Cellular Iot Market | Acumen Research and Consulting

Cellular IoT Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

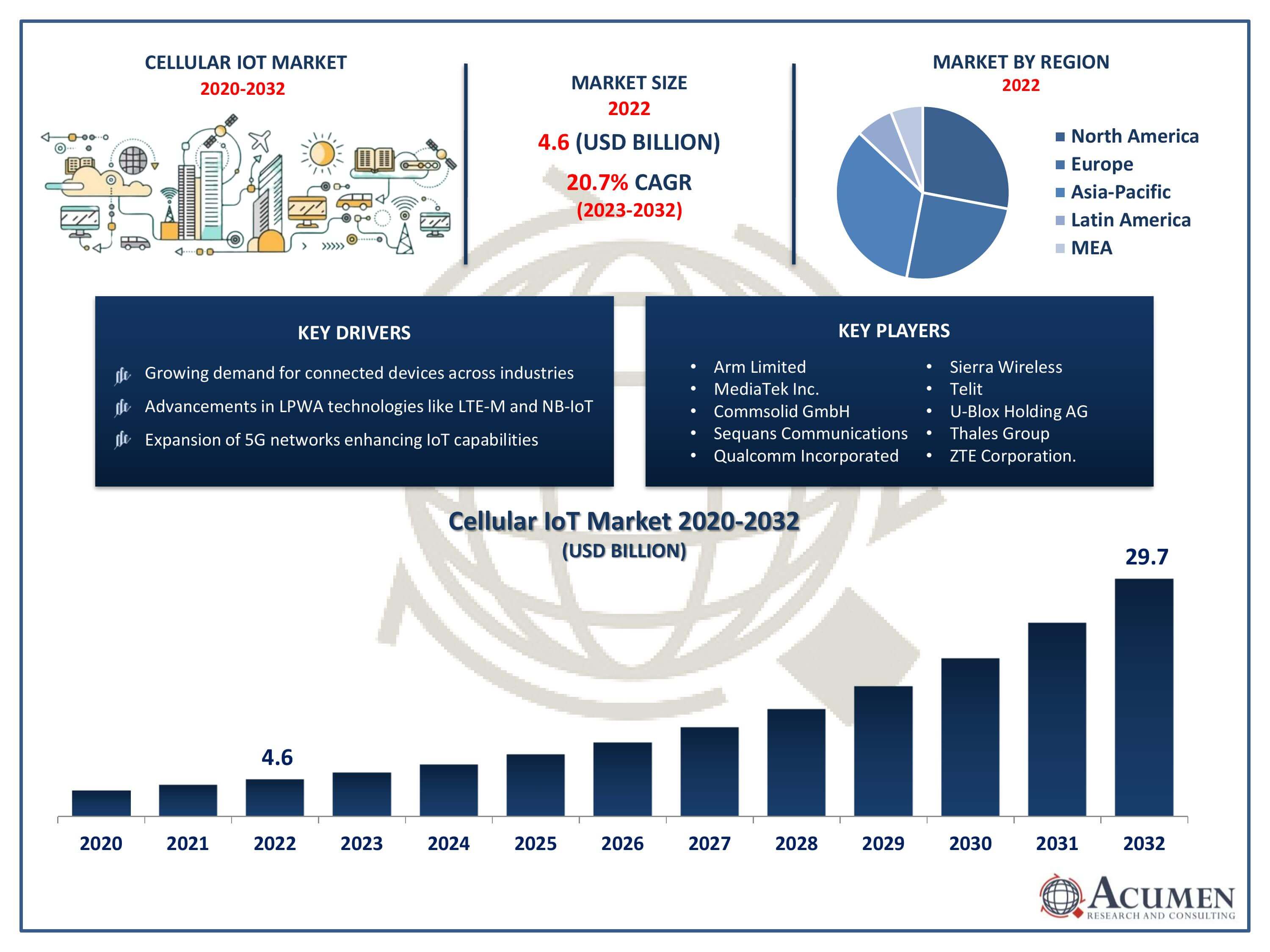

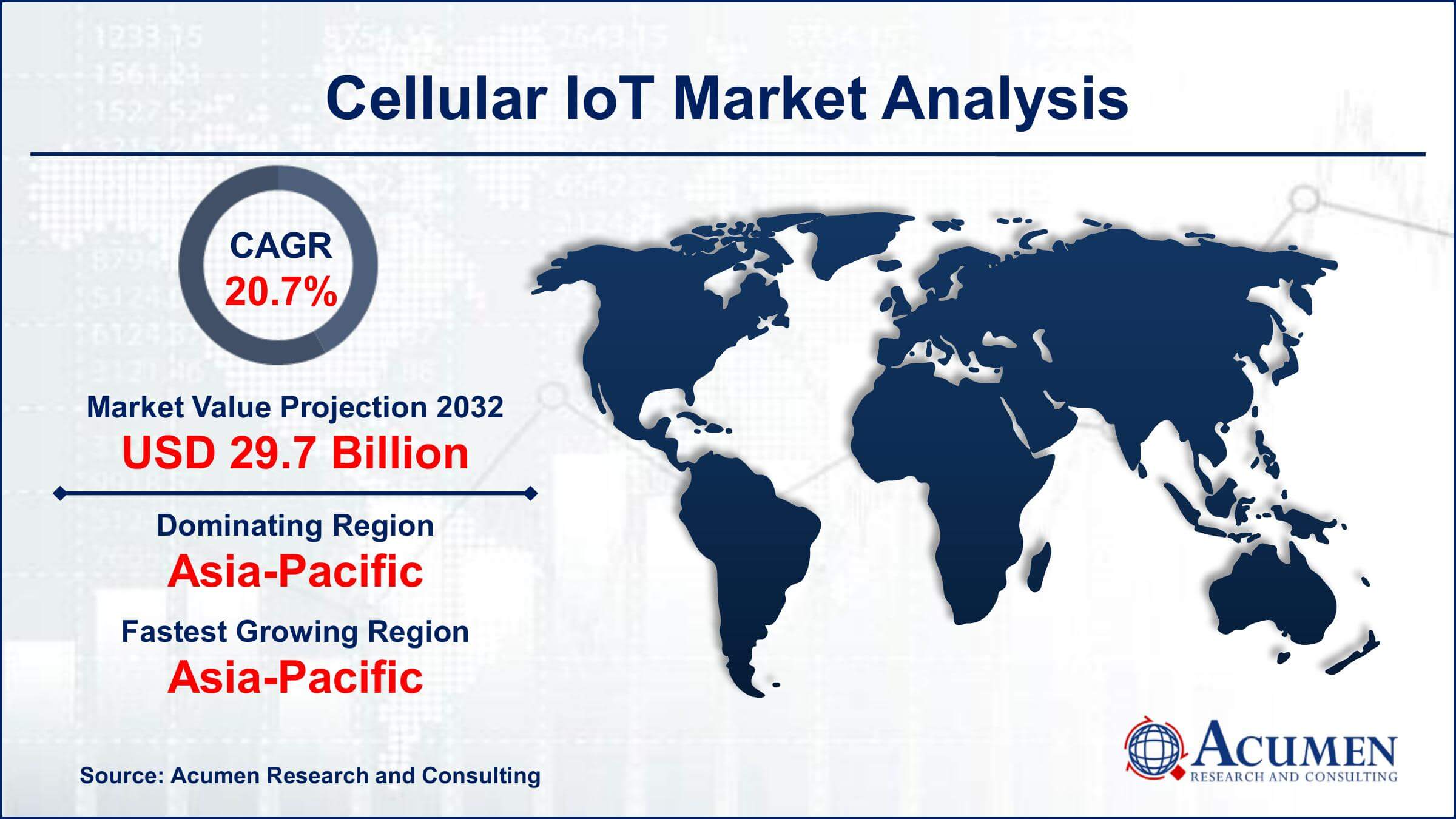

The Cellular IoT Market Size accounted for USD 4.6 Billion in 2022 and is projected to achieve a market size of USD 29.7 Billion by 2032 growing at a CAGR of 20.7% from 2023 to 2032.

Cellular IoT Market Highlights

- Global Cellular IoT Market revenue is expected to increase by USD 29.7 Billion by 2032, with a 20.7% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 37% of Cellular IoT Market share in 2022

- By component, the hardware segment contributed over 62% of revenue share in 2022

- By type, the 4G segment captured more than 38% of revenue share in 2022

- By end use, the automotive and transportation segment is projected to expand at the fastest CAGR over the projected period

- Increasing deployment in smart city infrastructure and building automation verticals, drives the Cellular IoT Market value

Cellular IoT (Internet of Things) is the use of cellular networks to provide connectivity to a wide range of smart devices and sensors beyond traditional smartphones and computers. It enables these devices to communicate with each other and with centralized systems, facilitating the exchange of data and enabling various applications in sectors like healthcare, agriculture, transportation, and manufacturing. Cellular IoT relies on low-power, wide-area (LPWA) technologies such as LTE-M (Long-Term Evolution for Machines) and NB-IoT (Narrowband IoT) to ensure efficient and cost-effective connectivity for IoT devices.

The market for cellular IoT has been experiencing significant growth in recent years, driven by the increasing adoption of IoT devices across various industries. The demand for connected devices and the need for real-time data analysis have propelled the expansion of cellular IoT networks. Businesses are leveraging cellular IoT solutions to enhance operational efficiency, reduce costs, and improve customer experiences. Additionally, advancements in 5G technology have further accelerated the growth of the cellular IoT market. The high data speeds, low latency, and massive device connectivity capabilities offered by 5G networks open up new possibilities for innovative IoT applications, fostering even more rapid expansion in this sector.

Global Cellular IoT Market Trends

Market Drivers

- Growing demand for connected devices across industries

- Advancements in LPWA technologies like LTE-M and NB-IoT

- Expansion of 5G networks enhancing IoT capabilities

- Increasing focus on operational efficiency and cost reduction

- Rise in smart city initiatives and IoT deployments

Market Restraints

- Security and privacy concerns associated with IoT devices

- High initial deployment costs for IoT infrastructure

Market Opportunities

- Integration of AI and machine learning in IoT systems

- Development of innovative IoT solutions for the smart home market

- Rise in demand for industrial IoT (IIoT) applications

Cellular IoT Market Report Coverage

| Market | Cellular IoT Market |

| Cellular IoT Market Size 2022 | USD 4.6 Billion |

| Cellular IoT Market Forecast 2032 | USD 29.7 Billion |

| Cellular IoT Market CAGR During 2023 - 2032 | 20.7% |

| Cellular IoT Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Type, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Arm Limited, MediaTek Inc., Commsolid GmbH (Goodix Technology (HK) Company Limited), Sequans Communications, Qualcomm Incorporated, Telefonaktiebolaget LM Ericsson, Sierra Wireless, Texas Instruments Incorporated, Telit, U-Blox Holding AG, Thales Group, and ZTE Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Unlike regular mobile connections, cellular IoT technologies are specifically designed to enable the efficient exchange of data between devices, sensors, and centralized systems. This is achieved through low-power, wide-area (LPWA) technologies such as LTE-M (Long-Term Evolution for Machines) and NB-IoT (Narrowband IoT), which allow for seamless, low-cost, and energy-efficient communication between devices. These technologies are particularly suitable for applications where devices need to send small amounts of data periodically, making them ideal for various IoT deployments. Overall, cellular IoT finds applications in sectors ranging from manufacturing and logistics to healthcare and environmental monitoring, revolutionizing processes and enhancing efficiency across various industries.

The growth of the cellular IoT market is further accelerated by the deployment of 5G networks. 5G technology brings high data speeds, low latency, and massive device connectivity capabilities, opening up new possibilities for innovative IoT applications. Industries are leveraging these advancements to enhance operational efficiency, reduce costs, and improve customer experiences. Smart city initiatives, industrial IoT deployments, and the integration of IoT with artificial intelligence and machine learning are some of the key areas driving the cellular IoT market growth. Additionally, the development of tailored IoT solutions for specific sectors, such as healthcare, agriculture, and logistics, is creating new avenues for market expansion. The demand for connected devices and the need for real-time data analysis have propelled the expansion of cellular IoT networks. Furthermore, the expansion of the consumer IoT market and the incorporation of cellular IoT into the smart home market will fuel cellular market growth in the coming years. Advancements in low-power, wide-area (LPWA) technologies such as LTE-M (Long-Term Evolution for Machines) and NB-IoT (Narrowband IoT) have played a pivotal role in enabling efficient and cost-effective connectivity for IoT devices.

Cellular IoT Market Segmentation

The global Cellular IoT Market segmentation is based on component, type, end use, and geography.

Cellular IoT Market By Component

- Hardware

- Software

- Signal Processing

- Device Management

According to the cellular IoT industry analysis, the hardware segment accounted for the largest market share in 2022. This growth is driven by the increasing demand for IoT devices across various industries. Advancements in semiconductor technology, miniaturization, and energy efficiency have paved the way for the development of highly specialized and cost-effective IoT hardware components. These components include sensors, microcontrollers, communication modules, and power management units, which are essential for the functioning of IoT devices. One significant trend in the hardware segment is the development of integrated IoT modules. These modules incorporate multiple functionalities into a single chip, reducing the overall size of devices and enhancing energy efficiency.

Cellular IoT Market By Type

- 2G

- 3G

- 4G

- LTE-M

- NB-LTE-M

- NB-IoT

- 5G

In terms of types, the 4G segment is expected to witness significant growth in the coming years. This growth is primarily fueled by the widespread adoption of LTE-M (Long-Term Evolution for Machines) technology and its versatility in supporting a wide range of IoT applications. LTE-M offers a balance between data rate, coverage, and power consumption, making it ideal for IoT devices that require efficient connectivity. One of the significant advantages of LTE-M technology is its ability to provide enhanced coverage, allowing IoT devices to operate in challenging environments such as basements and remote rural areas. This expanded coverage has been pivotal in the growth of IoT applications in sectors like agriculture, healthcare, and asset tracking, where reliable connectivity in diverse locations is essential. Additionally, the 4G segment has witnessed growth in IoT deployments due to the cost-effectiveness and maturity of LTE networks.

Cellular IoT Market By End Use

- Agriculture

- Consumer Electronics

- Automotive and Transportation

- Environment Monitoring

- Energy

- Smart Cities

- Healthcare

- Retail

- Others

According to the cellular IoT market forecast, the automotive and transportation segment is expected to witness significant growth in the coming years. One of the key drivers of this growth is the increasing integration of IoT devices in vehicles. Connected cars are equipped with cellular IoT technology, allowing them to communicate with other vehicles, infrastructure, and cloud-based platforms. These connected vehicles can access real-time data for navigation, traffic updates, and weather conditions, enabling drivers to make informed decisions and optimizing routes for fuel efficiency. Additionally, IoT connectivity enables advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, enhancing road safety and reducing accidents. Fleet management solutions are another significant contributor to the growth of cellular IoT in the automotive and transportation sector. Fleet operators utilize IoT devices and cellular connectivity to monitor vehicle location, track fuel consumption, and perform predictive maintenance.

Cellular IoT Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cellular IoT Market Regional Analysis

Asia-Pacific has emerged as the dominating region in the cellular IoT market due to a combination of factors that have propelled rapid adoption and innovation in the region. One of the key drivers is the sheer size of the population and the vast number of connected devices in countries like China and India. These countries have massive populations and burgeoning middle-class segments, leading to increased demand for smart devices, connected vehicles, and industrial IoT solutions. As a result, there is a large and diverse market for cellular IoT applications, ranging from smart home devices to complex industrial automation systems. Moreover, Asia-Pacific is home to some of the world's leading technology manufacturers and suppliers. Countries like China and South Korea are global leaders in electronics manufacturing, producing a wide range of IoT devices and components. The presence of these manufacturing giants in the region has led to economies of scale, reducing the overall cost of IoT devices and making them more accessible to consumers and businesses. Additionally, the region has a robust ecosystem of startups and innovative companies focusing on IoT solutions, leading to a continuous influx of new ideas and products in the market.

Cellular IoT Market Player

Some of the top Cellular IoT Market companies offered in the professional report include Arm Limited, MediaTek Inc., Commsolid GmbH (Goodix Technology (HK) Company Limited), Sequans Communications, Qualcomm Incorporated, Telefonaktiebolaget LM Ericsson, Sierra Wireless, Texas Instruments Incorporated, Telit, U-Blox Holding AG, Thales Group, and ZTE Corporation.

Frequently Asked Questions

How big is the cellular IoT market?

The market size of cellular IoT was USD 4.6 Billion in 2022.

What is the CAGR of the global Cellular IoT Market from 2023 to 2032?

The CAGR of cellular IoT is 20.7% during the analysis period of 2023 to 2032.

Which are the key players in the Cellular IoT Market?

The key players operating in the global market are including Arm Limited, MediaTek Inc., Commsolid GmbH (Goodix Technology (HK) Company Limited), Sequans Communications, Qualcomm Incorporated, Telefonaktiebolaget LM Ericsson, Sierra Wireless, Texas Instruments Incorporated, Telit, U-Blox Holding AG, Thales Group, and ZTE Corporation.

Which region dominated the global Cellular IoT Market share?

Asia-Pacific held the dominating position in cellular IoT industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cellular IoT during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cellular IoT industry?

The current trends and dynamics in the cellular IoT industry include growing demand for connected devices across industries, advancements in LPWA technologies like LTE-M and NB-IoT, and expansion of 5G networks enhancing IoT capabilities.

Which type held the maximum share in 2022?

The 4G type held the maximum share of the cellular IoT industry.