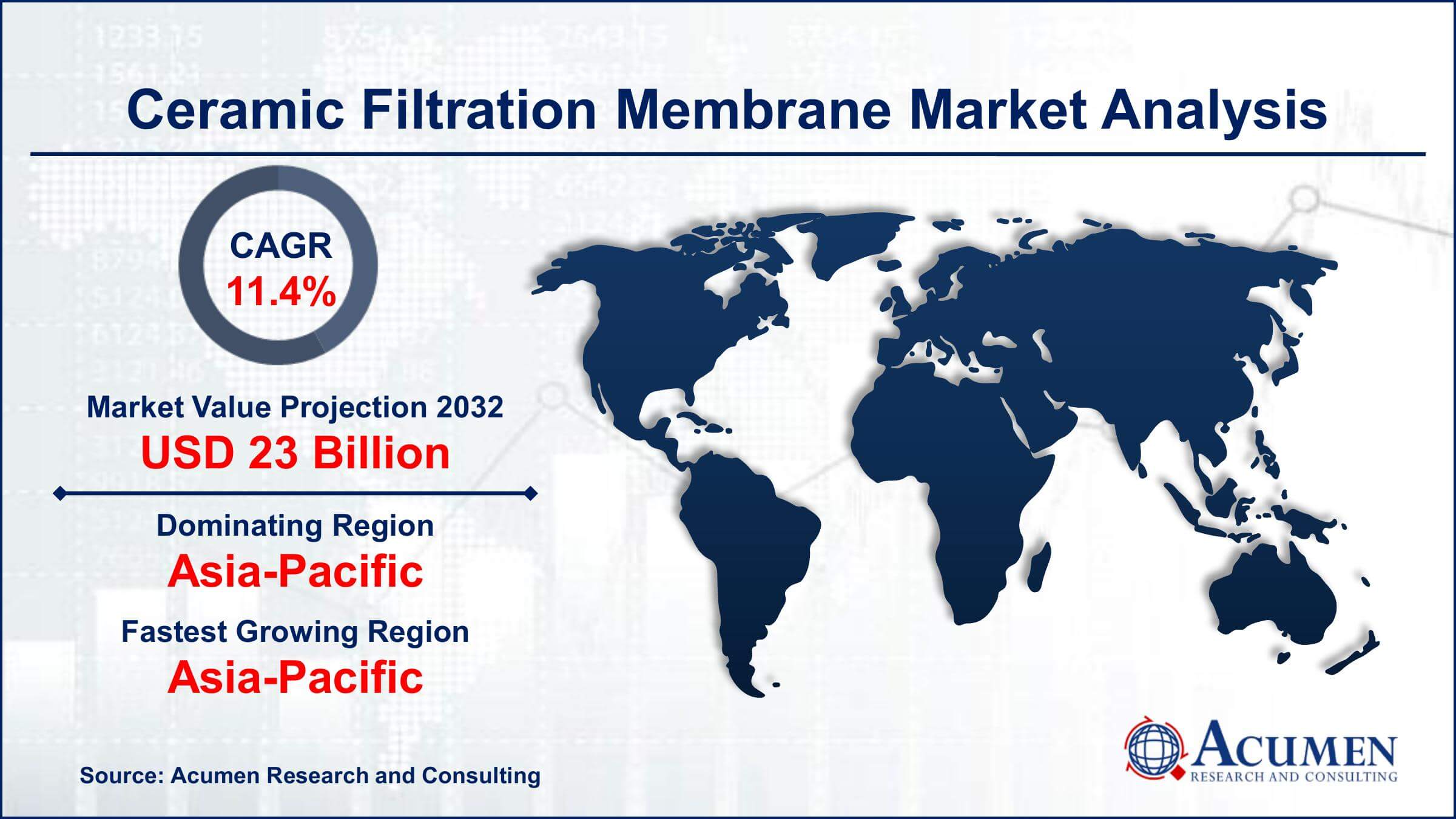

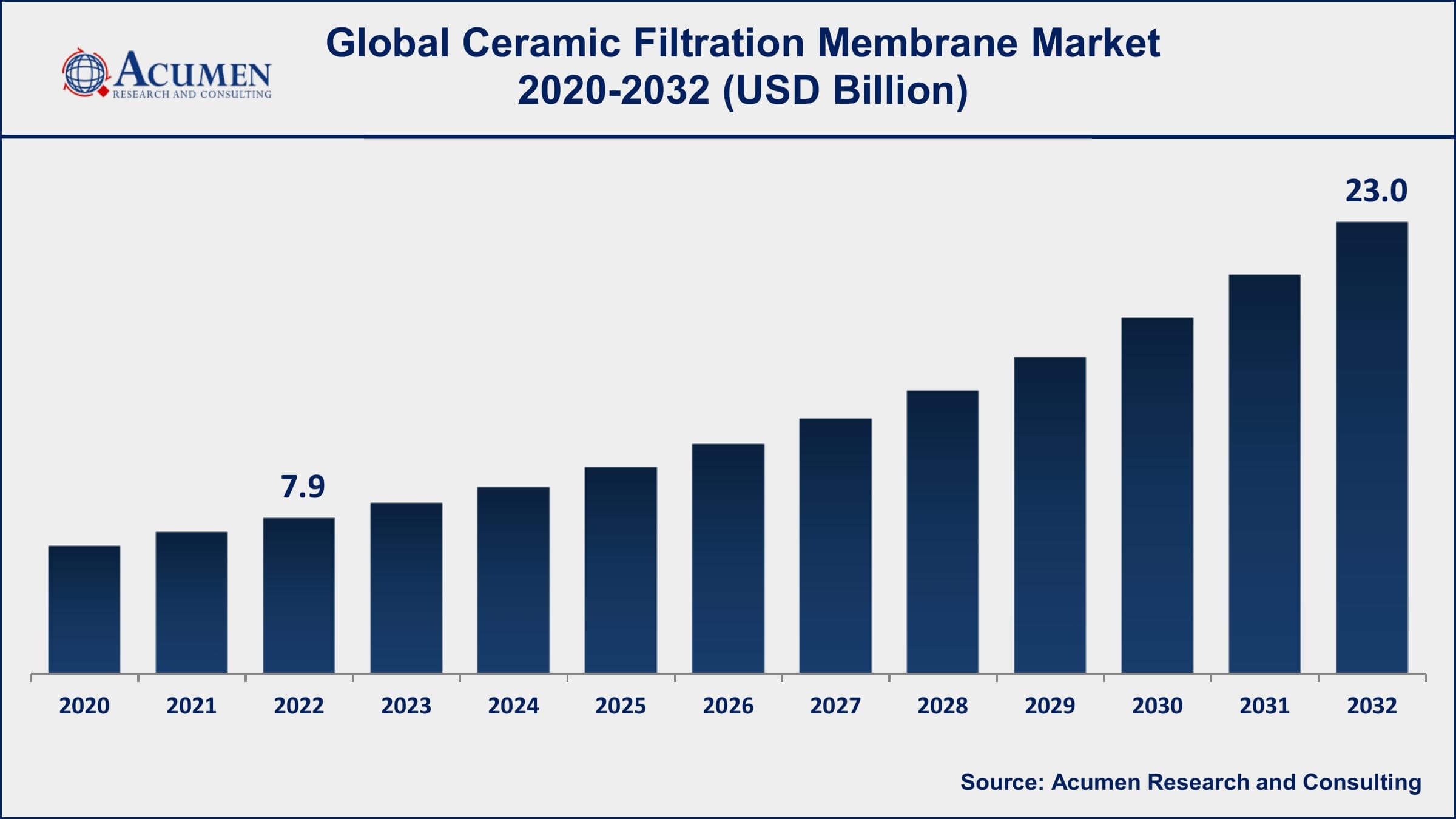

The Global Ceramic Filtration Membrane Market Size accounted for USD 7.9 Billion in 2022 and is projected to achieve a market size of USD 23.0 Billion by 2032 growing at a CAGR of 11.4% from 2023 to 2032.

Ceramic Filtration Membrane Market Highlights

- Global ceramic filtration membrane market revenue is expected to increase by USD 23.0 Billion by 2032, with a 11.4% CAGR from 2023 to 2032

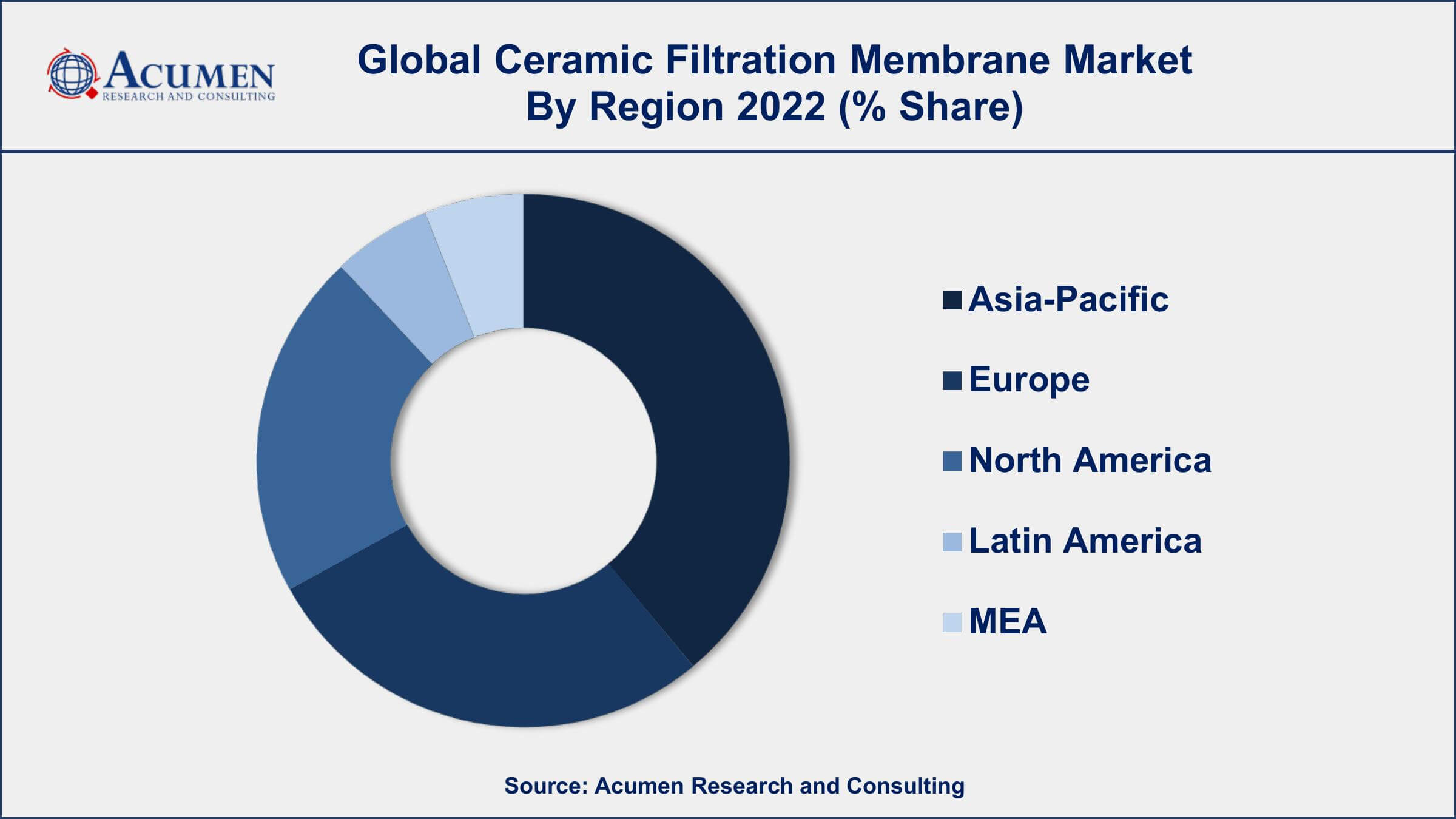

- Asia-Pacific region led with more than 38% of ceramic filtration membrane market share in 2022

- Alumina is the most commonly used material for ceramic filtration membranes, accounting for more than 54% of the market share in 2022

- The water and wastewater treatment segment is the largest application of ceramic filtration membranes, accounting for more than half of the market share in 2022

- By technology, the ultrafiltration segment is observed to witness a significant increase in the upcoming period

- Rising demand from the pharmaceutical and chemical industries, drives the ceramic filtration membrane market value

A ceramic filtration membrane is a type of membrane filtration technology that uses ceramic materials to filter and separate substances from fluids. It is widely used in various industries such as water and wastewater treatment, food and beverage, pharmaceutical, and chemical processing. Ceramic membranes have a high level of mechanical and chemical stability, making them durable and long-lasting, and are resistant to high temperatures and extreme pH conditions.

In recent years, the market for ceramic filtration membranes has experienced significant growth due to the increasing demand for clean water and wastewater treatment. Growing concerns over water scarcity, water pollution, and the need to meet stringent environmental regulations are some of the factors driving the demand for ceramic filtration membranes. The food and beverage industry also contributes to the growth of this market, as ceramic filtration membranes are used to purify and concentrate liquids such as fruit juices and dairy products. The pharmaceutical and chemical industries also use ceramic filtration membranes in their manufacturing processes to separate and purify different compounds.

Global Ceramic Filtration Membrane Market Trends

Market Drivers

- Increasing demand for clean water and wastewater treatment

- Growing concerns over water scarcity and water pollution

- Stringent environmental regulations

- Growing use of ceramic filtration membranes in the food and beverage industry

- Rising demand from the pharmaceutical and chemical industries

Market Restraints

- High capital investment is required for setting up ceramic membrane filtration systems

- Limited availability of raw materials for ceramic membrane manufacturing

Market Opportunities

- Development of new applications such as gas separation and wastewater reuse

- Advancements in ceramic membrane technology, such as the development of more efficient and cost-effective membranes

Ceramic Filtration Membrane Market Report Coverage

| Market | Ceramic Filtration Membrane Market |

| Ceramic Filtration Membrane Market Size 2022 | USD 7.9 Billion |

| Ceramic Filtration Membrane Market Forecast 2032 | USD 23.0 Billion |

| Ceramic Filtration Membrane Market CAGR During 2023 - 2032 | 11.4% |

| Ceramic Filtration Membrane Market Analysis Period | 2020 - 2032 |

| Ceramic Filtration Membrane Market Base Year | 2022 |

| Ceramic Filtration Membrane Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Application, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pall Corporation, Merck KGaA, 3M Company, Koch Membrane Systems, Inc., GE Water & Process Technologies, Hyflux Ltd., Veolia Water Technologies, Metawater Co., Ltd., Lenntech B.V., TAMI Industries, Nanostone Water, Inc., and Meidensha Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The ceramic filtration membrane system is a water treatment system to make clear and clean tap water by eradicating impurities such as protozoa and bacteria and pollutants in raw water from well water and river systems. It addresses current needs for tasty and safe tap water and also offers a cost-effective water treatment system. The ceramic membrane is tremendously durable and has excessive abrasion resistance. These are artificial membranes made from inorganic compounds such as zirconia, alumina, titania, and others.

Growing demand from several end-use industries such as pharmaceuticals, food and beverages, water and wastewater treatment, and biotechnology are driving the growth of this market. However, it is only suitable for straight-forward slurries thus, can limit its widespread adoption. The procedure benefits of ceramic membranes such as higher flux rates, pH resistance, and longer membrane service life are expected to drive the ceramic filtration membrane market growth in the near future.

Ceramic Filtration Membrane Market Segmentation

The global ceramic filtration membrane market segmentation is based on material, application, technology, and geography.

Ceramic Filtration Membrane Market By Material

- Titania

- Alumina

- Zirconia

- Silica

- Others

According to the ceramic filtration membrane industry analysis, the alumina segment accounted for the largest market share in 2022. Alumina ceramic membranes are a popular type of ceramic filtration membrane that is widely used in various industrial applications, such as water and wastewater treatment, food and beverage processing, and chemical processing. Alumina ceramic membranes are known for their excellent chemical and thermal stability, high mechanical strength, and good permeability, making them ideal for high-performance filtration applications. The alumina segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for water treatment solutions, particularly in the Asia-Pacific region, as well as the growing use of ceramic membranes in the food and beverage industry. Alumina ceramic membranes are also being increasingly used in the biotechnology and medical industries for applications such as protein concentration, virus filtration, and DNA purification.

Ceramic Filtration Membrane Market By Application

- Water & Waste Water Treatment

- Pharmaceuticals

- Food & Beverages

- Chemical Processing

- Textiles

- Others

In terms of applications, the water & wastewater treatment segment is expected to witness significant growth in the coming years. These membranes are used to remove impurities, suspended solids, and bacteria from water, making them safe for drinking, industrial processes, and agricultural purposes. Ceramic filtration membranes are preferred over other filtration technologies due to their high permeability, high mechanical and chemical stability, and excellent fouling resistance. The water and wastewater treatment segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for clean water and the growing need for efficient and cost-effective water treatment solutions. Rapid industrialization and urbanization, coupled with growing concerns over water pollution, are also contributing to the growth of this segment.

Ceramic Filtration Membrane Market By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

According to the ceramic filtration membrane market forecast, the ultrafiltration segment is expected to witness significant growth in the coming years. Ultrafiltration (UF) is a popular application of ceramic filtration membranes, particularly in the food and beverage industry, where UF is used for protein and enzyme concentration, clarification, and fractionation. Ceramic UF membranes are preferred over polymeric membranes due to their superior mechanical and chemical stability, higher flux rates, and better fouling resistance. Ceramic UF membranes are also used in the biotechnology, pharmaceutical, and chemical industries for various separation and purification applications. The ultrafiltration segment is expected to witness significant growth in the coming years. This growth is driven by the increasing demand for high-performance filtration solutions in various industries, particularly in the food and beverage industry. The increasing consumption of processed food and beverages, coupled with the growing need for efficient and cost-effective filtration solutions, is contributing to the growth of this segment.

Ceramic Filtration Membrane Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Ceramic Filtration Membrane Market Regional Analysis

Asia-Pacific is the largest and fastest-growing market for ceramic filtration membranes, accounting for a significant share of the global market. The dominance of Asia-Pacific in the ceramic filtration membrane market is driven by several factors, including rapid industrialization, increasing population, and growing environmental concerns. The region has a large number of industries, including food and beverage, pharmaceuticals, chemicals, and water and wastewater treatment, which are the major end-users of ceramic filtration membranes. Moreover, the region has a large and growing demand for clean water, driven by the increasing population, urbanization, and industrialization. The governments in the region are also focusing on improving the water and wastewater treatment infrastructure to meet the growing demand for clean water. For instance, the Indian government has launched the Namami Gange program, which aims to clean and rejuvenate the Ganga River, a major source of water for the country. Such initiatives are driving the demand for ceramic filtration membranes in the region.

Ceramic Filtration Membrane Market Player

Some of the top ceramic filtration membrane market companies offered in the professional report include Pall Corporation, Merck KGaA, 3M Company, Koch Membrane Systems, Inc., GE Water & Process Technologies, Hyflux Ltd., Veolia Water Technologies, Metawater Co., Ltd., Lenntech B.V., TAMI Industries, Nanostone Water, Inc., and Meidensha Corporation.

Frequently Asked Questions

What was the market size of the global ceramic filtration membrane in 2022?

The market size of ceramic filtration membrane was USD 7.9 Billion in 2022.

What is the CAGR of the global ceramic filtration membrane market from 2023 to 2032?

The CAGR of ceramic filtration membrane is 11.4% during the analysis period of 2023 to 2032.

Which are the key players in the ceramic filtration membrane market?

The key players operating in the global market are including Pall Corporation, Merck KGaA, 3M Company, Koch Membrane Systems, Inc., GE Water & Process Technologies, Hyflux Ltd., Veolia Water Technologies, Metawater Co., Ltd., Lenntech B.V., TAMI Industries, Nanostone Water, Inc., and Meidensha Corporation.

Which region dominated the global ceramic filtration membrane market share?

Asia-Pacific held the dominating position in ceramic filtration membrane industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of ceramic filtration membrane during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global ceramic filtration membrane industry?

The current trends and dynamics in the ceramic filtration membrane industry include increasing demand for clean water and wastewater treatment, growing concerns over water scarcity and water pollution, and rising demand from the pharmaceutical and chemical industries.

Which application held the maximum share in 2022?

The water & waste water treatment application held the maximum share of the ceramic filtration membrane industry.