Cellulosic Based Ethanol Market | Acumen Research and Consulting

Cellulosic Based Ethanol Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

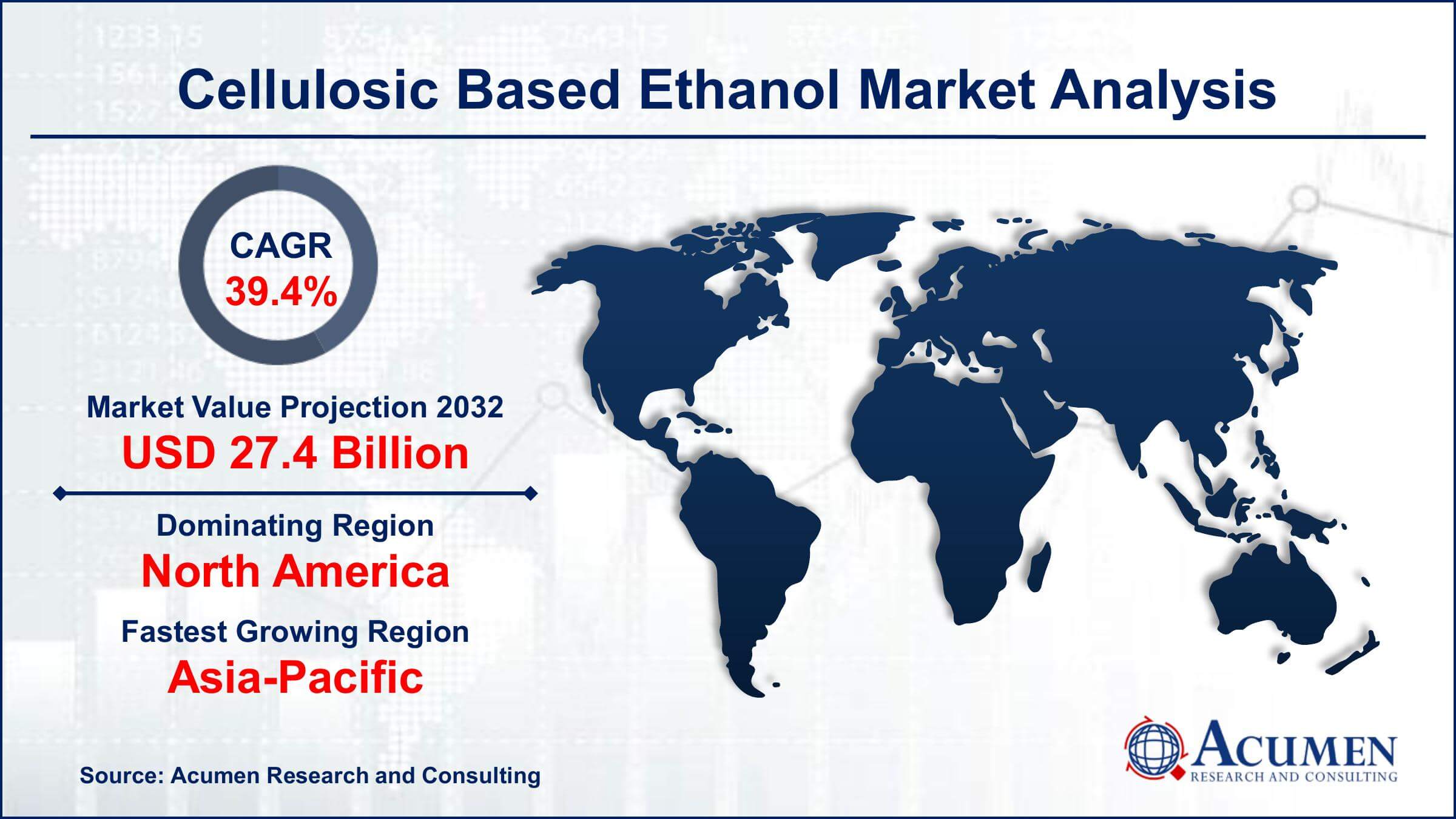

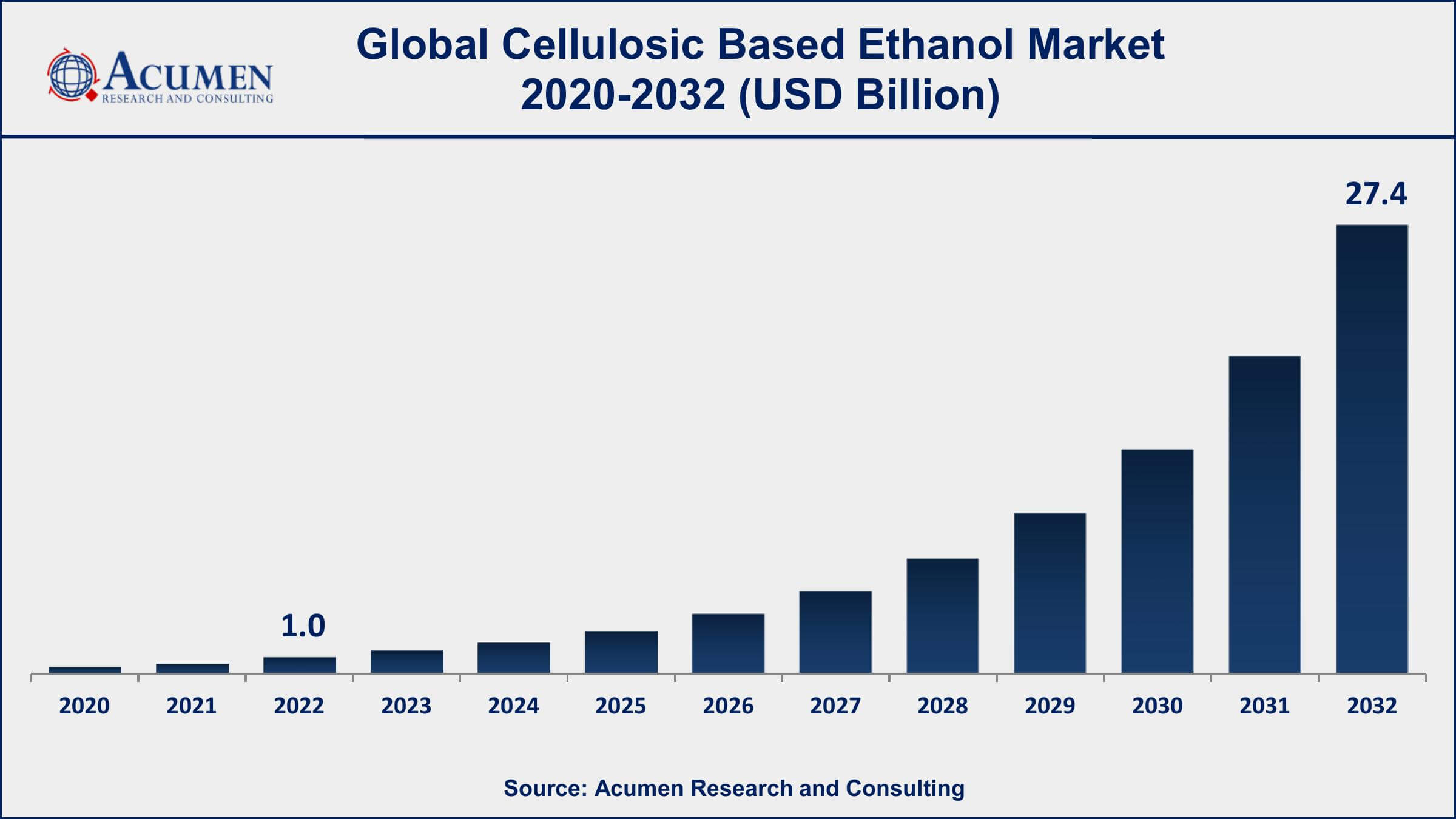

The Global Cellulosic Based Ethanol Market Size accounted for USD 1.0 Billion in 2022 and is projected to achieve a market size of USD 27.4 Billion by 2032 growing at a CAGR of 39.4% from 2023 to 2032.

Cellulosic Based Ethanol Market Key Highlights

- Global cellulosic based ethanol market revenue is expected to increase by USD 27.4 Billion by 2032, with a 39.4% CAGR from 2023 to 2032

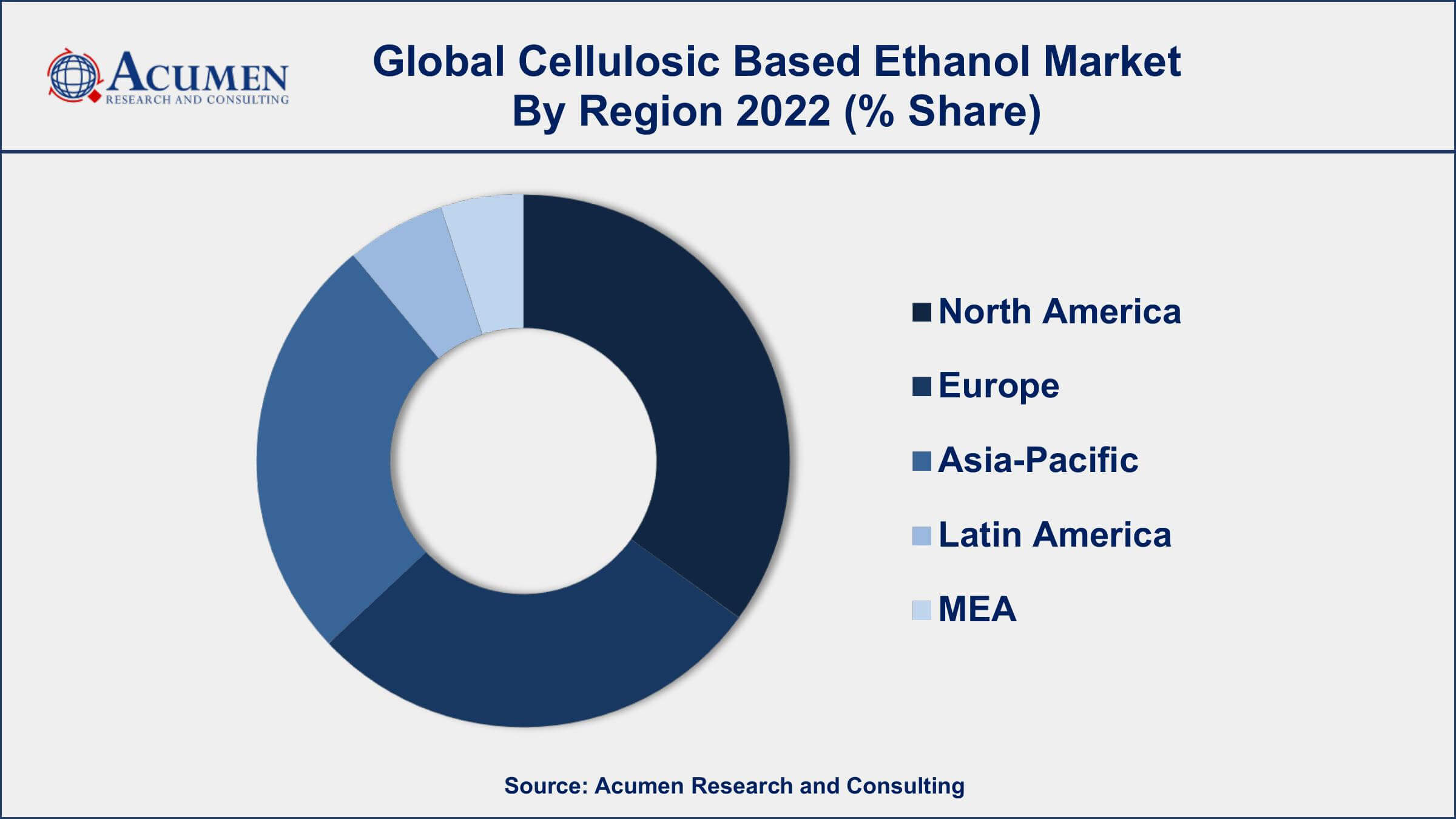

- North America region led with more than 38% of cellulosic based ethanol market share in 2022

- Asia-Pacific cellulosic based ethanol market growth will record a CAGR of over 42% from 2023 to 2032

- According to the International Energy Agency, cellulosic-based ethanol has the potential to provide up to 270 exajoules of energy per year by 2050

- The transportation sector is the largest consumer of cellulosic-based ethanol, accounting for over 63% of the global demand in 2022

- Increasing demand for renewable energy sources, drives the cellulosic based ethanol market value

Cellulosic-based ethanol is a type of biofuel that is made from cellulose, hemicellulose, and lignin found in non-food biomass such as agricultural waste, forestry residues, and municipal solid waste. It is produced using a complex process that involves breaking down the complex carbohydrates found in the biomass into simple sugars which can then be fermented and distilled to produce ethanol. Unlike traditional ethanol which is made from corn or sugarcane, cellulosic-based ethanol has the potential to be a more sustainable and environmentally friendly alternative as it does not compete with food crops for land and resources.

The market for cellulosic ethanol has been growing in recent years, driven by government policies aimed at reducing greenhouse gas emissions and promoting renewable energy sources. In the United States, the Renewable Fuel Standard (RFS) requires a certain amount of renewable fuels, including cellulosic ethanol, to be blended into transportation fuel each year. The RFS has helped to create a market for cellulosic ethanol, and several commercial-scale plants have been built in recent years. According to a report by the International Energy Agency, the global production of cellulosic biofuels is expected to reach 9.6 billion liters by 2025, up from just 10 million liters in 2015.

Global Cellulosic Based Ethanol Market Trends

Market Drivers

- Increasing demand for renewable energy sources

- Supportive government policies and regulations promoting the use of biofuels

- Growing awareness of the environmental benefits of cellulosic-based ethanol

- Advancements in technology and increasing efficiency of production processes

- Rising oil prices and concerns over energy security

Market Restraints

- High production costs due to the complexity of the production process

- Limited availability and accessibility of feedstock

Market Opportunities

- Expansion of feedstock sources to include agricultural and municipal waste

- Development of new and innovative technologies for the production and conversion of feedstock

Cellulosic Based Ethanol Market Report Coverage

| Market | Cellulosic Based Ethanol Market |

| Cellulosic Based Ethanol Market Size 2022 | USD 1.0 Billion |

| Cellulosic Based Ethanol Market Forecast 2032 | USD 27.4 Billion |

| Cellulosic Based Ethanol Market CAGR During 2023 - 2032 | 39.4% |

| Cellulosic Based Ethanol Market Analysis Period | 2020 - 2032 |

| Cellulosic Based Ethanol Market Base Year | 2022 |

| Cellulosic Based Ethanol Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Feedstock Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DuPont Industrial Biosciences, Abengoa Bioenergy, Beta Renewables, Novozymes A/S, Raizen Energia Participacoes S.A., POET-DSM Advanced Biofuels LLC, GranBio, Clariant AG, Fiberight LLC, Enerkem Inc., LanzaTech, and Mascoma LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cellulosic-based ethanol is derived by fermentation of sugars derived from corn, wheat, sugar sugarcane, beets, molasses, or starch from which alcoholic beverages can be produced. Cellulosic-based ethanol and other alcohol fuels can be used as a direct substitute for gasoline or in the form of blend additives. The advantages of alcohol fuels include increased energy diversification in the transportation sector and air pollution benefits from reduced emissions. Technological advances, including more efficient production and processing of sugarcane or other feedstock, are responsible for the availability and low price of bio-ethanol.

The market growth for cellulosic-based ethanol is supported by its characteristics of being an eco-friendly fuel for the transportation sector. Moreover, cellulosic-based ethanol is the ultimate long-term solution for energy supply security. In addition, cellulosic-based ethanol offers several advantages over first-generation biofuels. Also, the rise in environmental concerns and the need to lower GHG emissions also boosts the growth of the cellulosic ethanol market size. However, high investment and variable production costs are the major restraining factor for the cellulosic ethanol market growth. Moreover, the ongoing debate over food vs fuel also hampers the market for cellulosic-based ethanol. Nevertheless, government funding and investments in R&D by private companies offer huge growth opportunity for the cellulosic-based ethanol market value. Volatile price change in crude oil is also a growth opportunity for cellulosic-based ethanol manufacturers.

Cellulosic Based Ethanol Market Segmentation

The global cellulosic based ethanol market segmentation is based on feedstock type, application, and geography.

Cellulosic Based Ethanol Market By Feedstock Type

- Agricultural Residues

- Forestry Residues

- Municipal Solid Waste (MSW)

In terms of feedstock types, the agricultural residues segment has seen significant growth in the cellulosic-based ethanol market in recent years. Agricultural residues are the byproducts of crop production such as corn stover, wheat straw, and sugarcane bagasse, and are often considered waste materials. However, these residues can be used as feedstock for the production of cellulosic-based ethanol, which can help to reduce waste and increase the sustainability of agricultural practices. One of the key advantages of using agricultural residues as feedstock is that they are widely available and accessible, particularly in countries with large agricultural sectors. Overall, the agricultural residues segment of the cellulosic-based ethanol market is expected to continue to grow as the industry develops more efficient and cost-effective production processes, and as governments and companies increasingly look to reduce their carbon footprint and promote sustainable agriculture practices.

Cellulosic Based Ethanol Market By Application

- Transportation

- Chemicals

- Power Generation

- Others

According to the cellulosic based ethanol market forecast, the transportation segment is expected to witness significant growth in the coming years. As the demand for sustainable and low-carbon transportation fuels continues to increase, cellulosic-based ethanol is emerging as a viable alternative to traditional fossil fuels such as gasoline and diesel. One of the main advantages of cellulosic-based ethanol as a transportation fuel is its ability to reduce greenhouse gas emissions. According to the US Department of Energy, cellulosic-based ethanol can reduce greenhouse gas emissions by up to 90% compared to gasoline. This makes it an attractive option for companies and governments looking to reduce their carbon footprint and meet their emissions reduction targets. Furthermore, cellulosic-based ethanol can be used in existing transportation infrastructure with little to no modifications. This means that it can be easily integrated into existing fuel supply chains, and can be used in conventional gasoline engines with little to no impact on performance.

Cellulosic Based Ethanol Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cellulosic Based Ethanol Market Regional Analysis

North America is currently dominating the cellulosic-based ethanol market due to a combination of factors, including supportive government policies, a well-established biofuel industry, and abundant feedstock sources. The United States, in particular, has been a leader in the development and commercialization of cellulosic-based ethanol technology. In 2007, the US government established the Renewable Fuel Standard (RFS), which mandated a minimum level of biofuels, including cellulosic-based ethanol, to be blended into transportation fuel. This policy has been instrumental in driving investment and growth in the cellulosic-based ethanol industry in the US. In addition, North America has a well-established biofuel industry, which has provided a strong foundation for the development of cellulosic-based ethanol technology. The region has a highly developed infrastructure for biofuel production, distribution, and consumption, which has helped to reduce the cost and complexity of scaling up cellulosic-based ethanol production.

Cellulosic Based Ethanol Market Player

Some of the top cellulosic based ethanol market companies offered in the professional report include DuPont Industrial Biosciences, Abengoa Bioenergy, Beta Renewables, Novozymes A/S, Raizen Energia Participacoes S.A., POET-DSM Advanced Biofuels LLC, GranBio, Clariant AG, Fiberight LLC, Enerkem Inc., LanzaTech, and Mascoma LLC.

Frequently Asked Questions

What was the market size of the global cellulosic based ethanol in 2022?

The market size of cellulosic based ethanol was USD 1.0 Billion in 2022.

What is the CAGR of the global cellulosic based ethanol market from 2023 to 2032?

The CAGR of cellulosic based ethanol is 39.4% during the analysis period of 2023 to 2032.

Which are the key players in the cellulosic based ethanol market?

The key players operating in the global market are including DuPont Industrial Biosciences, Abengoa Bioenergy, Beta Renewables, Novozymes A/S, Raizen Energia Participacoes S.A., POET-DSM Advanced Biofuels LLC, GranBio, Clariant AG, Fiberight LLC, Enerkem Inc., LanzaTech, and Mascoma LLC.

Which region dominated the global cellulosic based ethanol market share?

North America held the dominating position in cellulosic based ethanol industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cellulosic based ethanol during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cellulosic based ethanol industry?

The current trends and dynamics in the cellulosic based ethanol industry include increasing demand for renewable energy sources, supportive government policies and regulations promoting the use of biofuels, and growing awareness of the environmental benefits of cellulosic-based ethanol.

Which feedstock type held the maximum share in 2022?

The agricultural residues feedstock type held the maximum share of the cellulosic based ethanol industry.