Cell Therapy Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Cell Therapy Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

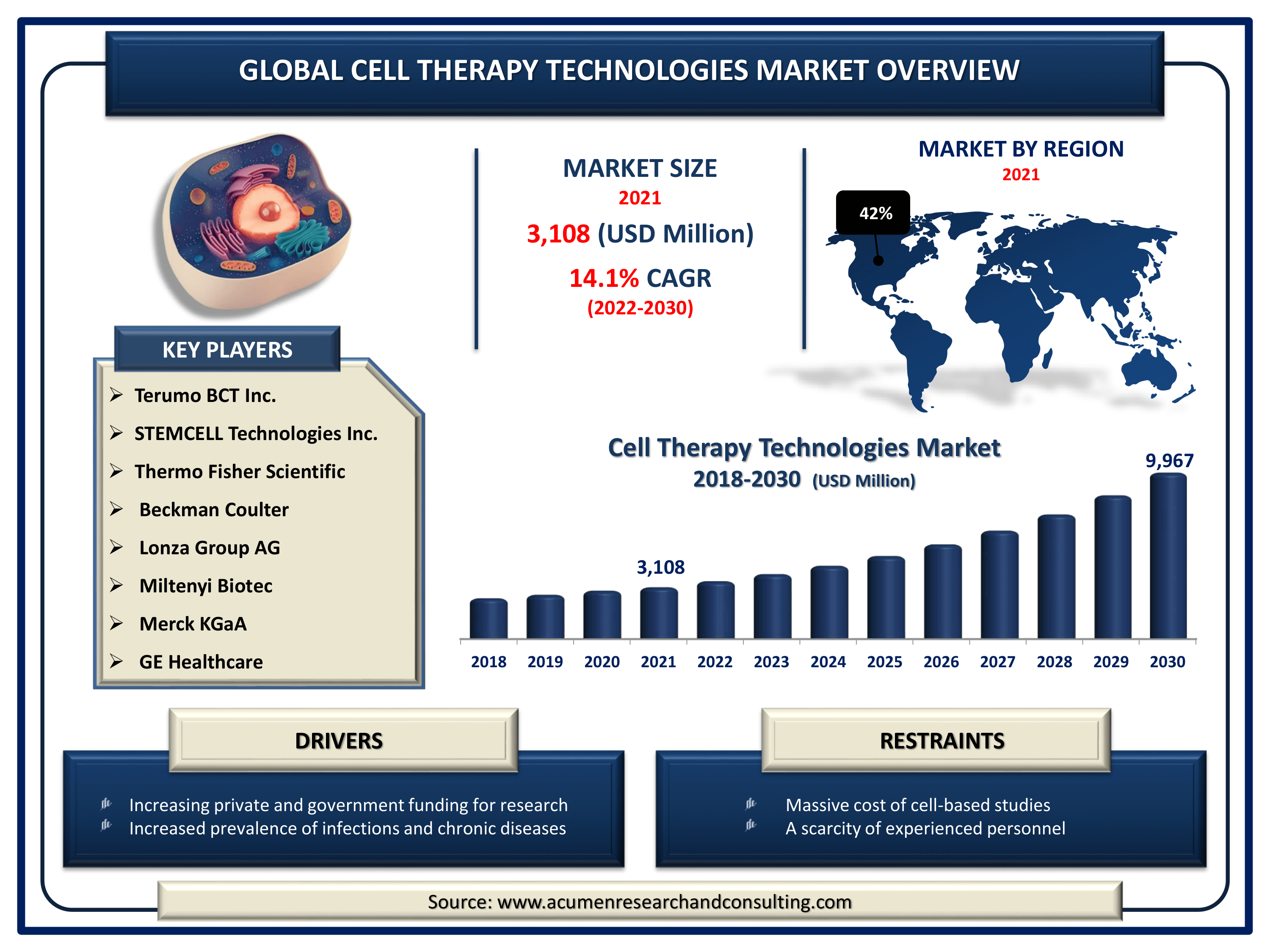

Request Sample Report

The Global Cell Therapy Technologies Market Size accounted for USD 3,108 Million in 2021 and is estimated to achieve a market size of USD 9,967 Million by 2030 growing at a CAGR of 14.1% from 2022 to 2030. The growing prevalence of infections and chronic diseases worldwide, particularly among the senior population, and the increasing use of tissue engineering technologies for the treatment of these diseases are driving the expansion of the cell therapy technologies market. Furthermore, rising spending by government and private organizations, rising demand for clinical studies on interventional cell-based therapeutic, and demand for sophisticated cell therapy instruments are boosting the worldwide cell therapy technologies market.

Cell Therapy Technologies Market Report Key Highlights

- Global cell therapy technologies market revenue intended to gain USD 9,967 Million by 2030 with a CAGR of 14.1% from 2022 to 2030

- According to the study, around 2,756 active cell therapy medicines in the worldwide immuno-oncology pipeline by 2022

- North America cell therapy technologies market captured more than 40% regional shares in 2021

- Asia-Pacific cell therapy technologies market will gain a phenomenal CAGR from 2022 to 2030

- Based on cell type, T-cells segment accounted for more than 75% of total market share in 2021

- According to Michael Bishop, the success rate of CAR T-cell therapy for long-term remission is around 30% to 40%

Cell therapy is the incorporation of intact, live cells into a patient's body to assist in curing or lessening the spread of disease. The cells used in cell therapy are classified based on their capability of transformation into different cell types. In May 2019, AveXis, a Novartis company announced that the US Food and Drug Administration (FDA) approved Zolgensma® (onasemnogene abeparvovec-xioi) for the treatment of pediatric patients less than 2 years of age suffering from spinal muscular atrophy (SMA). Additionally, in July 2020, the USFDA approved Tecartus (brexucabtagene autoleucel), cell-based therapy for the treatment of adult patients diagnosed with mantle cell lymphoma (MCL) who failed to respond or have fallen for other kinds of treatment. Tecartus, is the chimeric antigen receptor (CAR) T cell therapy and is the first cell-based therapy approved by the FDA for the treatment of MCL.

Global Cell Therapy Technologies Market Dynamics

Market Drivers

- Increasing private and government funding for cell-based research

- Increased prevalence of infections and chronic diseases

- Expanding GMP certifications for tissue engineering production facilities

- A significant number of cell therapy clinical studies in oncology

Market Restraints

- Massive cost of cell-based studies and low rate of success

- A scarcity of experienced personnel

Market Opportunities

- A greater emphasis on individualized medicine

- Increasing public-private cooperation for cell therapy development

Cell Therapy Technologies Market Report Coverage

| Market | Cell Therapy Technologies Market |

| Cell Therapy Technologies Market Size 2021 | USD 3,108 Million |

| Cell Therapy Technologies Market Forecast 2030 | USD 9,967 Million |

| Cell Therapy Technologies Market CAGR During 2022 - 2030 | 14.1% |

| Cell Therapy Technologies Market Analysis Period | 2018 - 2030 |

| Cell Therapy Technologies Market Base Year | 2021 |

| Cell Therapy Technologies Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By Cell Type, By Process, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Terumo BCT Inc., STEMCELL Technologies Inc., Thermo Fisher Scientific, Beckman Coulter, Lonza Group AG, Miltenyi Biotec, Merck KGaA, and GE Healthcare. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Big Calls For "Stem Cell Therapy"

As per the Australian government, Department of Health, Stem cell therapy is a proven treatment for the treatment of blood disorders such as leukemia, Hodgkin's disease, and non-Hodgkin's lymphoma. Stem cells possess the capability to treat many other types of incurable diseases. The self-eating process of stem cells is a new gateway to regenerative medicines. In July 2020, Penn Medicine, Philadelphia, commented that the self-eating process in embryonic stem cells known as chaperone-mediated autophagy (CMA) and a related metabolite can serve as a promising new therapeutic target to repair or regenerate damaged cells and organs. The new preclinical study in the first phase shows that the stem cells keep chaperone-mediated autophagy (CMA) at low levels promoting self-renewal and when the stem cell gets matured or ready it switches its suppression off to enhance CMA among other activities and differentiate into specialized cells. Such a newly discovered role of autophagy in stem cells is the beginning of further investigations that enhance researchers and physician-scientists to introduce better therapies and treat various disorders.

Are Stem Cells A Solution To Tackle The COVID-19 Pandemic?

Stem cells can prove the best solution against the COVID-19 pandemic. Currently, 17 clinical trials evaluate the therapeutic potential of Mesenchymal Stem Cells (MSCs) for the treatment of COVID-19; the majority are administered intravenously with one clinical trial testing MSC-derived exosomes via the inhalation route. MSCs could be a promising treatment for COVID-19 infections. Since the key to the treatment of COVID-19 lies in the management of the cytokine storm in the lungs, MSCs act as a proper fit considering the mechanisms of action (MOA) through immunomodulatory and anti-inflammatory-associated properties. Other types of stem cells investigated for the treatment of COVID-19 infections involve genetically engineered human-induced pluripotent stem cells. Regardless of the urgency of the need for MSCs-based therapies for COVID-19, the production of MSCs must stand in compliance with good manufacturing practices (GMP) and regulations before getting approved in humans.

Cell Therapy Technologies Market Segmentation

The worldwide cell therapy technologies market segmentation is based on the product, cell type, process, end user, and geography.

Cell Therapy Technologies Market By Product

- Consumables

- Equipment

- Systems & Software

In terms of product, the consumables segment accounted largest market share in the past and is expected to continue the same trend in the forthcoming years. Factors that contribute to the growth of the segment involve rising investments for the development of advanced products and high government involvement in enhancing cell-based research contribute fullest to the growth. Cell and gene therapy platform (C & GT) drives the science through the breakdown of innovative treatment for patients/new platform accelerates strategically all activities coupled with the value chain. In December 2020, Bayer AG announced the launching of a new cell and Gene therapy (C & GT) platform within its pharmaceutical division. Strategically, Bayer focuses on selected areas of C & GT such as stem cell therapies (with a focus on induced pluripotent cells or iPSCs), gene augmentation, gene editing, and allogeneic cell therapies in different indications. In November 2020, the Government of Canada and JDRF announced new research funding that accelerates stem cell-based therapies for type 1 diabetes. In Canada, more than 300,000 Canadians are living with type 1 diabetes (T1D), an autoimmune disease resulting in the dysfunction, damage, or loss of pancreatic beta cells that produce insulin in the body. The Minister of Health announced an investment of US$ 6 Mn through the CIHR-JDRF Partnership to Defeat Diabetes.

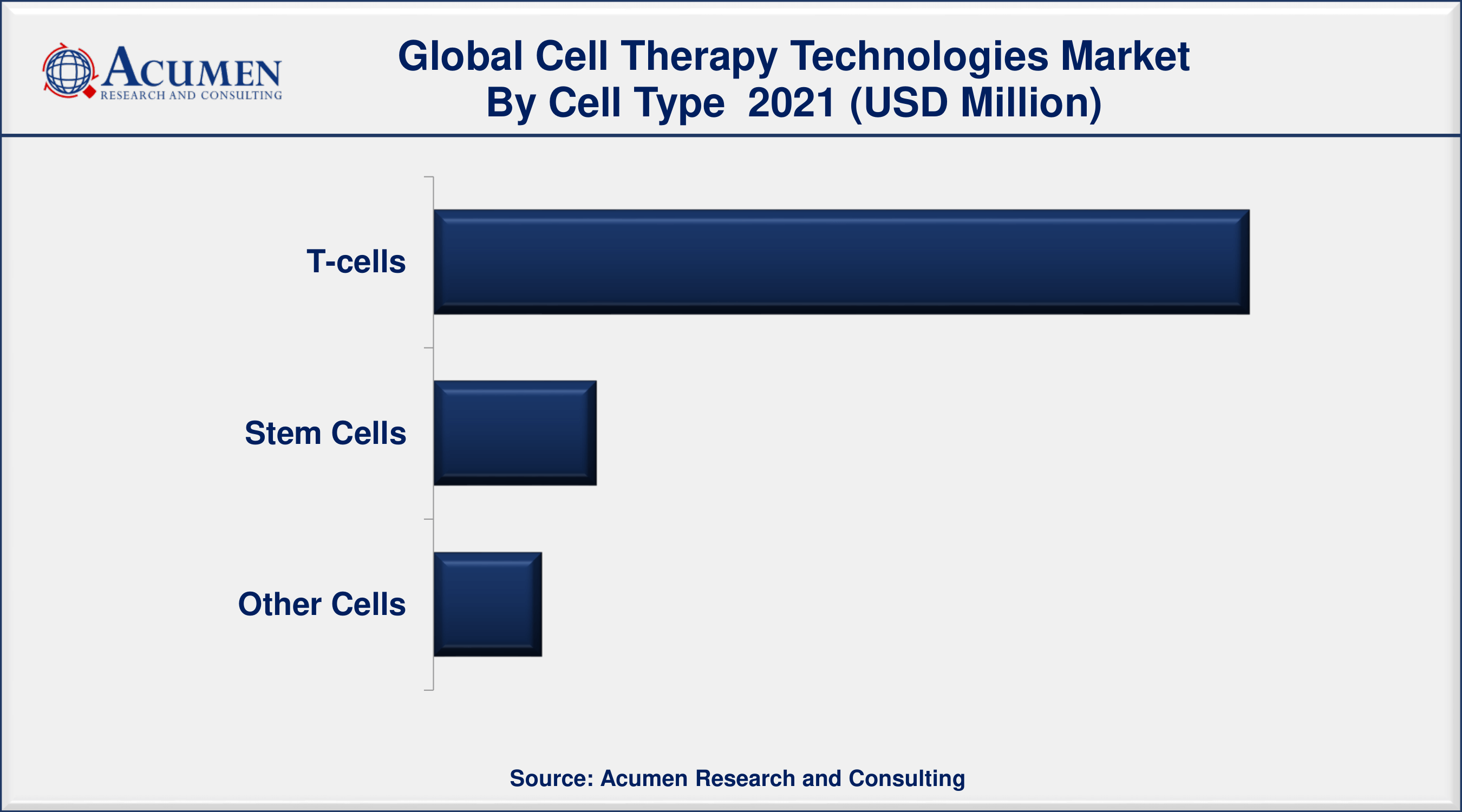

Cell Therapy Technologies Market By Cell Type

- T-cells

- Stem Cells

- Other Cells

According to cell therapy technologies industry analysis, the T-cells segment accounted for the largest share of the market in 2021. Rising demand for T-cell therapies and favorable government initiatives are the factors that bolster the growth of this segment. As T-cell therapy possess vast application such as therapy for boosting the immunity system of patients suffering from chronic diseases. Moreover, the growing occurrence of cancer globally has gained strong attention for T-cell therapy across the population. CAR T- cell therapy utilizes (CAR T), in a patient’s immune cells that are re-programmed to recognize and kill cancer cells throughout the body. The process involves the removal of some T-cells from a patient, and through the laboratory process, these T-cells are re-programmed to identify patient cancer cells. For patients suffering from leukemia and lymphoma, the T-cell therapies are currently being tested in clinical trials that seem to work well in the presence of a relatively small number of cells. For patients carrying solid tumors such as breast, lung, or pancreatic cancer, therapies require multiple doses of potent cells to reach and attack effectively against the tumors. There are undergoing studies for T-cell therapies for solid tumors.

Cell Therapy Technologies Market By Process

- Cell Processing

- Cell Preservation, Distribution, and Handling

- Process Monitoring and Quality Control

Based on the process, the cell processing segment dominated the market in the past and will have a positive influence in the coming years. This segment will record the highest CAGR in the analysis tenure. One of the prominent factors that contribute to the growth of the cell processing segment is that cell processing utilizes efficient cell therapy instruments and media, especially during culture media processing techniques. This acts positively for recording the largest growth of the segment in the worldwide market. With 675 clinical trials underway worldwide for cell therapy and cell-based immune-oncology as per the record in mid-2020 released by the Alliance for Regenerative Medicine, there are yet few cell therapies in development that become commercially available. During cell processing there are several factors to be considered such as safety and efficacy, transferring to manufacturing processes, lack of scalability, high cost of facilities, labor and equipment, and complexities associated with the processes involved. To avoid this manufacturers focus on the development of new techniques to counterattack such problems. For instance, in October 2020, Thermo Fisher Scientific announced the launching of a closed system for cell therapy manufacturing. Thermo Fisher Scientific is launching Gibco CTS Rotea Counterflow Centrifugation System, a modular, closed-cell therapy processing system that acts as a solution to the problem. The device is scalable, cost-effective, and has cell therapy development and manufacturing. The device is specialized in facilitating workflows from research through good manufacturing practices (GMP) clinical development and commercial manufacturing.

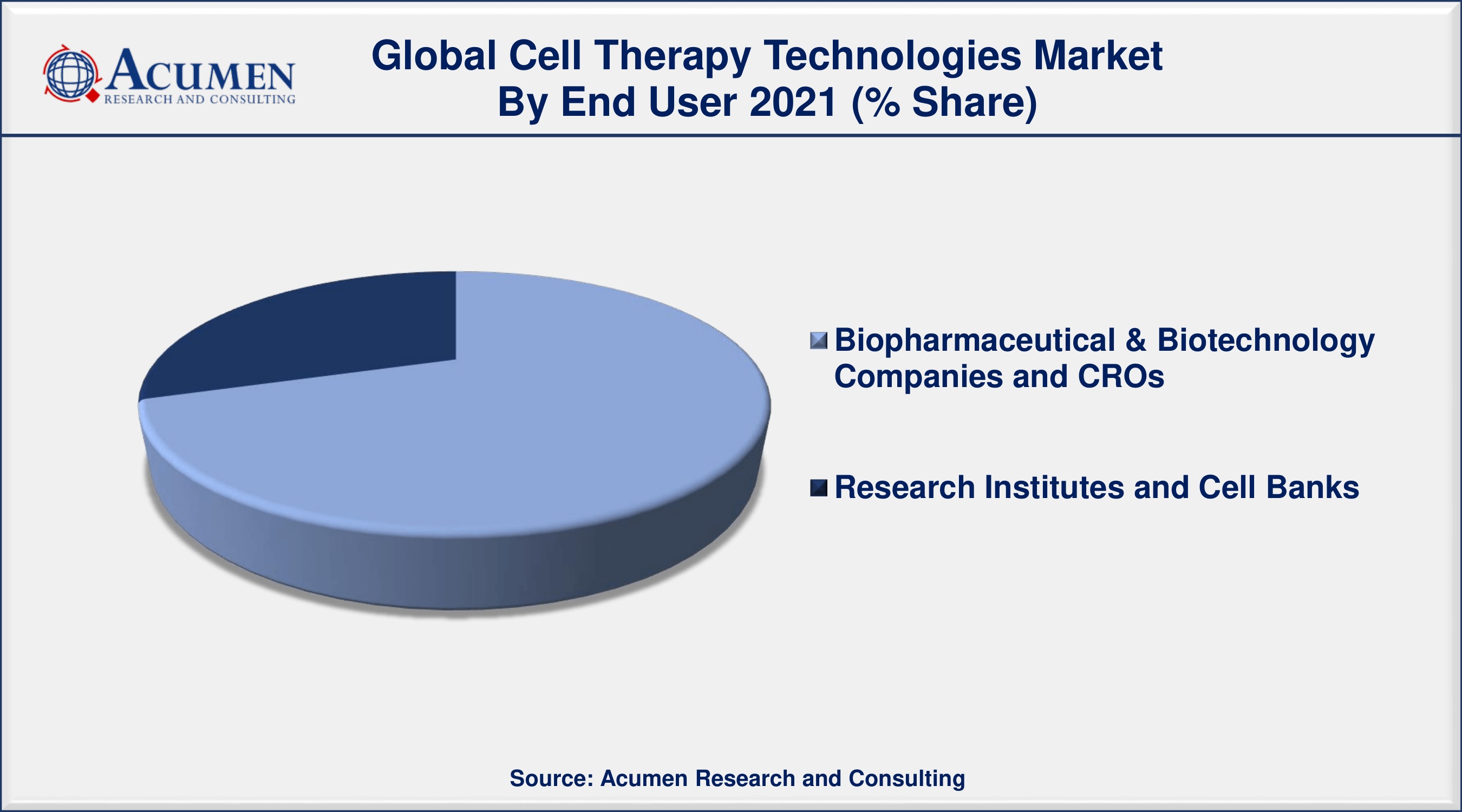

Cell Therapy Technologies Market By End User

- Biopharmaceutical & Biotechnology Companies and CROs

- Research Institutes and Cell Banks

According to the cell therapy technologies market forecast, the research institutes and cell banks segment is predicted to increase significantly in the market over the next few years. This growth is mainly attributed to the increasing R&D spending by private and public organizations as well as increasing clinical research is driving the segment over the forecasting years.

Cell Therapy Technologies Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

North America is predicted to dominate the market with the largest market shares

Geographically, North America registered the largest market share of the cell therapy technologies market globally. In the past, North America registered a commendable largest share of the cell therapy technologies market. This can be attributed to the rising prevalence of chronic diseases, rising healthcare expenditure, growing disposable incomes, growing healthcare awareness, and the availability of technologically advanced devices in the North American regional market.

Cell Therapy Technologies Market Players

Some of the top cell therapy technologies companies offered in the professional report include Terumo BCT Inc., STEMCELL Technologies Inc., Thermo Fisher Scientific, Beckman Coulter, Lonza Group AG, Miltenyi Biotec, Merck KGaA, and GE Healthcare.

Frequently Asked Questions

What is the size of global cell therapy technologies market in 2021?

The estimated value of global cell therapy technologies market in 2021 was accounted to be USD 3,108 Million.

What is the CAGR of global cell therapy technologies market during forecast period of 2022 to 2030?

The projected CAGR cell therapy technologies market during the analysis period of 2022 to 2030 is 14.1%.

Which are the key players operating in the market?

The prominent players of the global cell therapy technologies market are Terumo BCT Inc., STEMCELL Technologies Inc., Thermo Fisher Scientific, Beckman Coulter, Lonza Group AG, Miltenyi Biotec, Merck KGaA, and GE Healthcare.

Which region held the dominating position in the global cell therapy technologies market?

North America held the dominating cell therapy technologies during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for cell therapy technologies during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global cell therapy technologies market?

Increased prevalence of infections and chronic diseases, and expanding GMP certifications for tissue engineering production facilities drives the growth of global cell therapy technologies market.

By cell type segment, which sub-segment held the maximum share?

Based on cell type, t-cells segment is expected to hold the maximum share cell therapy technologies market.