Central Venous Catheters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Central Venous Catheters Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

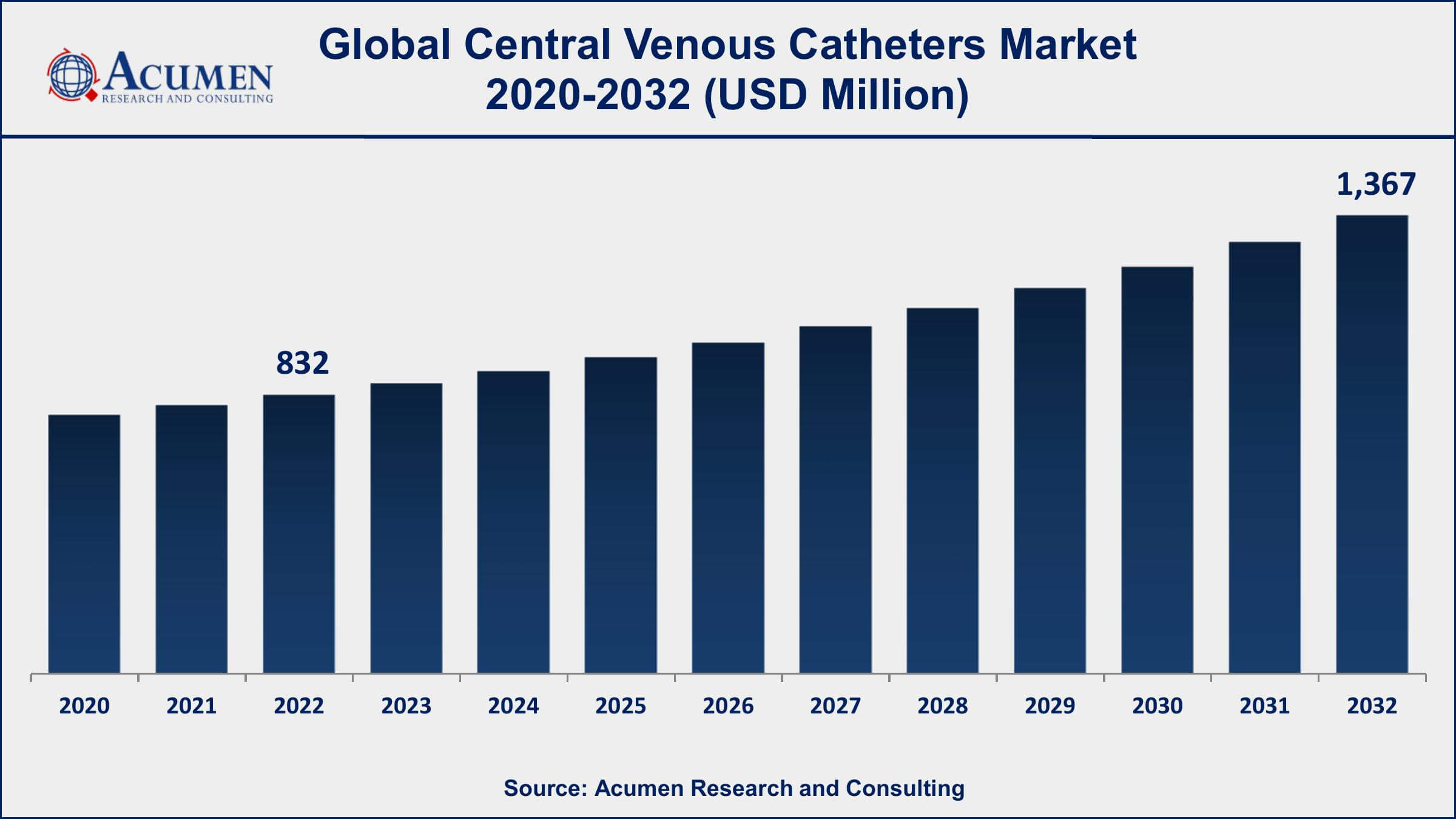

The Global Central Venous Catheters (CVCs) Market Size accounted for USD 832 Million in 2022 and is projected to achieve a market size of USD 1,367 Million by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Central Venous Catheters Market Highlights

- Global central venous catheters market revenue is expected to increase by USD 1,367 Million by 2032, with a 5.2% CAGR from 2023 to 2032

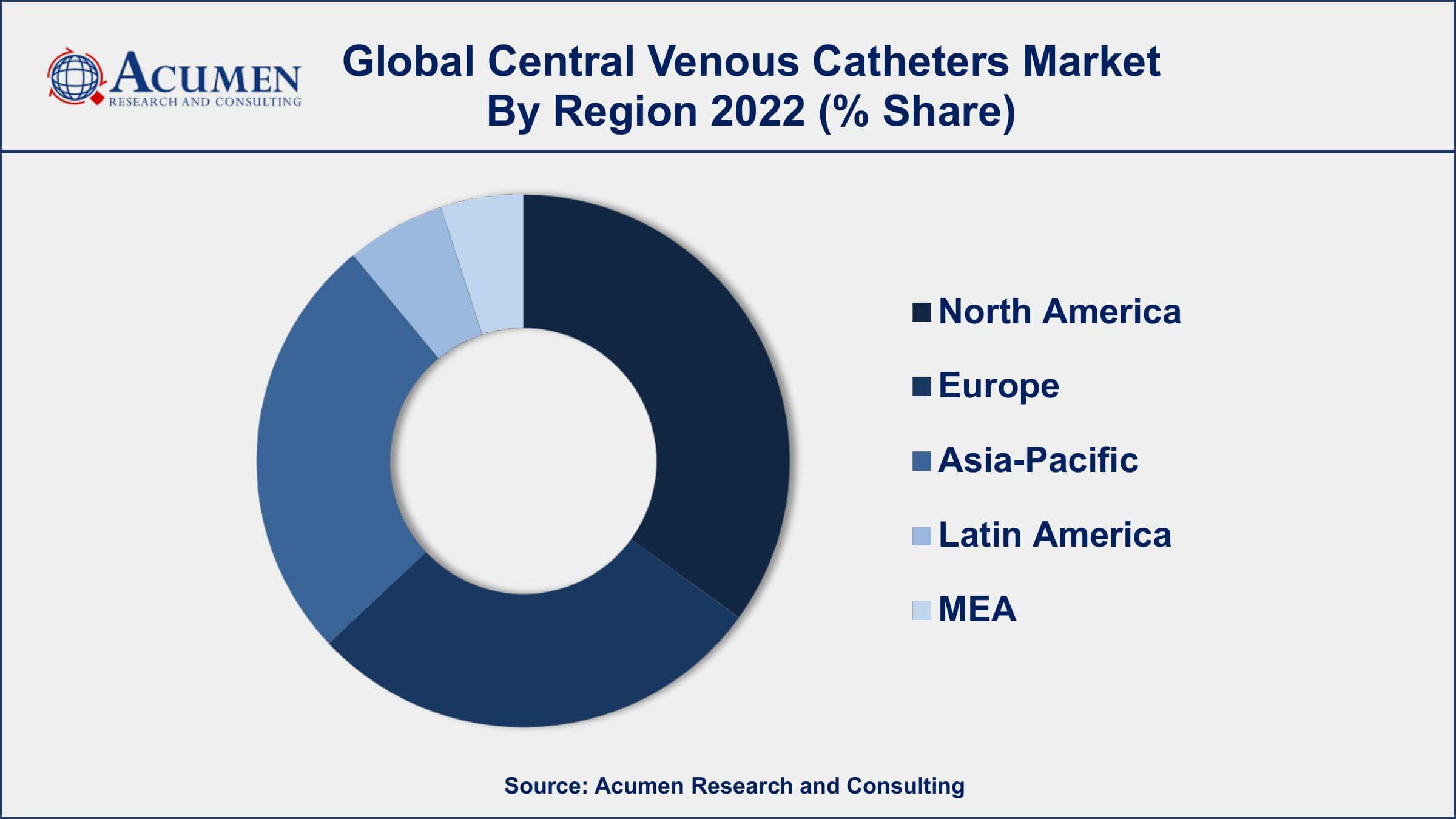

- North America region led with more than 49% of central venous catheters market share in 2022

- Asia-Pacific central venous catheters market growth will record a CAGR of around 6% from 2023 to 2032

- According to a 2015 study published in the journal Critical Care Medicine, central venous catheters are used by approximately 5 million patients per year in the United States

- By properties, the antimicrobial-coated segment of the CVC market is expected to grow at a CAGR of 5.6% during the forecast period

- Growing demand for sustainable agriculture practices, drives the central venous catheters market value

Central venous catheters (CVCs) are medical devices that are inserted into a patient's large vein, usually in the neck, chest, or groin, to administer medication, fluids, and nutrients, and to measure central venous pressure. They are also used for blood sampling and hemodialysis in critically ill patients. CVCs have become an essential tool in modern medicine, particularly in intensive care units (ICUs), where they are used to manage patients with complex medical conditions.

The global central venous catheters market has been experiencing steady growth in recent years, owing to the increasing incidence of chronic diseases, such as cancer and kidney failure, and the growing number of surgeries and medical procedures that require CVCs. Factors driving the growth of the CVC market include technological advancements in catheter design and materials, an increasing number of hospitals and healthcare facilities, and the rising geriatric population. However, the market is also facing some challenges, such as the risk of infection and complications associated with CVCs, which has led to the development of new and improved catheter materials and insertion techniques to reduce these risks. Additionally, the high cost of CVCs and the availability of alternative medical devices are also potential barriers to market growth.

Global Central Venous Catheters Market Trends

Market Drivers

- Increasing prevalence of chronic diseases

- Growing number of surgeries and medical procedures

- Advancements in catheter design and materials

- Rising geriatric population

- Increase in hospital and healthcare facilities

Market Restraints

- Risk of infection and complications associated with CVCs

- High cost of CVCs

Market Opportunities

- Growing demand for minimally invasive procedures

- Development of antimicrobial and antithrombogenic catheter coatings

Central Venous Catheters Market Report Coverage

| Market | Central Venous Catheters Market |

| Central Venous Catheters Market Size 2022 | USD 832 Million |

| Central Venous Catheters Market Forecast 2032 | USD 1,367 Million |

| Central Venous Catheters Market CAGR During 2023 - 2032 | 5.2% |

| Central Venous Catheters Market Analysis Period | 2020 - 2032 |

| Central Venous Catheters Market Base Year | 2022 |

| Central Venous Catheters Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Design, By Property, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Becton, Dickinson and Company, Teleflex Incorporated, C. R. Bard, Inc., Cook Medical Inc., Edwards Lifesciences Corporation, AngioDynamics, Inc., Smiths Medical, Inc., B. Braun Melsungen AG, Vygon SA, Argon Medical Devices, Inc., Terumo Corporation, and Medtronic plc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Arterial access catheters are used to provide fluids, drugs, and nutrients such as analgesics, antipyretics, and antibiotics when the patient is unable to consume food on their own. It is also used for the rectification of electrolyte unevenness and plasma transfusion in patients. These devices use an intravenous route of supervision that permits quick distribution of fluids and medication.

The market is driven by high dominance in the occurrence of chronic disorders, growing adoption, and a rising mandate for antimicrobial-coated catheters, along with increasing syndrome occurrences due to the rising senior population. In addition, increasing rates of hospitalizations and product innovations are also driving the growth of this market. The major challenge hampering the growth of the market is mechanical complications and lack of knowledge among the population for adoption. The rising popularity of antimicrobial CVCs and the increase in the number of oncologists recommending disinfectant-coated tunneled catheters for chemotherapy treatments further pave opportunities for the growth of this market. In addition, an upsurge in the usage of tip location devices is enormously expected to grow this market in future years.

Central Venous Catheters Market Segmentation

The global central venous catheters market segmentation is based on design, property, application, end user, and geography.

Central Venous Catheters Market By Design

- Multi-Lumen

- Single-Lumen

- Double-Lumen

- Triple-Lumen

According to the central venous catheters industry analysis, the multi-lumen segment accounted for the largest market share in 2022. Multi-lumen central venous catheters (CVCs) are medical devices that have multiple channels or lumens within a single catheter, which allow for the administration of multiple medications or fluids simultaneously. These devices are commonly used in critical care settings, where patients require multiple therapies, such as hemodialysis, parenteral nutrition, and antibiotic therapy. The multi-lumen segment of the CVC market has been experiencing significant growth in recent years, owing to its ability to improve patient outcomes and reduce the need for additional catheter insertions. The increasing prevalence of chronic diseases and the growing demand for minimally invasive procedures are some of the key factors driving the growth of the multi-lumen segment.

Central Venous Catheters Market By Property

- Antimicrobial Coated

- Non-antimicrobial Coated

In terms of properties, the antimicrobial coated segment is expected to witness significant growth in the coming years. Antimicrobial coated central venous catheters (CVCs) are medical devices that are coated with substances that prevent or inhibit the growth of microorganisms, such as bacteria, fungi, and viruses. These coatings can be applied to the surface of the catheter, or they can be impregnated into the catheter material itself. The antimicrobial coated segment of the CVC market has been experiencing significant growth in recent years, owing to their ability to reduce the risk of catheter-related infections, which are a major cause of morbidity and mortality in hospitalized patients. The increasing prevalence of catheter-related infections, the growing demand for minimally invasive procedures, and the development of advanced coating technologies are some of the key factors driving the growth of the antimicrobial coated segment.

Central Venous Catheters Market By Application

- Jugular Vein

- Subclavian Vein

- Femoral Vein

According to the central venous catheters market forecast, the jugular vein segment is expected to witness significant growth in the coming years. Jugular vein central venous catheters (CVCs) are medical devices that are inserted through the jugular vein in the neck and advanced into the superior vena cava or right atrium of the heart. These catheters are commonly used in critical care settings, where patients require frequent and prolonged access to the central venous system. The jugular vein segment of the CVC market has been experiencing significant growth in recent years, owing to their ability to provide rapid and reliable access to the central venous system, as well as their lower risk of pneumothorax compared to other insertion sites.

Central Venous Catheters Market By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Based on the end user, the hospitals segment is the largest end-user segment of the central venous catheters (CVC) market, as these devices are commonly used in critical care settings, such as intensive care units (ICUs), emergency departments, and surgical suites, where patients require frequent and prolonged access to the central venous system. The hospitals segment includes both public and private hospitals, as well as academic medical centers, which provide advanced care and research facilities. The hospitals segment of the CVC market has been experiencing significant growth in recent years, owing to the increasing prevalence of chronic diseases, the growing demand for minimally invasive procedures, and the need for effective infection control measures.

Central Venous Catheters Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Central Venous Catheters Market Regional Analysis

North America dominates the central venous catheters (CVC) market, accounting for the largest share of the global market. This can be attributed to several factors, including the presence of a well-established healthcare infrastructure, a high incidence of chronic diseases, and the availability of advanced medical technologies. The region is also home to several leading players in the CVC market, which have a strong presence and a wide range of product offerings. The high healthcare expenditure and favorable reimbursement policies in the region also contribute to the growth of the CVC market in North America. The US is the largest market for CVCs in North America, owing to the presence of a large patient pool, a well-established healthcare infrastructure, and the increasing adoption of advanced medical technologies. The region is also witnessing significant investments in research and development activities for the development of new and innovative CVCs, which is expected to drive the growth of the market in the coming years.

Central Venous Catheters Market Player

Some of the top central venous catheters market companies offered in the professional report include Becton, Dickinson and Company, Teleflex Incorporated, C. R. Bard, Inc., Cook Medical Inc., Edwards Lifesciences Corporation, AngioDynamics, Inc., Smiths Medical, Inc., B. Braun Melsungen AG, Vygon SA, Argon Medical Devices, Inc., Terumo Corporation, and Medtronic plc.

Frequently Asked Questions

What was the market size of the global central venous catheters in 2022?

The market size of central venous catheters was USD 832 Million in 2022.

What is the CAGR of the global central venous catheters market from 2023 to 2032?

The CAGR of central venous catheters is 5.2% during the analysis period of 2023 to 2032.

Which are the key players in the central venous catheters market?

The key players operating in the global market are including Becton, Dickinson and Company, Teleflex Incorporated, C. R. Bard, Inc., Cook Medical Inc., Edwards Lifesciences Corporation, AngioDynamics, Inc., Smiths Medical, Inc., B. Braun Melsungen AG, Vygon SA, Argon Medical Devices, Inc., Terumo Corporation, and Medtronic plc.

Which region dominated the global central venous catheters market share?

North America held the dominating position in central venous catheters industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of central venous catheters during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global central venous catheters industry?

The current trends and dynamics in the central venous catheters industry include increasing prevalence of chronic diseases, growing number of surgeries and medical procedures, and advancements in catheter design and materials.

Which design held the maximum share in 2022?

The multi-lumen design held the maximum share of the central venous catheters industry.