Cephalosporin Market | Acumen Research and Consulting

Cephalosporin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

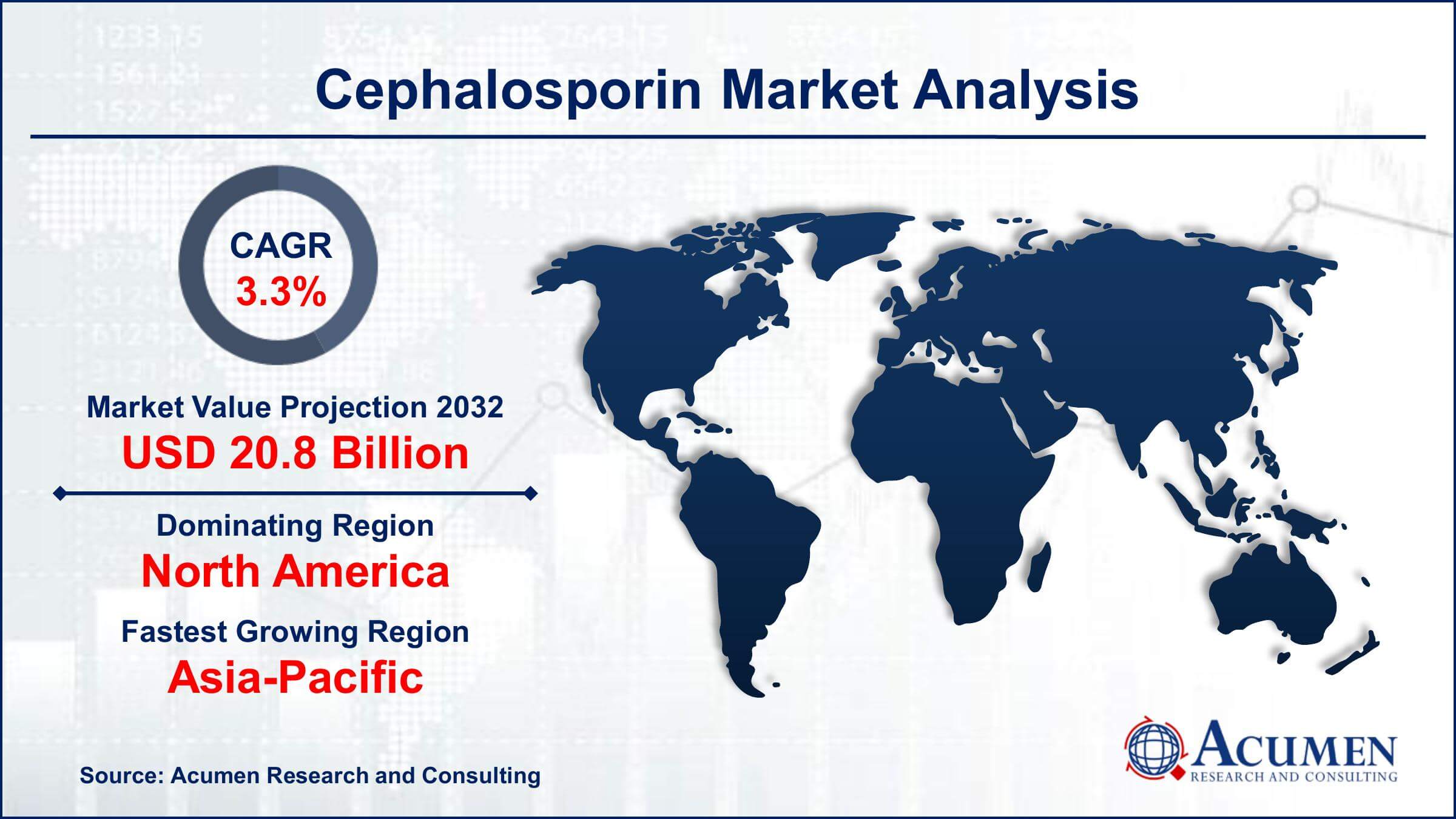

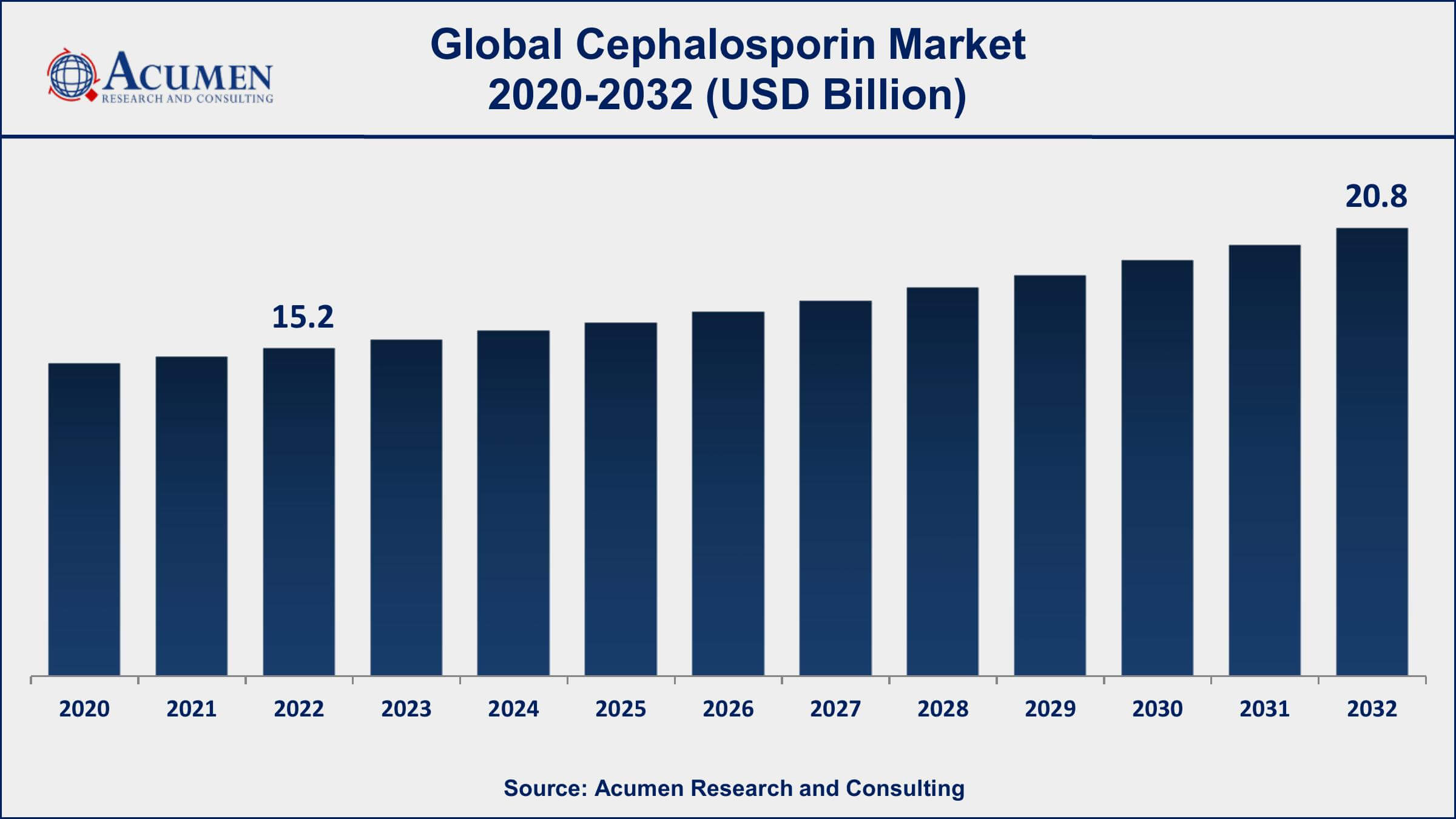

The Global Cephalosporin Market Size accounted for USD 15.2 Billion in 2022 and is projected to achieve a market size of USD 20.8 Billion by 2032 growing at a CAGR of 3.3% from 2023 to 2032.

Cephalosporin Market Key Highlights

- Global cephalosporin market revenue is expected to increase by USD 20.8 Billion by 2032, with a 3.3% CAGR from 2023 to 2032

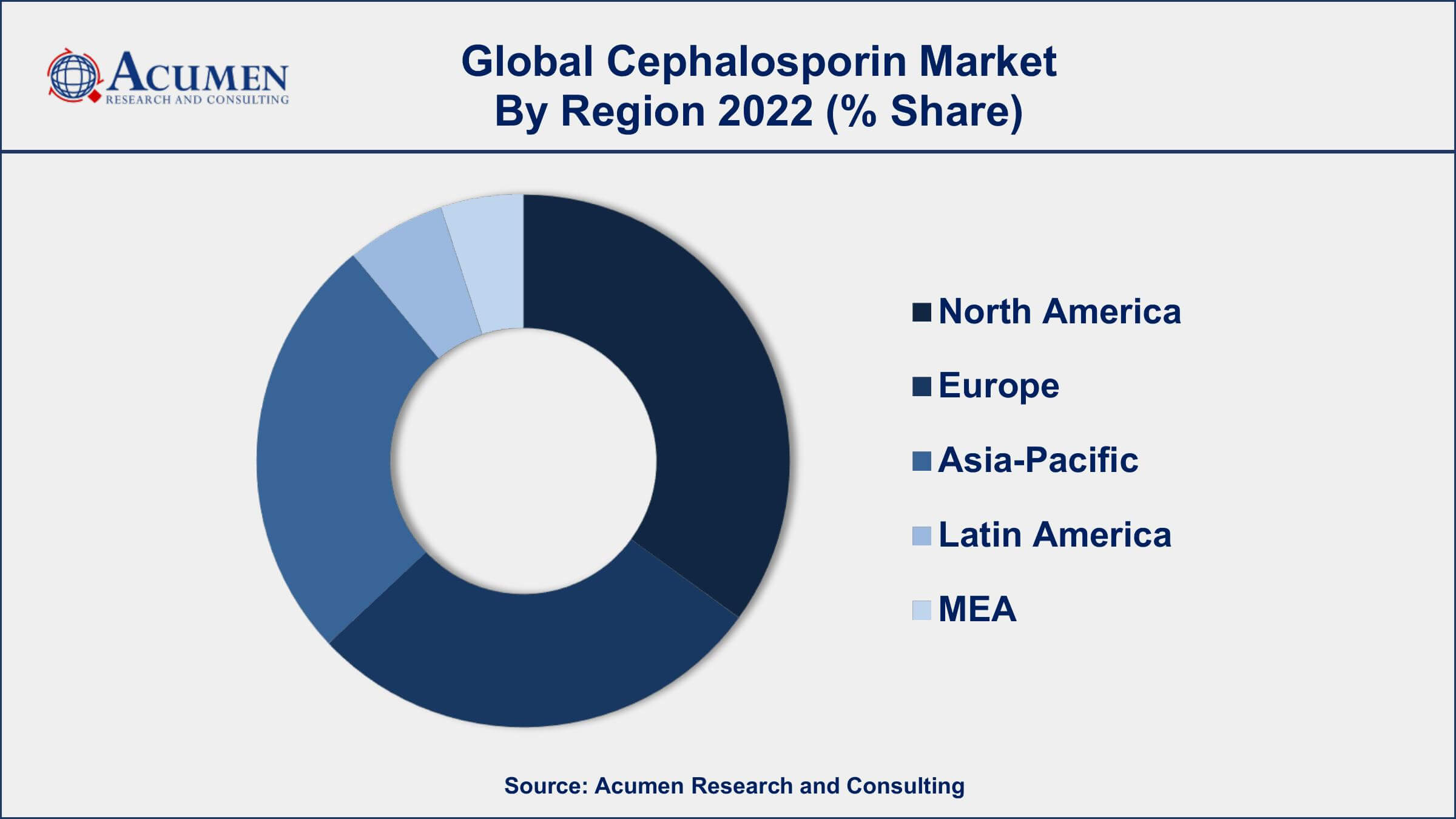

- North America region led with more than 41% of cephalosporin market share in 2022

- Asia-Pacific regional market growth will record a CAGR of over 4% from 2023 to 2032

- By generation, the third-generation cephalosporin segment is the largest segment in the market, accounting for over 44% of the market share

- The injection segment is the fastest-growing segment in the market, with a CAGR of 4.1% from 2023 to 2032

- Increasing prevalence of infectious diseases worldwide, drives the cephalosporin market value

Cephalosporins are a class of antibiotics used to treat various bacterial infections. They were first discovered in 1945 by Dr. Giuseppe Brotzu, an Italian pharmacologist, and are structurally similar to penicillin. However, cephalosporins are more resistant to bacterial enzymes that break down antibiotics, making them effective against a broader range of bacterial infections.

Since their introduction, cephalosporins have become one of the most widely prescribed antibiotics globally. The market growth for cephalosporins has been significant over the past few years, driven by the increasing incidence of bacterial infections, including antibiotic-resistant strains, and the rise in the global population. The cephalosporin market growth is also attributed to the increasing demand for effective and affordable antibiotics, especially in developing countries. Additionally, the development of new-generation cephalosporins with improved efficacy and safety profiles is also driving the market growth.

Global Cephalosporin Market Trends

Market Drivers

- Increasing prevalence of infectious diseases worldwide.

- Rising demand for efficient and safe antibiotics

- Rising awareness among healthcare providers about the benefits of cephalosporin antibiotics

- Introduction of novel cephalosporin antibiotics with improved efficacy and safety profiles

Market Restraints

- High cost of cephalosporin antibiotics

- Adverse side effects associated with cephalosporin antibiotics

Market Opportunities

- Increasing demand for combination therapy with cephalosporin antibiotics

- Growing popularity of online pharmacies and e-commerce platforms

Cephalosporin Market Report Coverage

| Market | Cephalosporin Market |

| Cephalosporin Market Size 2022 | USD 15.2 Billion |

| Cephalosporin Market Forecast 2032 | USD 20.8 Billion |

| Cephalosporin Market CAGR During 2023 - 2032 | 3.3% |

| Cephalosporin Market Analysis Period | 2020 - 2032 |

| Cephalosporin Market Base Year | 2022 |

| Cephalosporin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Generation, By Route of Administration, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc., GlaxoSmithKline plc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., AstraZeneca plc., Novartis International AG, Eli Lilly and Company, Bristol-Myers Squibb Company, Johnson & Johnson, AbbVie Inc., and Roche Holding AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cephalosporins are one of the largest and most diverse families of antibiotics of the bactericidal β-lactam group. Based on their antimicrobial activity, they are grouped into various types of generations. Cephalosporin inhibits enzymes in the cell wall of susceptible bacteria, hence disrupting cell synthesis. Increasing research and development activities and increasing demand for antibacterial drugs is propelling the market growth of cephalosporin.

The market for cephalosporin would continue to rise immensely with the aging population and increasing incidences of infectious diseases worldwide. Cephalosporin has a broad range of therapeutic applications and is effective in the treatment of streptococcal, pneumococcal, staphylococcal, Klebsiella, Escherichia coli, and Proteus infections. One of the significant roles of cephalosporin has been as a chemoprophylactic agent at the time of surgical procedures. In addition, cephalosporin has the ability to retain excellent pharmacokinetic properties, hence making cephalosporin drugs the first choice for the treatment of various infections. However, factors such as certain side effects associated with cephalosporin and the development of drug-resistant bacterial strains might restrain the market growth.

Cephalosporin Market Segmentation

The global cephalosporin market segmentation is based on generation, route of administration, application, and geography.

Cephalosporin Market By Generation

- First Generation

- Second Generation

- Third Generation

- Fourth Generation

- Fifth Generation

According to the cephalosporin industry analysis, the third generation segment accounted for the largest market share in 2022. This growth is primarily due to their broad spectrum of activity and effectiveness against antibiotic-resistant bacteria. Third-generation cephalosporins are a class of antibiotics that were developed to overcome some of the limitations of earlier generations of cephalosporins. They have a broad spectrum of activity and are effective against many gram-negative bacteria, including some strains that are resistant to earlier generations of cephalosporins. Third-generation cephalosporins are often used to treat severe infections, such as pneumonia, sepsis, and meningitis. One of the key drivers of the growth in the third-generation cephalosporin segment is the increasing incidence of antibiotic-resistant bacteria, particularly gram-negative bacteria.

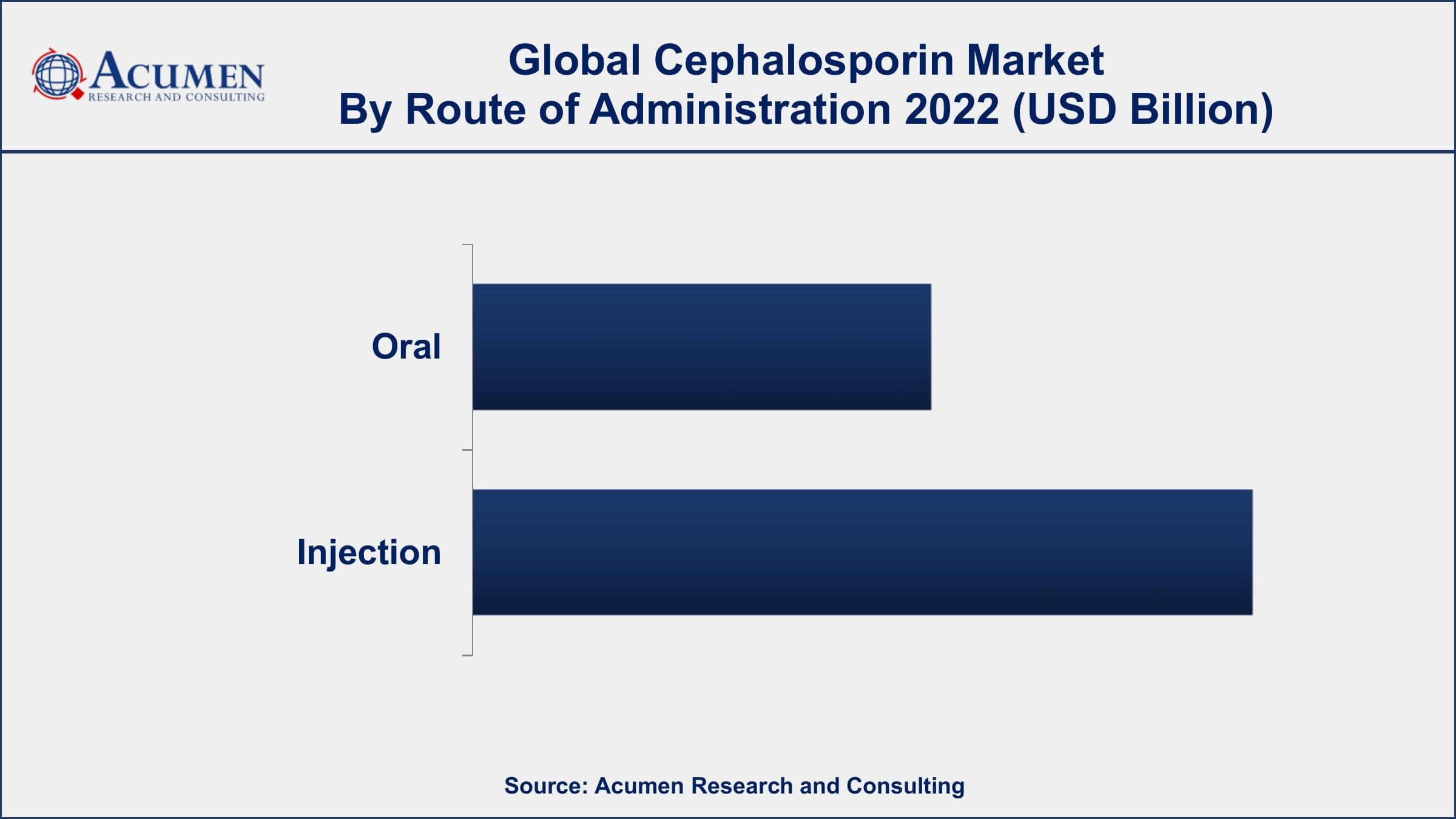

Cephalosporin Market By Route of Administration

- Oral

- Injection

In terms of the route of administration, the injection segment is expected to witness significant growth in the coming years. Cephalosporin injections are a preferred choice for treating severe bacterial infections that require immediate treatment, such as sepsis, pneumonia, and meningitis. They are also used in hospital settings, where they are administered intravenously or intramuscularly, ensuring rapid onset of action and high bioavailability. The growth of the injection segment is driven by several factors, including the increasing incidence of bacterial infections globally, particularly in hospital settings. The growing demand for effective and affordable antibiotics, especially in developing countries, is also driving the growth of the injection segment.

Cephalosporin Market By Application

- Respiratory Tract

- Ear Infection

- Skin Infection

- Sexually Transmitted Infection

- Urinary Tract Infection

- Others

According to the cephalosporin market forecast, the respiratory tract segment is expected to witness significant growth in the coming years. Cephalosporins are widely used to treat respiratory tract infections caused by various bacteria, including Streptococcus pneumoniae, Haemophilus influenzae, and Moraxella catarrhalis. These infections include pneumonia, bronchitis, sinusitis, and otitis media. The growth of the respiratory tract segment is driven by several factors, including the increasing prevalence of respiratory tract infections globally. The rise in antibiotic-resistant strains of bacteria causing these infections is also driving the growth of the respiratory tract segment. Additionally, the growing demand for effective and affordable antibiotics, especially in developing countries, is driving the growth of the respiratory tract segment. Furthermore, the adoption of combination therapies using cephalosporins and other antibiotics for the treatment of respiratory tract infections is also driving the growth of this segment.

Cephalosporin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cephalosporin Market Regional Analysis

North America is one of the dominant regions in the global cephalosporin market. This dominance is primarily due to the high incidence of bacterial infections, the presence of a well-established healthcare infrastructure, and the increasing adoption of advanced therapeutics in the region. Additionally, the high prevalence of antibiotic-resistant bacteria in the region is also driving market growth. Furthermore, the increasing government initiatives for the development of healthcare infrastructure, coupled with the high healthcare spending in the region, is expected to drive the North American market growth. Moreover, the presence of key market players in the region, such as Pfizer Inc., Merck & Co., and Teva Pharmaceutical Industries Ltd., is also contributing to regional growth. In addition, the regulatory framework in US and Canada are conducive to the growth of the North America cephalosporin industry.

Cephalosporin Market Player

Some of the top Cephalosporin market companies offered in the professional report include Pfizer Inc., GlaxoSmithKline plc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., AstraZeneca plc., Novartis International AG, Eli Lilly and Company, Bristol-Myers Squibb Company, Johnson & Johnson, AbbVie Inc., and Roche Holding AG.

Frequently Asked Questions

What was the market size of the global cephalosporin in 2022?

The market size of cephalosporin was USD 15.2 Billion in 2022.

What is the CAGR of the global cephalosporin market from 2023 to 2032?

The CAGR of cephalosporin is 3.3% during the analysis period of 2023 to 2032.

Which are the key players in the cephalosporin market?

The key players operating in the global market are including Pfizer Inc., GlaxoSmithKline plc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Sanofi S.A., AstraZeneca plc., Novartis International AG, Eli Lilly and Company, Bristol-Myers Squibb Company, Johnson & Johnson, AbbVie Inc., and Roche Holding AG.

Which region dominated the global cephalosporin market share?

North America held the dominating position in cephalosporin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cephalosporin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cephalosporin industry?

The current trends and dynamics in the cephalosporin industry include increasing prevalence of infectious diseases worldwide, and rising demand for efficient and safe antibiotics.

Which route of administration held the maximum share in 2022?

The injection route of administration held the maximum share of the cephalosporin industry.